What do pre employment background checks look for? Top 3!

Understanding What Pre-Employment Background Checks Look For

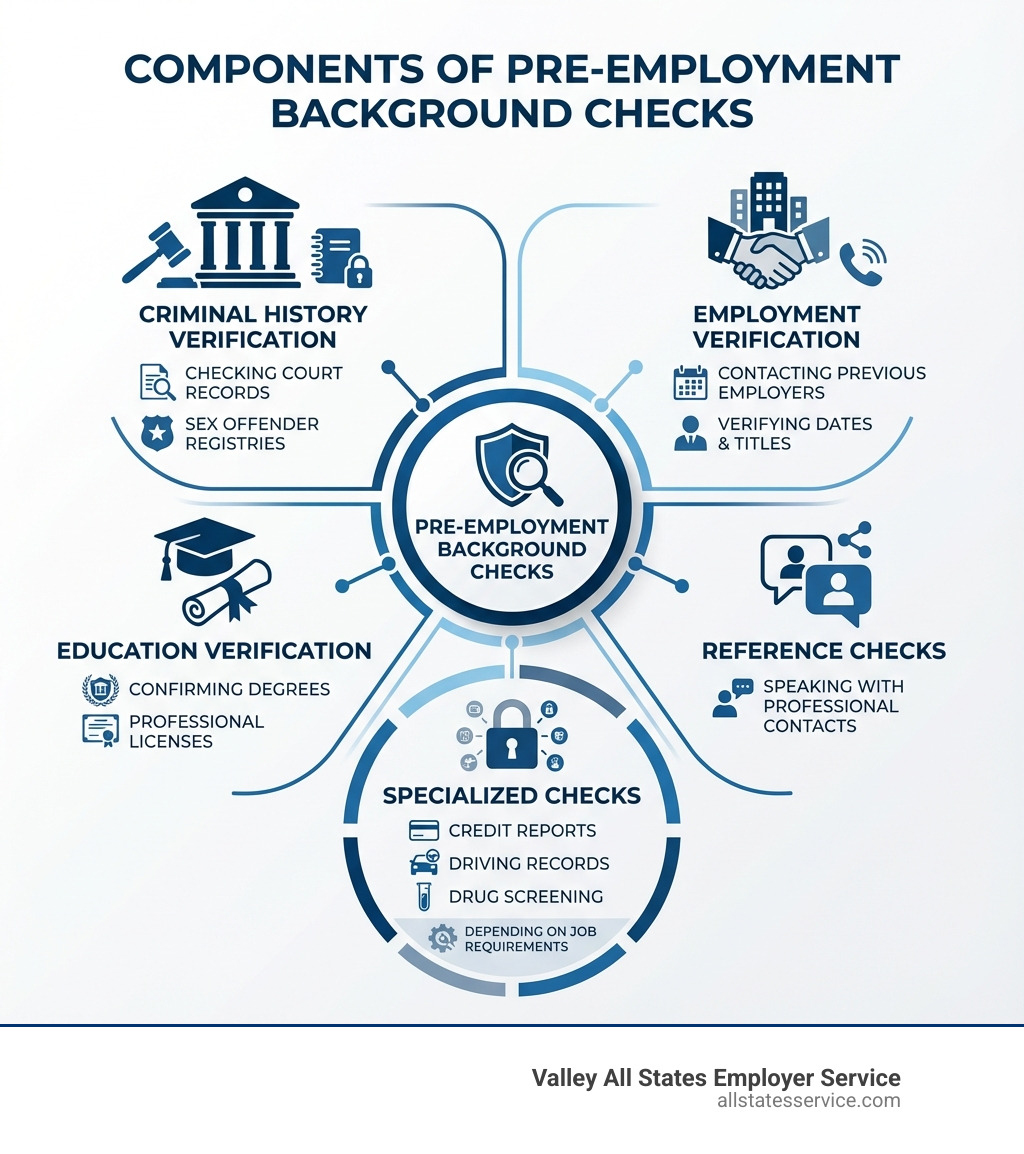

What do pre employment background checks look for? Most employers verify your criminal history, employment history, education credentials, and professional references. Depending on the job, they may also check your credit report, driving record, or conduct drug screening. The specific checks depend on the role, industry requirements, and applicable laws.

Here’s what employers typically examine during a background check:

- Criminal Records – Convictions, arrests, and sex offender registry status

- Employment History – Job titles, dates of employment, and reasons for leaving

- Education Verification – Degrees, diplomas, and professional certifications

- Reference Checks – Insights from former supervisors and colleagues

- Credit History – Financial responsibility (for finance-related roles)

- Driving Records – Motor vehicle history (for driving positions)

- Drug Testing – Substance screening (for safety-sensitive industries)

- Professional Licenses – Verification of credentials for regulated professions

If you’re preparing for a new job opportunity, understanding what shows up in a background check can help you feel confident during the hiring process. 75% of HR managers report finding lies on resumes, which is why employers take verification seriously.

Background checks aren’t about catching you in a mistake. They’re about protecting the workplace, ensuring candidates are qualified, and meeting legal requirements. For employers, they reduce the risk of negligent hiring. For candidates, they provide a fair and consistent evaluation process.

The checks can vary dramatically based on your industry. A healthcare worker might undergo sanction searches and vulnerable sector checks, while someone in finance faces credit history reviews. A delivery driver will have their motor vehicle record examined, but an office administrator probably won’t.

The good news? You have rights throughout this process. Employers must get your written permission before running most checks. If they find something concerning, they must give you a chance to respond before making a final decision.

The Pre-Employment Screening Process Explained

The journey from job applicant to valued employee often includes a crucial step: the pre-employment background check. This isn’t just a formality; it’s a comprehensive review designed to ensure that the person joining our team is the right fit, both in terms of qualifications and trustworthiness. For us, it’s about making informed hiring decisions that protect our business, our existing employees, and our clients.

When we extend a conditional job offer, it’s contingent upon verifying the qualifications and history you’ve presented. This verification process is essential for several reasons. First, it helps us confirm the accuracy of your application and resume. As the statistics show, resume embellishments are common, and we need to ensure the information we rely on for hiring is truthful. Second, it plays a vital role in maintaining a safe and secure workplace. By understanding a candidate’s history, we can proactively address potential risks. Finally, these checks ensure we meet various regulatory and industry-specific compliance standards. They’re a cornerstone of responsible hiring.

The Core Components: What Do Pre-Employment Background Checks Look For?

When we conduct a pre-employment background check, we’re casting a wide, yet legally compliant, net to gather relevant information. The goal is to build a complete picture of a candidate’s professional and personal history as it pertains to the job. So, what do pre employment background checks look for in detail? Let’s break down the key components.

Criminal History: More Than Just a Conviction Check

A criminal history check is a cornerstone of many pre-employment screenings. It helps us identify any past legal issues that might be relevant to the safety, security, or integrity of the position. We typically look for information from various levels:

- Federal District Criminal History Search: This search checks all 94 Federal District Courts for criminal history, including felonies and misdemeanors. It’s crucial because federal crimes may not appear at state or county levels.

- State and County Criminal History Searches: These searches look for felony or misdemeanor charges where an applicant has resided. We use statewide searches where reliable, and otherwise perform county-level checks.

- National Criminal Super Search: This online repository search covers approximately 350-400 million records, including sanction searches and wanted lists. While broad, it’s typically used to supplement, not replace, more targeted searches.

- Sex Offender Registry Checks: We search the US Department of Justice National Sex Offender database.

- OFAC Search: This checks The Office of Foreign Assets Control list for foreign nationals sanctioned by the US government, including known terrorists and narcotic traffickers.

It’s important to understand the difference between arrests and convictions. An arrest does not equal a conviction, and we individually assess any criminal records found, considering their severity, nature, and how recent they are, and most importantly, their direct relevance to the job duties. Under the Fair Credit Reporting Act (FCRA), criminal history information from more than seven years ago is generally restricted from being reported, though this doesn’t apply to salaried positions of $75,000 or more.

Employment & Reference Verification: Confirming Your Career Path

One of the most common areas where discrepancies appear is in a candidate’s work history. We verify past employment to ensure the information on your resume is accurate. This includes:

- Job Titles: Confirming the roles you held.

- Dates of Employment: Verifying start and end dates.

- Reasons for Leaving: While some previous employers may be hesitant to share this, we seek to understand the circumstances of your departure when permissible.

Our process for employment verification often involves contacting previous employers’ HR or payroll departments. We might also use services for Pre-employment Work History Verification to streamline this. For situations involving a Background Verification Closed Company Guide, we have established procedures to steer those challenges.

Reference checks provide valuable qualitative insights beyond official records. We typically contact professional references provided by the candidate, such as former supervisors or colleagues. We use a structured approach, often with job-specific, behavior-based surveys, to gather feedback on work ethic, skills, and accomplishments. This helps us get a well-rounded view of your capabilities and how you interact in a professional setting. We also partner with a Professional Reference Checking Company to ensure thoroughness and efficiency. Common issues we encounter include unresponsive former employers or candidates exaggerating their roles, which is why a robust verification process is essential.

Education & Credential Verification: Are Your Diplomas Real?

Just as with employment history, we verify educational qualifications to ensure candidates possess the degrees, diplomas, or certifications they claim. This process typically involves:

- Contacting Institutions: Reaching out to universities, colleges, or vocational schools directly.

- Checking Official Records: Confirming dates of attendance, degrees awarded, and majors.

- Professional Licenses and Certifications: For roles requiring specific credentials (e.g., medical licenses, CPA certifications), we verify their validity and good standing.

We use a Document Verification Service to ensure the authenticity of these credentials. We’re on the lookout for issues like fake degrees or diploma mills, name variations that can complicate verification, or delayed responses from educational institutions.

Other Specialized Checks You Might Encounter

Depending on the nature of the position, we may conduct additional specialized checks:

- Credit History Checks: For positions involving significant financial responsibilities, handling company funds, or requiring federal security clearances, a credit check may be performed. This can provide insight into an individual’s financial stability and responsibility. These checks are always subject to strict FCRA regulations and job relevance.

- Driving Records (MVR): If the job requires driving a company vehicle or operating any vehicle as part of the job duties, we will review your Motor Vehicle Record for violations, license status, and accident history.

- Drug Screening: Many employers require drug testing to maintain a safe and drug-free workplace. According to an annual report from Quest Diagnostics, 4.2% of applicants tested positive for drugs on urine screens in 2017, the highest rate since 2004. This highlights the ongoing need for such screening in safety-sensitive industries.

- Social Media Screening: We may review publicly available social media profiles to assess professionalism and cultural fit. However, this is done carefully, adhering to privacy laws and focusing only on job-relevant information. The Consumer Financial Protection Bureau (CFPB) has issued warnings regarding the use of AI in tracking applicants and employees, emphasizing compliance with privacy and transparency rules.

- E-Verify: While technically not a background check, we use E-Verify to confirm an employee’s authorization to work in the United States. This system compares information from an employee’s I-9 form with government records. For more details, you can refer to our guide on E-Verify Background Checks.

- OIG and SAM Checks: For positions in healthcare or those involving federal contracts, we conduct checks against the U.S. Department of Health & Human Services Office of Inspector General (OIG) exclusion list and the System for Award Management (SAM). These ensure candidates are not excluded from federal healthcare programs or prohibited from working with federal agencies.

Why Employers Conduct Background Checks

Why do we go through such a detailed process? It all boils down to creating a secure, productive, and compliant environment for everyone. Pre-employment background checks are not just an administrative task; they are a strategic tool for responsible business management.

One primary reason is mitigating risk. Consider the financial impact of employee dishonesty: the average value of internal retail theft cases increased by 3.8% in 2020 from 2019, with cases valued at $1,219.61 on average. These checks help us protect our company from potential losses due to theft, fraud, or other criminal behavior.

Workplace safety is paramount. We have a responsibility to provide a safe environment for our employees and clients. Thorough checks help us avoid hiring individuals who might pose a threat, preventing harassment, violence, or other safety issues. This due diligence can prevent negligent hiring lawsuits, which can be costly and damaging to our reputation.

These screenings also play a crucial role in improving our quality of hire. By verifying qualifications, employment history, and references, we ensure that we’re bringing on individuals who genuinely possess the skills and experience needed for the role. This leads to better team performance, higher employee retention, and a stronger company culture.

Finally, background checks are often essential for regulatory compliance. Many industries, especially those in healthcare, finance, or government contracting, have specific legal requirements for employee screening. Failing to adhere to these can result in significant penalties. Staying on top of these regulations is part of our commitment to HR Compliance.

Navigating the Legal Maze: Your Rights and Employer Responsibilities

While employers have a legitimate need to conduct background checks, applicants also have significant rights that we are committed to upholding. The process is governed by a complex web of federal and state laws designed to prevent discrimination and protect privacy. Navigating this legal maze correctly is a key part of our Human Resources Compliance efforts.

Understanding Your Rights Under FCRA and EEOC

In the United States, two primary federal bodies oversee background checks for employment: the Fair Credit Reporting Act (FCRA) and the Equal Employment Opportunity Commission (EEOC).

The FCRA dictates how employers can obtain and use “consumer reports” (which include most background checks) from third-party agencies. Key FCRA requirements include:

- Written Consent: We must provide you with a clear, standalone written notice that we intend to conduct a background check and obtain your written permission.

- Pre-Adverse Action: If we are considering not hiring you based on information in your background report, we must first provide you with a copy of the report and a “Summary of Your Rights Under the FCRA.” This gives you an opportunity to review the information and dispute any inaccuracies.

- Adverse Action Notice: If we ultimately decide not to hire you based on the report, we must send a final notice, including information about the reporting agency and your right to dispute the report.

The EEOC enforces federal laws that prohibit employment discrimination based on race, color, national origin, sex, religion, disability, genetic information, or age (40 or older). It’s crucial to remember that it’s illegal to discriminate against anyone on these protected bases, even when using background check information. The EEOC provides guidance emphasizing that policies must be job-related and consistent with business necessity, especially if they have a disparate impact on protected groups. For instance, blanket exclusions based on criminal records might be discriminatory if they disproportionately affect certain racial groups and aren’t directly relevant to job performance and safety.

Additionally, the federal Fair Chance to Compete for Jobs Act acts as a “ban-the-box” law for federal agencies and federal contractors, prohibiting inquiries about criminal history until a conditional offer of employment has been extended. Many states and localities, including Maryland, have similar “ban-the-box” laws that we adhere to.

What happens if they find something negative?

If a background check reveals negative information, it doesn’t automatically mean the end of your job application. We follow a strict process to ensure fairness and compliance:

- Pre-Adverse Action Notice: As required by the FCRA, we will send you a pre-adverse action letter. This letter includes a copy of the background report and a “Summary of Your Rights Under the FCRA.”

- Opportunity to Explain: You are given a reasonable amount of time (typically five business days) to review the report, dispute any inaccurate information with the reporting agency, or provide an explanation for the findings directly to us. We individually assess any criminal convictions found, considering how they relate to the duties of the position and the safety of the workplace.

- Final Adverse Action Notice: If, after considering your response or if you do not respond, we decide not to proceed with your employment, we will send a final adverse action notice. This notice confirms our decision and reiterates your rights regarding the background report.

Our goal is not to penalize you for past mistakes but to make a responsible and compliant hiring decision that aligns with the job requirements and our commitment to a safe workplace.

What do pre employment background checks look for in different industries?

The scope of a background check often varies significantly by industry due to differing regulations, risks, and job responsibilities. Here’s a look at what what do pre employment background checks look for in specific sectors within the United States:

- Healthcare: Beyond standard criminal checks, healthcare employers typically conduct searches against the Office of Inspector General (OIG) exclusion list. This list identifies individuals and entities excluded from participating in federal healthcare programs (like Medicare and Medicaid) due to fraud or other offenses. This is a critical check for patient safety and compliance.

- Finance: Positions involving handling money, sensitive financial data, or significant fiduciary responsibilities often require credit history checks. These help assess a candidate’s financial responsibility and trustworthiness. Such checks are always subject to strict FCRA guidelines and must be directly job-related.

- Transportation: For roles that involve driving company vehicles or operating heavy machinery, driving records (Motor Vehicle Records or MVRs) are essential. These reveal license status, violations, and accident history, which are crucial for safety and liability.

- Government Contractors: Companies that contract with the federal government have specific requirements. They often must use the E-Verify system to confirm employment eligibility and perform checks against the System for Award Management (SAM) to ensure individuals or entities are not debarred from federal contracts. If you’re curious about this, we have more information on What Employers Are Required to Use E-Verify.

- Roles with Vulnerable Populations: For positions working with children, the elderly, or individuals with disabilities (e.g., in schools, care facilities), employers often conduct improved criminal background checks, which may include fingerprint-based checks, to ensure the utmost safety.

These industry-specific screenings highlight the importance of tailoring background check policies to the unique demands and regulatory landscape of each sector.

Frequently Asked Questions about Pre-Employment Screening

We often get questions about the practicalities of background checks. Let’s tackle some of the most common ones.

How long does a pre-employment background check take?

The duration of a pre-employment background check can vary quite a bit, typically ranging from a few days to two weeks. Several factors influence the turnaround time:

- Number of Verifications: The more elements being checked (e.g., multiple past employers, several educational institutions), the longer it might take.

- Responsiveness of Sources: Delays can occur if past employers or educational institutions are slow to respond to verification requests.

- Type of Checks: Some searches, like basic criminal history, can be quick, while fingerprint-based federal checks or international background checks may take longer due to processing times and varying regulations.

- Accuracy of Information: Inaccurate or incomplete information provided by the candidate can lead to delays as we work to verify correct details.

We strive for efficiency and accuracy, understanding that time is of the essence in hiring. For a deeper dive into this, check out our guide on Pre-employment Background Check Time.

How far back do background checks go?

The timeframe covered by a background check depends largely on the type of information being sought and applicable laws.

- Criminal History: Under the FCRA, consumer reporting agencies generally cannot report non-conviction information (like arrests not leading to conviction) that is more than seven years old. For convictions, there is generally no time limit under federal law, but some states impose limits (e.g., seven years). However, this seven-year restriction typically doesn’t apply to positions with an annual salary of $75,000 or more.

- Employment and Education Verification: There are generally no time limits on how far back we can verify employment history or educational qualifications. We can go back as far as needed to confirm your resume details.

- Credit History: Similar to criminal records, negative credit information (like bankruptcies) typically has a seven-year reporting limit under the FCRA.

State and local laws can also impose stricter limits, so we always ensure our practices comply with the most restrictive applicable regulations, including those in Maryland.

What can disqualify you on a background check?

A background check aims to find relevant information, not to trip you up. However, certain findings can lead to disqualification, especially if they are directly related to the job’s duties or pose a significant risk. Here are some common factors:

- Job-Related Convictions: While a criminal record doesn’t automatically disqualify you, a conviction that directly relates to the job’s responsibilities or workplace safety can. For example, a conviction for embezzlement would likely disqualify someone from a financial role. We individually assess each case based on relevance, severity, and recency, following EEOC guidance.

- Falsified Information: Lies on your resume or application regarding employment history, educational qualifications, or professional licenses are serious red flags and almost always lead to disqualification. Honesty is always the best policy.

- Poor Driving Record (for driving jobs): If the position requires driving, a history of serious traffic violations, multiple accidents, or a suspended license would be a disqualifying factor.

- Failed Drug Test: For companies that require drug screening, failing a pre-employment drug test will typically lead to disqualification, especially in safety-sensitive industries.

- Negative References: While usually not a standalone disqualifier, consistently negative feedback from multiple professional references can raise concerns about your work ethic, reliability, or interpersonal skills.

- Exclusions/Debarments: For specific industries, being on an OIG exclusion list (healthcare) or a SAM debarment list (federal contractors) will disqualify a candidate from those roles.

The key is relevance to the job and compliance with legal standards.

Ensuring a Smooth and Compliant Hiring Process

For us, the goal of pre-employment background checks is to support a fair, safe, and efficient hiring process. We believe in taking a proactive approach to compliance and risk management. This means:

- Consistent Policy: We apply a consistent background check policy to all applicants for similar roles, ensuring fairness and avoiding discrimination.

- Clear Communication: We communicate transparently with candidates about our screening process, obtaining all necessary consents and providing opportunities to address any concerns.

- Partnering with Professionals: We understand the complexities of federal and state laws governing background checks. That’s why we partner with professional services, like Valley All States Employer Service, to ensure accuracy, compliance, and efficiency in our screenings. Our expertise in outsourced E-Verify workforce eligibility verification, for example, minimizes errors and administrative burdens for our clients. This allows us to Streamline HR Processes and focus on what we do best.

- Staying Updated: The legal landscape around background checks, including issues like AI legislation and privacy laws, is constantly evolving. We continuously monitor these changes to ensure our practices remain compliant. We also offer HR Compliance Assistance to help other businesses steer these challenges.

By carefully conducting these checks, we not only protect our organization but also contribute to a positive and trustworthy work environment for everyone. It’s about building a team we can all be proud of.

Ready to ensure your hiring is compliant and efficient? Explore our pre-employment screening solutions.