I-9 compliance training: Master 2025

Why I-9 Compliance Training Has Become Critical for HR Teams

I-9 compliance training is essential for any business that hires employees in the United States. With ICE issuing over $20 million in civil penalties related to I-9 violations in 2023 alone, proper training isn’t just recommended – it’s business-critical.

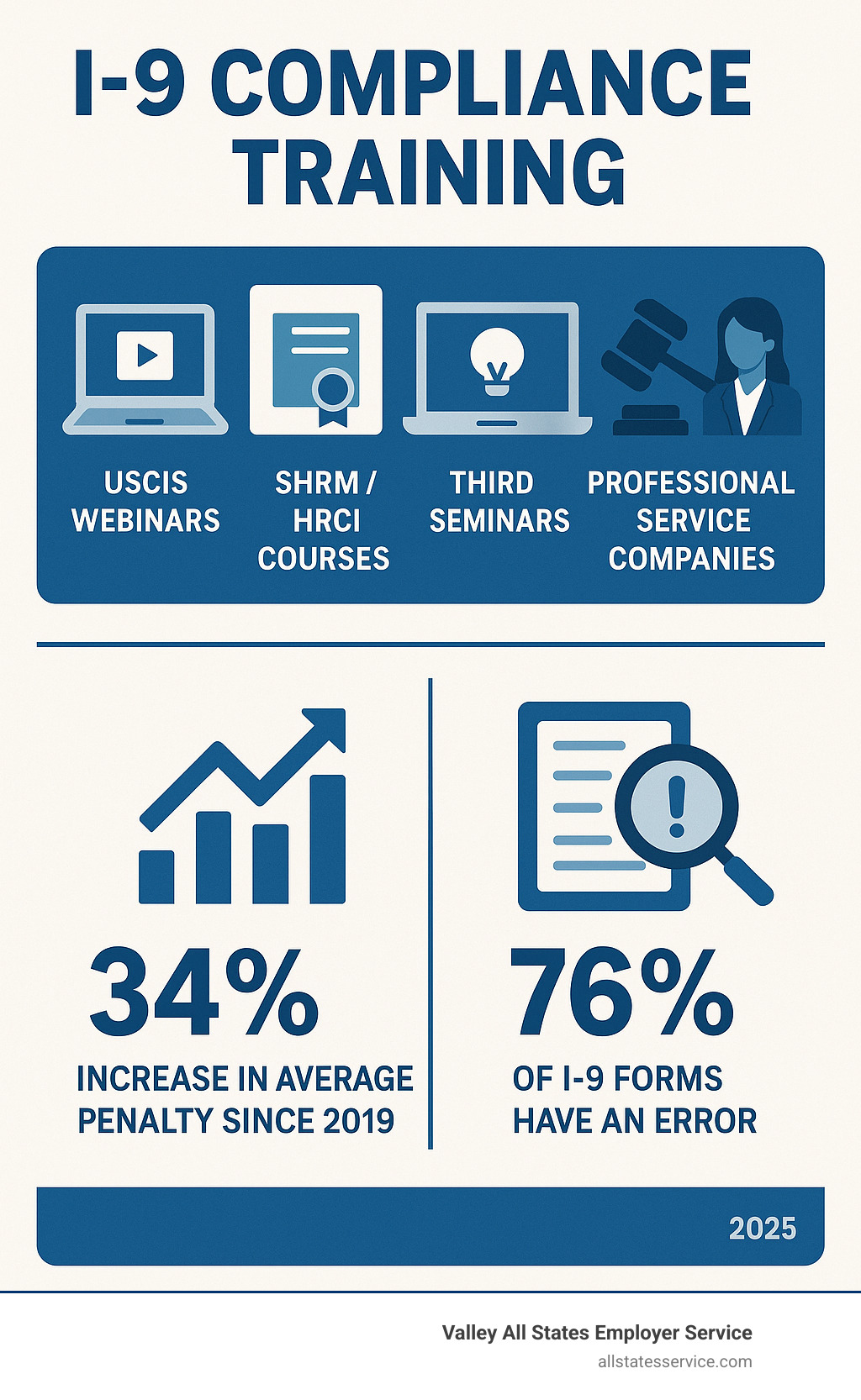

Quick Answer: Where to Find I-9 Compliance Training

- USCIS Free Webinars – Government-provided training with professional development credits

- SHRM and HRCI Courses – Certified programs for HR professionals

- Third-Party Training Providers – Specialized compliance education companies

- Legal Counsel Seminars – Attorney-led workshops focusing on recent updates

- Professional Service Providers – Companies like Valley All States that offer training alongside compliance services

The stakes have never been higher. A staggering 76% of I-9 forms contain at least one error that could result in penalties during an ICE audit. Even worse, the average fine per violation has risen 34% since 2019, making compliance mistakes increasingly expensive.

The problem isn’t just about money. ICE has dramatically expanded its enforcement efforts, hiring hundreds of new I-9 auditors and targeting industries that historically employ large numbers of workers. Organizations using electronic I-9 systems experience 93% fewer technical errors than those using paper-based processes, but only if their staff knows how to use these systems properly.

That’s where comprehensive I-9 compliance training becomes your first line of defense. Whether you’re dealing with remote employees, navigating E-Verify requirements, or simply trying to avoid the most common I-9 mistakes, proper training protects your business from costly violations and operational disruptions.

Understanding the Stakes: Form I-9 Essentials and Legal Risks

Is your hiring process protecting you from federal penalties? The answer depends on your understanding of Form I-9 compliance training and its legal requirements.

Form I-9 exists to verify that every person you hire can legally work in the United States. This requirement from the Immigration Reform and Control Act (IRCA) of 1986 applies to every employee, citizen or not.

The process confirms each employee’s identity and employment authorization. Every employer must complete and retain a Form I-9 for every hire. This federal mandate is non-negotiable.

The stakes are high, involving significant financial penalties and potential criminal charges. For detailed guidance, the official USCIS Employer Handbook provides comprehensive information.

Key Legal Requirements and Penalties

Timing is critical. Section 1 deadlines require employees to complete their portion by their first day of work. You then have three business days to complete Section 2. Missing these deadlines means you are in violation.

Document retention rules add another layer of complexity. You must keep completed Forms I-9 for three years after the hire date, or one year after employment ends, whichever is later. This becomes complex when managing many employees.

The financial consequences are sobering. Civil fines range from hundreds to thousands of dollars per violation. Knowingly hiring unauthorized workers can escalate to potential criminal charges, turning an oversight into a crisis.

An I-9 violation also leads to increased government scrutiny, including more frequent audits. Our guide on I-9 Compliance Penalties breaks down what these violations can cost your business.

Recent Enforcement Trends to Watch

I-9 enforcement has intensified. USCIS requested funding for 700 new positions in 2024, signaling a clear intent for increased ICE audits across all industries.

Targeting specific industries is a common ICE approach. Agriculture, retail, landscaping, and construction companies face heightened scrutiny. If your business is in these sectors, you are at higher risk.

The message is clear: proactive compliance is crucial. Don’t wait for an audit notice to strengthen your I-9 processes.

The hiring of new I-9 auditors continues, and they are trained to spot even minor violations. They have the authority to issue substantial penalties for every error they find.

Mastering the Form: A Step-by-Step Guide to I-9 Completion

The Form I-9 might look straightforward, but this three-section document is where many employers stumble, often without realizing it until an audit. Understanding each section is your key to avoiding the costly mistakes that plague 76% of forms.

Let’s walk through this step by step. For a general overview, check out What is I-9 Form?. For detailed guidance, our I-9 Form Completion resource has you covered.

Section 1 belongs to your new employee. They complete this on their first day of work, providing basic information and attesting under penalty of perjury to their citizenship or immigration status. This declaration carries serious legal weight. You can help them understand the form, but you cannot fill it out for them.

Section 2 is where you step in. Within three business days of their start date, you must physically examine the original documents your employee presents to verify their identity and work authorization. You’ll record the document details, then sign and date this section, certifying that the documents appear genuine.

Section 3 is for reverification when work authorization expires or when you rehire someone within three years. Instead of a new I-9, you can use this section to update their information, a time-saver many employers overlook.

Acceptable Documents for Verification

Here’s where I-9 compliance training becomes invaluable. Your employee chooses which documents to present, not you. Specifying documents can lead to discrimination trouble.

The system works like this: List A documents establish both identity and work authorization (e.g., U.S. passport). List B documents prove identity only (e.g., driver’s license). List C documents establish work authorization only (e.g., Social Security card).

Your employee can present one List A document or a combination of one from List B and one from List C. You must accept whatever valid combination they choose. For the complete list, the guide to acceptable documents from USCIS is your go-to resource.

During your physical examination, you’re looking for documents that reasonably appear genuine. You’re not a forensic expert, but obvious alterations or inconsistencies should be red flags.

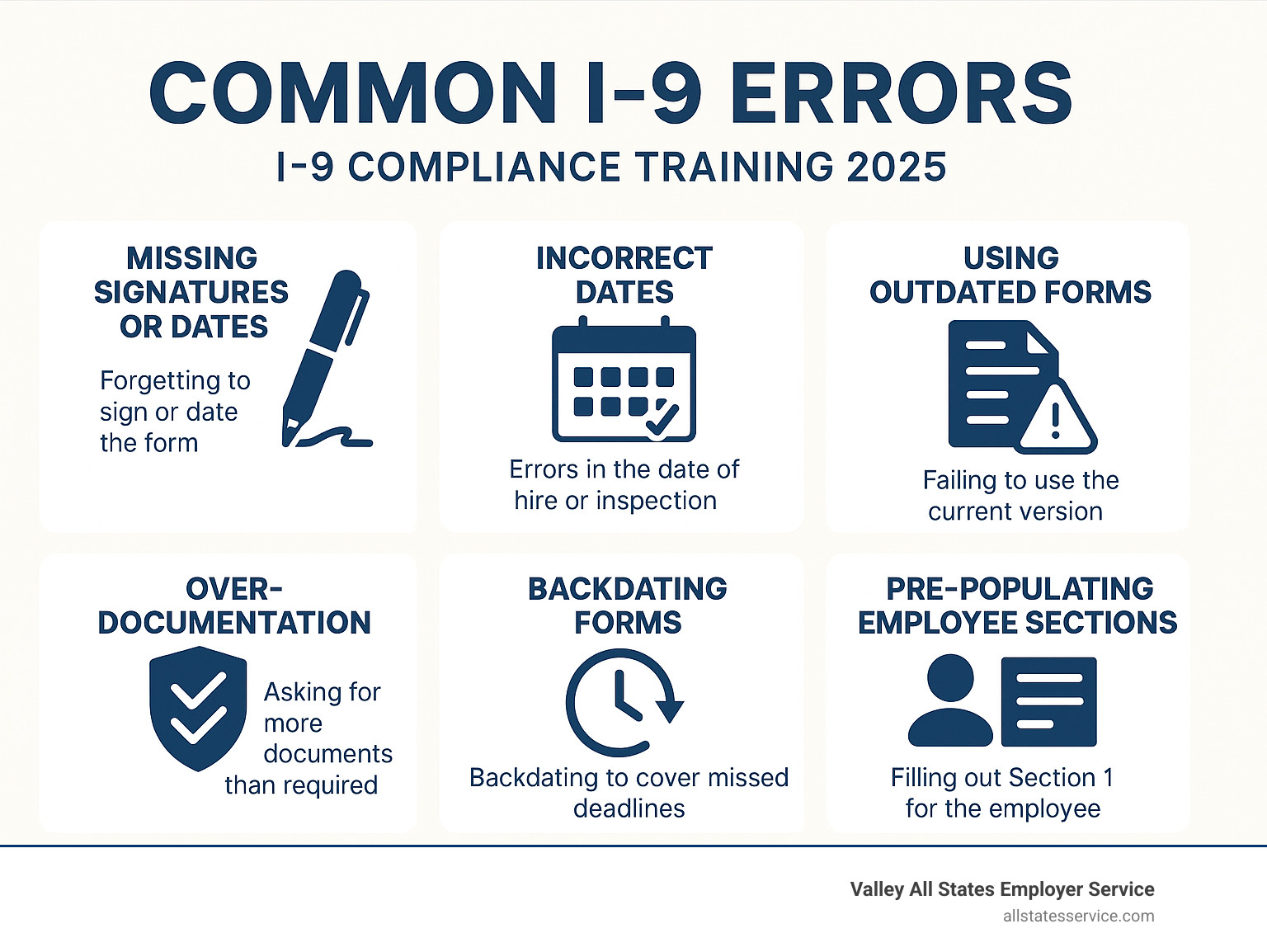

Common I-9 Errors and How to Avoid Them

Most I-9 forms contain preventable errors that could trigger penalties. The good news is most are avoidable once you know what to watch for.

Missing signatures and dates are common oversights. In the rush of onboarding, these critical elements get forgotten. Make signature and date verification part of your checklist.

Incorrect dates for hire and inspection must be accurate and fall within the strict timelines. A simple calendar check can save you trouble.

Using outdated forms is an automatic violation. USCIS updates the I-9 periodically, so always download the current form from the USCIS website.

Over-documentation happens when employers ask for more or specific documents than necessary, which can lead to discrimination claims. Accept what your employee chooses to present.

Backdating forms to fix missed deadlines is a serious violation. Deal with it honestly rather than compounding the problem.

Pre-populating employee sections is a mistake. Section 1 must be completed entirely by the employee.

Understanding these pitfalls is the first step toward bulletproof processes. Take a look at these High-Risk I-9 Practices to Eliminate Immediately to see how these errors play out in audits.

Once you establish solid procedures and train your team, these forms become routine rather than risky. Each correctly completed form is one less compliance worry.

Building a Bulletproof Program with I-9 Compliance Training

Creating an effective I-9 program goes beyond filling out forms. It’s about building a system that protects your business from costly mistakes and audits. Think of it as a fortress where I-9 compliance training is your strongest defense.

The foundation is standardized onboarding procedures. Every new hire should follow the same I-9 workflow with clear timelines. This consistency eliminates guesswork.

Regular self-audits are your early warning system. By reviewing your I-9s, you can catch and fix problems before ICE arrives. Our I-9 Self Audit guide shows you how to spot issues.

You’ll also need clear correction protocols. When errors are found, your team needs to know the proper way to fix them without creating bigger problems.

Finally, secure record-keeping is essential. Whether using paper or electronic systems, proper storage and organization can make or break your defense during an audit.

Why Ongoing I-9 Compliance Training is Essential

Employment law doesn’t stand still. One-and-done training sessions are not enough. You need ongoing I-9 compliance training to stay ahead.

Evolving regulations keep HR professionals on their toes. Your team must stay current with form updates, enforcement priorities, and new guidance to avoid violations.

Reducing human error through regular training refreshers is critical. We’re fighting against a 76% error rate industry-wide.

Think of ongoing training as insurance against penalties. Well-trained staff make fewer mistakes, which means fewer fines.

Empowering your HR staff through training builds confidence. When your team knows the rules, they work more efficiently and feel more secure in their decisions.

Regular training also creates a culture of compliance, making it part of your company’s DNA.

Finding the Right I-9 Compliance Training Resources

Excellent training resources are available, and many are free. Let’s explore your best options.

USCIS webinars should be your starting point. These free sessions come from the source and often qualify for professional development credits. The Free Employment Eligibility Webinars from USCIS page lists upcoming sessions.

For more structured learning, SHRM and HRCI courses offer certified programs for HR professionals that dive deep into compliance.

Third-party training providers fill the gap with online modules and live workshops, often using real-world scenarios.

Don’t overlook legal counsel seminars. Law firms frequently host sessions on recent court decisions and regulatory changes.

Professional service providers like Valley All States often include training with their compliance solutions. We combine expert guidance with hands-on support to ensure your team understands both I-9 and E-Verify processes.

Modern I-9 Challenges: Remote Work, E-Verify, and Technology

The workplace has transformed, and I-9 compliance training must evolve with it. Remote employees and digital verification systems present challenges that didn’t exist a few years ago.

The good news? Technology also provides powerful solutions. Organizations using electronic I-9 systems experience 93% fewer technical errors than those using paper forms. But these systems only work if your team knows how to use them properly.

The shift to digital is about survival in a complex compliance landscape. Whether you’re handling paper vs. electronic I-9s, understanding E-Verify’s role, or verifying documents for a remote hire, modern compliance requires a new approach.

The Role of E-Verify in Your Compliance Strategy

Think of E-Verify as your compliance safety net. This internet-based USCIS system works with Form I-9 to create a stronger verification process.

E-Verify compares information from a completed Form I-9 against records from the Department of Homeland Security and Social Security Administration. It’s a direct line to government databases to double-check information.

Once you complete Form I-9, you enter the same information into the E-Verify system. The system then confirms employment eligibility or flags a mismatch for resolution.

Federal contractors are often required to use E-Verify. Even if it’s not mandatory for you, E-Verify is powerful protection against unauthorized employment, helping you catch issues early.

The real benefit is in your error rates. The 93% reduction in technical errors is largely because E-Verify catches inconsistencies that might slip through manual review. You can explore this with our E-Verify & I-9 Compliance services.

Navigating I-9 Verification for a Remote Workforce

Remote work created a major I-9 compliance headache: how do you physically inspect documents for a distant new hire? The answer has evolved, and understanding these changes is crucial for modern I-9 compliance training.

During the COVID-19 pandemic, ICE’s temporary guidance allowed virtual inspections. As those flexibilities ended, the return to in-person inspection requirements caught many employers off guard.

Now, USCIS has a permanent alternative verification procedure for employers enrolled in E-Verify. This allows E-Verify employers to remotely examine employees’ documents, a game-changer for distributed teams.

For employers not enrolled in E-Verify, using an authorized representative is an option. This could be a notary or another trusted individual who physically examines the documents and completes Section 2. You are still liable for any errors your representative makes.

Documenting the process correctly is critical with remote verification. Whether using the alternative procedure or a representative, you need clear document copies and consistent processes. Our guide on the I-9 Verification Process for Remote Employees walks through these requirements. For more specifics, check our USCIS I-9 Remote Verification resource.

Frequently Asked Questions about I-9 Compliance

When we work with employers, certain questions about I-9 compliance training and procedures come up repeatedly. Let’s tackle the most pressing ones.

How often should my team receive I-9 compliance training?

No federal law dictates the frequency of I-9 compliance training, but best practice is annually for all personnel involved in the I-9 process. This includes HR staff and hiring managers.

Regulations change, new forms are released, and enforcement strategies shift. What your team knew last year might be incomplete. Training is required for all new HR staff or anyone handling I-9s and is crucial when new form versions are released. Annual training reinforces knowledge and reduces errors.

Can I use a notary as an authorized representative for remote I-9s?

Yes, but they act as a representative, not in a notarial capacity. This is a common point of confusion. When a notary helps complete Section 2 for a remote employee, they are acting as your agent to examine documents.

This means they don’t use their notary seal. The catch is: The employer remains liable for any errors they make. If your representative makes a mistake, it’s your problem during an audit. For help finding representatives, see our guide on Where to Find a Notary for I-9 Verification for Remote Employees.

What’s the difference between a technical and a substantive error?

This distinction can save you thousands in penalties. The difference is the seriousness of the mistake and its effect on the verification process.

Technical errors are minor, correctable omissions on the existing form, like a missing apartment number. They don’t undermine the verification process itself. You can fix them by adding the information, initialing, and dating the correction.

Substantive errors are more serious and may require a new I-9. These include failing to complete Section 2 on time, accepting unlisted documents, or forgetting to sign the employer certification. These errors suggest you didn’t properly verify identity or work authorization.

Fines are typically higher for substantive violations. Regular I-9 compliance training helps your team spot these issues and know how to handle corrections properly.

Conclusion

Think of I-9 compliance training as your business insurance policy. Just like you wouldn’t drive without car insurance, you shouldn’t handle employment verification without proper training. The numbers don’t lie: with ICE issuing over $20 million in penalties last year and 76% of forms containing errors, the question isn’t whether you can afford training. It’s whether you can afford not to have it.

We’ve covered a lot of ground together. From understanding the legal stakes to mastering form completion, from building bulletproof programs to navigating modern challenges like remote work. The thread connecting all of these topics is simple: knowledge protects your business.

Your HR team needs the confidence that comes from understanding I-9 rules inside and out. When they know how to handle everything from acceptable documents to remote verification procedures, they become your first line of defense against costly mistakes. This isn’t just about avoiding fines, though that’s certainly important. It’s about creating a workplace where compliance feels natural, not stressful.

The employment verification landscape keeps evolving. New regulations emerge, enforcement strategies shift, and technology changes how we work. Staying ahead of these changes through ongoing training isn’t optional anymore. It’s how successful businesses protect themselves.

Here’s what we know works: regular training sessions, clear procedures, and expert support when you need it. Valley All States Employer Service understands these challenges because we live them every day with our clients. We’ve built our reputation on making E-Verify processing simple, accurate, and stress-free for employers who want to focus on running their business, not worrying about compliance paperwork.

Ready to take the guesswork out of employment verification? Our team specializes in helping businesses like yours steer I-9 and E-Verify requirements with confidence. Explore our E-Verify and I-9 Compliance services and find how much easier compliance can be when you have the right partner.