Employment eligibility checks: Flawless Guide 2025

Why Employment Eligibility Checks Are Your First Line of Defense

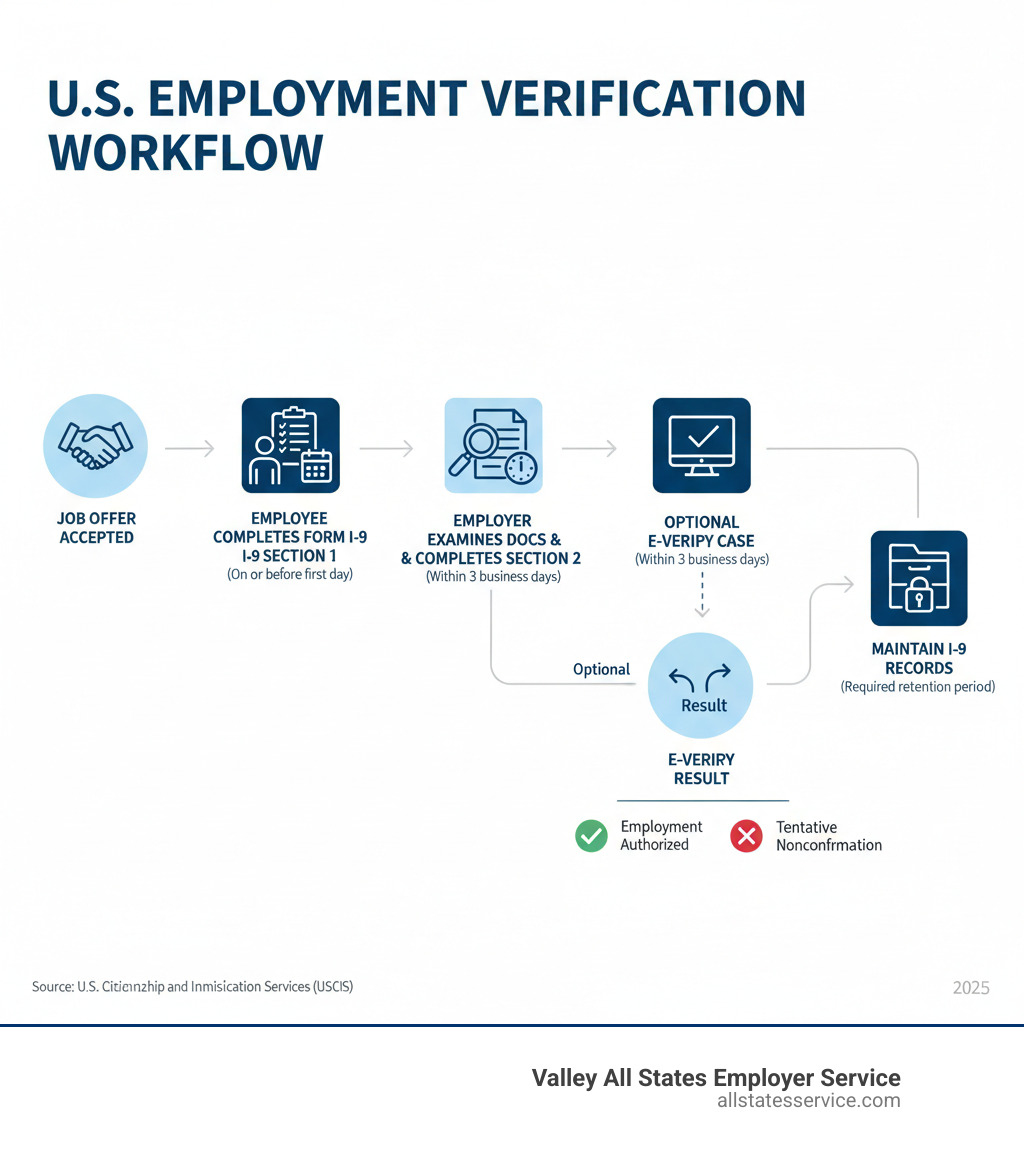

Employment eligibility checks are the mandatory processes U.S. employers use to verify that every new hire is legally authorized to work in the United States. These checks involve two main components: completing Form I-9 for all employees and, in some cases, using the E-Verify system to electronically confirm that information.

Quick Answer: What You Need to Know

- Form I-9 is required for every employee hired in the U.S., including citizens and non-citizens

- Section 1 must be completed by the employee on or before their first day of work

- Section 2 must be completed by the employer within three business days of hire

- E-Verify is an optional online system (mandatory in some states or for federal contractors) that cross-checks I-9 information against government databases

- Penalties for non-compliance range from $288 to $28,619+ per violation, depending on the offense

Since the Immigration Reform and Control Act of 1986, federal law has required every U.S. employer to perform these checks for every new hire, with no exceptions for company size or industry.

The stakes are high, as Immigration and Customs Enforcement (ICE) conducts thousands of I-9 audits annually. Employers face steep fines for everything from simple paperwork errors to knowingly hiring unauthorized workers, but compliance doesn’t have to be complicated.

Navigating complex immigration rules while hiring can feel overwhelming for busy HR managers. You need a clear roadmap to understand what to do, when to do it, and how to avoid costly mistakes.

This guide covers the entire verification process, from legal obligations to streamlined systems that protect your business and respect employee rights.

The Foundation of a Legal Workforce: Why Verification Matters

Employment eligibility verification is the foundation of your hiring process. Its purpose is to ensure every person you hire has the legal right to work in the United States.

The 1986 Immigration Reform and Control Act (IRCA) made it illegal for employers to knowingly hire or employ anyone unauthorized to work in the U.S. This law applies to all businesses without exception.

Your obligation is to build a workforce where every employee is legally authorized to work. This isn’t about creating barriers, but about following federal law and protecting your business.

Proper employment eligibility checks help you avoid unauthorized employment, which can lead to fines, legal trouble, and reputational damage. It also contributes to a fair employment system.

Instead of a hassle, view these checks as your shield. They demonstrate your commitment to compliance and ethical hiring, which is invaluable during an ICE audit. Our Employment Compliance Guide 2025 breaks down what you need to know, and you can find official guidance from U.S. Citizenship and Immigration Services.

Getting verification right from day one protects your business and everyone involved.

Mastering Form I-9: The Cornerstone of Compliance

Form I-9 is the heart of employment eligibility checks. Every U.S. employer must complete this form for every new hire, regardless of their citizenship status. Its purpose is to verify an employee’s identity and legal authorization to work in the U.S.

The form has strict deadlines. The employee completes Section 1 on or before their first day of work, providing personal information and attesting to their work authorization under penalty of perjury.

As the employer, you must complete Section 2 within three business days of the employee’s start date. This involves physically examining the employee’s original documents to ensure they appear genuine and relate to the individual, then recording the document information.

The record retention rules require you to keep each Form I-9 for three years after the hire date or one year after employment ends, whichever is later. The forms must be accessible for government inspection. For more details, see our resources on What is an I9? and Form I-9 Section 2.

Acceptable Documents for Verification

A critical anti-discrimination rule is that the employee chooses which documents to present for verification, not the employer.

List A documents establish both identity and work authorization. Examples include a U.S. passport or a permanent resident card. List B documents establish identity (e.g., driver’s license), while List C documents establish work authorization (e.g., Social Security card).

An employee must present either one document from List A or a combination of one from List B and one from List C. All documents must be unexpired. You cannot specify which documents to provide, as this is illegal document discrimination.

The employee’s right to choose is absolute. For a complete breakdown, visit our guide on Documents for I-9 or download the Official Form I-9 from USCIS.

Navigating I-9 Verification for Remote Employees

Form I-9 rules have adapted to remote work, providing options for examining documents when an employee is not physically present.

The Department of Homeland Security offers a permanent alternative procedure that allows for remote document examination, but only for employers enrolled in E-Verify.

This process involves the employee sending you copies of their documents, followed by a live video interaction where they show you the original documents for real-time examination.

If you don’t use E-Verify, you can designate an authorized representative to meet with the remote employee, physically examine their documents, and complete Section 2 on your behalf.

For more on managing distributed teams, see our guides on Remote I-9 Verification Best Practices 2025 and Can I-9 Verification Be Done Remotely?.

E-Verify: The Digital Layer of Employment Eligibility Checks

E-Verify is the digital companion to Form I-9. This internet-based system, run by DHS and the SSA, adds a layer of security by cross-referencing I-9 data with federal databases to confirm employment eligibility.

After completing Form I-9, you enter the employee’s information into E-Verify. The system checks this data against government records to confirm work authorization, which is a key part of employment eligibility checks.

While E-Verify is voluntary for most employers, it is mandatory for certain federal contractors and for some or all employers in specific states. These state-specific requirements vary widely.

Our E-Verify State Requirements Guide 2025 breaks down where your business stands. For more details, see our page What is E-Verify? or visit the official source, E-Verify.gov.

The E-Verify Process and Possible Outcomes

E-Verify is fast, typically providing a result in seconds. The most common result is Employment Authorized, which means the information matches and no further action is needed.

Occasionally, you may receive a Tentative Nonconfirmation (TNC), or mismatch. A TNC does not mean the employee is unauthorized to work. It simply indicates a discrepancy between the submitted information and government records, often due to a name change or data entry error.

If you get a TNC, you must notify the employee and provide a Further Action Notice. The employee then has the right to contest the TNC and has eight federal government workdays to contact the appropriate agency to resolve it.

During this time, you cannot take any adverse action against the employee, such as termination or delaying training. They have the right to work while resolving the issue. Our guide on E-Verify Tentative Nonconfirmation provides step-by-step instructions.

Employment may only be terminated if the employee chooses not to contest or receives a Final Nonconfirmation.

The Role of Self Check for Individuals

Self Check is a free myE-Verify service that allows individuals to check their own employment eligibility status against the same records used in E-Verify. This tool helps individuals proactively identify and correct discrepancies in their records, such as a name change, before they cause a TNC during the hiring process.

Remember: you cannot require or suggest that anyone use Self Check. This would violate anti-discrimination laws. It is a voluntary tool for individuals and does not replace any of the employer’s formal I-9 or E-Verify responsibilities.

The Guidance for Employers on Self Check spells out these restrictions clearly. Self Check is a helpful tool for individuals, but it stays firmly in their hands.

The High Stakes: Compliance, Penalties, and Key Distinctions

Getting employment eligibility checks wrong can cost your business thousands. Immigration and Customs Enforcement (ICE) conducts regular, thorough audits, and even minor errors like a missing signature can lead to penalties.

While a good faith effort to comply is important, it doesn’t prevent fines for common I-9 mistakes like incorrect dates, missing signatures, or improper record retention. These errors can add up quickly during an audit.

Strong record-keeping is your best defense. Store completed Forms I-9 securely and separately from other personnel files to protect sensitive information and streamline potential audits.

Conducting regular internal I-9 audits is a smart, proactive approach. This allows you to catch and correct errors before an official inspection, demonstrating your commitment to compliance and reducing risk. Our Internal I-9 Audit Complete Guide shows you how. For a look at potential penalties, see our resource on I-9 Compliance Penalties.

Critical Differences: Form I-9 vs. E-Verify Employment Eligibility Checks

Form I-9 and E-Verify are both key to employment eligibility checks, but they are not interchangeable. They serve different functions and have different requirements.

| Feature | Form I-9 (Employment Eligibility Verification) | E-Verify (Electronic Employment Eligibility Verification) |

|---|---|---|

| Requirement | Mandatory for all U.S. employers for every new hire. | Voluntary for most employers; mandatory for federal contractors and in some states. |

| Process | Paper or electronic form completed by employee (Section 1) and employer (Section 2) based on physical document examination. | Web-based system that electronically compares I-9 data against government databases. |

| Information Source | Employee attestation and employer’s physical examination of identity and work authorization documents. | Records from the U.S. Department of Homeland Security (DHS) and Social Security Administration (SSA). |

| Purpose | To document the verification of identity and employment authorization. | To electronically confirm the accuracy of information provided on Form I-9 and the employee’s work authorization. |

Form I-9 is the mandatory foundation for all employers and all new hires. It involves the physical examination of documents to verify identity and work authorization.

E-Verify is a digital layer that is optional for most but required for some. It electronically confirms the information from Form I-9 against government databases. E-Verify does not replace Form I-9; it adds an extra layer of verification after the I-9 is completed. Our page on E-Verify and I-9 breaks it down.

Understanding the Cost of Non-Compliance in Employment Eligibility Checks

The financial penalties for I-9 violations are serious and are regularly adjusted for inflation.

Uncorrected technical violations can cost you $288 to $2,861 per violation. If you have multiple errors, you could face tens of thousands of dollars in fines.

Document fraud carries steeper penalties. A first offense ranges from $590 to $4,730, with subsequent offenses jumping to $4,730 to $11,823.

The most serious violation is knowingly employing an unauthorized worker. A first offense costs $716 to $5,724 per worker. A second offense increases to $5,724 to $14,308. Multiple offenses can reach $8,585 to $28,619 per worker.

Beyond fines, non-compliance can damage your company’s reputation, affect your ability to attract talent, and lead to increased government scrutiny. In severe cases, it can even result in criminal charges. Our I-9 Audit Penalties Complete Guide provides more information.

Streamlining Verification with Technology and Expert Services

Juggling employment eligibility checks with other HR duties is challenging, making it easy for mistakes to happen. Smart technology and expert partners can streamline the process and prevent errors.

Many modern HR Information Systems (HRIS) integrate with digital I-9 solutions, changing a paper-heavy process into a manageable one.

These Electronic I-9 Solutions offer key advantages:

- Automated reminders ensure deadlines for Section 1 and Section 2 are met.

- Error-checking features catch common mistakes in real time, flagging missing information before it becomes a costly violation.

- Secure electronic storage handles retention requirements, keeping I-9s organized, accessible, and compliant with DHS standards for audits.

- For E-Verify users, seamless integration automatically creates cases from I-9 data, reducing manual entry and potential errors.

This automation frees up your time to focus on building your team and business.

Even with technology, many businesses choose to outsource the process to experts. This is especially helpful for companies with rapid growth or multi-state operations.

As an E-Verify Employer Agent, Valley All States Employer Service handles your E-Verify processing from start to finish. Our experienced team ensures accurate processing and stays current on all regulatory changes.

Partnering with an expert minimizes errors, reduces your administrative burden, and provides peace of mind. You get professional handling of your employment eligibility checks without adding to your HR headcount.

Whether you choose a digital solution, an expert service, or both, the key is finding a system that turns compliance from a worry into a streamlined part of your hiring process.

Frequently Asked Questions about Employment Eligibility Checks

Many employers have questions about employment eligibility checks. Here are clear answers to some of the most common ones.

How long do I need to keep Form I-9 records?

You must keep each completed Form I-9 for three years after the date of hire or one year after employment is terminated, whichever date is later. For example, if an employee works for you for five years, you must keep their I-9 for one year after they leave. If they only work for six months, you must keep the form for three years from their hire date. Keeping these records organized and secure is crucial for potential ICE audits.

Can I require a specific document, like a Green Card, from an employee?

The answer is a firm no. You cannot require a specific document, like a Green Card or U.S. Passport. This is a critical anti-discrimination protection. The employee has the legal right to choose which acceptable documents to present from the official lists: either one document from List A or a combination of one from List B and one from List C. The choice is theirs alone. Insisting on a specific document is considered document discrimination and can lead to serious legal penalties.

What happens if an employee receives an E-Verify TNC (mismatch)?

A Tentative Nonconfirmation (TNC) means the information entered into E-Verify did not match government records. It does not mean the employee is unauthorized to work. Mismatches often happen for innocent reasons, like a name change or a typo.

If an employee receives a TNC, you must notify them immediately and provide a “Further Action Notice.” This notice explains the mismatch and their right to contest it within eight federal government workdays.

While the employee works to resolve the issue, you cannot take any adverse action against them, such as termination or delayed training. They are legally protected during this period. Only if the employee chooses not to contest, or if they receive a Final Nonconfirmation after contesting, can you terminate employment based on the E-Verify result.

Conclusion

Employment eligibility checks are the foundation of a compliant business. A solid verification process protects your company, your team, and your reputation from the moment you hire.

From the mandatory Form I-9 to the digital safety net of E-Verify, compliance doesn’t have to be overwhelming. With the right approach, you can turn verification into a smooth part of your hiring workflow.

While the stakes are high, with potential ICE audits and large fines, you don’t have to manage compliance alone. Technology and expert partners can prevent errors and remove the administrative burden.

At Valley All States Employer Service, we make your employment eligibility checks flawless. As E-Verify experts, we handle the details, prevent mistakes, and give you confidence in your compliance, eliminating worries about deadlines, errors, or TNCs.

Your time is valuable, and your business deserves protection. Ensure your verification process is compliant and respects employee rights.

Ready to ensure flawless compliance? Explore our Outsourced HR Compliance Ultimate Guide and find how partnering with experts can simplify everything.