ICE I-9 Audit: Your Ultimate 2025 Guide

Why I-9 Compliance Is More Critical Than Ever

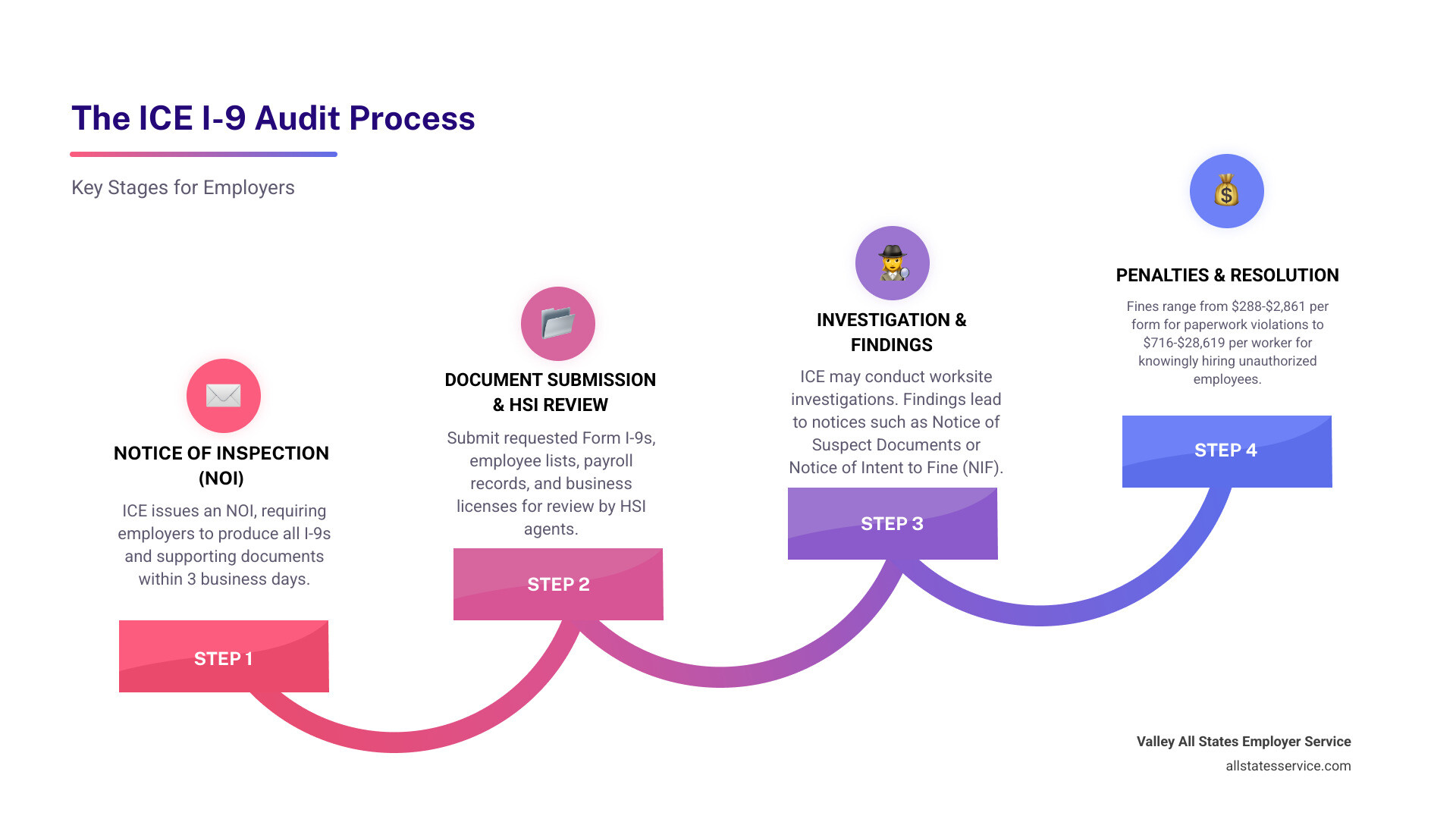

An ice i 9 audit is an inspection by Immigration and Customs Enforcement (ICE) of your business’s Form I-9 records. Audits usually start with a Notice of Inspection (NOI), giving you just three business days to produce all requested I-9s and supporting documents.

Quick Facts About ICE I-9 Audits:

- Triggers: Anonymous tips, industry targeting, random selection, or interagency referrals

- Timeline: 3 business days to respond to Notice of Inspection

- Documents Required: Form I-9s, employee lists, payroll records, business licenses

- Penalties: $288-$2,861 per form for paperwork violations; $716-$28,619 per worker for knowingly hiring unauthorized employees

- Audit Process: Document review, potential worksite investigation, various notices issued based on findings

Government investigations into I-9 compliance have nearly quadrupled recently. What was once rare is now a routine enforcement action that can devastate unprepared businesses.

Under the Immigration Reform and Control Act (IRCA), every U.S. employer must verify the identity and employment authorization of each employee using Form I-9. This isn’t just paperwork, it’s the law. And ICE is watching.

The stakes couldn’t be higher. Civil fines can reach thousands of dollars per offense, while criminal violations for knowingly hiring undocumented workers can result in heavy fines or even loss of business licenses.

The reality is that most I-9 violations are preventable. They often stem from simple administrative oversights like missing signatures, incorrect dates, or accepting invalid documents, all of which can cost your business dearly.

What to Expect During an ICE I-9 Audit

When an envelope arrives from Immigration and Customs Enforcement, your heart might skip a beat. But knowing what to expect during an ice i 9 audit can help you respond with confidence instead of panic.

The process usually starts with a Notice of Inspection (NOI). This official document gives you just three business days to produce all requested Form I-9s and supporting documentation. The timeline is strict, and the stakes are high.

Homeland Security Investigations (HSI) agents conduct the inspection. They are trained investigators ensuring your business complies with employment eligibility laws under the Immigration Reform and Control Act.

Most inspections start with an NOI, giving you a brief window to prepare. However, worksite investigations can sometimes involve unannounced visits or raids, particularly when ICE suspects serious violations. The official Form I-9 Inspection Process outlines how these inspections work.

What Triggers an ICE I-9 Audit?

You’re probably wondering why your business ended up in ICE’s crosshairs. While random selection happens, most ice i 9 audits have specific triggers.

Anonymous tips are a top trigger, often from disgruntled former or current employees, or even competitors. Unfortunately, workplace disputes can escalate into federal investigations.

Industry targeting is another major factor. If your business is in construction, hospitality, agriculture, or manufacturing, you’re already on ICE’s radar. These industries are prime targets for systematic enforcement.

Interagency referrals also trigger audits. Information from the Department of Labor or Social Security Administration can turn a routine compliance issue into an immigration investigation.

Sometimes your compliance history works against you. If your business was audited before, especially with violations, you might be scheduled for follow-up inspections.

The Audit Process from Start to Finish

Let’s walk through what happens once that NOI lands on your desk. Understanding each step helps you manage the process more effectively.

Receiving the NOI starts the non-negotiable three-business-day clock. Immediate action is essential as extensions are rarely granted.

Gathering documents is the top priority. Organized records are crucial. You’ll need every requested Form I-9 and any other specified documents. Designating one person to handle this prevents confusion.

Submitting I-9s occurs on the specified date. HSI agents collect and review your documents for technical and substantive errors, examining everything from missing signatures to improper document acceptance.

The ICE review period can last weeks or months, depending on the number of forms and ICE’s workload. They may request additional information during this time.

Potential worksite raids represent the most serious escalation. While not part of every audit, if ICE finds evidence of unauthorized workers, they may conduct unannounced workplace visits to interview employees.

The importance of legal counsel cannot be overstated. From the moment you receive an NOI, an experienced immigration attorney can protect your interests and help you steer the complex legal landscape.

What Documents Will ICE Request?

When ICE initiates an ice i 9 audit, they want a comprehensive picture of your employment practices. The document requests go beyond just your I-9 forms.

Form I-9s are the primary target, including every form for current and former employees whose retention period hasn’t expired.

Employee lists provide the roadmap ICE uses to cross-reference your workforce. They want complete rosters showing current and former employees, with hire dates and termination dates.

Payroll records help verify the employment information on your I-9s, confirming who worked for your company and when.

Business licenses and Articles of Incorporation establish your company’s legal status and operating authority.

If your company keeps copies of employee documents like driver’s licenses or Social Security cards, ICE may request these as well. While not required, if you keep them, they become part of the audit.

Common I-9 Mistakes and How to Fix Them

Form I-9 can feel like a minefield. Even careful employers make mistakes, as the rules are complex. What seems like a tiny oversight can become a costly violation during an ice i 9 audit.

The good news is that most I-9 errors fall into predictable categories, and once you know what to watch for, you can avoid them.

ICE classifies violations into two buckets: technical or procedural failures and substantive violations. Technical violations are fixable paperwork errors like missing signatures, late completion of sections, incorrect dates, or using an outdated form.

Substantive violations are more serious. They include failing to prepare a Form I-9, not producing forms for an audit, knowingly hiring unauthorized workers, or accepting invalid documents.

Most of these mistakes happen due to a lack of training or a consistent system. The devil is in the details with I-9s. For comprehensive guidance, check out our resource on I-9 Form Completion.

Correcting Errors on Form I-9

Found an error? Don’t panic. Many I-9 mistakes are correctable if you follow the rules carefully, as improper corrections can create more problems.

USCIS has specific guidelines for fixing errors. Employee errors in Section 1 can only be corrected by the employee. They must draw a single line through the incorrect information, write the correct details, and initial and date the change. If the employee no longer works for you, you may need to attach a memo explaining why the correction wasn’t made.

Employer errors in Section 2 or 3 follow a similar process, but you handle the corrections. Draw a single line through the wrong information, enter the correct details, and initial and date your changes. The original information must remain readable.

If errors are numerous, it may be better to complete a new Form I-9. Staple it to the original and attach a signed, dated explanation for the new form.

The golden rule is to never backdate anything. Always use the current date when making corrections. This shows honesty about when you found and fixed the problem. The USCIS guidance on correcting forms provides detailed instructions worth bookmarking.

Handling Missing or Incomplete I-9s

Finding a missing or incomplete I-9 is a serious substantive violation that ICE will note during an ice i 9 audit. However, you can take steps to minimize the damage.

If you find an active employee without a complete Form I-9, act immediately. Have the employee fill out Section 1 of a current form, then complete Section 2 yourself. Use the employee’s original hire date in the “first day of employment” field.

The most important step is attaching an explanatory memo. Write a clear, signed, and dated explanation that you found the missing form and took immediate action to fix it. This memo demonstrates good faith, which can reduce potential penalties.

You cannot backdate the signatures on the new form. The signatures should reflect when you actually completed the paperwork.

Taking swift corrective action shows ICE you’re committed to compliance, even if you had past oversights. It can save you thousands of dollars in fines.

The Aftermath: Understanding Notices, Fines, and Penalties

After the ice i 9 audit, you wait for the results. You’ve submitted documents and answered questions, and now an envelope from ICE will determine your fate.

It’s like waiting for test results; you might get a clean bill of health or a notice to open your checkbook.

The Notice of Inspection Results is the best outcome. This compliance letter means ICE found no violations or only minor, corrected technical errors.

A Notice of Suspect Documents means ICE believes certain employee documents appear fraudulent. You’ll typically have 10 days to address this, which often involves difficult conversations with affected employees.

The Notice of Technical or Procedural Failures identifies correctable errors. You usually get 10 business days to fix these issues. If you don’t, they become substantive violations with financial consequences.

A Warning Notice means ICE found problems but is giving you a pass, usually due to limited violations or your good faith efforts. It’s a “don’t let it happen again” message.

The Notice of Intent to Fine (NIF) is the most serious. It means ICE found substantive violations, uncorrected technical failures, or evidence of knowingly hiring unauthorized workers. The NIF details the violations and the proposed fine.

Civil penalties are monetary fines, while criminal penalties can involve imprisonment for egregious violations. For more information, check our guide on I-9 Compliance Penalties.

How ICE Calculates Fines

Seeing the numbers on a Notice of Intent to Fine is tough. Understanding how ICE calculates them can help make sense of the penalty.

ICE follows a structured approach with two main violation categories, each with penalty ranges adjusted annually for inflation.

Paperwork violations cover substantive errors and uncorrected technical failures. As of 2025, these fines range from $288 to $2,861 per form. The amount depends on the number and seriousness of the errors.

Knowingly hiring violations carry fines from $716 to over $28,619 per worker as of 2025. These apply when ICE determines you knew workers weren’t authorized to work in the U.S. Criminal charges are possible at this level.

ICE also uses an “Improvement Matrix” that considers five factors to adjust your final penalty up or down.

Your business size matters, as does demonstrating good faith through proactive self-audits. The seriousness of violations is also considered.

ICE also looks at whether unauthorized workers were employed and examines your history of previous violations. First-time offenders often receive more lenient treatment.

These penalties are adjusted annually for inflation. You can check the Federal Register for the most current fine amounts.

Beyond Fines: Other Consequences of Non-Compliance

The financial fines from an ice i 9 audit are often just the beginning. The hidden costs can hurt even more.

Debarment from government contracts can be a business killer if you rely on federal work. Serious I-9 violations can make you ineligible for future contracts.

Business disruption is significant. Management time is consumed, employee morale suffers, and productivity takes a hit. Some businesses never fully recover.

Loss of workforce is a reality when unauthorized workers must be terminated. This can cause staffing shortages that impact your ability to serve customers.

Negative publicity can be devastating. News of ICE audits, especially those with arrests or large fines, spreads quickly and can damage your reputation.

Beyond these, employers can face penalties for document fraud or for harboring individuals who have failed to depart after receiving final removal orders. Proactive compliance is about protecting everything you’ve worked to build.

Building Your Fortress: Proactive I-9 Compliance

Think of compliance as a fortress. The best defense against a costly ice i 9 audit is a bulletproof system that protects you before ICE arrives.

Proactive businesses rarely face devastating penalties. They conduct regular self-audits, maintain clear record retention practices, and use tools like E-Verify to strengthen their process. We provide More info on I-9 Record Keeping to help keep your records in order.

The companies hit hardest are usually those who treat I-9s as an afterthought, forgetting about them until ICE shows up with a Notice of Inspection.

How to Conduct an Internal I-9 Self-Audit

An internal I-9 self-audit is your secret weapon against an ice i 9 audit. It’s a practice run to protect your business’s financial health and reputation.

Self-audits let you fix mistakes before they become costly violations. USCIS encourages this proactive approach and provides guidelines for effective internal audits.

Establishing a routine is crucial. Whether you audit quarterly or annually depends on your hiring volume, but consistency is key.

Using a comprehensive checklist ensures you don’t miss common mistakes. Your checklist should cover every field and requirement of Form I-9.

When you review every form, examine those for current and recently terminated employees. Look for completeness, accuracy, and valid documentation.

Documenting corrections properly is essential. Correct errors according to USCIS guidelines and attach signed, dated memos explaining the changes. This demonstrates good faith.

Training your team regularly keeps everyone current on regulations. Anyone involved in the I-9 process needs proper training.

Your internal audit should follow neutral, non-discriminatory criteria. The Guidance for Employers Conducting Internal Audits from ICE provides detailed direction for this process.

The Role of E-Verify in an ICE I-9 Audit

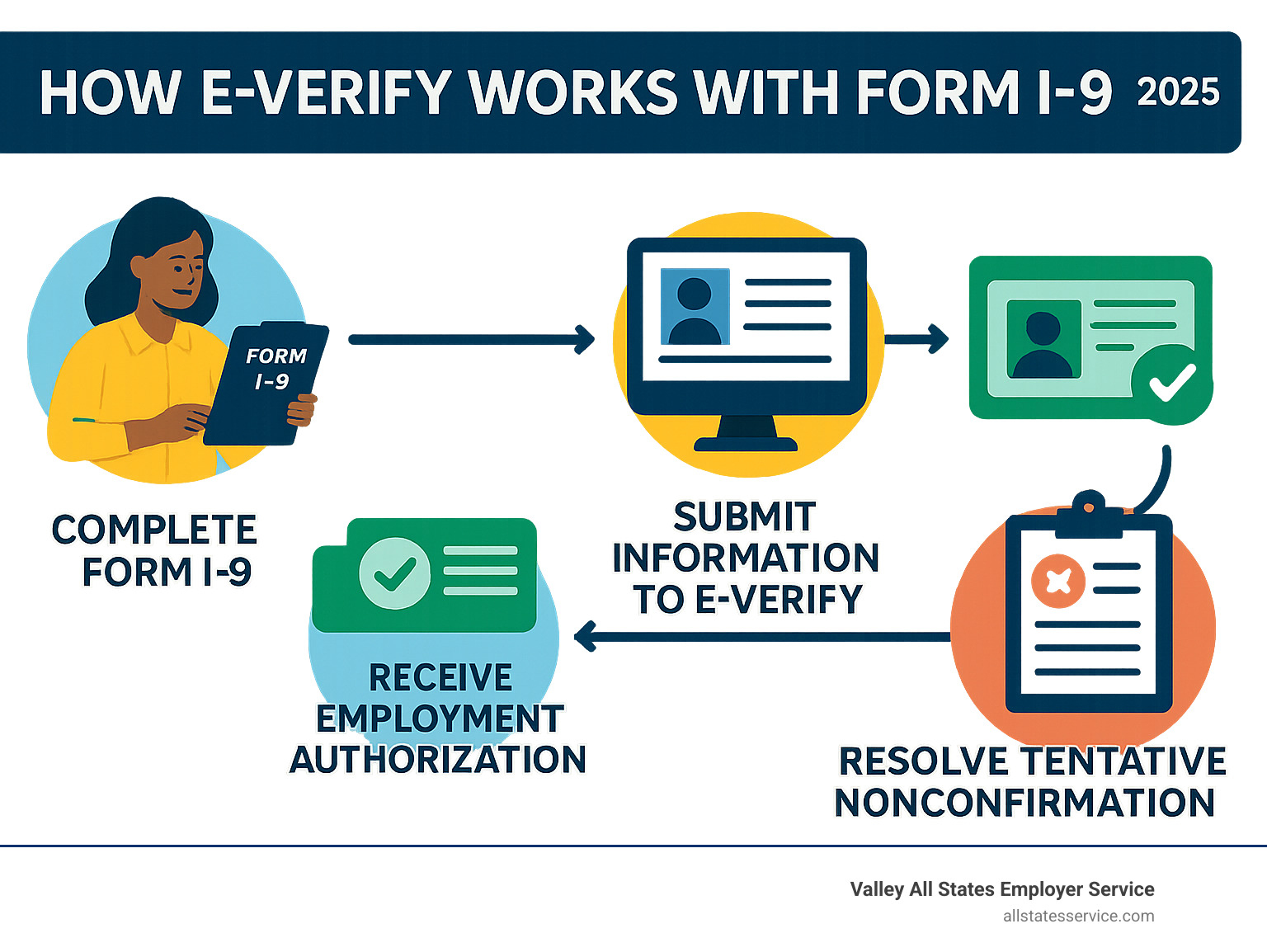

While not always mandatory, E-Verify is a powerful compliance tool. This internet-based system from DHS and the SSA lets you electronically confirm employment eligibility for new hires.

Here’s why E-Verify matters during an ice i 9 audit: participation demonstrates good faith effort. Voluntary E-Verify use shows you’re serious about hiring only work-authorized individuals.

E-Verify helps reduce errors by catching eligibility mismatches early, preventing larger problems that might surface during an inspection.

State requirements are expanding, with some states mandating E-Verify for all employers or those with government contracts.

The photo matching feature for certain documents adds an extra security layer, helping verify that the person presenting the document is the authorized holder.

While E-Verify doesn’t replace proper Form I-9 completion, it strengthens your verification process. To learn more, explore our E-Verify and I-9 services.

I-9 Retention and Storage Best Practices

Correctly completing Form I-9 is half the battle. Proper storage and retention are equally important. Poor practices can lead to penalties in an ice i 9 audit, even if the forms were perfect.

The 3-year/1-year rule governs retention. You must keep each Form I-9 for three years after the hire date, or one year after employment ends, whichever is later.

Secure storage protects sensitive employee information. Access should be strictly limited to authorized personnel.

Electronic storage is acceptable if your system meets DHS standards for integrity, accuracy, and accessibility, and can produce legible paper copies for an audit.

Separating I-9s from personnel files is a best practice that maintains confidentiality and makes audit responses more efficient.

Purging old forms once the retention period expires reduces your exposure to penalties. Create a systematic process for identifying and properly disposing of these forms.

Conclusion: Turn I-9 Anxiety into Action

The thought of an ice i 9 audit is stressful. The fines are steep, the disruptions are real, and the consequences go beyond your bank account. But that anxiety doesn’t have to be permanent.

The secret is simple: don’t wait for ICE to find your mistakes before you do.

Most stories of massive fines and disruptions have one thing in common: the employer was caught off guard. They were reactive, not proactive.

Self-auditing is your best defense. Regularly reviewing your Forms I-9 builds a shield around your business, letting you catch errors before they become costly violations.

Consistency is crucial. Every new hire’s I-9 needs careful attention, every form needs a thorough review, and every correction needs proper documentation. There’s no room for shortcuts.

The employers who sleep well at night are the ones who’ve made I-9 compliance part of their regular business routine. They’ve turned anxiety into action.

At Valley All States Employer Service, we see the relief on our clients’ faces when they know their I-9 house is in order. We specialize in outsourced E-Verify workforce eligibility verification that takes the guesswork out of compliance. Our expert, impartial, and efficient processing minimizes errors and lifts that administrative burden off your shoulders.

You don’t have to steer this alone, and you definitely don’t have to wait until it’s too late. Your business deserves the peace of mind that comes with knowing you’re protected.

Ready to turn your I-9 anxiety into confident action? Learn more about E-Verify and I-9 Compliance and find how we can help you build that fortress around your business today.