I-9 form processing: Definitive 2025 Guide

Why I-9 Compliance is Critical for Your Business

I-9 form processing is a federal requirement that every U.S. employer must steer correctly or face serious financial consequences. This mandatory verification system confirms that each new hire is legally authorized to work in the United States.

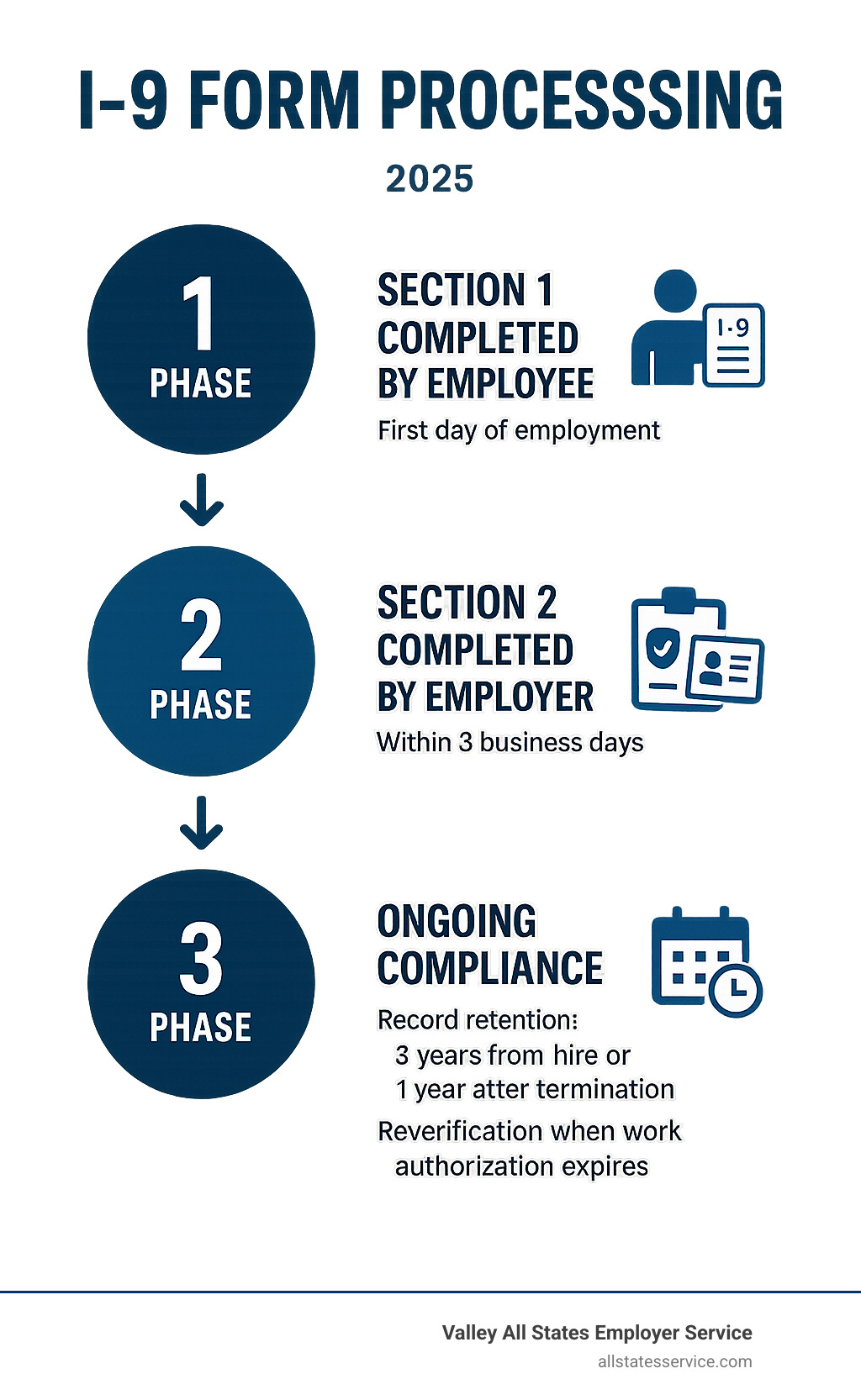

Quick Facts About I-9 Form Processing:

- Required for: Every employee hired after November 6, 1986

- Section 1 deadline: Employee’s first day of work

- Section 2 deadline: Within 3 business days of start date

- Retention period: 3 years from hire date OR 1 year after termination (whichever is longer)

- Error rate: An estimated 60-80% of completed Forms I-9 contain at least one error

- Potential fines: $272 to $2,701 per missing or incorrect form

The stakes couldn’t be higher. ICE can impose fines up to $2,292 per substantive Form I-9 error, and with 76% of paper forms containing at least one fineable mistake, a company with 1,000 annual hires faces a minimum risk of over $1.6 million in potential penalties annually.

Despite being around for decades, I-9 compliance remains one of the most error-prone aspects of the hiring process. Technical errors like missing signatures or dates can lead to warnings and correction opportunities, while substantive violations such as late completion or failure to examine documents result in immediate fines that cannot be corrected.

The complexity doesn’t end with initial completion. Employers must also manage reverification when work authorization expires, handle rehires properly, and maintain detailed records that could be audited at any time with as little as 72 hours’ notice from ICE.

Understanding the Form I-9: Key Sections and Responsibilities

Form I-9, Employment Eligibility Verification, is a crucial document that helps us confirm an individual’s identity and their legal authorization to work in the United States. It’s not just a piece of paper; it’s a critical component of federal law compliance for every employer. Understanding its structure and who is responsible for each part is the first step toward flawless I-9 form processing.

The current Form I-9 has been streamlined for clarity and accessibility, with the latest edition dated 08/01/23. You can always find the most current version and its instructions directly from the official source, the Form I-9 PDF provided by USCIS.

We’ve learned that both the employee and the employer (or an authorized representative) have distinct roles in completing this form. The employee attests to their eligibility, and the employer verifies it. For a deeper dive into the fundamentals, explore What is I-9 Form?.

Section 1: Employee Information and Attestation

This section is all about the employee. On or before their first day of employment, the new hire must complete Section 1, providing their personal information such as full name, date of birth, and address. Crucially, they must attest under penalty of perjury to their citizenship or immigration status. This means declaring whether they are a U.S. citizen, a noncitizen national, a lawful permanent resident, or an alien authorized to work.

Once all the required fields are filled out, the employee must sign and date Section 1. If someone assists the employee in completing or translating this section, a Preparer and/or Translator Certification (now known as Supplement A) must also be completed. This ensures transparency and accountability in the process.

Section 2: Employer Review and Verification

Now it’s our turn as the employer. Within three business days of the employee’s first day of work for pay, we must complete Section 2. This involves physically examining the documents the employee presents to verify their identity and employment authorization. These documents must appear genuine and relate to the person presenting them.

The acceptable documents are categorized into three lists:

- List A: Documents that establish both identity and employment authorization (e.g., U.S. passport, Permanent Resident Card).

- List B: Documents that establish identity only (e.g., driver’s license, state ID card).

- List C: Documents that establish employment authorization only (e.g., Social Security card, birth certificate).

The employee has the right to choose which documents they present from the acceptable lists, as long as they meet the requirements (either one List A document or one List B document AND one List C document). We then record the document information (title, issuing authority, number, expiration date) on the form, and sign and date Section 2 ourselves, attesting that we have examined the documents. For comprehensive guidance on filling out this section, refer to our insights on I-9 Form Completion.

Supplement B: Reverification and Rehires

Life happens, and work authorizations can expire. That’s where Supplement B (formerly Section 3) comes in. This section is used by employers to update and re-verify an employee’s information under specific circumstances.

Here’s when we typically need to use Supplement B:

- Expiring Work Authorization: If an employee’s employment authorization document has an expiration date, we must re-verify their eligibility before it expires. This ensures they continue to be legally authorized to work.

- Rehiring Former Employees: If we rehire an employee within three years of the date their original Form I-9 was completed, we may be able to use the original form and complete Supplement B, rather than a new Form I-9.

- Name Changes: If an employee legally changes their name, we can update this information in Supplement B.

We should not reverify U.S. citizens, noncitizen nationals, or lawful permanent residents who presented a Form I-551 (Permanent Resident Card) for Section 2. The USCIS provides clear guidelines on who Employers should not reverify certain individuals. Keeping track of these nuances is key to compliant I-9 form processing.

The Step-by-Step I-9 Form Processing Workflow

Think of I-9 form processing as a carefully choreographed dance between you and your new employee. Every step has its rhythm, and timing is everything. The process starts before your employee even walks through the door and continues throughout their time with your company.

Getting this workflow right isn’t just about following rules, it’s about protecting your business from costly penalties while making sure your new hires feel welcomed and supported. The USCIS Handbook for Employers serves as our trusted guide through this process, and we recommend keeping it bookmarked.

Meeting Critical Deadlines

When it comes to I-9 form processing, deadlines aren’t suggestions, they’re federal requirements. Missing them is like showing up late to a job interview with ICE, and trust us, they’re not the forgiving type.

Your employee’s Section 1 deadline is crystal clear: they must complete and sign this section no later than their first day of work for pay. Not the second day, not when they remember to bring a pen. Day one, period. This is when they officially attest to their work eligibility under penalty of perjury.

Now comes your turn with the Section 2 deadline. You have exactly three business days from your employee’s first day to complete your portion. We call this the “three-day rule,” and it’s non-negotiable. If someone starts on Monday, you need to finish Section 2 by Thursday. Start on Wednesday? You’ve got until Monday of the following week.

Here’s where it gets serious: late completion isn’t just a minor slip-up. Immigration authorities consider this a substantive violation, which means automatic fines with no chance for a do-over. It signals that you’re not taking employment eligibility verification seriously, and they respond accordingly with penalties that can quickly add up to thousands of dollars per violation.

Reviewing Acceptable Documents

This is where many employers feel like they’re walking through a minefield, but it doesn’t have to be that complicated. When your employee presents their documents, you’re essentially playing the role of a reasonable person, not a forensic expert.

The beauty of the system is that employees choose their own documents from the acceptable lists. You can’t demand to see a specific document or ask for more than what’s required. Think of it as a menu: they pick what works for them from the options available.

List A documents are the all-in-one option, proving both identity and work authorization. A U.S. passport or Permanent Resident Card fits this category perfectly. List B documents like a driver’s license or state ID card establish identity only, while List C documents such as a Social Security card or birth certificate prove work authorization.

Your employee needs to present either one document from List A, or one document each from Lists B and C. The key is examining these documents to ensure they reasonably appear to be genuine and relate to the person standing in front of you. You’re looking for obvious signs of tampering or fraud, but you’re not expected to be a document authentication specialist.

The golden rule here is avoiding over-documentation. Don’t ask for extra documents based on someone’s accent, appearance, or name. This can quickly turn into a discrimination issue, which creates an entirely different set of legal problems. For the complete rundown of what’s acceptable, bookmark the official List of Acceptable Documents.

Proper I-9 Record Retention

Once you’ve completed the form, your relationship with that piece of paper is far from over. Think of Form I-9 as a houseguest that overstays its welcome, but one you’re legally required to keep around.

The “3-year/1-year rule” might sound confusing at first, but it’s actually straightforward. You keep each completed Form I-9 for three years after the hire date OR one year after the employment ends, whichever date comes later.

Let’s say you hire someone who works for just two months before moving on. You still need to keep their form for the full three years from when you hired them. On the flip side, if someone works for you for five years, you only need to keep their form for one additional year after they leave.

Storing these forms securely is crucial, whether you go with traditional paper filing or electronic systems. If you choose electronic storage, make sure your system meets DHS security standards. Think of it as protecting a treasure chest, because that sensitive employee information could cause serious problems if it falls into the wrong hands.

Don’t forget about purging old forms once their retention period expires. Keeping forms longer than required might seem harmless, but it can actually work against you during an audit. It’s like keeping old tax returns forever, it just creates more paperwork to explain. For a deeper dive into best practices, check out our comprehensive guide on I-9 Record Keeping.

Avoiding Penalties: Audits, Common Mistakes, and Self-Correction

The thought of an ICE audit can send shivers down any employer’s spine. These audits, often initiated with as little as 72 hours’ notice, are designed to catch non-compliance in I-9 form processing. The consequences of getting it wrong are severe, ranging from hefty fines to criminal charges. We believe in proactive compliance to help our clients avoid these pitfalls.

Potential Penalties and the Cost of Non-Compliance

When it comes to I-9 violations, the government doesn’t mess around. Civil penalties for paperwork violations can hit your budget hard, with fines ranging from $272 to $2,701 per violation. These numbers get adjusted annually for inflation, so they keep climbing year after year. Think about it: a single missing signature or incorrect date can cost you hundreds of dollars.

The real nightmare scenario involves knowingly hiring unauthorized workers. These violations carry much steeper penalties, with civil fines ranging from $676 to $27,018 per worker. In extreme cases, you could face criminal charges that include imprisonment. Some employers even get barred from federal contracts entirely.

Statistics show just how common these problems are. With an estimated 60-80% of all completed Forms I-9 containing at least one error, most employers are walking around with potential violations they don’t even know about. For a deeper understanding of what you’re facing, check out our detailed breakdown of I-9 Compliance Penalties. The ICE Form I-9 Inspection Process provides the official government perspective on how audits work and penalties get calculated.

Common Mistakes in I-9 Form Processing

Even with the best intentions, employers consistently make the same mistakes in I-9 form processing. Some of these errors are technical (fixable), while others are substantive (not fixable and immediately fineable).

Missing information tops our list of frequent problems. Any blank field in Section 1 or 2, no matter how insignificant it seems, can render your form non-compliant. We see this happen when someone rushes through the process or doesn’t understand that every single field matters.

Timing violations cause serious headaches because they can’t be corrected after the fact. Failing to complete Section 1 on the employee’s first day or missing the three-business-day deadline for Section 2 creates a substantive violation that sticks with you forever.

Document-related errors show up constantly. Employers accidentally accept expired documents, take photocopies when originals are required, or approve documents that aren’t on the USCIS acceptable lists. Sometimes they go in the opposite direction and demand specific documents, which can lead to discrimination claims.

Backdating forms represents one of the most serious violations we encounter. Some employers think they can fix late completion by changing dates, but this actually makes things much worse. Immigration authorities view backdating as an attempt to hide non-compliance, and they respond with severe penalties.

Signature problems might seem minor, but they’re surprisingly common. Employees forget to sign Section 1, or employers skip signing Section 2. Sometimes people sign but forget to include dates, which creates the same compliance problem.

How to Conduct an I-9 Self-Audit and Correct Errors

The smartest defense against an ICE audit is conducting regular self-audits. This proactive approach lets you find and fix problems before they become expensive violations. Our comprehensive guide on I-9 Self Audit walks you through every step of this process.

Start by gathering all your Forms I-9, whether they’re stored on paper or electronically. You need complete visibility into your entire workforce’s documentation before you can assess compliance.

Review each form systematically, going field by field and comparing everything against current USCIS instructions. Check that Section 1 was completed on the employee’s first day and Section 2 was finished within three business days. Verify that all listed documents appear on the acceptable documents list and that their information was transcribed correctly.

Technical errors can usually be fixed. If you find a missing date or incorrect information that doesn’t impact employment eligibility, the person who made the original error should initial and date the correction. When that person isn’t available anymore, the current preparer can make the correction, initial and date it, then note that the original preparer is unavailable.

Substantive violations require a different approach because they can’t be corrected. Late completion falls into this category. Document these violations clearly, note the reason they occurred, and consider completing a new, current Form I-9 for the employee. You still have to keep the original non-compliant form for your records.

Create a detailed audit trail for every correction you make. Include the date of correction and who made it. This transparency becomes crucial if ICE shows up for an actual audit. It demonstrates your commitment to compliance and can support a “good faith” defense.

Regular self-audits help you sleep better at night, knowing you’re staying ahead of potential problems instead of waiting for them to find you.

Modernizing Your I-9 Form Processing

The workplace has transformed dramatically over the past few years, and I-9 form processing needs to keep pace. Between remote teams scattered across the country, new digital verification tools, and constantly evolving regulations, staying compliant isn’t just about following the same old playbook anymore.

Think about it: if your company hired someone in California while your HR team sits in Ohio, how do you physically examine their documents? Or what happens when immigration rules change overnight and your manual processes can’t adapt quickly enough? These are real challenges that modern employers face every day.

The good news is that technology and updated regulations are finally catching up to how we actually work today. Let’s explore how you can bring your I-9 form processing into the 21st century without losing sight of compliance. For comprehensive guidance on remote workforce challenges, check out our resource on I-9 for Remote Employees.

Handling I-9 Verification for Remote Employees

Remember when everyone worked in the same building and document verification meant walking down the hall? Those days feel like ancient history now. The traditional requirement of physically examining documents created a real headache for remote hires, but thankfully, we now have workable solutions.

The authorized representative approach has been available for years, though many employers didn’t realize it. Essentially, you can designate almost anyone (except the employee themselves) to complete Section 2 on your behalf. This could be a notary public, a family member, or even a trusted friend in the employee’s area. The key thing to remember is that while they’re doing the legwork, you’re still on the hook for any errors they make.

Here’s where things get interesting: as of August 1, 2023, the Department of Homeland Security introduced a permanent game-changer. If your company is enrolled in E-Verify and maintains good standing, you can now conduct remote document examination via live video. This isn’t just a temporary pandemic measure, it’s here to stay.

During a live video call, your employee presents their documents directly to the camera while you examine both the front and back. You’re looking for the same things you would in person: does the document appear genuine, and does it relate to the person showing it? The catch is that you must retain clear copies of all documents examined this way.

This remote verification option has revolutionized I-9 form processing for distributed teams. For detailed guidance on implementing this process, our guide on USCIS I-9 Remote Verification walks you through every step.

Integrating E-Verify with Your I-9 Form Processing

E-Verify isn’t just an add-on to your compliance process, it’s becoming an essential tool for smart employers. While not required for everyone, this government-run system adds a crucial layer of verification that can save you from costly mistakes down the road.

Here’s how it works in practice: after you complete Form I-9, you enter the employee’s information into the E-Verify system. Within seconds, it cross-references this data with Social Security Administration and USCIS databases. Think of it as a reality check on the information you’ve already verified.

The benefits go beyond just peace of mind. Using E-Verify correctly can provide a “safe harbor” defense against certain penalties if immigration authorities later question your hiring decisions. It demonstrates that you took reasonable steps to verify employment eligibility, which carries weight during audits.

But E-Verify isn’t foolproof. Sometimes the system issues a Tentative Nonconfirmation (TNC), which basically means “we need to double-check this.” When this happens, you must give the employee information about how to contest the TNC. Most importantly, you cannot take any adverse action against the employee based solely on a TNC, that would be discrimination.

The E-Verify Website provides comprehensive training and resources for getting started. For insights on how this system fits into your overall compliance strategy, our article on E-Verify and I-9 breaks down the integration process.

Best Practices for Ongoing Compliance

Compliance isn’t a destination, it’s a journey. The most successful companies treat I-9 form processing as an ongoing commitment rather than a checkbox to tick during onboarding.

Consistency is your best friend here. Develop a written, standardized process for every new hire and stick to it religiously. When auditors see that you handle every employee exactly the same way, it demonstrates good faith compliance. Random variations in your process raise red flags.

Staff training can’t be a one-and-done event either. Immigration laws shift, USCIS updates forms and instructions, and your team needs to stay current. The person who completed perfect I-9s five years ago might be making costly mistakes today if they haven’t kept up with changes.

Staying updated on rule changes requires more than just hoping someone will tell you when things change. Subscribe to USCIS updates, join professional organizations, and consider working with compliance experts who make it their business to track regulatory changes.

Electronic I-9 systems represent the biggest opportunity for modernization. These platforms don’t just digitize paper forms, they actively prevent common errors, send automatic reminders for reverifications, ensure proper retention periods, and make audit preparation infinitely easier. Many integrate seamlessly with E-Verify, creating a smooth workflow from start to finish.

The companies that excel at I-9 form processing treat it as a strategic advantage rather than a necessary evil. They invest in the right tools, train their people properly, and build processes that scale with their growth.

Simplify Your Compliance and Focus on Growth

Let’s be honest: I-9 form processing shouldn’t be keeping you up at night. Yet for many business owners, the complexity of employment eligibility verification creates a constant source of stress. Between tracking deadlines, examining documents, and worrying about potential audits, it’s easy to lose sight of what really matters: growing your business.

The numbers tell the story. With error rates hovering between 60-80% on completed forms and potential fines reaching thousands of dollars per violation, even the most well-intentioned employers find themselves drowning in administrative details. Every new hire brings another opportunity for costly mistakes, and the fear of an ICE audit can paralyze decision-making.

Here’s where we come in. At Valley All States Employer Service, we’ve built our reputation on one simple promise: making employment compliance straightforward and stress-free. We specialize in expert, impartial, and efficient E-Verify workforce eligibility verification, taking the guesswork out of I-9 form processing.

Think of us as your compliance safety net. While you focus on interviewing the perfect candidate or closing that important deal, we’re handling the technical details that keep your business legally protected. Our team stays current on every regulation change, every deadline, and every documentation requirement so you don’t have to.

When you partner with us, you’re not just outsourcing paperwork. You’re gaining peace of mind. No more scrambling to meet the three-day rule. No more second-guessing whether a document looks legitimate. No more sleepless nights wondering if your forms will pass an audit.

The benefits extend far beyond compliance. Our clients consistently tell us that removing this administrative burden allows them to redirect their energy toward revenue-generating activities. Instead of training staff on complex I-9 requirements, they’re training them on customer service. Instead of conducting internal audits, they’re conducting market research.

Ready to transform your approach to employment verification? Find how we can help you Streamline Your E-Verify and I-9 Compliance and get back to what you do best.