Understanding the Real E-Verify Compliance Cost

E-Verify compliance cost goes far beyond the “free” government system that employers often hear about. While the E-Verify portal itself doesn’t charge fees, the true investment includes setup time, staff training, ongoing administration, and handling verification errors.

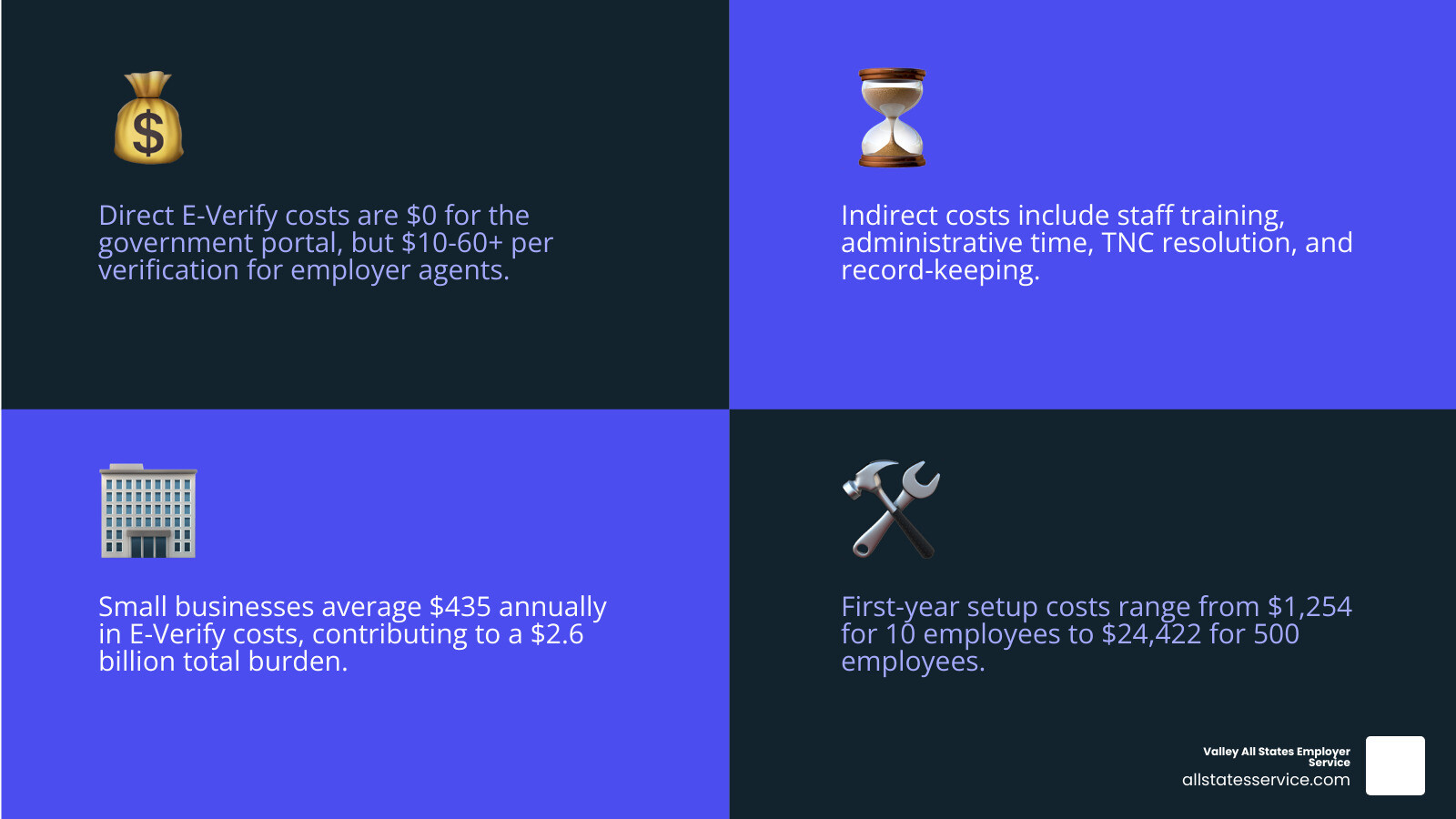

Quick E-Verify Cost Breakdown:

- Direct costs: $0 for government portal, $10-60+ per verification for employer agents

- Indirect costs: Staff training, administrative time, TNC resolution, record-keeping

- Small business impact: Average $435 annually, with Bloomberg estimating $2.6 billion total burden

- Setup costs: Range from $1,254 (10 employees) to $24,422 (500 employees) in first year

The reality hits when you dig deeper. Research shows that businesses with fewer than 500 workers bear the greatest burden, spending about $2.6 billion annually to use the government’s verification system. Small businesses alone incurred costs upwards of $81 million for using E-Verify in 2010, with an average of $127 per new hire query when factoring in responses to Tentative Non-Confirmations.

For busy HR managers juggling compliance requirements, understanding these costs upfront helps you budget properly and choose the right approach for your business. Whether you handle E-Verify in-house or work with an employer agent, knowing the full investment picture prevents costly surprises down the road.

The key is recognizing that “free” doesn’t mean cost-free when it comes to your team’s time and expertise.

What is E-Verify? A Primer for Employers

Think of E-Verify as your digital detective for employment eligibility. This internet-based system helps employers confirm that new hires are legally authorized to work in the United States. It’s like having a direct line to government databases to double-check what your employees tell you on their paperwork.

The system operates through a partnership between U.S. Citizenship and Immigration Services (USCIS), part of the Department of Homeland Security (DHS), and the Social Security Administration (SSA). When you enter information from an employee’s Form I-9 into E-Verify, it gets compared against these official government records.

E-Verify was established in 1996 as the Basic Pilot Program, and it’s grown into a cornerstone of workforce integrity. The core benefits are pretty compelling: it’s free to use through the government portal, relatively straightforward to steer, and lightning fast. Most E-Verify cases return results in just 3 to 5 seconds.

This speed isn’t just convenient, it provides immediate peace of mind. You’ll know quickly whether there are any red flags, and it helps combat identity fraud while keeping you compliant with federal law. For businesses concerned about E-Verify compliance cost, understanding how the system works is the first step in budgeting for it properly.

The E-Verify Process in a Nutshell

Here’s how the verification dance works. Your new employee fills out Section 1 of Form I-9, providing their personal information and swearing they’re eligible to work. You then complete Section 2 by examining their identity and work authorization documents.

Once the Form I-9 is buttoned up, you (or your designated agent) enter the employee’s information into the E-Verify system. This data, which is used with Form I-9, gets cross-referenced with both DHS and SSA databases.

Most of the time, you’ll get an “Employment Authorized” result, and everyone can breathe easy. But sometimes the information doesn’t line up perfectly, triggering a Tentative Nonconfirmation (TNC). A TNC isn’t necessarily bad news, it just means your employee needs to sort out a discrepancy with the relevant agency.

If the employee can’t resolve the TNC, it becomes a Final Nonconfirmation (FNC). At that point, federal law requires you to terminate the employee.

What is E-Verify+ and Is It Different?

You might be wondering about E-Verify+ and whether it affects your costs differently. E-Verify+ is the streamlined cousin of regular E-Verify, designed to combine Form I-9 and E-Verify into one smooth digital process.

The standout features include a combined Form I-9 and E-Verify process, which cuts down on duplicate data entry and creates a more integrated experience. It also offers employee self-service capabilities, letting new hires input their own information directly. This can seriously reduce your administrative headaches.

Good news for budget-conscious employers: Is there a cost to use E-Verify+? Nope. E-Verify+ is completely free, just like standard E-Verify. Currently, E-Verify+ isn’t available for Web Services or E-Verify Employer Agents, so it’s mainly for direct employer use.

For comprehensive support that goes beyond the basic government tools, our E-Verify and I-9 solutions ensure you steer both systems without the stress. You can learn more about E-Verify+ on the official USCIS website.

Is E-Verify Mandatory for Your Business?

While you might often hear E-Verify described as a voluntary program, the truth is, for many businesses, participation isn’t really a choice. Whether it’s due to federal regulations, state laws, or even specific contracts you’ve signed, a growing number of employers are actually required to use the system. Understanding if your business falls into this category is important. It directly impacts your potential E-Verify compliance cost and helps you plan ahead.

Federal E-Verify Mandates

The federal government sets the pace when it comes to E-Verify mandates. For instance, all federal agencies are required to use the system. Beyond that, if you’re a federal contractor or subcontractor and your contracts include the Federal Acquisition Regulation (FAR) E-Verify clause, you’re almost certainly mandated to use E-Verify. This typically applies to all new hires, and sometimes even to existing employees who are working directly on those federal contracts. So if your business does work with the government, E-Verify is very likely a must-have. You can dive deeper into these obligations with our Federal E-Verify Rules guide.

Some federal contracts might even require you to verify all employees working on federal projects within a short timeframe, like 90 calendar days of signing up. The official USCIS site offers helpful questions and answers for federal contractors. For custom support, especially for government contractors, our E-Verify for Contractors page offers custom solutions. In some cases, a business might even be required to use E-Verify through a court order.

State and Local E-Verify Laws

Moving beyond federal requirements, there’s a mix of state and local laws across the U.S. that make E-Verify mandatory for various employers. These mandates often depend on things like the size of your business, the industry you’re in, or whether your company holds contracts with the state.

Here’s a quick look at some states that currently have E-Verify mandates:

- Alabama: Mandatory for all public and private employers.

- Arizona: Mandatory for all public and private employers.

- Florida: Mandatory for all public employers and private employers with 25 or more employees.

- Georgia: Mandatory for all public employers and private employers with 11 or more employees.

- Mississippi: Mandatory for all public and private employers.

- North Carolina: Mandatory for all public employers and private employers with 25 or more employees.

- South Carolina: Mandatory for all public and private employers.

- Tennessee: Mandatory for all public employers and private employers with 35 or more employees.

- Utah: Mandatory for all public employers and private employers with more than 150 employees.

This list isn’t set in stone, and state laws can change. Some states might offer exceptions for smaller businesses, while others have even introduced requirements at the city or county level. For example, in Woodland, Washington, any company with a city contract over $10,000 must use E-Verify. Staying on top of the specific regulations in every place you operate is crucial. Valley All States Employer Service can help you steer these complex rules and understand your specific requirements.

The True E-Verify Compliance Cost: Direct and Indirect Expenses

Here’s where things get interesting, and honestly, a bit frustrating for many employers. The E-Verify compliance cost isn’t just about what you pay upfront. It’s like buying a “free” puppy and then finding the real expenses come from food, vet bills, and replacing your favorite shoes.

Bloomberg’s research painted a stark picture: mandatory E-Verify could burden small businesses with $2.6 billion annually. That’s not monopoly money we’re talking about. Businesses with fewer than 500 workers would shoulder the heaviest load, while small businesses voluntarily using E-Verify back in 2010 already faced costs exceeding $81 million. So much for “free,” right?

The truth is, while the government portal doesn’t charge fees, your real investment includes setup time, ongoing administration, staff training, and those inevitable hiccups that come with verification errors.

Calculating Your Direct E-Verify Compliance Cost

Let’s start with the straightforward stuff. If you use the government portal directly, you won’t write a check to USCIS for each verification. That part really is free. But here’s the catch: many employers quickly realize they need more support than the basic portal provides.

Enter third-party software and E-Verify Employer Agent services. These come with actual price tags. Setup fees might run you $40 to $60 just to get started. Per-verification costs typically range from $10 to $60 or more per new hire, depending on what level of hand-holding you need.

Some providers also charge monthly or annual fees for platform access and support. The pricing models vary wildly, which is why we focus on transparent, straightforward pricing that won’t surprise you three months down the road.

At Valley All States Employer Service, we’ve designed our pricing to minimize your direct costs while maximizing the efficiency you desperately need when dealing with compliance headaches.

Uncovering the Indirect E-Verify Compliance Cost

Now we’re getting to the sneaky stuff. These indirect costs don’t show up on invoices, but they’ll definitely show up in your budget and your stress levels.

Labor hours and administrative burden top the list. Someone on your team has to handle data entry, case submission, result monitoring, and record-keeping. With high turnover rates in many industries, this administrative time adds up faster than you’d expect.

Staff training represents another hidden investment. Your team needs to understand E-Verify rules, compliance requirements, and E-Verify Best Practices. This isn’t just “click here, type there” training. They need to grasp the nuances of handling sensitive employee information and navigating potential issues.

Handling TNCs (Tentative Nonconfirmations) creates its own administrative nightmare. When an employee receives a tentative nonconfirmation result, you’re looking at a time-sensitive process involving employee communication, rights notifications, and potentially complex government procedures.

Employee downtime during TNC resolution can disrupt workflow, even though employees generally continue working during the resolution period. The uncertainty alone can affect productivity.

Errors and corrections happen to everyone. Incorrect data entry leads to unnecessary TNCs, requiring additional time and effort to resolve. Procedural mistakes can trigger penalties, adding insult to injury.

| Task / Cost Factor | DIY E-Verify (In-house) | Using an Employer Agent (e.g., Valley All States) |

|---|---|---|

| Training | Significant internal time/resources to train staff | Minimal internal training; agent handles expertise |

| Data Entry | Dedicated staff time for manual input | Agent handles data entry; less burden on your team |

| TNC Management | Internal staff manage complex resolution processes | Agent guides/manages TNC resolution, reducing stress |

| Record Keeping | Manual tracking & secure storage of case numbers/printouts | Agent manages secure digital records & ensures compliance |

| Compliance Risk | Higher risk of errors, fines due to inexperience | Lower risk; agent specializes in compliance |

| Employee Downtime | Potential disruption during TNC resolution | Minimized; agent’s efficiency speeds up resolution |

| IT/Software Costs | Potential investment in third-party software/integrations | Included in agent fees; no separate software costs |

| Overall Admin Burden | High; requires dedicated HR/admin staff time | Low; significant time savings for your internal team |

The comparison makes it pretty clear: while the government portal costs nothing upfront, the indirect E-Verify compliance cost can be substantial. Many businesses find that partnering with a specialized service provider actually saves money in the long run, not to mention sanity.

Weighing the Investment: E-Verify Costs vs. I-9 Non-Compliance Penalties

When we talk about E-Verify compliance cost, it helps to shift our perspective a little. Instead of seeing it merely as an expense, think of it as a smart investment that protects your business from potentially larger financial hits. We’re talking about the significant penalties that come with I-9 non-compliance.

Even simple paperwork errors on your Form I-9s can lead to fines ranging from hundreds to thousands of dollars per form. If an audit finds mistakes across many employee files, that can add up fast. And if a business is found to be knowingly hiring or continuing to employ unauthorized workers, the consequences escalate dramatically. Penalties can include civil fines from $2,727 to $21,816 per unauthorized worker, and in severe cases, even criminal charges.

Beyond the direct financial penalties, there’s the impact of Immigration and Customs Enforcement (ICE) audits. These investigations can be disruptive, eating up valuable time and resources. Plus, don’t forget the hit to your reputation. Non-compliance issues can damage your brand, making it harder to attract good employees and even affecting customer trust.

Here’s where E-Verify becomes a powerful tool. When used correctly and consistently, it can act as a “safe harbor.” While it doesn’t offer complete immunity, demonstrating your good-faith participation in E-Verify can significantly mitigate penalties if an unauthorized worker is later found to be employed.

At Valley All States Employer Service, we understand this delicate balance. Our I-9 Verification Assistance is designed to help you steer these complex requirements. Our goal is to minimize your risk, streamline your processes, and give you peace of mind that your workforce is compliant.

Hidden Challenges and How to Mitigate Them

Let’s be honest: even when you’ve budgeted for the obvious E-Verify compliance cost, there are still some curveballs waiting in the wings. These hidden challenges can catch employers off guard, adding unexpected expenses and headaches to what should be a straightforward verification process.

System errors and erroneous TNCs represent one of the most frustrating challenges employers face. While E-Verify boasts impressive accuracy rates, no system is perfect. Sometimes a perfectly legal worker gets flagged with a Tentative Nonconfirmation simply because of a data mismatch, typo, or administrative error in government databases.

This creates a domino effect of problems. Your HR team suddenly needs to walk the employee through the TNC resolution process, which means explaining their rights, providing specific documentation, and potentially helping them steer visits to Social Security or DHS offices. Meanwhile, the employee experiences stress and anxiety about their job security. Independent studies have shown that a small percentage of authorized workers do receive erroneous TNCs, and some even face Final Nonconfirmations despite being legally eligible to work.

Identity fraud limitations present another challenge that many employers don’t anticipate. While E-Verify excels at catching name and Social Security number discrepancies, it struggles with sophisticated identity theft. When an unauthorized worker uses stolen or false documents that match government records, the system gives them a green light. Studies suggest that over half of unauthorized workers might slip through E-Verify by using fraudulent identities that appear legitimate in government databases.

This means you could be doing everything right, following every rule, and still unknowingly employ someone using fake credentials. During an ICE audit, this could still create problems for your business, even though you followed proper E-Verify procedures.

Record-keeping complexity adds another layer of administrative burden that catches many employers by surprise. E-Verify doesn’t replace your Form I-9 obligations; it actually increases your paperwork requirements. You must record the E-Verify case number on each employee’s Form I-9, print case confirmation documents, and maintain these records alongside your existing files. This requires robust organizational systems and attention to detail that many businesses underestimate. Our E-Verify Employer Requirements guide breaks down these obligations in detail.

Mitigation through outsourcing offers the most effective solution to these hidden challenges. When you partner with a specialized E-Verify Employer Agent like Valley All States Employer Service, these potential headaches become our responsibility, not yours. We handle the data entry with precision, manage TNC cases with expertise, and maintain meticulous records that keep you compliant.

Our team knows how to steer system errors quickly and efficiently, minimizing disruption to both your business and your employees. We understand the nuances of identity verification and can spot potential issues before they become major problems. Most importantly, we take the administrative burden off your shoulders, allowing your internal team to focus on what they do best.

This is exactly why smart employers turn to E-Verify Outsourcing. Instead of wrestling with unexpected challenges and hidden costs, you get predictable, professional service that transforms E-Verify from a compliance headache into a seamless part of your hiring process.

Conclusion: Making a Smart E-Verify Investment

Think of E-Verify compliance cost like buying a house. The sticker price is just the beginning. You’ve got closing costs, inspections, maintenance, and all those little expenses that add up over time. The same principle applies to E-Verify. What looks “free” on the surface comes with a hefty price tag when you factor in everything else.

The total cost of ownership tells the real story. You’re not just paying for verification checks. You’re investing in staff training, administrative time, error resolution, and the peace of mind that comes with proper compliance. When you balance these direct and indirect costs against the crushing weight of I-9 penalties, smart businesses realize that proactive compliance isn’t an expense. It’s protection.

Here’s where many employers get stuck. They know they need E-Verify, but they’re drowning in the details. Training staff takes weeks. Managing TNCs eats up valuable time. One small mistake can trigger an audit that costs thousands. The administrative burden grows heavier with each new hire.

The value of expert handling becomes crystal clear when you’re facing your tenth TNC of the month or trying to explain E-Verify requirements to a new HR coordinator. Professional E-Verify services transform this burden into a streamlined process. Instead of your team juggling compliance tasks, experts handle the heavy lifting while you focus on growing your business.

At Valley All States Employer Service, we’ve built our reputation on minimizing administrative burden for employers just like you. Our approach is simple: take the complexity off your plate and handle it with the expertise that comes from processing thousands of cases. We turn potential compliance headaches into smooth, efficient operations.

Ensuring accurate and efficient compliance isn’t just about following rules. It’s about protecting your business from costly mistakes while creating a hiring process that works for everyone. When employees receive erroneous TNCs, we guide them through resolution quickly. When documentation needs to be perfect for audits, we’ve got it covered.

Ready to transform your E-Verify compliance from a cost center into a competitive advantage? Our comprehensive E-Verify Services are designed to give you exactly what you need: expert handling, reduced risk, and the confidence that comes with knowing your compliance is in professional hands.