Auditing I-9 Forms: 4 Flawless Steps

Why Auditing I-9 Forms Matters for Your Business (and Your Bottom Line)

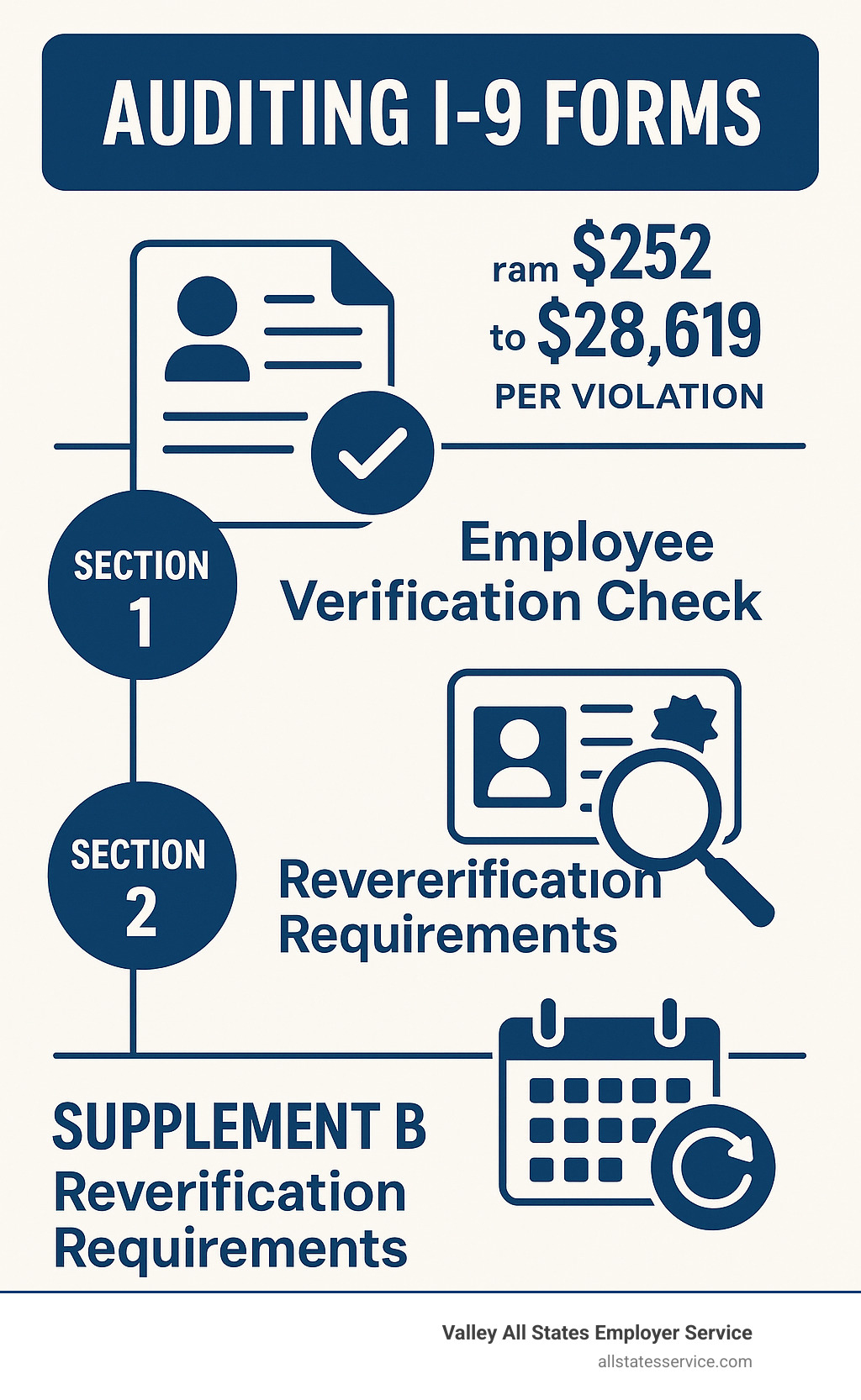

Auditing I-9 forms is your best defense against costly fines that can reach up to $28,619 per violation as of 2025.

Quick I-9 Self-Audit Checklist:

- Section 1: Employee name, signature, date, and immigration status are checked.

- Section 2: Valid documents from List A, B, or C are recorded correctly.

- Supplement B: Reverifications are completed for expired work authorization.

- Storage: Forms are retained for 3 years from hire or 1 year after termination.

- Corrections: Errors are fixed with the line-through method, initialed, and dated.

Every U.S. business must complete Form I-9 for each employee hired after November 6, 1986. This requirement from the Immigration Reform and Control Act (IRCA) mandates that employers verify both identity and work authorization for all new hires.

The stakes are high, as research shows 76% of I-9 forms contain at least one error. With Immigration and Customs Enforcement (ICE) issuing over $20 million in civil penalties in 2023 and average fines rising 34% since 2019, inaction is not an option.

Internal I-9 audits let you find and fix problems before government inspectors arrive. Unlike official ICE audits that give you just three business days to produce records, self-audits put you in control. Spending a few hours auditing now can save thousands in fines later, as proactive audits demonstrate good faith compliance that may reduce penalties.

Step 1: Get Ready for Your I-9 Self-Audit

Properly auditing I-9 forms starts with good preparation. First, gather every Form I-9 you have, including those for current employees and any terminated employees still within the retention period. Don’t worry about organizing them yet, just get them all in one place.

Next, create a simple tracking system, like a spreadsheet with employee names, hire dates, and audit status. This audit log is crucial for showing government inspectors your proactive compliance efforts. If you manage multiple locations, audit them one at a time to ensure accuracy.

You’ll also need a complete employee roster. Cross-reference this list with your I-9s to quickly spot any missing forms. Before diving in, decide on your audit scope. While reviewing every I-9 is ideal, you can start with a representative sample selected using neutral, non-discriminatory criteria if time is limited.

For detailed guidance, the Guidance for Employers Conducting Internal Employment Eligibility Verification Form I-9 Audits from ICE and IER is an excellent resource.

Who Needs an I-9 Form?

Every employee hired after November 6, 1986, needs a completed Form I-9, regardless of their citizenship or immigration status. If they receive a paycheck from you, they need an I-9.

However, independent contractors and volunteers do not need I-9 forms. The same applies to anyone hired before November 7, 1986, who is still continuously employed. If you have I-9s for contractors, remove them from your compliance files to avoid confusion during an audit. The key distinction is whether someone performs labor in exchange for wages. When in doubt, complete the form. For more details, see our guide on I-9 Form Completion.

Understanding I-9 Retention Rules

Federal law requires you to keep I-9s for specific periods. The retention rule is the “3-year/1-year rule”: keep each I-9 for three years from the hire date OR one year after the employee’s termination date, whichever is longer.

For example, if an employee hired March 1, 2021, leaves on June 1, 2023, you must keep their I-9 until June 1, 2024 (one year after termination is later than three years from hire).

If an employee hired January 15, 2020, leaves after two months, you must keep their form until January 15, 2023 (three years from hire is later than one year after termination).

Secure storage is non-negotiable. These forms contain sensitive personal information. Use locked filing cabinets for paper forms and encrypted systems with access controls for electronic storage. A pro tip is to store I-9s separately from general personnel files. This protects confidentiality and makes it easier to produce forms during an inspection.

For more on managing records, explore our guide on I-9 Record Keeping. To understand the form itself, see What is an I-9 Form?.

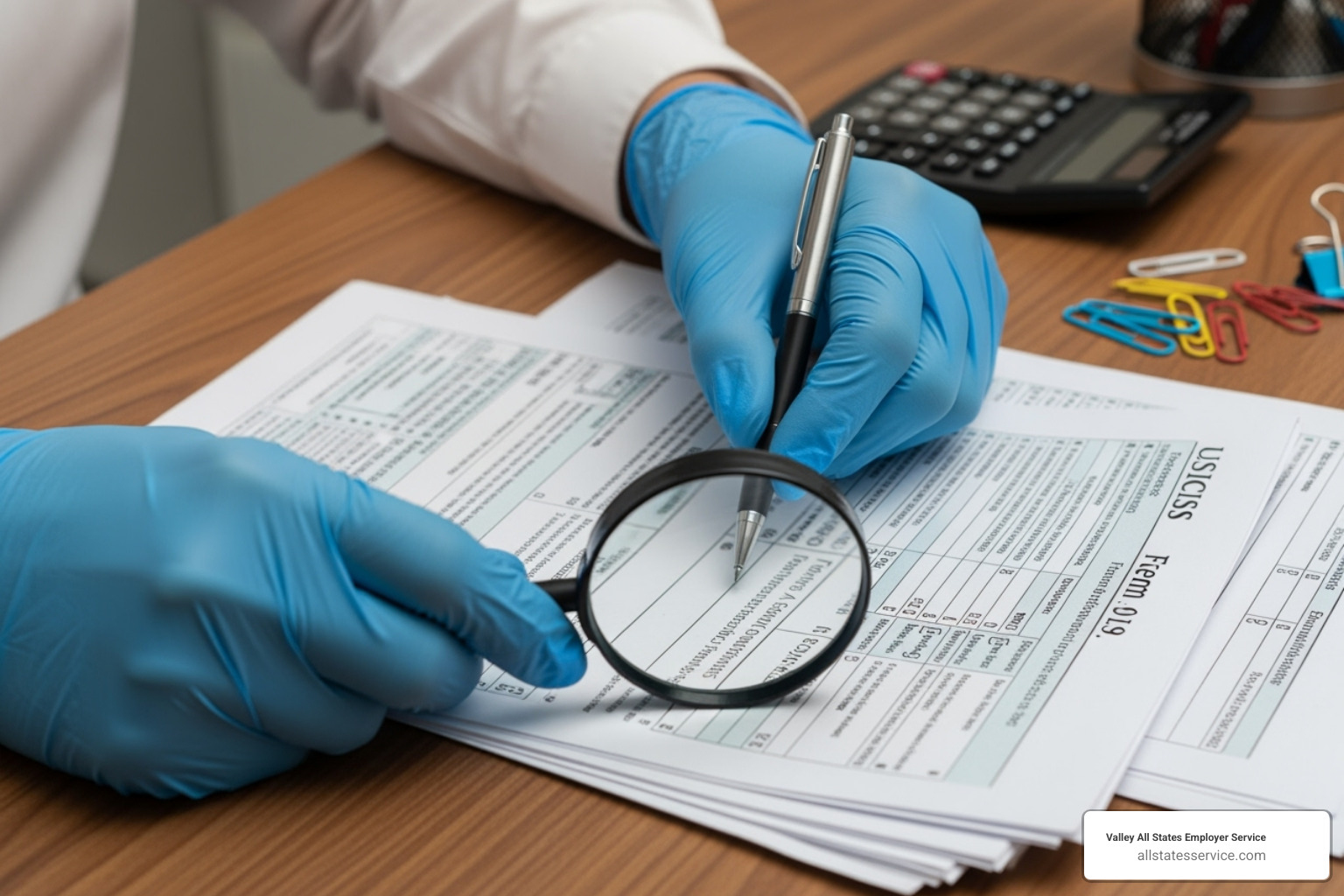

Step 2: Your Step-by-Step Guide to Auditing I-9 Forms

This is the core of auditing I-9 forms. The key is to review every form with the same careful eye. Use a simple audit log (a spreadsheet or document) to track each employee’s name, the review date, any issues found, and the corrective actions taken. This log is proof of your proactive compliance.

Most I-9s have at least one error, so don’t panic when you find them. The purpose of the audit is to catch and fix these issues. Every mistake you correct now is money saved later.

Reviewing Section 1: Employee Information and Attestation

Section 1 is the employee’s responsibility but requires your review. It must be completed on or before the employee’s first day. Common errors include:

- Incorrect Name: Employees may use nicknames instead of their full legal name.

- Incomplete Fields: Address and date of birth fields are often left blank.

- Immigration Status: Employees must check exactly one box. Multiple checks or no check is an error.

- Missing A-Number/USCIS Number: Lawful permanent residents or aliens authorized to work often forget to provide this number.

- Missing Signature or Date: The form is incomplete without the employee’s signature and a date proving completion by their first day.

If a preparer or translator assisted the employee, Supplement A must be completed with their information and signature. For more on proper completion, see our guide on I-9 Form Completion.

Reviewing Section 2: Employer Review and Verification

Section 2 is your responsibility and must be completed within three business days of the employee’s start date.

Document examination is the foundation. You must physically examine original, unexpired documents that prove both identity and work authorization. The employee chooses which documents to present from Lists A, B, and C. You cannot demand specific documents.

Recording document information correctly is critical. For each document, record the title, issuing authority, number, and expiration date (if any). A List A document is sufficient, but if using List B and C documents, you need information from both.

Your signature and date certify that you examined the documents and they appeared genuine. The date must be within three business days of the hire date. Also, ensure the date of hire field matches your payroll records.

For remote workers, follow specific alternative verification procedures. Learn more in our guide on the I-9 Verification Process for Remote Employees.

Reviewing Supplement B: Reverification and Rehires

Supplement B (formerly Section 3) covers expiring work authorization and rehires within three years.

Reverification deadlines are mandatory. You must reverify an employee’s work authorization before their Employment Authorization Document (EAD) or temporary work visa expires. Missing this deadline can lead to severe penalties.

U.S. citizens and permanent residents generally do not need reverification, even if their documents (like a Permanent Resident Card) expire. Their work authorization is permanent.

For rehires within three years of the original I-9, you can use the existing form if their work authorization is still valid by completing the rehire section in Supplement B. If it has expired, you must reverify. If it has been more than three years, complete a new I-9.

Name changes are also recorded in Supplement B. For the latest USCIS guidance, visit their official guidance page.

Step 3: How to Fix I-9 Errors the Right Way

Finding errors while auditing I-9 forms is expected. The key to fixing them is transparency. Never use white-out, erasers, or black markers to hide mistakes, as this raises more red flags than the original error.

The correct method is to draw a single line through the incorrect information, write the correct details nearby, then initial and date your correction using the current date. Using a different colored ink helps corrections stand out.

Understand the difference between technical errors (minor issues like typos) and substantive errors (serious problems like accepting invalid documents). Substantive errors carry steeper penalties. Crucially, never backdate anything. All corrections must reflect the date they were made.

Correcting Common I-9 Mistakes

Here’s how to approach the most frequent errors:

- Missing Signatures: If an employee forgot to sign Section 1, they must add their signature and the current date. You cannot sign for them.

- Incorrect Dates or Missing Fields: In Section 2, the employer should line through the error, write the correct information, and initial with the current date.

- Wrong Document Information: Use the same line-through method to correct any mistakes in recording document details.

A key rule is that employees must correct their own errors in Section 1, while employers handle corrections in Section 2 and Supplement B. For more examples, see the USCIS guide on correcting Form I-9 and our guide on I-9 Self-Audit.

When to Complete a New Form I-9

Sometimes, a form is too flawed to correct. In these cases, it’s better to complete a new one.

- Missing Forms: If an employee has no I-9, complete a new one immediately using the current date. Attach a memo explaining it was created to correct a missing form found during an audit.

- Forms with Major Errors: If a form has multiple, substantive errors, a new form provides clarity.

- Outdated Versions: If you find an old, incorrect version of the form was used, completing a current version is the best fix.

When creating a new form, staple the old, incorrect form to the new one and attach a signed memo explaining the reason for the replacement. This maintains a clear audit trail and shows good faith.

Step 4: Stay Compliant and Be Ready for Inspections

Completing your audit is a great step, but auditing I-9 forms is an ongoing process. You must stay prepared for ICE audits, which usually begin with a Notice of Inspection (NOI). This official document from Immigration and Customs Enforcement gives you just three business days to produce your I-9s.

Your proactive internal audit prevents a last-minute scramble. During an inspection, ICE agents will examine your forms for compliance. If they find technical or procedural problems, you typically get at least 10 business days to make corrections. However, uncorrected technical issues can become substantive violations with much higher fines.

Penalties start at $252 per violation and can climb to $28,619 for repeat offenders. In severe cases, businesses face criminal prosecution. Our guide on I-9 Compliance Penalties details the risks. For official information, review the Form I-9 Inspection – ICE factsheet.

How Often Should You Audit I-9 Forms?

While no frequency is mandated by law, regular audits are a best practice.

- Annually: An annual audit is the gold standard to catch errors before they multiply.

- After Mergers and Acquisitions: Audit acquired forms immediately, as you inherit their compliance history.

- During High Turnover: Conduct more frequent spot checks when hiring rapidly.

- For High-Scrutiny Industries: Businesses in construction, agriculture, and hospitality should consider quarterly audits.

- After System Changes: Audit after implementing new HR software or onboarding processes to ensure they work correctly.

How Technology Can Help

Technology makes auditing I-9 forms easier and helps prevent errors.

- Digital I-9 Storage: Eliminates bulky paper files and allows for instant retrieval.

- Automated Reminders: Tracks critical dates for Section 2 completion and work authorization expirations, preventing missed deadlines.

- Error-Checking Features: Flags incomplete fields or incorrect data formats in real-time, dramatically reducing the 76% error rate common in paper forms.

- Audit Trails: Creates a detailed record of every action taken on a form, demonstrating proper procedures.

- E-Verify Integration: Streamlines verification by connecting your I-9 process directly with E-Verify. Our E-Verify and I-9 support provides expert, impartial processing to minimize errors and administrative work.

Technology frees your HR team to focus on strategic initiatives instead of paperwork.

Frequently Asked Questions about Auditing I-9 Forms

When auditing I-9 forms, certain questions arise frequently. Here are answers to the most common concerns.

What are the most common and costly I-9 errors?

Most I-9 mistakes are preventable. The most common include:

- Missing Signatures: An employee forgetting to sign Section 1 or an employer skipping the signature in Section 2.

- Timing Violations: Completing Section 2 after the three-business-day deadline.

- Incomplete Document Details: Forgetting to record a document number, expiration date, or issuing authority.

- Missed Reverification: Failing to reverify an employee’s work authorization before it expires.

The most expensive mistakes involve knowingly hiring unauthorized workers or having substantive violations that invalidate the verification process. These can lead to fines of up to $25,076 per violation, with even higher penalties for repeat offenders.

Can I use the Spanish version of the Form I-9?

This depends on your location. If your business is in Puerto Rico, you may use the Spanish version of Form I-9 as your official record.

For all other U.S. locations, the English version is mandatory. The Spanish version can be used as a translation tool to help employees understand the form, but they must complete and sign the official English version. Always use the current version of Form I-9, which has a revision date of 08/01/2023 in the bottom left corner.

What if an employee can’t provide documents to fix an error?

If an employee cannot produce the necessary documents, handle the situation professionally and legally.

First, communicate clearly what is needed and provide a reasonable deadline. Document all communications to show your good-faith efforts to resolve the issue.

If an employee provides a receipt for a replacement document (like for a lost driver’s license), you can accept it temporarily, typically for 90 days. After that, they must present the actual document.

If an employee ultimately cannot provide acceptable documentation to prove their identity and work authorization, you may have to terminate their employment to protect your business from severe penalties. It is critical to be consistent in your approach with all employees in similar situations to avoid claims of discrimination.

Take Control of Your I-9 Compliance

Think of auditing I-9 forms as an insurance policy against compliance disasters. Proactively reviewing your records protects your business from penalties that can reach tens of thousands of dollars per violation.

The peace of mind from knowing your I-9s are in order is invaluable. Regular internal audits give you control over your compliance story before government inspectors arrive. Don’t wait for a Notice of Inspection from ICE to get your house in order.

Valley All States Employer Service understands that I-9 compliance can be overwhelming. Our team provides expert, impartial, and efficient E-Verify workforce eligibility verification services. We help businesses like yours minimize errors and reduce the administrative burden of managing compliance in-house.

Your business deserves protection from costly penalties. Working with professionals who understand employment verification is an investment in your company’s stability and growth.

Ready to simplify your I-9 compliance and protect your business? Contact our team today to learn more about our E-Verify I-9 Compliance support.