Employer compliance checklist: Master 2025 Risks

Why Every Business Needs an Employer Compliance Checklist

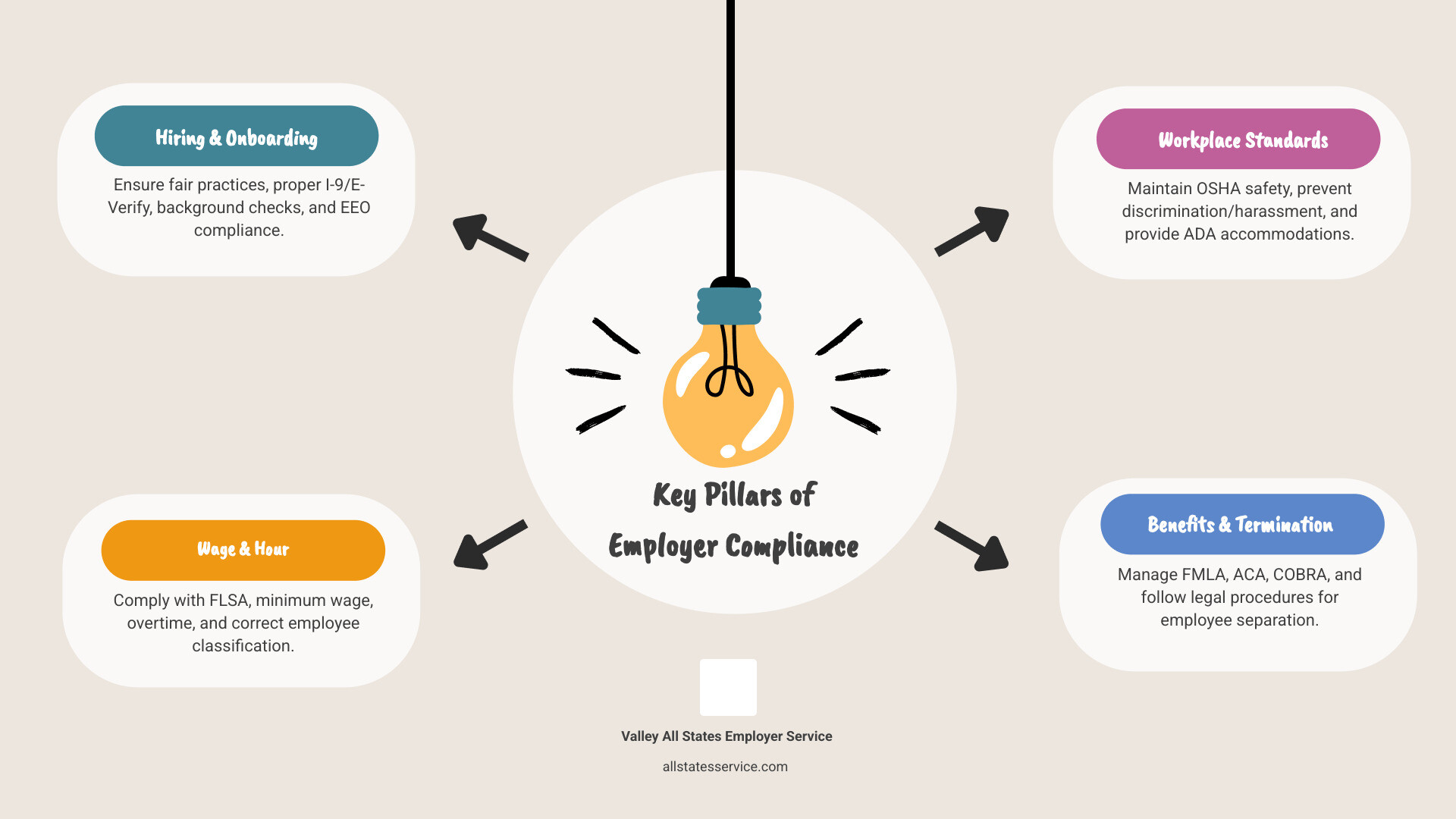

An Employer compliance checklist is your roadmap to avoiding fines, lawsuits, and penalties while creating a fair workplace. Here’s what every employer should include:

- Recruiting and Hiring: I-9 verification, E-Verify, background checks, and EEO compliance

- Wage and Hour Laws: FLSA requirements, employee classification, minimum wage, and overtime pay

- Workplace Safety: OSHA standards, emergency plans, and hazard prevention

- Anti-Discrimination: ADA compliance, harassment policies, and reasonable accommodations

- Benefits and Leave: FMLA, ACA, COBRA notices, and state leave laws

- Termination Procedures: Notice periods, final paychecks, and severance requirements

- Audits and Training: Regular compliance reviews, employee handbooks, and mandatory training

Navigating HR compliance is essential for every employer. The cost of non-compliance can be steep. For example, failing to pay non-exempt employees overtime can lead to lawsuits, back pay claims, and fines adding up to tens of thousands of dollars or more.

A proactive employer compliance checklist helps you reduce risk, improve efficiency, and build trust. It’s not just about avoiding penalties. It’s about creating a stable, fair workplace where you can focus on growing your business instead of fixing preventable problems.

Whether you’re dealing with Form I-9 verification, FMLA leave, or OSHA reporting, a clear checklist keeps you organized. Many states have their own minimum wage, paid leave, and other specific laws. Employers must track these changes to ensure compliance, especially if you manage remote workers or have employees in multiple locations.

Building Your Foundational US Employer Compliance Checklist

Federal and state labor laws never stand still. What was compliant last year might land you in hot water today. Understanding employee classification and keeping pace with regulatory changes is your best defense against costly fines and legal headaches.

Think of your employer compliance checklist as your business’s safety net. It’s a systematic way to spot potential problems before they become expensive lawsuits, protect your employees’ rights, and build consistent procedures across your organization.

Recruiting, Hiring, and Onboarding Compliance

Your compliance journey starts before an employee’s first day. Fair hiring practices mean your job ads and interview questions must avoid discrimination. Many states now prohibit asking about salary history to combat wage gaps. One wrong question can trigger a claim.

Equal Employment Opportunity (EEO) regulations are the backbone of fair hiring, prohibiting discrimination based on race, color, religion, sex, national origin, age, disability, or genetic information. The EEOC offers helpful Checklists for Employers that walk you through the requirements.

When you conduct background checks, the Fair Credit Reporting Act (FCRA) requires proper disclosures and written consent. Recent guidance has expanded FCRA’s reach to include AI-driven worker monitoring tools, so if you use AI assessments, you need clear consent protocols.

Form I-9 verification is non-negotiable. Every new hire must complete this form within three days to prove their identity and work eligibility. Keep these forms for at least three years after hire or one year after termination, whichever is longer. Our Employer I-9 Verification Guide breaks down this critical step.

E-Verify confirms that newly hired employees are authorized to work in the United States. Some states require it, while others make it voluntary. Our E-Verify Program Complete Guide gives you the full picture.

Finally, getting Employee Onboarding Compliance right from day one sets a positive tone for the entire employment relationship.

Wage, Hour, and Employee Classification

Wage and hour laws are a common compliance pitfall. The Fair Labor Standards Act (FLSA) sets federal rules for minimum wage, overtime, and record keeping. The biggest challenge is correctly classifying workers as exempt or non-exempt, which determines overtime eligibility. Misclassification can lead to years of back pay claims.

Exempt versus non-exempt status is about job duties and salary level, not titles. Non-exempt employees must receive 1.5 times their regular rate for hours over 40 in a workweek. Review these classifications regularly.

Independent contractor classification is another minefield. Misclassifying an employee as a contractor can trigger major tax and labor issues. Courts use specific legal tests focusing on your control over the worker.

Minimum wage laws vary by location. You must pay the highest applicable rate for each employee’s location, which can be complex with remote workers.

Overtime pay rules can also vary by state, with some having daily overtime requirements. Track all hours worked accurately for non-exempt employees.

Pay equity is increasingly scrutinized. Many states now require pay transparency, such as providing salary ranges in job postings. Regular internal pay audits help you spot and fix disparities.

Navigating these complexities often requires specialized expertise. Our HR Compliance Assistance services help businesses stay compliant without the headaches.

Workplace Safety and Anti-Discrimination

A safe, inclusive workplace is required by law. OSHA compliance means providing a safe environment, identifying hazards, conducting safety training, and having clear emergency action plans. Companies with over ten employees must post a summary of workplace injuries and illnesses annually.

The Americans with Disabilities Act (ADA) prohibits discrimination and requires providing reasonable accommodations for employees with disabilities. This might include modified duties, adjusted schedules, or assistive technology. The key is engaging in an interactive process with the employee.

Harassment and anti-discrimination policies should be clear, consistently enforced, and apply to all protected characteristics. Define unacceptable conduct, explain reporting procedures, and review policies regularly. The EEOC’s Checklists for Employers offer practical guidance.

For businesses needing comprehensive support, our Outsourced HR Compliance Ultimate Guide provides a roadmap for managing compliance.

Benefits, Leave, and Termination

Managing benefits, leave, and terminations requires careful attention to detail. The Family and Medical Leave Act (FMLA) requires eligible employers to provide up to 12 weeks of unpaid, job-protected leave for qualifying reasons. The Department of Labor spells out FMLA qualifying reasons in detail.

ACA compliance applies to businesses with 50 or more full-time equivalent employees, requiring you to offer qualifying health insurance and handle annual IRS reporting.

COBRA notices apply to businesses with 20 or more employees, requiring you to offer continuation health coverage after events like termination. Timely notices are critical.

Employee termination procedures are legally sensitive. State laws dictate notice periods and when final paychecks must be issued. Severance pay may be required by contract or policy. If you offer severance, ensure any release agreements are legally sound. Your employer compliance checklist should include clear procedures for each of these scenarios.

Navigating Canadian HR Compliance: A Cross-Border View

If your business operates in both the US and Canada, you’re navigating two distinct compliance worlds. Canadian employment law blends federal and provincial regulations, so your employer compliance checklist needs to cover multiple jurisdictions. Compliance follows the employee’s location, not your head office.

What’s required in Ontario might be completely different from British Columbia. Each province has its own rulebook.

Key Differences in Canadian Employment Standards

Canadian employment standards are a complex patchwork. What’s mandatory in one province can look different in another.

- Minimum wage varies by province and territory and changes regularly.

- Overtime rules are not universal. Some provinces trigger overtime after 44 hours a week, while others use a 40-hour threshold or have daily limits.

- Statutory holidays differ in number and date across provinces.

- Leave entitlements like maternity, parental, and compassionate care leave have federal minimums, but provinces often provide extra protections or longer durations.

The key takeaway? Following provincial guidelines is not optional. HR professionals must track the specific rules for each province, especially for termination requirements like notice periods and severance pay.

Health, Safety, and Data Privacy in Canada

Your Canadian employer compliance checklist must also address health, safety, and data privacy.

Occupational Health and Safety (OHS) is the law. Employers must conduct risk assessments, train employees, and maintain hazard prevention plans. Provincial laws, like Ontario’s, may also mandate regular updates to harassment policies and training.

WHMIS regulations (Workplace Hazardous Materials Information System) govern how hazardous materials are handled. Your checklist should verify that you have proper labels, current Safety Data Sheets (SDS), and provide comprehensive training. Workers need to know how to access these sheets.

PIPEDA (the Personal Information Protection and Electronic Documents Act) governs how you handle employee data. You need clear policies on data collection, use, and disclosure. With remote work, employee data protection requires robust cybersecurity measures.

Creating a Canadian Employer Compliance Checklist

Building a Canadian employer compliance checklist means understanding both federal and provincial nuances.

Your reasonable accommodation process should be a structured framework for assessing requests and working with employees with disabilities to find solutions.

Anti-discrimination policies are required. You need specific written policies, regular training, and a zero-tolerance stance on violations.

Termination requirements vary significantly by province. Notice periods and severance pay calculations depend on tenure, position, and provincial law. Accuracy is critical to avoid legal and financial liability.

Audits, Training, and Best Practices for Ongoing Compliance

Building a culture of compliance is an ongoing commitment. Regular audits and training help you avoid penalties and create a workplace where everyone understands the rules and feels protected.

Conducting Regular HR Compliance Audits

HR compliance audits are your early warning system, helping you spot gaps before they become legal problems.

Best practices start with consistency. We recommend conducting internal HR audits at least quarterly, reviewing employee files, payroll records, and policies. For specialized areas, our Internal I-9 Audit Complete Guide walks you through every step.

Your employee handbook needs attention at least once a year, or sooner if regulations change. Once updated, ensure every employee receives a copy and signs an acknowledgment. This proves everyone knows the current rules.

Document retention policies are crucial. Form I-9s must be kept for at least three years after hire or one year after termination, whichever is longer. When requested, you have 3 business days to provide them. Other records have their own timelines, so a clear policy is essential.

Essential Training and Documentation

Training creates a workplace where people know their rights and responsibilities.

Harassment prevention training is legally required in many states. For example, California requires specific training durations for employees and supervisors every two years. Effective training includes real-world examples and clear reporting procedures.

Mandatory compliance posters are required notifications about minimum wage, OSHA standards, and other rights. Start with the U.S. Department of Labor’s mandatory posters, but always check state and local requirements.

Employee files contain sensitive information that requires secure storage and robust data security measures. With growing cyber threats, regular privacy training is essential.

Your performance management system should be fair, objective, and consistent. Regular reviews based on clear standards help protect you from compliance risks related to promotions, discipline, or terminations.

Non-compete clauses are rapidly changing, with many states restricting or banning them. Your employer compliance checklist should include a regular review of these agreements to ensure they align with current state laws.

Leveraging Technology for Your Employer Compliance Checklist

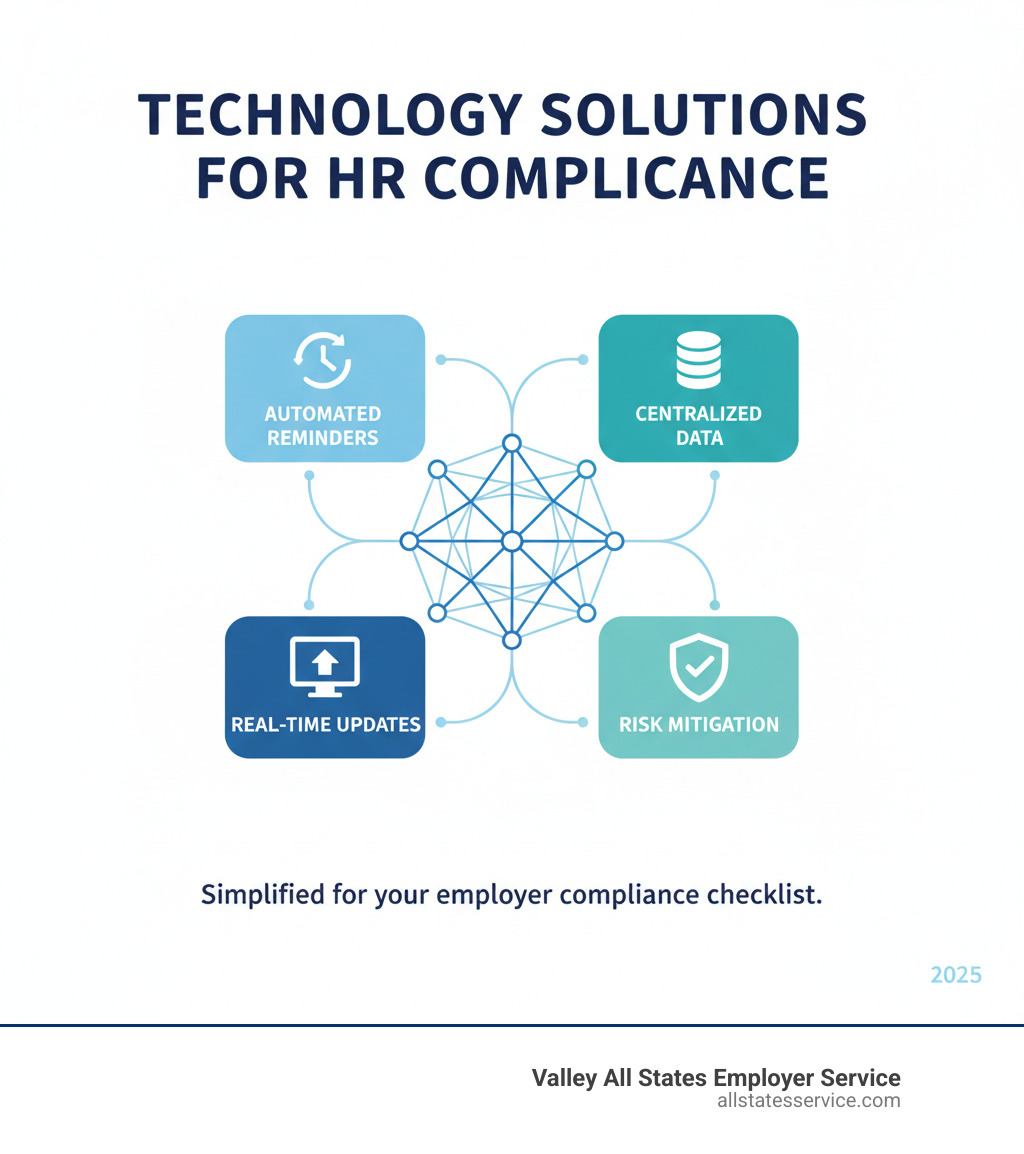

Let’s be honest: the volume of HR regulations can be overwhelming. Technology is essential for managing your employer compliance checklist without drowning in paperwork.

Interactive HR platforms can help you steer multi-jurisdictional requirements by tracking your compliance status in real time. These tools reduce the administrative burden, freeing your team to focus on people.

Automated deadline tracking is a game-changer. Modern systems can monitor critical dates for W-2s, EEO-1 reporting, ACA forms, and OSHA reports. They also help manage employee-triggered events like FMLA requests and workplace injuries, replacing spreadsheets with a centralized platform.

Specialized compliance software simplifies complex areas by providing up-to-date legal document templates and guidance. These tools can reduce reliance on expensive legal counsel for routine matters while ensuring you stay current.

Our Compliance Management Solutions integrate these types of technologies to minimize your risk. You get real-time updates and structured workflows, ensuring nothing falls through the cracks.

Frequently Asked Questions about Employer Compliance

How often should HR policies and employee handbooks be reviewed?

Your employee handbook is a living document. We recommend reviewing HR policies and handbooks at least once a year. However, you must update your materials immediately when major legal changes occur, such as new labor laws or court rulings.

After making changes, communicate them clearly to your entire team. Send out the revised sections and get signed acknowledgments from employees. This creates a paper trail showing everyone received and understood the new policies.

What are the biggest financial risks of non-compliance?

The cost of non-compliance can be staggering. It can trigger significant financial penalties from federal and state agencies, with some fines costing thousands per incident. Multiplying that by the number of affected employees can be devastating.

Beyond fines, employee lawsuits can result in back pay claims, damages, and legal fees that run into six or seven figures. Misclassifying just a few employees can lead to years of unpaid overtime claims. There is also reputational damage, which can make it harder to recruit talent and may affect customer relationships.

Most compliance violations are preventable with a solid employer compliance checklist and regular attention to detail.

How do I handle an employee reporting a compliance issue?

When an employee reports a concern, your initial response is critical. Start by following your established reporting procedures exactly as written in your handbook.

Investigate the issue promptly and confidentially. Share details only on a need-to-know basis. Thoroughness is more important than speed, so talk to everyone involved and review all relevant documents before drawing conclusions.

Document every step of your investigation, from the initial report to your final decision. This documentation protects both you and your employees. Finally, take appropriate corrective action based on your findings. Follow up with the reporting employee to let them know their concern was taken seriously. Retaliation against whistleblowers is illegal and can create even bigger problems.

Simplify Your Compliance Strategy

Here’s the truth: a proactive approach to compliance is about more than just avoiding fines. It’s about building a fair, stable workplace where your employees feel protected and your business can thrive.

Your employer compliance checklist is your roadmap, but it needs regular updates as laws and regulations evolve. While some areas can be managed in-house, complex tasks like workforce eligibility verification benefit from expert support. This is where partnering with Valley All States Employer Service provides genuine peace of mind.

We specialize in outsourced E-Verify workforce eligibility verification, offering expert, impartial, and efficient processing that minimizes errors and your administrative burden. You wouldn’t try to be an expert in every part of your business; the same principle applies to compliance. Having a dedicated partner for Form I-9 and E-Verify processing lets you focus on what you do best.

Ready to master one of the most critical parts of your checklist? Dive into our Internal I-9 Audit Complete Guide to get started. This resource walks you through best practices for conducting thorough I-9 audits and establishing a systematic approach that keeps you compliant.

Your compliance strategy doesn’t have to be overwhelming. With the right checklist, tools, and partners, you can create a workplace that’s not just compliant but genuinely fair for everyone.