Reduce compliance risk: 4 Steps, Zero Headaches

Why Compliance Risk Is Growing (And What It Means for You)

Reduce compliance risk by understanding what it is and taking proactive steps to protect your business. Here’s what you need to know right now:

- Compliance risk is the potential for financial, legal, and reputational harm when your organization fails to follow laws, regulations, or internal policies

- The cost is real: Non-compliance costs businesses an average of $14.82 million per year, a 45% increase since 2011

- Key steps to reduce risk: Identify your specific risks, assess their impact, implement controls, and monitor continuously

- Start with the basics: Clear policies, employee training, leadership support, and regular audits

The compliance landscape is more complex than ever. More than one-third of firms spend at least a full day each week tracking regulatory changes, time that could support hiring and onboarding.

The stakes are high. Fines, Board changes, and reputational damage can follow a single misstep. Reducing compliance risk is not only about avoiding penalties, it also protects assets, preserves trust, and guides better decisions.

You do not need to do this alone or drown in rules. A practical compliance management plan helps you stay ahead, cut errors, and win back time for your team.

This guide shows you how to reduce compliance risk with a clear, step-by-step approach. You will learn what compliance risk is, how it differs from other business risks, and how to build a system that protects your organization without overwhelming your staff.

What is Compliance Risk (And Why You Can’t Ignore It)

Compliance risk is the potential for legal trouble, financial penalties, or damage to your business’s reputation when you fail to follow laws, regulations, or even your own internal policies. It matters for every organization, from small businesses in Maryland to national companies.

Think of compliance risk as a smoke detector for your business, warning you about dangers related to following rules, from federal laws like the Fair Credit Reporting Act to state-specific employment regulations. While general enterprise risk management covers everything from market changes to operational hiccups, compliance risk zeroes in specifically on what happens when you don’t meet your regulatory obligations.

The rules keep changing, too. New regulations appear, old ones get updated, and what worked last year might not cut it this year. That’s why proactive compliance management isn’t just about avoiding trouble. It protects your business assets, safeguards your reputation, and ensures your decisions are legally sound. In other words, it builds a stronger, more trustworthy organization from the ground up.

The High Cost of Getting It Wrong

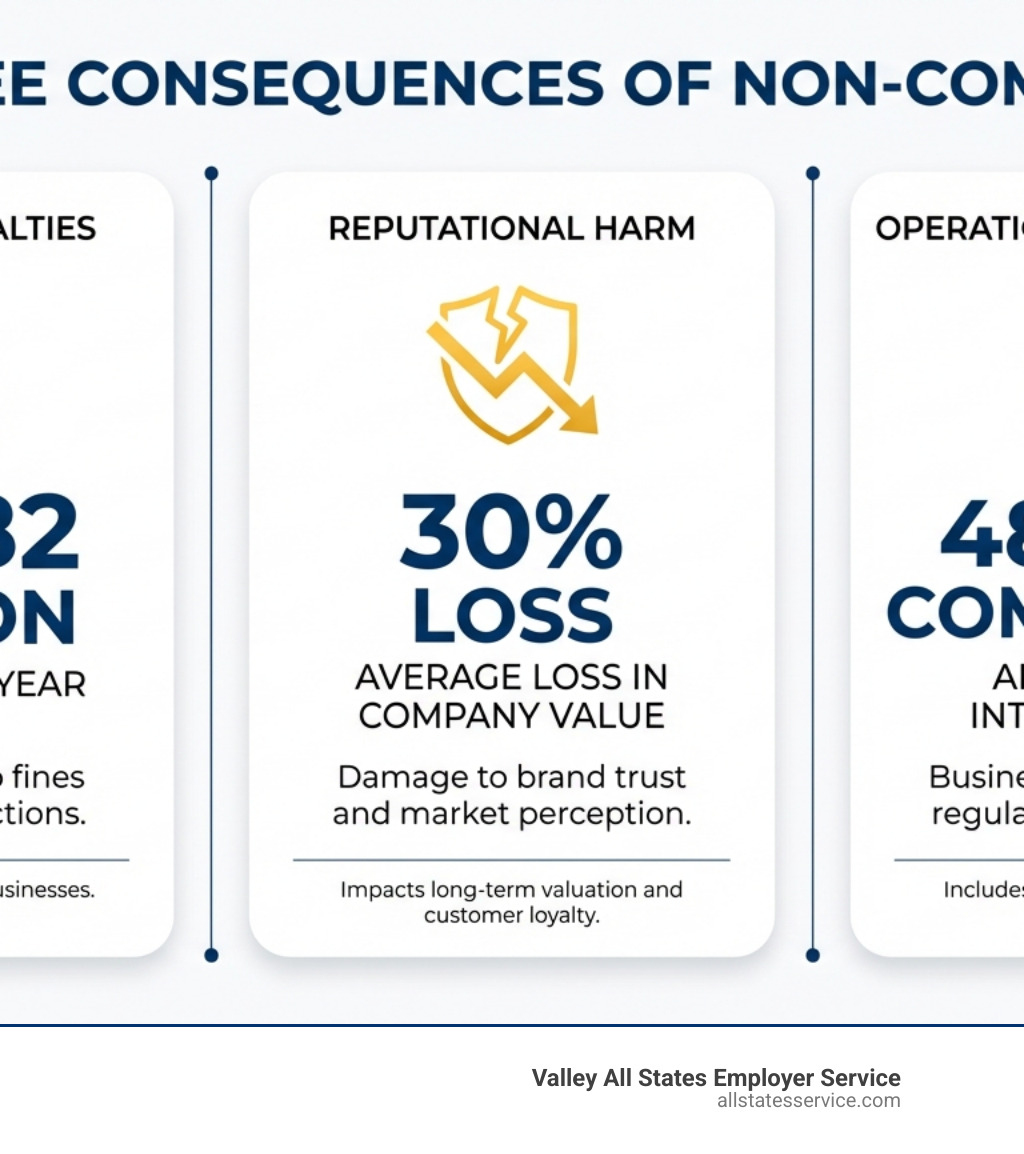

When compliance failures happen, the damage spreads fast and far. Legal penalties and fines come first. Regulatory bodies don’t mess around. I-9 violations alone can lead to significant monetary penalties, and if you’re a repeat offender, those fines escalate quickly. A 2023 Annual Litigations Trends Survey found that 48% of companies faced a regulatory proceeding that year.

But the money you pay in fines is just the beginning. Lost productivity and business interruptions follow close behind. When you’re dealing with investigations, audits, and legal battles, your team can’t focus. Resources get diverted, projects are delayed, and revenue takes a hit.

Then there’s the reputational damage. News travels fast these days, especially bad news. According to the Ponemon Institute’s Cost of Compliance study, businesses experienced a 30% average loss in company value following non-compliance incidents. Customers lose trust, partners get nervous, and talented employees start looking elsewhere.

Weak compliance controls also create opportunities for fraud and financial loss. The Association of Certified Fraud Examiners estimates that 5% of revenue is lost due to occupational fraud every year, with a median loss per case of $145,500. When internal controls are weak, fraudulent activities like false expense claims or payroll fraud can go unnoticed.

Want to understand where your vulnerabilities are? Our HR Compliance Audit Guide 2025 walks you through how to spot and fix potential compliance gaps before they become expensive problems.

How to Reduce Compliance Risk with a Strong Management Program

A strong compliance management program isn’t just defensive. It creates a foundation for sustainable growth and makes your business run smoother.

Start with clear policies and procedures. These are your roadmap. They need to be written in plain language, easy to find, and updated regularly to reflect current laws. If your team can’t understand your policies, they can’t follow them.

Ongoing training and education keeps everyone on the same page. Your employees are your first line of defense. When they understand their responsibilities and the risks of non-compliance, they become part of the solution. Regular training sessions, not just once-a-year check-the-box exercises, make all the difference.

Leadership support and accountability set the tone for your entire organization. When your leadership team visibly champions compliance, it sends a message that following the rules matters here. Clear accountability structures ensure everyone knows their role and takes it seriously.

You can’t improve what you don’t measure, which is where regular monitoring and auditing come in. Continuous monitoring helps you catch potential issues before they turn into full-blown crises. This includes everything from I-9 audits to payroll compliance checks. For more guidance, check out our resources on HR Regulatory Compliance and Employment Law Laws.

Even with the best systems, problems can happen. That’s why fast response and remediation are critical. A clear plan to investigate and fix issues quickly minimizes damage and shows regulators you take compliance seriously.

A comprehensive Compliance Management System brings these elements together, streamlining your efforts and reducing the administrative burden on your team.

Your 4-Step Action Plan to Reduce Compliance Risk

Building a robust compliance program does not have to be overwhelming. Use this practical 4-step plan to systematically reduce compliance risk.

Step 1: Identify Your Unique Compliance Risks

Map out which regulations apply. If you operate in Maryland, start with our Maryland Employment Law Compliance Guide plus federal mandates like I-9 and E-Verify. Our HR Regulatory Compliance resources and Employment Law Laws can help.

Review your real-world operations across the employee lifecycle. Look for gaps in hiring, onboarding, timekeeping, payroll, and offboarding.

Compare what you do with what your policies say. Update outdated policies and consider industry standards that shape expectations. A cross-functional review with HR, legal, and finance gives a fuller picture.

Step 2: Assess and Prioritize the Dangers

For each risk, rate the likelihood and potential impact. Consider past issues, control weaknesses, and the size of possible fines or disruptions. Use hard numbers and informed judgment.

A simple risk matrix makes priorities clear. Forty percent of companies skip annual assessments, which creates blind spots. Avoid that. For help, see our HR Compliance Review.

Step 3: Mitigate Risks with Smart Controls and Processes

Update or create policies in plain English and make them easy to find. Then add guardrails that prevent errors.

For HR, standardize Workforce Eligibility Verification. Follow our I-9 Compliance Services Complete Guide and, if required or desired, use the E-Verify Program Complete Guide.

Train the people who run these processes. Target training where issues occur, such as focused I-9 Compliance Training.

Use technology to automate, reduce errors, and keep audit trails. An Automated Eligibility Verification System can turn paperwork into a reliable, fast workflow.

Step 4: Monitor, Report, and Continuously Improve

Compliance is ongoing. Set regular checks that match each risk level. Run periodic audits to validate controls. The Internal I-9 Audit Complete Guide helps you catch issues early.

Report results and trends to leadership, including wins, near misses, and fixes. Stay alert for new risks. More than one-third of firms spend a day a week tracking regulatory changes, which helps them adapt quickly when laws or business operations change.

Keep cycling through identify, assess, mitigate, and monitor to maintain a program that keeps pace with your business.

Best Practices for Staying Ahead of Compliance Challenges

The four-step plan is your framework. Now weave compliance into daily habits so it feels natural, not burdensome.

Adopt a proactive mindset. Track upcoming rules, build compliance into new projects from day one, and anticipate risks before they surface.

Integrate checks into routine workflows. Onboarding should always include proper I-9 completion. Payroll systems should flag anomalies. When compliance becomes the default path, you remove friction and reduce compliance risk.

Leadership commitment sets the tone. When managers model compliance, employees follow. Clear accountability at every level builds a culture of integrity.

Keep documentation organized. Policies, training logs, audit trails, and incident reports should be complete and easy to find. Good records save time and prove diligence.

How to Overcome Common Compliance Problems

The cost of compliance can seem high, but non-compliance usually costs more. Focus on efficient solutions and, when helpful, partner with specialists.

Managing data is complex. Use clear data governance and the right tools to secure sensitive employee information.

To balance compliance and business speed, include compliance early in planning so processes are both compliant and efficient.

Address cultural resistance with simple explanations of the why, practical training, and transparency.

If you operate across states, lean on structured guidance. Our Outsourced HR Compliance Ultimate Guide can help you manage multi-jurisdiction requirements.

How to Reduce Compliance Risk with Technology and Culture

Automation cuts manual errors and creates reliable audit trails. Our Automated Eligibility Verification System streamlines E-Verify with built-in checks. Centralized platforms make it easier to manage policies, training, and reporting in one place.

Technology only works when people use it correctly. Build a culture of compliance with clear communication, regular and role-based training like I-9 Compliance Training, and safe channels to raise concerns. When accountability is shared, you reduce compliance risk and strengthen trust.

Frequently Asked Questions about Reducing Compliance Risk

You’ve got questions, and we’ve got answers. Here are some of the most common concerns we hear from businesses like yours when it comes to reducing compliance risk.

What are the most common compliance risks for a business?

If you’re wondering where to focus your compliance efforts first, these are the areas that trip up most organizations, especially when it comes to HR and employment matters.

Data security and privacy sits at the top of the list. Every piece of employee information you collect, from Social Security numbers to health records, needs protection. A single breach can trigger massive fines and destroy years of trust-building with your workforce.

Regulatory non-compliance in HR, payroll, and tax is another major pitfall. We’re talking about federal laws like the Fair Labor Standards Act (FLSA), FMLA, ADA, and Title VII, plus all the Maryland-specific regulations around wages, leave policies, and discrimination. And don’t forget proper payroll and tax compliance, which can get incredibly complex. If you’re running a smaller operation, our HR Compliance for Small Business guide breaks down these requirements in plain English.

Workforce eligibility verification continues to challenge employers across the country. Strict I-9 and E-Verify requirements don’t leave much room for error, and remote hiring has only made things trickier.

Beyond these, unethical conduct like conflicts of interest, bribery, or workplace harassment can land your business in serious legal trouble while damaging your reputation. And of course, health and safety compliance through OSHA regulations isn’t optional. Creating a safe working environment protects your people and your business.

What is a compliance failure?

A compliance failure happens when your organization, or someone in it, doesn’t follow applicable laws, regulations, industry standards, or even your own internal policies. Sometimes it’s because people didn’t know the rules. Other times, it’s due to weak processes, insufficient training, or in rare cases, intentional misconduct.

Here’s what makes compliance failures so serious: the consequences don’t stop at a slap on the wrist. You’re looking at legal penalties, substantial fines (check out our I-9 Compliance Penalties guide to see specific examples), financial losses, operational chaos, and damage to your reputation that’s incredibly hard to repair.

The good news? Most compliance failures are preventable. Strong compliance programs paired with continuous monitoring and regular audits catch problems before they snowball into disasters. Think of it as routine maintenance for your business, it’s far cheaper and less painful than emergency repairs.

How often should a compliance program be reviewed?

At minimum, you should review your compliance program at least once a year. The regulatory world doesn’t sit still. New laws appear, existing ones get amended, and your business evolves in ways that introduce fresh risks or change old ones.

That said, annual reviews are often just the baseline. You’ll want to review your program more frequently when certain things happen. If federal or Maryland-specific regulations change significantly, that’s your cue. Major organizational changes like expanding into new markets, mergers, or launching new products also warrant a fresh look at your compliance setup.

Did you have a compliance incident or a close call? That’s actually valuable information highlighting a weakness in your program that needs immediate attention. Even adopting new technologies that affect how you handle data or monitor employees should trigger a compliance review.

The smartest approach treats your compliance program as a living, breathing system that adapts as your business and the regulatory landscape shift. Using an Employer Compliance Checklist during these reviews ensures you’re covering all the critical bases and not overlooking anything important.

Take Control of Your HR Compliance Today

We’ve covered a lot of ground together, and if you’re feeling more confident about tackling compliance risk, that’s exactly what we hoped for. The truth is, navigating the complexities of compliance doesn’t have to keep you up at night or drain your team’s energy. When you understand what compliance risk really means, follow a systematic action plan, and accept the best practices we’ve discussed, something shifts. Compliance transforms from a reactive burden into a proactive strength that actually protects your business.

A robust compliance program does more than just help you avoid penalties. It reduces compliance risk in ways that matter every single day. It fosters trust with your employees, partners, and customers. It protects your reputation. And perhaps most importantly, it frees you up to focus on what you do best: supporting your workforce, growing your business, and achieving your strategic goals.

At Valley All States Employer Service, we understand the weight that HR compliance can place on your shoulders, particularly when it comes to the intricate world of employment verification. That’s exactly why we specialize in helping businesses like yours reduce compliance risk through expert, impartial, and efficient E-Verify processing. We handle the details, minimize errors, and take the administrative burden off your plate so you can breathe a little easier.

You don’t have to figure all of this out alone. Whether you’re struggling with I-9 documentation, trying to stay on top of changing regulations, or simply looking for a partner who can help you build a stronger compliance foundation, we’re here to help.

Ready to simplify your compliance journey and protect your business with confidence? Learn more about Federal I-9 Document compliance and find how we can help your business thrive without the constant worry of non-compliance hanging over your head.