Why I-9 Compliance Penalties Are Skyrocketing

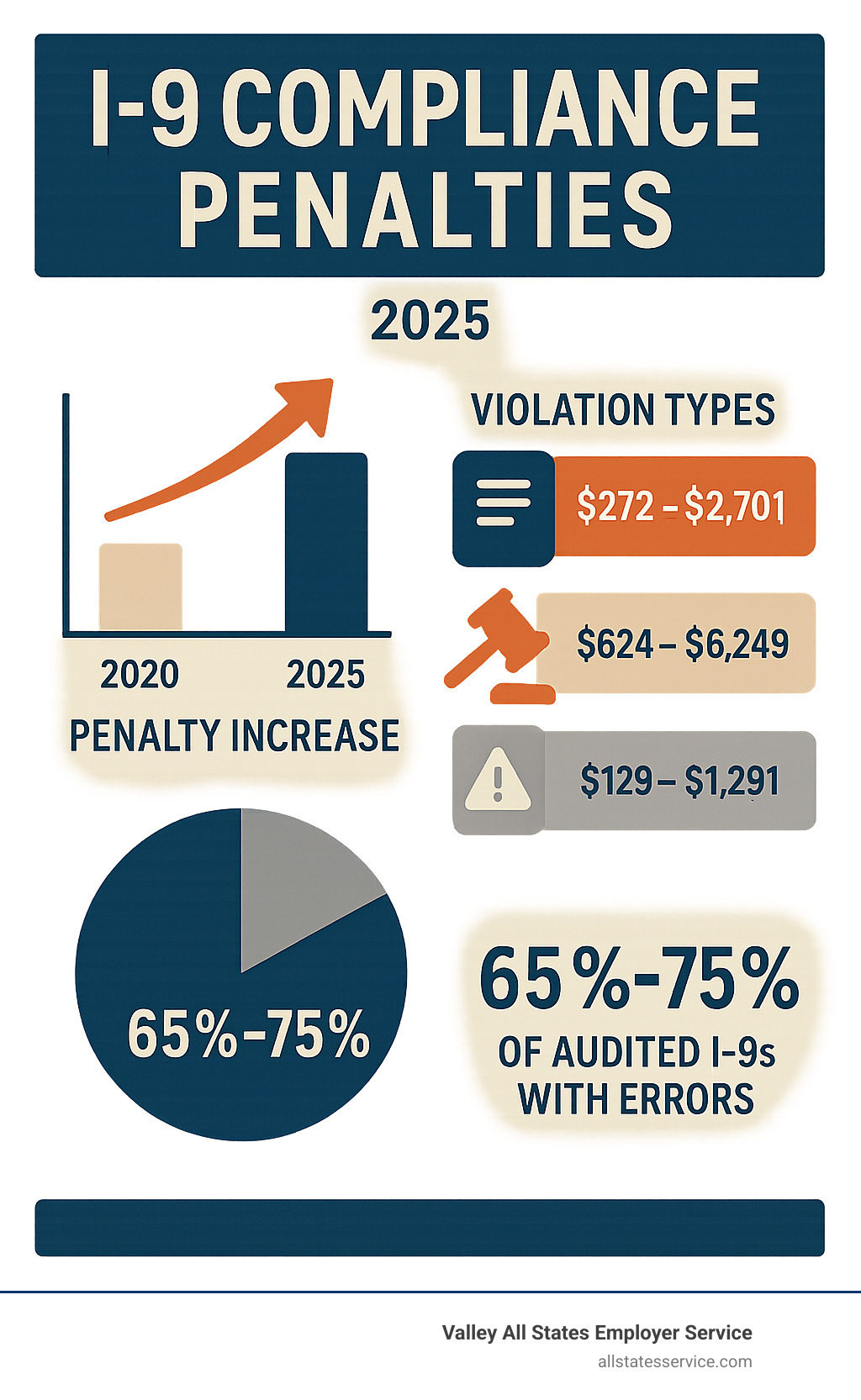

Failing to comply with I-9 regulations can lead to devastating I-9 compliance penalties. As of January 2025, fines range from $288 to $28,619 per violation, and the Department of Homeland Security adjusts these amounts for inflation each year.

Current I-9 Penalty Ranges:

- Paperwork violations: $288 – $2,861 per Form I-9

- Knowingly hiring unauthorized workers (1st offense): $698 – $5,724

- Second offense: $5,724 – $14,308

- Third or subsequent offense: $8,586 – $28,619

- Document abuse: $230 – $2,304 per violation

- E-Verify noncompliance: $973 – $1,942 per employee

The stakes are high. With increasing ICE audits, even small businesses can face massive fines. For example, an employer with 1,000 I-9s and a 65 percent error rate could face penalties over $1.8 million.

Beyond money, hidden costs include lost productivity, legal fees, reputational damage, and stress on your HR team. The good news is that most violations are preventable with the right systems.

Understanding the Full Spectrum of I-9 Compliance Penalties

I-9 compliance penalties represent real, hefty financial consequences for businesses that fail to follow federal immigration laws. The Department of Homeland Security (DHS) and U.S. Immigration and Customs Enforcement (ICE) enforce the Immigration Reform and Control Act (IRCA) of 1986, which requires every new employee to complete a Form I-9 to prove work authorization.

Monetary costs for I-9 violations are adjusted for inflation, so their impact remains significant. You can check the latest official fine schedule from the Federal Register to stay updated.

Fines for Paperwork and Technical Errors

Even small slips on a Form I-9 can lead to fines. These paperwork violations include substantive errors (serious issues suggesting a failure to verify) and technical errors (minor mistakes like a missing date). A technical error can become substantive if not corrected after an audit notification.

Fines for these violations range from $281 to $2,789 per Form I-9. With 65% to 75% of audited I-9s containing at least one error, costs can add up quickly. Common mistakes include incomplete fields, missing signatures, or accepting invalid documents. Our team offers specialized I-9 Verification Assistance to help ensure your forms are flawless.

Severe Penalties for Knowingly Hiring Unauthorized Workers

The most serious I-9 compliance penalties apply to employers who knowingly hire or continue to employ unauthorized workers. This means deliberately ignoring federal law. The fines are steep and increase with each offense. A first offense ranges from $698 to $5,579 per worker. A second offense jumps to $5,579 to $13,946, and a third or subsequent offense ranges from $8,369 to $27,894 per worker.

Beyond fines, consequences can include cease and desist orders or even criminal prosecution. We help you avoid these situations by ensuring your New Hire Eligibility verification process is strong and compliant.

The Cost of Discrimination and Document Abuse

Businesses also face penalties for discriminatory practices. The Department of Justice (DOJ) protects employees from unfair treatment during the I-9 process.

Document abuse is a key violation. This occurs when an employer requests more or different documents than required, rejects valid-looking documents, or specifies which documents an employee must provide. Employees have the right to choose from the Lists of Acceptable Documents. Other unfair practices include discrimination based on national origin or citizenship status.

Penalties for these violations range from $230 for document abuse to $23,048 for repeat offenses. It’s a delicate balance to remain compliant without discriminating. Our Employer HR Compliance services can help ensure your processes are both fair and lawful.

How ICE Calculates Fines and Assesses Violations

I-9 compliance penalties aren’t arbitrary. ICE uses a methodical approach called the ICE Fine Matrix to calculate fines, bringing some predictability to the process.

The calculation begins with your violation percentage (problematic I-9s divided by the total number of forms). This rate sets a base fine, which is then adjusted by aggravating or mitigating factors. You can find the full methodology in ICE’s official guidance on I-9 inspections.

The Five Factors That Determine Your Penalty

ICE examines five statutory factors that can significantly impact your final penalty:

- Size of the business: Larger companies are expected to have more resources and often face steeper fines.

- Good faith effort: Demonstrating a genuine attempt to comply (through policies, audits, and training) can reduce penalties. A lack of effort can increase them. This includes trying to fix errors when found.

- Seriousness of the violation: Major infractions, like failing to verify authorization, are treated more severely than minor paperwork mistakes.

- Involvement of unauthorized workers: The more unauthorized employees found, the higher the fines.

- History of previous violations: Repeat offenders face much harsher penalties, as this suggests willful non-compliance.

Each factor can adjust your base penalty, and these adjustments can stack, potentially pushing fines to the top of the range.

Civil vs. Criminal Consequences

Most I-9 issues result in civil violations and monetary fines. These cover paperwork errors and knowingly hiring unauthorized workers.

Criminal penalties are far more severe and apply when ICE finds a pattern or practice of knowingly hiring unauthorized workers. This means regular, intentional violations, not isolated mistakes. Criminal consequences can include imprisonment, additional fines, and debarment from government contracts, which can be devastating for businesses that rely on them.

Document fraud, such as using false documents or making false statements, can also lead to criminal prosecution, with penalties including fines and imprisonment for up to five years. Fortunately, criminal prosecution is rare and reserved for the most serious cases. Most audits result in civil penalties.

The I-9 Audit Process: What to Expect When ICE Knocks

Receiving a Notice of Inspection (NOI) from Homeland Security Investigations (HSI) signals the start of an I-9 audit. This can be a stressful moment, but understanding the process is your best defense.

Audits can be triggered by complaints, tips, or broader investigations. Once you receive an NOI, begin audit preparation immediately. Gather all your Form I-9s and related documents, and consider consulting with legal counsel specializing in I-9 compliance. Regular internal audits are the best way to find and fix errors before ICE does. Our I-9 Self-Audit services can help you proactively correct potential issues.

From Notice of Inspection to Final Order

The I-9 audit process follows a clear path:

- Notice of Inspection (NOI): You typically have three business days to present your Forms I-9.

- Inspection and Findings: HSI reviews your forms for technical, substantive, or knowingly hiring violations.

- Notice of Technical or Procedural Failures: If only minor errors are found, you get at least 10 business days to make corrections. Fixing them can help you avoid fines for those specific errors. Uncorrected errors can become substantive violations.

- Notice of Intent to Fine (NIF): Issued for substantive violations or uncorrected technical errors, this notice details the alleged violations and proposed fine.

- Response: After receiving an NIF, you have 30 days to request a hearing with the Office of the Chief Administrative Hearing Officer (OCAHO) or negotiate a settlement with ICE. Failure to respond results in a Final Order with no chance to appeal.

The Final Order is the final decision on penalties.

The Ripple Effect: Hidden Costs of I-9 Compliance Penalties

The direct fines for I-9 compliance penalties are just the tip of the iceberg. The hidden costs can be even more damaging to your business.

These include high legal fees for handling the audit and negotiations, and significant loss of productivity as your staff diverts time to gathering documents and fixing errors. If unauthorized workers are found, you face employee termination, losing valuable knowledge and incurring replacement costs.

Furthermore, reputational damage from news of an audit can harm your relationships with customers and make it harder to hire new talent. The entire process also puts an immense strain on HR staff, leading to stress and burnout. Being proactive about compliance is a smart business move that protects you from these ripple effects. Our Compliance Management Solutions are designed to help you avoid these risks.

Building a Bulletproof I-9 Compliance Strategy

The best way to avoid hefty I-9 compliance penalties is to have a proactive strategy. Instead of reacting to an audit, focus on fine-tuning your processes, training your team, and using the right tools to get ahead of potential issues.

I-9 compliance is an ongoing commitment that requires attention to detail, meticulous record-keeping, and regular internal checks. Our Employee Onboarding Compliance services are designed to integrate I-9 verification into your hiring flow for accuracy from day one.

Mastering the Basics: Form I-9 Timelines and Documentation

Getting the basics right is non-negotiable. Key timelines and rules include:

- Section 1: The employee must complete this on or before their first day of employment.

- Section 2: You, the employer, must complete this within three business days of the employee’s first day.

- Documentation: Employees must present documents proving identity and work authorization. List A documents prove both (e.g., U.S. Passport), while List B (e.g., driver’s license) and List C (e.g., Social Security card) documents are presented together. The employee chooses which valid documents to show from the official USCIS list of acceptable documents; you cannot demand specific ones.

- Record Retention: You must keep an employee’s Form I-9 for their entire employment. For terminated employees, retain the form for three years after their hire date or one year after their termination date, whichever is later.

The Power of Prevention: Training, Audits, and E-Verify

Proactive prevention is your best defense against I-9 compliance penalties. Key strategies include:

- Employee Training: Regularly train everyone involved in the I-9 process. Rules change, so annual retraining is a smart investment.

- Regular Self-Audits: Periodically review your own I-9s to find and fix errors before a government audit. Using I-9 software can help reduce human error with validation checks and reminders.

- E-Verify System: E-Verify confirms employment eligibility by checking Form I-9 information against government records. It’s mandatory for some employers but a powerful tool for all. Failing to notify DHS of a Final Nonconfirmation (FNC) can lead to penalties. Our E-Verify and I-9 services can help you steer this system easily.

Navigating Modern Hiring: Remote I-9 Verification Rules

With the rise of remote work, I-9 compliance has adapted. While physical document inspection was the traditional method, there is now an alternative for remote verification.

To use this option, your business must be enrolled in E-Verify and in good standing. The process involves a live video interaction to examine the employee’s documents. The employee must send you clear copies of their documents, which you must retain. This procedure has specific guidelines, so attention to detail is crucial for compliance. Our Workforce Eligibility Verification solutions support all your hiring needs, whether your team is remote or in-office.

Frequently Asked Questions about I-9 Compliance Penalties

As employers, we know you’ve got questions about I-9 compliance penalties. The rules can feel complex, but understanding common pitfalls is your best defense. Let’s tackle some of the most frequent questions.

What is the most common I-9 error?

The most common I-9 errors involve incomplete or missing information. These simple mistakes can lead to significant fines.

Key errors include:

- Section 1 not completed by the employee’s first day.

- Section 2 not completed by the employer within three business days.

- Missing signatures or dates from the employee or employer.

- Incomplete document information in Section 2 (title, number, etc.).

- Accepting expired documents (unless an extension is officially permitted).

How long do I need to keep Form I-9 records?

The record retention rules are very specific:

- For current employees, you must keep their Form I-9 for their entire period of employment.

- For terminated employees, you must keep the form for either three years after their date of hire OR one year after their termination date, whichever is later.

For example, an employee hired on 1/1/22 who leaves on 1/1/23 would require you to keep their I-9 until 1/1/25 (three years from hire). If that same employee left on 1/1/26, you would keep the form until 1/1/27 (one year from termination).

Can I get a warning instead of a fine for an I-9 violation?

Yes, it is possible for ICE to issue a Warning Notice instead of a fine for some minor I-9 violations. This is more likely for technical or procedural failures, especially if it is your first offense, you have a low error rate, and no unauthorized workers are found.

However, a warning is not guaranteed. ICE has full discretion, and even minor errors can result in fines. Relying on the possibility of a warning is not a sound compliance strategy. The best approach is to aim for perfect compliance to avoid I-9 compliance penalties altogether.

Secure Your Business and Simplify Compliance

Navigating I-9 rules can feel like a minefield, and the severe I-9 compliance penalties for non-compliance are a major challenge for any employer. These fines can hit your bottom line and disrupt your business operations.

The best way to safeguard your company is to be proactive. This means implementing robust internal processes, providing regular training, and maintaining diligent record-keeping. Making I-9 compliance a priority protects your business from fines, legal fees, and reputational damage, giving you peace of mind to focus on growth.

Ready to take the stress out of managing workforce eligibility? Partner with an expert like Valley All States Employer Service. We provide the assistance you need to ensure accuracy and compliance.

Ready to streamline your hiring process? Explore our E-Verify services today.