Why Business Compliance Can Make or Break Your Company

A compliance management system is a structured framework of policies, procedures, and controls that helps organizations meet legal requirements and industry standards while reducing risk. It’s the backbone that keeps businesses operating legally and ethically.

Quick Answer: What is a Compliance Management System?

- Definition: Collection of tools, processes, and controls for managing regulatory compliance

- Core Purpose: Learn responsibilities, ensure understanding, incorporate requirements, review operations

- Key Components: Board oversight, compliance program, audit function

- Main Benefits: Risk reduction, cost savings, operational efficiency, improved trust

In today’s business world, staying compliant isn’t just about following rules, it’s about survival. With legislation changing over 50,000 times per year, companies face an overwhelming maze of regulations that can shift without warning.

The stakes couldn’t be higher. Consider Binance’s staggering $4.3 billion fine for violating anti-money laundering rules, or Meta’s $1.3 billion penalty for GDPR violations. These aren’t isolated incidents, they’re wake-up calls showing what happens when compliance fails.

But here’s the surprising truth: 85% of consumers now consider a company’s data privacy policies before making purchases. This means compliance isn’t just about avoiding penalties anymore. It’s become a competitive advantage that builds trust and drives growth.

For busy HR managers juggling complex regulations like E-Verify requirements, a well-designed compliance management system transforms chaos into clarity. Instead of reactive firefighting, you get proactive protection.

The organizations positioning themselves for success aren’t just meeting compliance requirements, they’re using robust systems to streamline operations, reduce costs, and build unshakeable trust with customers and regulators alike.

What Exactly Is a Compliance Management System (CMS)?

Have you ever wished your business had a built-in GPS for all those tricky rules and regulations? Well, in a way, it can! A compliance management system (CMS) is just that – a comprehensive, integrated framework designed to help your organization steer the complex world of legal, regulatory, and internal policy obligations.

Think of a CMS as your business’s internal navigation system. It’s a smart collection of tools, clear policies and procedures, internal controls, and repeatable business processes. All these pieces work together to reduce compliance risk and make sure your team meets its responsibilities. It’s about keeping your business running smoothly, ethically, and most importantly, legally. For a deeper dive into how we can support your workplace compliance needs, be sure to explore our Workplace Compliance Solutions.

This smart system helps you centralize and even automate many key compliance tasks. From sharing new policies and checking controls, to reporting important data and tracking audits, a CMS brings it all together. It gives you a clear, real-time picture of where your compliance stands, making it a powerful tool for growth, not just a list of rules to check off.

The Core Purpose of a CMS

At its heart, a compliance management system serves several vital purposes for your business. It’s how your organization can truly:

- Understand its responsibilities: Stay up-to-date with a regulatory environment that’s always changing.

- Ensure everyone understands: Make sure your team, at every level, genuinely grasps these responsibilities. We’re talking about turning complex legal talk into clear, daily actions!

- Integrate requirements: Weave compliance requirements directly into your everyday business processes. This makes following the rules a natural part of what you do, rather than an afterthought.

- Review operations: Regularly check your operations to ensure responsibilities are being met and requirements are consistently followed.

- Take corrective action: Act quickly to fix issues and update materials or processes whenever problems pop up or regulations shift.

A strong CMS does more than just keep you out of trouble. It helps build a culture of integrity, encouraging ethical business practices and protecting your customers. Businesses that excel at building digital trust – through strong cybersecurity, data privacy, and responsible AI practices – often see their top and bottom lines grow by at least 10% each year. So, a well-implemented regulatory compliance management system doesn’t just prevent problems; it actively supports profitability and drives lasting growth.

Compliance Management vs. a Compliance Management System

It’s easy to mix up “compliance management” with a “compliance management system,” but there’s a key difference.

Compliance management is the bigger picture. It’s the overall strategy your organization uses to follow laws, regulations, and internal rules. Think of it as the “what” you’re aiming for – your commitment to being compliant. It’s the broad approach that includes all the tools and processes you use.

A compliance management system, on the other hand, is the practical solution, the “how” you actually achieve that goal. It’s the structured framework, the organized collection of specific tools, defined business processes, and built-in internal controls that make your compliance strategy a reality. So, while compliance management is your destination, the CMS is the reliable vehicle that gets you there, helping you consistently reach and maintain your compliance goals.

The Anatomy of an Effective CMS: Core Components and Key Players

An effective compliance management system isn’t a single entity, but rather a dynamic interplay of interdependent elements. It requires a clear top-down approach, ensuring leadership sets the tone, robust operational execution, and independent verification through audits.

The Three Pillars of a Strong CMS

At the foundation of every strong CMS are three critical pillars:

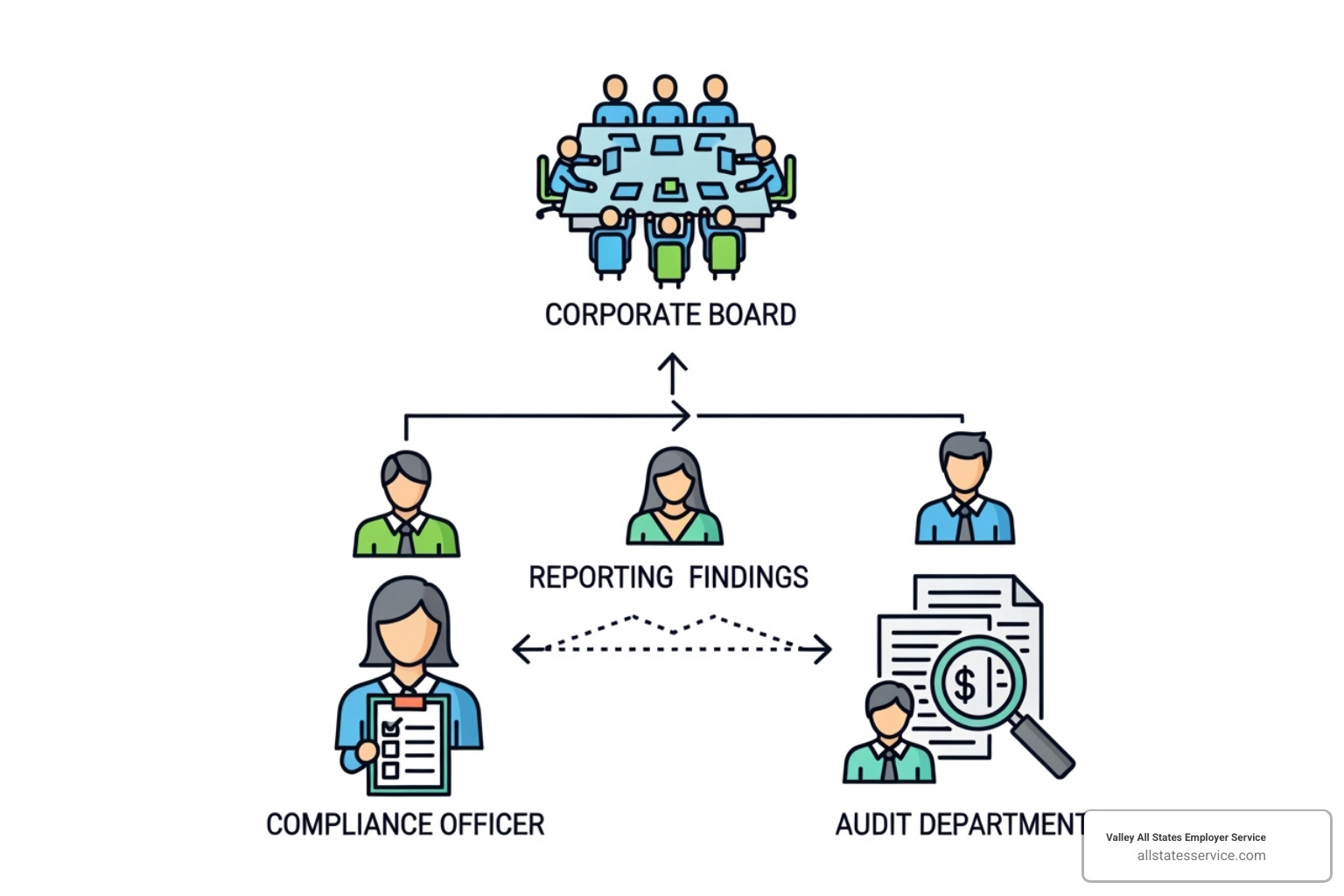

- Board and Management Oversight: This is where the “tone from the top” is set. The Board of Directors and senior management are ultimately responsible for establishing clear expectations regarding compliance, adopting robust policy statements, and allocating sufficient resources to the compliance function. They also ensure periodic audits are conducted and receive regular reports on compliance status.

- Compliance Program: This is the operational engine of the CMS. It includes the policies and procedures that define how compliance is achieved day-to-day, comprehensive training for employees, ongoing monitoring activities to identify weaknesses proactively, and a structured process for responding to consumer complaints.

- Compliance Audit: This pillar provides independent assurance. A compliance audit is an impartial review of an organization’s adherence to consumer protection laws, regulations, and internal policies. It assesses the effectiveness of the compliance program and reports findings directly to the Board or a designated committee, ensuring accountability and continuous improvement.

Key Roles and Responsibilities

For a CMS to function effectively, clear roles and responsibilities must be defined across the organization:

- Board of Directors: Holds the ultimate accountability for the CMS. Their responsibilities include setting the risk appetite, approving major compliance policies, appointing a qualified compliance officer, and ensuring adequate resources are dedicated to compliance.

- Senior Management: Tasked with executing the Board’s compliance vision. They allocate resources, implement policies, and ensure compliance is integrated into operational processes.

- Compliance Officer: This individual (or team) leads the compliance function. Their duties include developing policies, assessing risks, customizing the CMS, leading training initiatives, handling complaints, liaising with auditors, and reporting to both management and the Board. They need sufficient authority and independence to cross departmental lines and effect corrective action.

- All Employees: Every single employee plays a vital role in maintaining an organization’s compliance posture. This includes adhering to policies, participating in training, and reporting suspected violations. For support in this area, check out our HR Compliance Assistance.

Frameworks and Standards: The Role of ISO 37301

In the globalized business world, adhering to internationally recognized standards can significantly bolster a CMS. ISO 37301 is an international standard for compliance management systems that provides comprehensive guidelines for establishing, developing, implementing, evaluating, maintaining, and improving an effective and responsive CMS within organizations.

Implementing ISO 37301 demonstrates a strong commitment to ethical business practices and regulatory adherence, helping to mitigate risks, foster a culture of integrity, and improve organizational governance and reputation. It’s a powerful way to build trust among stakeholders, signaling that your organization operates according to global best practices. You can learn more about this standard directly from ISO 37301:2021.

Why Your Business Can’t Afford to Ignore Compliance

Imagine trying to build a strong house without a solid foundation. It might stand for a bit, but one big storm could bring it all down. That’s a bit like running a business without paying close attention to compliance. You might get by for a while, but ignoring the rules can lead to some really big problems.

In today’s fast-moving business world, rules and laws are always changing. Did you know that legislation can change over 50,000 times each year? That’s a lot to keep up with! Without a clear plan, it’s easy to get lost. The risks of not being compliant are simply too great for any business to ignore.

We’re talking about serious issues like big financial penalties, a damaged reputation for your brand, and even stopping your normal business operations. These are just a few of the tough consequences you could face.

The Steep Consequences of Non-Compliance

Let’s get real about what happens when compliance takes a backseat. The stories are powerful reminders, and they show us why it’s so important to have a strong compliance management system in place.

First, there’s the litigation risk. If you don’t follow the rules, you could end up facing expensive lawsuits. These can come from customers, employees, or even other businesses. Legal battles can drain your time, money, and focus.

Then, think about the huge monetary penalties. Regulators aren’t afraid to hit hard when companies don’t comply. Remember when Binance faced a staggering $4.3 billion fine for breaking banking secrecy laws? Or when Meta was penalized $1.3 billion for GDPR violations? These aren’t just big numbers. They’re real blows that can seriously hurt even very large companies.

It’s not just about fines. Regulators can also take enforcement actions. This means they might restrict how you operate, demand that you fix specific problems, or even take away your business licenses. Such actions can stop your business dead in its tracks.

And perhaps the hardest hit of all? Your damaged reputation. People really care about how companies act. If your business has a compliance problem, it can quickly lose public trust. This means fewer loyal customers and a harder time finding great new employees. Think about it: 85 percent of consumers actually check a company’s data privacy policy before they even consider buying from them. That shows how much trust matters!

The Tangible Benefits of a Robust CMS

Okay, so we’ve looked at the tough stuff. But here’s the good news: having a strong compliance management system isn’t just about avoiding trouble. It’s about turning compliance into a real business advantage. It helps your company grow and shine!

First up, risk mitigation. A great CMS helps you find, check, and fix compliance risks before they become huge problems. This means fewer fines, fewer lawsuits, and keeping your good name intact. It’s like having a superpower that lets you see potential issues and deal with them early.

Then there’s improved trust. When you show that your business is serious about following rules and acting ethically, people notice. Your customers, investors, and even regulators will trust you more. This trust can lead to stronger business relationships and a loyal customer base. In fact, studies show that organizations with solid cybersecurity, data privacy, and responsible AI practices are more likely to see annual growth rates of at least 10% on their top and bottom lines.

Next, consider operational efficiency. A good CMS helps you make your everyday work smoother. By building compliance right into your regular tasks, you’ll save time and effort. This means less wasted work, lower costs, and a boost in overall productivity. Who doesn’t want that?

It also leads to informed decision-making. With a clear picture of your compliance health, you’ll have better information to guide your choices. You can put your resources where they’ll do the most good and chase new opportunities with confidence. You’ll know your compliance foundation is solid.

Finally, a robust compliance management system offers fantastic scalability. As your business grows and changes – maybe you enter new markets or offer new products – your CMS can grow right along with it. You won’t need to start from scratch every time. It’s built to adapt and keep you compliant, no matter what.

Your 6-Step Blueprint for Implementing a CMS

Implementing a compliance management system might seem like a monumental task at first glance. But don’t worry, approaching it with a clear, step-by-step blueprint makes it much more manageable. Think of this not as a one-time project, but as a continuous journey. It’s all about building a solid foundation, customizing it to fit your unique business, and getting everyone on board.

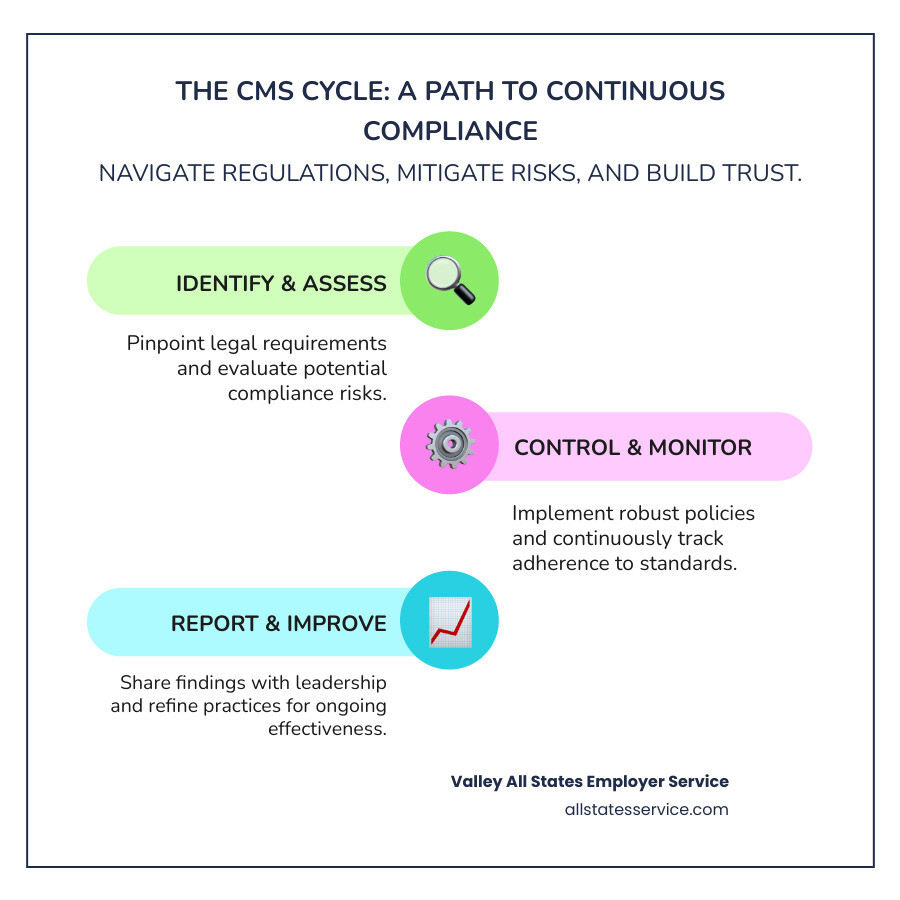

Step 1: Comprehensive Risk Assessment

The very first step is to truly understand your playing field. This means taking a good, hard look at your business environment. You need to pinpoint all the specific legal and regulatory requirements that apply to your operations. What are your biggest challenges? What areas pose the most risk? This comprehensive risk assessment helps you prioritize where to focus your efforts and how to best use your resources. Ready to dig deeper? Learn more about how to approach a Comprehensive Risk Assessment.

Step 2: Develop Policies and Controls

Once you know your risks, it’s time to build your defense. This involves creating clear, easy-to-understand policies and procedures. These documents should directly address the regulations and risks you identified, showing exactly how your organization will meet its obligations. It’s also crucial to assign specific roles and responsibilities for compliance tasks. Then, put internal controls in place. These are like built-in safeguards designed to prevent issues and catch any non-compliance quickly. For instance, when hiring, clear policies for verifying employment eligibility are key. Our guide to Employee Onboarding Compliance offers more details.

Step 3: Engage Stakeholders and Train Your Team

A compliance management system won’t work if no one knows about it or believes in it. Getting buy-in from key stakeholders, especially your Board of Directors and senior management, is essential. Their commitment sets the tone for the entire company. Just as important is educating your entire team. You need to train them regularly on their roles, why compliance matters, and how to use the CMS effectively. Training should be specific to each job function. This ensures everyone understands their part, from general policies to specialized tasks like E-Verify and I-9 processes, where precision is absolutely vital. This also helps define accountability, embedding compliance into your company’s culture.

Step 4: Implement and Integrate Technology

Technology truly is the backbone of an efficient compliance management system. Using compliance management software can centralize all your data, automate routine tasks, and give you real-time insights. This shifts your approach from simply reacting to problems to proactively identifying them. Make sure this new technology plays nicely with your existing business tools. Seamless integration means smoother operations and no more isolated data pockets. Our Automated Eligibility Verification System is a perfect example of how technology can streamline critical compliance tasks, cutting down on manual work and errors.

Step 5: Monitor, Audit, and Report

Think of your compliance management system as a living thing. It needs constant care and attention to thrive. This means continuously monitoring your operations to spot any weaknesses and ensure everyone is following policies and regulations. Regular audits, carried out by an independent party, give you an unbiased look at how well your compliance program is working. These audits check your controls, review processes, and even sample transactions to find any gaps. Most importantly, the findings from both monitoring and audits must be clearly reported to leadership. This way, they can make informed decisions and take quick action to fix any issues. For example, with employment verification, strong monitoring and regular checks, sometimes with our I-9 Verification Assistance, keep everything running smoothly.

Step 6: Commit to Continuous Improvement

Finally, a truly effective compliance management system is never really “finished.” It’s a journey of continuous improvement. You should analyze any incidents or near-misses to learn from them. Update your policies and procedures as regulations change or your business evolves. This means staying flexible and adapting to new rules as they come out. Fostering a strong compliance culture means you’re always looking for ways to make your system better, proactively address weaknesses, and adapt to new challenges. This ongoing commitment ensures your CMS remains robust, relevant, and ready for anything.

Overcoming Problems: Common Challenges and Modern Solutions

Let’s be honest, implementing a compliance management system isn’t exactly a walk in the park. Even the most well-intentioned organizations find themselves wrestling with resource constraints, drowning in regulatory updates, and struggling to make new systems play nicely with their existing technology. It’s like trying to solve a puzzle where the pieces keep changing shape.

Common Implementation Challenges

The road to effective compliance management is paved with predictable obstacles. Lack of resources tops the list for most organizations. Between tight budgets and overstretched teams, finding the time and money for compliance initiatives can feel impossible. You’re not alone if you’ve ever thought, “We know we need this, but where do we find the bandwidth?”

Then there’s employee resistance, which is completely understandable. Nobody wakes up excited about new policies and procedures, especially when they already feel overwhelmed. Change is hard, and when employees see compliance as just another item on their endless to-do list, pushback is inevitable.

The complexity of regulations doesn’t help matters. Legal language wasn’t designed for everyday understanding, and trying to translate dense regulatory requirements into actionable steps can leave even seasoned professionals scratching their heads. Add to this the challenge of integrating systems across different departments and technologies, and you’ve got a recipe for frustration.

Perhaps most discouraging is the difficulty of maintaining momentum over time. Compliance isn’t a project with a clear finish line, it’s an ongoing commitment that requires sustained attention. This challenge is reflected in a sobering statistic: only 18% of companies have successfully tied together their risk and compliance activities. That means 82% are still struggling with integration, a clear sign that these challenges are widespread.

The Role of Technology in Your Compliance Management System

Here’s where things get exciting. Modern technology has transformed what’s possible with compliance management, turning what used to be manual drudgery into streamlined, intelligent processes. Compliance management software isn’t just a nice-to-have anymore, it’s become essential for organizations serious about staying ahead of regulatory requirements.

Automation handles the routine tasks that used to eat up hours of your team’s time. Policy approvals, control assessments, and routine reporting can all run in the background while your people focus on strategic work. Centralized dashboards give you that bird’s-eye view you’ve been craving, showing your entire compliance posture at a glance and highlighting problem areas before they become crises.

Real-time alerts act like your compliance early warning system. When regulations change or issues pop up, you know immediately instead of finding out weeks later during an audit. The reporting and analytics capabilities are game-changers too, generating audit-ready reports automatically and providing insights that help you make smarter decisions about where to focus your efforts.

The change from burden to competitive advantage happens when you leverage these tools effectively. Our comprehensive Compliance Management Solutions demonstrate how the right technology can turn compliance from a necessary evil into a strategic asset.

Ensuring Continuous Improvement of Your CMS

Think of your compliance management system as a living, breathing part of your organization. Just like any living thing, it needs regular care and feeding to stay healthy and effective. Regular reviews keep your system current and aligned with both regulatory changes and your evolving business needs.

Feedback loops create the communication channels that make everything work better. When employees can easily report concerns and compliance findings flow smoothly across the organization, you build a culture where problems get solved quickly instead of festering. Incident analysis turns setbacks into learning opportunities, helping you understand not just what went wrong, but why it happened and how to prevent it next time.

Proactive updates separate the leaders from the followers in compliance. Instead of scrambling to catch up when new regulations hit, forward-thinking organizations stay ahead of the curve, updating their policies and training materials before requirements become effective.

Evolving the program means your CMS grows smarter over time. You’re not just reacting to changes, you’re anticipating future risks and leveraging new technologies to stay one step ahead. This continuous improvement mindset transforms compliance from a defensive necessity into a competitive advantage that builds trust and drives growth.

Conclusion: From a Business Obligation to a Strategic Advantage

Here’s the thing about compliance management systems: they’ve quietly evolved from being a necessary evil into one of your most powerful business tools. What started as a way to avoid getting in trouble with regulators has become the secret weapon that smart companies use to outmaneuver their competition.

Think about it this way. While your competitors are scrambling to put out compliance fires, you’re building a fortress of trust with your customers. You’re streamlining operations while they’re drowning in paperwork. You’re future-proofing your business while they’re playing catch-up with every regulatory change.

The numbers don’t lie. Companies that nail their compliance strategy don’t just protect their bottom line, they actively grow it. When consumers are making purchasing decisions based on how well you handle their data and follow the rules, compliance becomes your competitive edge, not your burden.

Your compliance management system transforms from a cost center into a profit enabler. It builds the kind of unshakeable trust that turns one-time customers into lifelong advocates. It creates the operational efficiency that lets you scale without breaking a sweat.

But here’s where it gets really practical. For specialized areas like workforce eligibility verification, you don’t have to go it alone. Partnering with an expert like Valley All States Employer Service can be a game-changer, streamlining a critical part of your HR compliance. While you focus on growing your core business, our specialists handle the intricate details that could otherwise trip you up.

The regulatory landscape isn’t getting simpler anytime soon. But with the right framework in place, you’re not just surviving those changes, you’re thriving because of them. Every new regulation becomes an opportunity to demonstrate your commitment to doing business the right way.

Ready to transform your compliance from a headache into a competitive advantage? Learn more about our E-Verify Services and find how partnering with true experts can turn your most complex compliance challenges into your strongest business assets.