Automated Employment Verification System: 4 Steps to Success

Why Manual Employment Verification Is Holding Your HR Team Back

An automated employment verification system is a digital platform that instantly confirms an employee’s job and income history. It replaces manual paperwork and phone calls with a secure, 24/7 connection between employers, verifiers (like lenders or landlords), and employees. This allows for instant verification for loans, housing, and benefits.

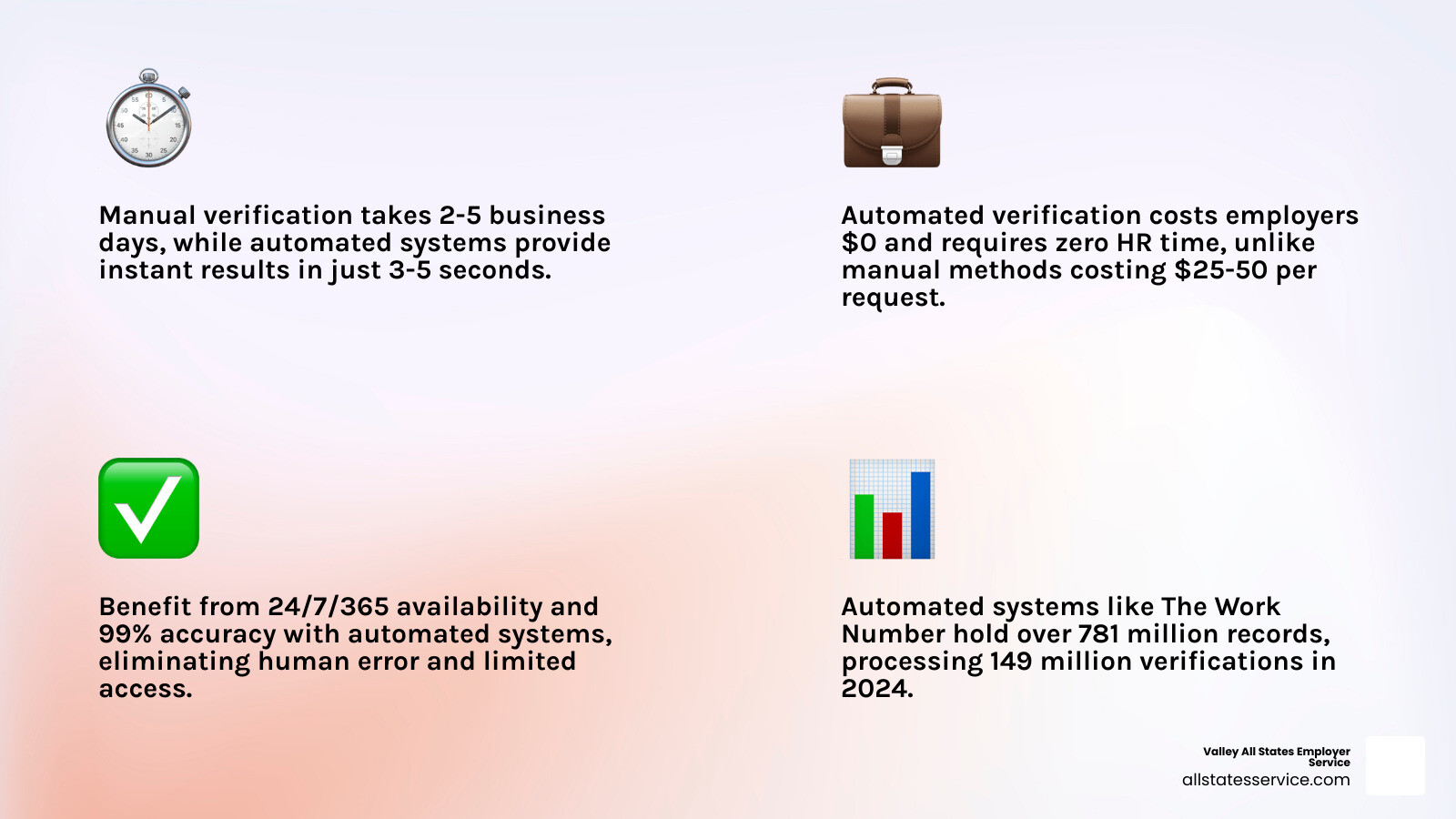

If your HR team is drowning in verification requests, you understand the problem. Manual checks take 15-30 minutes each, create liability risks, and delay important life events for your employees. With nearly 150 million verification requests processed in 2024, the burden on HR teams using outdated methods is immense. In contrast, automated systems allowed 52 million people to get verified outside of business hours in the same year.

These systems solve the problem by creating a secure bridge between your payroll data and credentialed verifiers. When an employee applies for a mortgage, the lender gets the data they need in seconds. Your HR team is free to focus on strategic work, and your employees get faster answers.

Key benefits of automation include:

- Instant results: Verification in seconds, not days.

- Reduced HR workload: Eliminates manual calls and paperwork.

- Lower costs: Most systems are free for employers.

- 24/7 availability: Verification happens anytime.

- Better compliance: Built-in privacy and FCRA protections.

What Is an Automated Employment Verification System?

Imagine an HR department free from the constant interruption of verification phone calls. No more digging through files for employment dates or signing stacks of forms. This is what an automated employment verification system makes possible.

These digital platforms handle the entire verification process for you. Instead of your staff manually responding to every request, the system provides instant, secure access to employment and income data. When an employee applies for a loan or apartment, the information flows automatically from your payroll system to the verifier.

The purpose is simple: deliver fast, accurate data when it matters most. These systems cut verification time from days to seconds, helping your employees get quicker answers on loans, housing, and credit applications while your HR team focuses on strategic work.

The Core Function: Instant, Secure Data Exchange

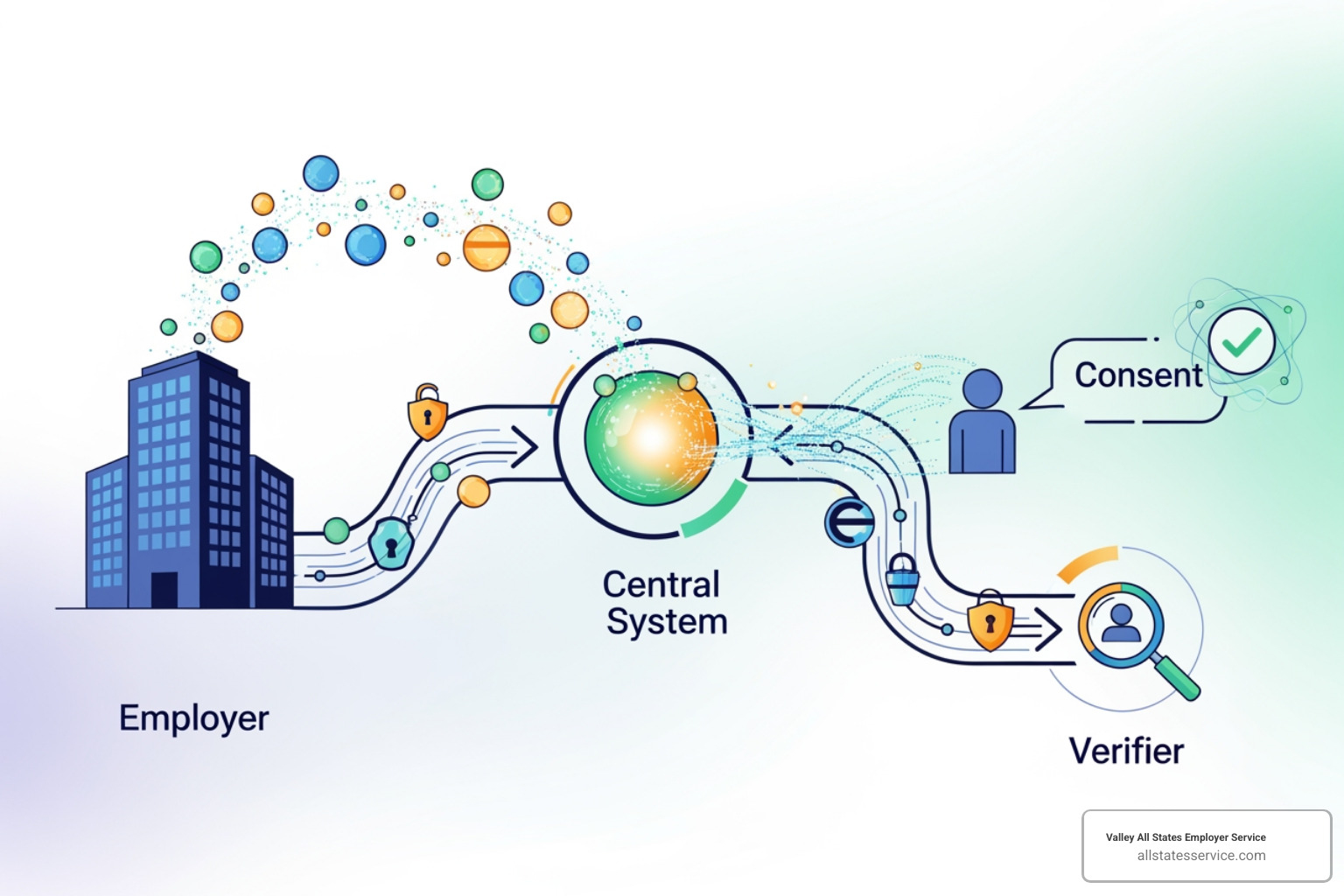

At the heart of an automated employment verification system is a secure data repository with employment and income records from thousands of employers. When a verifier needs to confirm an employee’s information, they access this repository through a secure portal.

A crucial safeguard is that all verifiers must be credentialed. They have to prove they are a legitimate entity with a permissible purpose, such as processing a mortgage application. This process, combined with strong security protocols, significantly reduces fraud risk and protects employee data. Verifiers get what they need in seconds, and your HR team is removed from the process entirely.

You can learn more about how these services function in our Employment Verification Service Complete Guide and explore the full scope of Employment and Income Verification Services available today.

Manual vs. Automated Verification: A Clear Comparison

The difference between manual and automated verification is stark.

| Feature | Manual Verification | Automated Verification |

|---|---|---|

| Turnaround Time | Slow (2-5 business days) | Instant (3-5 seconds) |

| Administrative Cost | High (HR staff time) | Low to none for employers |

| Accuracy | Prone to human error | High (data from payroll) |

| Data Security | Risk of unauthorized disclosure | Improved (encryption, audit trails) |

| Availability | Limited to business hours | 24/7 access |

| HR Involvement | High (direct handling) | Minimal to none |

Manual processes tie up your HR team during business hours, leaving employees waiting. Automated systems provide instant verification anytime, day or night. The data comes directly from your payroll, ensuring accuracy and security. This allows your HR team to focus on initiatives that improve your workplace culture and business outcomes.

How an Automated Employment Verification System Works

The process behind an automated employment verification system is straightforward, involving four key players: your company, your employee, the verifier, and the system itself.

Step 1: Data Contribution

Your company’s payroll and HR data flows into the verification system through a secure, encrypted connection. This happens automatically in the background, pulling details like job titles, hire dates, and income directly from your payroll system. This initial step helps you Streamline HR Processes without creating extra work.

Step 2: Employee Consent

When an employee applies for a mortgage or loan, they must give explicit permission for the verification to occur. This consent is a legal requirement under the Fair Credit Reporting Act that protects employee privacy. Without the employee’s consent, the process stops.

Step 3: Verifier Request

The lender or landlord, known as a credentialed verifier, submits a request to the system. They must prove they are a legitimate entity with a valid reason, or “permissible purpose,” to access the data. The system confirms the verifier’s credentials and the employee’s consent before proceeding.

Step 4: Instant Verification Report

Once all checks are passed, the system generates a verification report and delivers it to the verifier in seconds. The entire process happens without involving your HR team, saving time and ensuring the employee gets a fast response.

Integrating with Your Existing HR & Payroll Platforms

An automated employment verification system is designed to integrate with the software you already use. These systems use API integration, a secure connection between your payroll software and the verification database. Whether you use ADP, Workday, Oracle, or another major platform, a direct integration is likely available.

This connection creates a seamless, automatic data flow. Each time you process payroll, the updated information is sent to the verification system. There are no manual exports or data entry, which ensures the verification database is always current. This is especially smooth for businesses using a Web-Based Payroll Service, as cloud platforms are built for this type of integration.

The result is an up-to-date, accurate system that requires zero time from your HR team for routine verification requests.

The Top Benefits of Automation for Employers and Employees

Adopting an automated employment verification system creates tangible benefits for everyone involved. It builds a more efficient, secure, and supportive environment where HR teams are less burdened and employees can move forward with their lives faster.

Key Benefits for Employers

For HR departments, automation delivers advantages that impact the bottom line and daily operations.

- Reduced HR Workload: Your team is freed from answering verification calls and can focus on strategic initiatives like retention and development. This is a key way to Improve HR Efficiency.

- Lower Administrative Costs: Eliminating manual processes saves labor hours. Many automated services are free for employers, making the time savings even more impactful.

- Mitigated Compliance Risk: These systems are built with regulations like the FCRA in mind, reducing your risk of errors and unauthorized disclosures. Outsourcing verification to a compliant system shifts liability away from your team, as detailed in our Outsourced Employment Verification Ultimate Guide.

- Improved Data Security: Advanced encryption and strict verifier credentialing offer a much higher level of protection for sensitive employee data than manual methods.

- Improved Employee Satisfaction: Facilitating faster verifications shows you support your team during important life events, which builds loyalty and morale.

Key Benefits for Employees

Your employees gain significant advantages from an automated employment verification system, making stressful moments in life easier.

- Faster Loan and Credit Decisions: Instant confirmation of employment and income means mortgage approvals, car loans, and credit applications move forward without delay.

- 24/7 Access to Verification: Automated systems work around the clock. In 2024, 52 million people benefited from instant verifications outside of regular business hours.

- Improved Privacy: With minimal contact between verifiers and HR and a strict credentialing process, sensitive data only reaches authorized parties.

- Control Over Personal Data: Many systems offer employee self-service portals where workers can review their data and track verification requests, giving them more control over their personal information.

Key Players and Technologies in Automated Verification

The world of automated employment verification systems includes several innovative companies. Understanding the landscape can help you choose the right solution. Most providers use one of two models: a centralized database where employment data is stored, or a direct API integration that connects verifiers to your payroll system in real time. For help evaluating providers, our guide on choosing a reliable Background Verification Company offers valuable insights.

Major Database Providers

The most prominent players in this space, like The Work Number by Equifax, operate massive databases. They collect payroll data from millions of employers, creating a vast repository of over 781 million employment records.

The process is simple: employers contribute payroll data through a secure, automated feed. When a credentialed verifier with a permissible purpose requests information, the system pulls it from the database and delivers a report in seconds. This model has become an industry standard, fulfilling 149 million verification requests in 2024 alone.

Other Leading Solutions

While large databases dominate, other providers offer compelling solutions for an automated employment verification system, often with specialized features.

- Payroll-Integrated Solutions: Providers like ADP offer verification services that integrate seamlessly with their own payroll platforms. This is a convenient option for existing clients, as it leverages their current HR technology stack for verification.

- API-First Providers: Some companies, such as Vault Verify (now part of Equifax), focus on real-time API integrations. This approach creates a secure bridge between your payroll system and verifiers, offering more granular control over data access.

- Comprehensive Screening Services: Companies like HireRight include employment verification as part of a broader suite of background screening and workforce solutions. Their strength is often in global reach and comprehensive pre-employment checks.

- Specialized and Niche Providers: Other services, like EmpInfo, focus on the end-to-end experience for employers, employees, and verifiers. Niche providers like Tyler Technologies cater to specific sectors, such as public sector organizations, by integrating verification into their existing ERP software.

Each provider offers a different approach, from seamless payroll integration to advanced API capabilities. They all share the goal of making verification faster and more secure than manual methods.

E-Verify vs. Employment & Income Verification: What’s the Difference?

It’s a common point of confusion for employers: are E-Verify and employment verification the same thing? The answer is no. While both involve confirming employee information, they serve entirely different purposes. Understanding this distinction is essential for compliance and efficiency, especially for proper Workforce Eligibility Verification.

Think of it this way: one system confirms the legal right to work, while the other confirms job history and income for financial reasons.

E-Verify: Confirming the Right to Work

E-Verify is a web-based system run by the U.S. government. Operated by the Department of Homeland Security (DHS) and the Social Security Administration (SSA), its sole purpose is to confirm that an employee is legally authorized to work in the United States.

After a new hire completes their Form I-9, you enter their information into the E-Verify system. The system checks the data against federal records to confirm work authorization, usually in seconds. You can find more details at the government’s What is E-Verify page.

E-Verify does not provide any information about income, salary, or employment history for financial purposes. It is strictly for immigration compliance. While voluntary for many, E-Verify is required for federal contractors and in certain states. Our guides on E-Verify and I-9 and What Employers Are Required to Use E-Verify can help you determine your obligations.

Employment Verification: Confirming Job History and Income

An automated employment verification system is a service offered by private companies to confirm an individual’s job history, employment status, and income.

These systems are used when an employee applies for a mortgage, loan, or apartment. The lender or landlord needs to verify financial stability, and these platforms provide that information instantly. The data typically includes employment dates, job titles, and income details.

The critical point is that these systems do not fulfill I-9 or E-Verify requirements. You cannot use an income verification report for work authorization, and you cannot use E-Verify to help an employee get a loan. They are separate tools for separate needs. For a deeper dive, see our Employment Verification Process Ultimate Guide.

Navigating Compliance and the Future of Verification

When you use an automated employment verification system, you are handling sensitive employee information. Security and compliance must be built into the process from the start. Reputable automated systems take this responsibility seriously, using advanced technology to protect data and adhere to privacy laws.

How Systems Ensure Data Security and Privacy

Data security in these systems is multi-layered. Key features include:

- Encryption: Data is scrambled using powerful protocols like FIPS 140-2, a government-approved standard, both in transit and at rest.

- Secure Data Centers: Information is stored in facilities with robust physical security, including biometric access controls and 24/7 monitoring.

- Verifier Credentialing: Every organization requesting data is thoroughly vetted to ensure they are legitimate and have a permissible purpose.

- SOC 2 Type 2 Certification: Many leading providers undergo this independent audit, which confirms they have strong controls for security, confidentiality, and privacy.

- Audit Trails: The system logs every data access request, creating transparency and accountability.

These measures provide a much higher level of security than manual processes. For more on related security, see our information on Social Security Identity Checks.

Your Compliance Obligations: FCRA and CCPA

Legal compliance is just as important as technology. Two key laws governing this space are the Fair Credit Reporting Act (FCRA) and the California Consumer Privacy Act (CCPA).

The Fair Credit Reporting Act (FCRA) is a federal law that sets the rules for sharing employment and income data. Under FCRA, verifiers must have a permissible purpose, such as processing a credit application, to access data. Employee consent is also typically required, and the data must be accurate, with a clear process for employees to dispute errors. You can review the Act on the Consumer Financial Protection Bureau website.

The California Consumer Privacy Act (CCPA) gives California residents more control over their personal data, including the right to know what information is collected and to request its deletion. The official California Consumer Privacy Act page has more details. Automated systems must have features that allow employees to exercise these rights.

Navigating these regulations can be complex. Partnering with a specialized provider that builds compliance into its automated employment verification system is a smart way to ensure strong HR Regulatory Compliance and reduce the burden on your team.

Conclusion: Accept Efficiency and Empower Your Workforce

Shifting from manual checks to an automated employment verification system is a fundamental move toward greater efficiency, security, and employee empowerment. It frees your HR team from administrative burdens and reduces compliance risks, allowing them to focus on strategic initiatives. For employees, it means faster access to loans and housing, better privacy, and a smoother experience during important life events.

This transition is a win-win that creates a more responsive and supportive workplace. Instant, secure, and compliant verification is quickly becoming the standard for businesses across the United States.

For expert assistance with your workforce eligibility verification needs, including E-Verify and comprehensive employment compliance, consider a trusted partner like Valley All States Employer Service. We are here to help you steer these complexities and empower your workforce with seamless, compliant solutions. Find out how we can help in our Automated Eligibility Verification System Complete Guide.