I-9 Compliance Services 2025: Master Flawless

The Critical Importance of Flawless I-9 Compliance

I-9 compliance services help businesses manage employment eligibility verification, avoiding costly penalties and audit risks. These services typically include electronic I-9 management, E-Verify integration, remote verification support, and audit preparation.

Every U.S. employer must complete Form I-9 for each new hire to verify their identity and work authorization. While it sounds simple, the process is governed by over 1,200 rules.

This complexity leads to staggering error rates. 76% of paper I-9 forms contain at least one fineable error, and there’s a 95% chance your company will face an ICE audit within the next decade. With fines reaching thousands per violation, the stakes have never been higher.

Remote hiring, evolving immigration laws, and intensifying government enforcement add to the challenge. HR managers often feel overwhelmed, but you don’t have to handle this alone.

Modern I-9 compliance services transform this burden into a streamlined process that protects your business and frees up your team for more strategic work.

Understanding the Fundamentals of Form I-9

Form I-9, or Employment Eligibility Verification, is the backbone of federal hiring law. Every U.S. employer must complete it for every new hire to verify they are legally authorized to work in the United States. This process is governed by over 1,200 federal rules, where one mistake can lead to thousands in fines, making I-9 compliance services invaluable.

For detailed guidance, see What is I-9 Form? and always use the current version from the Official Form I-9 from USCIS website. Using an outdated form is a common and costly violation.

Employer and Employee Responsibilities

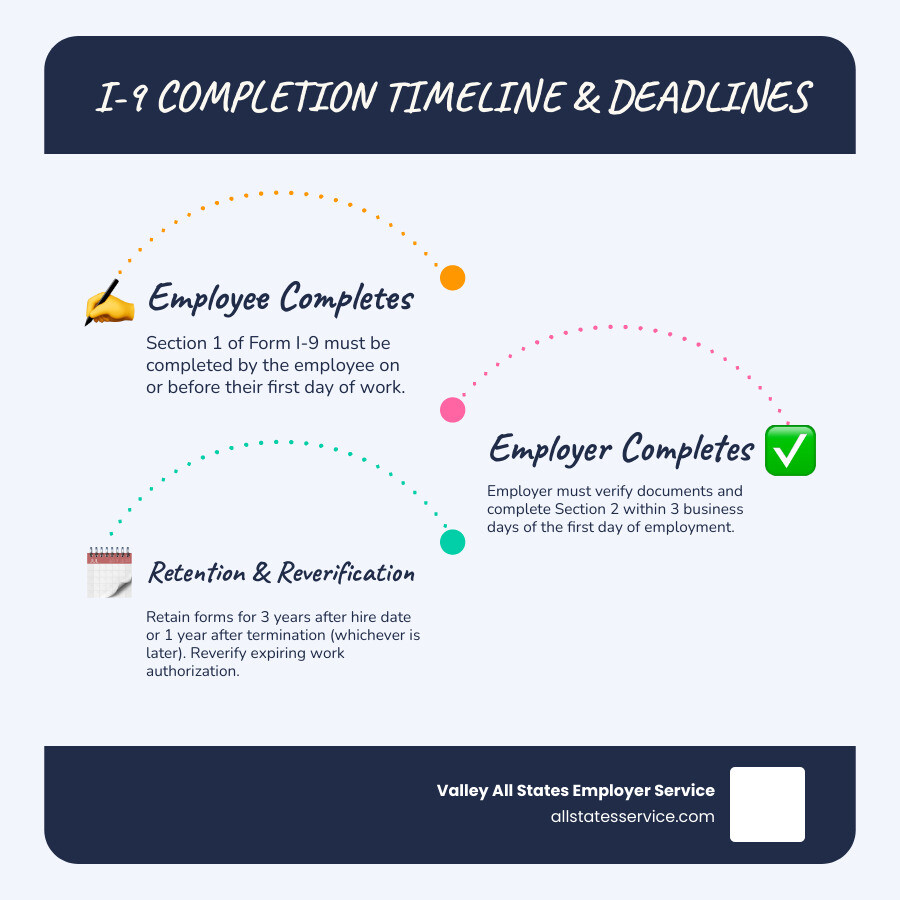

The I-9 process requires timely action from both you and your new employee.

The employee must complete and sign Section 1 of the form on or before their first day of work. They attest to their work authorization status and provide accurate personal information.

The employer has three business days from the employee’s start date to complete Section 2. This involves physically examining the employee’s original documents to ensure they appear genuine and relate to the person. You must record the document details, then sign and date the form. For a walkthrough, see our guide on Verifying I-9 Documents.

A crucial rule: you cannot tell employees which documents to present. You must accept any valid, unexpired documents from the official lists. Specifying documents or rejecting valid ones can be considered discrimination.

Navigating Document Lists and Retention Rules

Acceptable documents fall into three categories:

- List A documents (like a U.S. passport) establish both identity and work authorization.

- List B documents (like a driver’s license) establish identity only.

- List C documents (like a Social Security card) establish work authorization only.

An employee can present one document from List A, or a combination of one from List B and one from List C. Never accept expired documents.

Once completed, you must retain each Form I-9 for three years after the hire date or one year after the employee leaves, whichever is later. After this period, securely destroy the forms to protect employee privacy. Proper storage is non-negotiable, as these forms contain sensitive data. Our guide on I-9 Record Keeping covers these requirements in detail.

The High Stakes of Non-Compliance: Penalties and Audits

The consequences of I-9 non-compliance can be devastating, ranging from crushing financial penalties to criminal charges and debarment from federal contracts. This is why smart employers invest in professional I-9 compliance services.

U.S. Immigration and Customs Enforcement (ICE) conducts worksite audits that can be triggered by complaints or random selection. Companies face an average fine of $2,000 per substantive I-9 error. Worse, there’s a 95% chance your company will face an ICE audit within the next decade. For a breakdown of what you’re facing, see our guide on I-9 Compliance Penalties.

Penalties range from paperwork violations (incomplete or late forms) to substantive errors (improper verification). The most serious cases, like knowingly hiring unauthorized workers, can lead to criminal action against executives.

Common Mistakes That Trigger Major Fines

Even well-intentioned employers make costly mistakes. The most common include:

- Missing information: A single forgotten date, signature, or checkbox can trigger a fine.

- Late form completion: Section 1 is due by day one; Section 2 is due within three business days. Missing these deadlines results in penalties.

- Accepting expired documents: All documents must be current and valid at the time of inspection.

- Reverification errors: Forgetting to reverify expiring work authorizations using Section 3 is a frequent and costly oversight.

A sobering fact: 76% of paper I-9 forms contain at least one fineable error. Our I-9 Audit Complete Guide shows what auditors look for and how to fix problems before they find you.

The Reality of an ICE Audit

An ICE audit begins with a Notice of Inspection (NOI), giving you just three business days to produce all your I-9 forms. Agents then carefully examine every form for technical and substantive violations.

Preparing for an audit means keeping organized records and conducting internal audits to catch errors early. The best risk mitigation is prevention. While most audited businesses pay fines, those using professional I-9 compliance services fare much better due to superior preparation and documentation.

The Evolving Landscape: Remote Hiring and New Regulations

The rise of remote work has transformed hiring, and I-9 compliance services have evolved to keep pace. What began as temporary COVID-19 flexibilities for remote document review has become a permanent, sophisticated process.

Today, the DHS alternative procedure provides a compliant way to handle I-9s for a distributed workforce, enabling companies to build efficient digital workflows. This allows you to hire top talent from anywhere, but the rules must be followed precisely. Our guides on Can I-9 Verification Be Done Remotely? and USCIS I-9 Remote Verification explain what’s allowed.

Mastering Remote I-9 Verification

Compliant remote verification is more than a simple video chat. The process requires a trained authorized representative to conduct a live video interaction. The new hire first sends copies of their documents, then presents the originals on the video call for examination. Your representative must carefully inspect the documents for authenticity and annotate the Form I-9 to show the alternative procedure was used.

Mastering this process allows you to hire talent from coast to coast. For step-by-step guidance, see Remote I-9 Verification for Remote Employees and I-9 Remote Verification Best Practices 2025.

Staying Current with Form and Rule Updates

I-9 regulations change regularly. Staying compliant means staying informed on:

- New Form I-9 versions: Using an outdated form triggers penalties. The current form (08/01/23 edition) is valid until 07/31/2026.

- Immigration law changes: Updates to programs like Temporary Protected Status (TPS) can affect work eligibility. For example, a Federal Register TPS Updates court order recently extended work authorization for Venezuelan recipients.

- E-Verify mandates: Requirements vary by state and industry, so you must know the rules where you hire.

- Rehiring rules: You can’t always reuse an old I-9. Our I-9 Process for Rehires guide explains when a new form is needed.

A Deep Dive into I-9 Compliance Services

Given that 76% of paper I-9s contain errors, professional I-9 compliance services are a necessity, not a luxury. They transform a complex manual task into a smooth, automated process.

These services act as a compliance safety net, combining technology and expertise to catch mistakes, streamline workflows, and provide peace of mind. A comprehensive solution includes electronic I-9 management, E-Verify integration, audit support, and expert consulting. Explore what’s possible with our I-9 Verification Assistance.

Key Features of I-9 Compliance Services

Modern compliance platforms offer powerful features:

- Error-checking algorithms: Catch mistakes in real-time, guiding users to complete forms correctly and reducing the 76% error rate found on paper forms by over four times.

- Digital storage and retrieval: Eliminates paper files, making audit responses fast and manageable.

- Automated reverification alerts: Track expiring work authorizations and send timely notifications to prevent missed deadlines.

- Comprehensive audit trails: Log every action, demonstrating good-faith compliance efforts to inspectors.

These tools dramatically reduce the administrative burden on your HR team. To learn about fixing existing forms, see our guide on Auditing I-9 Forms.

The Role of E-Verify in Modern I-9 Compliance Services

E-Verify, a government system detailed at E-Verify Information, adds another layer of protection. It cross-checks I-9 information against federal databases to confirm work authorization. While optional for many, it’s mandatory for federal contractors and in certain states.

Integrated I-9 and E-Verify systems provide extra verification, help detect fraudulent documents, and demonstrate good-faith compliance. At Valley All States Employer Service, our expertise in precise E-Verify processing minimizes errors and administrative headaches for our clients.

Main Types of I-9 Services

- Electronic I-9 Management: Platforms that guide users through error-free completion and provide secure storage.

- Remote I-9 Verification Networks: Services that provide authorized representatives or technology for remote document examination.

- I-9 Auditing and Remediation: Specialists who review existing forms, identify risks, and guide corrections.

- I-9 and E-Verify Consulting: Expert guidance for complex compliance scenarios, policy development, and audit responses.

How to Choose the Right I-9 Compliance Partner

Choosing the right partner for your I-9 compliance services is a critical decision that impacts your hiring process and provides peace of mind. When trouble strikes, you need absolute confidence in their expertise.

Consider these factors when evaluating a provider:

- Expertise and Support: Does the partner truly understand I-9 regulations? Can you get real help when you face a tricky scenario? At Valley All States Employer Service, our team lives and breathes employment eligibility verification daily.

- Technology and Security: The platform should be intuitive with robust error-checking and military-grade encryption for data protection. It should also create automatic, comprehensive audit trails.

- Scalability and Integration: The solution must grow with your business and integrate smoothly with your existing HRIS, ATS, or payroll systems to avoid manual data entry.

- Remote Verification Options: Ensure the provider offers compliant solutions for a distributed workforce, like authorized representative networks or technology for live video examination. Our Third-Party I-9 Verification guide details these approaches.

- Audit Preparedness: A great partner helps you proactively identify and fix errors, providing tools that build confidence for potential inspections.

- Transparent Pricing: Look for clear, upfront pricing without hidden fees. The cheapest option is rarely the best value when non-compliance costs thousands per violation.

You’re not just buying software; you’re building a relationship with a trusted advisor. For more insights, our Employer I-9 Verification Guide covers other key considerations. The right partner transforms I-9 compliance from a source of stress into a competitive advantage.

Frequently Asked Questions about I-9 Compliance

The world of I-9 compliance services can be overwhelming. Here are answers to common questions that keep HR managers up at night.

What are the current penalties for a single I-9 error?

Civil penalties for I-9 paperwork violations currently range from $272 to $2,701 per violation. A single missing signature or date can cost your business thousands. Fines are based on company size, offense history, and good-faith efforts.

Penalties for knowingly hiring unauthorized workers are far more severe, including potential criminal charges and debarment from federal contracts. Since these fines are per error, per form, they can quickly become a financial disaster.

Can I complete I-9 verification for a remote employee myself?

Yes, but you must follow specific rules. If your company uses E-Verify, you can use the DHS alternative procedure, which involves a live video call to inspect original documents after receiving copies. You must annotate the Form I-9 accordingly.

If you don’t use E-Verify, you must designate an authorized representative to physically examine the documents and complete Section 2 on your behalf. However, you remain fully liable for any errors your representative makes. This risk is why many businesses rely on professional I-9 compliance services for their remote workforce.

How long do I need to keep I-9 forms after an employee leaves?

The rule is simple: you must keep a completed Form I-9 for three years after the date of hire or one year after the employee’s termination date, whichever date is later.

For example, if an employee works for five years, you would keep their I-9 for one year after they leave, since that date is later than three years from their hire date. Once the retention period ends, you must securely destroy the forms, either by shredding physical copies or using a certified data destruction service for electronic records.

Simplify Your I-9 Process and Ensure Compliance

I-9 compliance doesn’t have to be a minefield. After exploring the complexities and penalties, it’s clear that proactive management is your best defense. With a 76% error rate on paper I-9s and a 95% chance of an ICE audit in the next decade, hoping for the best isn’t a viable strategy.

Professional I-9 compliance services transform this burden into a manageable process, giving you invaluable peace of mind. Instead of worrying about costly mistakes, you can focus on growing your business.

At Valley All States Employer Service, we take the complexity out of employment verification. Our expert, impartial, and efficient E-Verify processing means fewer errors, less administrative headache, and more confidence in your hiring. Partnering with us frees your HR team to focus on strategic work, not decoding federal regulations.

Ready to stop worrying and ensure your compliance is bulletproof? Streamline your hiring with E-Verify and I-9 Compliance and find how much easier employment verification can be with the right partner.