Employment verification service: Simplify 2025

Why Employment Verification Matters for Your Hiring Process

Employment verification service is a third-party solution that confirms a candidate’s work history, income, and job details by contacting previous employers or accessing secure databases. These services help businesses make informed hiring decisions while reducing risk and ensuring compliance.

Quick Answer: Top Employment Verification Services

| Service | Best For | Key Feature |

|---|---|---|

| The Work Number | Fast database checks | Reduces verification time from weeks to minutes |

| Experian Verify | Instant income verification | Industry-leading data accuracy and compliance |

| HireRight | Global verification needs | Direct contact with former employers worldwide |

| PSI Background Screening | Comprehensive compliance | Includes I-9 and E-Verify agent services |

| E-Verify | Government eligibility checks | Federal employment authorization verification |

Every new hire represents both an opportunity and a risk. You need to know if candidates are who they claim to be, if their work history checks out, and if they’re legally eligible to work in the United States.

Manual verification through phone calls and paper trails can take over a week. Your HR team spends hours playing phone tag with former employers who may not respond promptly or at all. Meanwhile, your top candidate might accept another offer.

Modern employment verification services solve this problem. According to industry data, automated services like The Work Number can reduce verification response time from over a week to just minutes. This speed doesn’t sacrifice accuracy. In fact, these services often provide more reliable data than manual verification because they pull directly from payroll systems or use structured processes to contact employers.

But verification isn’t just about speed. It’s about compliance, accuracy, and risk management. The wrong hire can cost your business thousands in turnover, training, and potential liability. A verification service acts as your safety net, helping you build a trustworthy team while protecting your company.

Whether you’re verifying employment history for background checks, confirming income for lending decisions, or ensuring work authorization through E-Verify, choosing the right service makes all the difference. This guide will help you understand your options and select the solution that fits your needs.

The Core Components of an Employment Verification Service

An effective employment verification service is more than just a tool; it’s a strategic partner that streamlines your hiring process and fortifies your compliance efforts. We understand that navigating the complexities of employment data can be daunting, which is why these services are designed to simplify the process for both employers and employees. Let’s explore how they work and the significant benefits they bring.

How Verification Works for Employers

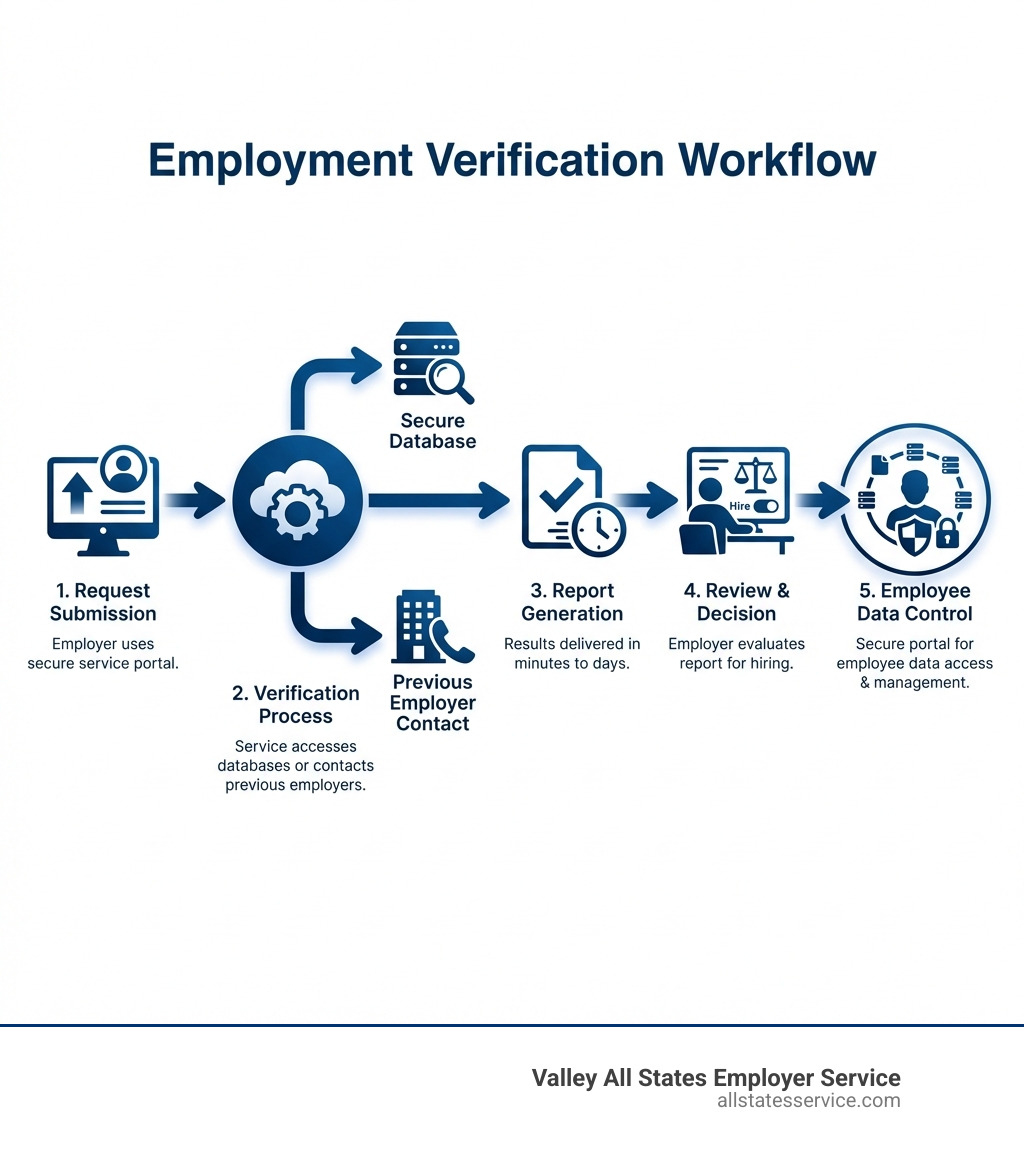

For employers, an employment verification service acts as a powerful extension of your HR department. Instead of your team spending valuable hours on manual outreach, these services handle the heavy lifting. When you need to verify a candidate’s employment or income, you submit a request through the service’s secure online portal. The service then leverages its networks and technology to retrieve the necessary information.

Many top-tier services offer real-time API integration with a wide array of payroll and HRIS systems, including popular platforms like UKG, Dayforce, PeopleSoft, Workday, Paylocity, and Infor. This means that data can flow seamlessly between your existing systems and the verification platform, drastically reducing manual data entry and potential errors. What’s more, some providers offer free setup, training, and implementation, making the transition to an outsourced solution smooth and cost-effective. This integration capability allows us to help you truly streamline HR processes and focus on what matters most: growing your business.

Benefits for Your Business

The advantages of utilizing a dedicated employment verification service are manifold:

- Accuracy: By tapping into direct data sources, such as payroll systems, or by following structured protocols for direct employer contact, these services provide highly accurate information. This reduces the risk of relying on misrepresented or fraudulent data.

- Efficiency: Automated processes significantly cut down on the time it takes to get verification results. What once took days or even weeks can now be completed in minutes, helping you make quicker hiring decisions and avoid losing top talent.

- Reduced Liability: Verifying employment and income data through a compliant third-party service helps your business adhere to federal and state regulations, reducing your legal exposure. This is crucial for maintaining HR compliance and avoiding potential penalties.

- Informed Hiring Decisions: With reliable data at your fingertips, you can confidently assess candidates’ qualifications, ensuring they have the experience and financial stability that align with your requirements.

- Faster Onboarding: Quicker verification processes mean you can move candidates through the hiring pipeline faster, leading to a more efficient and positive streamlined onboarding process.

- Minimized Administrative Burden: Outsourcing this function frees up your HR team to concentrate on strategic initiatives rather than administrative tasks. This is a core benefit of an outsourced employment verification ultimate guide.

How Employees Benefit from a Modern Verification Service

It’s not just employers who benefit from these services; employees also gain significant advantages from a robust employment verification service. We believe in empowering employees with control over their data:

- Data Control and Privacy: Modern verification services prioritize employee privacy. Platforms like Experian Verify emphasize employee consent, allowing individuals to control when and to whom their employment and income data is released. Some services offer a “salary key” feature, which gives employees a unique code they can provide to third-party verifiers, ensuring their explicit permission is required for data access.

- Faster Approvals: Whether applying for a mortgage, an auto loan, or an apartment lease, employees often need quick proof of employment and income. Automated services can provide this information almost instantly, accelerating approval processes and making life easier.

- Transparency: Employees can often access their own verification data, view who has requested their information, and review their employment history, fostering trust and transparency.

- Reduced Stress: Knowing that their employment and income verification can be handled quickly and securely by a reputable service reduces the stress associated with these critical life events.

To dive deeper into the advantages for individuals, explore our employee verification service complete guide.

Comparing Top Employment Verification Services

When it comes to choosing an employment verification service, you’ll find a range of options, each with unique strengths. Understanding these differences is key to selecting the provider that best aligns with your organization’s specific needs, whether you’re focusing on speed, comprehensive background checks, or strict compliance.

The Work Number by Equifax

The Work Number, an Equifax Workforce Solutions product (formerly TALX), is one of the largest and most widely used automated employment and income verification services in the United States. We often see it as a gold standard for its efficiency.

- How it Works: The Work Number operates on a vast database model. Employers contribute their payroll data directly to The Work Number. When a verifier (like a lender or landlord) needs to confirm employment or income, they access this database, often receiving instant results.

- Key Features:

- Speed: It can reduce verification response time from over a week to minutes, a significant benefit for both verifiers and employees.

- Employee Control: Employees can obtain a “salary key” from The Work Number website or by calling 1-800-367-2884. This key, along with their Social Security Number and employer company code, allows them to control who accesses their salary information.

- Broad Use Cases: It’s frequently used for mortgage applications, reference checks, loan applications, apartment leases, and government benefit determinations. For government agencies, the service provides a dedicated portal to begin verifying for government benefit determinations or other permissible purposes.

- Government Integration: The U.S. Department of Labor, for instance, uses The Work Number for its current and former employees, allowing third parties to verify employment and salary information quickly. Verifiers can access the service online using DOL’s code: 10915, or by phone at 1-800-367-5690.

- Best For: Organizations and employees seeking rapid, automated employment and income verification, especially for common financial and housing applications.

Experian Verify

Experian Verify is another prominent employment verification service known for its instant and accurate responses, powered by extensive data.

- How it Works: Experian Verify offers instant employment and income verification services, drawing on unique, industry-best data. It provides distinct portals custom for different users: employees, commercial verifiers, social service verifiers, and employers.

- Key Features:

- Instant Verification: A major highlight is the ability to provide immediate verification, crucial for transactions.

- High Accuracy: The service prides itself on data accuracy, powered by robust data sources.

- Compliance: Experian Verify is compliant with all federal and state privacy acts and laws, ensuring secure and legal data handling.

- User-Specific Portals:

- Employees can log into a dedicated portal to access their verification data, request history, and privacy controls.

- Verifiers (commercial or social service) can log into their own portal for quick access to information. Social service verifiers often receive complimentary access for government assistance program eligibility.

- Employers have full access to view and manage verifications, and can even outsource their verification fulfillment through Experian.

- Reduced HR Burden: It aims to eliminate the administrative load on HR and payroll teams by automating verification requests.

- Best For: Companies and individuals needing instant, highly accurate, and legally compliant employment and income verification for a wide range of purposes, including loan approvals, housing rentals, and pre-employment screenings.

HireRight: A Comprehensive Employment Verification Service

HireRight offers a broad suite of verification and background check services, making it a comprehensive solution, particularly for organizations with global needs or specialized requirements.

- How it Works: Unlike purely database-driven services, HireRight often verifies employment history directly with former employers or their authorized agents. This direct outreach can provide more nuanced information. They offer a range of verification services, including education, employment history, professional qualifications, and licenses.

- Key Features:

- Direct Verification: HireRight prides itself on verifying employment history directly with former employers or their authorized agents, ensuring a thorough check.

- Global Reach: They offer global education and employment verification, crucial for international hiring.

- Comprehensive Screening: Beyond basic employment, HireRight provides services like professional license verification, professional qualifications verification, and professional reference check reports.

- Specialized Verifications: They cater to specific industries with services like DOT Drug & Alcohol Verification and DOT Employment Verification (fulfilling FMCSA requirements for prospective drivers), as well as aviation solutions.

- Due Diligence: Their offerings extend to identity services, due diligence (registry, media, civil record checks), and criminal background services, trusted by 40,000 companies worldwide.

- Best For: Employers seeking a thorough, direct, and often global approach to pre-employment screening, including detailed work history, education, and credential verification, and specialized industry compliance. For a broader look at pre-employment checks, see our pre-employment background checks guide.

PSI Background Screening

PSI Background Screening positions itself as a partner in the hiring process, offering customized pre- and post-employment screening solutions with a strong emphasis on compliance.

- How it Works: PSI provides an unbiased and thorough screening process, combining criminal history searches, social security number traces, and motor vehicle reports with employment and education verification. They use a proprietary database and Smart Form Technology for I-9 forms.

- Key Features:

- Partnership Approach: PSI aims to be a partner, not just a service provider, going the “extra mile” to ensure new hires are legitimate.

- Comprehensive Screening: They offer a wide range of background screening services, including criminal history searches (county, state, federal, international), social security number traces, and motor vehicle reports.

- I-9 & E-Verify Compliance: PSI is an authorized E-Verify Employer Agent, helping companies ensure their workforce is legally authorized to work in the United States and reducing compliance risk. They also provide electronic I-9 systems with storage and audit assistance.

- Immunization Tracking: A unique offering is their immunization tracking system, which helps collect and store healthcare records and provides alerts for compliance.

- Third-Party Verification: They handle employment verification requests from other companies looking to potentially hire current or former employees.

- Best For: Organizations in Maryland and across the U.S. that need a comprehensive, compliant background screening partner, particularly those requiring I-9 and E-Verify agent services, and detailed employment/education verification. Learn more about their offerings as a background verification company.

E-Verify: The Government’s Role in Employment Eligibility

Beyond verifying employment history and income, a critical aspect of hiring in the United States is ensuring that new employees are legally authorized to work. This is where E-Verify comes into play, representing a distinct but equally vital part of the broader employment verification service landscape.

What is E-Verify and How Does It Work?

E-Verify is an internet-based system operated by the U.S. Citizenship and Immigration Services (USCIS) in partnership with the Social Security Administration (SSA). Its primary purpose is to compare information from an employee’s Form I-9, Employment Eligibility Verification, to data from U.S. Department of Homeland Security (DHS) and SSA records to confirm employment eligibility.

- The Process: When an employer hires a new employee in the United States, they complete a Form I-9. Within three business days of the employee’s first day of employment, the employer submits the information from Section 1 and Section 2 of the Form I-9 into the E-Verify system.

- Database Check: E-Verify instantly checks this information against millions of government records.

- Results: Most cases receive an immediate “Employment Authorized” status. If there’s a mismatch, it results in a Tentative Nonconfirmation (TNC). The employee then has the opportunity to resolve the discrepancy with the relevant agency (SSA or DHS).

- Compliance: E-Verify is mandatory for federal contractors and some states, including Maryland, have specific requirements for its use. It’s a critical tool for maintaining workforce eligibility compliance.

For a deeper understanding of this essential system, refer to our what is E-Verify guide and the E-Verify Program Complete Guide. You can also visit the official E-Verify website at https://everify.uscis.gov/ and learn more about Form I-9 at https://www.uscis.gov/i-9-central. The E-Verify system is constantly evolving, with recent updates including improved account security with Login.gov integration and new features like E-Verify+.

E-Verify vs. Traditional Employment Verification

It’s important to distinguish E-Verify from other employment verification service offerings:

- Purpose:

- E-Verify: Confirms a new hire’s legal eligibility to work in the United States. It does not verify employment history, education, or other credentials.

- Traditional Employment Verification: Confirms details like dates of employment, job title, and sometimes salary with previous employers. It’s a due diligence measure, not a legal requirement for all employers.

- Legal Requirement: E-Verify is a federal legal requirement for certain employers (e.g., federal contractors) and in specific states, while traditional employment history verification is generally optional but highly recommended for risk management.

- Scope of Information: E-Verify solely focuses on work authorization using government databases. Other services dig into the specifics of a candidate’s professional background.

Understanding these distinctions is crucial for comprehensive compliance. Our E-Verify vs I-9 guide provides further clarity on this topic.

Why Outsource Your E-Verify Compliance?

While E-Verify seems straightforward, managing it correctly requires attention to detail and adherence to strict regulations. Errors can lead to penalties and compliance issues. This is why many employers, especially in Maryland and across the U.S., choose to outsource their E-Verify compliance to expert agents.

- Expert Agents: As an authorized E-Verify Employer Agent, Valley All States Employer Service specializes in navigating the system. We ensure accurate and timely submissions, minimizing the risk of Tentative Nonconfirmations (TNCs) due to clerical errors.

- Error Reduction: Our expertise significantly reduces the likelihood of costly mistakes, helping you avoid fines and legal complications. We are committed to minimizing errors and administrative burden for our clients.

- Audit Support: Should your business face an I-9 or E-Verify audit, an outsourced partner can provide invaluable support, helping you prepare and respond effectively.

- Administrative Relief: Outsourcing frees your HR team from the administrative burden of E-Verify, allowing them to focus on core business functions. This is a key component of effective HR compliance assistance.

By leveraging an E-Verify outsourcing solution, you gain peace of mind knowing your workforce eligibility verification is handled expertly and compliantly.

Navigating Legal and Privacy Considerations

When implementing an employment verification service, understanding the legal and privacy landscape is paramount. We are committed to ensuring our clients operate within the bounds of the law while respecting employee rights, particularly concerning sensitive personal data.

Key Legal Frameworks to Know

Several laws and regulations govern how employment and background information can be collected, used, and shared in the United States:

- Fair Credit Reporting Act (FCRA): This federal law regulates the collection, dissemination, and use of consumer information, including background checks and employment verification. If a third-party employment verification service is used, and it provides information about an individual’s “character, general reputation, personal characteristics, or mode of living” that is used for employment purposes, it falls under the FCRA.

- Permissible Purpose: Under FCRA, employers must have a “permissible purpose” to obtain a consumer report (which includes employment verification).

- Disclosure and Authorization: You must provide a clear disclosure to the applicant/employee that you intend to obtain a consumer report and get their written authorization.

- Adverse Action Procedures: If information from the report leads to an adverse hiring decision (e.g., not hiring someone), specific adverse action procedures must be followed, including providing the applicant with a copy of the report and a summary of their rights.

- State Laws: Beyond federal regulations, states like Maryland may have their own laws regarding employment verification and background checks, sometimes imposing stricter requirements. It’s crucial to be aware of these local nuances.

- Privacy Acts: Services like Experian Verify explicitly state compliance with all federal and state privacy acts and laws, highlighting the importance of secure data handling.

Navigating these legal frameworks can be complex. Our legal employment verification guide 2025 offers comprehensive insights into these critical considerations for your business. For overall compliance, our HR compliance complete guide for businesses is an invaluable resource.

Protecting Employee Privacy and Data

Protecting employee privacy and ensuring data security are ethical obligations and legal requirements for any employer utilizing an employment verification service.

- Employee Consent: A cornerstone of privacy is obtaining explicit employee consent before accessing or sharing their employment and income data. This is why services often require employees to provide a unique identifier or “salary key” to authorize verification requests.

- Data Security Protocols: Reputable verification services employ robust data security measures to protect sensitive information from unauthorized access, breaches, or misuse. This includes encryption, secure servers, and strict access controls.

- Access Logs: Many services maintain detailed access logs, allowing employees to see who has requested their information and when, enhancing transparency and accountability.

- Secure Portals: Platforms designed for employees, like Experian Verify’s employee portal, allow individuals to manage their data, view request history, and control privacy settings, giving them agency over their own information.

- I-9 Record Keeping: Beyond verification, proper I-9 record keeping is essential, ensuring that all employment eligibility documents are stored securely and compliantly.

We always advise our clients to choose verification partners that demonstrate a strong commitment to data privacy and offer transparent mechanisms for employee control.

Choosing the Right Partner for Your Needs

Selecting the ideal employment verification service for your business is a strategic decision that can significantly impact your operational efficiency, compliance posture, and overall hiring success. It’s not a one-size-fits-all solution, so we encourage you to consider your specific needs carefully.

Key Features to Look For in a Provider

As you evaluate different employment verification service providers, keep the following critical features in mind:

- Speed and Turnaround Time: How quickly can the service provide verification results? For database-driven services like The Work Number or Experian Verify, this can be minutes. For services relying on direct outreach (like HireRight or PSI Background Screening), inquire about average turnaround times. Faster results mean quicker hiring decisions.

- Accuracy and Data Sources: Investigate where the data comes from. Is it directly from payroll systems (highly accurate), or does it involve manual outreach? Look for providers that boast industry-best data and robust verification processes.

- Compliance and Legal Tools: Does the service help you remain compliant with FCRA, state laws, and federal requirements like E-Verify? Look for features like I-9 management, E-Verify agent services, and adherence to privacy acts. This is especially important for compliance management solutions.

- User Experience for HR and Employees: Is the platform intuitive and easy to use for your HR team? Are there clear, secure portals for employees to manage their data and consent? A good user experience improves efficiency and satisfaction for all parties.

- Integration with HRIS/ATS: Seamless integration with your existing Human Resources Information Systems (HRIS) and Applicant Tracking Systems (ATS) can save immense time and reduce manual errors. Look for providers that offer real-time API integration with popular systems.

- Reporting and Analytics: Can the service provide insightful reports on verification trends, compliance metrics, and audit trails? Robust reporting helps you monitor performance and maintain accountability.

- Customer Support: What kind of support does the provider offer? Responsive and knowledgeable customer service is invaluable when you encounter questions or issues.

- Scope of Services: Do you need basic employment verification, or comprehensive background checks including education, licenses, and criminal history? Some providers specialize, while others, like HireRight and PSI, offer a broader suite.

- Cost-Effectiveness: Compare pricing models and ensure the service offers a good return on investment by saving your HR team time and mitigating risk.

Conclusion: Streamline Your Hiring and Stay Compliant

Choosing the right employment verification service is a crucial step towards building a more efficient, compliant, and secure hiring process. From accelerating candidate onboarding to safeguarding your business against fraud and legal risks, the benefits are clear. Modern services offer speed, accuracy, and robust compliance features that manual processes simply cannot match.

By understanding the different types of services available—from automated database solutions like The Work Number and Experian Verify, to comprehensive background screeners like HireRight and PSI, and the essential government eligibility check of E-Verify—you can make an informed decision that best suits your organization’s needs. Focusing on legal and privacy considerations ensures you protect both your company and your employees.

At Valley All States Employer Service, we specialize in taking the complexity out of eligibility verification, offering expert, impartial, and efficient E-Verify processing. We minimize errors and administrative burden for our clients in Maryland and throughout the United States, allowing you to hire with confidence.

Ready to master your I-9 process and ensure seamless compliance? Explore our complete guide to I-9 audits.