Legal employment verification: Mastering 2025 Compliance

Why Legal Employment Verification Protects Your Business

Legal employment verification is the process of confirming a job candidate’s work history, eligibility, and credentials while following federal and state laws. Here’s what you need to know for compliance:

Key Legal Requirements:

- Get written consent before conducting third-party background checks (FCRA)

- Follow anti-discrimination laws during the verification process (Title VII)

- Use E-Verify for work authorization confirmation (if required)

- Provide adverse action notices when denying employment based on verification results

- Maintain consistent processes for all candidates to avoid legal liability

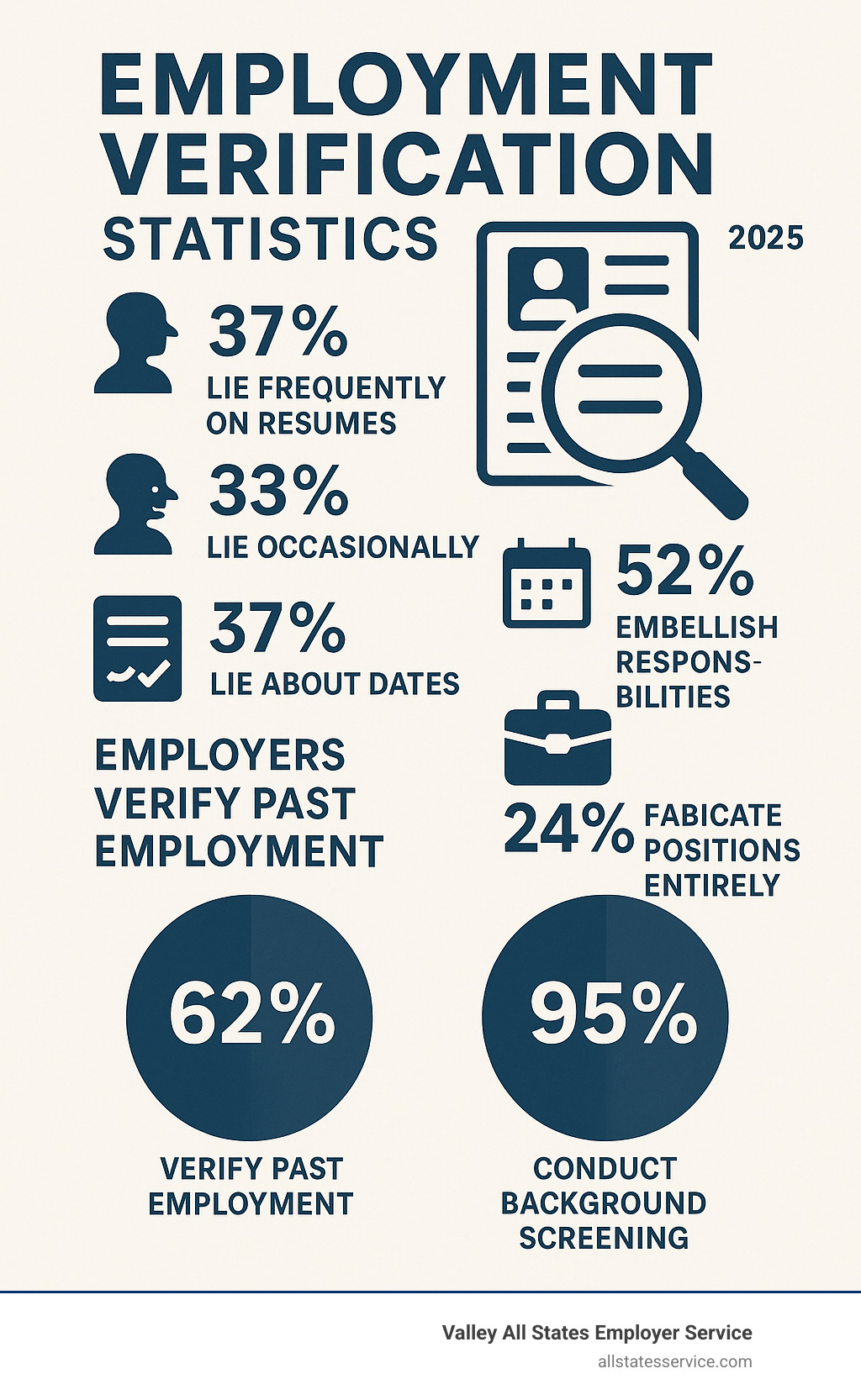

The numbers tell a sobering story about why verification matters. Research shows that 37% of people lie frequently on their resumes, while another 33% admit to lying at least once. Even more alarming, 52% of job seekers embellish their responsibilities, 37% lie about employment dates, and 24% completely fabricate positions.

Yet despite this widespread resume fraud, only 62% of employers actually verify past employment, even though 95% conduct some form of background screening.

This gap creates real risk for your business. When you skip proper verification or do it incorrectly, you’re not just risking a bad hire. You’re potentially facing legal trouble, discrimination claims, and compliance violations that can cost thousands in fines and legal fees.

The good news? Legal employment verification doesn’t have to be complicated or time-consuming when you understand the rules and use the right processes.

Understanding the Basics: Verification vs. Reference Checks

Here’s where things get interesting. Many employers think employment verification and reference checks are the same thing. They’re not, and mixing them up can leave gaps in your hiring process that clever candidates might exploit.

Think of it this way: legal employment verification is like checking someone’s driver’s license to confirm they are who they say they are. Reference checks are like asking their friends what kind of driver they are. Both matter, but they serve completely different purposes.

Employment verification is all about cold, hard facts. Did this person really work at ABC Company from 2020 to 2023? Were they actually a Marketing Director, or just a Marketing Assistant with big dreams? Did they earn that $75,000 salary they listed on their application?

Reference checks dive into the subjective stuff. How well did they work with their team? Did they meet deadlines? Would you hire them again? These are opinion-based questions that help you understand what it might be like to actually work with this person.

Here’s the tricky part: many former employers have gone into “neutral reference” mode. They’re so worried about potential lawsuits that they’ll only confirm basic facts like job titles and dates. That means your reference check might not give you much more than a verification would anyway.

| Feature | Employment Verification | Reference Check |

|---|---|---|

| Purpose | Confirm factual employment history | Assess candidate’s character, skills, and performance |

| Information Sought | Dates of employment, job titles, salary (with consent) | Work ethic, teamwork, problem-solving, rehire eligibility |

| Nature of Information | Objective, verifiable facts | Subjective opinions, qualitative feedback |

| Source | HR departments, automated services, payroll records | Individuals provided by the candidate |

The bottom line? You need both, but verification should come first. There’s no point asking about someone’s performance if they never actually held the job they claim to have had.

What is an Employment Verification Letter?

An employment verification letter is basically your official stamp of approval that someone worked for your company. It’s a formal document that confirms the facts about an employee’s time with you, and it’s more important than you might think.

The purpose is simple: provide proof that someone actually worked where they say they worked. But the ripple effects are huge. Banks want these letters before approving mortgages. Landlords request them before handing over apartment keys. Immigration offices require them for visa applications. New employers need them to confirm resume details.

Key information in these letters includes the employee’s full name, exact job title, employment dates, and current status (like full-time, part-time, or contract work). Sometimes you’ll include salary information, but only with the employee’s written consent. Nobody wants their pay details floating around without permission.

Here’s what makes these letters so crucial: they build trust in a world where 37% of people frequently lie on their resumes. When you provide accurate, timely verification letters, you’re helping honest employees move forward with their lives while protecting other employers from potential fraud.

Getting these letters right is part of solid HR Compliance Assistance, and frankly, it’s just good business practice. Your current employees will appreciate your professionalism, and future employers will trust your company’s word.

Types of Verification and When to Use Them

Not all verification requests are created equal. Different situations call for different types of documentation, and knowing which one to use can save everyone time and headaches.

Proof of Employment Letters are your standard verification workhorses. These cover the basics like job title, employment dates, and current status. You’ll use these for loan applications where lenders need to confirm steady income, rental agreements where landlords want to verify financial stability, and background checks where new employers are fact-checking resumes.

Income Verification Letters take things a step further by including detailed salary information, bonuses, and commissions. These typically show up in high-stakes lending situations like mortgage applications, where every dollar of income matters for qualification purposes.

The I-9 Form is in a category all its own. This federal requirement applies to every single person you hire in the United States, regardless of citizenship status. It’s not just about verifying past employment, it’s about confirming someone’s legal right to work here in the first place. The process is detailed enough that we’ve created an entire guide on What is an I-9 Form? to walk you through it.

Unemployment Verification Forms serve a different purpose entirely. Former employees use these to prove their unemployment status when applying for benefits like unemployment insurance. They need documentation showing they actually worked for you and are now legitimately unemployed through no fault of their own.

The key is matching the right verification type to the specific need. A mortgage lender needs income details, but a new employer might only need employment dates. An immigration attorney needs comprehensive work history documentation, while an unemployment office needs proof of job loss. Getting this right the first time saves everyone from back-and-forth requests and delays.

The Core of Legal Employment Verification: Laws You Must Follow

Getting legal employment verification right isn’t just about checking boxes. It’s about understanding the legal landscape that protects both your business and the people you’re evaluating. When you skip these rules or handle them incorrectly, you’re opening your company to lawsuits, hefty fines, and serious reputation damage.

The truth is, employment verification touches on some of the most sensitive areas of employment law. We’re dealing with personal data, making decisions that affect people’s livelihoods, and navigating privacy rights. That means every step needs to follow strict legal guidelines.

What makes this particularly challenging is that these laws weren’t written specifically for HR professionals. They’re complex federal regulations that apply across industries. But here’s the good news: once you understand the key requirements, you can build processes that protect everyone involved.

The Role of the FCRA in Legal Employment Verification

The Fair Credit Reporting Act (FCRA) might sound like it’s only about credit reports, but it actually governs much more than that. Any time you use a third-party service to verify employment history, you’re operating under FCRA rules. This includes background check companies, verification services, and even automated systems that pull employment data.

Here’s what this means for your verification process. First, you need to provide clear disclosure to candidates before you run any background checks. This can’t be buried in fine print or mixed in with other documents. The FCRA requires a separate, standalone disclosure that clearly states you might obtain a background report.

Next comes written authorization. You must get the candidate’s signature on a form that gives you permission to run the check. No exceptions, no verbal agreements, no implied consent.

The tricky part comes if you decide not to hire someone based on what you find. The FCRA requires a specific adverse action process that gives candidates a chance to review and dispute any inaccuracies. You have to provide them with a copy of the report and explain their rights before making your final decision.

Companies that ignore these requirements face serious consequences. We’re talking about class-action lawsuits and federal fines that can reach into the millions. That’s why working with Pre-employment Background Check Companies that understand FCRA compliance is so critical.

Title VII and Anti-Discrimination Laws

Title VII of the Civil Rights Act might seem unrelated to employment verification, but it actually plays a huge role in how you conduct these checks. The law prohibits discrimination based on race, color, religion, sex, or national origin. Even a seemingly neutral verification process can create discriminatory outcomes if you’re not careful.

The key is consistency. You need to verify employment for all candidates using exactly the same process. If you’re more thorough with some applicants than others, or if you interpret discrepancies differently based on who the candidate is, you’re creating legal risk.

Unconscious bias is another major concern. Maybe you’re more likely to follow up on gaps in employment history for certain candidates, or you give some people the benefit of the doubt while questioning others more closely. These subtle differences can add up to a discrimination claim.

The Equal Employment Opportunity Commission (EEOC) takes these issues seriously, and violations can result in significant penalties. The solution is building verification processes that treat every candidate exactly the same way, focusing only on job-related information that’s consistent with business necessity.

Obtaining Consent for Legal Employment Verification

Getting proper consent isn’t just a nice-to-have. It’s often a legal requirement, and skipping this step can expose your business to serious privacy violations and lawsuits. Before you contact previous employers or use any third-party verification services, you need explicit written authorization from your candidate.

A good release form should spell out exactly what you’re planning to verify. This includes employment dates, job titles, salary information, and reasons for leaving. It should also identify who you might contact, whether that’s previous employers, educational institutions, or other references.

The form needs to explain why you’re gathering this information and how it will be used in your hiring decision. Transparency builds trust and helps ensure you’re only collecting data that’s actually relevant to the position.

Legal implications of skipping consent are severe. Depending on your state and the type of information involved, you could be violating privacy laws like the California Consumer Privacy Act or similar regulations. These violations can result in hefty fines and civil lawsuits that are expensive to defend.

Getting written consent protects both your candidates’ privacy and your business from liability. It shows you’re committed to ethical data handling and gives you a clear legal foundation for your verification activities. For comprehensive guidance on managing these requirements, Employer HR Compliance resources can help you build processes that work.

Best Practices for Conducting Verifications

Conducting thorough and compliant employment verifications is an art and a science. It requires attention to detail, adherence to legal guidelines, and a consistent approach. When done right, it protects your business and helps you make informed hiring decisions.

Our best practices revolve around transparency, consistency, and accuracy. We aim to gather the necessary information while respecting the rights of the candidate and maintaining legal integrity. This includes knowing what to ask, how to ask it, and what to do when discrepancies arise. Finding inaccurate or misleading information isn’t necessarily a deal-breaker, but how we handle it certainly can be. We always allow candidates a fair opportunity to explain any inconsistencies before making final decisions.

What to Include in a Verification Request

When we reach out to verify employment, whether directly or through a third-party, knowing exactly what information to request is crucial. We want to be thorough without overstepping or asking for information that is not legally permissible or directly relevant to the role.

Typically, a compliant employment verification request should seek:

- Confirmation of Employment: Did the individual work for the company?

- Job Titles Held: What positions did they hold?

- Start and End Dates: When did their employment begin and, if applicable, when did it end?

- Eligibility for Rehire: While often a sensitive question, some employers will answer if the employee is eligible for rehire, which can provide insight.

- Salary Confirmation: This is often provided only with explicit written consent from the candidate, as it is considered sensitive information.

It’s important to prepare targeted questions and stick to them to ensure consistency across all verifications. This helps avoid potential discrimination claims and ensures we gather only job-related information.

Responding to Verification Requests

Just as we conduct verifications, we also receive requests to verify the employment of our current or former employees. Our approach to responding to these requests is just as important for legal compliance and protecting our business.

Our company policy guides how we respond to these inquiries. Generally, it’s best practice to stick to factual, objective information to minimize legal risks, particularly those related to defamation. Providing a neutral reference, confirming only dates of employment and job titles, is a common strategy to avoid potential liability for negative comments.

If we’re providing an employment verification letter, using a consistent template is highly recommended. A template ensures that all necessary information is included, the format is professional, and legal disclaimers are present. This helps us avoid common mistakes such as omission and saves valuable time.

The implications of providing inaccurate or misleading information in an employment verification letter can be severe. If a third party relies on false information and suffers harm (e.g., denying a loan or a job offer based on malicious or negligent misstatements), it could lead to lawsuits. Conversely, withholding information that an employer is legally obligated to provide (though this is less common for general employment verification) could also create issues. Accuracy, truthfulness, and adherence to company policy are paramount.

Leveraging Technology for Efficient and Compliant Verification

The days of playing phone tag with HR departments and waiting weeks for employment verification letters are quickly becoming a thing of the past. Technology has revolutionized how we handle legal employment verification, making the process faster, more accurate, and surprisingly less stressful for everyone involved.

Think about it: manual verification processes are like trying to organize a dinner party through handwritten letters. It works, but wouldn’t you rather send a quick text? Automated systems and specialized third-party services are doing exactly that for employment verification, changing what used to be a paperwork nightmare into a streamlined, compliant process.

These technological solutions do more than just save time (though they definitely do that). They reduce administrative burden on HR teams who have better things to do than chase down employment records all day. They minimize human error because computers don’t accidentally transpose dates or forget to follow up on requests. Most importantly, they ensure consistent application of verification policies, which is crucial for staying compliant with anti-discrimination laws.

When you’re using an Automated Eligibility Verification System, you’re not just upgrading your technology. You’re upgrading your entire approach to workforce management.

How Automated Verification Services Operate

Let’s talk about one of the biggest game-changers in employment verification: large, automated verification services. These services have created massive, centralized employment databases that partner with millions of employers across the United States. It’s like having a direct line to employment records without all the bureaucratic runaround.

Here’s where it gets really interesting. Instead of your HR team spending hours fielding verification calls, these services operate as centralized databases that handle requests automatically. Employers feed their payroll data into the system regularly, and when someone needs employment verification (think lenders, landlords, or new employers), they can get instant digital verifications instead of waiting days or weeks for a response.

But here’s what makes these systems particularly smart: they put employees in control of their own data. Through a service’s employee portal, employees can access their data anytime they want. They can see exactly what information is on file and, more importantly, who’s been asking about them.

Disputing inaccuracies is built right into the system too. If someone finds incorrect information in their Employment Data Report, they can challenge it directly. They can even request an employment data freeze if they don’t want verifiers accessing their information through the system. It’s like having a privacy control panel for your work history.

This approach benefits everyone. Employers spend less time on administrative tasks, verifiers get the information they need quickly, and employees maintain control over their personal data. It’s efficiency with a human touch.

The Role of E-Verify in Workforce Eligibility

When we’re talking about confirming someone’s legal right to work in the United States, E-Verify is the gold standard. This federal system, run by the Department of Homeland Security in partnership with the Social Security Administration, takes the guesswork out of workforce eligibility verification.

E-Verify works hand-in-hand with the I-9 form integration process. After you complete the I-9 form with a new hire (which you’re already required to do), E-Verify takes that information and cross-references it with government databases to confirm work authorization. It’s like having a direct line to federal records to make sure everything checks out.

The system is remarkably fast, usually providing results within seconds. If there’s a match, you get a confirmation and you’re good to go. If there’s a discrepancy, the system flags it with what’s called a “Tentative Nonconfirmation,” giving the employee a chance to resolve any issues with their records.

While E-Verify isn’t mandatory for all employers nationwide, it is required for federal contractors and subcontractors. Some states have also made it mandatory for certain types of employers. Understanding E-Verify Employer Requirements can save you from compliance headaches down the road.

What makes E-Verify particularly valuable is its role in comprehensive workforce management. When you combine it with other verification processes, you create a robust system that protects your business while ensuring you’re hiring legally authorized workers. That’s why we specialize in helping employers steer E-Verify and I-9 compliance, taking the administrative burden off your shoulders so you can focus on what you do best.

Frequently Asked Questions About Employment Verification

We get it. Legal employment verification can feel overwhelming, especially when you’re trying to balance compliance with efficiency. These are the questions that land in our inbox most often, and we’re here to give you the straight answers you need.

Do most companies verify past employment?

Here’s something that might surprise you: while 37% of people admit to lying frequently on their resumes, most companies are actually doing their homework. Yes, the vast majority of employers verify past employment in some form.

The numbers tell the whole story. According to Thomson Reuters, an impressive 95% of employers conduct some kind of pre-employment background screening. More specifically, research from CareerBuilder found that 62% of employers specifically confirm past employment.

Why such high numbers? Simple. With resume fraud so common, verification has become essential due diligence. Smart employers know that a few phone calls or database checks now can save them from costly hiring mistakes later.

Can an employer refuse to provide an employment verification?

This one catches people off guard, but yes, an employer can generally refuse to provide detailed employment verification. There’s no federal law forcing private employers to share information about current or former employees beyond what they choose to disclose.

Many companies have adopted “neutral reference” policies for good reason. They’ll confirm basic facts like dates of employment and job title, but that’s it. No performance reviews, no detailed feedback, no personal opinions. This approach helps them avoid potential defamation lawsuits while still providing some useful information.

State laws can vary, though. Some states have specific requirements or protections about what information can be shared. And here’s an important exception: if the request comes with a signed release from the former employee or from a government agency with legal authority, the rules might change.

The bottom line? Having a clear, consistent company policy for handling verification requests protects everyone involved.

Can I charge an applicant a fee for their background check?

Absolutely not. This is one of those compliance issues where there’s no wiggle room. Under the Fair Credit Reporting Act (FCRA), employers must pay for any background checks or employment verifications they order. Charging applicants for these services is illegal and can land you in serious legal trouble.

Think of background checks as a cost of doing business, not something you can pass along to job candidates. The FCRA guidelines are crystal clear on this point, and violations can result in hefty fines and class-action lawsuits.

This rule makes sense when you think about it. Background checks benefit the employer by helping them make informed hiring decisions. It wouldn’t be fair to make candidates pay for something that primarily serves the company’s interests.

Conclusion: Making Compliance Your Competitive Advantage

Navigating the complexities of legal employment verification might seem daunting, but it’s an indispensable part of building a strong, compliant, and thriving workforce. From understanding the nuances of FCRA and Title VII to leveraging modern verification technologies, we’ve explored the essential components that protect your business and empower confident hiring decisions.

By embracing best practices—like obtaining proper consent, maintaining consistent processes, and accurately responding to requests—we not only mitigate legal risks but also foster a culture of fairness and integrity. The proactive approach to compliance transforms it from a mere obligation into a competitive advantage, allowing you to hire with clarity and peace of mind.

At Valley All States Employer Service, we understand these challenges intimately. We are experts in employment compliance and HR services, providing outsourced E-Verify workforce eligibility verification that is impartial, efficient, and designed to minimize errors and administrative burden. Our goal is to streamline your processes, ensuring you meet all legal requirements without getting bogged down in paperwork.

Ready to simplify your employment verification process and ensure seamless compliance? Learn how to streamline your Employee Onboarding Compliance with our expert assistance today.