I-9 compliance guide: Master 3 Steps, Stay Compliant

Why Every HR Manager Needs This I-9 Compliance Guide

An I-9 compliance guide is essential for every U.S. employer. Federal law requires you to verify the identity and employment authorization of every person you hire. The rules are strict, and the penalties for non-compliance are severe.

Key I-9 Compliance Requirements:

- Who: All U.S. employers for every new hire.

- Section 1 Deadline: By the employee’s first day of work.

- Section 2 Deadline: Within three business days of the employee’s start date.

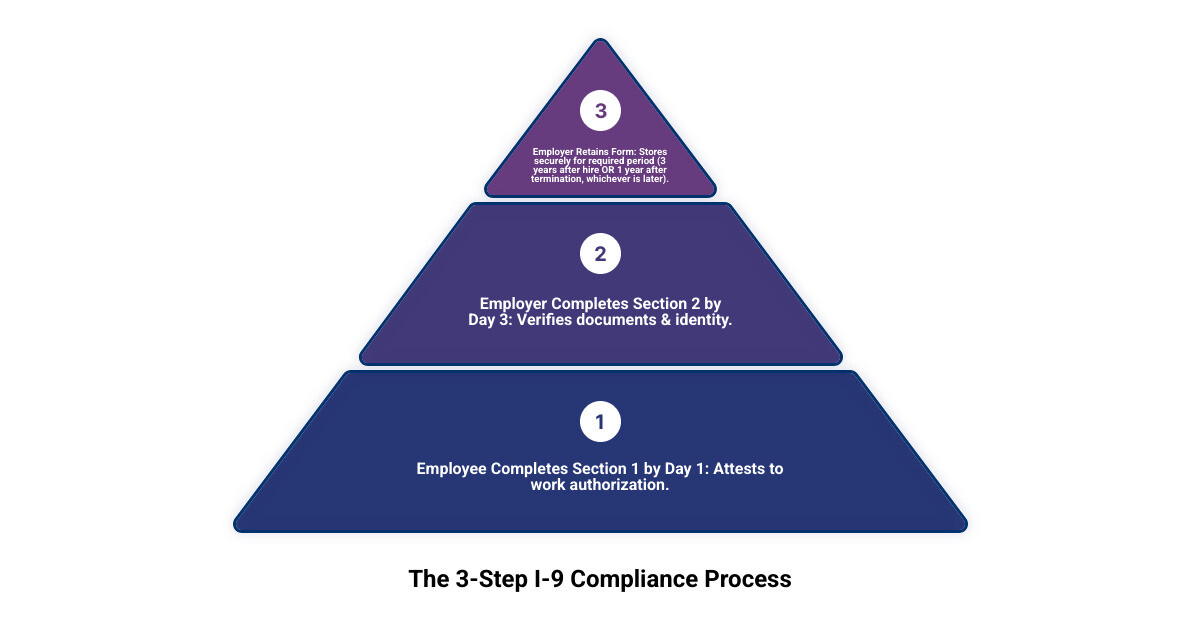

- Retention: Three years after hire date OR one year after termination, whichever is later.

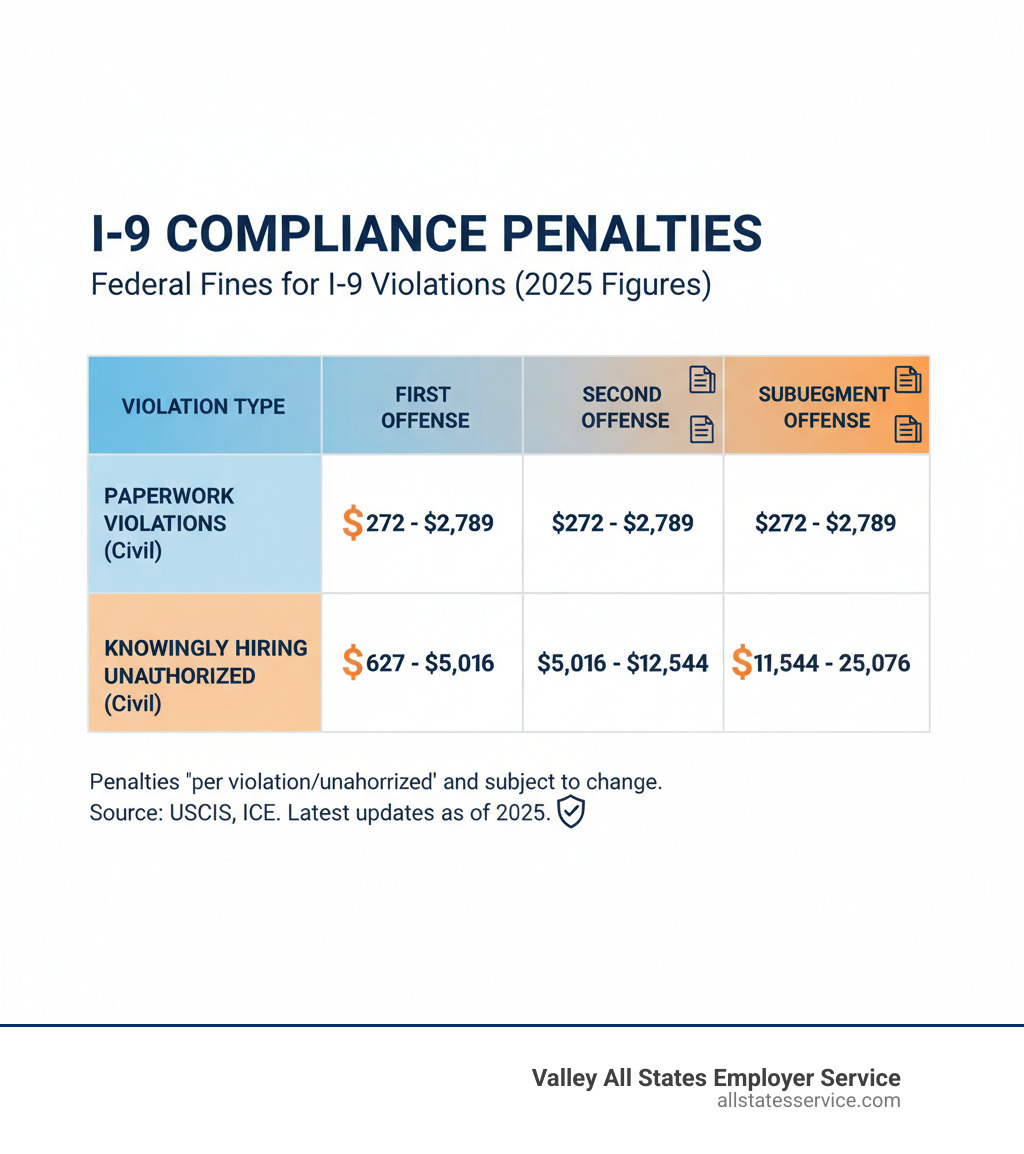

- Penalties: Fines from $272 to $2,789 per form for paperwork errors, and up to $25,076 per unauthorized worker.

For HR managers, Form I-9 can feel like a minefield. A single mistake, like a missing signature or a missed deadline, can trigger costly penalties. The form itself is short, but the rules are complex, and the government expects perfect execution every time.

Since the Immigration Reform and Control Act of 1986, employers must use Form I-9 to prove they are not knowingly hiring unauthorized workers. U.S. Citizenship and Immigration Services (USCIS) manages the form, while Immigration and Customs Enforcement (ICE) handles audits and enforcement.

This guide simplifies I-9 compliance, explaining what to do, when to do it, and how to avoid common mistakes that lead to audits.

What is Form I-9 and Why Is It So Important?

Form I-9 is the official document used to verify the identity and employment authorization of every new hire. It’s mandatory for all U.S. employers, stemming from the Immigration Reform and Control Act (IRCA) of 1986, which made it illegal to knowingly hire unauthorized workers.

Every new employee, whether a U.S. citizen or non-citizen, must have a completed Form I-9 on file. This isn’t casual paperwork; government audits are common, and penalties for errors are steep, costing thousands of dollars per violation. For a deeper dive, our guide on What is an I9? covers the fundamentals.

Employee and Employer Responsibilities

Completing Form I-9 is a two-part process with distinct roles for the employee and employer.

The employee’s role: By their first day of work, the new hire must complete Section 1. This includes providing personal information and attesting to their work authorization status by checking one of four boxes: U.S. Citizen, Noncitizen National, Lawful Permanent Resident, or Alien Authorized to Work. They must also present original, unexpired documents to prove their identity and work eligibility.

Your role as the employer: Within three business days of the employee’s start date, you must complete Section 2. This involves physically examining the documents your new hire presents to ensure they reasonably appear genuine and relate to the individual. You then record the document details on the form. You cannot accept photocopies (with rare exceptions) or tell an employee which documents to provide. Doing so is a form of discrimination known as document abuse.

For a detailed walkthrough of your duties, see our guide on Filling Out an I-9 Employer. You can also direct new hires to the official Form I-9, Employment Eligibility Verification Employee Information Sheet from USCIS.

The I-9 Verification Process: A Step-by-Step Breakdown

The I-9 process follows strict deadlines. Missing a step can lead to penalties, so it’s crucial to know the timeline. For a full walkthrough, see our I-9 Form Completion guide.

- Section 1 Deadline: The employee must complete Section 1 on or before their first day of employment.

- Section 2 Deadline: You have three business days from the employee’s start date to complete Section 2. For hires working less than three days, Section 2 is due on their first day.

Completing Section 1: The Employee’s Part

Section 1 is the employee’s responsibility. They provide their personal information and attest to their work status by checking one of four boxes: U.S. Citizen, Noncitizen National, Lawful Permanent Resident, or Alien Authorized to Work. They must provide their Alien Registration/USCIS number or work authorization details if applicable.

Accuracy is key, as incomplete forms are a common audit trigger. If an employee needs assistance, a preparer or translator can help but must complete Supplement A to certify their involvement. This step is a vital part of your New Hire Paperwork I-9 process.

Completing Section 2: The Employer’s Verification Duty

After the employee completes Section 1, your duty is to complete Section 2. You must examine the employee’s original, unexpired documents to verify they appear genuine and belong to the employee. You are not expected to be a document expert, just to use reasonable judgment.

You cannot accept photocopies (except for a certified copy of a birth certificate) or dictate which documents an employee provides. The employee chooses from the Lists of Acceptable Documents:

- List A: Documents that establish both identity and employment authorization (e.g., U.S. Passport, Permanent Resident Card).

- List B & C: A combination of one document from List B (identity, e.g., Driver’s License) and one from List C (work authorization, e.g., Social Security card).

After examining the documents, record the details in Section 2, sign, and date the form. Properly Verifying I-9 Documents is a cornerstone of compliance.

Your Complete I-9 Compliance Guide to Post-Verification Tasks

Completing the Form I-9 is just the beginning. This part of our I-9 compliance guide covers the critical post-verification tasks of retention, corrections, and maintenance.

You must retain each Form I-9 for three years after the date of hire or one year after employment ends, whichever is later. You can store forms as paper copies in a secure location or use an electronic system that meets DHS standards for integrity and accessibility. Our Electronic I-9 Solutions are designed to meet these requirements.

How to Handle I-9 Corrections and Internal Audits

Mistakes on Form I-9 can be fixed, but the method is important. To correct an error, draw a single line through the incorrect information, write the correct data, and then initial and date the change. Never use correction fluid or backdate changes. The employee corrects Section 1, and the employer corrects Section 2 or Supplement B.

Conducting internal I-9 audits is a smart, proactive step. These self-checks help you find and fix errors before a government inspection. When auditing, ensure your selection process is neutral and non-discriminatory. For more on this, see our guides on Auditing I-9 Forms and the I-9 Self Audit.

Managing Reverification and Rehires

Supplement B is used for reverification and rehires.

- Reverification: This is required when an employee’s temporary work authorization is about to expire. You must complete it on or before the expiration date. Importantly, you do not reverify U.S. Citizens, Noncitizen Nationals, or Lawful Permanent Residents.

- Rehires: If you rehire an employee within three years of their original I-9 date, you can update the existing form using Supplement B. If it has been more than three years or the form is outdated, complete a new Form I-9. Our I-9 Process for Rehires guide provides detailed instructions.

Navigating Modern I-9 Challenges: Remote Hires, E-Verify, and Updates

The modern workplace, with its remote and hybrid models, presents new I-9 compliance challenges. For remote hires, you can designate an authorized representative to complete Section 2 on your behalf. This can be a notary, a colleague, or another trusted individual, but you, the employer, remain liable for any errors. Our guide to Remote Employee I-9 Verification offers more details.

The New Rules for Remote I-9 Document Examination

As of August 1, 2023, DHS established a permanent alternative procedure for remote document examination. This allows qualified employers enrolled in E-Verify to inspect documents via a live video call. You must retain clear copies of the documents and note on the Form I-9 that you used this method. This is a game-changer for remote workforces. Learn more about if I-9 verification can be done remotely and the specifics of USCIS I-9 remote verification.

How E-Verify and I-9 Work Together

E-Verify is an internet-based system that complements Form I-9 by electronically confirming employment eligibility against federal databases. While voluntary for most employers, it is mandatory for many federal contractors and in some states. After completing the I-9, you enter the employee’s data into E-Verify. If a Tentative Nonconfirmation (TNC) occurs, you must notify the employee and allow them to resolve the discrepancy without taking adverse action. Explore more at E-Verify and I-9 or the official E-Verify I-9 Central site.

Staying Current: Latest I-9 Updates and Alerts

Employment eligibility rules change constantly. A good I-9 compliance guide must stay current. Always use the latest version of Form I-9 and be aware of updates to immigration statuses like Temporary Protected Status (TPS), which often include automatic extensions of Employment Authorization Documents (EADs). Regularly check official sources like I-9 Central for the latest guidance and Federal Register notices.

Avoiding Pitfalls: Penalties, Discrimination, and Special Cases

Even with the best intentions, mistakes in your I-9 compliance guide adherence can lead to government inspections. ICE audits are a real risk for any business, and they can be triggered by anything from routine checks to employee complaints. An audit involves a thorough review of your I-9 records, and errors can be costly. Our ICE I-9 Audit page explains what to expect.

The High Cost of Non-Compliance: Penalties and Fines

I-9 penalties are severe and designed to ensure compliance. They fall into two main categories:

- Paperwork Violations: Technical errors like incomplete forms or missed deadlines can result in fines from $272 to $2,789 per form.

- Knowingly Hiring Unauthorized Workers: This is a far more serious offense, with civil penalties from $627 to $25,076 per worker. A pattern of violations can even lead to criminal charges.

Fines escalate for repeat offenses. For a full breakdown, see our I-9 Compliance Penalties page.

| Violation Type | First Offense (per violation/worker) | Second Offense (per violation/worker) | Subsequent Offense (per violation/worker) |

|---|---|---|---|

| Paperwork Violations (Civil) | $272 – $2,789 | $272 – $2,789 | $272 – $2,789 |

| Knowingly Hiring Unauthorized (Civil) | $627 – $5,016 | $5,016 – $12,544 | $12,544 – $25,076 |

Note: These figures are subject to change based on inflation adjustments.

The Anti-Discrimination Provisions: A Critical Part of the I-9 Compliance Guide

The I-9 process includes strict anti-discrimination rules. Violating them is as serious as a paperwork error. Key pitfalls to avoid include:

- Document Abuse: Never specify which documents an employee must present. They have the right to choose from the Lists of Acceptable Documents.

- Citizenship or National Origin Discrimination: You must apply the same I-9 process uniformly to all employees, regardless of their citizenship, immigration status, or national origin.

Consistency is your best defense. The official Handbook for Employers: M-274 provides detailed guidance on avoiding discrimination, as does the Department of Justice’s guidance on avoiding unlawful discrimination when using electronic I-9 systems.

Special Rules for Agricultural Recruiters

Agricultural recruiters and referrers for a fee have specific I-9 obligations. They must complete Form I-9 for each person they recruit or refer, following the standard deadlines. However, the retention rule is different: they must keep the form for three years after the first day of employment, regardless of employment duration.

Frequently Asked Questions about I-9 Compliance

Here are answers to common questions that will strengthen your I-9 compliance guide knowledge.

Can I accept a photocopy of a document for Form I-9?

No, photocopies are not acceptable. You must examine original documents to complete Section 2. The only exception is a certified copy of a birth certificate. All other documents must be originals, viewed either in person or via the approved remote procedure.

What if an employee presents an expired document?

Expired documents are not acceptable for Form I-9 verification. All documents must be unexpired when you complete Section 2. Politely inform the employee and ask them to provide a different, valid document from the Lists of Acceptable Documents. Specific automatic extensions for certain documents are rare and announced in the Federal Register.

What do I do if I forgot to complete an I-9 for an employee?

If you find a missing I-9, complete a form immediately. Have the employee fill out Section 1 and you complete Section 2 using the current date. Do not backdate the form, as this is considered falsification. Attach a brief, signed note explaining the oversight and the date the form was completed. This demonstrates good faith.

For official guidance, always refer to USCIS resources like I-9 Central and the Handbook for Employers: M-274.

Simplify Your I-9 and E-Verify Process

Maintaining strict I-9 compliance guide standards is a demanding, full-time job. Tracking deadlines, managing remote hires, and staying current on regulatory changes can overwhelm even the most dedicated HR team. A single error can lead to significant penalties.

I-9 and E-Verify compliance is a specialized skill that requires constant vigilance. For many employers, the administrative burden is simply too high to manage in-house.

That’s where Valley All States Employer Service comes in. Our mission is to provide expert, impartial, and efficient E-Verify workforce eligibility verification. We help businesses minimize errors and administrative overhead, freeing your HR team to focus on building great teams.

Partnering with us gives you peace of mind. Our specialists handle your I-9 and E-Verify processes, ensuring they are streamlined, secure, and always compliant with the latest regulations. We reduce your risk of costly penalties and help you manage the complexities of a modern workforce with confidence.

Ready to simplify compliance and safeguard your business? Explore our Form I-9 Ultimate Guide for more in-depth information. Contact our team today to learn how we can take the I-9 and E-Verify burden off your shoulders.