I-9 Compliance Solutions 2025: Secure Your Business

Why I-9 Compliance Is More Critical Than Ever

I-9 compliance solutions help employers verify employee eligibility, avoid costly fines, and stay audit-ready. Here’s what they offer:

- Electronic Form I-9 platforms with built-in error checking

- E-Verify integration for automated work authorization confirmation

- Remote verification services using authorized representatives

- Audit support and digital storage to meet federal retention requirements

- Expert consulting for policy review and ICE inspection preparation

Every U.S. employer must complete Form I-9 for each new hire. It sounds simple, but the stakes are incredibly high.

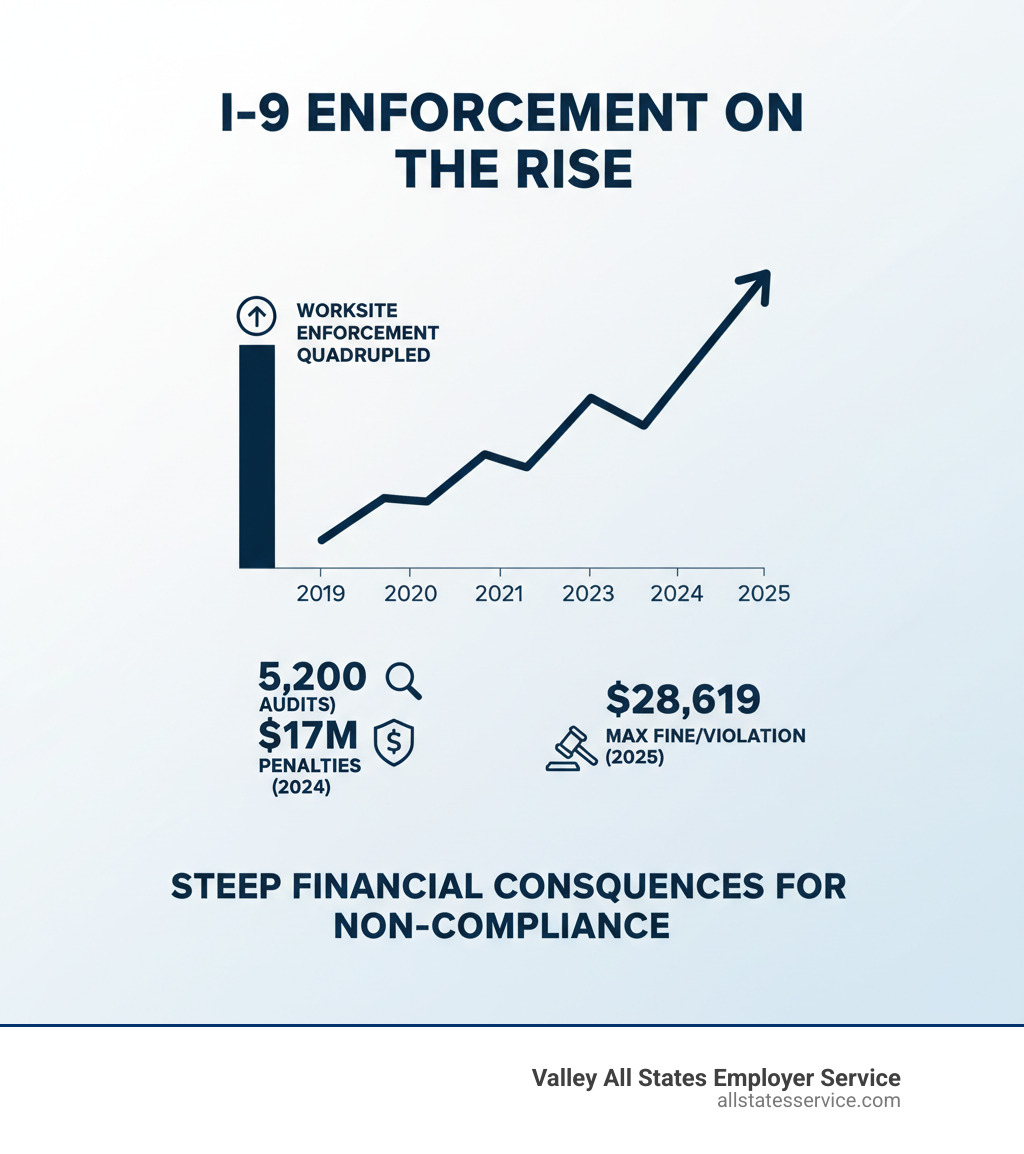

In fiscal year 2024 alone, U.S. Immigration and Customs Enforcement (ICE) conducted 5,200 I-9 audits and imposed $17 million in fines. With worksite enforcement quadrupled since 2019 and penalties climbing to $28,619 per violation in 2025, the risk has never been greater.

The problem is that Form I-9 is deceptively complex, containing over 300 possible errors. A simple mistake like a missing signature or incorrect date can trigger penalties from $272 to $2,789 per form. Knowingly hiring unauthorized workers leads to even steeper fines.

The rise of remote work adds another layer of complexity. Temporary COVID-19 flexibilities have ended, and employers must now steer complex rules for remote document inspection using authorized representatives, all while maintaining strict compliance.

This is where I-9 compliance solutions come in. Whether you’re a small business or a large enterprise, the right tools and partners can transform I-9 verification from a compliance headache into a streamlined, audit-ready process.

The Growing Complexity: Common Pitfalls and the Rise of Remote Work

Form I-9 used to be straightforward. An employee walked into your office, you checked their documents, and you filed the paperwork. Not anymore.

The shift to remote and hybrid work has transformed this once-simple process. We’re now dealing with distributed teams, virtual onboarding, and evolving regulations that create new compliance risks that catch even well-intentioned employers off guard.

Every U.S. employer must complete Form I-9 for each new hire, regardless of citizenship. It’s federal law, and the rules apply to everyone, from a three-person startup to a Fortune 500 company. The consequences of getting it wrong range from substantial fines to serious legal trouble. To get a full picture of what’s at stake financially, check out our guide on I-9 Compliance Penalties.

Navigating the Minefield of Common I-9 Errors

Form I-9 is a minefield with over 300 possible errors, divided into substantive and technical categories, each with its own penalty structure.

Common mistakes include missing signatures, incorrect dates, and incomplete sections where employees or employers leave fields blank. Document inspection mistakes, like accepting expired documents, and timeliness issues are also frequent. Section 1 must be completed by the employee’s first day, and employers have three business days to complete Section 2. Missing these deadlines means an immediate violation.

The financial stakes are real. The USCIS can fine employers between $280 and $2,800 per form for technical errors, with substantive violations costing up to $2,789 per form. Knowingly hiring an unauthorized worker multiplies those fines. Most I-9s contain at least one error, posing a real threat that can cost your business thousands in an audit.

The Remote Work Revolution and I-9 Challenges

Remote work didn’t just change where we work; it disrupted the I-9 verification process. The temporary COVID-19 flexibilities that allowed virtual inspection have ended.

Now, employers enrolled in E-Verify can use the alternative procedure for remote verification. This involves an authorized representative examining document copies via a live video call. For hybrid employees, a physical inspection is required later, but fully remote workers can stick to the remote process under certain conditions.

Crucially, you, the employer, remain liable for any errors made by your authorized representative. They must have clear instructions and understand the strict requirements for document review.

This complex landscape is why Remote I-9 Compliance solutions are essential. With specific regulations and steep penalties, a proper support system is necessary to protect your business.

Your Shield Against Audits: Key Features of Modern I-9 Compliance Solutions

The thought of an ICE audit is daunting, but modern I-9 compliance solutions can transform this threat into a manageable part of your operations. These tools build a foundation of audit readiness, mitigate risks, and bring efficiency to your hiring process.

Instead of scrambling for a Notice of Inspection, you’ll have everything organized and ready. This allows your HR team to focus on strategic tasks, not paperwork. Technology is key to this shift, as detailed in our insights on Electronic I-9 Solutions.

Core Components of Effective I-9 compliance solutions

An effective I-9 compliance solution is more than a digital form; it integrates intelligence and automation into every step.

The backbone is error-checking algorithms and smart validation. These tools catch mistakes in real-time, guiding users through Sections 1 and 2 to prevent many of the 300+ possible errors. This feature alone can save thousands in potential fines.

Centralized digital storage replaces paper files with a secure, searchable platform. This is essential for quick retrieval during audits and protects data with strong encryption, often meeting SOC2 Type 2 standards.

Automated reverification alerts track work authorization expiration dates, preventing missed deadlines. Purge notifications help you comply with federal retention rules by telling you when to securely destroy old forms, avoiding the risks of keeping them too long. These features reduce your administrative burden while making your I-9 process more accurate. For a deeper dive, visit our guide on I-9 Form Management.

Streamlining with Technology: Electronic I-9s and E-Verify

Combining electronic platforms with E-Verify integration is a game-changer, turning a days-long process into minutes.

Electronic I-9 platforms let employees complete Section 1 from any device with guided instructions and error-checking. For Section 2, employers can electronically attach documents, eliminating lost paperwork and speeding up onboarding.

Advanced solutions feature E-Verify integration. E-Verify is a government system that confirms employment eligibility. Instead of manual double-entry, an integrated solution automatically submits I-9 data to E-Verify, saving time and effort.

This automated E-Verify submission eliminates duplicate data entry, reduces processing time, and provides real-time tracking for verification results. If a Tentative Non-Confirmation (TNC) occurs, the system guides you through the next steps. The result is less manual work, faster onboarding, and higher accuracy. Want to understand how these two critical systems work together? Our comprehensive page on E-Verify and I-9 breaks it all down.

Ensuring Security and Audit-Readiness

Handling sensitive I-9 data requires top-tier security. A reliable I-9 compliance solution prioritizes data protection with multiple safeguards.

Data security is paramount. Look for solutions with end-to-end encryption and SOC2 Type 2 certification, which verifies that the provider meets high standards for security and operational controls.

Audit trails are also crucial. They create an unalterable log of every action taken on an I-9, providing a complete history that demonstrates good-faith compliance during an audit.

Federal document retention rules require you to keep I-9s for three years after hire or one year after termination, whichever is later. Digital solutions automate this by alerting you when it’s time to purge old records, preventing legal risks from over-retention.

When ICE gives you a three-day Notice of Inspection, a digital system is invaluable. It allows for instant, organized retrieval of all necessary forms and reports, making the tight deadline manageable. This level of organization gives you confidence that you’re always audit-ready. For more details on meeting federal requirements, explore our guide on I-9 Record Keeping.

Choosing Your Partner: Types of Solutions and What to Look For

Selecting the right I-9 compliance solution is a critical decision. It’s not a one-size-fits-all situation. Making an informed choice means understanding your business’s unique needs, considering scalability, and evaluating the different types of solutions available. Our goal is to help you find a partner that simplifies your compliance journey. For more on finding the right provider, visit our page on Compliance Solution Providers.

Finding the Right Fit: Types of I-9 compliance solutions

The market offers a range of I-9 compliance solutions, each designed to address different organizational needs. We typically see three main categories:

| Solution Type | Description | Best For |

|---|---|---|

| DIY Software (SaaS Platforms) | Your team uses a subscription-based platform to manage I-9s electronically. Includes error-checking, E-Verify integration, and storage. You handle all data entry and document review. | Companies with in-house HR teams that want control over the process but need powerful tools to ensure accuracy and efficiency. |

| Full-Service Outsourcing | A third-party provider manages the entire I-9 and E-Verify process, from sending forms to new hires to managing remote verification, reviewing documents, and storing forms. They act as an extension of your HR team. | Businesses of all sizes that want to minimize administrative burden, reduce risk, and ensure expert oversight without hiring a dedicated compliance manager. |

| Consulting and Audit Services | Engage experts for specific needs like internal audits, policy development, or staff training. This focuses on strategy and risk assessment rather than daily processing. Ideal for improving internal processes or responding to an audit. | Organizations that have an existing process but need to validate its compliance, address specific challenges, or prepare for a government inspection. |

Your Checklist for Selecting an I-9 Partner

When choosing an I-9 compliance solution, use this checklist to guide your decision:

- Seamless E-Verify Integration: Does the solution offer automatic submission to E-Verify? Can it track results in real-time and provide alerts for TNCs?

- Robust Remote Verification Options: Does the solution support the current alternative procedure for remote I-9 verification? Can it manage authorized representatives effectively?

- Comprehensive Audit Support: What happens if you receive a Notice of Inspection (NOI)? A good solution should provide detailed audit trails, easy retrieval of forms, and expert remediation services.

- User-Friendliness and Intuitive Design: Is the platform easy for both employees and HR to use? Look for guided completion and smart validation.

- Strong Security Protocols: How does the solution protect sensitive employee data? Look for features like data encryption and SOC2 Type 2 compliance.

- Expert Support and Consulting: Does the provider offer access to I-9 experts for compliance questions, training, and policy review?

- Fraudulent Document Review Capabilities: Can the solution help identify potentially fraudulent documents? Some providers offer services where document experts review suspicious IDs.

- Scalability: Can the solution grow with your business, from a few hires to hundreds annually?

Our I-9 Audit Services emphasize these very points, ensuring our clients are prepared for any inspection.

The Benefits of Outsourcing to a Third-Party Expert

For many businesses, the complexity of I-9 compliance makes outsourcing to a third-party expert an attractive option. This lets you focus on your core business, not paperwork.

Here are the compelling benefits of using an outsourced I-9 compliance solution:

- Reduced Administrative Burden: Frees your HR team from manual form completion, document tracking, and reverification reminders, saving countless hours.

- Expert Guidance and Accuracy: Specialists stay current on all regulations and trends, ensuring higher accuracy and reducing the risk of costly errors.

- Minimized Risk: Reduces your exposure to compliance violations and penalties. Experts handle complex requirements like remote verification and E-Verify.

- Improved Consistency: Ensures a consistent, compliant process across all locations, which is a strong defense in an audit.

- Focus on Core HR Functions: Allows your HR team to focus on strategic initiatives like talent development and employee engagement instead of administrative tasks.

Outsourcing isn’t just about offloading a task; it’s about partnering with specialists who can provide peace of mind and strategic advantage. Learn more about how we can help with Outsourced Compliance Solutions.

Frequently Asked Questions about I-9 Compliance

Employers often have the same questions about I-9 compliance. The rules can be confusing, and the stakes are high. Here are answers to the most common questions we hear.

What’s the biggest mistake employers make with Form I-9?

The biggest mistake is assuming Form I-9 is simple. While it’s only one page, there are over 300 ways to make an error. This assumption leads to two critical errors.

First, failing to complete Section 2 on time. You have exactly three business days from the hire date to finish Section 2. Missing this deadline is a common and avoidable violation.

Second, improperly inspecting documents. This includes not physically examining original documents (or following remote procedures correctly), accepting unapproved documents, or recording information incorrectly. You must verify that documents appear genuine and relate to the employee.

These are compliance violations that cost $272 to $2,789 per form. Our I-9 Section 2: Complete Guide can help you avoid them.

Can I use a notary for remote I-9 verification?

Yes, but it’s critical to understand that using a notary doesn’t transfer your liability. As the employer, you are always responsible for any mistakes made by your authorized representative.

When you designate an authorized representative, their errors become your errors. If they accept an invalid document or miss a signature, you face the penalties. Most notaries are not I-9 compliance specialists and may not know how to spot fraudulent documents or understand the nuances of acceptable IDs for employment verification.

For the permanent alternative procedure for remote verification, a notary can conduct the video review, but you must provide them with clear instructions. A better option is to train them or partner with a service that manages this for you.

If you’re looking for guidance on this specific challenge, we’ve put together a helpful resource: Where to Find Notary for I-9 Verification for Remote Employees.

Do I need to use E-Verify?

Whether you need to use E-Verify depends on your business and location. E-Verify is a web-based system that confirms employment eligibility. For some, it’s mandatory; for others, it’s optional but highly recommended.

Federal contractors with a Federal Acquisition Regulation (FAR) E-Verify clause in their contract must use E-Verify.

State and local laws are also a factor. While voluntary at the federal level for most private employers, many states require E-Verify for certain businesses, such as state contractors or those of a certain size. Be sure to check requirements for your specific location, like Maryland.

Even when not required, many employers use E-Verify voluntarily. It’s a powerful tool for ensuring a legal workforce, reducing risk, and demonstrating good-faith compliance during an audit.

The bottom line is you need to know your obligations. Our comprehensive guide, What Employers Are Required to Use E-Verify?, breaks down federal and state-specific laws.

Conclusion: Secure Your Business and Streamline Your Hiring

I-9 compliance is complex and the stakes are high, with increasing ICE audits and steep penalties. However, the right I-9 compliance solutions can transform this challenge into a smooth, efficient part of your hiring process.

Electronic platforms, E-Verify integration, and secure remote verification options all work together to protect your business and simplify hiring. Whether you choose software, outsourcing, or consulting, you gain peace of mind.

It’s not just about avoiding fines. It’s about building confidence in your compliance, streamlining hiring, and freeing up your HR team to focus on growing your business.

At Valley All States Employer Service, we specialize in expert E-Verify and workforce eligibility verification. We help businesses across the U.S., including in Maryland and Lutherville MD, minimize errors and reduce administrative burdens. With our deep compliance knowledge, you get a partner invested in your success.

The world of I-9 compliance is always changing, but you don’t have to steer it alone. The right partner and tools will help you secure your business, protect your workforce, and hire with confidence.

Ready to take the next step? Explore our Federal I-9 Documents for essential resources, or reach out to our team to discuss how we can help your specific situation. Let’s make compliance one less thing you have to worry about.