What is E-Verify and How Does It Work?

Are you an HR manager struggling with compliance? Navigating the rules for E-Verify for small businesses can be a challenge. Here’s a quick look at whether it’s mandatory for you:

- Federal Requirement: E-Verify is generally voluntary at the federal level.

- Federal Contractors: If your business holds certain federal contracts, E-Verify is mandatory.

- State Laws: Many states have laws making E-Verify mandatory for some or all employers. For example, Alabama, Arizona, Mississippi, and South Carolina require all employers to use it.

- Local Rules: Some cities and counties also have their own E-Verify mandates.

So, while not all small businesses must use E-Verify, knowing your local and state rules is key.

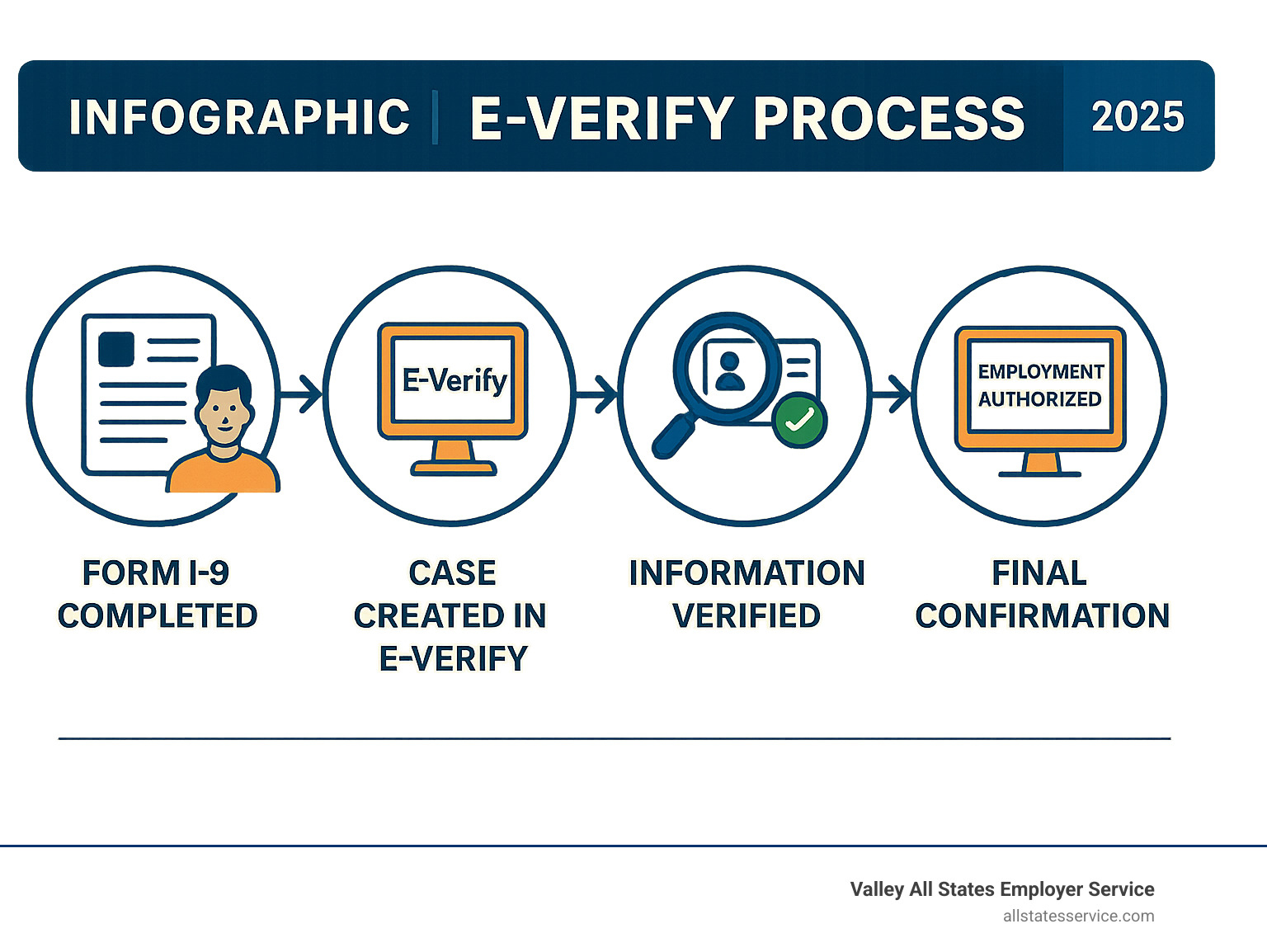

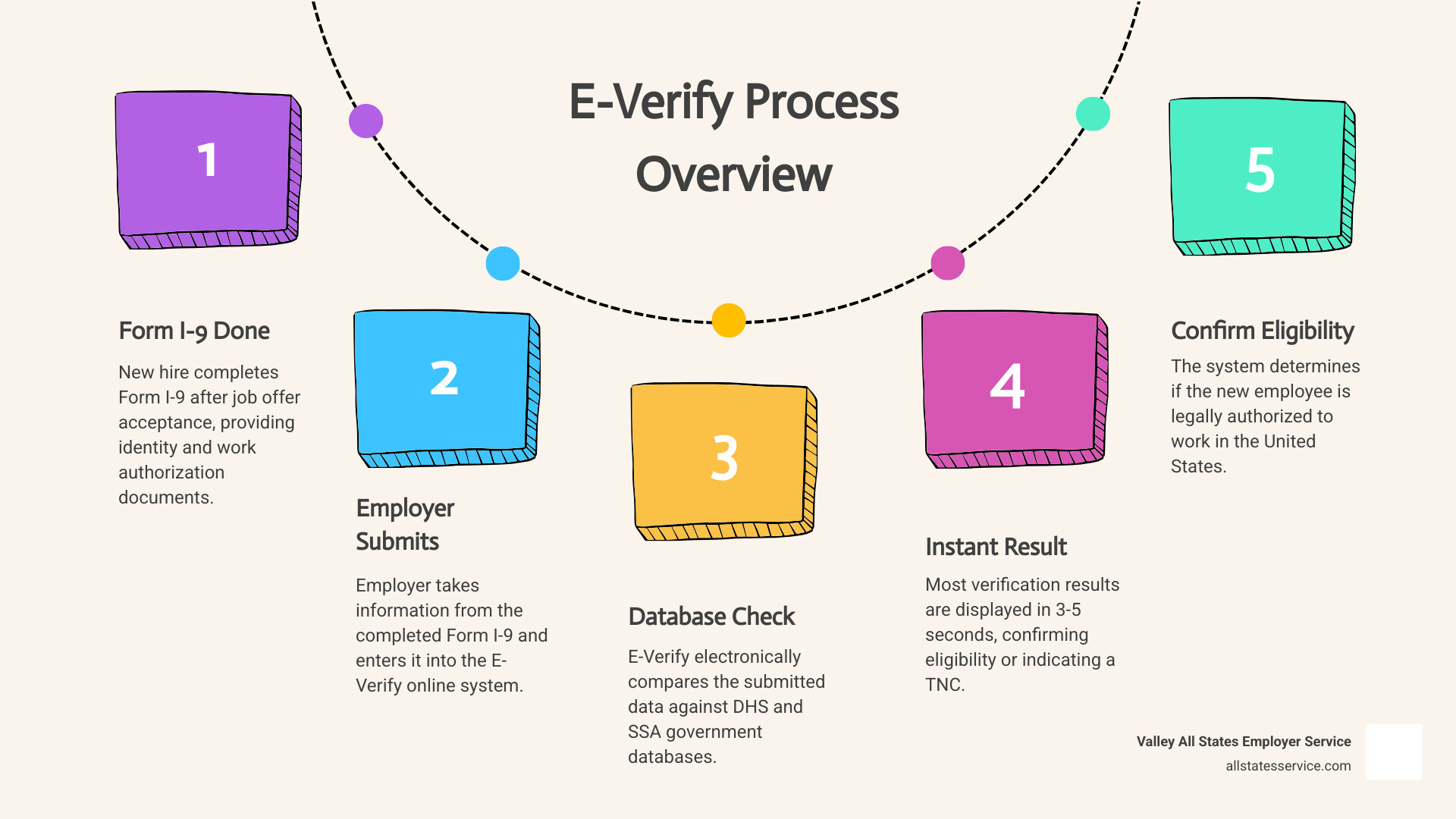

E-Verify is an online system run by the U.S. Department of Homeland Security (DHS) and the Social Security Administration (SSA). It confirms that new hires are legally authorized to work in the United States by checking information from an employee’s Form I-9 against government databases. The process is remarkably fast, with most results appearing in just a few seconds. E-Verify is only for new hires, used after they have accepted a job offer and completed their Form I-9.

This guide will break down everything you need to know, from benefits and challenges to enrollment and best practices.

The Critical Link: E-Verify and Form I-9

E-Verify does not replace the mandatory Form I-9; it complements it. Think of E-Verify as an advanced verification step that builds on the information collected in the Form I-9.

Every U.S. employer must complete a Form I-9 for each new employee to verify their identity and employment authorization. E-Verify takes key information from that form, like the employee’s name, Social Security Number (SSN), and document details, and electronically compares it against DHS and SSA databases. This cross-referencing confirms the employee’s work authorization.

Our team at Valley All States Employer Service understands this process. We can guide you through both Form I-9 requirements and E-Verify, ensuring compliance. For more support, explore our I-9 Verification Assistance.

The Great Debate: Pros and Cons of E-Verify for Small Businesses

For a small business owner, implementing a new system like E-Verify can bring both the peace of mind of a compliant workforce and concerns about administrative burdens. Understanding both sides is key to making the best decision for your business.

Let’s explore how E-Verify can be a powerful tool for building a legal workforce, and also acknowledge the potential problems you might face.

Key Benefits of E-Verify for Small Businesses

Using E-Verify can be a game-changer for your hiring process, offering several advantages that protect your business.

First, it helps reduce document fraud. E-Verify’s photo-matching feature allows you to compare the photo on an employee’s identity document with government records, adding a layer of security. This proactive step also minimizes audit risk by lowering the chance of accidentally hiring an unauthorized worker, which looks great to auditors and helps you avoid hefty penalties.

Beyond avoiding trouble, E-Verify leads to improved compliance by ensuring your entire team is legally authorized to work in the U.S. For businesses employing foreign STEM workers, E-Verify participation offers a valuable STEM worker visa extension, delaying the need to file for an H1-B visa. Finally, most E-Verify cases get results in seconds, leading to fast verification times that accelerate your hiring process.

For more on how E-Verify can streamline your hiring, hop over to our page on E-Verify Employment Verification. Our expertise in Employer HR Compliance is always here to assist you further.

Potential Challenges and Drawbacks

While the benefits are appealing, implementing E-Verify for small businesses isn’t without its considerations.

One common concern is the administrative workload. For smaller businesses without a dedicated HR department, managing E-Verify requires careful data entry, case tracking, and sticking to strict timelines.

Then there’s the Tentative Nonconfirmation (TNC) process. This happens when entered information doesn’t match government records. It could be a simple typo, but resolving it requires specific steps that can be time-consuming and stressful for both you and your new hire, sometimes leading to hiring delays.

It’s also crucial to be mindful of legal exposure from false non-confirmations. If a TNC isn’t handled precisely, or if you take action against an employee before the resolution process is complete, you could face discrimination claims. Following every step correctly is incredibly important.

Finally, E-Verify involves handling sensitive employee data, so you’ll need robust data security measures. Plus, all staff involved will need employee training to use the system correctly and uphold non-discrimination policies. These challenges are why many small businesses choose to outsource their E-Verify process to a team like ours.

Is E-Verify Mandatory? A Guide to Federal and State Rules

Ever wonder if your small business has to use E-Verify? The answer isn’t always a simple yes or no. While E-Verify is often voluntary at the federal level, your location or business activities can make it a requirement.

Let’s start with federal contractors. If your E-Verify for small businesses operation holds a federal contract with the Federal Acquisition Regulation (FAR) clause, then E-Verify is a must. This applies to all employees working on that contract and all new hires at related work sites.

Beyond federal rules, state-level mandates play a huge role. Many states have their own laws making E-Verify mandatory. For example, states like Alabama, Arizona, Mississippi, and South Carolina require all employers to use it. Other states might require it based on employee count or for public agencies and state contractors.

And just when you think you’ve got it figured out, county and city rules can add another layer of complexity. To stay informed, check the current E-Verify laws in the states where you operate. Official state government websites are the best source for this information. Of course, our team at Valley All States Employer Service is always here to offer custom guidance on E-Verify Employer Requirements and ensure your business stays compliant.

A New Perk for Remote Hiring

Good news for modern workplaces! The world of employment verification has gotten a fantastic upgrade, especially if you have remote employees. Historically, completing Form I-9 meant physically inspecting an employee’s documents, a hurdle for distributed teams.

Recognizing that remote work is here to stay, the U.S. Department of Homeland Security (DHS) introduced a new alternative in 2023. This procedure now lets E-Verify participants in good standing examine Form I-9 documents remotely through a live video call.

What does this mean for your E-Verify for small businesses approach? It’s a game-changer. If your business is enrolled in E-Verify, you can now perform document checks virtually, making it much easier to hire talent from anywhere. Your employee sends you copies of their documents, and you have a live video chat to visually inspect them.

This update streamlines Employee Onboarding Compliance for your remote teams. You can dive deeper into these changes, including the New Form I-9 and remote examination rules, directly from official sources.

Getting Started: A Step-by-Step Guide to E-Verify Enrollment

Ready to take the plunge? If you’ve decided that E-Verify for small businesses is right for your company, enrollment is your next step. The process is straightforward, but you must complete it in one session. Gathering all your information beforehand is crucial.

Before you begin, make sure you have this information ready:

- Your Employer Identification Number (EIN) (federal tax ID).

- Your complete company legal name, physical address, and mailing address.

- The first three digits of your NAICS code (North American Industry Classification System).

- An approximate total number of employees.

- Contact information for the Memorandum of Understanding (MOU) signatory and at least one Program Administrator.

The actual enrollment involves visiting the official E-Verify website, accepting their terms, and creating your company account. You’ll provide your company details, designate hiring sites, and set up your key personnel. After a final review, you’ll submit your enrollment.

For step-by-step guidance, the official Enrolling in E-Verify page is a great resource. Of course, if this sounds overwhelming, our E-Verify Services can handle the enrollment for you, ensuring everything is set up correctly from day one.

Choosing Your Path: Direct Enrollment vs. Using an Employer Agent

You have two main options for managing E-Verify, and the choice will impact your day-to-day operations.

Direct enrollment means you handle everything internally. Your team creates cases, manages TNCs, and stays current on policy changes. This approach offers complete control but means you shoulder the entire administrative load.

The alternative is working with an E-Verify Employer Agent like our team at Valley All States Employer Service. We are authorized by USCIS to handle the verification process on your behalf.

Why do so many small businesses choose the agent route? We take the administrative tasks off your plate. Our team specializes in this work, so we handle it efficiently and with fewer errors. We also provide expert compliance, staying on top of every rule change to reduce your risk of costly mistakes. When TNCs occur, we guide you through the resolution process step-by-step.

For businesses that want the benefits of E-Verify without the hassle, an Employer Agent makes perfect sense. You can focus on your business while we handle your employment verification. Learn more about our Outsourced Compliance Solutions and see how we can simplify this process for you.

Best Practices for E-Verify Compliance and Support

Enrolled in E-Verify? Great! Now, maintaining compliance for E-Verify for small businesses is key to ensuring a smooth and fair hiring process. Adhering to best practices isn’t just about avoiding penalties; it’s about creating an efficient system for everyone.

Here are the key practices to follow:

- Adhere to the Three-Day Rule: You must create an E-Verify case for each new hire no later than the third business day after they start working for pay.

- Proper Record Retention: Record the E-Verify case number on the employee’s Form I-9 or keep a printout of the case details with their I-9. Remember to follow Form I-9 retention rules (typically three years after hire or one year after termination, whichever is later).

- Practice Non-Discrimination: E-Verify must be used consistently for all new hires, not just those you suspect may be unauthorized. Never pre-screen applicants before a job offer.

- Display Right to Work Posters: E-Verify employers must display both the “E-Verify Participation” and “Right to Work” posters where they are visible to prospective and current employees.

- Handle TNCs Correctly: If an employee receives a Tentative Nonconfirmation (TNC), you must follow the precise steps outlined by E-Verify. This includes notifying them, explaining their rights, and giving them time to contest the finding. You cannot take adverse action based solely on a TNC.

Performing regular self-audits of your Form I-9s and E-Verify cases is also a smart move. For more detailed guidance, we’ve got you covered with our E-Verify Best Practices and helpful resources on I-9 Self-Audit.

Where to Find Help and Training

Feeling a little overwhelmed? Don’t worry, there are fantastic official resources and support channels available.

The Official E-Verify Website is your primary source for user manuals, policy updates, and authoritative guidance. USCIS also provides free USCIS Webinars that cover everything from basics to complex topics. You can check out their E-Verify Overview Webinar to get started. The dedicated Employer Resources page is another goldmine of useful tools.

Here at Valley All States Employer Service, we complement these resources with personalized support. Consider us your dedicated E-Verify Customer Support, ensuring you always have a knowledgeable partner by your side.

Frequently Asked Questions about E-Verify for Small Businesses

Navigating employment verification can bring up a lot of questions, especially when it comes to E-Verify for small businesses. Let’s explore the questions we hear most often.

Can I use E-Verify to screen job applicants before I hire them?

No, this is strictly prohibited. E-Verify is not a pre-screening tool. You can only use it after a job applicant has officially accepted your offer of employment and has completed Section 1 of their Form I-9. Using it to screen candidates can lead to serious legal trouble, including discrimination claims.

What happens if an employee gets a Tentative Nonconfirmation (TNC)?

A Tentative Nonconfirmation (TNC) simply means the information entered into E-Verify didn’t match government records. It is not a final decision and could be due to a simple error like a typo or a name change.

If an employee receives a TNC, you must:

- Inform the employee and provide them with the official TNC Notice.

- Allow the employee to decide whether to contest the finding.

- Refer the case to the appropriate agency if they choose to contest it.

- Give them 8 federal work days to respond.

Crucially, you cannot fire, suspend, or take any other negative action against an employee based solely on a TNC while they are working to resolve it.

Do I still need to keep Form I-9 records if I use E-Verify?

Yes, absolutely. E-Verify is a partner to Form I-9, but it does not replace it. You still have a legal obligation to complete and retain a Form I-9 for every new hire according to federal law.

When you use E-Verify, you should write the E-Verify case number on your employee’s Form I-9 or attach the printed case details to it. Keeping complete and organized records for both Form I-9 and E-Verify is your best defense for audit preparedness.

Conclusion: Simplify Your Compliance with an E-Verify Expert

Navigating E-Verify for small businesses involves complex rules, from enrollment to handling Tentative Nonconfirmations. While the benefits of a compliant workforce are clear, the administrative tasks can be a burden for a busy owner or HR manager. Your energy should go into growing your company, not wrestling with regulations.

This is where having an expert in your corner makes all the difference. At Valley All States Employer Service, we specialize in taking that E-Verify burden off your shoulders. We offer outsourced workforce eligibility verification that is expert, impartial, and incredibly efficient.

Our goal is to provide you with genuine administrative relief. We work hard to minimize errors and help you maintain compliance without the worry. Our team stays up-to-date on the latest policies, including the new remote document examination procedures, so you don’t have to.

Choosing us as your E-Verify Employer Agent means you can look forward to a streamlined hiring process and significantly reduced legal risks. Imagine the peace of mind knowing your employment eligibility checks are handled with precision, freeing you to focus on what you do best.

Ready to streamline your hiring process and ease your compliance worries? Learn more about our E-Verify Employer Agent Service.