Employer I-9 Verification: Avoid 2025 Penalties

What is Form I-9 and Why It Matters for Your Business

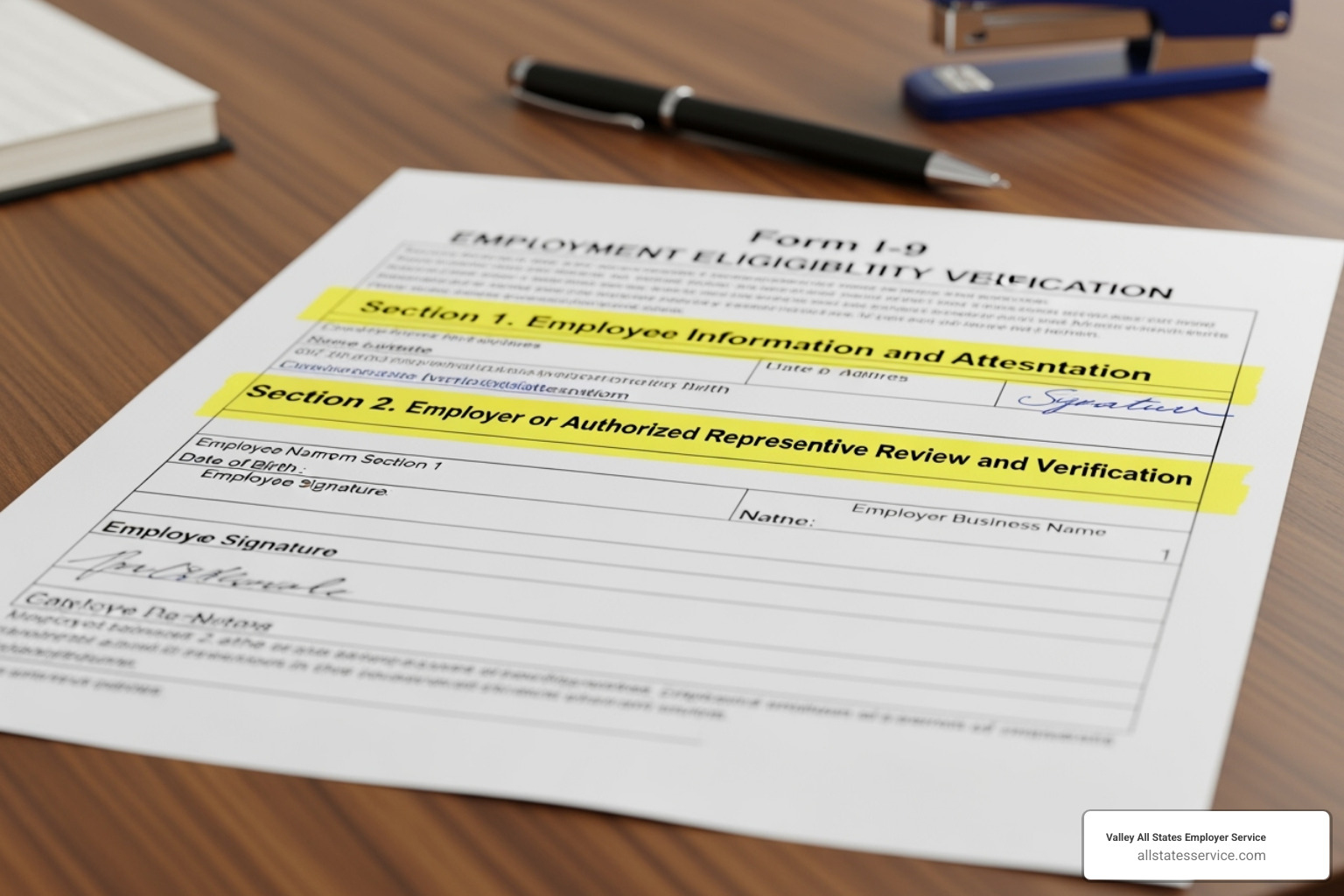

Employer I-9 verification is the legal process every U.S. business must follow to confirm that new hires are authorized to work in the United States. This requirement stems from the Immigration Reform and Control Act of 1986 and applies to every employee, regardless of citizenship status.

Here’s what employer I-9 verification involves:

- Form I-9 completion – A mandatory federal document verifying identity and work authorization

- Document examination – Reviewing acceptable identification and employment eligibility documents

- Record retention – Storing completed forms for 3 years after hire or 1 year after termination (whichever is later)

- Compliance deadlines – Section 1 by first day of work, Section 2 within 3 business days

The stakes are high. Fines for I-9 violations can range from hundreds to thousands of dollars per violation, and incomplete or incorrect forms put your business at serious financial and legal risk.

The good news? The process became simpler in November 2023 when USCIS released a streamlined, single-page Form I-9 with clearer instructions. Plus, employers enrolled in E-Verify can now examine documents remotely under specific conditions.

Whether you’re managing a small team or overseeing hundreds of employees, getting I-9 verification right protects your business from costly penalties while ensuring you maintain a legally authorized workforce.

At Valley All States Employer Service, we understand that navigating the complexities of employment eligibility can feel like a maze. Our goal is to simplify this for you, so your business can thrive without compliance headaches. Let’s dive deeper into what makes Form I-9 so important and how it ties into the broader landscape of employment verification. For more foundational knowledge, you can always refer to our guide on What is an I-9?.

Form I-9 and E-Verify: How They Work Together

When it comes to employer I-9 verification, many business owners wonder about the difference between Form I-9 and E-Verify. While these two systems work hand in hand, they’re not the same thing. Think of it this way: Form I-9 is the foundation of your house, while E-Verify is the security system that adds an extra layer of protection.

Form I-9 serves as your legal foundation. It’s the mandatory federal document that every U.S. employer must complete for every new hire, no exceptions. This form verifies both identity and employment authorization for each person joining your team.

E-Verify acts as your electronic confirmation tool. This internet-based system takes the information from your completed Form I-9 and cross-checks it against government databases from the Social Security Administration and Department of Homeland Security. It’s like having a direct line to verify that the information your employee provided is legitimate.

Here’s where it gets important: E-Verify doesn’t replace Form I-9. Even if you use E-Verify, you still need to complete the I-9 for every employee. The systems complement each other beautifully, and we dive deeper into this relationship in our guide on E-Verify and I-9.

| Feature | Form I-9 | E-Verify |

|---|---|---|

| Required vs. Optional | Mandatory for all U.S. employers | Optional for most, mandatory for federal contractors |

| Social Security Number | Not always required (depends on documents) | Always required for verification |

| Photo ID | Not always needed | Required on identity documents when using List B/C combo |

| Reverification | Must be used for expired work authorization | Cannot be used for reverification |

The beauty of using both systems together is the added confidence they provide. While Form I-9 ensures you’re following the law, E-Verify gives you electronic confirmation that your hiring decisions are solid. The government provides excellent resources on E-Verify and Form I-9 if you want to explore the official details.

When is E-Verify Required?

While most employers can choose whether to use E-Verify, certain situations make it mandatory for employer I-9 verification.

Federal contractors generally must use E-Verify for employees working on covered federal contracts. This ensures that taxpayer money isn’t going toward employing unauthorized workers. If this applies to your business, check out our detailed guide on E-Verify for Contractors.

State-specific rules vary widely across the country. Some states require all employers to use E-Verify, while others only require it for government contractors or public agencies. The requirements can change, so staying current with your state’s laws is crucial.

Public agencies at various levels often have their own E-Verify requirements, regardless of federal mandates.

Even when E-Verify isn’t required, many smart business owners choose to use it anyway. It’s like having an extra safety net that helps prevent compliance headaches down the road. Plus, it demonstrates to customers, partners, and government agencies that you’re serious about maintaining a legally authorized workforce.

Mastering the Core Rules of Employer I-9 Verification

Let’s get straight to the point: employer I-9 verification has some non-negotiable rules that every business owner needs to master. Think of these as the foundation that keeps your company safe from costly penalties and legal headaches.

The first thing you need to know? You might be using an outdated form without even realizing it. The new Form I-9 became mandatory on November 1, 2023, and it’s actually a welcome improvement. Gone are the days of flipping through multiple pages. This updated version is now a single-page format with much clearer instructions that make the whole process less confusing for everyone involved.

The new form also includes helpful guidance on acceptable receipts and document auto-extensions, which means fewer questions and fewer mistakes. But here’s the catch: using the old version can get you in trouble with government auditors. Always make sure you’re using the official Form I-9 from USCIS to stay current.

Key Deadlines for Employer I-9 Verification

Here’s where many businesses trip up, and it’s completely avoidable. Missing deadlines is one of the most common (and expensive) mistakes in employer I-9 verification. Let’s make sure you never fall into this trap.

Your new employee must complete Section 1 no later than their first day of employment. Not the second day, not when they get around to it. The first day. But don’t have them fill it out before they accept your job offer, that’s actually against the rules too.

Now for your part as the employer: you have exactly three business days after their first day to complete Section 2. If someone starts on Monday, you need to finish Section 2 by Thursday. No exceptions. There’s one special case though: if the job lasts less than three days total, you need to complete Section 2 on their very first day.

These aren’t suggestions or guidelines. They’re federal requirements, and missing them opens your business up to significant fines. Getting this timing right is a crucial part of I-9 Form Completion.

Record Retention and Anti-Discrimination

Once you’ve completed the form, your responsibilities are far from over. Proper record keeping is where many businesses get sloppy, and it can cost them dearly during an audit.

You must keep every I-9 form for three years after the hire date or one year after the employee leaves, whichever comes later. This is called the 3-year/1-year rule, and it’s non-negotiable. These forms need proper storage in a secure location where you can quickly access them if government officials come knocking.

Speaking of government officials, they can request to see your I-9 forms at any time. The Department of Homeland Security, Department of Labor, or Department of Justice all have the authority to audit your records. Being prepared isn’t just smart, it’s required. Our guide on I-9 Record Keeping covers all the details you need to stay compliant.

But here’s something that surprises many employers: the anti-discrimination rules are just as important as the paperwork itself. You cannot show document preference during the verification process. That means you can’t tell an employee, “I need to see your driver’s license and Social Security card.” The employee gets to choose which acceptable documents they present, as long as they’re valid.

You also need to treat every employee exactly the same way. Don’t ask for extra documents from someone because of their accent or appearance. Don’t require additional proof because you have a “feeling” about someone. This kind of discrimination can lead to lawsuits and hefty fines that make I-9 penalties look small by comparison.

The bottom line? Master these core rules, respect the deadlines, and treat every employee fairly. Your business will thank you when you sail through audits while your competitors scramble to explain their mistakes.

The Document Review Process: Physical and Remote I-9 Verification

The heart of employer I-9 verification lies in the document review process. This is where you, or your authorized representative, examine the documents presented by your new hire to confirm their identity and authorization to work.

Think of the document review process like a simple matching game. USCIS provides three lists of acceptable documents, and employees get to choose which ones they want to present. It’s really that straightforward.

List A documents are the all-in-one option. These establish both identity and employment authorization in a single document. Your employee might hand you a U.S. passport, a permanent resident card (that green card you’ve heard about), or an Employment Authorization Document. When someone presents a List A document, you’re done. No other documents needed.

List B documents prove identity only. Think driver’s licenses or state-issued ID cards. These are the documents most of us carry every day. List C documents handle the employment authorization side. A Social Security card or birth certificate fits here perfectly.

Here’s the key rule: if your employee chooses a List B document, they must also present a List C document. It’s like having two pieces of a puzzle that fit together. The employee gets to decide which route they want to take, and you cannot request specific documents. Always check the official List of Acceptable Documents when you’re unsure.

How Remote Employer I-9 Verification Works

The world of work changed dramatically, and employer I-9 verification evolved right along with it. For years, physical examination of documents was the only acceptable method. Then remote work became the norm, and the government had to adapt.

Good news arrived in August 2023. Employers enrolled in E-Verify can now use remote verification under specific conditions. This means you might not need your remote employees to mail documents or drive hours to an office just for I-9 completion.

The process works through live video interaction. You’ll conduct a real-time video call with your employee, just like any other business meeting. During this session, your employee presents their documents to the camera. You examine clear copies of both sides of their identity and employment authorization documents, making sure they appear genuine and belong to the person you’re talking to.

There are some important requirements though. This remote option is available primarily to E-Verify employers in good standing. You’ll need to retain clear copies of the documents and note on the Form I-9 that you used the alternative procedure. The employee must be working exclusively in a remote setting or hired during certain declared emergencies.

We’ve seen this remote option transform how businesses handle distributed workforces. It offers genuine flexibility without compromising compliance. You can learn more about this process in our guide on I-9 Verification for Remote Employees. The government also provides detailed information on the New remote document examination option.

Handling Special Document Scenarios

Sometimes employees present documents that require extra attention. These special situations pop up regularly, and knowing how to handle them keeps your employer I-9 verification process smooth and compliant.

Temporary Protected Status (TPS) creates some interesting scenarios. Individuals with TPS are authorized to work, but their Employment Authorization Documents sometimes get automatically extended by court orders or government actions. Recently, Venezuelan TPS recipients had their EADs automatically extended to April 2026 due to a court decision. When this happens, employees can present their expired EAD along with documentation of the extension.

Afghan and Ukrainian parolees represent another special case that’s become more common. These individuals are employment authorized based on their parole status. They can present an unexpired Form I-94 with specific class codes like “PAR” for Afghan parolees or “DT” for Ukrainian parolees issued within certain dates. This serves as a List A receipt, giving them 90 days to obtain either an EAD or present an unrestricted Social Security card plus a List B identity document.

Acceptable receipts come into play when employees have applied for replacement documents or initial EADs. These receipts are valid temporarily, usually for 90 days, during which the employee must present the actual document. Not all receipts are acceptable, so it’s crucial to understand which ones count and their specific validity periods.

These scenarios highlight why staying current with immigration law changes matters so much for your business. The rules shift, extensions get announced, and new situations emerge regularly. When you’re unsure about a document or situation, the I-9 Central TPS information page provides excellent guidance, or you can always consult with compliance experts who track these changes daily.

Avoiding Common I-9 Mistakes and Penalties

Let’s be honest – employer I-9 verification can feel like walking through a minefield sometimes. Even the most careful HR professionals stumble into costly mistakes, and we’ve seen it happen to good companies time and time again.

The mistakes we see most often might surprise you with how simple they seem. Incomplete fields are probably the biggest culprit – a missing signature here, a blank date there, or forgetting to fill in document details. It’s easy to overlook these details when you’re juggling multiple new hires.

Missed deadlines are another frequent stumbling block. Section 1 must be done by the employee’s first day, and you have exactly three business days to complete Section 2. Miss that window, and you’re looking at a violation.

Then there’s the document drama. Accepting expired documents (unless there’s an automatic extension in play), taking photocopies when you shouldn’t, or accepting documents that just don’t look right can all land you in hot water. And here’s a mistake that catches many employers off guard – using outdated forms. Since November 1, 2023, only the new single-page Form I-9 is acceptable.

Don’t forget about storage slip-ups either. Those completed I-9 forms need to stick around for three years after hire or one year after the employee leaves, whichever comes later. Lose them or store them improperly, and you’re facing penalties.

The financial hit from these mistakes isn’t small change. We’re talking hundreds to thousands of dollars per violation, depending on how serious the error is. Substantive violations like failing to complete forms or accepting invalid documents carry much steeper fines than minor typos.

But the money is just the beginning. ICE audits become more likely when you have a pattern of errors. Nobody wants federal agents showing up to scrutinize every I-9 in your files. Beyond that, you’re looking at potential legal battles if discrimination comes into play, and your company’s reputation can take a serious beating if compliance issues become public.

Here’s the good news – most of these problems are totally preventable. Staff training is your first line of defense. Make sure everyone involved in hiring knows the current rules and common pitfalls. The regulations change, so regular refresher sessions aren’t just helpful, they’re essential.

Internal checklists work wonders too. Create step-by-step guides for your team to follow, covering everything from document examination to proper storage. When people have a clear roadmap, mistakes drop dramatically.

Consider investing in digital I-9 systems that can guide you through each step, flag missing information, and handle record retention automatically. These systems catch errors before they become expensive problems.

Most importantly, don’t wait for the government to find your mistakes. Regular internal audits let you spot and fix issues on your own timeline. It’s much better to find a problem during your own review than during an ICE inspection.

For a deeper dive into what these violations might cost your business, check out our detailed breakdown at I-9 Compliance Penalties. The key is staying proactive – catching problems early saves money, stress, and sleep.

Best Practices: Audits, Corrections, and Streamlining Your I-9 Process

Taking a proactive approach to employer I-9 verification is like getting regular check-ups for your business health. You catch small issues before they become expensive problems, and you sleep better knowing everything is running smoothly.

Internal I-9 Audits

Think of internal I-9 audits as your insurance policy against compliance nightmares. When you review your completed forms regularly, you’re not just checking boxes – you’re protecting your business from the kind of penalties that can seriously hurt your bottom line.

The key to effective auditing is using neutral criteria that keep you out of legal hot water. Never audit specific employees because of their accent, appearance, or where you think they might be from. Instead, focus on objective factors like hire date ranges, department rotations, or random sampling. This approach protects you from discrimination claims while ensuring thorough compliance.

Transparency matters when you’re conducting these audits. If you’re reviewing current employees’ forms, let them know what you’re doing and why. A simple explanation goes a long way: “We’re conducting a routine compliance review to make sure all our paperwork is complete and accurate.”

Keep detailed records of everything you find and fix. This documentation shows government auditors that you’re serious about compliance and making good faith efforts to stay on track. Our I-9 Self Audit guide walks you through the entire process step by step.

Correcting Errors: A Gentle Touch

Finding mistakes during your audit isn’t a disaster – it’s actually a win! You’ve caught problems before they became penalties. The trick is knowing how to fix them without creating bigger issues.

For Section 1 errors, this is the employee’s section, so they need to make the corrections themselves. They should draw a single line through the wrong information, write in the correct details, and add their initials with the date. You can guide them, but you cannot make these changes for them.

For Section 2 or 3 errors, you’re in the driver’s seat. Use that same single-line method – cross out the mistake, write the correction, and initial with the current date. Keep it simple and clear.

Here’s something that trips up many employers: never backdate anything. It’s tempting to use the date when the error should have been corrected, but always use today’s date when making corrections. Backdating can look like you’re trying to hide something, which creates more problems than it solves.

Sometimes you’ll find forms that are so messed up that corrections won’t cut it. In these cases, complete a fresh Form I-9, attach it to the original, and write a brief explanation of why you started over. Sign and date that explanation too.

Streamlining with Expert Support

Let’s be honest – managing employer I-9 verification can feel like a full-time job, especially when you’re juggling remote workers, high turnover, or operations across multiple states. That’s where partnering with experts makes perfect sense.

At Valley All States Employer Service, we’ve built our reputation on taking the headache out of E-Verify and I-9 compliance. We act as your E-Verify Employer Agent, handling all the submissions, monitoring, and follow-up work that usually keeps your HR team buried in paperwork.

When you work with us, you’re not just outsourcing tasks – you’re reducing your administrative burden while ensuring accuracy. Our team stays current on every regulatory change, from new TPS extensions to updated remote verification procedures. We catch the details that are easy to miss when you’re focused on running your business.

This streamlined approach means your internal team can focus on what they do best: finding great employees and supporting your workforce. Meanwhile, we handle the compliance side with the expertise that comes from processing thousands of cases every year.

The Handbook for Employers M-274 from USCIS remains the ultimate reference guide for all things I-9 related. But when you need hands-on support that goes beyond reading manuals, our E-Verify Employer Agent Service delivers the peace of mind that comes with expert handling of your compliance needs.

Wrapping Up: Make Employer I-9 Verification Simple and Secure

You’ve made it through the maze of employer I-9 verification, and honestly, that’s no small feat. What might have seemed overwhelming at first is really just a matter of understanding the basics and staying consistent.

Here’s the bottom line: Form I-9 isn’t optional. It’s a legal requirement that protects both your business and the broader employment system. Every new hire, every time, no exceptions. The good news? Once you establish solid processes, it becomes second nature.

Accuracy is your best friend when it comes to I-9 compliance. Those seemingly small details like signatures, dates, and document information can make the difference between smooth sailing and costly penalties. Fines can add up quickly, and nobody wants an unexpected visit from ICE auditors.

E-Verify adds an extra layer of confidence to your hiring process. While it’s not required for everyone, it’s mandatory for federal contractors and increasingly popular with employers who want that additional verification step. Think of it as insurance for your compliance efforts.

The employment verification landscape keeps evolving. Remote verification options, updated forms, and changing immigration policies mean staying informed isn’t just helpful, it’s essential. But you don’t have to steer these waters alone.

Expert help makes all the difference. At Valley All States Employer Service, we’ve built our reputation on taking the complexity out of workforce eligibility verification. Our E-Verify Services handle the technical details so you can focus on what you do best: running your business.

We understand that employer I-9 verification can feel like just another administrative burden. That’s exactly why we exist. Our team manages the entire E-Verify process as your authorized agent, catching potential issues before they become problems and ensuring your forms are completed correctly every time.

Proactive compliance keeps your business safe and your workforce legitimate. It’s not just about avoiding fines, though that’s certainly important. It’s about building a foundation of trust and legal certainty that lets your business thrive.