I-9 document requirements: Ultimate 2025 Checklist

Why Understanding I-9 Document Requirements Is Critical for Every U.S. Employer

I-9 document requirements are the foundation of lawful hiring in the United States. Every employer must verify that new hires are authorized to work, and every employee must prove their identity and eligibility. It’s not optional, and getting it wrong can cost you thousands in fines.

Here’s what you need to know:

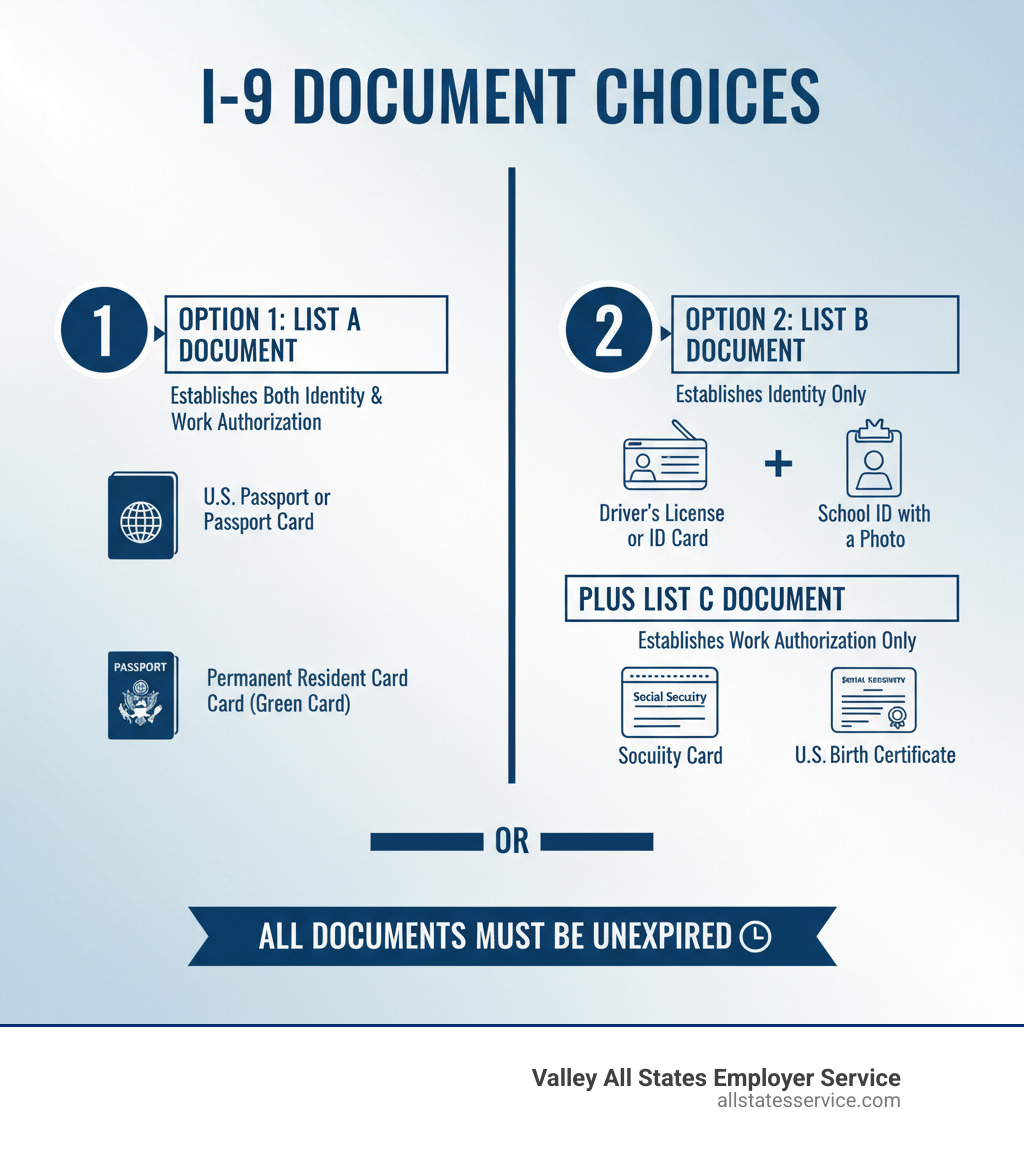

- Employees choose which documents to present from three official lists

- List A documents establish both identity and work authorization (one document only)

- List B + List C documents can be combined (one from each list)

- All documents must be unexpired (with rare exceptions)

- Employers must complete Section 2 within three business days of the employee’s first day

- You cannot tell employees which documents to provide (that’s discrimination)

Form I-9 exists because of the Immigration Reform and Control Act of 1986 (IRCA). This federal law requires all U.S. employers to verify the identity and employment authorization of every person they hire.

The form has three sections. Section 1 is completed by the employee no later than their first day of work, Section 2 is completed by the employer within three business days, and Section 3 is used for reverification or rehires.

The consequences of non-compliance are serious. Employers face fines ranging from $230 to over $20,000 per violation. Even small paperwork errors can add up fast during an audit. Beyond the financial risk, there’s reputational damage and increased scrutiny from immigration authorities.

The good news? Once you understand the document lists and follow the rules, I-9 compliance becomes manageable. This guide breaks down exactly which documents are acceptable, how to handle special situations, and how to avoid the most common mistakes.

What is Form I-9 and Why Is It Crucial?

Form I-9, Employment Eligibility Verification is the document that stands between you and serious legal trouble when it comes to hiring. Every U.S. employer must complete this form for every person they hire, whether they’re a U.S. citizen, permanent resident, or authorized foreign worker. There are no exceptions.

The form does two critical things: it verifies identity (proving the person is who they say they are) and verifies employment authorization (confirming they’re legally allowed to work in the United States). Think of it as the federal government’s way of making sure everyone in the American workforce has the legal right to be there.

All U.S. employers must use Form I-9, from sole proprietors hiring their first employee to multinational corporations. It doesn’t matter if you’re hiring full-time, part-time, seasonal, or temporary workers. If someone is working for compensation, you need an I-9 on file.

Here’s how the timeline works. The employee must complete Section 1 of the form no later than their first day of work, not before they accept the job offer, but definitely by day one. This is where they attest to their work authorization status and provide basic information.

For more details on this critical first step, check out our guide on New Hire Paperwork: I-9.

Then it’s your turn. As the employer, you have three business days from the employee’s first day to complete Section 2. This means physically examining the documents they present, recording the information, and signing off that you’ve done your due diligence.

If you’re hiring someone for less than three business days, you need to complete Section 2 on their first day. Yes, it’s a tight deadline, but it’s non-negotiable. Our I-9 Form Completion guide walks you through every step.

The consequences of non-compliance aren’t something to brush off. Even simple paperwork errors can result in fines ranging from hundreds to thousands of dollars per form. Knowingly hiring unauthorized workers carries much steeper penalties, including criminal charges in severe cases. Immigration and Customs Enforcement (ICE) conducts audits, and when they find violations, they don’t hesitate to issue citations.

Beyond the financial hit, there’s the reputational damage. Being known as the company that cut corners on employment verification isn’t exactly good for business. It invites scrutiny from government agencies and can shake employee and customer confidence.

The good news? Understanding I-9 document requirements and following the process correctly protects you from all of this. Want the complete picture? Start with What is an I-9? to build your foundation.

The Core I-9 Document Requirements: Lists A, B, and C

Understanding I-9 document requirements really comes down to knowing three lists of acceptable documents. Think of these lists as your verification toolkit. The most important thing to remember? The employee gets to choose which documents to present. We can’t tell them what to bring, period.

Here’s how it works: an employee can present either one document from List A or one document from List B plus one document from List C. That’s their call, not ours. Our job is to physically examine whatever they bring, make sure the documents look genuine and relate to the person standing in front of us, and confirm that any documents with expiration dates haven’t expired.

The Handbook for Employers (M-274) is your best friend when you need detailed examples and guidance. And if you want to dig deeper into the verification process itself, check out our guide on Verifying I-9 Documents.

List A: Documents That Establish Both Identity & Employment Authorization

List A documents are the heavy hitters of I-9 verification. They do double duty by proving both who someone is and that they’re authorized to work in the U.S. When an employee presents one of these, you’re done. No other documents needed.

The U.S. Passport or U.S. Passport Card is probably the most straightforward option. It’s the gold standard for proving American citizenship and identity in one go.

The Permanent Resident Card (Form I-551), commonly called a Green Card, is another solid List A document. It proves lawful permanent resident status. Even older card designs remain valid until they expire. If you need more details on using this document, our guide on Filling Out I-9 with Permanent Resident Card walks you through it.

Sometimes you’ll see a foreign passport with a temporary I-551 stamp or temporary I-551 printed notation on a machine-readable immigrant visa. This serves as temporary proof for lawful permanent residents while they’re waiting for their actual card. Just remember these require reverification later.

The Employment Authorization Document (Form I-766) with a photograph, often called an EAD card, is issued by DHS to people authorized to work in the U.S. This is a List A document, not List C. That’s an important distinction that trips people up sometimes.

List B: Documents That Establish Identity Only

List B documents answer one question: who is this person? They don’t say anything about whether someone can legally work in the U.S., which is why they must always be paired with a List C document.

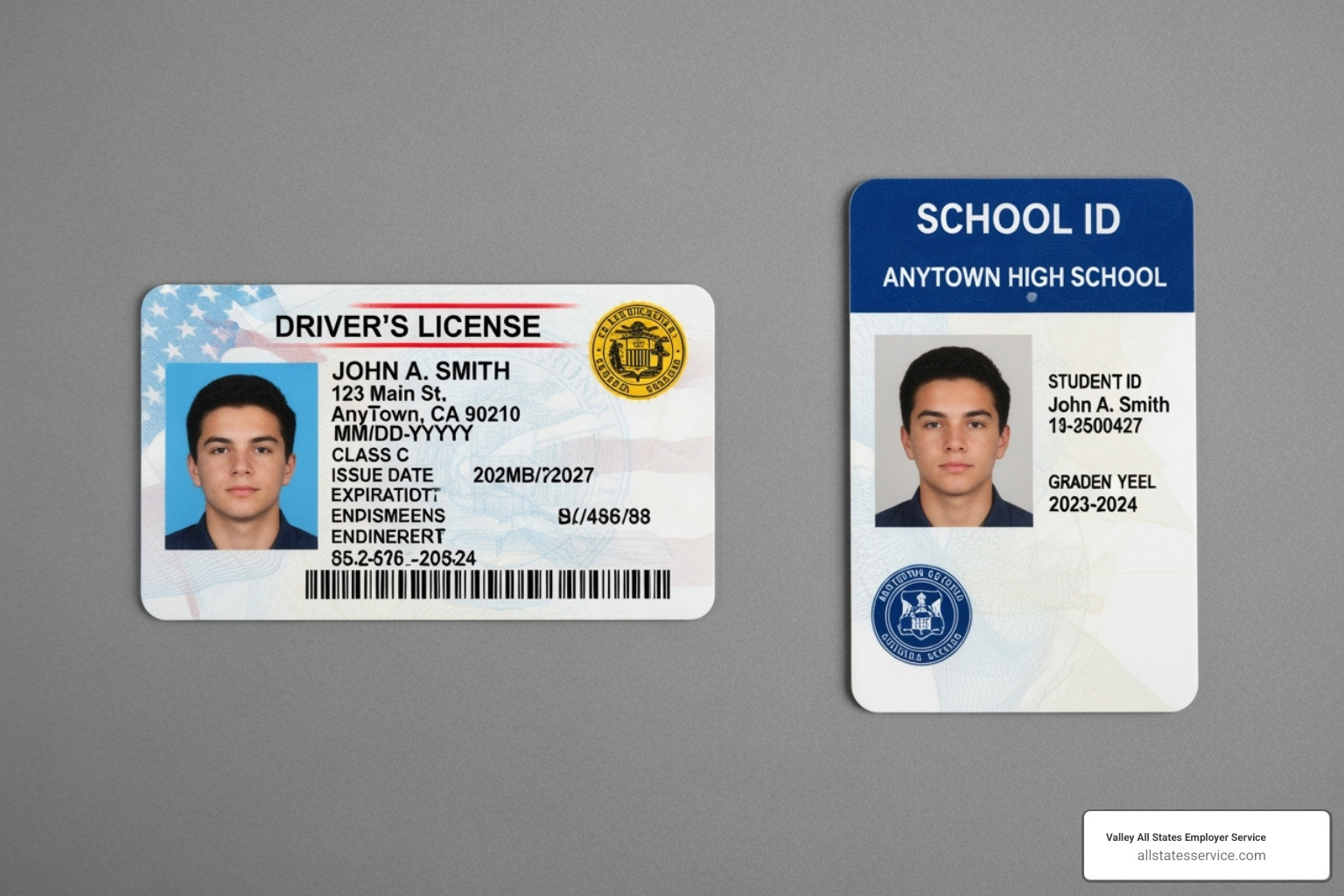

A driver’s license or ID card issued by a U.S. state or outlying possession is probably the most common List B document you’ll see. It needs to have either a photograph or identifying information like name, date of birth, gender, height, eye color, and address.

An ID card issued by federal, state, or local government agencies works the same way. It needs a photograph or the same kind of identifying data you’d find on a driver’s license.

A school ID card with a photograph is popular, especially with younger employees or students. A U.S. Military card or draft record works for those who have served or registered. Military dependents can use a military dependent’s ID card.

For those in maritime professions, the U.S. Coast Guard Merchant Mariner Card is acceptable. Members of federally recognized tribes can present a Native American tribal document. And yes, even a driver’s license issued by a Canadian government authority counts for identity verification.

The thread connecting all these? They prove identity, nothing more.

List C: Documents That Establish Employment Authorization Only

List C documents answer the other half of the puzzle: is this person authorized to work in the United States? They don’t prove identity, so they must always be presented with a List B document to satisfy I-9 document requirements.

The U.S. Social Security Account Number card is probably the most common List C document. But here’s the catch: it can’t have restrictive wording like “NOT VALID FOR EMPLOYMENT,” “VALID FOR WORK ONLY WITH INS AUTHORIZATION,” or “VALID FOR WORK ONLY WITH DHS AUTHORIZATION.” An unrestricted card is perfectly fine.

A Certification of Birth Abroad issued by the U.S. Department of State (Form FS-545 or Form DS-1350) proves U.S. citizenship for people born outside the U.S. to American parents. An original or certified copy of a birth certificate issued by a U.S. state, county, municipal authority, or territory bearing an official seal is the classic proof of citizenship.

One important note: only Puerto Rico birth certificates issued on or after July 1, 2010, are acceptable.

The U.S. Citizen Identification Card (Form I-197) and Identification Card for Use of Resident Citizen in the United States (Form I-179) are less common but perfectly valid.

Then there are employment authorization documents issued by the Department of Homeland Security (DHS). This category includes various forms like Form I-94, Form I-94A, Form I-571 (Refugee Travel Document), or other documents indicating employment authorization from DHS. It’s important to distinguish these from the List A Form I-766, which combines both identity and authorization.

For more details on confirming work authorization, our article on Work Authorization Verification provides additional context.

Special Considerations and Best Practices for Employers

Understanding I-9 document requirements is just the starting point. As employers, we have additional responsibilities that go beyond simply knowing which documents to accept. Getting these details right protects both our business and our employees. Our Employer I-9 Verification Guide walks through these duties in depth.

Let’s talk about document retention first. We’re required to keep every completed Form I-9 for three years after the employee’s date of hire, or for one year after their employment ends, whichever comes later. These forms need to be stored securely and must be available for inspection if officials from the Department of Homeland Security, Department of Labor, or Department of Justice come calling.

While it’s not legally required, it’s smart to keep copies of the documents employees present. This creates a paper trail if questions arise later.

Here’s something critical: anti-discrimination laws are woven into every part of the I-9 process. We cannot, under any circumstances, tell employees which documents to provide. That choice is always theirs.

We can’t ask for extra documents beyond what’s required, and we can’t reject documents that look genuine just because they have an expiration date. Treating employees differently based on citizenship status, immigration status, or national origin isn’t just bad practice, it’s illegal and can result in hefty fines.

Think of our role as impartial examiners. We’re checking that documents appear genuine and relate to the person standing in front of us. Nothing more, nothing less. If we need to make corrections to a completed I-9, we do it on the original form and note the date of the change. For broader guidance on staying compliant across all HR functions, our HR Compliance Consulting service can help.

What Are ‘Acceptable Receipts’ for Form I-9?

Life happens. Documents get lost, stolen, or damaged. Sometimes an employee starts work while their replacement document is still being processed. That’s where acceptable receipts come in.

A receipt serves as temporary proof while the actual document is on its way. An employee can present a receipt in place of a List A, List B, or List C document, but there’s a catch: it’s only valid for 90 days. Within that window, the employee must provide the actual replacement document.

Let’s say someone applied for a replacement Permanent Resident Card because their original was stolen. They can give us the receipt for that application, and we’ll accept it. But when those 90 days are up, we need to see the real Green Card. The Handbook for Employers (M-274) has specific details on which receipts are acceptable and how long they’re valid.

Some receipts are a bit different. A Form I-94 with a temporary I-551 stamp, or a foreign passport with the same stamp, also counts as a receipt for List A documents. These are subject to reverification once the temporary period expires. The key is to mark your calendar and follow up. Missing that 90-day deadline puts you out of compliance.

Special I-9 document requirements for minors

Hiring someone under 18 who doesn’t have a driver’s license yet? No problem. The law recognizes that younger employees might not have standard identification, so there are alternatives.

For employees under 18 who can’t provide a List B document, school records or report cards work perfectly well. So do clinic, doctor, or hospital records. Even daycare or nursery school records are acceptable for our youngest workers.

These alternative documents establish identity only. The employee still needs to provide a List C document to prove employment authorization. When we fill out Section 2 of the I-9, we write “Individual under age 18” in the space for the List B document title. This simple notation shows we followed the rules and accommodated a minor employee properly.

Managing Electronic and Remote I-9 Verification

The workplace has changed dramatically, and so have our options for handling I-9 document requirements. Electronic I-9 systems are perfectly legal, but only if they meet strict DHS standards for electronic generation, storage, and retention. Cutting corners here can lead to serious penalties.

Here’s a common mistake: using a fillable PDF and thinking you’re electronic. If you’re using a standard fillable PDF version of Form I-9, both the employee and employer must print it out and sign it by hand. Simply typing in a signature or using an electronic signature tool on a fillable PDF typically doesn’t meet DHS requirements.

If you want a truly electronic system, you need software specifically designed to comply with federal standards. Our Electronic I-9 Solutions can help you steer these options.

The traditional rule is clear: we must physically examine original documents in person. However, DHS has occasionally authorized alternative procedures, especially during emergencies like the COVID-19 pandemic. During those periods, virtual inspection via video call was permitted, though it often required a follow-up in-person inspection once the flexibility period ended.

If you use an authorized representative to examine documents for remote employees, remember this: you’re still on the hook for any mistakes. That representative is acting on your behalf, which means their errors become your errors. Choose carefully and provide thorough training.

For detailed guidance on handling remote verification, check out our articles on USCIS I-9 Remote Verification and I-9 Verification Process for Remote Employees. Staying current with DHS guidance is essential, especially as policies evolve.

Frequently Asked Questions about I-9 Documents

We understand that I-9 document requirements can be a maze of regulations. To help clarify common concerns, here are answers to some of the most frequently asked questions we encounter.

What are the penalties for I-9 non-compliance?

Ignoring or improperly handling Form I-9 can be a costly mistake for employers. The consequences for non-compliance are severe and can include significant financial penalties, legal complications, and reputational damage.

Penalties vary depending on the nature and severity of the violation:

- Paperwork Violations: For technical or substantive errors, such as incorrect dates, missing fields, or improper document recording, fines can range from $230 to $20,130 per violation. These fines are cumulative, meaning multiple errors on multiple forms can quickly add up.

- Knowingly Hiring or Continuing to Employ Unauthorized Individuals: This is the most serious offense. Penalties for each unauthorized employee can range from $573 to $20,130, and may also include criminal charges, imprisonment, and debarment from government contracts.

U.S. government officials from the Department of Homeland Security (DHS), Department of Labor (DOL), and Department of Justice (DOJ) regularly conduct I-9 audits. These audits can uncover past errors, leading to substantial fines even years after an employee was hired. It’s a stark reminder that attention to detail is paramount. For a comprehensive look at the risks, see our guide on I-9 Compliance Penalties.

Can an employer tell an employee which documents to provide?

Absolutely not. This is a crucial point regarding anti-discrimination laws in the I-9 process. Employers cannot tell an employee which specific documents from the Lists of Acceptable Documents they must provide. Employees have the right to choose which documents they wish to present, as long as they meet the requirements of either List A or a combination of List B and List C.

Specifying which documents an employee must provide, or requesting more documents than are legally required, is considered discriminatory. This is because such actions can lead to unlawful treatment based on an individual’s citizenship, immigration status, or national origin. The Form I-9 itself includes an anti-discrimination notice to highlight this.

Our responsibility is to provide the employee with the Lists of Acceptable Documents and allow them to make their choice. This ensures a fair and lawful hiring process for everyone.

If an employee believes they have been discriminated against based on their national origin, citizenship, or immigration status, resources like the Immigrant and Employee Rights Section (IER) hotline (800-255-7688) or the Equal Employment Opportunity Commission (EEOC) (800-669-4000) are available for assistance.

How does E-Verify relate to I-9 document requirements?

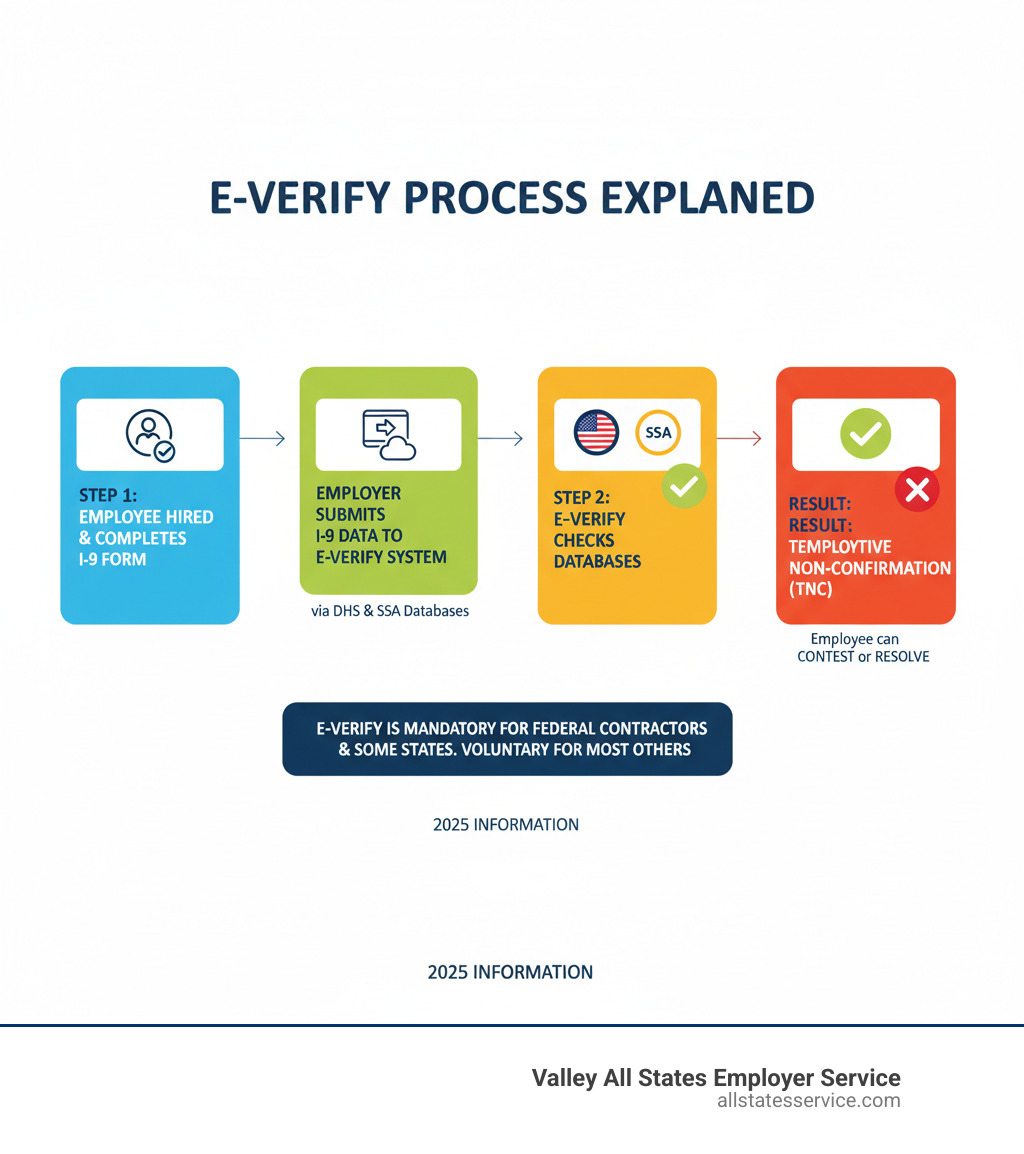

E-Verify is an internet-based system operated by the DHS and Social Security Administration (SSA) that allows employers to electronically confirm the employment eligibility of their newly hired employees. While it’s closely tied to Form I-9, it’s important to understand that they are separate but complementary systems.

E-Verify essentially takes the information provided on the Form I-9 and cross-references it with government databases to confirm work authorization. If an employer participates in E-Verify (which is mandatory for some federal contractors and in certain states, but voluntary for most), employees must provide their Social Security number in Section 1 of Form I-9.

This is a mandatory requirement for E-Verify participants, even if the employee would typically use a List A document that doesn’t require an SSN.

The system also includes a photo matching tool for certain List A documents, adding another layer of verification. It’s a powerful tool for ensuring compliance, but it doesn’t replace the need to properly complete and retain the physical or electronic Form I-9. For a detailed understanding of how these two systems work together, our I-9 and E-Verify Compliance Guide is an invaluable resource.

Be aware that E-Verify records from cases last updated on or before December 31, 2015, will be disposed of by USCIS on January 5, 2026. Employers using E-Verify should download any necessary records before January 4, 2026.

Simplify Your I-9 and E-Verify Compliance

Let’s be honest: keeping up with I-9 document requirements and E-Verify rules can feel overwhelming. Between tracking deadlines, examining documents, and worrying about audits, it’s easy for compliance to eat up hours of your week. And with penalties reaching thousands of dollars per violation, the pressure to get everything right is real.

We get it. That’s exactly why Valley All States Employer Service exists. We take the complexity of I-9 and E-Verify compliance off your plate entirely. Our team specializes in providing outsourced E-Verify workforce eligibility verification and comprehensive employment compliance solutions.

What makes us different? We’re experts at impartial, efficient E-Verify processing that minimizes errors and cuts your administrative burden dramatically.

Think of us as your compliance safety net. While you focus on running your business and building your team, we handle the nitty-gritty details. We ensure every Form I-9 is completed correctly, every document is properly examined, and every E-Verify case is processed without a hitch.

We stay current on federal regulations so you don’t have to, giving you the peace of mind that comes with knowing you’re fully protected.

Whether you’re managing a small team or a large workforce with high turnover, whether your employees are all local or scattered across remote locations, we’ve designed our services to keep you compliant no matter what. Our E-Verify Employer Agent Service takes the guesswork out of workforce verification, handling everything from initial processing to follow-up on mismatches.

The bottom line? You shouldn’t have to become an I-9 expert just to hire people. That’s our job, and we’re really good at it. When you partner with us, you’re not just reducing risk, you’re freeing up your HR team to focus on what matters most: finding great people and helping them succeed.

Ready to simplify your compliance and get back to growing your business? Reach out to our team today and find how much easier employment verification can be. For a complete deep dive into everything I-9 related, check out Form I-9: The Ultimate Guide on our site. We’re here to make compliance simple, so you can focus on what you do best.