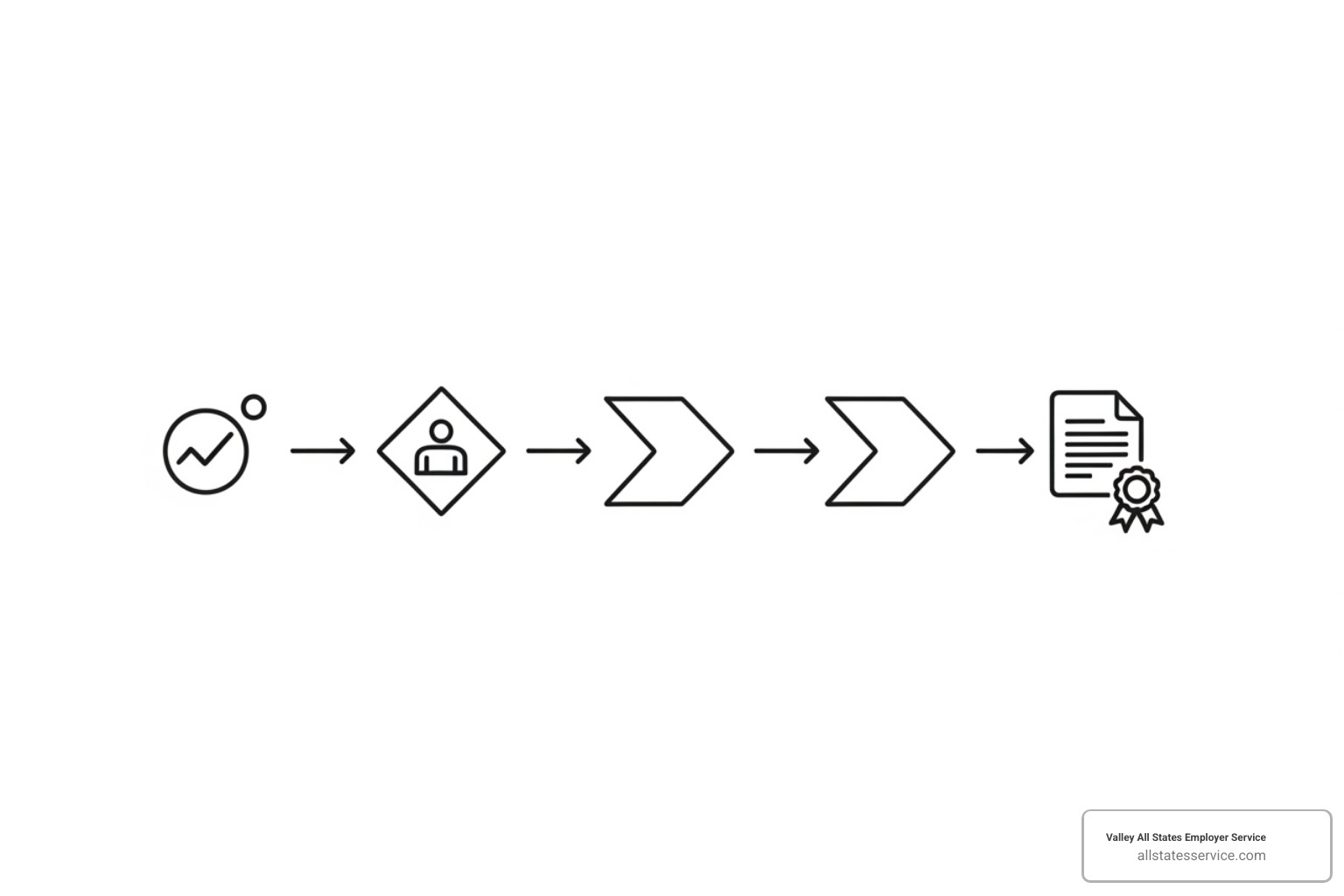

Employment verification process: 4 Seamless Steps

Why Employment Verification Is Non-Negotiable for Today’s Employers

The employment verification process is the systematic method employers use to confirm a candidate’s work history, job titles, employment dates, and eligibility to work in the United States. It involves collecting consent, contacting previous employers or using third-party services, verifying key information, and documenting findings to ensure accurate hiring decisions and legal compliance.

Here’s what the employment verification process typically includes:

- Obtaining candidate consent (required by law under FCRA)

- Confirming employment dates and job titles with previous employers

- Verifying work eligibility through I-9 and E-Verify systems

- Documenting findings for compliance and record-keeping

- Handling discrepancies fairly and transparently

According to a survey report by CareerBuilder, 58% of employers have caught a lie on a resume. That’s more than half of all hiring managers who’ve finded candidates inflating job titles, fudging employment dates, or exaggerating responsibilities.

In a competitive job market, the pressure to hire quickly is intense. Rushing the process without proper verification, however, can lead to bad hires, compliance violations, and serious reputation damage.

Employment verification is more than a box to check. It’s your first line of defense against resume fraud and a critical compliance requirement. Whether you’re a small business or a mid-sized company, getting verification right protects your business and ensures you’re hiring people who are who they claim to be.

What is Employment Verification? The Core Components

Let’s break down what the employment verification process actually means. It’s your hiring safety net, confirming that a job applicant’s work history is accurate and that they’re legally allowed to work in the United States. Instead of taking someone’s word for it, you’re doing your homework to make sure their resume matches reality.

When you verify employment, you’re looking at several key pieces of information:

First on the list are job titles and responsibilities. Did the candidate actually hold the position they claimed? These details are crucial for matching skills to your open role.

Next are employment dates. You’ll want to see if their start and end dates line up with their resume. Unexplained gaps aren’t deal-breakers, but they are worth understanding to get the full picture.

Salary information can be tricky to verify. Some states have laws preventing employers from releasing this data, so you must get proper consent and know the local rules. When legal, it helps confirm a candidate’s compensation history.

The reason for leaving a previous job offers valuable insight into a candidate’s motivations and potential cultural fit. Did they leave for career growth or were they laid off?

You might also check if the candidate is eligible for rehire. If a former boss would gladly take them back, that’s a strong signal about their performance.

Identity verification is a foundational step. Before checking work history, you must confirm a person is who they say they are, typically by checking government-issued IDs. This is critical for preventing fraud and meeting regulatory requirements.

Finally, there’s work eligibility. You must confirm a candidate has the legal right to work in the United States. This is where forms like the I-9 Form come in. Many employers also use E-Verify, an electronic system that checks eligibility against federal databases.

Benefits for Employers and Employees

The employment verification process creates real value for everyone involved. For employers, it’s an insurance policy against costly hiring mistakes.

Risk mitigation is a top benefit, as you reduce the chance of hiring someone who misrepresented their qualifications. This protects your company from wasted resources, legal headaches, and reputational damage.

Better hiring decisions come from having accurate information. When you know a candidate’s real experience, you can assess if they are the right fit, leading to a stronger, more capable workforce.

Compliance is essential. Employment verification helps you follow federal and state regulations, keeping you clear of fines and legal troubles.

Reduced turnover is another benefit. Employees who are a good fit are more likely to succeed and stay with your company longer.

Verification also helps candidates. A verifiable work history is crucial when they apply for a mortgage, lease, or personal loan. It can also help them access social services. For new hires, accurate data from day one ensures a smooth onboarding process. Some services even let employees access their own employment data reports to check for accuracy, giving them control over their information.

The Legal Landscape: Staying Compliant with FCRA and I-9 Rules

The legal side of employment verification is manageable once you understand the key regulations.

The Fair Credit Reporting Act (FCRA) is the big one. This federal law applies when you use a third-party service to run background checks that include employment verification.

Under the FCRA, you must get written consent from your candidate before you start any verification covered by the law. You need to provide a clear disclosure explaining that you’ll be conducting a background check, and the candidate needs to sign off on it.

The FCRA also requires a specific adverse action process. If you decide against hiring someone based on the background check, you cannot just send a rejection email. You must provide a pre-adverse action notice, a copy of the report, and a summary of their rights. This gives them a chance to review and dispute incorrect information before you make a final decision.

Beyond the FCRA, every employer in the United States must complete the I-9, Employment Eligibility Verification form for every new hire. This form confirms your new employee has provided acceptable documents proving their identity and authorization to work.

Many employers also participate in E-Verify, an internet-based system that electronically confirms work eligibility. If you want to make sure you’re doing everything right, our E-Verify and I-9 Compliance Guide walks you through the details.

Staying compliant isn’t optional. It’s the law, and it protects both your business and your employees.

A Step-by-Step Guide to the Employment Verification Process

Let’s walk through how the employment verification process works. A standardized approach ensures fairness and legal compliance. Most verifications take one to three days, but the timeline can stretch to weeks depending on employer responsiveness or a complex work history. International checks can take up to three weeks due to different record-keeping systems and local regulations.

What happens when something doesn’t add up, like mismatched dates or job titles? Our approach is to investigate fairly and communicate openly with the candidate. Before jumping to conclusions, we give individuals a chance to explain inconsistencies. Often, there is a reasonable explanation, like a company merger that changed job titles.

Throughout the entire process, clear communication with candidates is essential. They should know what to expect, how long verification might take, and who to contact if they have questions. This transparency builds trust and makes for a smoother hiring experience.

Method 1: The Manual Approach (DIY Verification)

Many businesses, especially smaller ones, handle verification themselves. This manual approach means your HR team calls or emails previous employers with a standard questionnaire about job titles, employment dates, and other details.

In reality, the DIY method is full of frustrations. Unresponsive employers are a common headache, with calls and emails going unanswered for weeks. You may also get inaccurate or limited data, as many companies only confirm job titles and dates to avoid legal risk. The process is also incredibly time-consuming, eating up hours of HR’s time with follow-ups and documentation. Finally, data privacy concerns add complexity, especially when navigating different state laws.

Method 2: Streamlining with Valley All States Employer Service

This is exactly why we exist. At Valley All States Employer Service, we’ve seen how manual verification bogs down HR teams. We streamline the employment verification process with automated solutions and expert management, so you can focus on finding the right talent.

Our automated solutions leverage technology to speed up verification dramatically. Instead of your team spending hours on the phone, our systems can quickly access comprehensive databases like The Work Number to retrieve verified employment and income data in minutes, not days.

We’re also proud to serve as an expert E-Verify Third Party Agent. This means we handle your E-Verify submissions with precision, minimizing errors and ensuring you stay compliant with federal mandates. Our team stays current on all the latest regulations, so you don’t have to. You can learn more about this service on our E-Verify Third Party Agent page.

Partnering with us brings tangible benefits. You’ll notice the speed first, as our automated processes reduce turnaround times so you can onboard talent faster. We guarantee accuracy, providing reliable information that reduces the risk of bad hires. The efficiency gains are substantial, freeing your HR team from administrative tasks to focus on strategic initiatives. Finally, compliance is built into everything we do, ensuring all verifications follow FCRA, I-9, and other relevant laws.

Our comprehensive Employment Verification Services Complete Guide provides even more details about our commitment to seamless, compliant processing. We’re here to be your trusted partner in building a verified, reliable workforce.

Best Practices for a Smooth and Compliant Verification

Running an effective and legally sound employment verification process requires a solid game plan. Consistency, transparency, and attention to detail are key to avoiding headaches.

First, you must obtain written consent. Before verifying a candidate’s background, you need their explicit written permission. This is required by law under the Fair Credit Reporting Act (FCRA).

Consistency is your best friend in avoiding discrimination claims. Apply the same verification standards to every candidate for similar positions. If you check five years of work history for one candidate, you need to check five years for all of them.

Don’t overlook documentation. Keep detailed records of every request, response, and conversation. This paper trail is invaluable if questions arise or you face an audit.

Data privacy and security should be top of mind. You’re handling sensitive personal information, so use secure systems, limit access, and follow data privacy principles.

When information comes in, cross-check it against multiple sources. Compare what the candidate provided with what their previous employer confirms and what any third-party services report.

When you find a discrepancy, handle it fairly. A job title might not match due to different company terminology, or dates could be slightly off. Give candidates a chance to explain before making assumptions. A simple conversation can often clear things up.

If verification results lead you to decide against hiring someone, you must follow the adverse action procedures outlined in the FCRA. This means providing notices, copies of reports, and information about the candidate’s rights.

For positions requiring specific credentials, verify professional licenses and educational qualifications directly with the issuing boards and institutions.

Finally, stay informed about state-specific laws, as they can vary significantly regarding what information can be shared.

For Employers: Building a Stronger Workforce

A thorough employment verification process is a powerful tool for building a high-performing team that stays. When you verify skills and experience, you’re reducing turnover before it starts. In a fierce market for talent, you can’t afford to waste resources on bad hires.

Ensuring job fit is another huge benefit. When you know for certain that a candidate held the positions they claimed, you can make confident hiring decisions. This leads to employees who contribute meaningfully from day one.

Your company’s reputation matters. A workforce built on verified qualifications protects your reputation with clients, partners, and the community.

For small businesses, implementing a solid verification process is a critical piece of HR Compliance for Small Business. It helps you avoid costly mistakes that could result in fines or legal issues.

For Candidates: How to Ensure Your History is Verifiable

If you’re job hunting, you can make the verification process smoother and faster for everyone. Start by keeping accurate personal records of your employment history, including exact dates, official job titles, and contact information for HR departments.

When you provide contact information for previous employers, make sure it’s correct and current. Outdated phone numbers or contacts for people who have left the company will slow things down.

If a previous employer is out of business, your W-2 forms and pay stubs can provide solid proof of employment. You can visit the IRS website to download copies of your tax forms if needed.

You can also check your own employment data. Services like The Work Number allow you to request your Employment Data Report. Review it for errors and dispute anything that’s wrong before a potential employer sees it.

Finally, be transparent about your work history. If you have employment gaps or career changes, be ready to explain them honestly. Most hiring managers appreciate candor.

Frequently Asked Questions about Employment Verification

We know you might have more questions about the employment verification process. Let’s tackle some of the most common ones.

How long does the employment verification process usually take?

The timeline varies, but most straightforward verifications take 1 to 3 days. Delays can occur if former employers are slow to respond or if information is inaccurate. International employment checks can take up to three weeks due to different record-keeping systems and regulations. The process is also slower when done manually compared to using an automated service that can instantly access employment databases.

What happens if a discrepancy is found on my application?

Finding a discrepancy isn’t an automatic deal-breaker. Our approach is to investigate thoroughly and give the candidate a chance to explain. There are often legitimate reasons for inconsistencies, like a company merger that changed job titles. We evaluate each situation individually. Minor discrepancies, like dates being off by a few days, are less concerning than major ones, like a fabricated job title. If a significant discrepancy influences the hiring decision, we follow the proper adverse action process under the FCRA. This ensures the candidate receives a copy of the report and has the right to dispute the findings.

Can a former employer give a bad reference?

Legally, former employers can share information, but they must be careful. Factual information like employment dates and job titles is generally safe to share. They can also discuss job performance if it’s based on documented facts. However, sharing false or malicious information can lead to defamation lawsuits. Because of this risk, many companies adopt a neutral verification policy, confirming only basic details. Some may state if a former employee is eligible for rehire, which indirectly signals satisfaction. We advise all employers to stick to factual, verifiable information to protect everyone involved.

Streamline Your Hiring with Expert E-Verify Assistance

The employment verification process is essential, but it can feel like a full-time job. Tracking down former employers, keeping up with compliance rules, and worrying about penalties is a lot for any HR team to handle.

We get it. That’s exactly why Valley All States Employer Service exists.

Think of us as your compliance partner. When you work with us, you’re gaining seamless E-Verify processing handled by experts who know the system inside and out. We make sure every submission is accurate, every deadline is met, and every federal mandate is followed.

When we take the verification workload off your plate, your HR team can focus on what they do best: strategic initiatives. Instead of administrative tasks, they can improve company culture, develop employees, and focus on people, not paperwork.

With our deep expertise in FCRA, I-9, and E-Verify regulations, you can rest easy knowing your employment verification process is always compliant. We stay on top of the rules so you don’t have to, protecting your business from potential penalties.

Why let the complexities of employment verification slow down your hiring or create unnecessary risk? Partner with us and build a workforce that’s both compliant and strong.

Ready to simplify your HR compliance? Explore our outsourced compliance solutions.