Why New Hire Eligibility Matters for Every Employer

New hire eligibility determines which employees qualify for work authorization, benefits, and legal employment status. Getting this process right protects your business from costly compliance violations and ensures new team members receive the benefits they’re entitled to.

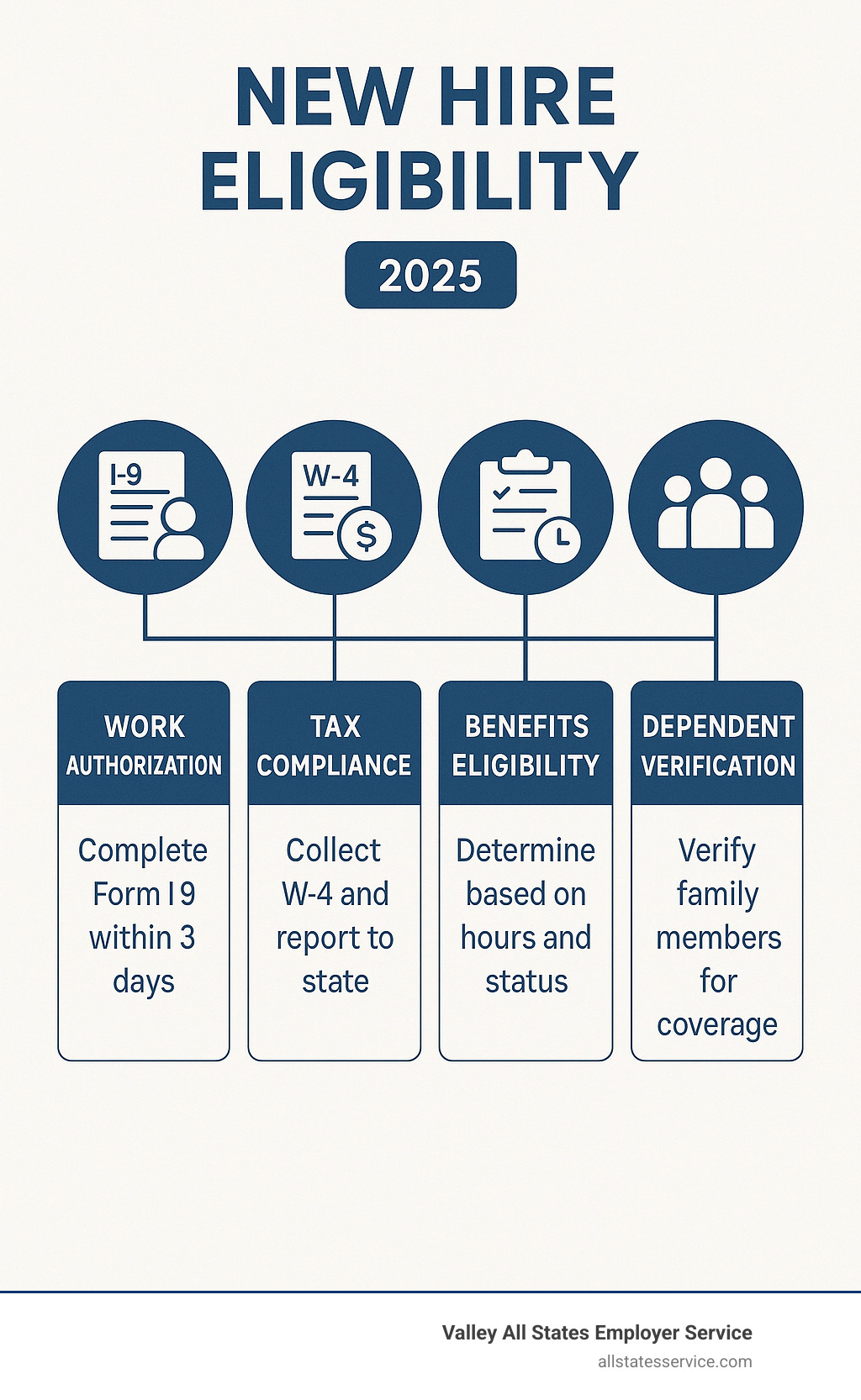

Quick Reference: Core New Hire Eligibility Requirements

- Work Authorization: Complete Form I-9 within 3 business days of hire.

- Tax Compliance: Collect W-4 forms and report new hires to state agencies.

- Benefits Enrollment: Determine eligibility based on hours worked and employment status.

- Dependent Coverage: Verify family member eligibility for health and insurance benefits.

The stakes for compliance are high. Federal guidelines make employers liable for errors on employment eligibility forms, with penalties ranging from hundreds to thousands of dollars per violation.

The challenge is that new hire eligibility isn’t a single task. It involves multiple federal and state forms, benefits calculations, and strict deadlines that vary by employee type and location.

However, understanding the key steps allows you to create a systematic approach for smoother, compliant onboarding. Whether you’re hiring full-time, part-time, or across multiple states, the fundamentals are the same.

Common new hire eligibility vocab:

Step 1: Verify Employment Authorization with Form I-9

The first crucial step in new hire eligibility is verifying that your new team member is legally authorized to work in the United States. This is done using Form I-9, Employment Eligibility Verification, a foundational piece of paperwork for every employee.

The Form I-9 process has strict deadlines you cannot miss:

- Section 1 (Employee): Must be completed and signed no later than the first day of employment.

- Section 2 (Employer): You must complete and sign this section within three business days of the employee’s start date. This involves reviewing documents that prove identity and work authorization.

Your new hire will choose which documents to present from the government’s official lists:

- List A documents: Prove both identity and employment authorization (e.g., U.S. Passport).

- List B and C documents: If no List A document is available, they must provide one from List B (proves identity, like a driver’s license) AND one from List C (proves authorization, like a Social Security card).

You cannot specify which documents an employee must provide. You must examine the documents, which can be done in person (physical document review) or via a remote examination following authorized DHS procedures, to ensure they appear genuine.

You can find the current form and instructions from USCIS: Employer use Form I-9, Employment Eligibility VerificationPDF.

Understanding Your I-9 and E-Verify Responsibilities

Completing Form I-9 is a serious legal requirement, and employers are liable for failures. This includes adhering to the anti-discrimination notice, which ensures you do not treat employees differently based on their citizenship or national origin during verification.

Completed Form I-9s must be retained for three years after the hire date or one year after termination, whichever is longer. They must be available for government inspection.

To add a layer of confidence, many employers use E-Verify, an online system that confirms employment eligibility against government records. While not mandatory for all employers, it is required for some federal contractors and in certain states. At Valley All States Employer Service, we offer expert E-Verify processing to minimize errors and reduce your administrative burden.

Learn more about our services for E-Verify and I-9 Compliance and Workforce Eligibility Verification.

Common I-9 Mistakes to Avoid

Small I-9 errors can lead to costly penalties. Here are common mistakes to avoid:

- Missed Deadlines: Forgetting the employee’s first-day deadline for Section 1 or the employer’s three-day deadline for Section 2.

- Incomplete Sections: Leaving fields blank or missing signatures and dates.

- Accepting Expired Documents: Documents for Section 2 must be unexpired.

- Over-documentation: Asking for more documents than required or telling an employee which specific documents to provide.

- Improper Reverification: Not using Supplement B for rehires or reverifications when appropriate.

Avoiding these errors is vital. Regularly conducting an I-9 Self-Audit can help you catch and fix issues. For more tips, check out our E-Verify Best Practices.

Step 2: Complete Essential Tax and Reporting Paperwork

Beyond work authorization, new hire eligibility involves essential tax and reporting paperwork. This step ensures correct payroll deductions and compliance with state reporting requirements.

Federal Tax Withholding (Form W-4)

New employees must complete Form W-4, Employee’s Withholding Certificate. This form tells you how much federal income tax to withhold from their wages. The employee is responsible for filling it out accurately.

For payroll, every employee needs a Social Security Number (SSN). An Individual Taxpayer Identification Number (ITIN) is not valid for employment. If an employee doesn’t provide a completed W-4, you must withhold tax as if they are single with no adjustments. You can learn more about Social Security number (SSN) verification.

State-Level New Hire Reporting

Employers must also report new hires to state agencies. This system helps states enforce child support orders and detect fraudulent unemployment or workers’ compensation claims.

You must report any individual for whom you complete an IRS Form W-2. The report typically includes the employee’s name, address, SSN, and hire date. Most states require this report within 20 days of hire.

If your company operates in multiple states, you can report new hires to each state individually or select one state to report all new hires. If you choose the latter, you must register as a multistate employer with the U.S. Department of Health and Human Services (HHS). This process is a key part of Employee Onboarding Compliance. Multistate employers can find more information on Online reporting for multistate employers.

Step 3: Steer Benefits Eligibility and Enrollment

After legal and tax paperwork, the next piece of the new hire eligibility puzzle is determining who qualifies for your company’s benefits package.

Defining Your Company’s New Hire Eligibility for Benefits

Unlike federal forms, benefits eligibility is largely determined by your company. Your company policy should clearly define who qualifies. Eligibility often depends on employee classification (full-time vs. part-time) and is linked to the number of hours worked per week. For example, the Affordable Care Act (ACA) generally defines a full-time employee as someone working at least 30 hours a week.

Many companies set an hours worked threshold or use a probationary period. For instance, an employer might offer benefits to associates working 30 or more hours per week, with coverage starting after a 30 or 90-day waiting period. It’s crucial to be transparent and share these guidelines clearly during onboarding. You can see different approaches from companies like Starbucks.

Understanding Waiting Periods and Enrollment Windows

Once an employee is deemed eligible, timing is everything. The initial enrollment period is the specific window, often 30 days from the hire date, when new employees can sign up for benefits.

The waiting period is the time after enrollment before benefits become active. Common waiting periods are 30, 60, or 90 days. The ACA sets a maximum waiting period for health insurance at 90 days.

If an employee misses their initial enrollment deadline, they typically must wait for the next annual open enrollment period. However, a Qualifying Life Event (QLE), like marriage or the birth of a child, allows them to enroll or change benefits outside of the standard windows. Since most eligible workers enroll in offered coverage, clearly explaining the timeline and effective dates is essential for helping new hires plan.

Step 4: Clarify Dependent and Family Member Eligibility

When discussing new hire eligibility for benefits, it’s not just about the employee, it’s often about their family too. Offering dependent coverage is a key part of a comprehensive benefits package, so understanding who qualifies is essential.

Who Qualifies as an Eligible Dependent?

The definition of an eligible dependent generally includes spouses, domestic partners, and children, but specific rules apply.

Most plans cover legally married spouses. Some companies also extend coverage to domestic partners, which may require an affidavit or other proof of the relationship.

Under the Affordable Care Act (ACA), if your plan offers dependent coverage, you must make it available to children up to age 26. This rule applies regardless of their marital, financial, or student status. The term “children” typically includes biological, adopted, stepchildren, and sometimes foster children.

If a child is unable to support themselves due to a disability that began before age 26, their coverage may extend beyond that age limit, usually with medical certification.

To prevent errors, many employers request documentation like marriage or birth certificates to verify dependent eligibility. It’s also important to note that when a dependent “ages out” of coverage, they usually have the option to continue it temporarily through COBRA, which acts as a bridge to new insurance.

Contrasting Private Sector vs. Federal Employee Eligibility

While the core principles of new hire eligibility apply everywhere, the process can look different in the private sector versus the federal government. Private companies have more flexibility, while the government follows a highly standardized plan.

The Process for Private Sector Employees

In private companies, benefits eligibility varies significantly. Each business designs its own benefits package, balancing costs, talent attraction, and employee needs. You’ll find a wide variety of company-specific plans for medical, dental, vision, and life insurance, often alongside 401(k) plans and Health Savings Accounts (HSAs).

Eligibility typically depends on employment status (full-time vs. part-time) and hours worked. Large employers (50+ full-time equivalent employees) must also comply with the Affordable Care Act’s (ACA) employer mandate, which requires offering affordable, basic health coverage. Companies must define their benefit rules in official documents like a Summary Plan Description (SPD) to ensure clarity.

The Process for Federal Employees

Federal employees receive a more standardized and comprehensive set of benefits managed by the U.S. Office of Personnel Management (OPM). This ensures consistency across all federal agencies.

New federal employees are typically eligible for a suite of benefits with a 60-day enrollment window. This includes the Federal Employees Health Benefits (FEHB) Program, which offers a wide selection of health plans, and the Federal Employees Dental and Vision Insurance Program (FEDVIP).

Life insurance is covered by the Federal Employees’ Group Life Insurance (FEGLI) Program, with basic coverage often being automatic. Other options include the Federal Flexible Spending Account Program (FSAFeds) for pre-tax health and dependent care savings and the Federal Long Term Care Insurance Program (FLTCIP).

For retirement, the Federal Employees Retirement System (FERS) includes Social Security, a Basic Benefit Plan, and the Thrift Savings Plan (TSP). The TSP is similar to a 401(k), with automatic agency contributions and matching funds. The predictable, broad coverage for federal employees contrasts sharply with the diverse, employer-specific packages in the private sector. You can learn more from the Federal Employees Health Benefits Program Handbook and the Thrift Savings Plan website.

Frequently Asked Questions about New Hire Eligibility

Employers often have common questions about new hire eligibility. Let’s tackle a few to clarify your responsibilities.

What are an employer’s record-keeping responsibilities for new hire documents?

Maintaining accurate records is a cornerstone of compliance. Here are the key requirements:

- Form I-9: You must keep this form for three years after the hire date, or for one year after employment ends, whichever is later. It’s wise to store these forms securely and separately from general personnel files.

- Form W-4: This tax form should be kept for at least four years after the employee leaves your company.

For other onboarding documents, follow your company’s record retention policy and any relevant state and federal laws. Proper record-keeping is a vital part of Employer HR Compliance.

Do I have to report a rehired employee?

This depends on how long the employee was away. Many states have a rule based on the break in service. For example, if an employee returns in less than 60 days, you may not need to report them as a new hire. If the break is longer, you typically must report them again with their new start date.

For Form I-9, if you rehire an employee within three years of their original I-9 completion date, you may be able to use Supplement B to reverify their employment authorization instead of completing a new form. Otherwise, a new Form I-9 is required.

Are independent contractors subject to new hire eligibility rules?

No, independent contractors are not subject to the same rules as employees. An “employee” receives a Form W-2, while an “independent contractor” is self-employed and receives a Form 1099-NEC. You do not need to complete a Form I-9 for independent contractors, nor are they subject to state new hire reporting requirements.

Misclassifying an employee as a contractor can lead to significant penalties, so it’s critical to understand the distinction.

Simplify Your Onboarding and Ensure Compliance

Understanding new hire eligibility can seem complex, but breaking it down into manageable steps makes it achievable. By ensuring work authorization, handling tax forms, and clarifying benefits, you can build an onboarding process that is both compliant and welcoming.

Getting this right protects your business from costly errors and helps new employees feel supported from day one. It’s the foundation of a successful working relationship.

Here at Valley All States Employer Service, we make this journey easy. We specialize in expert, impartial, and efficient E-Verify workforce eligibility verification. We handle the heavy lifting and minimize errors, lifting the administrative burden so you can focus on growing your team.

Ready to transform your onboarding process? Let us help you ensure every new hire starts on the right foot.

Streamline your process with an Automated Eligibility Verification System.