New Hire Paperwork I-9: Master 3 Crucial Steps

What is Form I-9 and Why is it Crucial for New Hires?

New hire paperwork i 9 refers to Form I-9, the federal Employment Eligibility Verification form every U.S. employer must complete for each new hire. This required step verifies identity and work authorization and helps you stay compliant with immigration law.

Quick Answer: Essential I-9 Requirements

- Who: All U.S. employers must complete Form I-9 for every new hire

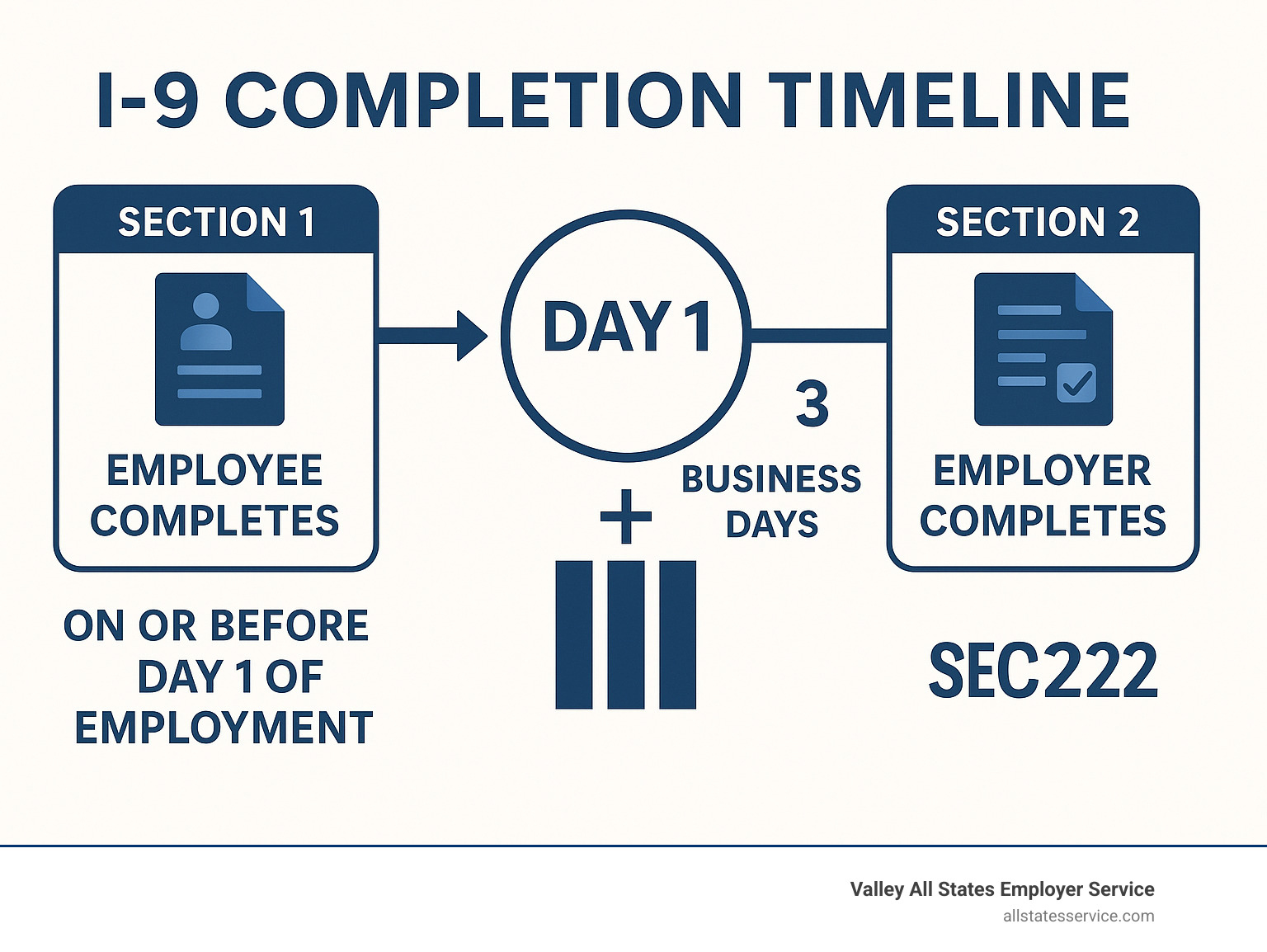

- When: Employee completes Section 1 on or before their first day; employer completes Section 2 within 3 business days

- Purpose: Verify identity and employment authorization

- Documents: Employee chooses from List A (identity + work authorization) OR List B (identity) + List C (work authorization)

- Retention: Keep forms for 3 years after hire date or 1 year after termination, whichever is later

Form I-9 is your legal shield. Federal law requires every employer who recruits, refers for a fee, or hires in the U.S. to complete this employment eligibility verification form for each new hire.

The stakes are high. Incomplete or incorrect I-9 forms can result in fines from hundreds to thousands of dollars per form. Missing the three-day deadline for Section 2 completion is another compliance violation that could cost your business significantly.

When you understand the process and follow the rules, I-9 compliance becomes a straightforward part of your onboarding routine. The form helps you verify that new employees are legally authorized to work while protecting both your business and their rights.

A Step-by-Step Guide to Completing the New Hire Paperwork I-9

Navigating the new hire paperwork I-9 might seem daunting, but it’s manageable once you understand the steps. The process has clear responsibilities for the employee and employer, and our goal is to make sure you’re confident handling this crucial document.

The Form I-9 is structured into sections with distinct purposes. This division streamlines the process and clarifies responsibilities. Let’s explore each part.

Employee’s Role: Completing Section 1

The Form I-9 journey begins with your new employee. Section 1, “Employee Information and Attestation,” is their responsibility. This section must be completed and signed by the employee on or before their first day of employment for pay. They can fill it out earlier, but only after accepting your job offer. This prevents asking for sensitive information before a formal employment relationship begins.

In this section, the employee provides personal details like their legal name, address, date of birth, and Social Security number (SSN). They must also attest under penalty of perjury to their citizenship or immigration status, declaring if they are a U.S. citizen, a noncitizen national, a lawful permanent resident, or an alien authorized to work. If they are not a U.S. citizen, they must provide additional information like their Alien Number, USCIS Number, Form I-94 admission number, or foreign passport number, and the expiration date of their employment authorization, if applicable.

We encourage employees to provide their email and phone number, especially if you use E-Verify, as this helps with communication about their case. However, this information is not required.

Employees have rights. You cannot discriminate based on national origin or citizenship. The Immigrant and Employee Rights Section (IER) at the Department of Justice enforces this. Employees also have the right to choose which acceptable documents to present from the official lists; you cannot demand a specific one. Upholding these rights fosters a fair and inclusive workplace. For more details, see our guide on New Hire Eligibility.

Employer’s Role: Completing Section 2

Once Section 1 is complete, it’s your turn. Section 2, “Employer or Authorized Representative Review and Verification,” must be completed within three business days of the employee’s first day of employment for pay. This tight deadline is a key compliance point.

Your role involves two critical steps: physically examining the employee’s documents and recording their information on the form. The employee will present one document from List A (for both identity and employment authorization) OR one document from List B (identity only) AND one from List C (employment authorization only).

When examining documents, you must ensure they reasonably appear genuine and relate to the employee. This requires reasonable judgment, not document expertise. Look for inconsistencies or alterations. Documents must be unexpired unless officially extended by the issuing authority.

After your examination, record the document title, issuing authority, document number, and expiration date (if applicable) in Section 2. You then sign and date the attestation, certifying you have examined the documents and that they appear genuine. You cannot specify which documents an employee must present. This is crucial to prevent discrimination.

For comprehensive guidance, we highly recommend consulting the official Handbook for Employers (M-274) from U.S. Citizenship and Immigration Services (USCIS). It’s an invaluable resource.

Understanding the Lists of Acceptable Documents

The backbone of the I-9 verification process is the “Lists of Acceptable Documents,” found on page 2 of the form. Understanding these lists is fundamental to correctly completing your new hire paperwork I-9.

Here’s a breakdown:

-

List A Documents: Establish Both Identity and Employment Authorization

- If an employee presents one document from List A, they need no other documents.

- Examples include:

- U.S. Passport or U.S. Passport Card

- Permanent Resident Card (Form I-551), often called a “Green Card”

- Foreign passport with a temporary I-551 stamp or printed notation

- Employment Authorization Document (EAD) that contains a photograph (Form I-766)

- For certain nonimmigrant aliens: a foreign passport with Form I-94 or Form I-94A with an endorsement of their nonimmigrant status.

-

List B Documents: Establish Identity Only

- If an employee chooses a document from List B, they must also present a document from List C.

- Examples include:

- Driver’s license or ID card issued by a state

- School ID card with a photograph

- Voter’s registration card

- U.S. Military card or draft record

-

List C Documents: Establish Employment Authorization Only

- If an employee chooses a document from List C, they must also present a document from List B.

- Examples include:

- U.S. Social Security card (without employment restrictions)

- Certification of Birth Abroad issued by the Department of State

- Original or certified copy of a U.S. birth certificate with an official seal

- Native American tribal document

- Employment authorization document issued by the Department of Homeland Security (DHS)

All documents must be unexpired. A receipt for a replacement document is generally acceptable for a temporary period. For the most up-to-date list, always refer to the Official list of acceptable documents on the USCIS website.

Navigating Common I-9 Challenges and Special Cases

Even with a clear understanding, the new hire paperwork I-9 can present unique challenges like remote employees, errors, and complex record keeping. We’re here to help you steer these tricky situations.

Staying compliant means being prepared. Let’s dig into common problems and their solutions.

Handling the I-9 for Remote Employees

Remote work adds complexity to I-9 compliance. Traditionally, employers physically examined documents, but that’s difficult with remote hires. There are a few options:

- Authorized Representative: You can designate an “authorized representative” to complete Section 2. This can be a trusted person, such as a notary public or colleague. They must physically examine the documents, complete Section 2, and return the form to you. This option works well for many.

- DHS-Authorized Alternative Procedure: Since August 1, 2023, DHS offers a permanent alternative for E-Verify employers. You can remotely examine documents via a live video call after the employee transmits copies. You then create an E-Verify case. This is a game-changer for remote hiring.

- Third-Party Services: Employers can use a third-party service, like us, to handle remote I-9 verification. This ensures expert, efficient processing, minimizing errors and administrative work.

Regardless of the method, the documents must be examined and the information recorded correctly. For more in-depth guidance, explore our pages on Details on Remote Form I-9 and Ensuring Remote I-9 Compliance.

What Happens if Your New Hire Paperwork I-9 is Late or Incorrect?

Sometimes, despite best intentions, an I-9 is late or has errors. The consequences can be significant, with U.S. Immigration and Customs Enforcement (ICE) imposing substantial fines for non-compliance.

- Late Completion: If Section 2 is not completed within three business days of the start date, it’s a violation. Complete it immediately and attach a dated explanation for the delay.

- Incorrect Information/Missing Fields: Fines for incomplete or incorrect I-9s can range from hundreds to thousands of dollars per form. Even small omissions can render the form non-compliant.

- Substantive Violations: These are serious errors, like failing to verify identity or employment authorization, and can lead to higher fines.

- Knowingly Hiring Unauthorized Workers: This is the most severe violation, carrying criminal penalties, including large fines and even imprisonment.

If you find an error, act quickly. Correct it by crossing out the wrong information, adding the correct data, and initialing and dating the change. Never use correction fluid. For best practices, see the USCIS website. To delete an I-9, which is rare, contact USCIS or a legal expert.

We strongly recommend regular I-9 self-audits to identify and correct errors before a government audit. To dig deeper, read our guide on Understanding I-9 Compliance Penalties.

Proper I-9 Retention and Storage Rules

Completing the Form I-9 is the first step. Proper retention and storage are also crucial for compliance. The rules are specific:

- Retention Period: You must retain each completed Form I-9 for three years after the date of hire, or for one year after employment is terminated, whichever is later.

- Accessibility for Inspection: Forms must be available for inspection by authorized U.S. government officials, who typically provide at least three days’ notice.

When it comes to storage, you have options:

- Physical Storage: Keep paper forms securely in a locked cabinet, separate from other personnel files to prevent discrimination claims.

- Electronic Storage: Electronic systems can be efficient but must meet specific DHS standards for generation, storage, and security. Simply scanning a form may not be sufficient.

You don’t need to keep Page 2 (Lists of Acceptable Documents) with the form. Supplements A and B only need to be retained if they were used for that employee.

Proper record keeping is a cornerstone of I-9 compliance. For an in-depth look at best practices, check out our Guide to I-9 Record Keeping.

The Role of E-Verify in Modern I-9 Compliance

Think of E-Verify as your new hire paperwork I-9’s digital partner. It takes Form I-9 information and checks it against government databases for an extra layer of confirmation, like a second opinion from the federal government.

E-Verify is an internet-based system from DHS and the Social Security Administration. It’s valuable because it provides results in seconds. After completing Form I-9, you create an E-Verify case. The system responds quickly with statuses like “Employment Authorized” or “Tentative Nonconfirmation (TNC)” to guide your next steps.

Is E-Verify required for your business? For most employers, it’s voluntary. However, federal contractors with qualifying contracts must use it. Additionally, seventeen states mandate E-Verify for some or all private employers. If you fall into these categories, using E-Verify is the law.

Using E-Verify has extra requirements. Employees must provide their SSN in Section 1. List B documents must have a photo. Also, you must copy and keep any U.S. passport, passport card, Permanent Resident Card, or Employment Authorization Document presented.

E-Verify complements, not complicates, your I-9 process. It’s an added verification step that boosts confidence in your hiring and reduces the risk of hiring unauthorized workers, protecting you from penalties.

E-Verify supplements, but never replaces, Form I-9. You still need a properly completed I-9 for every new hire. The two systems work together for comprehensive verification, keeping you compliant.

Want to dive deeper? Check out the official E-Verify website for detailed guidance, or explore our resource explaining E-Verify and I-9 explained to see how they fit into your hiring workflow.

Frequently Asked Questions about Form I-9

We often hear the same questions from employers about new hire paperwork I-9. It’s understandable, as some rules can feel counterintuitive. Let’s tackle the most common concerns to help you feel more confident.

Can I tell an employee which documents to provide for their I-9?

This is a common mistake, and the answer is a firm no. You cannot tell an employee which documents to provide. Suggesting specific documents, even to be helpful, is discriminatory under federal law.

The employee has the complete right to choose which acceptable documents to present from the official lists. They can provide one document from List A, or one from List B plus one from List C. The choice is theirs.

Specifying documents can be seen as treating employees differently based on national origin or citizenship. The Department of Justice takes this seriously, and violations can lead to substantial penalties.

Your role is to present the Lists of Acceptable Documents and let the employee decide. Resist making suggestions, even if you’re trying to help. This protects both you and your employees.

What if a new hire is waiting for their Social Security Number (SSN)?

This happens often, especially with new workers or recent immigrants. The good news is there’s a clear process.

The employee should still complete Section 1 of Form I-9 on or before their first day of work. In the SSN field, they should write “SSN Applied For” instead of leaving it blank. You should attach a note to the employee’s I-9 form explaining the situation.

The employee can start working while waiting for their Social Security Number. Once they receive it, they must provide it to you promptly. You’ll then need to update their Form I-9 by crossing out “SSN Applied For,” writing in the actual number, and initialing and dating the change.

If you’re an E-Verify employer, you must wait to create the E-Verify case until you receive the employee’s SSN. When you create the case, note the reason for any delay beyond the typical three-day window.

Do I need to keep copies of the documents an employee shows me?

The answer depends on whether you use E-Verify, as the rules are specific.

If you don’t use E-Verify, you are not required to copy documents, but you can choose to. If you decide to make copies, you must do it consistently for all employees to avoid claims of discrimination.

If you do use E-Verify, the rules are more specific. You must make and keep copies of certain documents: U.S. Passports, U.S. Passport Cards, Permanent Resident Cards, and Employment Authorization Documents. These copies must be stored with the employee’s completed Form I-9.

For other documents, E-Verify employers aren’t required to make copies, but again, if you choose to, consistency is key. Apply your policy to everyone equally.

We always recommend storing any document copies securely with the I-9 form itself. This keeps everything organized and ready for an audit.

Conclusion: Simplify Your I-9 and E-Verify Process

The world of new hire paperwork I-9 doesn’t have to be overwhelming. While there are deadlines, document rules, and penalties, the right approach can make compliance a smooth part of your hiring process.

Every properly completed I-9 protects your business. It’s more than avoiding fines; it’s about building trust with employees and showing your commitment to the law.

Most I-9 mistakes happen when employers lack the right expertise. Small errors, like missing a deadline or accepting a wrong document, can lead to big problems and thousands in fines during an audit.

That’s where we come in. At Valley All States Employer Service, we’ve built our reputation on making employment compliance simple and stress-free. Our team specializes in outsourced E-Verify workforce eligibility verification, which means we handle the complex parts while you focus on growing your business.

We’ve seen it all: remote employees, questionable documents, tight hiring deadlines, and last-minute compliance questions. Our expert, impartial, and efficient processing takes the guesswork out of the equation. We minimize errors and reduce your administrative burden because we know what to look for and how to handle special situations.

When you work with us, you get a partner who understands that compliance isn’t just about following rules, it’s about protecting what you’ve worked so hard to build.

Ready to turn your I-9 and E-Verify process from a source of stress into a competitive advantage? We’re here to help you achieve seamless compliance with confidence and ease. Streamline your E-Verify and I-9 Compliance and find how much simpler employment verification can be.