Federal contractor E-Verify 2025: Ultimate Guide

Why Federal Contractor E-Verify Compliance Matters

Federal contractor E-Verify is a mandatory requirement for many businesses working with the U.S. government. If your company has a federal contract awarded after September 8, 2009, with the Federal Acquisition Regulation (FAR) E-Verify clause, you must use the system to verify your workforce’s employment eligibility.

Quick Summary: Federal Contractor E-Verify Requirements

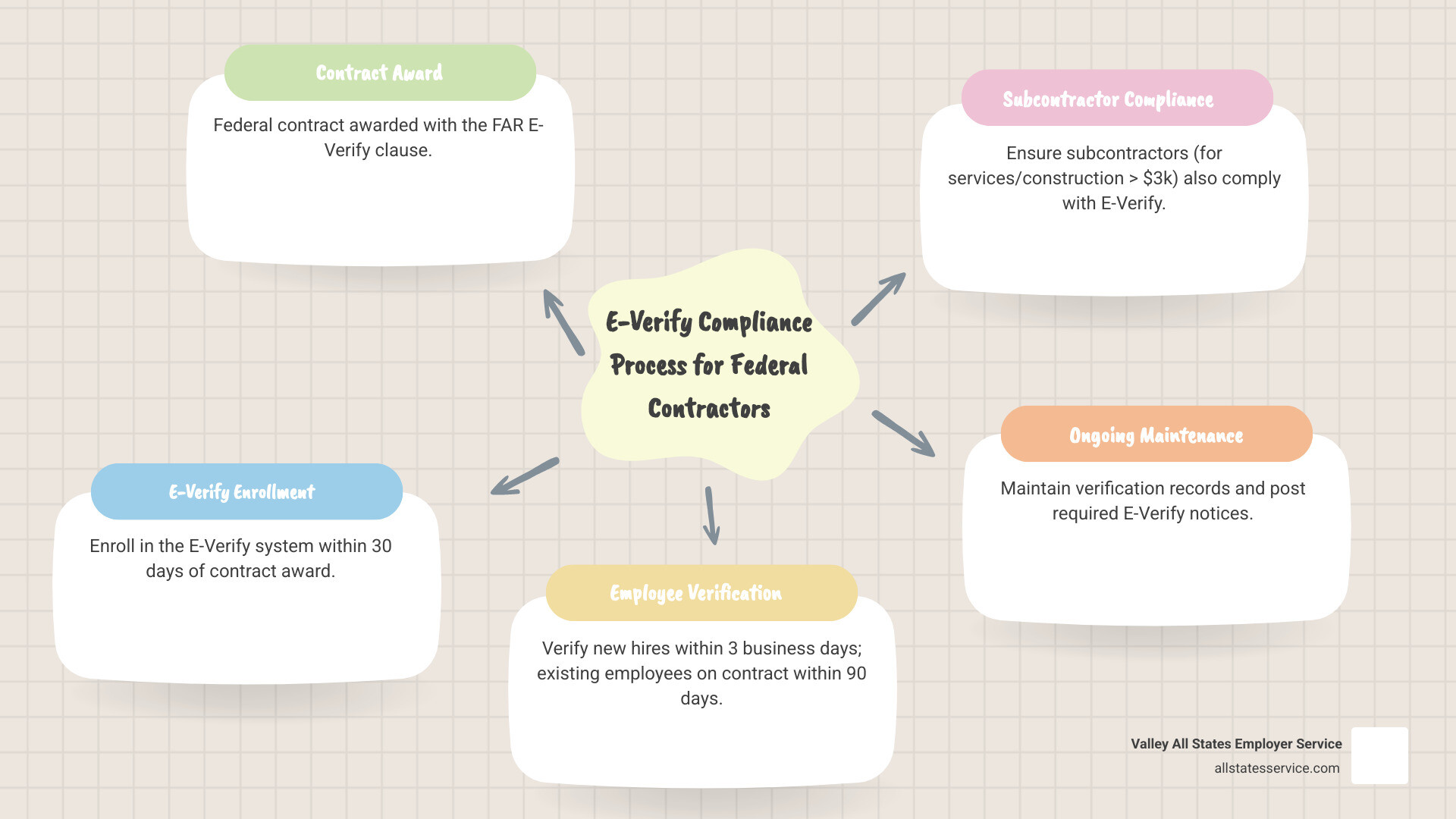

- Who it affects: Federal contractors awarded contracts after September 8, 2009, with the FAR E-Verify clause (48 C.F.R., Subpart 22.18)

- Contract thresholds: Prime contracts over $100,000 with a performance period longer than 120 days

- Subcontractor requirements: Subcontracts for services or construction over $3,000 must also comply

- Enrollment deadline: 30 days after contract award

- New hire verification: Within 3 business days of start date

- Existing employee verification: Within 90 days of enrollment (for those assigned to the contract)

- Entire workforce option: 180 days if you choose to verify all employees

Winning a federal contract is a major achievement, but it comes with the responsibility to maintain a legal workforce. The federal government’s policy is clear: it only does business with organizations that employ a verified, legal workforce. If your contract includes the E-Verify clause, compliance is not optional.

Many HR managers find the complexity of E-Verify overwhelming. The strict timelines, detailed rules, and severe consequences of non-compliance, like contract suspension or debarment, create significant pressure. This guide breaks down what you need to know about federal contractor E-Verify compliance, from which contracts are affected to managing subcontractor obligations.

Understanding the E-Verify Federal Contractor Rule

If you’ve landed a federal contract, you need to know about Federal contractor E-Verify. The rule, found in the Federal Acquisition Regulation (FAR) at 48 C.F.R., Subpart 22.18, requires you to use E-Verify to confirm your employees are legally authorized to work in the U.S.

E-Verify is an internet-based system from the Department of Homeland Security (DHS) and the Social Security Administration (SSA) that compares an employee’s Form I-9 information against government databases. When you win a federal contract, you’re not just agreeing to deliver a service; you’re committing to maintain and prove you have a legally authorized workforce. If you’re new to the system, our guide on What is E-Verify? breaks down the basics.

Who is Affected and When?

Not every federal contract triggers the E-Verify requirement. The rule applies to new federal contracts awarded on or after September 8, 2009, that include the FAR E-Verify clause. Even contracts predating 2009 can be affected if a modification adds the clause, so watch for any changes.

For prime contracts, the rule applies when the contract value exceeds $100,000 and the performance period is longer than 120 days. Both conditions must be met. A $150,000 contract that wraps up in 90 days is not covered, but a $200,000 contract lasting six months is.

For subcontractors, the threshold is much lower. If the prime contract includes the FAR E-Verify clause, any subcontract for services or construction valued over $3,000 must also comply. The requirement flows down from the prime contractor, and it’s your responsibility to know about it.

Understanding these details helps you figure out if Federal contractor E-Verify applies to your business. For a broader look at who needs to use E-Verify beyond just federal contractors, check out What Employers Are Required to Use E-Verify?.

Are There Exemptions to the Rule?

Some exemptions exist for certain types of contracts.

Commercially Available Off-the-Shelf (COTS) items are usually exempt. These are products you can buy in the regular commercial marketplace. This exemption often covers food and agricultural products too.

Contracts performed entirely outside the United States typically don’t require E-Verify, since the system verifies U.S. work authorization.

Contracts below the dollar thresholds we mentioned earlier are also exempt. Prime contracts under $100,000 and subcontracts under $3,000 generally don’t trigger the requirement.

Certain work by institutions of higher education may be exempt, along with some contracts involving state and local governments and tribal organizations.

These exemptions can be complex. Always check your contract for the FAR E-Verify clause to confirm your obligations, as assuming you are exempt can be a costly mistake.

The official E-Verify website provides detailed guidance on federal contractor requirements and exemptions: Official E-Verify requirements for Federal Contractors. It’s worth bookmarking that page because it comes straight from the source.

Your Obligations as a Federal Contractor E-Verify User

Once your contract falls under the Federal contractor E-Verify rule, you have several key responsibilities. As a prime contractor, you must manage your own E-Verify obligations and ensure your subcontractors comply.

Your first responsibility is enrolling in E-Verify on time and using it for your workforce. This includes verifying new hires and existing employees assigned to perform direct work on the federal contract, not those in purely administrative or overhead roles. You must also post required notices, maintain proper records, and follow specific verification timelines. Your broader responsibilities as an employer using E-Verify are covered in depth here: E-Verify Employer Responsibilities.

Managing Subcontractor Compliance

The E-Verify rule includes a “flow-down” requirement. If your prime contract has the E-Verify clause, it flows down to subcontracts for services or construction valued over $3,000. Your job is not to verify their employees, but to provide oversight.

Ensure your subcontractors are enrolled in E-Verify and using it correctly for their staff on the project. Start by including a flow-down clause in your subcontract language that requires E-Verify compliance. This sets clear expectations and protects both parties.

Next, require proof of enrollment from your subcontractors, such as their Employment Eligibility Verification page from the E-Verify system, and keep it on file as evidence of due diligence.

Regular communication is key, especially with subcontractors new to federal work. If a subcontractor fails to comply and you knowingly continue working with them, you could face penalties too. For more detailed guidance on navigating E-Verify as a contractor, check out: E-Verify For Contractors.

Key Deadlines for Federal Contractor E-Verify Compliance

In Federal contractor E-Verify, timing is everything. Missing deadlines can jeopardize your contract and lead to serious consequences.

The clock starts ticking the moment your contract is awarded. You have 30 days to enroll in E-Verify as a federal contractor. This enrollment window is non-negotiable. During this time, you’ll sign your Memorandum of Understanding with the government and set up your account.

Once enrolled, the three-business-day rule kicks in for all new hires. This is standard E-Verify practice. After a new employee completes their Form I-9, you must create their E-Verify case within three business days of their start date. This applies to every new hire, regardless of whether they’ll work on the federal contract.

For existing employees assigned to work on the federal contract, you have 90 days from your enrollment date to verify them in E-Verify. “Assigned to the contract” means employees who are directly performing work under the contract, not those in general administrative or overhead roles.

You can also elect to verify your entire workforce, not just those assigned to federal contracts. If you make this choice, you must notify DHS and complete verification for all current employees within 180 days of your enrollment. This option can simplify processes if you have multiple federal contracts or expect to grow your federal work.

Staying on top of these deadlines requires organization. If you need help streamlining your process, our guide on the E-Verify onboarding process walks through best practices: E-Verify Onboarding Process.

The E-Verify Process from Start to Finish

The Federal contractor E-Verify process begins with the Form I-9. Every new hire completes this foundational document. Once the Form I-9 is properly filled out, you log into the E-Verify system and enter the information.

The system electronically compares that data against records from the Department of Homeland Security (DHS) and the Social Security Administration (SSA), usually returning a result in seconds. E-Verify is a partner to the Form I-9, not a replacement; you must still keep a completed I-9 on file. The two work together to verify employment eligibility. For a more detailed look at how these two processes connect, take a look at this resource: E-Verify and I-9.

How to Verify New and Existing Employees

The Form I-9 is always the first step. After it’s completed, you log into E-Verify to create a case by entering the employee’s information from their I-9. The system guides you through the process.

For new hires, the rule is simple: verify everyone within three business days of their start date. This applies to all new employees, whether they work on your federal contract or not. If you’re enrolled in E-Verify as a federal contractor, this becomes your standard practice.

Existing employees are where federal contractor requirements get more specific. You are only required to verify employees directly assigned to perform work on the federal contract. You have 90 days from your company’s E-Verify enrollment to complete verification for these existing employees assigned to the contract.

Many employers mistakenly think E-Verify is only for new hires. As a federal contractor, your responsibilities extend to relevant existing staff as well. If you want to dig deeper into the nuances of verifying employees already on your payroll, this guide can help: E-Verify For Existing Employees.

Handling a Tentative Nonconfirmation (Mismatch)

A Tentative Nonconfirmation (TNC) does not mean an employee is unauthorized to work. It simply indicates a mismatch between the information you entered and government records, which is often fixable.

When E-Verify returns a TNC, you must promptly notify the employee in private. You’ll give them a Further Action Notice, which explains the mismatch and their options. This conversation should be confidential and respectful.

Your employee has the right to contest the TNC. They typically have eight federal government workdays to contact either DHS or SSA to resolve the issue. During this time, they work directly with the government to fix whatever caused the mismatch, such as a typo or a name change that wasn’t updated.

Critically, for Federal contractor E-Verify users, you cannot take any adverse action against an employee resolving a TNC. This means you cannot refuse to assign them to the contract, remove them, delay training, change their schedule, reduce hours, or withhold pay. They must continue working with full rights and pay. Taking adverse action violates your E-Verify agreement and can lead to serious consequences.

The employee will work through the resolution process. In many cases, the issue gets cleared up and the case is updated to “Employment Authorized.” If an employee chooses not to contest, or if the issue can’t be resolved, you’ll receive a Final Nonconfirmation. Only at this point may you consider termination, following proper procedures and your company’s policies.

Understanding the TNC process is crucial for staying compliant. For detailed guidance on navigating these situations, we recommend this resource: E-Verify Tentative Nonconfirmation.

The Option to Verify Your Entire Workforce

As a Federal contractor E-Verify user, you have the voluntary option to verify your entire workforce, not just new hires or those on federal contracts. This can simplify compliance if employees move between projects, as it eliminates the need to track who is “assigned to the contract.”

If you choose this route, you must formally notify DHS and complete verification for all current employees within 180 days of enrolling. This creates a consistent verification approach across your organization.

However, it’s not the right choice for every company. Verifying your entire workforce means more administrative work upfront and potentially more TNCs to resolve. You’ll need adequate resources to handle it all within the 180-day window.

Think carefully about your company’s structure, the number of federal contracts you hold, and your administrative capacity before choosing this option. For guidance on making this decision, check out: E-Verify Best Practices.

Ensuring Compliance and Finding Support

Ongoing Federal contractor E-Verify compliance requires vigilance and accuracy. Managing I-9 audits, potential penalties, and regulatory changes can stretch HR teams thin, which is why knowing your support options is critical. Proactive support, as we’ve seen in our HR Regulatory Compliance work, makes all the difference.

Penalties for Non-Compliance with the Federal Contractor E-Verify Rule

The consequences for failing to comply with the Federal contractor E-Verify rule are serious. The government strictly enforces its legal workforce requirements, and violations have significant penalties.

Civil penalties can quickly add up. Failure to properly complete, retain, or present Forms I-9, or violating E-Verify requirements, could lead to fines from hundreds to thousands of dollars per violation.

Losing federal contracts is a major risk. If you’re found non-compliant, the government may suspend or terminate your existing contracts, which is a blow to your finances and reputation.

Debarment from future contracts is also possible, meaning your company could be barred from receiving federal contracts for a specified period. For businesses built on government work, this can be devastating.

There’s also back pay liability to consider. If you take adverse action against an employee during a TNC resolution process, you may be on the hook for back pay and other remedies.

Non-compliance can also trigger increased worksite enforcement scrutiny from agencies like Immigration and Customs Enforcement (ICE), leading to time-consuming I-9 audits. Severe violations could even cause you to lose access to the E-Verify system.

The stakes are high. For a comprehensive look at potential penalties related to I-9 compliance, we recommend reviewing: I-9 Compliance Penalties.

Where to Find Help and Official Resources

You are not alone in navigating compliance. Excellent official resources are available to help you maintain Federal contractor E-Verify compliance.

The E-Verify.gov website should be your first stop. It’s the official hub for everything E-Verify, offering comprehensive guides, FAQs, and policy updates. You can find detailed information specifically for federal contractors here: Official E-Verify requirements for Federal Contractors.

USCIS webinars and training sessions are another valuable resource. U.S. Citizenship and Immigration Services hosts free webinars for federal contractors that walk through enrollment, timelines, and complex scenarios. You can register for upcoming sessions here: Upcoming E-Verify for Federal Contractors Webinars.

Don’t overlook the E-Verify User Manuals. These detailed guides provide step-by-step instructions for using the system and managing cases.

When you encounter specific problems, E-Verify customer support is there to help. The support team can walk you through system issues and answer procedural questions. For more information on how to access support, visit: E-Verify Employer Customer Service.

Using these resources can ease your compliance burden and help you steer E-Verify with confidence.

Streamline Your E-Verify Compliance

Navigating Federal contractor E-Verify compliance can be overwhelming. The strict deadlines, subcontractor oversight, and complex rules create a significant administrative burden, especially for small to medium-sized contractors. Your HR team is already busy, and adding E-Verify compliance can stretch resources thin when accuracy and timeliness are critical.

This is where partnering with an experienced E-Verify Employer Agent can transform your compliance from a burden into a seamless process. When you outsource your E-Verify workforce eligibility verification, you gain a dedicated partner who lives and breathes E-Verify regulations, ensuring every case is handled correctly and every deadline is met.

At Valley All States Employer Service, we specialize in taking the complexity of E-Verify off your plate. Our approach is simple: expert, impartial, and efficient processing that minimizes errors and frees up your team. We work with businesses across the United States, including those in Lutherville, MD, and throughout Maryland, helping them maintain compliance without the stress.

When you work with us, your HR team can refocus on strategic initiatives while we handle the day-to-day E-Verify requirements. That means accurate data entry, proactive case management, proper record-keeping, and staying current with regulatory changes. We bring deep expertise in the E-Verify system and understand the specific nuances that federal contractors face. Learn more about the advantages of working with a dedicated agent here: E-Verify Employer Agent.

The peace of mind that comes from knowing your compliance is in capable hands is invaluable. You’ll have more time to focus on winning contracts and delivering excellent work, while we ensure you’re always audit-ready.

Ready to ensure your I-9 and E-Verify processes are audit-proof? Get a complete guide to I-9 audits and compliance.