Compliance Consulting Firms: Ultimate 5-Step Guide

Why Smart Businesses Partner with Compliance Consulting Firms

Compliance consulting firms help businesses steer complex regulations, avoid costly penalties, and build robust compliance programs. If you’re searching for the right partner, here’s what you need to know:

Top compliance consulting firms typically offer:

- Regulatory navigation and interpretation of complex laws across jurisdictions

- Risk assessments and audits to identify vulnerabilities before regulators do

- Policy development and implementation custom to your industry

- Employee training programs to build a culture of compliance

- Ongoing monitoring and updates as regulations evolve

- Audit representation and remediation when issues arise

The business environment today feels like navigating a maze blindfolded. Federal regulations, state laws, industry standards, and international requirements all intersect in ways that can trip up even the most careful organizations. Three-quarters of risk stakeholders say real-time alerting and structured solution plans would have been invaluable during their most disruptive compliance events.

The stakes are high. Non-compliance doesn’t just mean fines, though those can be substantial. It means reputational damage, lost business relationships, and sometimes the inability to operate at all. FINRA member firms, for example, face not just monetary penalties but can lose their ability to provide services entirely.

That’s why more businesses are turning to compliance consulting as a strategic investment rather than a necessary evil. These firms bring former regulators, certified compliance officers, and industry specialists who know the regulatory landscape inside and out. They help you stay ahead of changes, implement effective programs, and turn compliance from a burden into a competitive advantage.

The right consulting partner doesn’t just keep you out of trouble. They free up your team to focus on growth while ensuring your compliance foundation is rock-solid.

What Do Compliance Consulting Firms Actually Do?

Think of compliance consulting firms as your business’s GPS through regulatory territory. They don’t just warn you about roadblocks ahead, they help you find the smoothest path forward and keep you moving confidently.

How They Help You Steer the Regulatory Landscape

The rules keep changing. New laws appear, old ones get updated, and what was compliant last year might land you in hot water today. This constant shift creates headaches for any business, especially if you’re operating across different states or juggling multiple industry requirements.

This is where compliance consultants shine. They interpret complex laws by translating dense legal language into clear action steps your team can actually follow. Whether you’re trying to understand federal employment requirements or specific Maryland regulations, they break it down into plain English.

They also act as your early warning system, keeping you ahead of regulatory changes before they catch you off guard. Instead of scrambling to adapt after a new law takes effect, you’ll have time to prepare. Their jurisdictional expertise means they understand the nuances of federal mandates like E-Verify as well as state-specific requirements, ensuring you’re covered wherever you operate.

When it comes to liaising with regulatory bodies, consultants serve as your experienced representatives, making sure communications are clear and professional. If an audit comes knocking, you’ll want someone who knows how to handle it. That’s where expert audit representation becomes invaluable, protecting your interests and ensuring your processes are properly explained.

For businesses dealing with people, HR regulatory compliance guidance ensures your hiring, management, and termination practices align with all relevant laws. Getting this right prevents costly mistakes down the road.

Core Services Offered by Top Compliance Consulting Firms

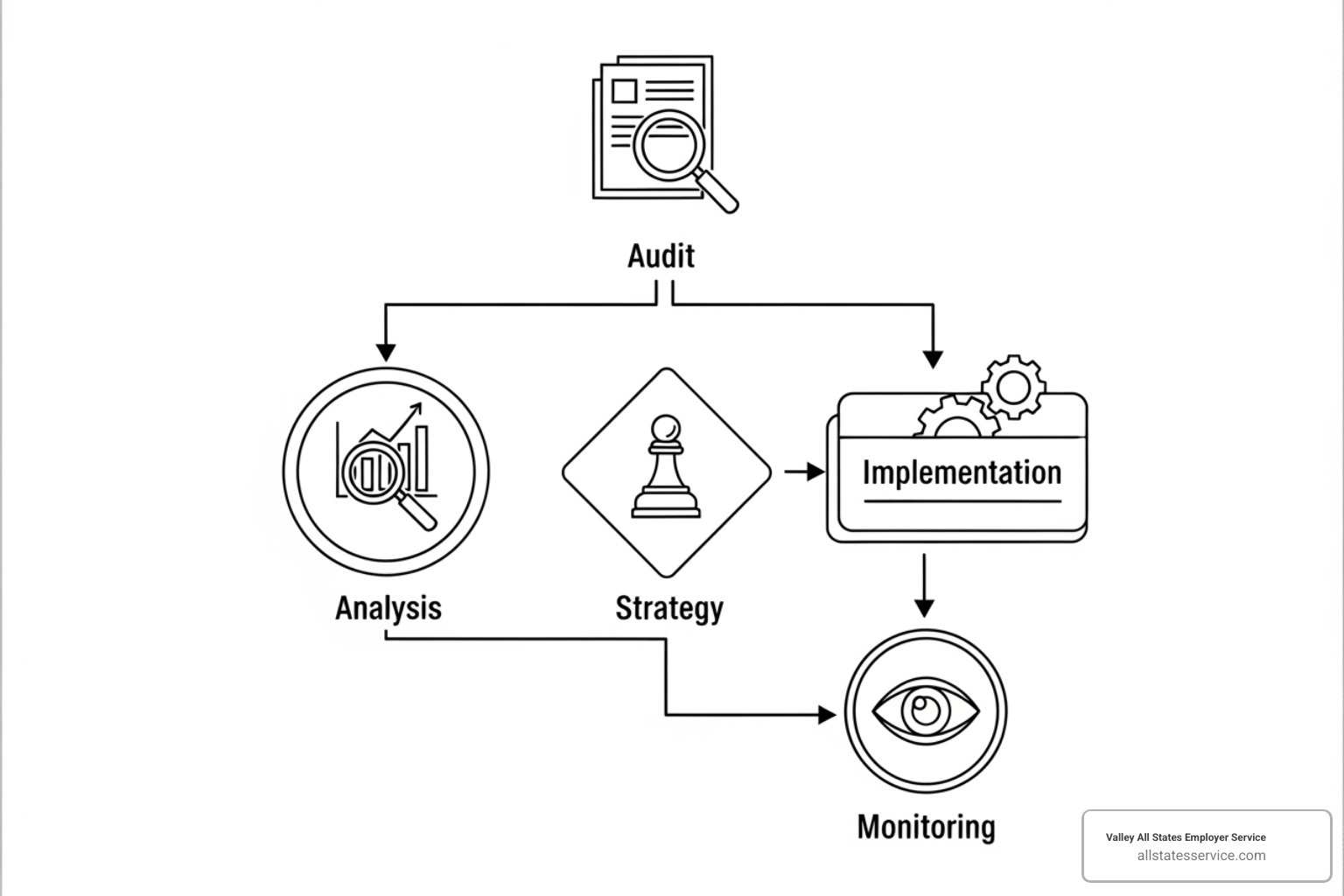

Compliance consulting firms offer comprehensive services designed to cover every angle of your compliance needs. Their work starts with compliance program design, where they either build a framework from scratch or strengthen what you already have. They customize everything to your specific risks and industry requirements.

Before regulators show up, consultants conduct risk assessments and mock audits to spot vulnerabilities you might have missed. Think of it as a practice run that identifies weak spots in your I-9 documentation or E-Verify processes before they become real problems.

They also handle policy drafting and implementation, turning regulatory requirements into clear, practical internal policies your team can actually use. A policy that sits in a binder gathering dust helps no one. Consultants create policies that work in the real world.

Many firms provide compliance management system support, helping you set up technology platforms that track and manage compliance activities automatically. This keeps everything organized and ensures nothing falls through the cracks.

Employee training programs ensure everyone in your organization understands their compliance responsibilities. Different roles need different knowledge, and good consultants tailor training accordingly. Some firms, like Berkshire Associates, even offer free monthly webinars on topics like workforce analytics and non-discrimination practices, particularly valuable for federal contractors.

The specialized areas these firms cover are extensive. For affirmative action compliance, firms provide expertise in OFCCP regulations, compensation analyses, and EEO-1 and VETS-4212 reporting, essential for federal contractors. Financial services companies need help with anti-money laundering and financial crime compliance, covering advisory work, governance, internal audit, and controls.

With cyber threats on the rise, IT and cybersecurity compliance services help manage risk and ensure your systems meet regulatory standards. And for financial firms just starting out, regulatory authorization and registration support guides you through the launch process with bodies like the SEC and FINRA. ACA has helped over 1,000 firms successfully steer these waters.

The bottom line? These firms handle the complex compliance work so you can focus on running your business.

The Big Payoff: Why Your Business Needs a Compliance Partner

Let’s talk about the real value of working with compliance consulting firms. This isn’t just about staying out of trouble, though that’s certainly part of it. It’s about making a strategic investment that protects your bottom line and positions your business for sustainable growth.

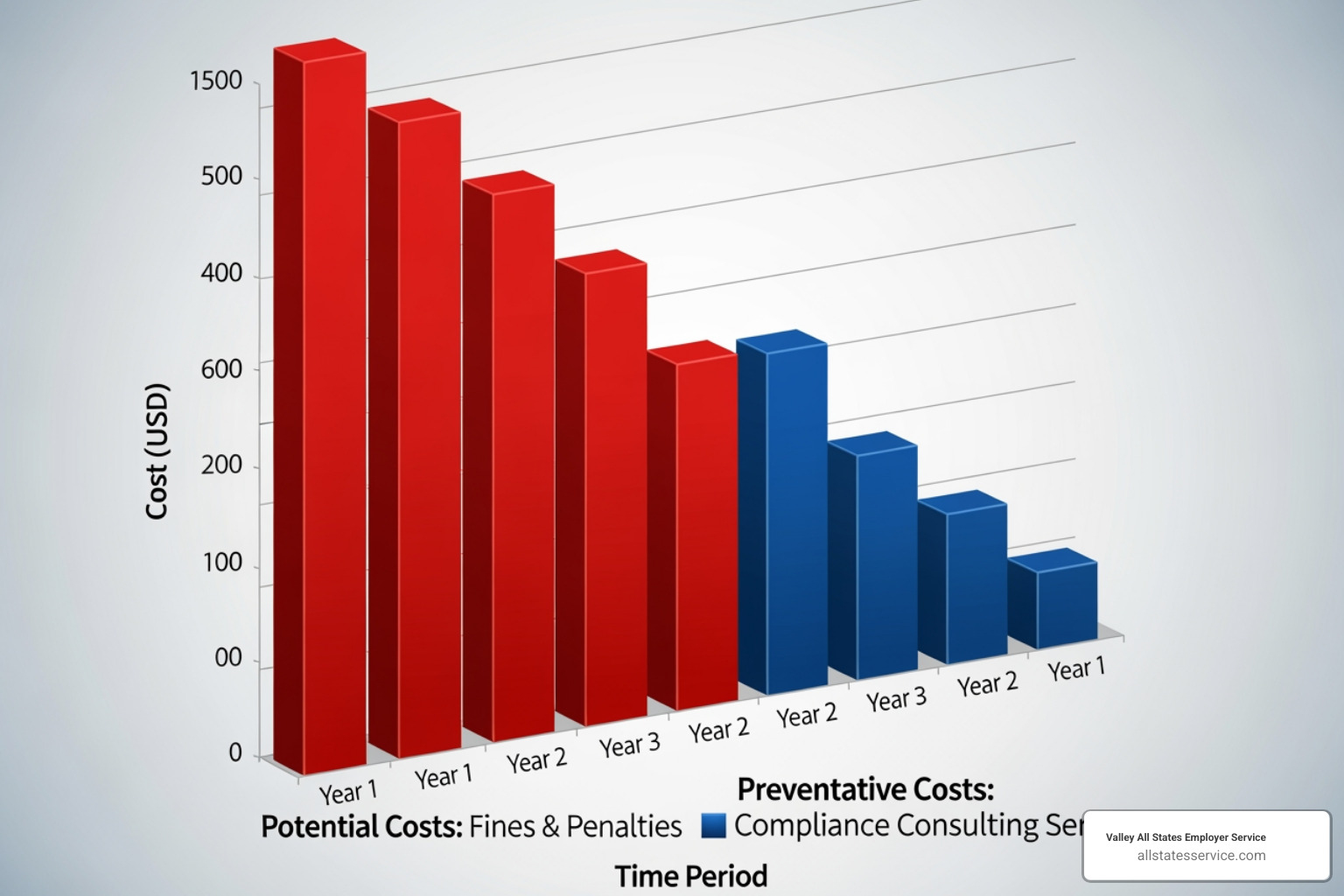

Think about it this way: would you rather pay a consulting fee now, or face a regulatory fine that could be ten or twenty times that amount? The math is pretty straightforward, but the benefits go much deeper than simple arithmetic.

Mitigating risk is at the heart of what compliance consultants do. They help us spot potential problems before they become actual problems. It’s like having a skilled navigator who can see the rocks beneath the water’s surface. They identify, assess, and help manage risks across your entire operation, from HR practices to financial reporting.

The most obvious benefit? Avoiding penalties and fines. These aren’t small numbers we’re talking about. FINRA violations can cost member firms hundreds of thousands of dollars, and in some cases, they can lose their authorization to operate entirely. For businesses handling employment verification, mistakes in I-9 documentation or E-Verify processing can trigger audits and substantial penalties. When you work with experts, you dramatically reduce this exposure.

Here’s something that surprises many business owners: compliance can actually improve operational efficiency. Good compliance isn’t about adding red tape. It’s about creating clear, streamlined processes that everyone understands and follows. When consultants help us implement these systems, they often find ways to cut unnecessary steps and reduce administrative burden. Your team spends less time confused about procedures and more time doing productive work.

Your reputation is one of your most valuable assets, and safeguarding it should be a top priority. A single compliance failure can make headlines and erode years of trust-building with customers and partners. On the flip side, a strong compliance record tells the world that you’re a responsible, ethical organization. That reputation opens doors.

This reputation building translates directly into boosting stakeholder confidence. Investors want to know their money is in good hands. Clients want to work with businesses they can trust. Employees want to feel proud of where they work. A solid compliance program, built with expert guidance, sends a powerful message to all these groups. For businesses looking to streamline HR compliance specifically, you can Reduce HR Compliance Risk by Outsourcing to specialists who know the landscape inside and out.

Measuring ROI on compliance consulting can feel tricky because you’re often measuring what didn’t happen. How do you put a price on the audit that went smoothly, or the fine you never had to pay? But when you look at the cost of even one major compliance failure, the investment in consulting services looks incredibly smart. It’s insurance that actually prevents the accident, not just pays for it afterward.

Measuring the Success of Your Compliance Consultant

So how do you know if your compliance consulting firm is actually delivering value? While some benefits are hard to quantify, there are clear indicators we can track.

The most straightforward measure is reduced non-compliance incidents. Are you seeing fewer regulatory violations? Fewer internal breaches of policy? If the answer is yes, your consultant is doing their job. This is especially important in areas like E-Verify processing, where errors can quickly add up.

Positive audit outcomes are another strong signal. When regulators review your records and find everything in order, that’s a direct reflection of the compliance program your consultant helped build. Passing audits with minimal findings should become the norm, not a pleasant surprise.

Look at your improved efficiency metrics too. Are compliance tasks taking less time than they used to? Is your team spending fewer hours on administrative work related to regulatory requirements? These time savings represent real cost reductions and allow your people to focus on revenue-generating activities.

Smart businesses track Key Performance Indicators (KPIs) around compliance. This might include completion rates for mandatory training, how quickly identified issues get resolved, or whether reports are filed on time. Top consulting firms like ACA maintain a 98% client satisfaction score precisely because they help clients achieve these measurable improvements.

Don’t underestimate the value of employee feedback and culture surveys. A strong compliance culture, where people understand and accept regulatory requirements rather than resenting them, is a huge win. Your consultant should be fostering this mindset throughout your organization.

Regular assessments, like an HR Compliance Review, help us continuously measure how well our programs are working. These periodic check-ins ensure we’re not just compliant today, but ready for whatever regulatory changes come tomorrow.

The right compliance partner doesn’t just keep you out of trouble. They make your entire operation stronger, more efficient, and better positioned for growth. That’s the real payoff.

How to Choose from the Top Compliance Consulting Firms: A 5-Step Guide

Picking the right compliance consulting firm isn’t something to rush. This decision affects your business’s future in real ways, from avoiding costly mistakes to building a culture of integrity. You’re not just hiring a vendor to check boxes. You’re looking for a true partner who understands your world and helps you thrive in it.

Think of it like hiring a guide for a challenging hike. You wouldn’t pick someone who specializes in desert treks if you’re climbing a snowy mountain. The same principle applies here. Let’s walk through five essential steps to help you find the right fit.

1. Verify Their Industry Specialization

Compliance looks completely different depending on your industry. What works for a healthcare provider won’t necessarily work for a financial services firm or a federal contractor. The regulations, the risks, and the solutions are all unique.

If you’re in financial services, you need a firm that lives and breathes SEC rules, FINRA updates, and state regulations. Firms like COMPLY and Deloitte have built their reputations on exactly this kind of expertise. They understand the nuances of investment advisors, hedge funds, and broker-dealers.

For healthcare, HIPAA compliance is the big one. Patient data privacy and security require specialized knowledge that general consultants simply don’t have.

If you’re dealing with HR and employment law, which is where we spend most of our time, you need consultants who genuinely understand the maze of federal and state requirements. This includes E-Verify procedures, I-9 compliance, affirmative action programs, and wage and hour laws. A firm that knows Maryland’s specific requirements, like those covered in our Maryland Employment Law Compliance Guide, brings real value. Berkshire Associates, for example, has spent over 35 years working with OFCCP regulations, making them true specialists in affirmative action.

Cybersecurity compliance, especially CMMC for federal contractors, is another specialized area. And speaking of federal contracting, those regulations from OFCCP and federal E-Verify mandates require consultants who know that world inside and out.

2. Assess the Team’s Expertise and Background

The people behind the firm matter just as much as the firm itself. You want a team that’s been in the trenches, not just read about compliance from a textbook.

Former regulators bring something special to the table. They’ve sat on the other side of the desk. They know how regulatory bodies think, what triggers their attention, and what they’re really looking for during audits. ACA has over 60 former regulators on their team, which gives them incredible insight into how agencies operate.

Certified Chief Compliance Officers who’ve actually managed compliance programs understand the daily challenges you face. They’ve dealt with real employees, real budgets, and real constraints. ACA also has over 90 former in-house CCOs, meaning they’ve walked in your shoes.

Legal professionals who specialize in regulatory law can interpret the fine print and help you understand not just what the rules say, but what they mean for your specific situation. Data analysts are increasingly important too, especially as compliance becomes more data-driven. They can spot patterns, predict risks, and help you make sense of complex reporting requirements.

And don’t underestimate industry veterans who’ve worked in your specific field. They bring context-aware advice that generic consultants can’t match.

3. Evaluate Their Use of Technology

The days of managing compliance with spreadsheets and filing cabinets are long gone. The best compliance consulting firms leverage technology to make your life easier and your programs more effective.

RegTech platforms are purpose-built solutions that help manage regulatory requirements more efficiently. They automate routine tasks, track deadlines, and keep everything organized in one place.

AI for risk prediction is becoming a game-changer. Instead of waiting for problems to surface, artificial intelligence can analyze patterns and flag potential issues before they become real headaches. Dow Jones, for instance, combines the expertise of 450 researchers with AI and automation tools to give clients a unified view of their risk landscape.

Real-time monitoring and alerting means you’re not flying blind. Technology can continuously watch your compliance status and send instant alerts when something needs attention. Firms like MetricStream and BearingPoint emphasize how data analytics and AI provide real-time intelligence that keeps you ahead of problems.

Data analytics for insights goes beyond just monitoring. It helps you understand trends, measure how well your programs are working, and make smarter strategic decisions. PwC and KPMG use collaborative approaches with tech partners to make sense of data and identify risk signals that humans might miss.

4. Understand Their Engagement Model

How a firm actually works with you matters a lot. The engagement model needs to fit your budget, your needs, and how much compliance capacity you have in-house.

Project-based engagements work well when you have a specific challenge to solve. Maybe you need help with a one-time audit, or you’re implementing a new program and need expert guidance to get it right.

A retainer model gives you ongoing access to expert advice. This works beautifully when regulations keep evolving and you want someone on call who knows your business. You’re not starting from scratch every time you have a question.

Fully outsourced compliance solutions are perfect if you’d rather hand the entire function to external experts. This can include specialized services like our Outsourced Compliance Solutions for employment verification, where we handle the details so you can focus on running your business.

The best firms offer flexible support that scales with your business. Whether you’re a small business in Lutherville MD or a larger organization with operations across the United States, they should adapt their services to your unique situation, not force you into a one-size-fits-all package.

5. Check Their Track Record and Reputation

Past performance tells you what to expect. Don’t just take a firm’s word for how great they are. Look at what they’ve actually accomplished.

Case studies and client testimonials show you real examples of how they’ve helped businesses like yours. Pay attention to whether those examples match your industry and challenges.

Industry rankings and awards can offer objective assessments based on extensive data and client feedback. Look for firms that are recognized leaders in the compliance field as a starting point for your research.

Proven success stories matter most. Has the firm helped clients avoid major fines? Have they successfully guided companies through complex regulatory authorizations? ACA, for example, has supported over 1,000 firms through their launch, registration, and authorization processes with bodies like the SEC and FINRA. That’s a track record worth paying attention to.

At the end of the day, you’re looking for a firm that not only understands compliance but understands you. Take your time with this decision. The right partner will help you build something that lasts.

Staying Ahead of the Curve: Future Trends in Compliance

The compliance landscape never sits still. New technologies emerge, regulations evolve, and what worked yesterday might not cut it tomorrow. That’s why partnering with forward-thinking compliance consulting firms isn’t just about solving today’s problems. It’s about preparing for the challenges we don’t even see coming yet.

Emerging Risks

Think of the compliance world as a constantly shifting puzzle. Just when you think you’ve got all the pieces in place, someone adds new ones to the board. ESG reporting (that’s Environmental, Social, and Governance for those not yet familiar) has moved from corporate buzzword to business imperative. Investors want to know your carbon footprint. Customers care about your social impact. Even state-level regulations are catching up, making ESG compliance a reality we all need to face.

Then there’s AI governance, which sounds like science fiction but is very much our present reality. As businesses adopt artificial intelligence tools, questions about ethical use, data privacy, and algorithmic bias become compliance concerns. Who’s responsible when an AI makes a mistake? How do we ensure transparency? These are the questions consultants are helping businesses answer right now.

Data privacy continues to be a moving target. While GDPR set the standard globally, here in the United States we’re seeing a patchwork of state laws like California’s CCPA. Consultants help us implement Privacy Impact Assessments to identify risks before they become problems, especially when handling sensitive employee or customer data.

Cybersecurity threats are growing more sophisticated by the day. A single breach can cost millions in fines, not to mention the reputational damage. Compliance experts help us fortify our defenses and meet industry-specific cybersecurity mandates.

And let’s talk about remote work compliance. The pandemic changed where we work, but the regulations didn’t all catch up at once. Managing Remote I-9 Compliance is just one example of how traditional processes need fresh approaches for our new distributed workforce reality.

The Evolving Role of Technology in Compliance

Here’s where things get exciting. Technology isn’t just supporting compliance anymore. It’s fundamentally changing how we think about it.

We’re seeing hyper-specialization in niche areas as regulations become more intricate. Instead of generalists who know a little about everything, firms are developing deep expertise in very specific domains. This means when you need help, you’re getting someone who truly speaks your language.

Increased automation of routine tasks is freeing up human experts to focus on what they do best: strategic thinking and complex problem-solving. AI and robotic process automation handle the repetitive stuff like monitoring transactions or flagging potential issues. This isn’t about replacing people. It’s about making them more effective.

The real game-changer is predictive analytics for proactive risk management. Instead of waiting for problems to happen and then reacting, businesses can now use data to see trouble coming from miles away. It’s like having a weather forecast for compliance risks. Publications like Technology Magazine regularly feature these emerging tools and platforms that are reshaping how we manage regulatory obligations.

The firms leading this charge are combining human expertise with cutting-edge technology. They’re not just keeping pace with change. They’re helping their clients stay two steps ahead of it.

Conclusion: Build Your Proactive Compliance Strategy

Choosing the right compliance consulting firm isn’t just about checking a box or avoiding trouble. It’s a strategic investment in your company’s future, one that protects your business while freeing you to focus on what you do best. Whether you’re operating in Maryland or serving clients across the United States, the right partnership transforms compliance from a burden into a business advantage.

The key is finding a true partner, not just another vendor. You need a firm that takes time to understand your unique challenges, speaks your industry’s language, and helps you build systems that actually work in the real world. The best consultants don’t just tell you what to do; they work alongside you to create sustainable, practical solutions that your team can implement and maintain.

For specialized needs like outsourced workforce eligibility verification, you want a partner who lives and breathes this work every day. Valley All States Employer Service offers expert, impartial, and efficient guidance in E-Verify processing and I-9 compliance. We help you minimize errors, reduce administrative burden, and stay confident that your employment verification processes are rock-solid. While you focus on growing your business, we handle the complexities that keep you compliant with federal regulations.

Think of it this way: every hour your HR team spends wrestling with I-9 forms or navigating E-Verify issues is an hour they’re not spending on recruiting top talent, developing your people, or supporting your business goals. The right compliance partner gives you that time back while actually improving your compliance outcomes.

Ready to build a rock-solid compliance framework that protects your business and fosters real growth? Explore our Compliance Outsourcing Solutions today and let us help you steer the regulatory landscape with confidence. Your future self will thank you for making this investment now.