Workforce verification solutions: Stop Fraud 2025

The Hidden Risks in Your Hiring Process

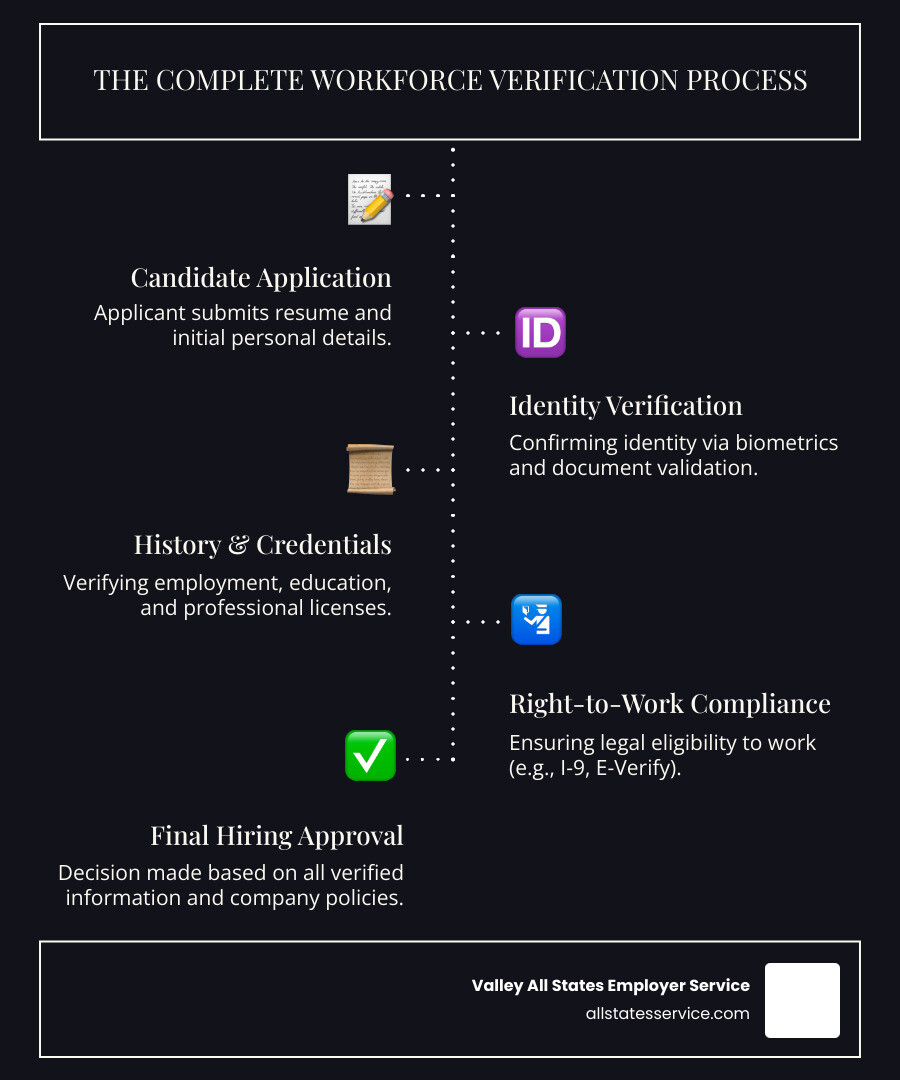

Workforce verification solutions are digital platforms and services that authenticate employee identities, employment history, and work authorization to prevent hiring fraud and ensure compliance. Here are the leading types available today:

Primary Workforce Verification Solutions:

- Employment & Income Verification – Validates job history and salary information through databases like The Work Number

- Identity Verification – Uses biometric technology and document authentication to confirm identity

- Right-to-Work Compliance – E-Verify and I-9 processing to ensure legal work authorization

- Education & Credential Verification – Confirms degrees, certifications, and professional licenses

- Background Check Integration – Comprehensive screening combining multiple verification types

Every time you hire someone new, you’re making a trust decision worth thousands of dollars. But what if that trust is misplaced?

The numbers tell a concerning story. With 149 million verification requests processed in 2024 alone through just one major platform, it’s clear that hiring fraud and credential misrepresentation are massive problems facing employers today.

From fake degrees to fabricated work histories, bad actors are getting more sophisticated at infiltrating companies through the hiring process. Even worse, up to 50% of IT tickets are password and account recovery requests, often stemming from identity-related issues that could have been prevented with proper verification upfront.

The good news? Modern workforce verification solutions have evolved far beyond simple background checks. Today’s platforms use AI-powered fraud detection, biometric authentication, and real-time database access to verify identities in minutes rather than days.

Why Every Hire Needs Verification: Benefits Beyond the Obvious

Here’s something that might surprise you: 52 million people benefited from instant verifications last year alone. That’s not just employers checking up on candidates, that’s employees getting verified for mortgages, loans, and apartment rentals at 2 AM on a Sunday because they needed it right then and there.

When you think about workforce verification solutions, you probably picture HR managers double-checking resumes. But the real magic happens in all the ways verification makes everyone’s life easier while keeping your business safe from increasingly clever bad actors.

The truth is, trusting someone’s word during hiring isn’t just naive anymore, it’s genuinely risky. But verification isn’t about being suspicious of people. It’s about creating systems that work better for everyone involved, from your HR team to your newest hire to your IT department that’s drowning in password reset requests.

More info about our Compliance Outsourcing Solutions

Streamline HR and Boost Efficiency

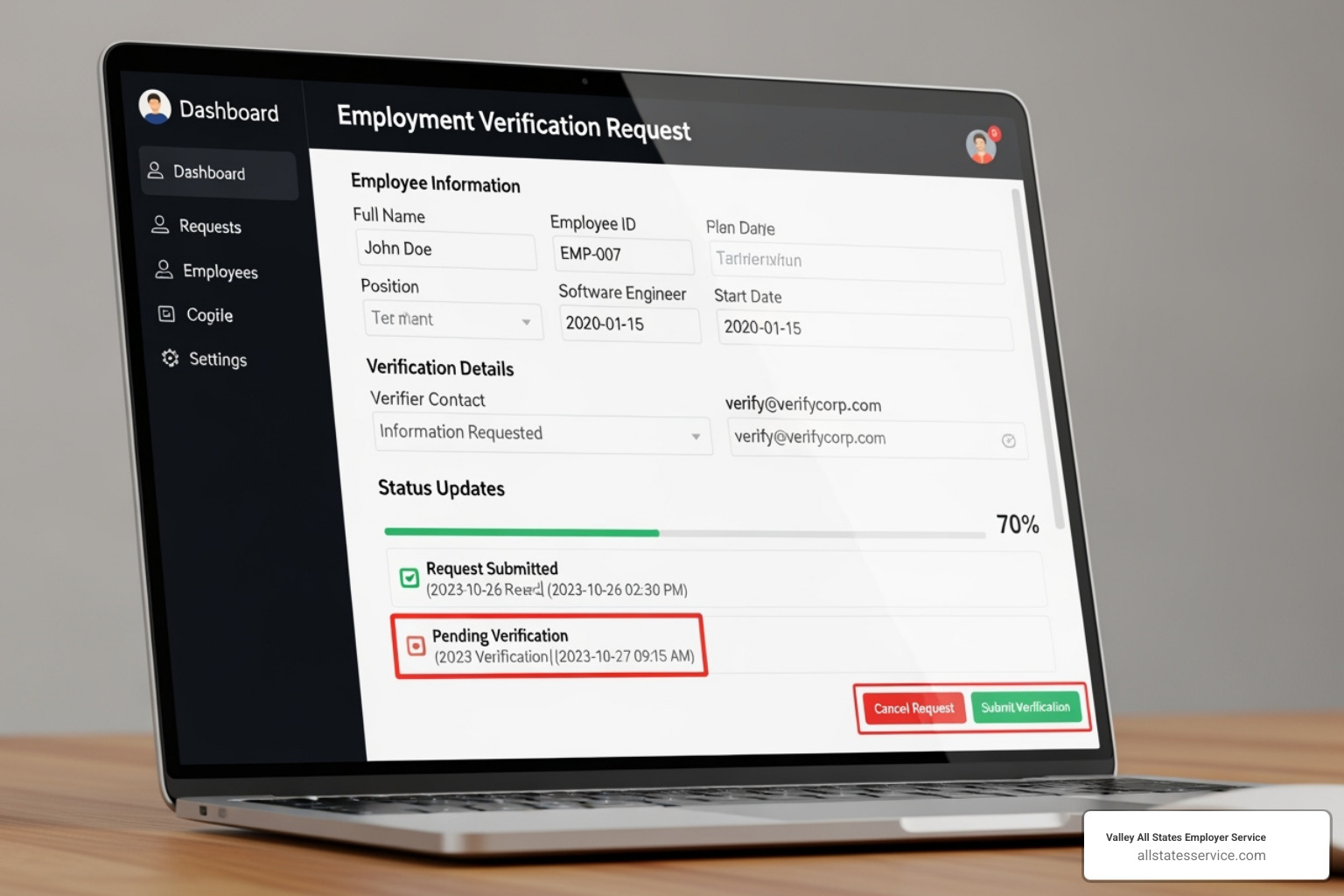

Picture your HR team spending hours on the phone, trying to reach someone at a candidate’s previous employer who actually remembers them from three years ago. Now imagine that same information appearing on your screen in about thirty seconds instead.

Automated workflows eliminate those frustrating phone tag games entirely. Your team gets faster hiring decisions without the usual back-and-forth delays, and candidates don’t sit in limbo wondering if they got the job. It’s a win-win that makes your entire hiring process feel more professional and responsive.

But here’s where it gets really interesting. You know how your IT team is constantly fielding password reset requests? Well, up to 50% of IT tickets are for password and account recovery issues. When you integrate identity verification into your systems, employees can securely recover their own accounts without bothering anyone. Suddenly, your IT team has time for actual IT work instead of playing digital locksmith all day.

The reduced administrative burden means your HR folks can focus on finding great people instead of drowning in paperwork. And with minimized manual errors, you avoid those awkward situations where someone’s start date gets mixed up or their background check paperwork goes missing.

More info about HR Compliance for Small Business

Mitigate Risk and Improve Security

Let’s talk about the elephant in the room: social engineering attacks are getting scary good. Bad actors aren’t just sending obvious phishing emails anymore. They’re creating fake LinkedIn profiles, deepfake videos, and elaborate backstories that can fool even experienced hiring managers.

Workforce verification solutions act like a digital bouncer for your company. They’re preventing infiltration by bad actors before these people ever make it through your front door. When someone applies with a perfectly crafted resume and glowing references, verification tools can spot the inconsistencies that human eyes might miss.

Insider threat prevention goes beyond just the hiring stage too. Even good employees can become risks if their credentials get stolen or if they leave on bad terms. Modern verification systems help you secure high-risk actions throughout an employee’s entire journey with your company, not just during onboarding.

The really clever part is how these systems combat insider threats by making sure the person accessing your systems is actually who they claim to be, every single time. Whether someone’s logging into payroll data or accessing customer information, that extra layer of verification stops problems before they start.

More info about Background Check Pre-Employment Screening

The Core Types of Workforce Verification

Think of workforce verification solutions as a toolkit where each tool serves a specific purpose. Just like you wouldn’t use a hammer to fix a leaky pipe, different verification methods tackle different aspects of the hiring puzzle. Some focus on confirming work history, others dig deep into identity authentication, and still others ensure legal work authorization.

The beauty lies in how these different types work together to create a complete picture of who you’re bringing onto your team. Let’s explore the three main categories that form the backbone of modern workforce verification.

More info about Workforce Eligibility Verification

Employment and Income Verification

Here’s where we roll up our sleeves and dig into a candidate’s professional past. Employment history checks aren’t just about catching resume embellishments (though that happens more often than you’d think). They’re about understanding the full story of someone’s career journey.

When we verify employment, we’re confirming past job titles to make sure that “Senior Manager” role was actually senior management and not a creative interpretation of “Senior Customer Service Representative.” We’re also verifying dates of employment because unexplained gaps or overlapping positions can raise red flags worth investigating.

Validating salary history becomes particularly important for certain roles, helping ensure fair compensation discussions and preventing inflated expectations. But here’s what many employers don’t realize: this verification process isn’t just about protecting your company. It’s actually powering life’s moments for employees too.

Think about it. When your employee needs to secure a mortgage, apply for a car loan, or even rent an apartment, they need quick access to verified employment and income data. Modern systems make this possible 24/7, which is why millions of people rely on these services for their personal financial needs.

More info about what an I-9 Form is

Identity and Credential Verification

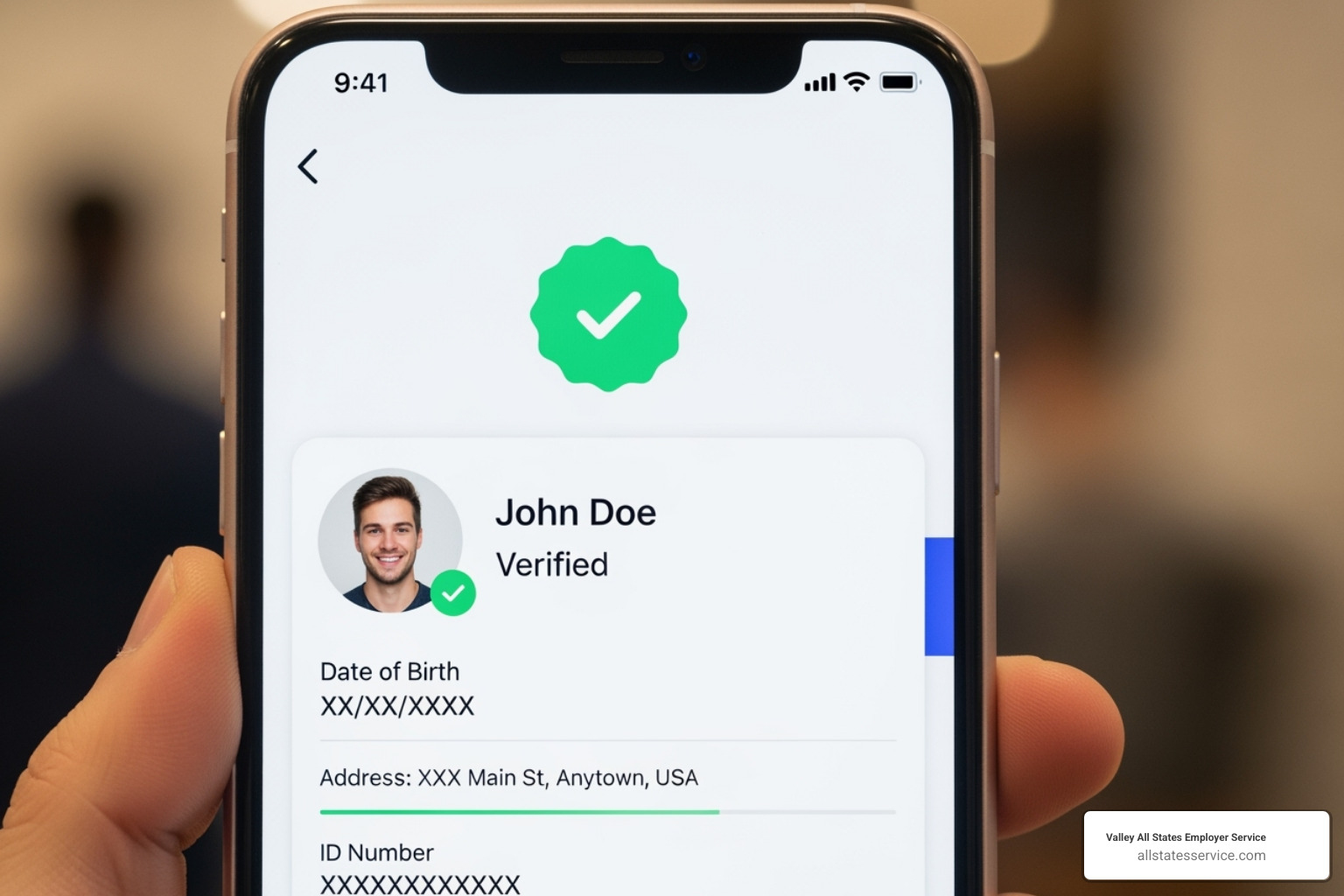

When creating fake documents has become surprisingly sophisticated, identity verification has had to step up its game. We’re not just checking names anymore; we’re using cutting-edge technology to ensure the person standing in front of you (or on the video call) is genuinely who they claim to be.

Digital identity proofing combines document scanning with facial recognition technology, creating a secure remote verification process that’s both thorough and convenient. Biometric verification takes this a step further, using unique biological characteristics like facial scans or fingerprints that are nearly impossible to fake.

Government ID validation cross-references identification documents against official databases, catching sophisticated forgeries that might fool the human eye. For specialized roles, professional license confirmation ensures that healthcare workers, lawyers, engineers, and other licensed professionals actually hold valid, current credentials.

This level of verification is becoming essential as deepfake technology and document forgery become more accessible to bad actors. The good news? The tools to combat these threats are evolving just as quickly.

More info about I-9 Verification Assistance

Right-to-Work and E-Verify Compliance

Every employer in the United States faces the same legal requirement: ensuring every new hire is authorized to work. This isn’t optional, and the penalties for getting it wrong can be substantial. Right-to-work eligibility verification involves two critical components that work hand in hand.

Form I-9 compliance requires documenting each employee’s identity and work authorization, regardless of their citizenship status. It sounds straightforward, but the devil is in the details. Small errors in completing or storing these forms can result in significant fines during government audits.

What is E-Verify? It’s an internet-based system that cross-references your employee’s I-9 information with USCIS and SSA database checks. While not mandatory for all employers, federal contractor requirements under the FAR clause make E-Verify participation mandatory for government contractors. Additionally, many state-specific mandates are expanding E-Verify requirements across different industries.

At Valley All States Employer Service, we’ve seen how complex these requirements can become. That’s why we specialize in handling the entire process, from I-9 completion through E-Verify submission, ensuring your new hires are legally authorized to work while minimizing your administrative burden and compliance risk.

More info about our E-Verify Services

A Guide to Leading Workforce Verification Solutions

The world of workforce verification solutions has exploded with options, each taking a different approach to solving the same fundamental challenge: How do we know our employees are who they say they are? Think of it like choosing a security system for your home. You’ve got basic alarms, smart cameras, and full-service monitoring companies. Each serves a purpose, but the right choice depends on your specific needs.

Let’s walk through some of the standout players in this space. Each brings something unique to the table, whether it’s massive data resources, cutting-edge biometrics, or employee-friendly processes. Understanding what makes each solution tick will help you find the perfect fit for your organization.

The Work Number by Equifax: The Data Powerhouse

If workforce verification were a library, The Work Number would be the Library of Congress. This Equifax powerhouse isn’t just another verification service; it’s the backbone that feeds data to countless other platforms. With 4.6 million employers contributing employment and income data, they’ve built something truly impressive.

Here’s what makes them special: instant database verification that works around the clock. When someone applies for a mortgage at 10 PM on a Sunday, The Work Number can instantly confirm their employment status from a database containing over 767 million records. No waiting for HR departments to return calls or dig through filing cabinets.

The magic happens through their verifier credentialing system. Legitimate organizations like banks, government agencies, and auto lenders get special access to this treasure trove of data. Everything stays FCRA compliant, so you know the data handling meets strict legal standards.

For employers, this means fewer interruptions. Instead of fielding constant verification calls, your data flows automatically to approved verifiers. Your employees benefit too, getting instant access to their employment information whenever they need it for life’s big moments.

CLEAR: Biometric Identity for the Workforce

You know CLEAR from those speedy airport security lines, but they’re bringing that same biometric magic to workplace security. Their philosophy is simple but powerful: verify the person, not just the credentials. When hackers can steal passwords and fake documents look increasingly real, this approach makes perfect sense.

CLEAR’s biometric multi-factor authentication combines government ID verification with facial recognition and liveness detection. Think of it as creating a digital fingerprint that’s nearly impossible to fake. Once someone’s verified, they carry this trusted identity with them for all workplace interactions.

The real beauty lies in their IAM platform integration with systems like Okta and Ping Identity. This means CLEAR plugs right into your existing security infrastructure without major overhauls. Community Health Network finded this when they implemented CLEAR for account recovery in just nine weeks.

The results speak volumes: 90% employee adoption, 6,000 fewer password reset calls, and $90,000 in call center savings. When employees can securely recover their own accounts using biometrics, everyone wins. IT stops drowning in password reset tickets, and employees get back to work faster.

Nametag: Deepfake Defense for Onboarding

In the arms race between fraudsters and security technology, Nametag is fighting fire with fire. Their VerifiedHire™ product tackles one of the most unsettling trends in modern fraud: deepfakes and AI-generated identities that can fool traditional verification methods.

Nametag’s Deepfake Defense technology represents the cutting edge of identity verification. As AI gets better at creating fake faces and voices, traditional photo ID checks become less reliable. Nametag’s system can detect these sophisticated fakes, ensuring the person on the other end of the screen is real, not a computer-generated impostor.

But they don’t stop at hiring. Nametag also addresses the ongoing headache of secure account recovery. Statistic about 50% of IT tickets being password resets? Nametag’s self-service approach lets employees prove their identity and recover their accounts without calling the help desk.

This dual focus on preventing infiltration by bad actors during onboarding and combating social engineering throughout the employee lifecycle makes Nametag particularly valuable for companies handling sensitive data or operating in high-security environments.

Truework: The Employee-Centric Network

Truework takes a refreshingly different approach to workforce verification by putting employees firmly in the driver’s seat. Their employee-consent-driven model means workers control who sees their employment data and when. It’s like having a personal gatekeeper for your professional information.

The process is beautifully simple. When someone needs employment verification, Truework reaches out to the employee first. Once they give consent, the verification happens quickly through automated verification requests that typically complete within 24 hours. No more playing phone tag between lenders and HR departments.

This API integration approach connects directly with existing HR and payroll systems, minimizing manual work and reducing errors. The data flows automatically once consent is given, making the whole process smoother for everyone involved.

Truework also pioneered the concept of reverifications, recognizing that employment verification isn’t always a one-time need. Whether someone’s applying for a second mortgage or needs updated income documentation, Truework makes it easy to provide fresh verification data without starting from scratch.

Key Features and Future Trends in Workforce Verification

The world of workforce verification solutions moves fast. Between new fraud techniques, evolving regulations, and breakthrough technologies, what worked last year might not cut it today. Smart businesses are looking ahead, understanding both what makes a verification platform effective right now and where the industry is headed.

This section explores what to look for in modern workforce verification solutions and the exciting (and sometimes scary) technologies reshaping how we verify identities and employment.

Essential Features in a Modern Verification Platform

When you’re shopping for a verification platform, it’s easy to get caught up in flashy features. But the best solutions nail the basics while preparing you for the future.

API integration should be your first non-negotiable. If your new verification system can’t talk to your existing HRIS, payroll software, or applicant tracking system, you’ll spend more time wrestling with data transfers than actually verifying people. Seamless integration means automated workflows, which means your HR team can focus on strategy instead of spreadsheets.

Scalability matters more than you might think. That startup with 20 employees could become a 200-person company faster than expected. Your verification solution should handle growth gracefully, processing more verifications without slowing down or breaking your budget.

The user experience needs to work for everyone. Your HR team deserves an intuitive dashboard with clear reporting. Your employees need a simple, self-service portal where they can manage their data and consent to verifications without calling IT. When verification feels easy, people actually use it properly.

Security protocols can’t be an afterthought. Look for advanced encryption, multi-factor authentication, and strict adherence to data privacy standards. Your employees trust you with their personal information. Don’t let them down.

Detailed reporting and analytics help you spot trends, track verification statuses, and generate those audit reports that compliance teams love. Plus, good data helps you improve your processes over time.

Customizable workflows recognize that every business is different. A healthcare company has different verification needs than a tech startup. Your platform should bend to fit your requirements, not force you into someone else’s process.

Finally, mobile accessibility isn’t optional anymore. People expect to complete tasks on their phones, whether they’re new hires uploading documents or verifiers checking credentials on the go.

At Valley All States Employer Service, we see how efficient processes make everyone’s life easier, especially when teams are working remotely.

More info about our Remote I-9 Verification Complete Guide

The Impact of AI, Blockchain, and Emerging Tech

Technology isn’t just supporting workforce verification solutions anymore. It’s completely changing them. The changes happening right now will define how we verify identities for years to come.

AI-powered fraud detection is getting scary good at catching bad actors. These systems analyze massive datasets to spot patterns that human reviewers would miss. They can detect doctored documents, catch inconsistencies across application data, and even predict potential risks based on historical patterns. Companies like Socure are using AI to provide real-time identity verification that’s both faster and more accurate than traditional methods.

Blockchain technology is creating something revolutionary: True Proofs that people actually own. Instead of your credentials living in some company’s database, blockchain creates a decentralized, tamper-proof record that you control. When you need verification, you grant access with your explicit consent. No more wondering who has your data or how they’re using it.

Liveness detection and advanced biometric verification are fighting back against deepfakes and sophisticated spoofing attempts. These systems don’t just recognize your face. They make sure you’re actually alive and present, not a photo or AI-generated fake. Combined with emerging biometrics like voice patterns or typing behavior, the technology is getting incredibly sophisticated.

The future of workforce verification will likely see these technologies working together seamlessly. Imagine instant, secure verification that protects privacy while providing absolute confidence in someone’s identity. We’re not there yet, but we’re getting close.

Navigating Compliance: KYC, FCRA, and Industry Needs

Compliance isn’t just about checking boxes. Different industries face different regulations, and the stakes for getting it wrong keep getting higher. Understanding these requirements helps you choose the right workforce verification solutions for your specific situation.

Know Your Customer (KYC) principles are spreading beyond banking into workforce verification. It’s not enough to just identify someone anymore. You need to understand their background and assess potential risks. Solutions like CLEAR, with their focus on verifying the actual person rather than just documents, align perfectly with KYC thinking. This is especially important if you handle sensitive data or work in regulated industries.

Fair Credit Reporting Act (FCRA) standards apply to any background check involving consumer reports. That includes credit history, criminal records, and employment verification. The FCRA has strict rules about consent, disclosure, and dispute resolution. Many leading verification providers, including The Work Number, are designed to be FCRA-compliant from the ground up, protecting both you and your employees.

Different industries have wildly different verification needs. Healthcare requires rigorous checks for professional licenses, certifications, and exclusion lists to ensure patient safety and HIPAA compliance. Government contractors must steer E-Verify requirements, security clearances, and specific background checks for public trust roles. Auto lending companies need rapid, accurate income and employment verification to assess loan risk, which is exactly where services like The Work Number shine.

The complexity can be overwhelming, but it doesn’t have to be. We at Valley All States Employer Service specialize in understanding these nuances, particularly for E-Verify and I-9 compliance. We help businesses meet their legal obligations without the headache.

More info about our Employer I-9 Verification Guide

Simplify Your Compliance and Secure Your Workforce

The threat of hiring fraud isn’t going away, but here’s the good news: you don’t have to face it alone or empty-handed. Today’s workforce verification solutions have evolved into powerful allies that can transform what used to be a paperwork nightmare into a streamlined, secure process.

Think about it this way. Companies like The Work Number are processing millions of verification requests because businesses everywhere are waking up to a simple truth: trust but verify isn’t just a catchy phrase, it’s essential business strategy. When you combine comprehensive employment databases with cutting-edge biometric security from providers like CLEAR, you’re not just checking boxes. You’re building a fortress of compliance around your organization while making life easier for legitimate candidates.

The beauty of modern verification lies in its dual nature. These solutions protect your business from sophisticated fraud attempts while actually improving the employee experience. No more waiting days for employment confirmations or scrambling to provide documentation for life’s big moments like buying a home or securing a loan.

But let’s be honest about something: E-Verify and I-9 compliance can feel overwhelming. The forms, the deadlines, the potential for costly mistakes during audits. This is where specialized expertise makes all the difference.

At Valley All States Employer Service, we’ve made E-Verify and I-9 compliance our specialty because we know how critical it is to get this right. Every new hire must be legally authorized to work, and every Form I-9 must be completed correctly. When you partner with us, you’re not just outsourcing paperwork. You’re gaining peace of mind that comes from knowing experts are handling the details while you focus on growing your business.

We handle the complexity, minimize your administrative burden, and ensure you stay compliant with ever-changing regulations. Because at the end of the day, your energy should go toward building great teams, not worrying about compliance missteps.

Ready to build a more secure and compliant workforce? Explore our E-Verify and I-9 Compliance solutions.