Employment law laws: Simplify 2025 Compliance

Understanding Employment Law Laws: Your Business’s Foundation for Fair and Legal Operations

Employment law laws govern the relationship between employers and employees. These rules cover everything from wages and hours, workplace safety, and anti-discrimination to leave entitlements and termination. For HR managers, this means juggling compliance with federal agencies like the Department of Labor (DOL), the EEOC, and OSHA, while also tracking state-specific requirements.

The stakes are high. Most employers with 15 or more employees are covered by EEOC laws, and the Fair Labor Standards Act affects nearly all private and public employment. Violations can lead to steep fines and legal fees, making compliance essential.

Employment law is also constantly evolving. Recent years have brought new pay transparency laws, shifting marijuana testing policies, and emerging AI hiring regulations. Federal laws set the minimum standard, but states like California and New York often add more layers of protection.

Understanding employment law laws is not optional. It is the foundation for protecting your business from lawsuits, maintaining a fair workplace, and building a team that trusts you.

Navigating U.S. Federal Employment Law Laws

Understanding federal employment law laws provides a clear framework for compliance across the United States. Think of federal law as the foundation, while states can add more protections on top. You can never do less than what federal law demands.

Three main agencies enforce these rules: the U.S. Department of Labor (DOL) for wages and benefits, the U.S. Equal Employment Opportunity Commission (EEOC) for discrimination, and the Occupational Safety and Health Administration (OSHA) for workplace safety. If you need help navigating these rules, explore our Workplace Compliance Solutions for custom support.

Wages, Hours, and Leave: FLSA and FMLA

Two key laws shape pay and time off: the Fair Labor Standards Act (FLSA) and the Family and Medical Leave Act (FMLA).

The Fair Labor Standards Act (FLSA) covers most employers, setting the federal minimum wage, requiring overtime pay for hours over 40 in a workweek, and limiting child labor. A common challenge is correctly classifying employees as exempt or non-exempt from overtime, as mistakes can lead to costly wage disputes. You can find more info on the FLSA directly from the DOL.

The Family and Medical Leave Act (FMLA) gives eligible employees of covered employers up to 12 weeks of unpaid, job-protected leave per year. This can be for events like the birth of a child, a serious personal health condition, or caring for a sick family member. The FMLA applies to employers with 50 or more employees. Check out FMLA details for a complete breakdown.

Preventing Discrimination and Harassment

Fairness in the workplace is federal law. The EEOC enforces employment law laws that prevent discrimination, applying to most employers with at least 15 employees (or 20 for age discrimination).

- Title VII of the Civil Rights Act of 1964 is the cornerstone, banning discrimination based on race, color, religion, sex, and national origin. You can view the legal text at Title VII of the Civil Rights Act of 1964.

- The Americans with Disabilities Act (ADA) requires employers to provide reasonable accommodations for qualified individuals with disabilities. The EEOC offers resources on ADA your employment rights.

- The Age Discrimination in Employment Act (ADEA) protects workers 40 and older from age-based discrimination. Learn more about the Age Discrimination in Employment Act of 1967.

- The Equal Pay Act (EPA) requires equal pay for men and women performing substantially similar jobs.

Harassment is also illegal when unwelcome conduct based on a protected characteristic creates a hostile work environment. Even minor incidents can contribute to a hostile environment, so it’s critical to have strong anti-harassment policies. Learn more about HR Regulatory Compliance to ensure your policies are airtight.

Workplace Safety and Employee Benefits

Federal laws also protect employees’ physical safety and financial security.

The Occupational Safety and Health Act (OSH Act) requires employers to provide a workplace free from recognized hazards. OSHA sets and enforces these standards. For the complete legal framework, see the OSH Act details.

For retirement and health benefits, the Employee Retirement Income Security Act of 1974 (ERISA) establishes minimum standards for private industry plans. The DOL provides extensive information on Employee Retirement Income Security Act (ERISA).

Workers’ compensation is managed at the state level. Each state has its own system to provide benefits for employees injured on the job. Most states require employers to carry this insurance.

Staying on top of these federal mandates can be complex. Our Employer HR Compliance services can help you manage the complexities and keep your business protected.

A Tale of Two Systems: U.S. vs. Canadian Employment Law Laws

If you manage teams across North America, you’ll find that employment law laws in the United States and Canada follow different paths. Both aim to protect workers, but their approaches reflect distinct legal traditions. Understanding these differences is essential for smart hiring and avoiding legal pitfalls.

At-Will Employment vs. Termination with Notice

The most dramatic difference appears when you part ways with an employee.

In the United States, “at-will” employment is the default. This means you can generally terminate an employee at any time for any reason that isn’t illegal, such as discrimination or retaliation. No advance notice or severance is typically required. This gives employers flexibility but can feel precarious for workers.

Canada takes a different approach. There is no at-will employment. If you dismiss an employee without cause, you must provide reasonable notice of termination or pay in lieu of notice. A “for cause” termination is possible for serious misconduct like theft or fraud, but the bar is high and requires solid documentation.

For terminations without cause, Canadian law requires statutory notice, but common law often requires much longer notice periods based on the employee’s age, service, and position. This system prioritizes employee security and requires employers to plan workforce changes carefully.

Federal vs. Provincial/State Jurisdiction

How legislative power is divided is another key distinction.

In the U.S., federal employment law laws set a nationwide baseline. The FLSA, Title VII, and other statutes apply everywhere, but states can add more protections, like a higher minimum wage or more generous leave. Employers must follow whichever law is more favorable to the employee.

Canada flips this structure. Most employment relationships fall under provincial or territorial jurisdiction. Each province has its own employment standards legislation covering wages, overtime, vacation, and termination. The rules in British Columbia differ from Ontario, which differ from Quebec.

Federal employment law in Canada only applies to a narrow set of federally regulated industries, like airlines, banks, and interprovincial transportation. For example, Saskatchewan’s provincial standards mandate specific rest periods and meal breaks, and overtime generally kicks in after 40 hours. These details vary by province, and you can check current rates across Canada in the minimum wage database.

For businesses expanding into Canada, especially as Canada increases immigration targets to address labor shortages, understanding provincial rules is the foundation of compliance.

Common Legal Issues and Emerging Trends

The landscape of employment law laws is always changing. For HR managers, staying alert to both classic legal pitfalls and new rules is critical for managing teams effectively.

Common Causes of Action in Employment Law Laws

Certain legal disputes between employers and employees arise frequently.

Employee claims often involve wrongful termination, where someone is fired for an illegal reason like discrimination or in violation of a contract. Retaliation is another common complaint, where an employee is punished for exercising a legal right, like reporting wage theft. Other frequent claims include harassment, wage and hour violations (like unpaid overtime), discrimination, and denial of legally protected leave.

Employers occasionally bring claims too, though less often. These can include negligence when an employee’s carelessness causes damage, defamation, violation of non-compete clauses, or theft of trade secrets. Understanding these flashpoints helps you build stronger preventative measures, like properly completing I-9 forms. If you’re curious about what happens when this step goes wrong, check out I-9 Compliance Penalties.

The Evolving Landscape of Employment Law Laws

Three major trends are reshaping workplaces right now.

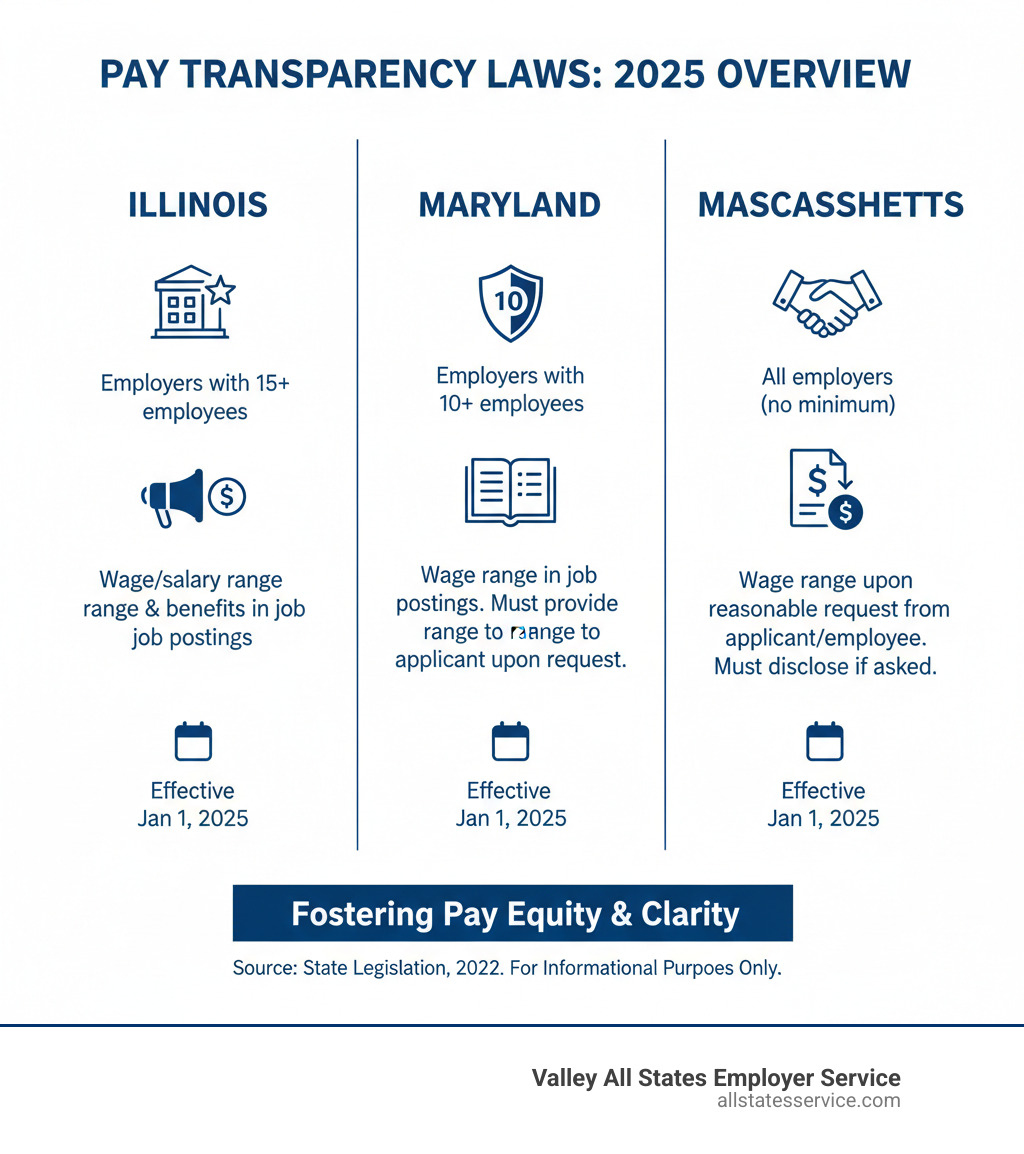

Pay transparency laws are spreading rapidly, requiring employers to disclose salary ranges in job postings. States like Illinois, New Jersey, Massachusetts, and Maryland have all passed laws with varying requirements. The goal is to close wage gaps and empower job seekers. You can see the specifics of Illinois’ pay transparency law if you’re operating there.

Marijuana legalization is forcing a rethink of drug testing. New employment law laws are protecting off-duty cannabis use. California’s AB 2188 and Washington’s SB 5132 prevent discrimination for off-duty use that doesn’t cause impairment at work. The focus is shifting from past use to current impairment on the job.

AI in hiring is the newest frontier. Regulators are concerned about hidden bias in algorithms that screen resumes or evaluate performance. Illinois passed a law prohibiting AI use that produces discriminatory results. Colorado’s AI regulation, enforceable in 2026, will be the first comprehensive U.S. law targeting high-risk AI systems in employment.

These changes affect how you write job postings, test applicants, and use technology. For a comprehensive look at what you need to know, our Employment Compliance Guide 2025 breaks down the major updates.

Frequently Asked Questions about Employment Law Laws

When running a business, questions about employment law laws are constant. Here are answers to some of the most common concerns.

What’s the difference between an employee and an independent contractor?

Misclassifying a worker can lead to serious penalties. The difference comes down to control. Courts and agencies look at three key areas.

- Behavioral Control: Do you direct how, when, and where the work is done? This points toward an employee.

- Financial Control: Do you control how the worker is paid, reimburse expenses, or provide tools? Employees are paid a regular wage with taxes withheld, while contractors typically invoice for their work.

- Relationship of the Parties: Is the work a core part of your business? Is the relationship long-term? Do you provide benefits like health insurance? These factors suggest an employee relationship.

An independent contractor generally controls their own schedule, offers services to multiple clients, and handles their own taxes and insurance. Getting this right is crucial for compliance.

Do employment law laws apply to small businesses?

Yes, this is a common myth. While some federal laws have employee count thresholds, many still apply to small businesses.

The Fair Labor Standards Act (FLSA), covering minimum wage and overtime, applies to businesses with at least $500,000 in annual revenue or any employee engaged in interstate commerce, which is broadly defined.

Federal anti-discrimination laws typically kick in at 15 or more employees (20 for age discrimination), and the FMLA applies at 50 employees. However, your state or local laws often have lower thresholds or no minimum employee count at all for certain protections.

The bottom line is that business size does not grant an exemption from compliance. Our HR Compliance for Small Business support is designed to help you steer these rules.

How can I verify a new hire’s eligibility to work in the U.S.?

Verifying that new hires are legally authorized to work in the U.S. is a fundamental requirement. The primary tool is Form I-9, Employment Eligibility Verification, which is mandatory for every new hire.

Both you and the employee complete the form. The employee presents documents proving their identity and work authorization, and you must examine them to ensure they appear genuine. You must complete and retain an I-9 for every employee hired after November 6, 1986.

E-Verify is an internet-based system that takes this a step further by electronically checking I-9 information against government records. While optional for many, some states and federal contracts require it. Using E-Verify adds an extra layer of protection against hiring unauthorized workers.

Small mistakes can lead to fines, which is why many businesses seek expert help. You can learn more about Workforce Eligibility Verification and how professional support can ensure everything is done correctly.

Simplify Your Compliance Journey

Staying current with employment law laws is the foundation that keeps your business protected, your team treated fairly, and costly disputes at bay. From federal rules like the FLSA to emerging trends like pay transparency, compliance is a moving target. The penalties for falling behind can affect your bottom line and your reputation.

You don’t need to steer this maze alone.

Keeping up with every regulatory change is overwhelming. That’s where Valley All States Employer Service comes in. We specialize in expert, impartial, and efficient HR compliance support, including outsourced E-Verify workforce eligibility verification. Our mission is to minimize errors, lighten your administrative load, and ensure your business stays on the right side of the law.

While you focus on growing your business, we handle the details that keep you compliant. Whether you’re verifying new hires or just need reliable guidance on employment law laws, we make the process straightforward.

Compliance doesn’t have to be a burden. With the right support, it becomes a strategic advantage. Ready to simplify your compliance journey? Get expert HR compliance assistance today!