I-9 best practices: Flawless Compliance in 2025

Why I-9 Best Practices Matter More Than Ever

Mastering I-9 best practices has never been more critical for employers. With 76% of paper I-9 forms containing errors that could lead to penalties, and ICE issuing over $20 million in civil penalties in 2023 alone, getting employment eligibility verification right the first time isn’t just good practice, it’s essential business protection.

Essential I-9 Best Practices:

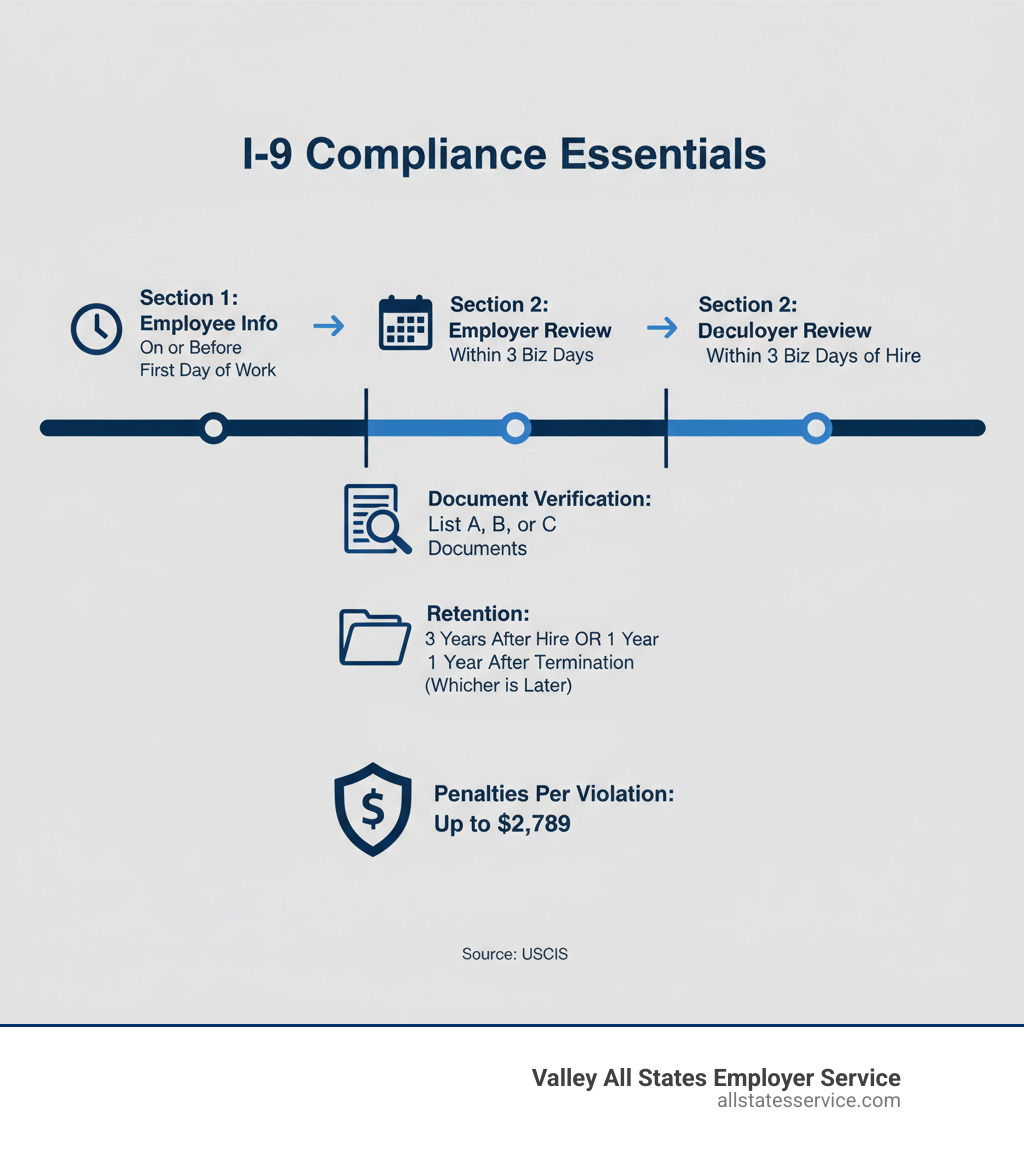

- Complete Section 1 on or before the employee’s first day of work

- Finish Section 2 within 3 business days of the start date

- Use only the current form (08/01/23 edition) to avoid automatic violations

- Let employees choose their documents from the acceptable lists

- Keep I-9s separate from personnel files for easy audit access

- Retain forms for 3 years after hire or 1 year after termination (whichever is longer)

- Never specify which documents an employee must provide

- Conduct regular internal audits to catch and correct errors early

The Immigration Reform and Control Act of 1986 requires every U.S. employer to verify each employee’s eligibility to work through Form I-9. Compliance has gotten trickier, as the average fine per violation has risen 34% since 2019, with penalties now reaching up to $2,789 per form.

The good news? Organizations using electronic I-9 systems experience 93% fewer technical errors than those using paper processes. Whether you manage five employees or 500, the right approach to I-9 compliance protects your business from costly mistakes while streamlining your onboarding.

Understanding the Fundamentals of Form I-9

Think of Form I-9 as your business’s first line of defense against compliance violations. Every single person you hire for work in the United States needs this form completed, no exceptions. The USCIS Employer Handbook makes it crystal clear: this is not optional paperwork, it is federal law.

Since November 6, 1986, the Immigration Reform and Control Act has required employers to verify that every employee is authorized to work in the U.S. Whether you’re hiring your first employee or your hundredth, understanding what an I9 is protects your business from steep penalties.

The beauty of mastering I-9 best practices lies in their simplicity once you understand the system. You are not just filling out forms, you are building a compliance foundation that keeps your business safe while ensuring proper new hire eligibility verification.

The Three Core Parts of the Form

Form I-9 breaks down into three distinct sections, each with clear ownership and timing requirements. Understanding who does what and when makes compliance straightforward.

Section 1 belongs entirely to your employee. They will provide their personal information like name, address, and date of birth. Most importantly, they must attest to their work authorization status, such as being a U.S. citizen, lawful permanent resident, or authorized alien. If someone helps them complete this section, you will also need Supplement A for preparer and translator certification.

Section 2 is your responsibility as the employer. Here, you physically examine and record the documents your employee presents to verify identity and work authorization. The employee chooses which acceptable documents to provide.

Supplement B handles the ongoing stuff like rehires and reverification when work authorization expires. This supplement keeps you compliant throughout an employee’s tenure. For detailed guidance on getting this right, check out our comprehensive guide on I-9 form completion.

Critical Deadlines You Can’t Miss

Timing violations are among the most common I-9 mistakes, and they are completely avoidable once you know the rules.

Your employee must complete Section 1 on or before their first day of work for pay. This is a hard deadline that ICE takes seriously during audits.

You have three business days from the employee’s first day to complete Section 2. If someone starts on Monday, you need to finish your part by Thursday. Business days refer to days your business is operational, not just Monday through Friday.

Late filing creates violations even for authorized employees. Timely completion is key to avoiding unnecessary penalties.

Key Updates to the New Form I-9 (08/01/23 Edition)

Using outdated forms is like painting a target on your business for ICE audits. The Department of Homeland Security released the current Form I-9 with an edition date of 08/01/23, and it became mandatory after November 1, 2023.

The single-sided design puts Sections 1 and 2 on one page, simplifying storage and handling without worrying about separated sections.

Standalone supplements moved the preparer/translator certification and reverification sections to separate forms. This streamlines the main form for most situations.

The mobile-friendly design works well on tablets, phones, and computers, adapting to how people work today.

You can download the latest Form I-9 directly from USCIS. Using any previous version after November 1, 2023, is an automatic compliance violation, making this a simple but serious rule to follow.

The Document Verification Process: A Step-by-Step Guide

Getting document verification right is where the rubber meets the road in I-9 compliance. This is also where most employers stumble, contributing to that staggering 76% error rate. The good news is the process becomes straightforward once you understand it. Let’s walk through how to examine documents properly while respecting employee rights.

Physical examination is non-negotiable. You must personally look at each document to determine if it reasonably appears genuine and relates to the person presenting it. Think of it like a bouncer checking IDs, you are looking for obvious signs of tampering or fraud, not conducting a forensic analysis.

Remote verification has expanded significantly, especially for employers using E-Verify. If you manage remote workers, you will want to explore our detailed guide on verifying I-9 documents to understand your options.

The key is finding that sweet spot between being thorough and being reasonable. You are not expected to be a document expert, but you should notice obvious issues, like an ID that looks fake or a photo that clearly doesn’t match the employee.

Acceptable Documents (Lists A, B, and C)

Here’s something many employers get wrong: employees have the right to choose which documents they present from the acceptable lists. You cannot play favorites or demand specific documents just because they are easier for you to verify.

List A documents are the gold standard because they establish both identity and employment authorization in one shot. A U.S. Passport or Permanent Resident Card (Green Card) from this list is all you need.

List B documents prove identity only. These include familiar items like driver’s licenses and state ID cards.

List C documents establish employment authorization only. Social Security cards and birth certificates fall into this category.

When an employee presents documents from List B and List C, you need one from each list. Keep the Form I-9 Acceptable Documents list handy and make sure your HR team knows it inside and out.

Staying current with this list is a cornerstone of solid I-9 best practices.

Avoiding Discrimination During Verification

This is where things get legally serious, and where many well-meaning employers accidentally step into trouble. The Immigration and Nationality Act (INA) has strict anti-discrimination provisions that protect employees during the I-9 process.

Claims of unfair I-9 practices jumped 12% in 2023, showing that scrutiny is increasing. The Immigrant and Employee Rights Section (IER) is paying attention, and violations can cost you dearly.

Consistent treatment is your best defense. If you ask one employee for additional verification, you need to ask all employees for the same thing. You cannot have different standards based on an employee’s accent, appearance, or name. This is not just about fairness, it is about following federal law.

Over-documentation is a trap. Asking for more documents than required is a form of discrimination, especially when targeting employees who appear ‘foreign’ or have accents.

Never dictate document choice. Telling an employee you prefer a driver’s license and Social Security card when they offer a valid foreign passport is a clear example of discrimination. Let employees choose from the acceptable options.

The penalties for discriminatory practices are steep, ranging from $573 to $22,928 per violation as of June 2024. Beyond the financial cost, these claims can damage your reputation and create a hostile work environment.

Mastering Ongoing I-9 Best Practices for Long-Term Compliance

I-9 compliance is not a one-time task, it is an ongoing commitment that requires consistent attention and smart systems. The companies that thrive are those that build I-9 best practices into their daily operations. Think of it like maintaining a car: a little consistent care prevents major breakdowns. Our comprehensive guide on I-9 record keeping can help you build these systems.

The “3-Year/1-Year” Rule for Document Retention

Here’s a rule that sounds complicated but is straightforward. You need to keep each completed Form I-9 for three years after the date of hire or one year after employment ends, whichever comes later.

For example, if an employee works for four years, you must keep their I-9 for one year after their termination date, as this is later than three years from their hire date.

Storing I-9s separately from regular employee files is essential. During an ICE audit, you want to provide a neat stack of I-9s, not dig through personnel files mixed with performance reviews. Keep current employee I-9s in one secure location and terminated employee forms in another.

Security matters too. Whether you use locked filing cabinets or electronic systems with password protection, these forms contain sensitive personal information that needs safeguarding. A regular I-9 self-audit helps ensure your retention system is working properly.

Managing Reverification and Rehires

Employee situations change, and you need to be ready. Knowing when reverification is required is key to avoiding common mistakes.

You must reverify if an employee’s temporary work authorization expires. Set up a tracking system with automated reminders at 90, 60, and 30 days before expiration. This gives everyone ample time to handle renewals.

When reverification is needed, use Supplement B, the new standalone form. This lets you document continued eligibility without starting from scratch with a new I-9.

Critically, lawful permanent residents do not need reverification when their Green Cards expire. Their status is permanent. Asking them to reverify can be considered a discriminatory practice. An expired Green Card does not affect their right to work.

For employees returning to your company, our detailed guide on the I-9 process for rehires walks you through when to use a new I-9 versus an existing one.

Essential I-9 Best Practices for Remote Employees

Remote work has made I-9 compliance trickier, but it is manageable. While COVID-19 flexibilities ended in July 2023, you still have good options for remote employees.

Your best bet is using an authorized representative, someone who can physically examine documents on your behalf. This can be a notary public, a local colleague, or even a family member. This person acts as your agent to examine original documents and complete Section 2. Since you remain responsible for any errors, choose your representative carefully and give them clear instructions.

If you are enrolled in E-Verify, you have a significant advantage. The E-Verify employer-agent option allows virtual document verification, eliminating the need for a physical examination. This is a game-changer for companies with remote teams. Our guide on remote I-9 verification best practices 2025 covers this process in detail.

Documentation is everything with remote verification. Record who served as your representative and when they examined the documents. Consistent remote processes protect you during audits. Check out what remote I-9 verification is to learn more.

The bottom line is that remote work does not have to create compliance headaches. With the right systems and procedures, you can maintain high standards for all employees, wherever they work.

Audits, Errors, and Penalties: Protecting Your Business

With a staggering 76% of paper I-9 forms containing at least one error, knowing how to handle mistakes and audits is crucial for protecting your business from steep fines. That means more than three out of every four paper forms have problems. ICE’s enforcement actions make it clear that I-9 best practices are no longer optional. Our page on I-9 compliance penalties details the risks.

Errors happen, but what separates compliant companies from those facing fines is knowing how to spot problems early and fix them correctly. Let’s walk through what you need to know to keep your business protected.

How to Correct I-9 Errors the Right Way

Finding errors on I-9 forms can feel overwhelming, but correcting them is a critical I-9 best practice. The key is transparency. Never try to conceal changes or backdate information.

For minor technical errors, the process is straightforward. The person who made the error, whether the employee or employer, should draw a single line through the incorrect information, write the correct information nearby, and then initial and date the correction. Never use correction fluid, white-out, or erase original entries. ICE needs to see the original entry.

If an error is significant, like a blank section or an outdated form, you may need to complete a new Form I-9. Attach the new form to the original with a memo explaining why the new form was necessary. This memo demonstrates your good faith effort to comply and can make a huge difference during an audit. Our guide to auditing I-9 forms and the Guidance for Employers on Internal Audits provide comprehensive steps.

Understanding the High Cost of Non-Compliance

The penalties for I-9 violations are not just paperwork fines, they are business-threatening expenses. In 2023, ICE issued over $20 million in civil penalties for I-9 violations, and the average fine per violation has risen 34% since 2019.

The penalty calculation matrix considers factors like the percentage of errors, the seriousness of the violations, and whether it is a first or repeat offense. For paperwork violations, fines range from $281 to $2,789 per form. Minor errors across multiple forms can quickly add up.

Knowingly hiring violations carry the most severe penalties. Fines can range from $548 to nearly $20,000 per violation, and in extreme cases, can lead to criminal charges.

Beyond the financial hit, reputational damage from non-compliance can severely impact your company, leading to operational disruptions and increased government scrutiny.

For example, a first-time offender with 100 employees and errors on 20% of their I-9s could face a fine of $876 per violation. That totals $17,520 for preventable errors. This underscores why proactive I-9 best practices are essential business protection.

Leveraging Technology: E-Verify and Electronic I-9 Systems

Technology offers powerful solutions to improve your I-9 compliance. The numbers don’t lie: organizations using electronic I-9 systems experience 93% fewer technical errors than those using paper, according to 2023 compliance survey data.

E-Verify is an internet-based system from DHS and SSA that allows you to confirm employee work eligibility. While mandatory for some, it is a valuable voluntary tool for all employers. E-Verify helps you verify eligibility quickly and can streamline remote verification. Our page on E-Verify and I-9 explains the connection.

Electronic I-9 software can be a game-changer. These systems guide users through the process, use validation checks to catch errors before they happen, and automatically track critical deadlines. They ensure compliance with federal standards for e-signatures and storage and create detailed audit trails. When ICE comes knocking, you will be ready.

Frequently Asked Questions about I-9 Compliance

When it comes to I-9 best practices, certain questions come up again and again. These are real-world situations that can make the difference between smooth compliance and costly penalties.

Can I tell an employee which document to provide for their I-9?

This is probably the most common mistake, and the answer is a firm no. You absolutely cannot dictate which documents an employee provides. This is not just a suggestion from USCIS, it is a violation of anti-discrimination laws under the Immigration and Nationality Act (INA).

Your employee has the legal right to choose which valid, unexpired documents to present from the Lists of Acceptable Documents. They can pick a single List A document or combine one from List B with one from List C. The choice is theirs.

Telling an employee, for example, ‘I need to see your driver’s license and Social Security card’ when they offer a valid passport can lead to discrimination penalties from $573 to $22,928 per violation. The Immigrant and Employee Rights Section (IER) takes these cases seriously.

What do I do if an employee’s “Green Card” expires?

Many well-meaning employers get into trouble here. When you see a Permanent Resident Card is expiring, your instinct might be to ask for an updated one. Don’t do it.

Lawful Permanent Resident status is permanent. An expired Permanent Resident Card (Form I-551) does not change their permanent status, just as an expired driver’s license does not change a person’s U.S. citizenship. Requesting reverification from a lawful permanent resident is generally considered a discriminatory practice.

Their work authorization does not have an expiration date, even if the physical card does. This I-9 best practice can save you from significant legal trouble, as asking for unnecessary reverification can trigger discrimination complaints.

What are the I-9 rules for the Commonwealth of the Northern Mariana Islands (CNMI)?

This question comes up less frequently, but it is important for employers with operations in the Pacific territories. The short answer is that CNMI now follows the same standard Form I-9 requirements as other U.S. employers.

While special transition rules existed in the past as the CNMI integrated into the U.S. immigration system, those are no longer in effect. Employers in the CNMI must use the same forms, meet the same deadlines, and accept the same documents as their mainland counterparts.

The deadlines for Section 1 (first day of work) and Section 2 (three business days) apply there just as they do on the mainland. The current Form I-9 (08/01/23 edition) is mandatory, and the penalty structure is identical.

This consistency simplifies compliance for employers with a presence in U.S. territories, as one set of procedures can cover the entire workforce.

Conclusion: Make I-9 Compliance Your Strength

Getting I-9 best practices right does not have to keep you up at night. Think of it this way: every business has processes they have mastered, from inventory management to customer service. I-9 compliance can become another one of those strengths.

When you adopt proactive compliance strategies, what once felt like a regulatory burden can transform into a competitive advantage. Your onboarding process becomes smoother and your audit readiness improves. Most importantly, you gain peace of mind knowing your business is protected from steep penalties.

The numbers tell the story. With 76% of paper I-9s containing errors and average fines reaching $2,789 per violation, the cost of getting it wrong far exceeds the investment in getting it right. Smart technology, regular training, and consistent processes are not just nice-to-haves, they are business essentials.

Electronic I-9 platforms can slash error rates by 93%, E-Verify participation opens up remote verification options, and regular internal audits catch problems before ICE does.

At Valley All States Employer Service, we have seen how the right approach transforms I-9 compliance from a source of anxiety into a source of confidence. Our specialized E-Verify processing helps businesses steer these requirements with expertise that comes from focusing only on employment eligibility verification.

Your business deserves that same peace of mind. Ready to make I-9 compliance your competitive advantage? Get expert E-Verify and I-9 compliance help from our team today.