E-Verify I-9 verification: Secure Compliance 2025

Why E-Verify I-9 Verification Matters for Every U.S. Employer

E-Verify I-9 verification is the two-step process that confirms every new hire in the United States is legally authorized to work. Understanding how these systems work together is essential for HR managers who need to stay compliant while managing a hiring workflow.

Quick Answer: What You Need to Know

- Form I-9 is the mandatory paper or electronic form that every U.S. employer must complete for each new hire within three business days of their start date.

- E-Verify is an optional online system (mandatory for federal contractors and some state employers) that electronically checks I-9 information against government databases.

- The connection: Form I-9 is the foundation. E-Verify builds on it by verifying the data you entered against Social Security Administration and Department of Homeland Security records.

- Key difference: All employers must complete Form I-9. Only some must use E-Verify, but it significantly reduces the risk of hiring unauthorized workers.

Since the Immigration Reform and Control Act of 1986, Form I-9 has been the bedrock of employment eligibility verification. Every employer hiring workers in the U.S. must complete this form, whether they run a small startup or a large corporation. The form requires employees to present documents proving their identity and work authorization, and employers must examine those documents within a tight deadline.

E-Verify entered the picture later as a free, web-based system operated by U.S. Citizenship and Immigration Services (USCIS). It takes the information from your completed Form I-9 and matches it against federal records to confirm accuracy. While voluntary for most private employers, it is required for federal contractors and in several states with specific mandates.

The challenge for busy HR managers is clear: you need to get both processes right. Miss a deadline on Form I-9, and you risk penalties during an audit. Use E-Verify incorrectly, and you could face discrimination claims or compliance violations. With federal contractors subject to the FAR E-Verify clause and state laws creating a patchwork of requirements, staying compliant means understanding exactly how these two pillars work together.

Terms related to E-Verify I-9 verification:

The Foundation: Understanding Form I-9

The primary purpose of Form I-9 is straightforward: it ensures that every person hired for employment in the United States is legally authorized to work here. This critical document stems from the Immigration Reform and Control Act (IRCA) of 1986, making it a universal requirement for all U.S. employers. If you hire someone, you must complete a Form I-9 for them. It’s not an option, it’s the law.

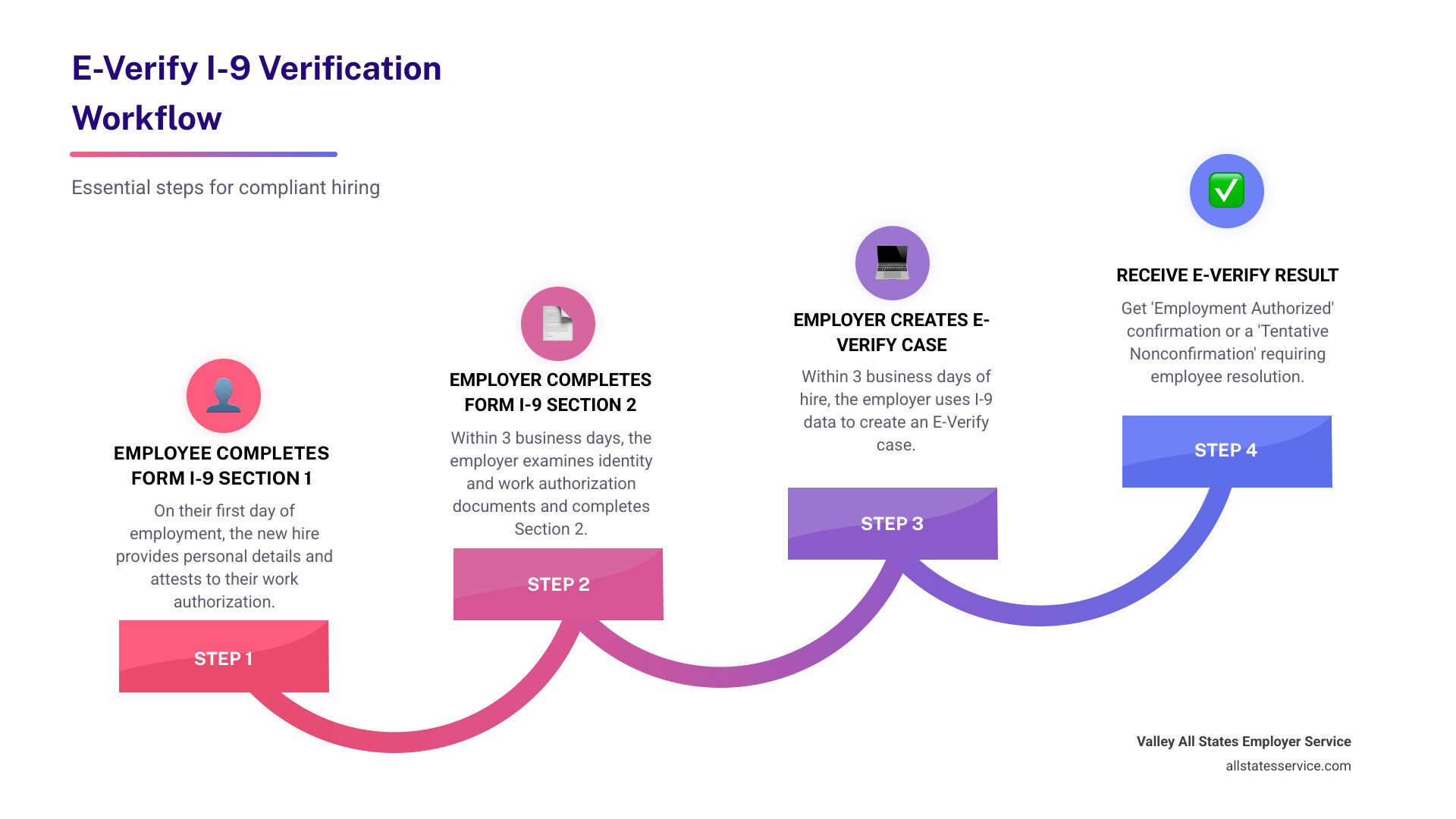

The process begins on the employee’s first day of work when they complete Section 1 of the form. This section collects their personal information and attestations of their employment eligibility. Then, within three business days of the employee’s start date, we, as employers, must complete Section 2. This involves examining specific documents the employee presents to establish both their identity and their authorization to work. These documents can be a single List A document, which proves both, or a combination of one List B document (identity) and one List C document (employment authorization).

Understanding this foundational step is crucial for any employer. Without a correctly completed Form I-9, you’re already starting on shaky ground regarding compliance. For more in-depth information on what documents are acceptable, you can refer to our I-9 Document Requirements Complete Guide.

Form I-9 Requirements and Record-Keeping

Compliance with Form I-9 goes beyond just filling it out. There are strict deadlines and specific rules for how to handle the forms once completed.

-

Deadlines for Completion: The employee must complete Section 1 of Form I-9 no later than their first day of employment. As the employer, we must complete Section 2 within three business days of that first day. If the employee is hired for less than three business days, then Section 2 must be completed no later than their first day of employment. This tight timeframe highlights the need for an efficient onboarding process.

-

Physical vs. Remote Document Examination: Traditionally, we’ve physically examined the original documents presented by employees. However, with the rise of remote work, the Department of Homeland Security (DHS) issued a final rule, effective August 1, 2023, allowing for alternative procedures for examining Form I-9 documents. This means that for employers enrolled in E-Verify and in good standing, we can now conduct remote examinations using live video interaction, provided certain steps are followed. We’ll dig deeper into this alternative procedure later in the article.

-

Retention Rules: Once completed, the Form I-9 isn’t sent to USCIS or ICE. Instead, we must retain and store it. The rule is clear: retain the form for three years after the date of hire, or for one year after employment is terminated, whichever is later. This is a crucial statistic to remember for audit preparedness.

-

Storing Forms: Proper storage is key. Forms I-9 should be kept secure, whether in paper or electronic format, and made readily available for inspection if requested by authorized U.S. government officials. Preparing for an I-9 Audit means having these records organized and accessible. For more guidance on all aspects of Form I-9, the Handbook for Employers: Guidance for Completing Form I-9 (M-274) is an invaluable resource. You can also explore our dedicated guide on I-9 Record Keeping.

The Improvement: What is E-Verify?

While Form I-9 lays the groundwork, E-Verify takes employment eligibility verification a step further. E-Verify is a web-based system operated by USCIS that allows employers to electronically confirm the eligibility of their newly hired employees to work in the U.S. Its primary purpose is to improve the integrity of the hiring process by electronically comparing information from an employee’s Form I-9 against vast government databases from the Social Security Administration (SSA) and the Department of Homeland Security (DHS).

Think of E-Verify as an extra layer of assurance. It doesn’t replace the Form I-9, but rather complements it by validating the data we collect. The system is free to use and is available to participants in all 50 states, the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, and the Commonwealth of the Northern Mariana Islands. This widespread availability makes it a powerful tool for employers across the United States. For a more comprehensive understanding, visit our page What is E-Verify?.

Who Must Use E-Verify and How It Works

While E-Verify is voluntary for most private employers, there are significant exceptions that make it a mandatory system for many.

-

Mandatory for Federal Contractors: If your business is a federal contractor, you likely fall under specific requirements. Federal contracts issued on or after September 8, 2009, as well as older contracts that have been modified, may contain the FAR E-Verify clause. This clause mandates participation in E-Verify for all new hires and, in some cases, existing employees assigned to a federal contract.

-

State-Specific Mandates: Beyond federal requirements, many states have enacted laws mandating E-Verify use for some or all employers. While specific rules vary by state, they often apply to public employers, state contractors, or private employers above a certain size. For employers operating in Maryland, understanding these nuances is particularly important. Navigating this patchwork of state laws can be complex, and it’s why we always recommend staying informed about the requirements in your operating locations. Our E-Verify State Laws Complete Guide can provide valuable insights.

-

How It Works: After completing the Form I-9, we enter the employee’s information from Sections 1 and 2 into the E-Verify system. This usually includes their name, date of birth, and Social Security Number (SSN). E-Verify then electronically compares this data with records from SSA and DHS. Within seconds, it typically provides an employment authorization confirmation or, sometimes, a Tentative Nonconfirmation (TNC), which we will discuss shortly.

-

Login.gov and E-Verify+: To improve security and user experience, access to E-Verify accounts is increasingly integrated with Login.gov. This secure sign-on service provides a single, secure way to access various government services. Furthermore, USCIS is introducing E-Verify+, an improved platform designed to bring innovation, protection, convenience, transparency, and efficiency to the employment eligibility verification process. This new service aims to streamline the experience for employers, making compliance even smoother. You can always access your account through the E-Verify employer login.

Form I-9 vs. E-Verify: A Head-to-Head Comparison

While both Form I-9 and E-Verify are integral to ensuring legal employment, they serve distinct roles and have different requirements. Understanding these key differences is vital for a robust E-Verify I-9 verification process.

Let’s look at a head-to-head comparison:

| Attribute | Form I-9 | E-Verify |

|---|---|---|

| Process | Form I-9 is a physical or electronic document that serves as the foundation for verifying employment eligibility. It is completed by both the employee and the employer. | E-Verify is a web-based system that electronically compares the information entered from the Form I-9 against federal government databases. |

| Requirement Level | Mandatory for all U.S. employers for every new hire, regardless of citizenship or immigration status. | Voluntary for most private employers, but mandatory for federal contractors with the FAR E-Verify clause and for employers in certain states. |

| Information Source | Relies on documents presented by the employee, physically or remotely, to establish identity and work authorization. | Electronically compares I-9 information to records from the Social Security Administration (SSA) and Department of Homeland Security (DHS). |

| SSN Necessity | Generally voluntary for Section 1, unless the employer participates in E-Verify. | Mandatory for all employees whose eligibility is verified through E-Verify. |

| Photo ID Rule | Not all List B (identity only) documents require a photograph. | Any List B document presented to an E-Verify employer must contain a photograph, with limited exceptions (e.g., religious objections). |

| Reverification | Used to reverify an employee’s employment authorization when it expires. | Cannot be used for reverification of expired employment authorization. |

As you can see, Form I-9 is the initial, document-based verification, while E-Verify is the electronic check that validates that information against government records. They are interconnected, but distinct, pieces of the employment eligibility puzzle. For further clarity, explore our dedicated resource on E-Verify and I-9.

Navigating E-Verify I-9 Verification Procedures

Understanding the procedural nuances of both Form I-9 and E-Verify is key to successful E-Verify I-9 verification. It’s not just about filling out forms, it’s about executing a precise, compliant process every time. Our goal is always to help you manage these complexities with ease. For a complete guide on navigating these requirements, take a look at our E-Verify I-9 Compliance page.

Special Rules: Federal Contractors and State Mandates

For certain employers, E-Verify is not just an option, it’s a firm requirement. This is particularly true for federal contractors and those operating in states with specific mandates.

-

Federal Contractors: If your business holds a federal contract, you likely operate under the Federal Acquisition Regulation (FAR) E-Verify clause. This clause mandates E-Verify participation. Specifically, federal contracts issued on or after September 8, 2009, or older contracts that have been modified, typically include this requirement. This means we must use E-Verify for all new hires and, significantly, for existing employees who are directly working on a covered federal contract. There are some exemptions, such as contracts lasting fewer than 120 days or valued at $150,000 or less, but the general rule is clear: if you’re a federal contractor, E-Verify is part of your compliance landscape. For more detailed information, our Federal Contractor E-Verify guide and the official E-Verify Supplemental Guide for Federal Contractors are excellent resources.

-

State-Specific Mandates: While E-Verify is a federal program, many states have introduced their own laws making its use mandatory for certain employers. These mandates can vary widely, requiring all employers, public employers, or state contractors to participate. For employers operating in multiple states, such as here in Maryland, this creates a complex compliance environment. We must stay updated on the specific E-Verify laws in each jurisdiction to ensure full adherence. Ignoring these state mandates can lead to significant penalties, highlighting the importance of a comprehensive compliance strategy.

Handling a Tentative Nonconfirmation (TNC)

One of the most critical aspects of the E-Verify process is understanding and correctly handling a Tentative Nonconfirmation, or TNC. A TNC occurs when the information entered into E-Verify does not immediately match records from the SSA or DHS. A TNC is not a final determination of an employee’s work authorization, nor does it mean they are unauthorized to work. It simply indicates a mismatch that requires further action.

-

Employer Responsibilities: If E-Verify returns a TNC, our immediate responsibility is to notify the employee promptly. We must provide them with the TNC notice and explain their rights and the steps they need to take. This includes giving them the opportunity to contest the mismatch. We cannot take any adverse action, such as termination or suspension, based solely on a TNC.

-

Employee Rights: Employees have the right to contest a TNC. If they choose to do so, they must contact the appropriate agency (SSA or DHS) within the specified timeframe to resolve the discrepancy. We must give them sufficient time to do this and continue to allow them to work while the TNC is being resolved.

-

Prohibited Actions: It’s crucial to avoid any adverse action against an employee due to a TNC, unless and until a Final Nonconfirmation is issued. Premature action can lead to discrimination claims and severe penalties. Effective communication and adherence to the TNC resolution process are paramount. For insights into the status of your E-Verify cases, you can check our E-Verify Case Status resources.

The Rise of Remote I-9 Verification

The shift towards remote work has fundamentally changed how many businesses operate, and employment verification has adapted as well. The traditional requirement for physical examination of Form I-9 documents presented a challenge for remote hires. Fortunately, the Department of Homeland Security (DHS) issued a final rule, effective August 1, 2023, which allows for an alternative procedure for examining the documents employees must present to complete Form I-9.

-

Eligibility: This alternative procedure is available to employers who are enrolled in E-Verify and are in good standing. This means that if you’re already committed to the improved verification that E-Verify provides, you can leverage this flexibility.

-

How it Works: Instead of a physical in-person inspection, the alternative procedure allows for a live video interaction. We, as employers, or our authorized representatives, can examine copies of the employee’s documents (List A or List B and C) remotely. Following this, we must then conduct a live video call with the employee to review the original documents. This ensures we can authenticate the documents while accommodating remote hiring.

-

Document Retention: Even with remote inspection, the document retention rules remain the same. We must keep copies of the documents with the employee’s Form I-9. This new flexibility is a game-changer for businesses with remote teams, like those we serve in Maryland and across the United States. To learn more about this process, refer to our guides on USCIS I-9 Remote Verification and I-9 for Remote Employees.

Staying Compliant and Avoiding Penalties

Maintaining a compliant E-Verify I-9 verification process is not just about following rules, it’s about protecting your business. A proactive compliance strategy and diligent risk mitigation are essential in this changing regulatory landscape. Our goal is to help you steer these waters successfully. For a comprehensive overview of how to stay on track, our I-9 Compliance Guide 2025 is an excellent starting point.

Anti-Discrimination Provisions for E-Verify I-9 Verification

While the primary goal of Form I-9 and E-Verify is to ensure a legal workforce, it’s equally important to uphold anti-discrimination laws throughout the verification process. The Immigrant and Employee Rights Section (IER) of the Department of Justice actively enforces these provisions, and we must be vigilant to avoid violations.

-

Avoiding Document Abuse: We must never ask for specific documents from an employee, nor can we reject documents that reasonably appear to be genuine and relate to the person presenting them. Employees have the right to choose which acceptable documents from the Lists of Acceptable Documents they wish to present. For example, we cannot demand a green card from a lawful permanent resident or a birth certificate from a U.S. citizen who “looks foreign.”

-

Prohibitions on Discrimination: It is illegal to discriminate against individuals based on their citizenship status or national origin during the I-9 or E-Verify process. This means applying the same verification standards to all new hires, regardless of their background. Using E-Verify selectively or requiring more or different documents from certain individuals can lead to serious legal consequences.

-

Consistent Application: To avoid discrimination, we must apply our E-Verify I-9 verification procedures consistently for all employees. This includes how we handle TNCs and how we communicate with employees about their rights. For a deeper dive into these crucial protections, consult our I-9 Compliance Services Ultimate Guide.

Consequences of Non-Compliance and Recent Updates

The penalties for failing to comply with Form I-9 and E-Verify requirements can be substantial, ranging from monetary fines to criminal charges in severe cases. This underscores the importance of staying informed about regulations and recent updates.

-

I-9 Penalties: Errors on Form I-9, even technical ones, can lead to fines. These penalties are typically based on the number of violations and can quickly add up. More severely, knowingly hiring or continuing to employ unauthorized workers carries much heftier fines and potential criminal prosecution. An ICE audit can be a costly experience if your records aren’t in order. Our I-9 Audit Penalties Complete Guide provides a detailed breakdown of these risks.

-

USCIS E-Verify Records Disposal Policy: Staying updated is critical. For instance, USCIS announced that it will permanently delete E-Verify cases updated before December 31, 2014, starting January 6, 2025. This means employers must act now to download Historic Records Reports and retain them with corresponding Forms I-9 for audit preparedness. Failing to do so could leave us vulnerable during an audit, as we would lack proof of past E-Verify checks.

-

E-Verify Outages: Even temporary disruptions can have compliance implications. We saw this with a past E-Verify outage where USCIS gave employers until Tuesday, October 14, 2025, to create E-Verify cases for employees hired while the system was down. Such events highlight the need for flexibility, documentation, and a clear understanding of extended deadlines. These updates emphasize that E-Verify I-9 verification is a dynamic area, requiring continuous attention and adaptation.

Simplify Your Hiring Compliance

The journey of E-Verify I-9 verification can feel like navigating a complex maze. Form I-9 is the mandatory foundation, a meticulous document-based process that ensures every new hire attests to and proves their eligibility to work in the United States. E-Verify then acts as the powerful electronic check, validating that information against federal databases, adding an essential layer of security and compliance.

Managing both processes correctly and consistently is critical for maintaining a legal workforce and protecting your business from significant penalties. From adhering to strict deadlines and proper record-keeping to understanding federal contractor obligations, state mandates, and anti-discrimination provisions, the demands on HR teams are considerable.

This is where we come in. At Valley All States Employer Service, we specialize in providing outsourced E-Verify workforce eligibility verification. Our expertise ensures that your E-Verify I-9 verification processes are impartial, efficient, and minimize errors and administrative burdens. We help businesses like yours in Maryland and across the United States steer these complexities, allowing you to focus on what you do best: growing your business.

Ready to simplify your hiring compliance and ensure peace of mind? Let us help you streamline your onboarding process and manage your E-Verify Employer Requirements effectively.