I-9 training for employers: Master 2024 Updates

Why I-9 Training for Employers Is Critical for Your Business

I-9 training for employers is essential compliance education that helps businesses verify employee eligibility while avoiding costly penalties. Here’s what you need to know:

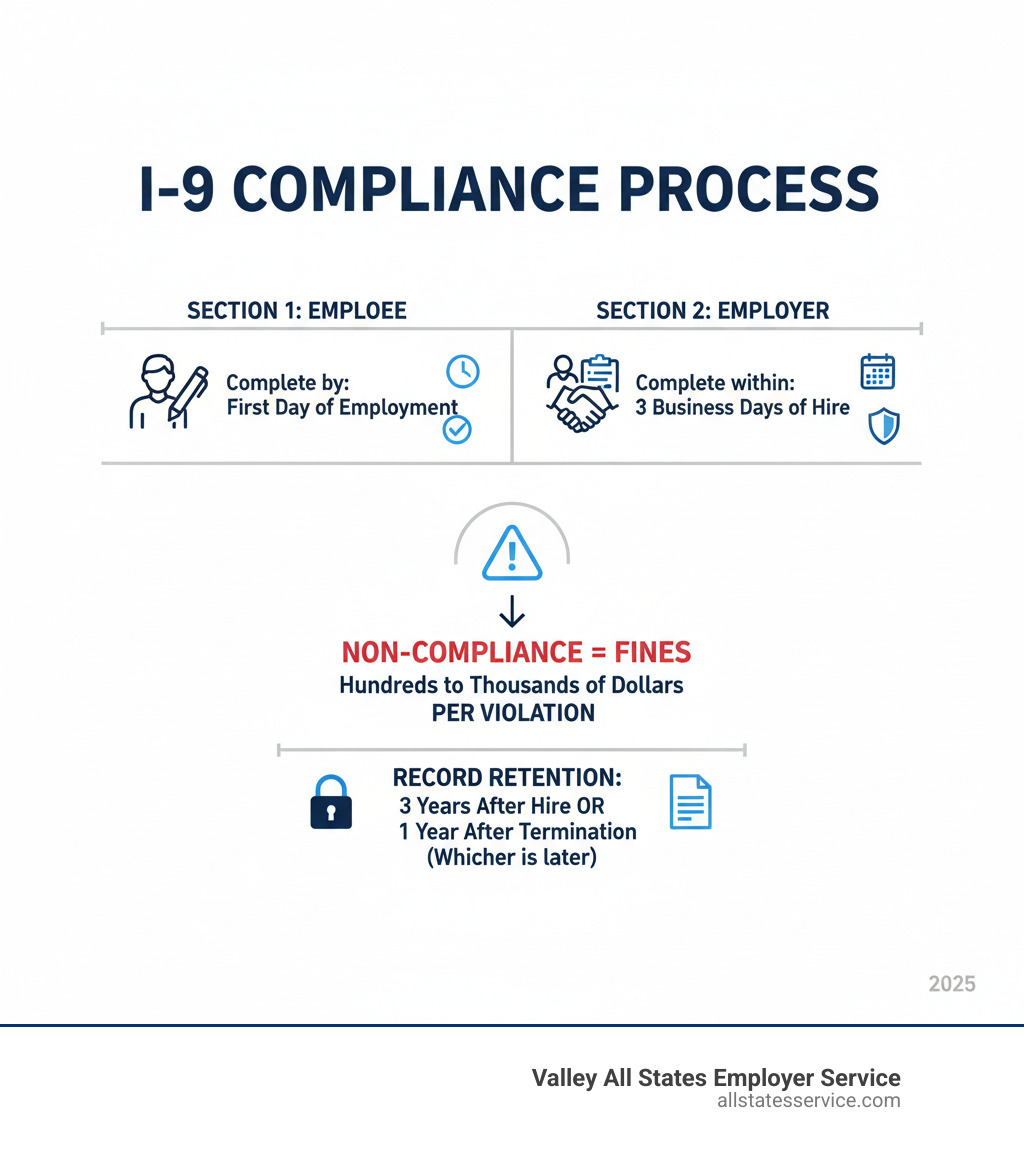

Quick Reference: I-9 Training Essentials

- Section 1: Employee completes by first day of work

- Section 2: Employer completes within 3 business days of hire

- Training Topics: Form completion, document verification, anti-discrimination, record retention

- Available Resources: Free USCIS webinars, SHRM/HRCI credited courses, third-party training

- Penalties: Range from hundreds to thousands of dollars per violation

- Record Retention: 3 years after hire or 1 year after termination (whichever is later)

Every employer in the United States must complete Form I-9 for every new hire. Failure to comply can result in hefty fines, legal battles, and reputational damage that puts your business at serious risk.

The numbers tell a sobering story. Non-compliance penalties can range from hundreds to thousands of dollars per violation. A single incomplete form or missed deadline can trigger an expensive audit that disrupts your entire operation.

But the reality is that Form I-9 instructions aren’t always crystal clear. Small mistakes can snowball into major compliance headaches that affect your bottom line.

The good news is that proper training transforms this challenge into a manageable routine. When your team understands the process, compliance becomes confidence.

Understanding the Fundamentals of Form I-9

Form I-9 is the foundation of legal hiring in America, keeping your business out of hot water with federal authorities.

Every employer in the United States must complete this form for every new hire. This requirement comes from the Immigration Reform and Control Act of 1986, which made it illegal to knowingly hire anyone unauthorized to work here. Form I-9 is mandatory for everyone, from your first employee to your thousandth.

Think of Form I-9 as your business insurance policy. It verifies two critical things: identity and employment authorization. When completed properly, it proves you’ve done your due diligence. When done incorrectly, those expensive penalties come knocking.

The form is your first line of defense against compliance issues. It protects your business while ensuring everyone on your team has the legal right to be there. For more background on the essentials, check out more info about the I-9 form.

Section 1: Employee Information and Attestation

Section 1 belongs entirely to your new hire. They must complete it no later than their first day of employment. Day one, period.

In this section, your employee attests to their legal status and right to work in the U.S. It’s a straightforward declaration, but the timing is critical.

A common mistake is for employers to fill out Section 1. You can’t do it for them, even to be helpful. If they need assistance due to language barriers or other challenges, a preparer or translator can help, but the employee must still sign to confirm its accuracy.

This employee-only rule ensures the information comes directly from the person claiming work eligibility, not from someone making assumptions.

Section 2: Employer Review and Verification

Once Section 1 is complete, you have three business days from the employee’s first day to complete Section 2. This deadline isn’t negotiable and won’t fly during an audit.

Your job is to physically examine your employee’s original, unexpired documents, like a driver’s license or passport. You then record the document information on the form and sign to confirm you believe the documents are genuine.

This used to require face-to-face meetings, but recent updates introduced a remote verification option for eligible employers. This flexibility is finally catching up with modern work arrangements.

The key is thoroughness without overstepping. You must be diligent, but you can’t be discriminatory about which documents you accept. Your employee chooses which qualifying documents to present. For detailed guidance, refer to a guide to verifying I-9 documents.

Section 3: Reverification and Rehires

Section 3 handles the “what happens next” scenarios, like expiring work authorization or rehires.

Reverification is your safety net for employees whose work authorization has an expiration date. You must complete this section before their current authorization expires to ensure no gap in their legal ability to work.

Rehiring former employees within three years can be simpler. If their previous I-9 is valid, you might use Section 3 for reverification instead of completing a new form, saving time and paperwork.

But the rules for reusing an old form are specific. Get it wrong, and you’ve created a compliance problem. Understanding the I-9 process for rehires is crucial for any business with employee turnover.

Effective I-9 training for employers covers all three sections thoroughly, as each presents unique compliance challenges.

The High Cost of Non-Compliance: Common Mistakes and Penalties

I-9 training for employers is critical because penalties range from hundreds to thousands of dollars per violation. These are not slaps on the wrist; they are financial consequences that can seriously impact your business.

I-9 violations often result from small oversights. Incomplete forms are a common culprit, where a missed signature or blank date field represents a potential violation. Missed deadlines create another expensive trap, as failing to complete Section 1 by day one or Section 2 within three business days are automatic violations.

Things get particularly tricky with improper document requests. Asking for specific documents, rather than letting the employee choose from the acceptable lists, can lead to discrimination charges.

Discriminatory practices are serious violations. Treating employees differently based on appearance, accent, or name can result in costly legal battles that damage your reputation.

The government distinguishes between technical violations (like a missing date) and substantive violations (failing to complete a section). Technical errors may be correctable without fines if caught quickly, but they become substantive if not fixed within 10 days of notification. Dive deeper into these risks at I-9 compliance penalties explained.

Avoiding Discriminatory Practices

I-9 compliance has pitfalls that can lead to discrimination charges. The key principle is simple: treat all employees equally during verification, regardless of national origin, citizenship, or immigration status.

This means you cannot apply extra scrutiny or ask for different documents based on someone’s appearance, accent, or name.

The employee chooses which documents to present, not you. They can select any valid combination from the Lists of Acceptable Documents. Your job is to accept documents that are unexpired and appear genuine, not to make assumptions.

Understanding anti-discrimination principles protects your employees and your business. Consider attending training like Learn about employee rights to stay current.

Record Retention Rules

Your compliance duties continue after the form is complete. Proper record retention is just as important as filling it out correctly.

The 3-year/1-year rule is the standard: keep I-9s for three years after the hire date OR one year after employment ends, whichever is later. This is a federal requirement.

Storing forms securely is essential. Whether paper or electronic, these sensitive documents must be kept separate from personnel files but be accessible for an audit.

When the retention period expires, use a secure purging process to protect the sensitive information. Improper storage or disposal can trigger violations. We cover these requirements in our guide on Best practices for I-9 record keeping.

Your Guide to Effective I-9 Training for Employers

View I-9 training for employers as an investment, not an expense. When your team understands Form I-9, compliance worries fade. Instead of scrambling over requirements or deadlines, your HR staff becomes confident and efficient.

The magic happens when training is proactive, not reactive. Rather than learning from costly mistakes, your team prevents them. This builds a compliance culture where accuracy becomes second nature and everyone understands their role in protecting the business.

Effective training covers the essentials: form completion walks through each section, document review teaches how to spot acceptable documents, anti-discrimination practices ensure fair treatment, record retention clarifies storage rules, and self-audits help catch problems before they become expensive.

But what makes training truly effective is that it’s ongoing. Regulations change, and even experienced HR professionals need refreshers. The best programs treat education as a continuous journey, not a one-time event.

Finding the Right I-9 Training for Employers

The good news is you don’t have to reinvent the wheel. USCIS, the agency overseeing Form I-9, offers fantastic free resources that many employers don’t know exist.

Their webinars are valuable because they come straight from the source, meaning you get the most current and accurate information. Plus, many sessions qualify for SHRM and HRCI credits, so your HR team can meet professional development requirements while staying compliant.

USCIS offers free employer training webinars that cover everything from basic completion to complex situations. The instructors know where employers struggle most and address those pain points directly.

Beyond government resources, third-party experts offer specialized training. Online courses provide flexibility for busy teams, while in-person seminars allow for interactive discussions. The key is finding training that matches your team’s learning style and schedule.

Essential Resources for Employer I-9 Training

Every smart employer keeps certain resources bookmarked. Think of these as your compliance toolkit.

The I-9 Central website is your home base for everything Form I-9 related. It’s where USCIS posts updates, clarifications, and policy changes. Bookmark it and check it regularly.

The M-274 Handbook for Employers deserves a special place in your compliance library. This guide answers real-world questions, like how to handle an unusual document or a name change.

If you’re using E-Verify (and we strongly recommend it), their resource center is equally important. The system integrates with your I-9 process, but only if your team knows how to use it properly.

Regular self-audits using these resources can save you thousands in potential penalties. A complete guide to I-9 self-audits walks you through reviewing your own forms and catching errors before an inspector does.

Staying Current: 2024 Updates and Remote Verification

The I-9 world keeps moving, and staying current separates compliant businesses from those facing penalties. The good news is that recent updates have made things easier, not harder.

On November 1, 2023, USCIS rolled out a streamlined I-9 form that’s shorter, clearer, and more user-friendly. It’s the same legal requirements in a package that makes more sense.

But the real game-changer is that remote verification is now a permanent option for eligible employers. This isn’t a temporary pandemic accommodation. If you hire remote workers, this update could transform your I-9 compliance.

Of course, there’s a catch. To use remote verification, you must be enrolled in E-Verify. Think of it as USCIS offering flexibility in return for an extra layer of verification. For the complete picture, check out The latest on USCIS I-9 remote verification.

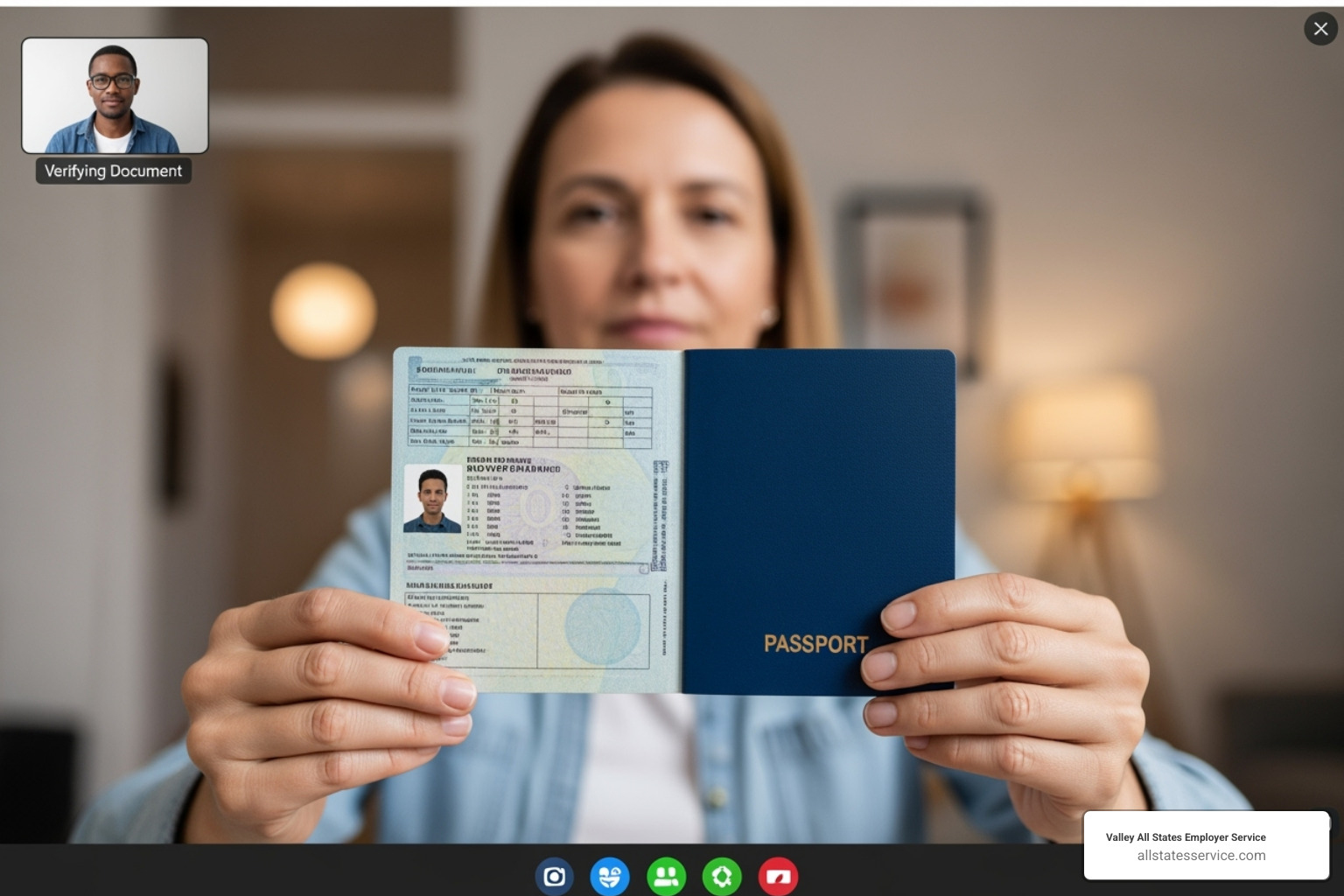

The New Remote Verification Option

Remote verification doesn’t mean skipping the careful document review. You still need to examine documents carefully, but now you can do it through live video interaction instead of in person.

Here’s how it works: You schedule a video call with your new hire, who presents their documents to the camera. You examine both sides of each document during the live session. Afterward, the employee sends you copies, and you are responsible for keeping them with your I-9 records.

The E-Verify enrollment requirement is not a suggestion. Without it, you can’t use remote verification. But if you’re already using E-Verify, this option gives you incredible flexibility for remote hires or satellite offices.

Document retention works a bit differently here. You’ll keep copies of the documents alongside the completed I-9 form, and these must be available for an ICE audit. For detailed guidance, our guide on Best practices for remote I-9 verification covers the practical details.

How to Stay Informed

Keeping up with I-9 changes doesn’t have to be overwhelming. The trick is knowing where to look and setting up systems that bring information to you.

USCIS updates should be your first stop. Their website posts official announcements, and their email alerts save you from checking manually.

Federal Register notices provide advance warning of major changes, giving you a heads-up before new rules take effect.

Don’t overlook HR news outlets and industry publications. They often translate complex regulations into practical advice. Legal counsel is valuable when changes are complex or you’re unsure how new rules apply to you.

Subscribing to newsletters from compliance experts and organizations like SHRM can keep you informed. The key is finding sources that explain what’s changing and what it means for your daily operations.

Effective I-9 training for employers isn’t a one-time deal. As regulations evolve, your training must evolve too. The employers who stay ahead are the ones who build staying informed into their regular routine.

Beyond the Form: E-Verify, Audits, and Technology

Effective I-9 training for employers goes beyond the form. Strategic compliance involves creating a system that protects your business by integrating technology, staying audit-ready, and building seamless HR processes.

Think of it this way: mastering Form I-9 is like learning to drive, but a complete compliance strategy is like becoming a skilled navigator who knows the best routes and potential roadblocks. For a comprehensive look, check out An ultimate guide to I-9 E-Verify.

This holistic approach transforms compliance from a reactive scramble into a proactive advantage. You’re not just checking boxes; you’re building resilience into your hiring practices.

How E-Verify Integrates with the I-9 Process

E-Verify is your digital verification partner, an internet-based system run by USCIS and the Social Security Administration. While not required for every employer, it’s increasingly valuable, especially if you want to use remote I-9 verification.

E-Verify provides quick, electronic confirmation of an employee’s work eligibility, usually within 24 hours. Instead of wondering if a social security number matches government records, you get a clear answer from the source.

The process flows from your I-9 completion. Once Section 2 is done, you enter the employee’s information into E-Verify. Most cases are confirmed immediately, giving you peace of mind. If there’s a question, you’ll receive a Tentative Nonconfirmation (TNC). The system walks you through the next steps, which often resolve quickly.

E-Verify prevents problems before they start. You’ll know right away about any social security or document issues, protecting both you and your employee. Learn more at E-Verify overview from the source.

Preparing for an ICE Audit

No one wants an audit, but smart employers prepare. Proper preparation makes audits manageable, not terrifying.

An ICE audit typically starts with a Notice of Inspection (NOI), giving you 72 hours to gather your I-9 records. If you’ve maintained good records and conducted self-audits, this is an administrative task, not a crisis.

The key to audit readiness is staying ahead through regular internal reviews. Set aside time quarterly or semi-annually to go through your I-9 forms. Look for missing signatures, blank fields, or expired documents. When you find issues, fix them promptly. You have 10 days to correct technical errors once found, preventing them from becoming major violations.

Keep your I-9 forms organized and accessible, whether electronic or paper. During an audit, you want to demonstrate that you take compliance seriously.

The audit outcome can range from a simple compliance notice to more serious consequences. Employers who demonstrate good faith efforts and have organized, mostly compliant records typically fare much better. For detailed guidance, refer to A complete guide to I-9 audits.

Conclusion

Building a compliant workforce takes time, and I-9 training for employers is the cornerstone. You wouldn’t give keys to an untrained driver, so why trust hiring compliance to untrained staff?

Ongoing training is absolutely key because regulations evolve and forms get updated. The 2024 updates, including the streamlined form and remote verification options, prove this point.

Compliance is a continuous process, not a destination. It’s like maintaining business insurance or financial records. Regular self-audits, refresher training, and staying plugged into USCIS updates keep your business protected.

This commitment protects you from hefty fines, keeps you audit-ready, and builds a natural compliance culture. Your team gains confidence, processes become smoother, and you gain peace of mind knowing your workforce is legally authorized.

Gaining peace of mind in today’s complex regulatory environment is invaluable. When your I-9 process runs like clockwork, you can focus on growing your business.

At Valley All States Employer Service, we’ve seen how the right support transforms compliance from a headache into a competitive advantage. Our expert, impartial E-Verify processing takes the guesswork out of workforce eligibility verification, minimizing errors and freeing up your time.

Ready to turn compliance confidence into reality? Simplify your workload with our E-Verify and I-9 Compliance services and find how much easier your hiring process can be.