E-Verify for Existing Employees: What Employers Can and Cannot Do

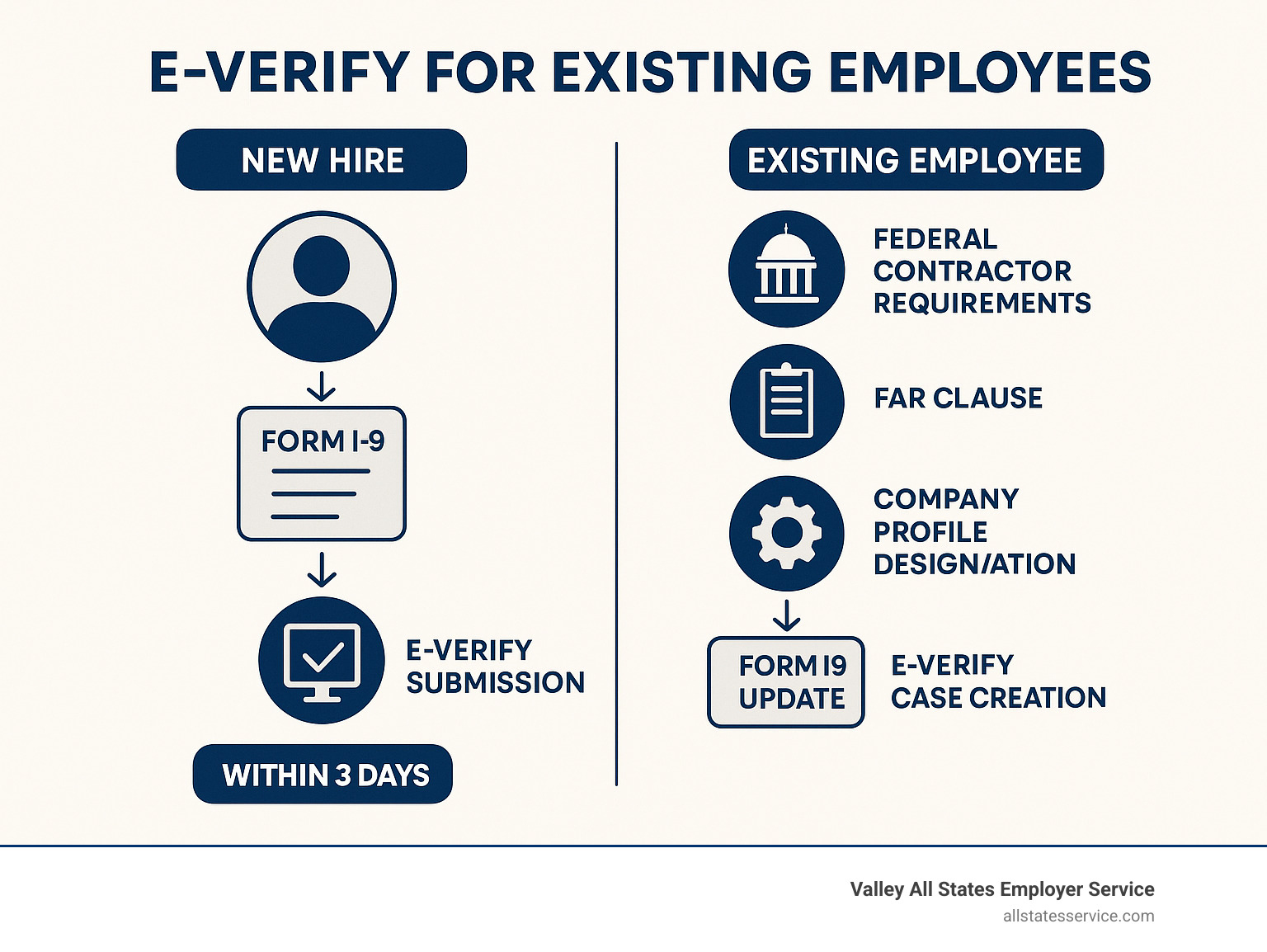

Wondering if you can run E-Verify for existing employees? In most cases, you cannot. There are important exceptions for federal contractors, and knowing where you fit keeps your business compliant.

Here’s what you need to know.

Quick Answer for E-Verify for Existing Employees:

- General rule: You cannot use E-Verify for existing employees.

- Exception: Federal contractors with the FAR E-Verify clause.

- Before you start: Designate your federal contractor status in your E-Verify Company Profile.

- I-9 process: Complete a new Form I-9 or update the existing one consistently for everyone in scope.

- Timeline: Use the same three business day rule you follow for new hires.

Most HR teams think of E-Verify as a new hire step, complete Form I-9, run the check, and file it. But what if your organization just won a federal contract or went through a merger? That is when the rules for your current staff come into play.

The rules for E-Verify for existing employees are specific. E-Verify is built for new hires, but certain situations allow, and sometimes require, verification of your current workforce. Getting this right helps you avoid compliance mistakes and discrimination claims.

The General Rule: Can Employers Verify Existing Employees?

Generally, E-Verify for existing employees is off-limits. The system was designed for newly hired workers to prevent discrimination. The E-Verify FAQ is clear: most employers cannot run checks on their current workforce. Allowing selective verification could lead to patterns of discrimination based on an employee’s name, accent, or appearance, creating serious legal risks.

E-Verify complements the Form I-9 process by cross-referencing information with government databases. This ensures employment eligibility verification is consistent and fair for all new hires. You can learn more about how these processes work together in our guide on E-Verify and I-9.

So, who is the exception to the rule?

Federal contractors with a contract containing the Federal Acquisition Regulation (FAR) E-Verify clause are the main exception. For them, verifying certain existing employees is a contractual obligation. Before creating cases, you must update your company profile in E-Verify to reflect your status as a federal contractor. While some state-level mandates require E-Verify, they typically focus on new hires, making the federal contractor rule the most significant exception for existing staff.

What about employees from a merger or acquisition?

Mergers and acquisitions can turn existing employees into “new” hires. If your company acquires another business and treats the inherited staff as new hires, you must use E-Verify for them. This requires completing new Forms I-9 for every acquired employee to avoid selective verification and discrimination claims. You have three business days from the acquisition date to create E-Verify cases for all of them, just like any other new hire. The same rules apply regardless of company size, as detailed in our E-Verify for Small Businesses guide.

The Federal Contractor Exception: Rules for E-Verify for Existing Employees

For federal contractors, the rules for E-Verify for existing employees are different. The Federal Acquisition Regulation (FAR) E-Verify clause requires you to verify employees working on a covered federal contract, even if they have been with your company for years.

Before you begin, you must update your E-Verify account settings in your “Company Profile” to designate your status as a federal contractor. This is a critical step that legally permits you to verify existing employees. Our E-Verify for Contractors guide offers more details on these obligations.

What are the specific requirements for federal contractors?

The verification scope is a key decision. You must verify any existing employee assigned to a contract with the FAR E-Verify clause. Alternatively, you can choose the entire workforce option to verify all non-exempt existing employees, which can simplify compliance. Once you choose the entire workforce option, you generally cannot reverse it for those employees.

The verification timeline is the same as for new hires: you have three federal business days to submit the E-Verify case after the employee’s Form I-9 is completed or updated. Adhering to these Federal E-Verify Rules is essential.

What steps must contractors take to verify existing employees?

Verifying existing employees requires a clear process:

- Decide your verification scope: Choose to verify only employees on covered contracts or your entire existing workforce. Make this selection in your E-Verify Company Profile.

- Identify exempt employees: Determine who does not need to be verified based on exemptions.

- Handle the Form I-9: The employee’s Form I-9 must be current. This may require completing a new form or updating the existing one.

- Create E-Verify cases: Once the Form I-9 is ready, create the E-Verify case within the three-day timeline.

Are any existing employees exempt from this process?

Yes, some employees are exempt even for federal contractors:

- Employees hired on or before November 6, 1986.

- Employees hired in the Commonwealth of the Northern Mariana Islands (CNMI) before November 27, 2009.

- Employees with certain active security clearances or HSPD-12 credentials may have special exemptions.

- If you do not verify your entire workforce, employees not assigned to a covered federal contract are exempt.

Always consult the official E-Verify Supplemental Guide for Federal Contractors for the most current guidance on exemptions.

The Practical Steps: Updating Form I-9 for Verification

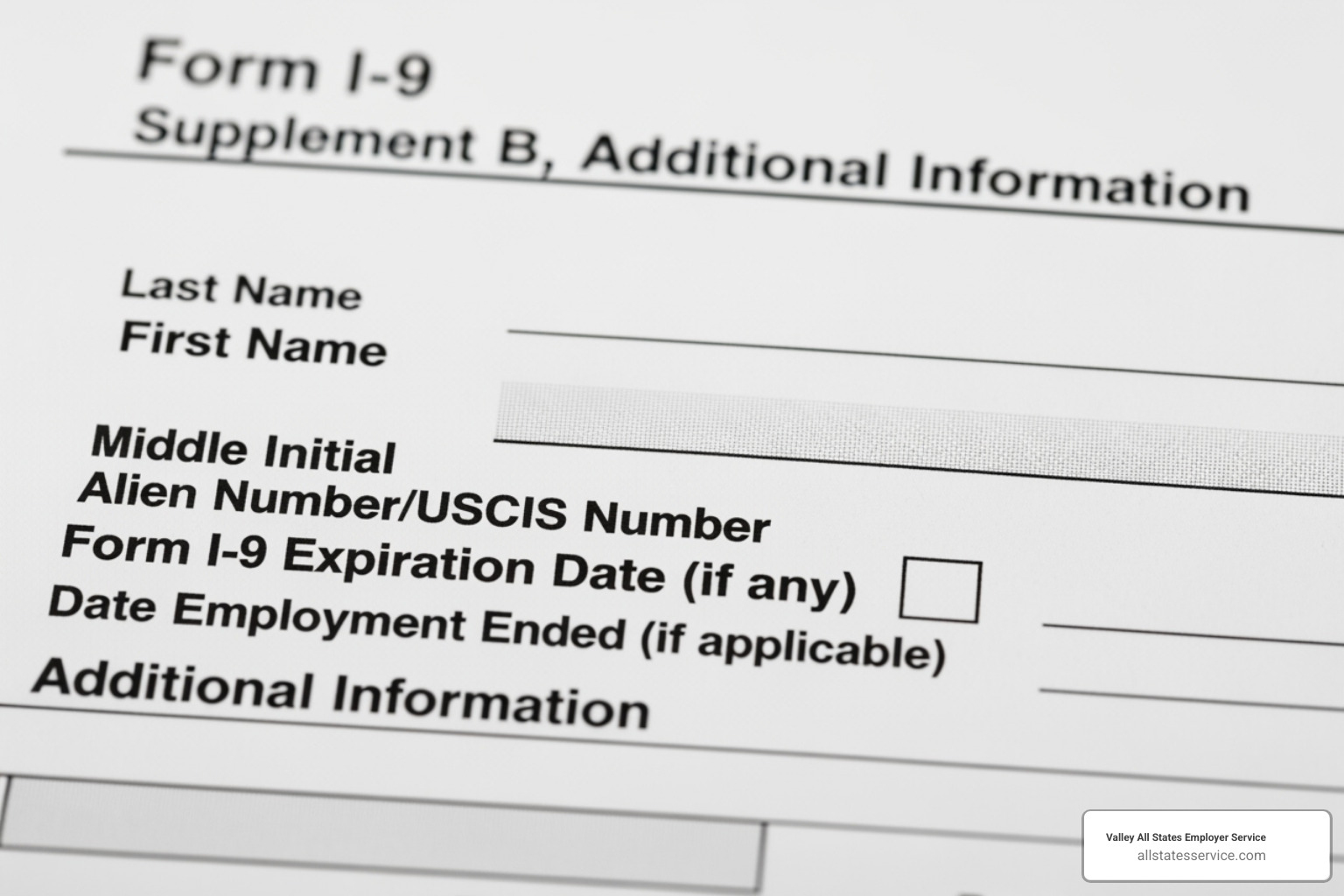

After identifying an existing employee for verification, you must address their Form I-9. The form must be accurate and complete before you can create an E-Verify case.

Employers have two options: complete a new Form I-9 or update the existing one. Your choice must be applied consistently and never be based on an employee’s citizenship, immigration status, or national origin, a key principle of E-Verify I-9 Compliance. For official guidance, consult the M-274 Handbook for Employers.

Option 1: Completing a New Form I-9

Completing a new Form I-9 for each employee is a straightforward approach.

- Simplified Process: This follows the same procedure as for new hires, reducing confusion.

- Avoiding Discrimination Claims: Requiring a new Form I-9 from all affected employees ensures a consistent, non-discriminatory approach.

- Document Retention: You must retain all previously completed Forms I-9 for the employee along with the new one.

Option 2: Updating an Existing Employee’s Form I-9

Alternatively, you can update the employee’s current Form I-9, often using Supplement B, “Reverification and Rehire.”

- When to Use: This is suitable if the original Form I-9 is valid and just needs an update, for instance, when an employee is assigned to a covered federal contract.

- Careful Determination: You must have a consistent, non-discriminatory reason for choosing to update some forms while requiring new ones for others. The decision cannot be based on citizenship or national origin.

- Assessment: Review each existing Form I-9 to ensure it meets current standards before deciding to update it.

The Future is Here: E-Verify+ and Your Current Team

The world of employment verification is changing, and E-Verify+ represents the next evolution in how we handle E-Verify for existing employees. Think of it as E-Verify’s tech-savvy younger sibling that combines Form I-9 completion and E-Verify verification into one streamlined digital experience.

While E-Verify+ was primarily designed with new hires in mind, it’s creating new possibilities for federal contractors who need to verify their existing workforce. The digital workflow puts more control in employees’ hands, letting them submit their information and documents electronically. This means fewer data entry errors, better identity protection, and a much smoother process overall.

For busy HR teams juggling compliance requirements, E-Verify+ feels like a breath of fresh air. You can even track your progress more easily with features like E-Verify Status Check becoming more accessible through these digital platforms.

How does E-Verify+ impact the process of E-Verify for existing employees?

Here’s where things get interesting for federal contractors. E-Verify+ can be a game-changer, but only in specific situations involving your current workforce.

The key requirement is simple: E-Verify+ works for existing employees only when they need to complete a new Form I-9. If you’re a federal contractor choosing to complete brand new Forms I-9 for your existing employees due to the FAR E-Verify clause, E-Verify+ suddenly becomes a viable option.

This employee-driven process transforms how verification happens. Instead of HR staff manually entering all the employee information, your existing employees can log into a secure portal and handle much of the process themselves. This reduced employer burden is significant, as the risk of transcription errors drops dramatically.

However, if you’re simply updating an existing Form I-9 using Supplement B, E-Verify+ isn’t designed for that scenario. It’s built specifically for new Form I-9 completion.

What are the key differences between E-Verify and E-Verify+ for this task?

For federal contractors weighing their options for verifying existing employees, understanding the differences between traditional E-Verify and E-Verify+ can help you choose the right approach:

- Process Integration: Traditional E-Verify requires you to complete the Form I-9 first, then separately create the E-Verify case. E-Verify+ combines both steps into one integrated digital workflow.

- Employee Involvement: With traditional E-Verify, employers handle all the data entry. E-Verify+ lets employees enter their own information directly into the system.

- Error Reduction: Traditional E-Verify relies on accurate data transfer from paper forms. E-Verify+ eliminates this transfer step, reducing transcription errors.

- Flexibility: Traditional E-Verify works for both new Form I-9 completion and existing Form I-9 updates. E-Verify+ only works when completing a new Form I-9.

The choice between traditional E-Verify and E-Verify+ for your existing employees ultimately depends on whether you’re completing new Forms I-9 or updating existing ones.

The General Rule: Can Employers Verify Existing Employees?

Generally, E-Verify for existing employees is not allowed. The system was created to confirm the eligibility of new hires and prevent discriminatory use. The official E-Verify FAQ on verifying existing employees states that most employers cannot use the system for their current workforce. Selective verification is prohibited because it could lead to discrimination based on national origin or other protected characteristics.

E-Verify works with Form I-9, cross-checking information against Department of Homeland Security (DHS) and Social Security Administration (SSA) databases. This partnership ensures a fair and consistent process. For more on this relationship, see our guide on E-Verify and I-9.

So, who is the exception to the rule?

Federal contractors are the most significant exception. If your company has a federal contract with the Federal Acquisition Regulation (FAR) E-Verify clause, you are required to verify certain existing employees. This is a contractual obligation, not an option. Before you start, you must designate this status in your E-Verify company profile.

While some state-level mandates exist, they usually apply to new hires, making the federal contractor rule the primary pathway for verifying an existing workforce.

What about employees from a merger or acquisition?

If you are a successor employer after a merger or acquisition, you can treat the acquired employees as new hires. In this case, you must create E-Verify cases for them. The process requires you to complete new Forms I-9 for all acquired employees, without picking and choosing. This consistency is vital for avoiding discrimination claims. You must then create E-Verify cases for all these employees within three business days of the acquisition date. This rule applies to businesses of all sizes, including those needing guidance on E-Verify for Small Businesses.

The Federal Contractor Exception: Rules for E-Verify for Existing Employees

For federal contractors, the landscape of E-Verify for existing employees changes significantly. The Federal Acquisition Regulation (FAR) E-Verify clause makes it mandatory to use E-Verify for existing employees assigned to federal contracts.

This is a requirement tied to your federal contract. Before verifying existing employees, you must update your E-Verify account under “Company Profile” to indicate you are a federal contractor subject to this clause. This step is crucial for compliance. For more detailed insights, explore our resources on E-Verify for Contractors.

What are the specific requirements for federal contractors?

Federal contractors face heightened requirements for their existing workforce:

- Verification Scope: You must verify all new hires and existing employees assigned to a federal contract containing the FAR E-Verify clause. Alternatively, you can opt to verify your entire existing workforce, which simplifies compliance but is generally an irreversible decision for those employees.

- Verification Timeline: The E-Verify case for an existing employee must be submitted within three federal business days of completing or updating their Form I-9.

Understanding these nuances is vital for maintaining compliance with Federal E-Verify Rules.

What steps must contractors take to verify existing employees?

For federal contractors, verifying existing employees involves a structured approach:

- Decide your verification scope: Choose to verify only employees on a covered contract or your entire workforce, and make this selection in your E-Verify profile.

- Identify exempt employees: Not every employee needs to be E-Verified.

- Complete or update Forms I-9: Before creating a case, ensure the employee’s Form I-9 is current and accurate.

- Create E-Verify cases: Once the Form I-9 is in order, create a case for each applicable employee within the three-day timeline.

Are any existing employees exempt from this process?

Yes, even for federal contractors, certain existing employees may be exempt:

- Employees hired on or before November 6, 1986.

- Individuals hired in the Commonwealth of the Northern Mariana Islands (CNMI) on or before November 27, 2009.

- Employees who hold an active confidential, secret, or top-secret security clearance.

- Employees with credentials issued pursuant to Homeland Security Presidential Directive 12 (HSPD-12).

- Existing employees not assigned to a covered contract, if you choose not to verify your entire workforce.

Consult the E-Verify Supplemental Guide for Federal Contractors for the most precise information on exemptions.

The Practical Steps: Updating Form I-9 for Verification

Once you’ve determined that an existing employee needs to be verified through E-Verify, the next step involves their Form I-9. This form must be accurate and complete before an E-Verify case can be created.

Employers have two primary options: completing a new Form I-9 or updating an existing one. Whichever path you choose, consistency is paramount. Decisions should never be based on an employee’s citizenship, immigration status, or national origin. This is a key principle of E-Verify I-9 Compliance.

For detailed guidance, we always refer to the official M-274 Handbook for Employers.

Option 1: Completing a New Form I-9

One straightforward approach is to complete a new Form I-9 for each existing employee you need to verify.

- Simplified Process: This option follows the same procedure you use for new hires, which can reduce confusion.

- Avoiding Discrimination Claims: By treating all affected existing employees the same way, you minimize the risk of discrimination claims.

- Document Retention: Remember to retain all previously completed Forms I-9 for the employee, even if you complete a new one.

Option 2: Updating an Existing Employee’s Form I-9

The alternative is to update the employee’s existing Form I-9, typically using Supplement B, “Reverification and Rehire.”

- When it’s allowable: This option is suitable when the existing Form I-9 is still valid and only needs an update to reflect the new verification requirement.

- Careful Determination: This option requires a careful, non-discriminatory policy to determine which employees need a new form versus an update.

- Assessment: You’ll need to assess each employee’s existing Form I-9 to ensure it meets current requirements before updating it.

The Future is Here: E-Verify+ and Your Current Team

E-Verify+ streamlines employment eligibility verification by combining the Form I-9 and E-Verify into one seamless digital process. While E-Verify+ is primarily designed for new hires, its capabilities can be used for verifying existing employees, especially for federal contractors.

E-Verify+ offers a digital workflow, empowering employees to submit their information and documentation electronically. This leads to a more efficient, error-reduced process and bolsters identity protection. You can also check your E-Verify Status Check through simplified means.

How does E-Verify+ impact the process of E-Verify for existing employees?

For federal contractors, E-Verify+ is applicable for existing employees only if they need to complete a new Form I-9. If a federal contractor decides to complete new Forms I-9 for existing employees due to the FAR E-Verify clause, E-Verify+ is a viable option.

- New Form I-9 Completion: E-Verify+ allows the employer and employee to collaborate electronically to complete both the Form I-9 and the E-Verify process simultaneously.

- Employee-Driven Process: E-Verify+ empowers the employee to enter their own biographic information and upload documents through a secure portal, reducing the data entry burden on the employer.

However, if you are simply updating an existing Form I-9, E-Verify+ cannot be used. It’s designed only for scenarios where a new Form I-9 is being completed.

What are the key differences between E-Verify and E-Verify+ for this task?

For federal contractors verifying existing employees, the choice between traditional E-Verify and E-Verify+ depends on your process. Here’s a comparison:

| Feature | Traditional E-Verify | E-Verify+ |

|---|---|---|

| Process | Separate Form I-9 and E-Verify case creation. | Integrated Form I-9 and E-Verify workflow. |

| Data Entry | Employer enters employee data from Form I-9. | Employee enters their own information directly. |

| Use Case | Can be used for new Forms I-9 and updates to existing ones. | Only for completing a new Form I-9. |

| Error Potential | Higher risk of transcription errors. | Lower risk of errors due to direct employee input. |

Ready to find out how this fits your team? Learn more about our E-Verify services through our guide on E-Verify and I-9 or get deeper into contractor requirements with E-Verify for Contractors.

Ready to simplify compliance? Contact our team today.