The Shift from Manual Payroll to Cloud-Powered Efficiency

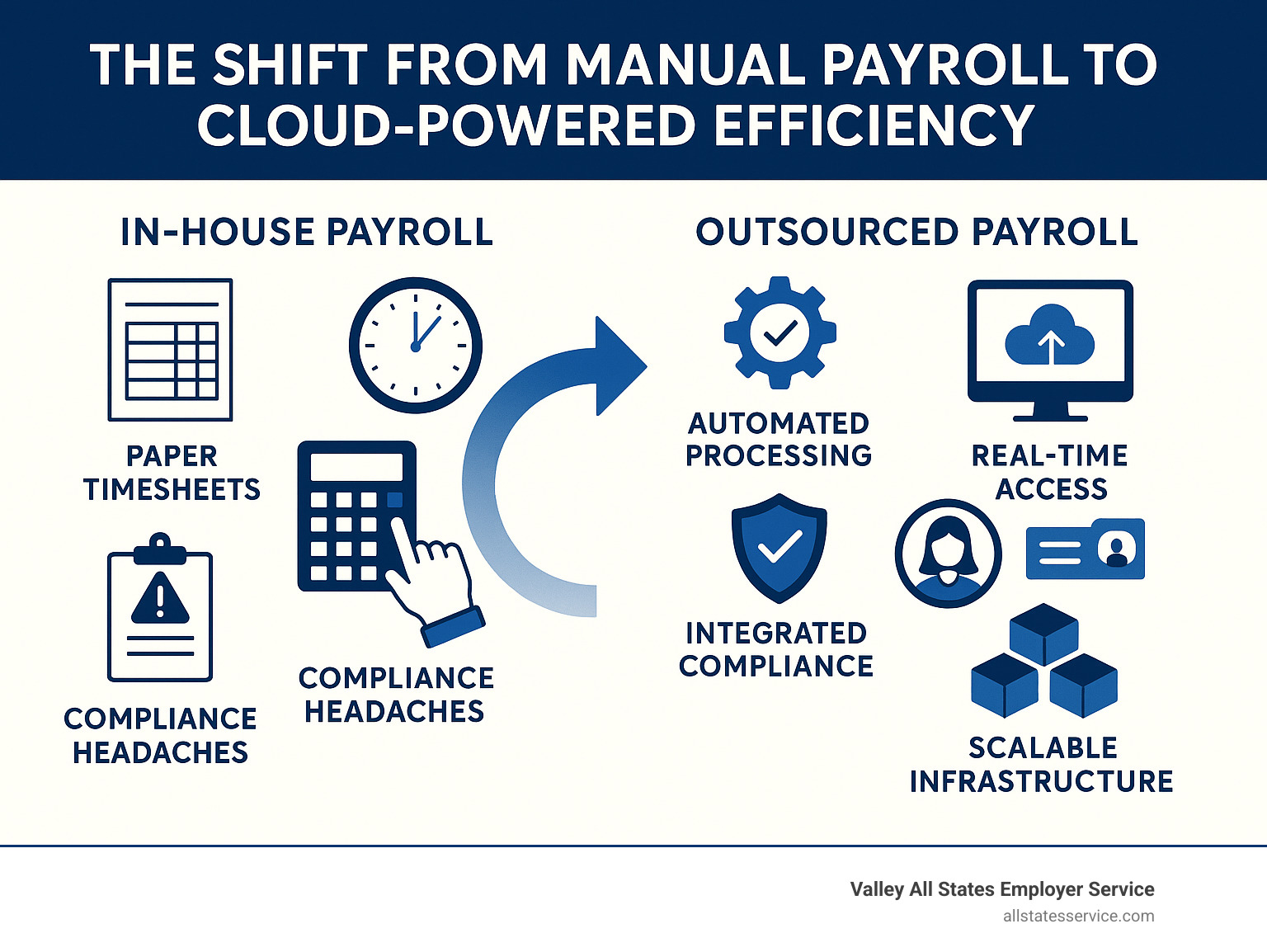

Outsourcing payroll cloud services are changing how HR departments manage their most time-consuming tasks. As businesses move from manual calculations to automated, cloud-based solutions, they find benefits that go far beyond simple cost savings.

Key benefits of outsourcing payroll cloud services:

- Cost reduction: Save 30-40% on payroll processing costs

- Time savings: Reduce payroll processing time by up to 80%

- Improved accuracy: Eliminate human errors in tax calculations and compliance

- Scalability: Easily add or remove employees without system upgrades

- Security: Access enterprise-level data protection and encryption

- Compliance: Stay current with federal, state, and local tax regulations automatically

The numbers tell a compelling story. According to the Deloitte Global Outsourcing Survey 2024, 30% of organizations cite cost savings as their top reason for outsourcing. Meanwhile, Gartner predicts that cloud workloads will jump from 25% to 70% by 2028, showing just how rapidly businesses are embracing this technology.

Gone are the days of physical documents and manual processes. Thanks to cloud-based payroll solutions, HR teams can now access and manage payroll information from anywhere with an internet connection.

For busy HR managers, this shift is about reclaiming time to focus on strategic initiatives that drive business growth.

Traditional in-house payroll leaves HR teams drowning in paperwork and costly errors. Cloud payroll outsourcing flips this script, offering automation and expert support that transforms HR from a cost center into a strategic partner.

Why Businesses Are Moving Payroll to the Cloud: Core Benefits and Savings

Moving to outsourcing payroll cloud services is a smart business decision. The Deloitte Global Outsourcing Survey 2024 shows companies gain immediate cost savings and long-term strategic advantages.

It’s about more than just keeping up with technology, it’s about freeing up resources to focus on what drives your business forward.

Slashing Costs and Boosting Efficiency

In-house payroll has hidden costs beyond software licenses. You’re also paying for training staff, managing updates, and fixing human errors from manual processes.

The reduced overhead is a major draw. Partnering with a cloud provider eliminates expensive software and IT infrastructure costs. You access enterprise-level technology on a pay-as-you-go model that scales with your business.

Here’s where it gets interesting: the 2021 EY Global Payroll Survey found that inaccurate employee data is the most common payroll compliance issue, affecting 32% of businesses. Those errors translate into real money through penalties and the time spent fixing mistakes.

Cloud payroll providers specialize in accuracy. Their systems catch errors early, and their expertise in tax calculations and compliance means fewer surprises at audit time. When you consider that payroll mistakes can result in hefty penalties, the investment in professional payroll services through our Payroll Outsourcing Solutions often pays for itself.

The labor cost control aspect is compelling for growing businesses. Instead of hiring more staff to handle increased payroll complexity, you can scale your services up or down based on actual needs.

Reclaiming Time to Focus on Strategic Growth

Think about how much time your team spends on payroll tasks. Calculating wages, tracking hours, and handling tax filings create an administrative burden that can consume days each pay period.

Outsourcing payroll to the cloud frees your HR team from spreadsheets and paperwork. They can then focus on core business activities that move your company forward.

Imagine your HR professionals spending their time on strategic HR initiatives like improving employee onboarding, creating professional development opportunities, or working on retention strategies. These activities improve employee development and your overall customer experience by creating a more engaged workforce.

This shift allows your internal teams to focus on what they do best while leaving the complex world of payroll compliance and processing to the experts.

The Power of “Cloud” in Outsourcing Payroll Cloud Services

When we talk about outsourcing payroll cloud services, it’s more than just moving files online. It’s like having an expert assistant that never makes calculation errors and always knows the latest tax laws.

The shift to cloud technology is a business revolution. Gartner’s research shows that while only 25% of tech workloads currently operate in the cloud, that number will rise to 70% by 2028. Companies are finding that cloud solutions deliver automation, scalability, and real-time collaboration that traditional systems can’t match.

Opening up Seamless Scalability and Adaptability

With traditional payroll, a growth spurt means expensive software upgrades and new hires to manage it all. It can feel like a punishment.

Cloud-based payroll is different. Growing from 10 employees to 100 doesn’t require a single infrastructure upgrade on your end. The system already knows state tax laws and can handle multi-country compliance.

This adaptability shines for businesses with hybrid teams and remote workers. Your employees could be spread across different time zones, and your payroll system handles it seamlessly. Whether you’re a startup or an established company, cloud solutions grow with you. Our HR Solutions Outsource services are designed for this kind of flexible support.

The Role of Automation in Modern Payroll

Automated tax calculations happen in real-time using the latest rates, with no manual updates needed. Direct deposits, pay stubs, and time tracking integrations all run automatically.

Think about how tax laws change constantly. What used to require manual research and data entry now happens automatically. The system manages benefits deductions without human intervention.

This automation is timely. The accounting sector is struggling with a severe talent shortage, making it hard to find qualified staff. Cloud automation handles routine work, freeing your team for strategic tasks.

Enhancing Collaboration and Transparency

Cloud payroll includes employee self-service portals so workers can access pay stubs and update information anytime, reducing questions for HR.

For your internal teams, shared dashboards and real-time data access improve collaboration between HR and finance. Both teams see the same accurate information, making reporting on workforce costs or trends simple.

This level of transparency drives better decision-making. When 60% of CEOs cited digital change as their top growth driver in 2022, they were recognizing this kind of change. Cloud-based payroll is about creating a connected, transparent workplace where information flows freely.

Navigating Security and Compliance in the Cloud

When considering outsourcing payroll cloud services, security is a top concern. You’re handing over sensitive data like Social Security numbers and banking information, so it’s natural to be cautious.

However, reputable cloud payroll providers often have better security than most businesses can manage in-house. Their entire business model depends on keeping your data safe.

Partnering with the right provider strengthens your security and simplifies compliance. That’s why we offer comprehensive Outsourced Compliance Solutions and specialized support for HR Compliance for Small Business.

Fortifying Data Security with Cloud Providers

Consider your current setup. Do you have enterprise-grade encryption or multi-factor authentication? Most small to medium businesses can’t afford the security that cloud providers offer as standard.

Professional providers invest millions in security, spreading the cost across their clients. This gives you access to military-grade security measures for a fraction of the in-house cost.

Security features typically include advanced encryption for data in transit and at rest, role-based access control to limit who sees sensitive information, and secure servers monitored around the clock.

According to IBM’s 2024 Cost of a Data Breach Report, companies using security automation and AI saved an average of $2.22 million more than those that didn’t. That’s the kind of advanced protection you get with a quality cloud provider.

Mastering Compliance with Expert Outsourcing Payroll Cloud Partners

Compliance is a complex maze of changing federal tax laws, state regulations, and local ordinances. Missing one update can lead to significant penalties.

This is where outsourcing payroll cloud services excel. They employ compliance experts who monitor tax law changes and new federal regulations, ensuring your payroll stays compliant while you run your business.

The peace of mind alone is worth it. No more worrying about filing the right forms by the right deadlines or withholding the correct tax amounts. Your provider handles accurate record-keeping automatically and ensures you’re always on the right side of the law.

When non-compliance penalties can run into thousands of dollars, having experts manage this complexity is smart business. We understand these challenges, which is why our Workplace Compliance Solutions are designed to take this burden off your shoulders.

Choosing Your Ideal Cloud Payroll Partner: A Practical Guide

Finding the right outsourcing payroll cloud partner requires choosing someone reliable and trustworthy who understands your needs. The key is to compare features and pricing carefully.

Choosing well means finding a partner that grows with you. A poor choice can lead to hidden fees, bad service, and new compliance headaches.

Let’s walk through how to make this decision with confidence. If you’re considering broader workforce solutions, our guide to Employee Outsourcing Companies offers additional insights.

Key Features to Look for in an Outsourcing Payroll Cloud Provider

Look beyond basic payroll processing. Integration capabilities are crucial. Ensure the system connects with your accounting and time-tracking software to eliminate double data entry and reduce errors.

A user-friendly interface is essential. A difficult system will frustrate your team and employees, negating time savings.

Customer support separates great providers from mediocre ones. When payroll goes wrong, it needs to be fixed immediately. Look for providers offering multiple contact methods and reasonable response times.

Reporting and analytics capabilities can provide valuable insights into your workforce costs. The ability to generate custom reports helps with budgeting and strategic planning.

Don’t overlook mobile access. A solid mobile app benefits everyone, from employees checking pay stubs to managers approving payroll on the go.

Here’s how some leading providers stack up:

| Provider | Best For | Starting Price | Key Strengths |

|---|---|---|---|

| ADP | Large businesses with complex needs | $79/month + $4 per employee | Comprehensive features, global capabilities, extensive reporting |

| Gusto | Small businesses and startups | $40/month + $6 per employee | Simple interface, great benefits administration, contractor payments |

| Paychex | Growing small to mid-sized companies | $39/month + $5 per employee | Scalable solutions, strong HR support, compliance expertise |

These prices are starting points. Your actual costs will depend on which features you need and how many employees you have.

Assessing Your Business Needs for the Perfect Fit

First, assess your own situation. Company size is a key factor, as a startup’s needs differ greatly from a large manufacturer’s.

Your industry may have special requirements, like certified payroll for construction or complex tip calculations for restaurants. Ensure any provider has experience in your sector.

Budget constraints are real, but consider the total cost of ownership, not just the monthly fee. Sometimes paying more upfront saves money long-term.

Think about your scalability needs. If you plan to grow, make sure your chosen provider can handle that growth without forcing you to switch systems.

For companies with employees in multiple states or countries, global capabilities are essential. You’ll need a provider with serious global expertise.

Our Employee Benefits Outsourcing Companies resource can help you think through additional considerations.

Mitigating Potential Challenges of Outsourcing

Acknowledge potential downsides to avoid them. The biggest concern is often loss of control. Mitigate this by choosing a provider with real-time dashboards and detailed reporting so you always know what’s happening.

Hidden fees are common. Get everything in writing and ask specifically about additional costs for features like direct deposit or tax filing.

Data migration requires careful planning. Choose a provider with a proven process and dedicated support for the transition.

Communication gaps can be problematic. Establish clear expectations for response times and know who to call when issues arise.

Pay close attention to Service Level Agreements (SLAs). These documents spell out provider promises on uptime, response times, and data security.

Frequently Asked Questions about Cloud Payroll Outsourcing

When exploring outsourcing payroll cloud services, business owners have common questions about cost, implementation, and scope. Let’s address them.

How much does outsourcing payroll to the cloud typically cost?

The cost for outsourcing payroll cloud services varies but typically follows a simple structure: a monthly base fee plus a per-employee charge.

You’ll typically see base fees ranging from $30 to $100 per month, with per-employee costs between $4 and $10. For a small business with 10 employees, you might pay a $40 base fee plus $6 per employee, for a total monthly cost of about $100.

These are starting points. Higher-tier packages may bundle HR support or time tracking. Always get a transparent, detailed quote to avoid surprise fees.

The beauty of this pricing model is its predictability. Unlike the hidden costs of in-house payroll, you’ll know exactly what you’re paying each month.

What’s the difference between a PEO and a cloud payroll provider?

This is a common question. While the terms sound similar, PEOs and cloud payroll providers serve very different needs.

A cloud payroll provider handles technical tasks like wage calculations and tax filings. Crucially, you remain the employer of record, keeping full control over HR decisions and strategy.

A PEO operates under a co-employment model, becoming the employer of record for tax purposes. They handle a broader scope of HR tasks, including benefits administration, workers’ compensation, and HR compliance.

The PEO model can provide access to better benefits packages by pooling employees from multiple companies. However, this comprehensive service comes at a higher price and means sharing control over HR functions. If you just need efficient payroll processing while maintaining full control, a cloud payroll provider is likely your best bet.

How long does it take to switch to a cloud payroll service?

Switching to a cloud payroll service is smoother than you might think. For most small to medium-sized businesses, the entire transition usually takes 2 to 4 weeks.

The timeline includes data migration (transferring historical records) and system setup (configuring cycles, deductions, and reporting).

The onboarding process involves training your team on the new platform and setting up employee self-service portals.

Finally, you’ll run your first payroll cycle with close support from your new provider to ensure everything is perfect.

Factors like payroll complexity or the volume of historical data can influence this timeline. Most reputable providers assign a dedicated implementation specialist to guide you through each step, making the transition as seamless as possible.

Conclusion: Future-Proof Your HR with Smart Outsourcing

Moving to outsourcing payroll cloud solutions is more than a tech upgrade. It’s a strategic shift that transforms HR and positions your business for long-term success by freeing up critical resources.

Cost savings of 30-40% represent real money that can be reinvested into your business. By eliminating in-house overhead and reducing compliance risks, you make a smart financial decision.

The time savings are equally compelling. With 80% less time spent on processing, your HR team can focus on strategic initiatives like building culture and developing talent.

Most importantly, outsourcing payroll cloud services provide compliance expertise and security infrastructure that most businesses can’t afford in-house. Partnering with specialists who manage changing tax laws and security threats is a smart move.

At Valley All States Employer Service, we understand how critical it is to get compliance right. Our expertise in E-Verify workforce eligibility verification complements cloud payroll solutions perfectly, creating a comprehensive approach to employment compliance that minimizes risk and administrative burden. When businesses combine expert payroll outsourcing with reliable E-Verify processing, they create a robust HR ecosystem that operates smoothly and stays compliant.

The future of HR is powered by cloud technology, automation, and expert partnerships. Companies that accept this evolution are building more agile, efficient, and resilient organizations.

Making the switch to cloud payroll outsourcing isn’t about giving up control. It’s about gaining the freedom to focus on core business activities while ensuring critical functions are handled by specialists. It’s a strategic investment in your company’s future.

Ready to streamline your HR and ensure compliance? Explore our Payroll Outsourcing Solutions.