I 9 Audit: Ace Your 2025 Review

What is an I-9 Audit and Why is it Crucial?

The term “i 9 audit” can send shivers down an HR manager’s spine, but it doesn’t have to be that way. An I-9 audit is a review of your company’s Form I-9 documents to check if employees are authorized to work in the U.S. These audits can be done by the government (like ICE) or by employers themselves (self-audits).

Here’s what you need to know about an I-9 audit:

- What it is: A thorough check of your Form I-9s, which verify identity and work authorization.

- Who conducts it: Usually U.S. Immigration and Customs Enforcement (ICE) or you can perform one yourself.

- Why it matters: It ensures you comply with federal employment laws and avoid penalties.

- The goal: To ensure every employee has a correct and complete I-9 form on file.

Staying compliant with federal employment laws is essential. This guide will walk you through everything about I-9 audits, showing you how to prepare, avoid common mistakes, and keep your business safe.

At its core, the Form I-9 (Employment Eligibility Verification) is a crucial document for every U.S. employer. It verifies the identity and employment authorization of individuals hired in the United States. This requirement stems from the Immigration Reform and Control Act (IRCA) of 1986, established to prevent the hiring of individuals not eligible to work.

Understanding the I-9 is the first step to mastering the i 9 audit process. For a deeper dive, you can refer to What is an I-9? or find The official I-9 form from USCIS.

Federal Audits vs. Self-Audits

It’s important to distinguish between federal audits and self-audits. While both aim for compliance, their triggers and implications differ.

Federal audits, led by U.S. Immigration and Customs Enforcement (ICE), are formal government inspections. They often begin with a Notice of Inspection (NOI), giving employers at least three business days to produce their I-9s. These can be triggered by random sampling, employee tips, or broader investigations. The Department of Justice (DOJ) also plays a role, especially concerning anti-discrimination provisions.

A self-audit is a proactive internal review. This voluntary process allows you to identify and correct errors before a federal audit, reducing your risk and demonstrating good faith. Many employers conduct self-audits annually or hire third-party auditors for objectivity. For guidance, the government provides resources like the Guidance for Employers Conducting Internal Audits.

The key difference is control. A self-audit puts you in charge, letting you fix mistakes in a low-stakes environment. A federal audit means you’re reacting to government scrutiny, where errors can lead to penalties.

The Purpose Behind the Paperwork

The i 9 audit and Form I-9 exist to ensure that all individuals working in the U.S. are legally authorized to do so. It’s about upholding federal law and maintaining a legal workforce.

For every person hired after November 6, 1986, employers must complete an I-9 form by:

- Verifying identity: The employee presents documents establishing their identity.

- Confirming work authorization: The employee presents documents proving their eligibility to work.

Your responsibility is to examine these documents to see if they reasonably appear genuine and relate to the person. This is a cornerstone of responsible hiring that protects your business.

The High Cost of Non-Compliance: Penalties and Common Errors

Ignoring I-9 compliance is a high-stakes gamble for your business. Even minor paperwork errors can lead to significant fines, and knowingly hiring unauthorized workers has severe consequences. A sobering statistic reveals that about 76% of paper I-9s have at least one error, highlighting how easy it is to fall short and why an i 9 audit is so vital.

The penalties for non-compliance are substantial. In 2019, ICE conducted over 6,450 I-9 audits, leading to 2,675 arrests and more than $14 million in fines. This shows that enforcement is active and the financial repercussions are serious. To understand the full scope, we’ve outlined them on our I-9 Compliance Penalties page.

Understanding the Penalties

Let’s break down the penalties you might face during an i 9 audit:

- Paperwork Penalties: These are for errors or omissions on the Form I-9, even if the employee is authorized to work. The penalty ranges from $234 to $2,322 per violation, depending on factors like employer size, number of violations, and good faith efforts.

- Knowingly Hiring Unauthorized Workers: This is the most severe violation. Penalties range from $590 to $4,722 for a first offense. A third offense can cost up to $23,607 per unauthorized worker. Beyond fines, these violations can lead to criminal prosecution and debarment from federal contracts.

Civil monetary penalties are adjusted annually for inflation, so the cost of non-compliance is always rising. You can check the latest adjustments in the Federal Register. This makes a proactive i 9 audit even more critical.

Common I-9 Errors to Avoid

Many I-9 errors are simple mistakes that can be avoided with proper training. Here are some of the most common pitfalls:

-

Section 1 (Employee): The employer is accountable for ensuring the employee completes this section correctly.

- Missing signatures or dates: The employee must sign and date Section 1 on or before their first day.

- Incorrect citizenship status box: Employees must check one of the four boxes indicating their status.

- No A-Number or I-94 number when required: Non-citizen employees must provide their Alien Registration Number (A-Number), USCIS Number, or Form I-94 Admission Number if applicable.

-

Section 2 (Employer): The employer or their representative verifies the employee’s documents here.

- Not completed within 3 business days: Section 2 must be completed within three business days of the employee’s first day.

- Missing document details: All details from the documents (title, number, expiration date) must be recorded accurately.

- Employer signature or date missing: The employer’s representative must sign and date Section 2.

- Not entering the correct hire date: The “First Day of Employment” must match the employee’s actual start date.

-

Section 3 (Reverification): This section, now Supplement B on the current form, is for reverification or rehires.

- Not completed before work authorization expires: Section 3 must be updated before an employee’s work authorization expires.

- Reverifying U.S. citizens or permanent residents: Employees with permanent work authorization should never be reverified, as this can lead to discrimination claims.

- Not using Supplement B: The current Form I-9 uses Supplement B for reverification. Using the old Section 3 or not completing the supplement correctly is an error.

Understanding these common mistakes is a key step toward acing your next i 9 audit.

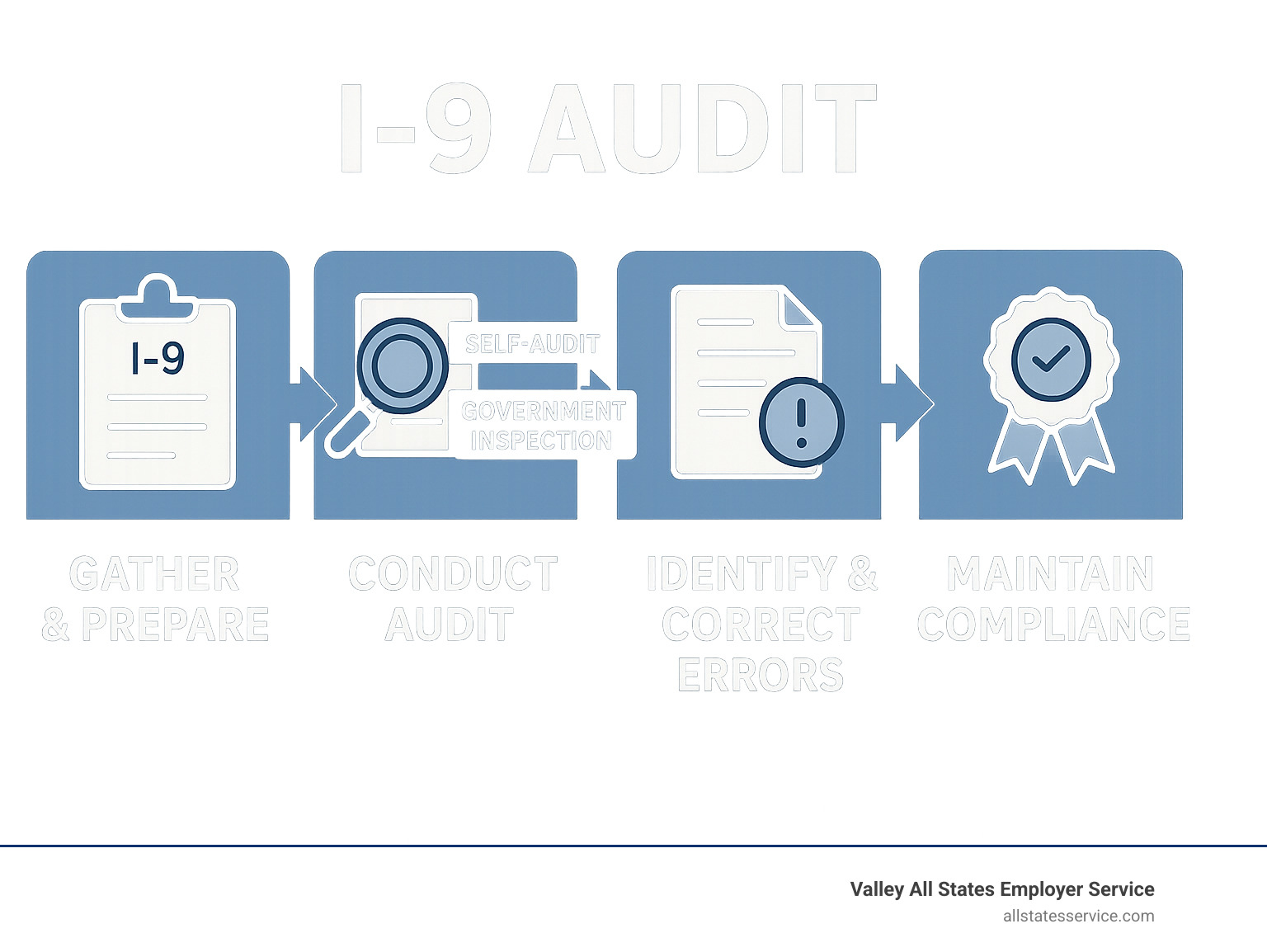

Your Proactive Guide to Preparing for an I-9 Audit

The best defense against a federal i 9 audit is a proactive internal audit. This approach helps you find and fix errors on your own terms, before a government agency gets involved. It provides peace of mind and significantly mitigates risks. Our page, I-9 Audit: What Employers Need to Know, offers more insight into this crucial step.

A self-audit demonstrates your commitment to compliance and a good faith effort, which can be a mitigating factor during a government inspection. It’s about taking control of your compliance.

Step-by-Step Internal I-9 Audit Checklist

Ready to conduct your own internal i 9 audit? Here’s a practical checklist:

- Gather All Forms: Collect every Form I-9 for current and terminated employees. Remember the retention rule: keep I-9s for terminated employees for three years from the hire date or one year from the termination date, whichever is later.

- Separate Files: Keep separate files for current and terminated employees for better organization.

- Identify Missing I-9s: For any current employee without an I-9, have them complete one immediately. Use the current date for signatures, note the actual hire date, and attach a memo explaining the delay.

- Review Section 1 (Employee Errors):

- Check for missing signatures or dates.

- Ensure the correct citizenship or immigration status box is checked.

- Verify that any required A-Number, USCIS Number, or I-94 Number is present.

- Confirm the Preparer/Translator Certification is completed if applicable.

- Check Section 2 (Employer Accuracy):

- Confirm completion within 3 business days of hire.

- Verify all document details (title, issuing authority, number, expiration date) are recorded.

- Ensure the employer’s representative signed and dated the section.

- Check that the “First Day of Employment” is correct.

- Verify Section 3 (Reverifications and Rehires):

- For employees with expiring work authorization, ensure Section 3 (or Supplement B) was completed before expiration.

- Confirm you are not reverifying U.S. citizens or lawful permanent residents.

- For rehires, ensure the form was properly updated or a new one was completed.

- Document Everything: Create an audit log detailing every error found, the correction made, and the date. This documentation is crucial for demonstrating good faith.

How to Correct Errors Found During Your I-9 Audit

Finding errors during your internal i 9 audit is an opportunity to improve. The key is to correct them properly according to USCIS guidance.

First, know the difference between technical (minor) and substantive (significant) errors.

Here’s how to correct errors:

- For Section 1 (Employee Errors): The employee must draw a single line through the error, write the correct information, and then initial and date the change. Do not use correction fluid.

- For Section 2 or 3 (Employer Errors): The employer representative who completed the section should make the correction using the same method: line through, correct, initial, and date.

- Never Backdate: This is critical. All corrections must be dated with the current date. Backdating is considered fraudulent and carries severe penalties.

- Attaching a Memo: For significant errors or when completing a new form, attach a signed and dated memo. It should explain the error, how it was found (e.g., “during a self-audit on [date]”), and the corrective action taken.

- When to Complete a New Form: If a form has multiple or substantive errors, it’s often best to complete a new Form I-9. Attach the new form to the old one with an explanatory memo.

Always refer to the official USCIS guidance on correcting Form I-9 for detailed instructions. Following these guidelines validates your corrections and shows good faith during a federal i 9 audit.

Best Practices for Ongoing I-9 Compliance

An i 9 audit is a snapshot of your ongoing compliance. To avoid audit stress, you need to embed best practices into your daily HR operations by standardizing procedures, maintaining meticulous records, and using technology.

Consistent compliance reduces errors and demonstrates a commitment to lawful hiring. It’s about building a robust system that works for you.

I-9 Retention: The 3-Year/1-Year Rule

Proper I-9 retention is non-negotiable. This is often called the “3-year/1-year rule.”

- For current employees: Retain the Form I-9 for as long as the individual works for you.

- For terminated employees: You must retain their Form I-9 for either three years from the date of hire or one year from the date employment ends, whichever is later.

For example, if an employee was hired on Jan 1, 2020, and terminated on June 30, 2023:

- Three years from hire: Jan 1, 2023

- One year from termination: June 30, 2024

- The later date is June 30, 2024, so you must keep the I-9 until then.

Store Forms I-9 securely and separately from other personnel files. Once the retention period passes, securely destroy the forms. Our guide on I-9 Record Keeping provides more detail.

The Role of Electronic I-9 Systems and E-Verify

Relying on paper I-9s can be a headache during an i 9 audit. Electronic I-9 systems and E-Verify offer significant advantages.

-

Electronic I-9 Systems: These systems automate the I-9 process, guiding users, flagging errors in real-time, and ensuring all required information is captured. They reduce human error, provide secure digital storage, create detailed audit trails, and streamline corrections.

-

E-Verify Integration: E-Verify is a DHS system that works with Form I-9 to electronically confirm a new hire’s employment eligibility. After completing the I-9, employers use E-Verify to compare the form’s information against government records, adding an extra layer of verification. You can learn more on our E-Verify and I-9 page.

For businesses with remote workers, electronic I-9 systems are especially beneficial. They streamline managing I-9s for employees who are not physically present, making Remote I-9 Compliance much more manageable.

Frequently Asked Questions about the I-9 Audit Process

Even with the best preparation, questions can arise. Here are some common questions about the i 9 audit process:

What happens if I receive a Notice of Inspection (NOI) from ICE?

Receiving an NOI from ICE can be unnerving, but a calm, strategic response is key.

- Acknowledge and Act Quickly: You typically have at least three business days to produce your Forms I-9. Acknowledge the notice and immediately begin gathering the requested records.

- Do NOT Create or Backdate Forms: This is paramount. Creating or backdating forms can lead to criminal charges and higher penalties. It’s better to admit a missing form than to commit fraud.

- Contact Legal Counsel: We highly recommend engaging an attorney or an I-9 compliance expert. They can advise you on your rights, review your forms, and represent you during the audit.

- Organize Your Documents: Present your I-9s in an organized manner, separating current and terminated employee files.

- Understand the Outcomes: After the inspection, ICE will issue a written notice. This could be a Compliance Letter (no violations), a Warning Notice (minor violations to be corrected), a Notice of Suspect Documents, or a Notice of Intent to Fine (NIF) for substantive violations. If you receive a NIF, you have 30 days to request a hearing.

Demonstrating good faith and a willingness to correct errors can positively influence the outcome.

How should I handle I-9s for remote employees?

Remote work has added new complexities to I-9 compliance. While in-person document examination was the standard, the Department of Homeland Security (DHS) now provides flexibility.

- Authorized Representative: For employers not using the new alternative, you can designate an authorized representative (like a notary or trusted individual) to complete Section 2. This person physically examines the employee’s documents. The employer remains liable for any errors made by the representative.

- DHS Alternative Procedure: As of August 1, 2023, employers enrolled in E-Verify in good standing can use an optional alternative procedure. This allows for remote document examination via live video after the employee transmits copies. Specific requirements apply, including retaining clear copies of the documents.

Understanding remote I-9 verification is essential for modern businesses. We offer guidance on the I-9 Verification Process for Remote Employees.

Can I just ask all my employees to fill out new I-9 forms?

While it might seem like an easy fix, asking all employees to complete new I-9s without a specific, non-discriminatory reason is not advisable and carries significant risks.

- Potential Discrimination Claims: Requiring re-verification could be seen as discriminatory based on national origin or citizenship status, which is prohibited by the Immigration and Nationality Act (INA).

- Good Faith: The best practice for forms with errors is to correct them following USCIS guidelines, not start over. This demonstrates a good faith effort to comply.

Completing new forms might be defensible only if a large number of forms are severely deficient and you have a legitimate, non-discriminatory business reason. In such rare cases, you should:

- Attach the new, correctly completed form to the original.

- Include a signed and dated memo explaining the reason.

- Crucially, do not backdate the new forms. Always use the current date.

Consulting with legal counsel before requiring all employees to complete new I-9s is highly recommended.

Conclusion

Navigating i 9 audit compliance doesn’t have to be a source of anxiety. By understanding the requirements, conducting proactive internal audits, and implementing best practices, you can turn a potential headache into a routine part of your business operations.

Proactive compliance is about more than avoiding penalties; it’s about ensuring a legal workforce and gaining the peace of mind that comes from knowing your business is protected. It’s about being prepared, not scared.

We at Valley All States Employer Service understand the complexities of employment eligibility verification. Our expertise can help minimize errors and administrative burden, ensuring your business is always audit-ready.

Ready to take control of your E-Verify and I-9 compliance? Let us help you streamline your processes. Visit our Take control of your E-Verify and I-9 compliance page to learn more about how we can assist you.