Why Your I-9 Process Matters

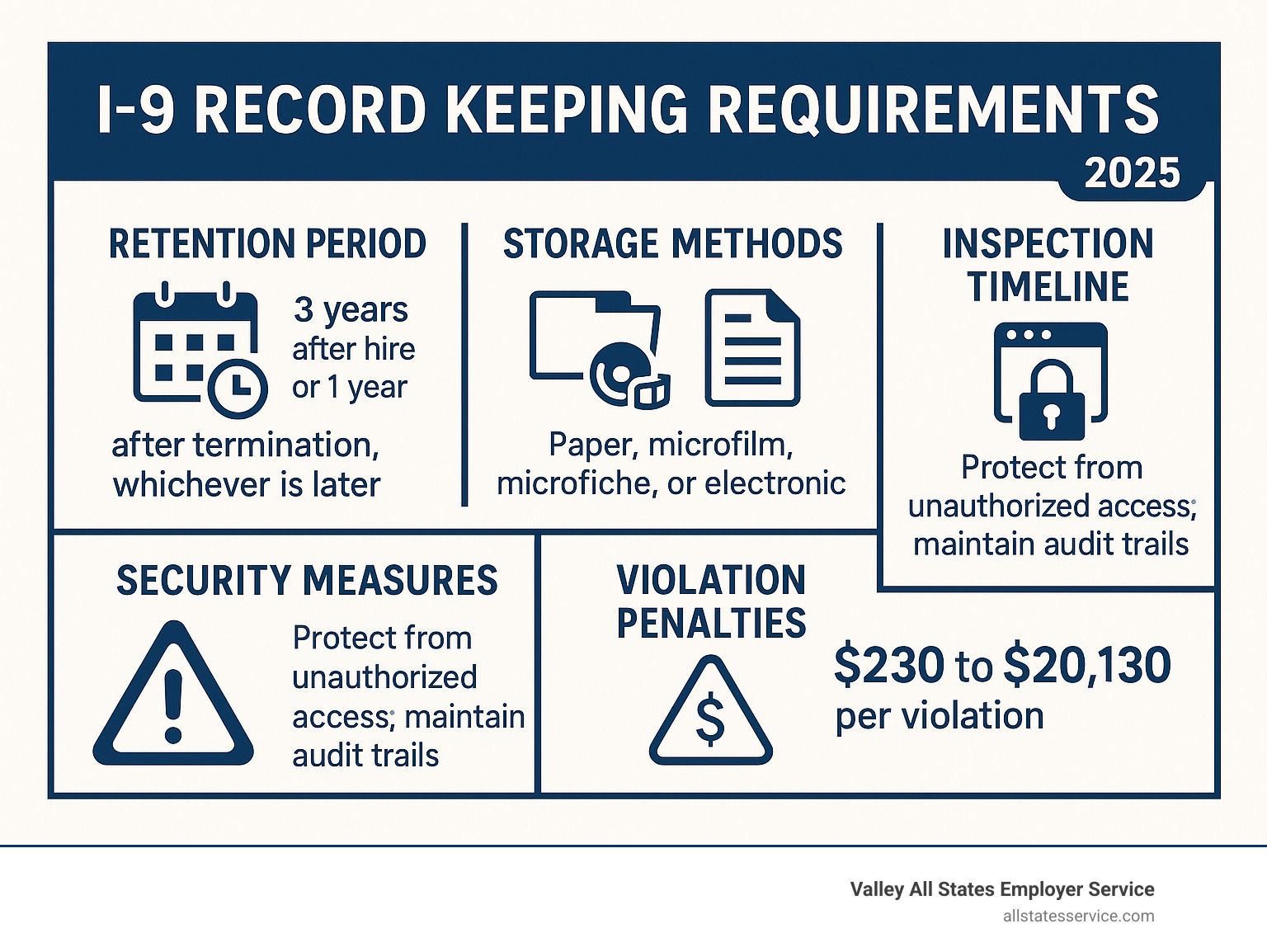

I-9 record keeping is the foundation of employment compliance that every HR manager must master. With penalties ranging from $230 to $20,130 per violation, proper Form I-9 retention isn’t just good practice – it’s essential protection for your business.

Quick I-9 Record Keeping Essentials:

- Retention Period: Keep forms for 3 years after hire date OR 1 year after termination (whichever is later)

- Storage Options: Paper, microfilm, microfiche, or electronic systems

- Inspection Ready: Must produce forms within 3 business days of government request

- What to Keep: Only completed pages with employee/employer data (discard instructions and blank supplements)

- Security Required: Protect from unauthorized access and maintain audit trails for electronic systems

Since 1986, federal law has required all U.S. employers to verify the identity and employment authorization of every new hire using Form I-9. Yet many HR professionals find themselves overwhelmed by the complex retention requirements and storage regulations that come with this critical compliance task.

The stakes are higher than ever. Immigration and Customs Enforcement has increased workplace audits, and the Department of Homeland Security can request your I-9 forms with just three days’ notice. A single missing form or retention error can trigger costly penalties and unwanted government scrutiny.

Whether you’re managing a growing team or streamlining existing processes, understanding the fundamentals of I-9 record keeping will help you avoid compliance pitfalls and keep your organization protected.

The Basics of I-9 Record Keeping

At its heart, Form I-9 serves a crucial purpose: verifying the identity and employment authorization of individuals hired in the United States. This requirement stems directly from the Immigration and Nationality Act (INA), making it a non-negotiable employer obligation. Congress has required all employers to verify the identity and employment authorization of all new workers since 1986.

Every new employee, regardless of their citizenship status, must complete a Form I-9. This includes U.S. citizens, permanent residents, and foreign nationals authorized to work in the U.S. It’s a fundamental step in ensuring a lawful workforce and upholding federal law. Understanding your obligations for new hire eligibility is the first step towards robust I-9 record keeping.

The Core Rule of I-9 Retention: How Long to Keep Forms

Here’s the question that keeps HR managers up at night: “How long do I actually need to keep these I-9 record keeping forms?” The answer isn’t as straightforward as you might hope, but it’s manageable once you understand what we call the 3-Year/1-Year Rule.

You must retain each completed Form I-9 for three years after the date of hire OR one year after the date employment ends, whichever is later. Think of it as a safety net with two different measuring sticks. This rule applies to every employee hired after November 6, 1986, regardless of whether they’re still with your company.

The tricky part? You can’t just set a timer and forget about it. Each employee’s retention period is unique because it depends on both their hire date and termination date. This careful calculation is especially crucial for HR compliance for small business operations where every detail matters.

Calculating Retention for Former Employees

Let’s make sense of this retention puzzle with some real examples. The calculation hinges on one key factor: how long your employee actually worked for you.

For short-term employees who worked less than two years, you’ll keep their Form I-9 for three years from their hire date. Here’s why: if someone was hired on March 1, 2023, and left on February 15, 2024 (just under a year), you’d keep their form until March 1, 2026. The three-year rule from hire date wins because it’s longer than one year from termination.

For long-term employees who worked two years or more, you’ll keep their Form I-9 for one year after they leave. Imagine an employee hired on January 15, 2020, who worked until March 1, 2024 (over four years). You’d keep their form until March 1, 2025. In this case, one year from termination extends beyond three years from hire.

The moment someone’s employment ends, calculate their specific retention deadline and mark your calendar. The official USCIS guidance on retaining Form I-9 provides additional details if you need to dive deeper into complex situations.

What Parts of the Form to Keep

Not every piece of paper in your I-9 process needs permanent storage. Smart I-9 record keeping means knowing exactly what to retain and what you can safely discard.

You only need the pages that contain actual employee and employer information. This includes Section 1 (completed by your employee), Section 2 (completed by you or your authorized representative), and Section 3 if you needed to reverify or rehire someone.

What can you toss? The instruction pages, the Lists of Acceptable Documents, and any blank supplement pages. These are just reference materials, not part of your employee’s specific verification record.

Now here’s where it gets interesting. If you make copies of the documents your employees show you during verification, those copies must stay with the I-9 or in the employee’s file. But remember, copying employee documents has compliance implications. If you copy documents for some employees, you must do it for everyone to avoid discrimination issues. The copies never replace the completed Form I-9 itself, they’re just additional documentation that travels together.

Mastering I-9 Record Keeping: Storage Methods and Requirements

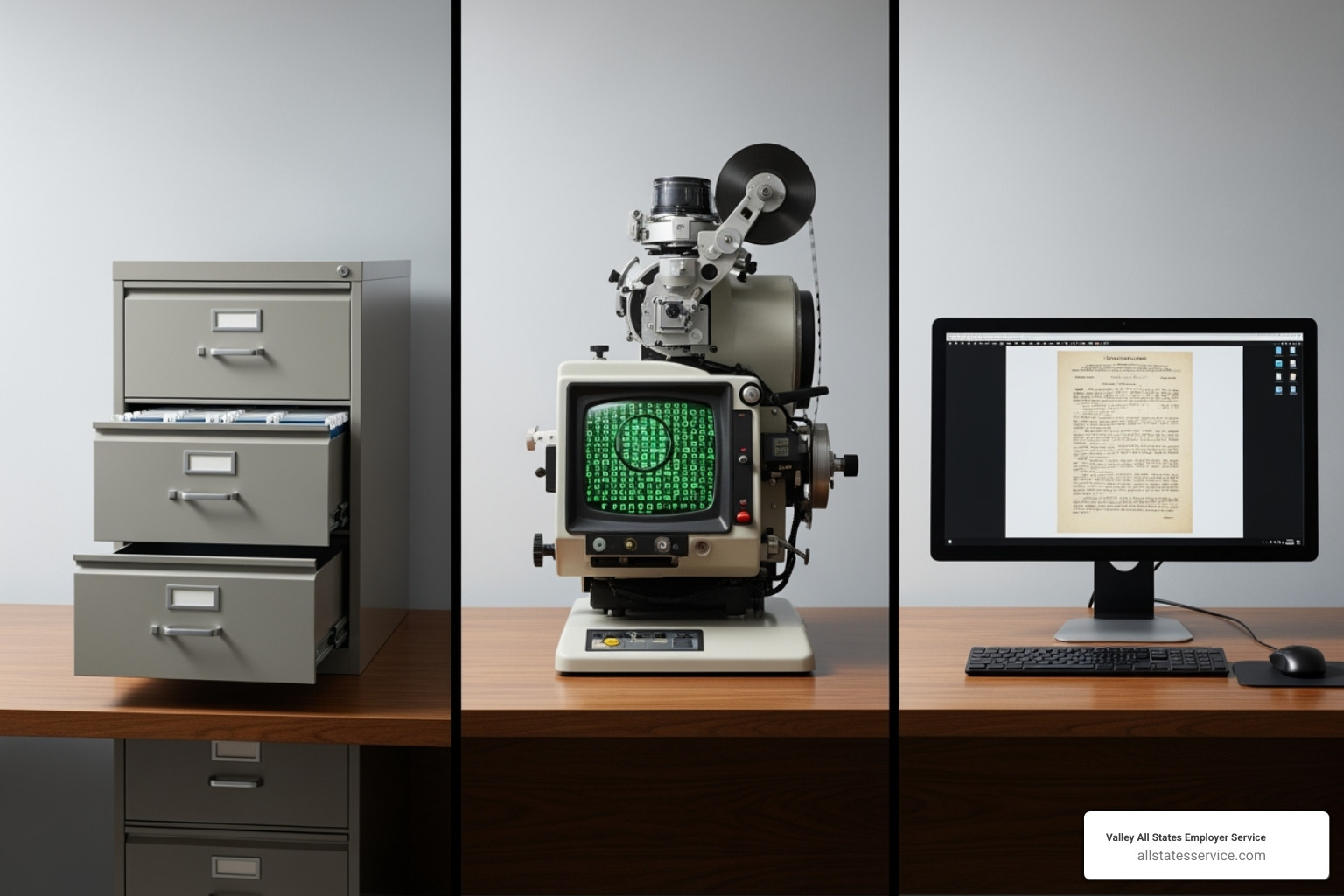

Once you understand how long to keep Form I-9, the next crucial step is figuring out where and how to store them. Think of it like choosing the right filing system for your most important business documents. You have several acceptable options: paper forms in filing cabinets, microfilm or microfiche, or electronic storage systems. The golden rule? Whatever method you choose, those forms must be ready for inspection at a moment’s notice.

Here’s what makes I-9 record keeping particularly challenging: government officials can knock on your door and request to see all your Forms I-9 with just three business days’ notice. These inspectors might come from the Department of Homeland Security, the Immigrant and Employee Rights Section at the Department of Justice, or the U.S. Department of Labor. That tight timeline means your storage system needs to be organized, accessible, and foolproof. It’s a critical part of your overall employer HR compliance strategy.

Storing Paper Forms

Many businesses still prefer the tried-and-true method of keeping paper Forms I-9 in physical files. There’s something reassuring about being able to walk over to a filing cabinet and pull out exactly what you need. You can store these forms on-site at your main business location or at a secure off-site storage facility. The key is making sure you can get your hands on them quickly when needed.

Security should be your top priority when storing paper forms. These documents contain sensitive employee information, so keeping them in a locked cabinet or secure room isn’t just smart, it’s essential. Here’s a pro tip that will save you headaches during an inspection: store your Form I-9s separately from your regular personnel files.

Why keep them separate? When government officials come calling, they only want to see the I-9 forms, not employee performance reviews or vacation requests. Having them in their own dedicated filing system makes retrieval lightning-fast and protects your employees’ other personal information from unnecessary exposure. For detailed guidance on this approach, check out how to retain and file I-9 forms.

Using Microfilm or Microfiche

While it might sound like something from a library archive, microfilm and microfiche are still perfectly acceptable methods for I-9 record keeping. If you choose this somewhat old-school approach, you’ll need to pay extra attention to quality and organization.

The images must be crystal clear and completely legible. Think about it: there’s nothing worse than trying to read a blurry document during a high-pressure inspection. You’ll need high-quality film stock and professional imaging equipment to ensure every detail comes through perfectly. An organized indexing system is absolutely critical because you need to locate specific forms immediately, not spend hours searching through reels of film.

During an inspection, you must provide a properly maintained reader-printer so officials can view and print copies of the forms. Regular quality control checks will help you catch any issues before they become compliance problems.

Storing Forms Electronically

Electronic storage has revolutionized I-9 record keeping for many businesses, and it’s easy to see why. No more bulky filing cabinets taking up office space, no more digging through stacks of paper, and no more worrying about documents getting lost or damaged. You can scan existing paper forms or go completely digital from day one.

But electronic storage isn’t as simple as taking a photo with your phone and calling it done. Your electronic system needs to meet specific requirements to ensure the integrity, accuracy, and reliability of your records. The system must prevent unauthorized changes or deletions, maintain a clear audit trail of any modifications, and include quality assurance measures.

Most importantly, your electronic system must be able to produce clear, legible displays or printouts for inspection. Many businesses find that an automated eligibility verification system can streamline this entire process, making compliance easier and more reliable.

Diving Deep into Electronic I-9 Systems

The digital age has transformed how we handle I-9 record keeping, and the possibilities are more flexible than many employers realize. You can actually create your own custom electronic Form I-9, which might surprise you. The catch? It must follow USCIS standards to the letter. This means keeping the exact content, sequence, and instructions intact without adding your own creative touches or extra fields.

Think of it like following a recipe for compliance. You can use your own mixing bowl (the electronic system), but you can’t change the ingredients or the steps. The official USCIS data elements stay exactly as they are, no matter how much you might want to streamline or customize them.

Electronic signatures become part of the equation when you go digital, and they come with their own rulebook. Your system needs to create detailed audit trails that track every change, every access, and every modification. It’s like having a security camera for your digital files, recording who did what and when they did it.

These electronic systems have become essential parts of modern workplace compliance solutions, offering efficiency that paper systems simply can’t match.

Best Practices for Electronic I-9 Record Keeping

Building a reliable electronic I-9 record keeping system is like constructing a digital vault. Your electronic system needs to be just as secure and dependable as that locked filing cabinet, but with added layers of protection that only technology can provide.

System controls form the foundation of your digital fortress. Your system must prevent unauthorized changes, deletions, or deterioration of stored forms. Think of these controls as multiple locks on a bank vault, each one adding another layer of security to protect your sensitive employee data.

Accuracy and reliability require ongoing attention through quality assurance programs. You’ll want to regularly test your system’s ability to capture and store information correctly. It’s not enough to set up the system and forget about it. Regular check-ups ensure everything stays in working order.

Preventing unauthorized access means implementing strong authentication measures and clear permission levels. Only the people who absolutely need access should have it, and even then, their access should be limited to what they need for their specific job functions.

Documentation of your business processes isn’t optional. USCIS requires complete descriptions of your electronic system, including how you create, modify, and verify the authenticity of electronic Form I-9 records. This documentation serves as your compliance roadmap and proof that you’re following proper procedures.

Your system must produce clear, legible paper copies whenever needed, especially during government inspections. An efficient indexing system makes retrieval quick and painless, which you’ll appreciate when you have just three days to respond to an inspection request.

These requirements aren’t suggestions from USCIS. They’re mandatory elements outlined in official retention and storage guidance that keep your electronic I-9 record keeping both legal and audit-ready.

Electronic Signature and Security Requirements

Electronic signatures bring convenience to your I-9 process, but they also bring responsibility. Getting them right means understanding exactly what makes an electronic signature legally valid and secure.

Your electronic signature system needs to do several important things. It must verify the signatory’s identity at the time of signing, not just accept any digital mark. The signature gets attached to the specific Form I-9 during the transaction, creating a permanent connection between the person and their attestation.

Creating a transaction record provides proof that the signing actually happened. This record includes details about when the signature occurred and who provided it. You’ll also need to offer printed confirmations to employees who request them, giving them tangible proof of their electronic transaction.

The security measures for electronic I-9 record keeping go beyond just the signature itself. Access controls ensure only authorized personnel can view or modify electronic records. Your backup and recovery plan protects against data loss from system failures, cyber attacks, or natural disasters. What happens if your server crashes on a Friday afternoon? You need a plan that gets your records back online quickly.

Training authorized personnel reduces the risk of accidental changes or deletions. Even well-meaning employees can cause problems if they don’t understand how to properly handle electronic records. Audit trails create permanent records of every access, showing the date, the person’s identity, and what actions they took.

These security measures transform your electronic I-9 record keeping from a simple digital filing system into a comprehensive compliance solution that protects both your business and your employees’ sensitive information.

Staying Compliant: Audits, Penalties, and Special Cases

Nobody likes to think about government audits, but when it comes to I-9 record keeping, being prepared isn’t just smart—it’s essential. The reality is that several federal agencies have the authority to knock on your door and request your Forms I-9, often with little warning.

The Department of Homeland Security leads most workplace inspections, but you might also hear from the Immigrant and Employee Rights Section (IER) at the Department of Justice or the Department of Labor. Each agency has its own focus, but they all share one thing in common: they expect your records to be organized and ready for review.

Here’s where that 3-day rule becomes critical. Once you receive an inspection notice, you have exactly three business days to present your Forms I-9. Three days might sound reasonable, but if your records are scattered across different locations or buried in disorganized files, it can feel like three minutes. This is why conducting regular I-9 self audits is such a valuable practice—it helps you spot problems before the government does.

Penalties for Non-Compliance

Let’s be honest about the financial stakes here. I-9 compliance penalties aren’t just a slap on the wrist—they can seriously impact your bottom line. The government has structured these penalties to get employers’ attention, and they’ve certainly succeeded.

Technical or substantive violations might sound minor, but they carry penalties ranging from $230 to $2,292 per violation. This includes situations like failing to produce a Form I-9 during an inspection, having incomplete information, or missing signatures. When you multiply these amounts by the number of affected employees, the costs add up quickly.

The penalties get much steeper for knowingly hiring and continuing to employ unauthorized individuals, with fines ranging from $573 to $20,130 per violation. These aren’t just numbers on a page—they represent real financial consequences that can strain any business budget.

Beyond the immediate financial impact, non-compliance creates a ripple effect. Your business reputation may suffer, you’ll likely face increased government scrutiny going forward, and in severe cases, you could even lose eligibility for federal contracts. For more details on these penalties, you can review our comprehensive guide to I-9 compliance penalties.

Special Considerations for E-Verify Users

If your company participates in E-Verify, there’s an exciting development that affects your I-9 record keeping responsibilities. The Department of Homeland Security introduced a game-changing alternative procedure for remote examination of Form I-9 documents, which became available to E-Verify participants on August 1, 2023.

This DHS-authorized alternative procedure allows you to examine employee documents through live video interaction rather than requiring in-person verification. It’s particularly valuable for remote workforces or when employees can’t easily travel to your office location.

However, this flexibility comes with a specific record-keeping requirement that’s crucial to understand. If you choose to use remote examination, you must retain clear and legible copies of all documents you examine. This isn’t optional—it’s a mandatory part of the process.

The remote examination typically involves a live video call where the employee presents their documents to the camera. You’ll need to capture and store copies of these documents as part of your I-9 record keeping system. This requirement applies only to remotely examined forms, but it’s an important distinction that affects your retention procedures.

This new procedure offers tremendous flexibility while maintaining compliance standards. For businesses managing distributed teams or dealing with challenging logistics, it can simplify the verification process significantly. To learn more about how this integrates with your overall compliance strategy, explore our detailed information on E-Verify and I-9 processes.

Simplify Your I-9 Compliance Today

Managing I-9 record keeping doesn’t have to feel like navigating a maze blindfolded. Throughout this guide, we’ve walked through the essential elements: that critical 3-Year/1-Year retention rule, your storage options from traditional paper files to cutting-edge electronic systems, and yes, those eye-watering penalties that can reach over $20,000 per violation.

Here’s the bottom line: consistent processes save businesses. When you establish clear procedures for every new hire, regularly review your existing forms, and stay current with regulations, you’re not just checking compliance boxes. You’re building a foundation that protects your business from costly surprises.

The recent updates, including the revised Form I-9 that became mandatory in November 2023, remind us that employment law never stands still. What worked last year might leave you vulnerable today. That’s why proactive compliance isn’t just smart business, it’s essential business.

We get it. Between running your operations, managing your team, and growing your business, diving deep into I-9 record keeping regulations probably isn’t how you want to spend your time. The good news? You don’t have to go it alone.

At Valley All States Employer Service, we’ve made employment compliance our specialty so you can focus on what you do best. Our expert E-Verify processing takes the guesswork out of workforce eligibility verification. We handle the details, minimize errors, and reduce your administrative burden, whether you’re based in Maryland or anywhere across the United States.

Think of us as your compliance safety net. While you’re building your business, we’re making sure your I-9 record keeping meets every federal requirement. No more wondering if you’ve calculated retention periods correctly or worrying about whether your storage system will pass inspection.

Ready to transform your I-9 compliance from a source of stress into a streamlined process? Your future self will thank you for taking action today.