Outsourced employee verification: 24/7 Effortless HR

The End of Manual Verification Headaches

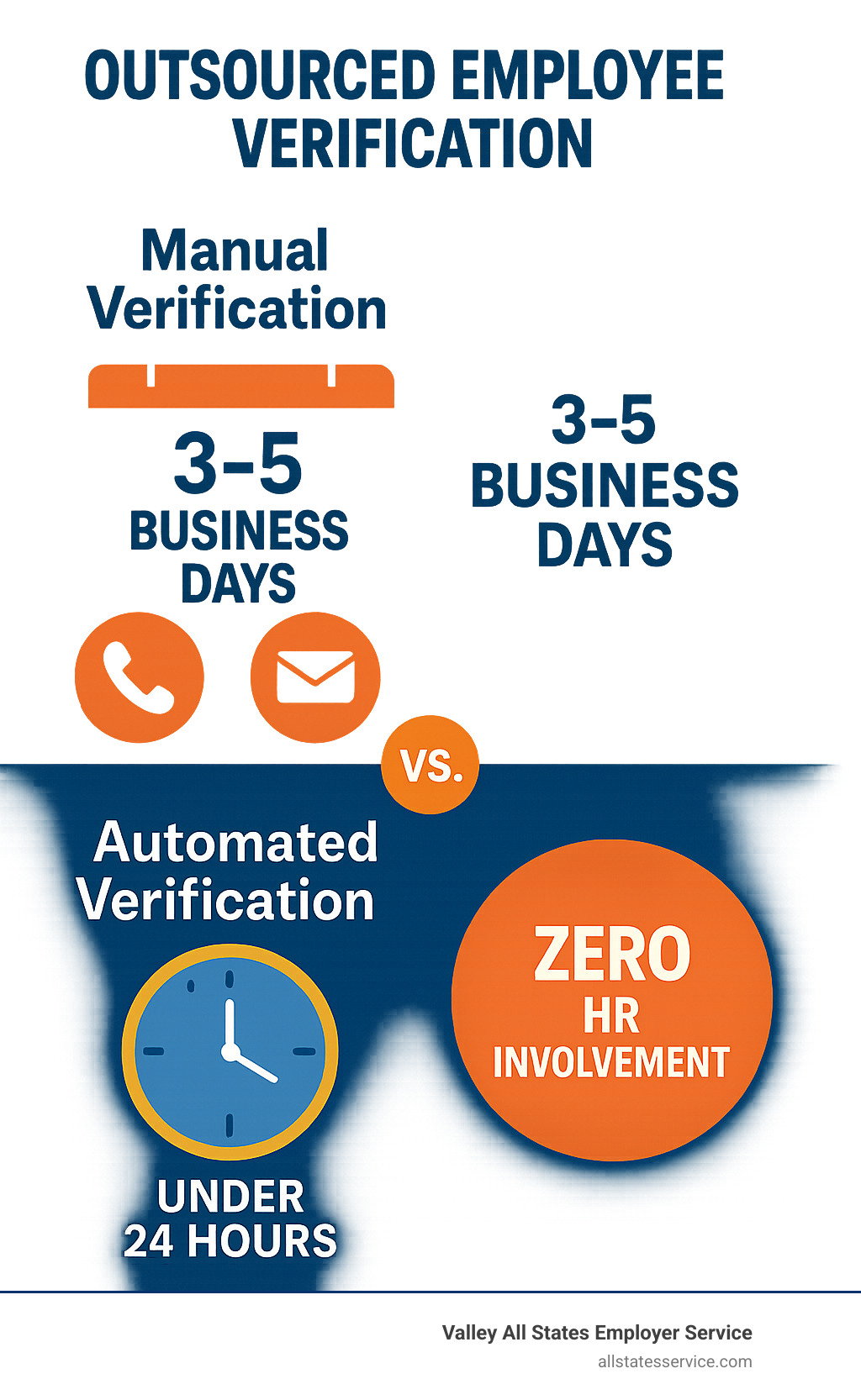

Outsourced employee verification transfers time-consuming employment and income checks to specialized third-party providers. They use automated systems and secure databases to verify employee information faster and more accurately than manual processes.

Key Benefits of Outsourcing Employee Verification:

- Time Savings: Most employees verified within 24 hours vs. days or weeks for manual processing

- Cost Reduction: Eliminates HR administrative burden and reduces compliance penalties

- Improved Security: FIPS 140-2 encryption and secure data centers protect sensitive information

- 24/7 Availability: Instant verifications available around the clock for faster hiring decisions

- Compliance Assurance: Expert handling of FCRA, CCPA, and other regulatory requirements

In 2024 alone, 149 million verification requests were processed, with 52 million people benefiting from instant verifications outside business hours.

Manual handling drains HR resources and increases the chance of errors that can trigger compliance issues or slow hiring.

Modern outsourced solutions use real-time API integrations and secure databases like The Work Number, which contains over 767 million records, to provide instant, accurate responses. This shift saves time and transforms how your HR department operates.

What Is Employee Verification and Why Outsource It?

Think of employee verification as your business’s way of confirming the facts about someone’s work life. It’s the process where you check details like where someone worked, what their job title was, how long they stayed, and sometimes how much they earned. These checks happen more often than you might think. Every time someone applies for a mortgage, rents an apartment, or even applies for a new job, there’s usually a verification request heading to their current or former employer.

Income verification takes this a step further by diving into the financial details. Lenders and social service agencies need to know not just where someone works, but exactly how much they make and how often they get paid. It’s the difference between confirming “Yes, John works here” and “Yes, John works here as a manager making $65,000 annually.”

As an employer, you have your own verification responsibilities too. When you hire someone new, you’ll need to complete I-9 Form Completion to verify their identity and confirm they’re legally allowed to work in the United States. Many employers also use E-Verify, which cross-checks your new hire’s information against government databases to make sure everything matches up.

Getting verification right isn’t just about paperwork. It’s your frontline defense against fraud and helps you make smarter hiring decisions. When you can trust that the information you’re getting is accurate, you’re building a more reliable team and protecting your business from unnecessary risks. That’s why solid verification processes are such a critical part of Employer HR Compliance.

The Challenge with In-House Verification

Here’s where things get tricky for most HR teams. Handling verification requests internally can feel like trying to drink from a fire hose. Your phone rings constantly with verification requests, your email inbox fills up with forms to complete, and suddenly your HR staff is spending hours each day digging through employee records instead of focusing on strategic work.

The manual nature of this process creates a perfect storm for mistakes. Someone misreads a date, accidentally transposes numbers in a salary figure, or forgets to include a crucial detail. These human errors aren’t just embarrassing; they can lead to serious compliance issues or cause problems for your employees who are counting on accurate information for their loan applications or new job offers.

Data security becomes a major headache when you’re handling sensitive employee information manually. Every phone call, every email, and every faxed document creates another opportunity for a data breach. Plus, if you make a mistake with someone’s personal information or don’t follow regulations like the Fair Credit Reporting Act properly, you could be looking at significant legal liability.

The biggest frustration? All this administrative work pulls your HR team away from the strategic initiatives that actually move your business forward. Instead of developing talent or improving employee engagement, they’re stuck playing phone tag with mortgage brokers.

The Outsourcing Solution

Outsourced employee verification changes this entire equation by putting specialists in charge of what they do best. When you partner with a third-party verification provider, you’re essentially handing off this entire headache to people who have built their business around doing it efficiently and correctly.

These providers operate on secure platforms designed specifically for handling sensitive employment data. They know the regulations inside and out, they have the technology to automate most of the process, and they can respond to verification requests much faster than your internal team ever could.

The beauty of this approach is that it transforms verification from a manual, error-prone process into a streamlined, automated system. Your liability drops significantly because you’re working with compliance experts who stay current on all the latest regulations and best practices. For specialized needs like E-Verify processing, E-Verify Outsourcing ensures that eligibility checks are handled impartially and accurately, giving you peace of mind and freeing up your team to focus on what they do best.

The Core Benefits of Outsourced Employee Verification

When you make the switch to outsourced employee verification, you are not just handing off a tedious task. You are opening a new level of efficiency that changes how your HR team works.

Save Time and Boost HR Productivity

With automated responses, requests are handled instantly, day or night. Most employees are verified within 24 hours, not days or weeks. Verifiers can get what they need at any hour, which speeds up hiring and reduces back-and-forth. Your team can focus on building great teams, not chasing paperwork. Pair this with Payroll Outsourcing Solutions for an even smoother HR operation.

Improve Data Security and Ensure Compliance

Privacy rules are complex. Providers invest in secure data centers, FIPS 140-2 Encryption, and SOC 2 certification so your data stays protected. They live and breathe the FCRA and CCPA, which reduces your risk and workload. Many solutions cut data exposure dramatically compared to manual emails and calls. With Compliance Outsourcing Solutions, you get continuous monitoring and fewer headaches.

The Financial ROI of Outsourced Employee Verification

Shifting verifications off your HR desk lowers labor costs and frees time for strategic work. Avoiding compliance mistakes saves even more. Some providers offer no-cost models where the verifier pays the fee, aligning well with teams focused on cost control and Affordable Payroll Services.

Improve Accuracy and Prevent Fraud

Direct integrations pull from current payroll data, which boosts accuracy and reduces manual errors. Credentialed verifiers must have a valid reason to access data, helping prevent misrepresentation. Adopting Fast Workforce Screening builds trust and protects employees and your business.

How the Verification Process Works: A Look Behind the Curtain

Ever wonder what happens after you decide to outsource your employee verification? The process is surprisingly straightforward, and understanding how it works can help you appreciate just how much time and stress it saves your HR team. Let’s peek behind the curtain and see how outsourced employee verification transforms from setup to successful completion.

Employer Setup and Integration

The journey begins with choosing the right verification provider for your business needs. Think of this as picking a trusted partner who will handle one of your most sensitive HR functions. Once you’ve made your choice, the real magic starts with connecting your existing systems to theirs.

The integration process typically happens in one of two ways, and trust us, one is definitely better than the other. Modern providers use real-time API integrations that create a secure bridge between your HRIS or payroll system and their verification platform. This means your employee data flows seamlessly and stays current with every payroll cycle. Companies like Vault Verify champion this approach because it delivers timely, accurate reports without the security headaches.

The alternative, traditional file feeds, is becoming as outdated as fax machines. These older systems require periodic data uploads (weekly or bi-weekly), which can leave your information stale and create unnecessary security risks. Smart providers are moving away from file feeds entirely, keeping your employee data protected around the clock.

Once your systems are talking to each other, your employment and income data becomes part of a secure, massive database. Take The Work Number by Equifax, for example. It houses over 767 million records and gets updated continuously by millions of contributing employers. This creates the foundation for lightning-fast verifications that would have taken your HR team hours to complete manually. If you’re using a Web Based Payroll Service, the integration often happens smoothly, making your setup even simpler.

The Verifier and Employee Journey

Here’s where the beauty of automation really shines. When someone needs to verify your employee’s information, whether it’s a bank processing a mortgage application or a landlord checking rental qualifications, they simply log into the provider’s secure portal. No more phone calls interrupting your HR team’s day.

The process starts with the verifier’s request, but it doesn’t go anywhere without proper authorization. Thanks to regulations like the FCRA, verifiers must have a legitimate reason for requesting the information, and your employee needs to give their consent. This usually happens through a secure online portal or signed consent form, ensuring everyone’s privacy stays protected.

Once consent is confirmed, the automated verification system springs into action. The provider’s database instantly retrieves the requested information and delivers it to the verifier. To put this in perspective, The Work Number alone processed 149 million verification requests in 2024, with 52 million people getting instant verifications outside regular business hours. That’s a lot of HR teams who didn’t have to drop what they were doing to handle verification calls.

Many leading providers also offer an employee portal that gives your team members control over their own information. Employees can view their employment and income data, see who has requested their information, and even generate their own verification reports when needed. This transparency builds trust and reduces the number of questions that might otherwise land on your HR desk.

The entire process transforms what used to be a manual, error-prone task into something that happens automatically in the background. Your employees get verified quickly, verifiers get accurate information, and your HR team stays focused on strategic work instead of administrative tasks. Ready to see how this could work for your organization? Explore our Employment and Income Verification Services to learn more about streamlining your verification process.

How to Choose the Right Verification Partner

Finding the right outsourced employee verification partner is a high-impact decision. You want reliability, strong security, and an easy fit with your systems. If you operate globally, some providers excel at international verification and can handle complex requirements across countries. Your choice should align with your goals and integrate well with current tools, and working with Pre-Employment Background Check Companies can help round out screening.

Key Features to Compare in a Provider

- Technology stack: Real-time APIs and AI keep data fresh and fast. Modern API integrations, like Vault Verify’s approach, update with each payroll cycle, while legacy file feeds can leave data stale.

- Security: Look for FIPS 140-2 encryption, SOC 2 Type 2, and secure data centers. These standards protect sensitive employee information.

- Compliance expertise: Your partner should know FCRA, CCPA, and state rules cold, reducing your legal risk.

- Integration options: Smooth HRIS or payroll integration means fewer manual steps and fewer errors.

- Customer support: Responsive, knowledgeable help is essential.

- Range of services: Some offer employment and income verification, I-9 support, and unemployment claims. At Valley All States, our E-Verify Employer Agent service ensures seamless federal E-Verify compliance.

Each major provider brings strengths. Some prioritize speed, others focus on accuracy or large databases for 24/7 availability. No-cost employer models and reduced data exposure are valuable differentiators.

Key Considerations for Outsourced Employee Verification

- Scalability: Can they grow from 50 to 500 employees with no disruption?

- Employee experience: Is the employee portal simple and transparent?

- Data ownership and access: Can you export data easily if you switch?

- Implementation: What is the setup timeline and level of support?

- Cost structure: Understand per-verification pricing, subscriptions, or no-cost employer options.

Choose a partner that fits your tech, supports your growth, and truly reduces HR workload.

Frequently Asked Questions about Outsourcing Verification

When businesses consider outsourced employee verification, a few common questions come up. Here is what you need to know.

Is outsourcing employee verification secure?

Yes. Reputable providers invest in FIPS 140-2 encryption, SOC 2 Type 2 certification, and tightly controlled data centers. They credential verifiers and require a permissible purpose under laws like the FCRA and CCPA, which is often safer than emails, phone calls, and faxes handled in-house.

What is the difference between E-Verify and employment verification?

E-Verify confirms that a new hire is legally authorized to work in the United States and is tied to the I-9 process. Learn more about E-Verify and I-9. Employment verification confirms job history, dates, titles, and sometimes income for needs like loans, rentals, or new jobs. Two different purposes, two different processes.

Do employees need to give consent for their data to be shared?

Yes. Under the Fair Credit Reporting Act (FCRA), verifiers need a permissible purpose and employees must provide consent. Top providers use secure portals where employees can review and approve requests, see who accessed their data, and stay informed throughout the process.

Take the Next Step Towards Effortless Compliance

Outsourced employee verification turns manual, error-prone work into a secure, automated workflow. You save HR time, reduce costs, strengthen compliance, and speed up decisions.

At Valley All States Employer Service, we specialize in expert, impartial, and efficient E-Verify and verification solutions. We minimize errors and administrative burden so your team can focus on people and growth.

Ready to simplify compliance and free up your HR team? Explore our Employment and Income Verification Services and see how we can help turn verification into a seamless advantage.