E-Verify Tentative Nonconfirmation: Resolve 2025

What is an E-Verify Mismatch and Why Does It Happen?

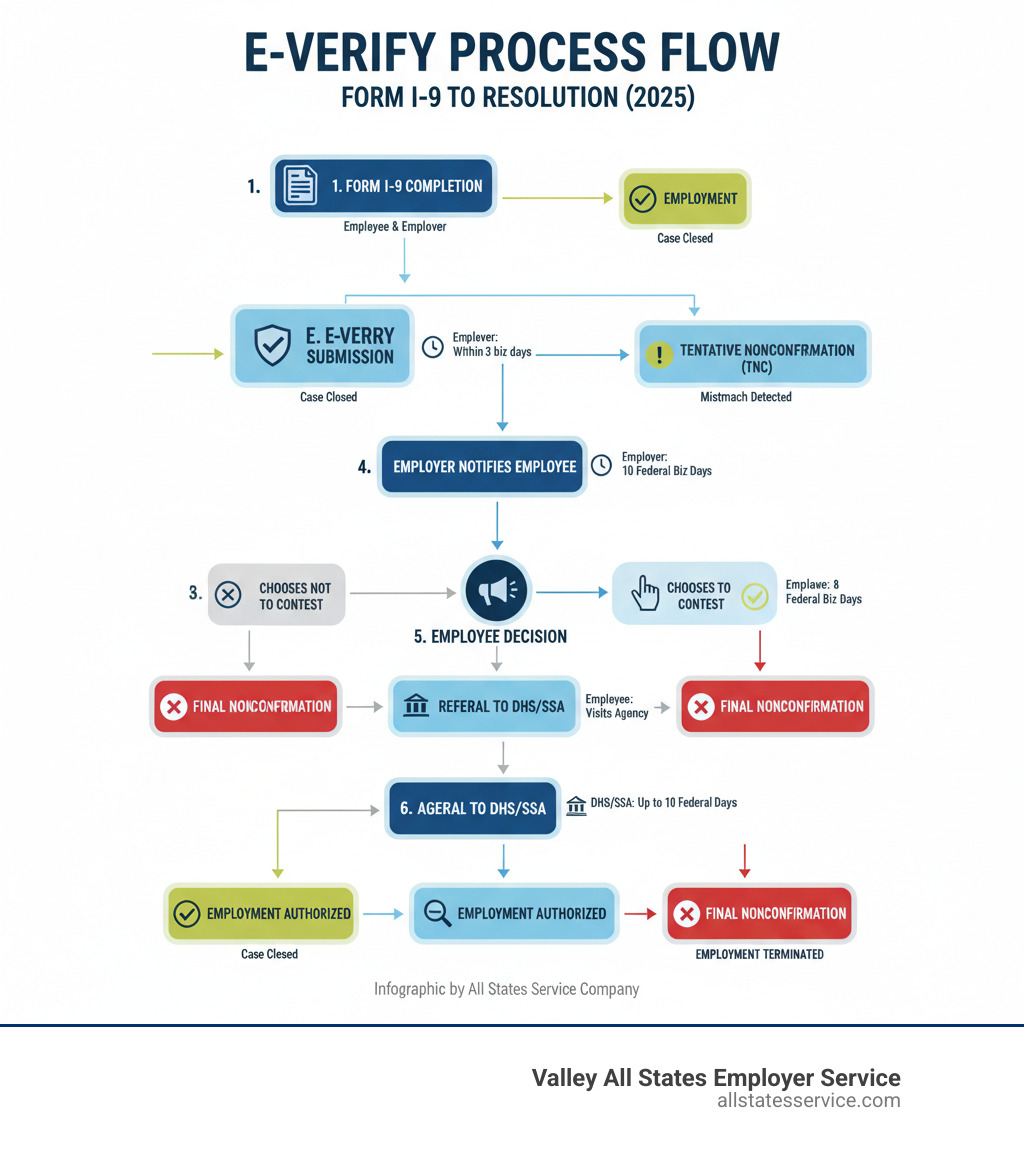

An E-Verify Tentative Nonconfirmation occurs when the information from an employee’s Form I-9 doesn’t match records available to the Department of Homeland Security (DHS) or Social Security Administration (SSA). This mismatch doesn’t mean the employee isn’t authorized to work, it simply means there’s a discrepancy that needs to be resolved.

Quick TNC Overview:

- What it is: An initial finding that employment eligibility information doesn’t match government records

- Not final: Employees have the right to contest and resolve the mismatch

- Time sensitive: Employers have 10 federal working days to notify employees, employees have 8 days to take action after referral

- Protection: Employers cannot fire, suspend, or take adverse action during the resolution process

- Common causes: Data entry errors, outdated records, unreported name changes, or document verification issues

Think of a TNC like a yellow traffic light rather than a red one. It’s a signal to pause and verify information, not an immediate stop sign for employment.

The E-Verify system compares employee information from Form I-9 against records available to DHS and SSA. When these don’t align perfectly, the system flags a potential issue. This could be as simple as a typo in someone’s name or as complex as outdated citizenship status in government databases.

A dual mismatch can occur when records don’t match with both agencies simultaneously, requiring resolution with both DHS and SSA.

Understanding an E-Verify Tentative Nonconfirmation (TNC)

A Tentative Nonconfirmation (TNC), or mismatch, is an initial result from E-Verify indicating that the information from an employee’s Form I-9 doesn’t align with government records. It’s crucial to remember that a TNC is not a final determination of employment ineligibility. It simply points to an information discrepancy that requires further action.

For employees, this means there’s a chance to clarify or correct information. For employers, it means following specific procedures to ensure compliance and avoid discrimination. We understand that seeing a TNC can be alarming, but it’s often resolvable. A mismatch result does not necessarily mean that an employee is not authorized to work in the United States. To dive deeper into the basics, check out our guide on More info about the E-Verify and I-9 process.

Common Reasons for a Social Security Administration (SSA) Mismatch

When an E-Verify Tentative Nonconfirmation stems from the Social Security Administration, it typically means there’s an issue with the employee’s Social Security records. These can range from minor oversights to significant data discrepancies.

Here are some common reasons for an SSA mismatch:

- Name Change Not Reported: The employee legally changed their name, but it wasn’t updated with the SSA.

- Incorrect Personal Information: The employee’s name, Social Security number, or date of birth is incorrect in SSA records.

- Citizenship or Immigration Status Not Updated: The employee’s citizenship or immigration status was not updated with the SSA.

- Another Type of Error: There could be other inaccuracies in the SSA’s records.

- Employer Data Entry Error: Sometimes, the employer simply entered the employee’s information incorrectly into E-Verify.

It’s a good idea for employees to regularly verify their personal information with the SSA. If you ever need to visit an SSA office, you can Find your local SSA field office easily.

Common Reasons for a Department of Homeland Security (DHS) Mismatch

A Tentative Nonconfirmation from the Department of Homeland Security indicates that the employee’s information doesn’t match records held by DHS. These issues often relate to immigration documents or status.

Here are common reasons for a DHS mismatch:

- Incorrect Identification Numbers: The employee’s name, Alien Registration Number (A-Number or USCIS number), Form I-94 (Arrival-Departure Record) number, or foreign passport number differs from DHS records.

- Document Verification Issues: Information from the employee’s U.S. passport, passport card, driver’s license, state ID, or foreign passport could not be verified by DHS.

- Outdated DHS Records: The employee’s information, such as citizenship or immigration status, was not updated in DHS records.

- Immigration Status Change: A change in the employee’s citizenship or immigration status has not been fully processed or recorded.

- Photo Mismatch: If E-Verify displays a photo that doesn’t match the photo on the employee’s document, it can trigger a photo mismatch.

- Employer Data Entry Error: Just like with SSA, an employer’s incorrect entry of information into E-Verify can lead to a DHS mismatch.

Ensuring your work authorization documents are current and accurately reflected in government databases is key to a smooth E-Verify process. For more details on this, explore our resources on More info about work authorization.

The Immediate Steps After Receiving a TNC

When an E-Verify Tentative Nonconfirmation hits your desk, time becomes your most important ally. Think of it like a fire drill where everyone knows their role and moves quickly, but nobody panics.

The moment E-Verify issues a TNC, both employers and employees have specific actions they must take within tight deadlines. The entire process revolves around a critical 10 federal government working day window that starts ticking immediately after the mismatch result appears.

Here’s where many employers get nervous, and understandably so. You’re dealing with someone’s livelihood, legal requirements, and strict timelines all at once. But remember, this system was designed to protect everyone involved. The employee gets a fair chance to resolve any discrepancies, and you get clear guidelines on exactly what you can and cannot do.

The most important rule during this entire process? You cannot take any adverse action against the employee. No firing, no suspending, no withholding pay, no delaying training. The Further Action Notice becomes the roadmap that guides both you and your employee through the next steps.

This protection exists for good reason. Many TNCs stem from simple data entry errors or outdated government records, not actual work authorization issues. Taking hasty action could land you in legal trouble and harm an employee who’s perfectly eligible to work. For a deeper dive into these critical requirements, check out our comprehensive guide on employer responsibilities.

Employer Responsibilities: What You Must Do

Getting an E-Verify Tentative Nonconfirmation means you’re now the messenger, and your job is to deliver that message correctly and compassionately. Your first move should be finding a private space to talk with your employee. This isn’t water cooler conversation material.

You’ll need to hand over the Further Action Notice that E-Verify generates automatically. This isn’t just a piece of paper to pass along and forget about. Take time to walk through it with your employee, explaining what the mismatch means and what options they have. If your employee doesn’t speak English fluently, do your best to help them understand or provide the notice in their preferred language if possible.

Your employee then has those crucial 10 federal government working days to decide whether they want to contest the TNC. They must tell you their decision within this timeframe. If they choose to fight the mismatch, you’ll need to complete the referral process in E-Verify, officially passing their case along to the appropriate government agency.

During this entire period, your hands are tied when it comes to adverse actions. You can’t change their work schedule, reduce their responsibilities, or treat them any differently than before the TNC appeared. Maintaining confidentiality is equally important. Other employees don’t need to know about this situation.

The hardest part for many employers is the waiting. You want resolution, but the timeline isn’t up to you anymore.

Employee Responsibilities: Understanding Your Choices

If you’ve just learned about your E-Verify Tentative Nonconfirmation, take a deep breath. This doesn’t mean you’re in trouble or that you’ll lose your job. It simply means there’s a paperwork puzzle to solve.

Your first task is carefully reviewing that Further Action Notice your employer just handed you. Look at every detail with fresh eyes. Is your name spelled correctly? Is your date of birth accurate? Does your Social Security number match what you provided? Sometimes the issue is as simple as a typing error that you can spot immediately.

You have 10 federal government working days to make a decision. That might sound like pressure, but it’s actually protection. This window ensures you have enough time to think things through without your employer making hasty decisions about your employment.

Your choice is straightforward: contest the mismatch or let it stand. If you believe there’s an error in government records or if your employer entered something incorrectly, contesting makes sense. If you choose not to contest, your employer may close the case, which typically leads to a Final Nonconfirmation.

The most important thing you can do is communicate your decision to your employer before that 10-day deadline expires. Don’t leave them guessing. A simple conversation can keep the process moving smoothly.

[TABLE] comparing Employer vs. Employee Immediate Responsibilities

| Employer Responsibility | Employee Responsibility |

|---|---|

| Notify employee of TNC privately | Review the Further Action Notice for accuracy |

| Provide and explain the Further Action Notice | Decide whether to take action to resolve the TNC |

| Do NOT take adverse action (fire, suspend, etc.) | Inform the employer of the decision within 10 days |

| Refer the case if the employee contests | Sign and date the Further Action Notice |

Resolving an E-Verify Tentative Nonconfirmation

When an employee decides to contest an E-Verify Tentative Nonconfirmation, they’re essentially saying, “Hey, let’s get to the bottom of this.” That’s when the real resolution work begins. Think of it as moving from the findy phase to the action phase.

The process becomes more structured at this point. After the employer formally refers the case through E-Verify, the employee gets 8 federal government working days to contact the appropriate agency. This isn’t a suggestion, it’s a requirement. The employer will hand over a Referral Date Confirmation document that contains all the important contact information and deadlines the employee needs.

During this time, E-Verify continuously updates the case status. Both employer and employee should keep an eye on these updates because they tell the story of what’s happening behind the scenes. For the complete official process, you can review the Official TNC overview from E-Verify.

Contesting an E-Verify Tentative Nonconfirmation: The Employee’s Role

Once an employee chooses to contest their E-Verify Tentative Nonconfirmation, they become the main character in their own resolution story. The good news? Government agencies have streamlined this process to make it as straightforward as possible.

For DHS mismatches, employees can call the dedicated line at 888-897-7781 (TTY users can call 877-875-6028). There’s also a digital option: creating or logging into a myE-Verify account to submit documents electronically. This online portal has made the process much more convenient than it used to be.

SSA mismatches require a more traditional approach with an in-person visit to an SSA field office. Yes, it means taking some time out of your day, but SSA staff are trained to help resolve these issues efficiently. For SSA citizenship mismatches, employees get to choose their preferred route, either calling DHS or visiting the SSA office.

The key to success is bringing the right documentation. Employees should gather any documents that prove their identity and work authorization, plus the Further Action Notice and Referral Date Confirmation they received from their employer. Following the agency’s instructions precisely within that 8-day window is absolutely critical.

Throughout this process, staying informed about your case progress is essential. Our comprehensive guide on More info on E-Verify case statuses can help you understand what each status update means.

What if the Employer Made a Mistake?

Sometimes an E-Verify Tentative Nonconfirmation happens because of a simple human error during data entry. Maybe someone typed “Smtih” instead of “Smith,” or accidentally transposed two numbers in a Social Security number. It happens to the best of us, and fortunately, E-Verify has a straightforward fix for these situations.

When an employer realizes they made a data entry mistake, they need to take immediate action. First, they’ll select the “Incorrect Information” option in E-Verify, which acknowledges that the mismatch was due to employer error. This closes the current TNC case immediately.

Next comes the cleanup work. The employer must correct the original Form I-9 to show the accurate information, then create a brand new E-Verify case using the corrected data. This ensures the employee gets a fair verification based on their actual information, not a typo.

This process protects everyone involved. The employee doesn’t get penalized for someone else’s mistake, and the employer can demonstrate they’re committed to accurate record-keeping. Proper attention to detail during the initial I-9 process can prevent many of these errors from occurring in the first place. For more guidance on maintaining accuracy, check out our resource on More info on I-9 compliance.

Understanding Other Case Statuses: ‘Case in Continuance’ and ‘Needs More Time’

While resolving an E-Verify Tentative Nonconfirmation, you might encounter case statuses that essentially mean “hold on, we’re still working on this.” These aren’t red flags, they’re just the system’s way of saying the agencies need more time to do their job properly.

‘E-Verify Needs More Time’ typically appears when E-Verify requires additional manual review of government databases. Think of it as the system calling in a human expert to take a closer look at the records. DHS aims to complete most of these manual reviews within 24 hours, though some complex cases might take longer. The important thing to remember is that employees can continue working normally during this status.

‘Case in Continuance’ means the employee has successfully contacted DHS or SSA, but the agency needs more than the standard 10 federal government working days to resolve the issue. This often happens when an employee needs to obtain additional documentation, like applying for a replacement Social Security card or requesting a copy of their birth certificate from another state.

Both statuses represent active progress, not roadblocks. During these waiting periods, employers cannot take any adverse action against the employee. The protection continues until there’s a final resolution. Patience becomes important here, both agencies are working diligently to resolve legitimate work authorization questions, and rushing the process could actually cause more problems than it solves.

How to Prevent Mismatches and Ensure a Smooth Process

Let’s be honest: dealing with an E-Verify Tentative Nonconfirmation isn’t anyone’s idea of fun. The good news? Most TNCs are completely preventable with the right approach and attention to detail. Think of it like proofreading an important email before hitting send, except the stakes are a bit higher.

The secret to avoiding mismatches lies in proactive measures rather than reactive fixes. When employers focus on accurate data entry and employees keep their records current, the E-Verify process typically runs like clockwork. It’s really that straightforward.

Double-checking Form I-9 information before submitting it to E-Verify can save everyone time and stress. The same goes for employee communication about the importance of accurate documentation. When both sides understand their role, the process becomes much smoother.

Regular self-audits of your E-Verify processes can catch potential issues before they become actual problems. For a deeper dive into these strategies, check out our comprehensive guide on E-Verify best practices.

Tips for Employers

The majority of E-Verify Tentative Nonconfirmation cases we see could have been avoided with better employer practices. It’s not about being perfect, it’s about being careful.

Review I-9 instructions thoroughly before each new hire. Yes, you’ve done this a hundred times, but government forms have a way of changing when you least expect it. Taking five minutes to refresh your memory can prevent hours of TNC resolution later.

Transcribe information carefully from the Form I-9 into E-Verify. This sounds obvious, but data entry errors are the leading cause of TNCs. Double-check every name, every number, every date. If “Smith” looks like it could be “Smyth” on the document, ask the employee to clarify.

Provide clear instructions to employees about what documents they’ll need and how important accuracy is. Many employees don’t realize that a nickname on their driver’s license when their legal name is on their Social Security card can trigger a mismatch. A quick conversation during onboarding can prevent confusion later.

Use an E-Verify Employer Agent if your business processes multiple verifications regularly. At Valley All States Employer Service, we specialize in catching these details before they become problems. Our expert processing minimizes errors and takes the administrative burden off your plate, ensuring verification is handled with precision and impartiality.

Tips for Employees

Your role in preventing an E-Verify Tentative Nonconfirmation starts well before your first day at a new job. A little preparation goes a long way.

Update records after name changes with the Social Security Administration immediately. Got married? Divorced? Legally changed your name for any reason? Don’t wait to update your SSA records. This is the most common reason we see for TNCs, and it’s entirely preventable.

Ensure SSA has correct citizenship status if you’ve recently become a U.S. citizen or your immigration status has changed. Government databases don’t update automatically, and outdated information will trigger a mismatch every time.

Review your documents for accuracy before starting a new job. Check that your Social Security card, driver’s license, and passport all show consistent information. If you spot discrepancies, address them before you need these documents for employment verification.

The bottom line is simple: accurate records lead to smooth verifications. When everyone does their part, E-Verify works exactly as intended.

Frequently Asked Questions about E-Verify TNCs

Getting an E-Verify Tentative Nonconfirmation can feel overwhelming, and we understand that you probably have questions. Let’s walk through the most common concerns we hear from both employees and employers.

Can I be fired for getting a TNC?

Here’s the good news: absolutely not. Federal law is crystal clear on this point. Your employer cannot legally fire you, suspend you, or take any other negative action against you simply because you received a Tentative Nonconfirmation.

Think of it this way: a TNC is like getting a letter from the bank asking you to verify a transaction. It doesn’t mean you’re guilty of anything, it just means there’s something that needs to be sorted out. The same protection applies here.

Your employer can only consider termination if your case eventually results in a Final Nonconfirmation after you’ve had every opportunity to resolve the issue. Until that point, you have the right to keep working while the matter gets sorted out.

What happens if I don’t do anything about my TNC?

This is where timing becomes really important. If you don’t make a decision about contesting your E-Verify Tentative Nonconfirmation and tell your employer within those crucial 10 federal government working days, your employer must close your case.

Unfortunately, staying silent is treated the same as choosing not to take action. This automatically leads to a Final Nonconfirmation, and at that point, your employer can legally terminate your employment.

We know 10 days might not seem like much time, especially if you’re trying to figure out what went wrong. But remember, you don’t have to have everything resolved within those 10 days. You just need to decide whether you want to contest the mismatch and let your employer know your decision.

How long does it take to resolve a TNC?

The timeline for resolving an E-Verify Tentative Nonconfirmation really depends on what caused the mismatch in the first place. Some cases wrap up quickly, while others need a bit more patience.

Once you contact DHS or visit an SSA office within your 8-day action window, the government agency will review your information and update your case status. You might see ‘Employment Authorized’ if everything checks out smoothly. Sometimes you’ll see ‘E-Verify Needs More Time’ if manual review is needed, which typically resolves within 24 hours.

For more complex situations, like when you need to get replacement documents or update records with multiple agencies, your case might show ‘Case in Continuance’. This means the agency needs more than the standard 10 days to sort things out, but you can keep working during this time.

The key is staying in touch with the appropriate agency and responding quickly to any requests for additional information. Most straightforward cases resolve fairly quickly, but it’s always better to start the process sooner rather than later.

Simplify Your E-Verify Compliance

Dealing with an E-Verify Tentative Nonconfirmation can feel overwhelming, but it doesn’t have to be. The key is understanding that these mismatches are often resolvable with the right approach and proper attention to those critical timelines we’ve discussed throughout this guide.

For employees, knowing your rights and responsibilities means you can steer the process confidently. For employers, following the correct procedures protects both your business and your workforce from compliance issues.

The reality is simple: most TNCs stem from preventable errors. Data entry mistakes, outdated records, unreported name changes, these common issues can turn what should be a smooth onboarding process into a bureaucratic maze. But here’s the thing, you don’t have to steer this maze alone.

Many businesses find that managing E-Verify compliance in-house creates unnecessary stress and administrative burden. Between staying current with changing regulations, ensuring accurate data entry, and managing the TNC resolution process, it’s easy to see why errors happen. That’s where expert help makes all the difference.

Valley All States Employer Service specializes in taking the complexity out of employment verification. We handle your E-Verify processing with the expertise and attention to detail that prevents TNCs from occurring in the first place. When they do happen, we guide you through the resolution process step by step.

Our approach is straightforward: we minimize errors through careful processing, reduce your administrative burden, and ensure your compliance is handled correctly from day one. Think of us as your compliance safety net, there to catch issues before they become problems.

Ready to make compliance effortless? Learn more about our E-Verify Services.