Why E-Verify for Contractors is Critical for Federal Contract Compliance

E-Verify for contractors became mandatory for federal contractors on September 8, 2009, when the Federal Acquisition Regulation (FAR) E-Verify clause took effect. This web-based system, operated by the Department of Homeland Security and Social Security Administration, verifies that employees are authorized to work in the United States.

Quick Answer for Federal Contractors:

- Who Must Use It: Federal contractors with contracts containing the FAR E-Verify clause

- When Required: Contracts over $150,000 with 120+ day performance periods

- Deadline: Enroll within 30 days of contract award

- Verification Timeline: 90 days for new users to verify existing employees

- Subcontractors: Must comply if subcontract exceeds $3,500 for services/construction

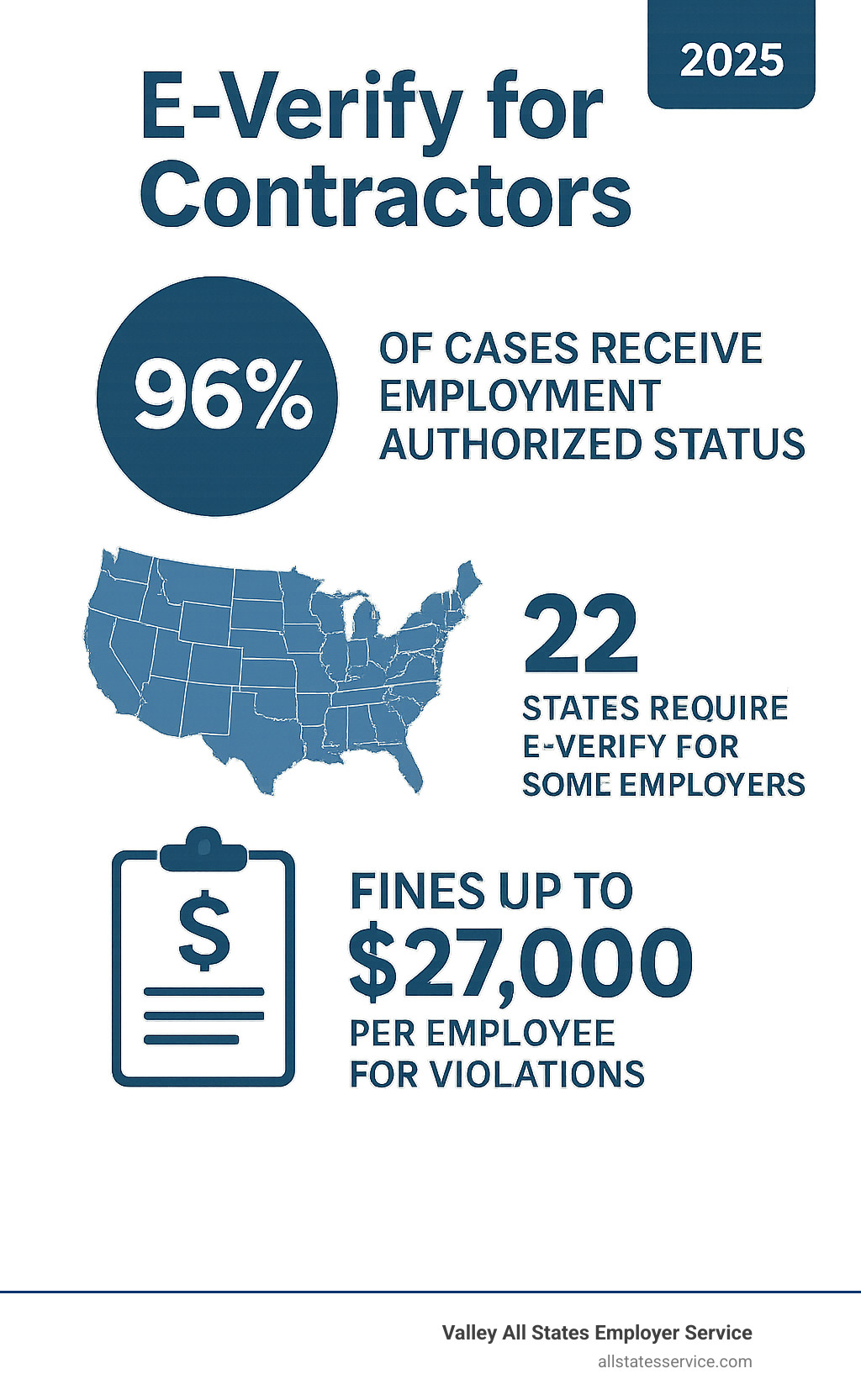

The stakes are high. As one employment attorney noted in recent industry coverage, “The government can get pretty creative in imposing liability for this legal concept of being a joint employer.” Fines for knowingly hiring ineligible workers can reach $27,000 per employee, and contractors risk losing their federal contracts entirely.

Understanding E-Verify requirements isn’t optional anymore. With 22 states now requiring E-Verify for some or all employers, and more states adopting these rules, contractors need a clear roadmap to steer this complex compliance landscape. The system reinforces the federal government’s policy of doing business only with organizations that maintain a legal workforce.

Whether you’re a prime contractor managing multiple subcontractors or a small business owner landing your first federal contract, getting E-Verify wrong can derail your entire operation. The good news? With the right knowledge and systems in place, compliance becomes manageable.

E-verify for contractors terms simplified:

What is E-Verify and Why is it a Must for Federal Contractors?

Think of E-Verify for contractors as your digital partner in workforce verification. This free, web-based system lets you electronically confirm that your employees are authorized to work in the United States by checking their Form I-9 information against government databases from the Department of Homeland Security and Social Security Administration.

The system didn’t appear out of nowhere. It grew from Executive Order 12989, which established a clear federal policy: the government will only do business with organizations that maintain a legal workforce. This wasn’t just about creating more paperwork. It was about ensuring that taxpayer-funded contracts support businesses that play by the rules.

Here’s something that might surprise you: more than 96 percent of E-Verify cases get an “Employment Authorized” result. That means the system works efficiently without creating unnecessary roadblocks for legitimate workers. You can use E-Verify in all 50 states, Washington D.C., Puerto Rico, Guam, and the U.S. Virgin Islands.

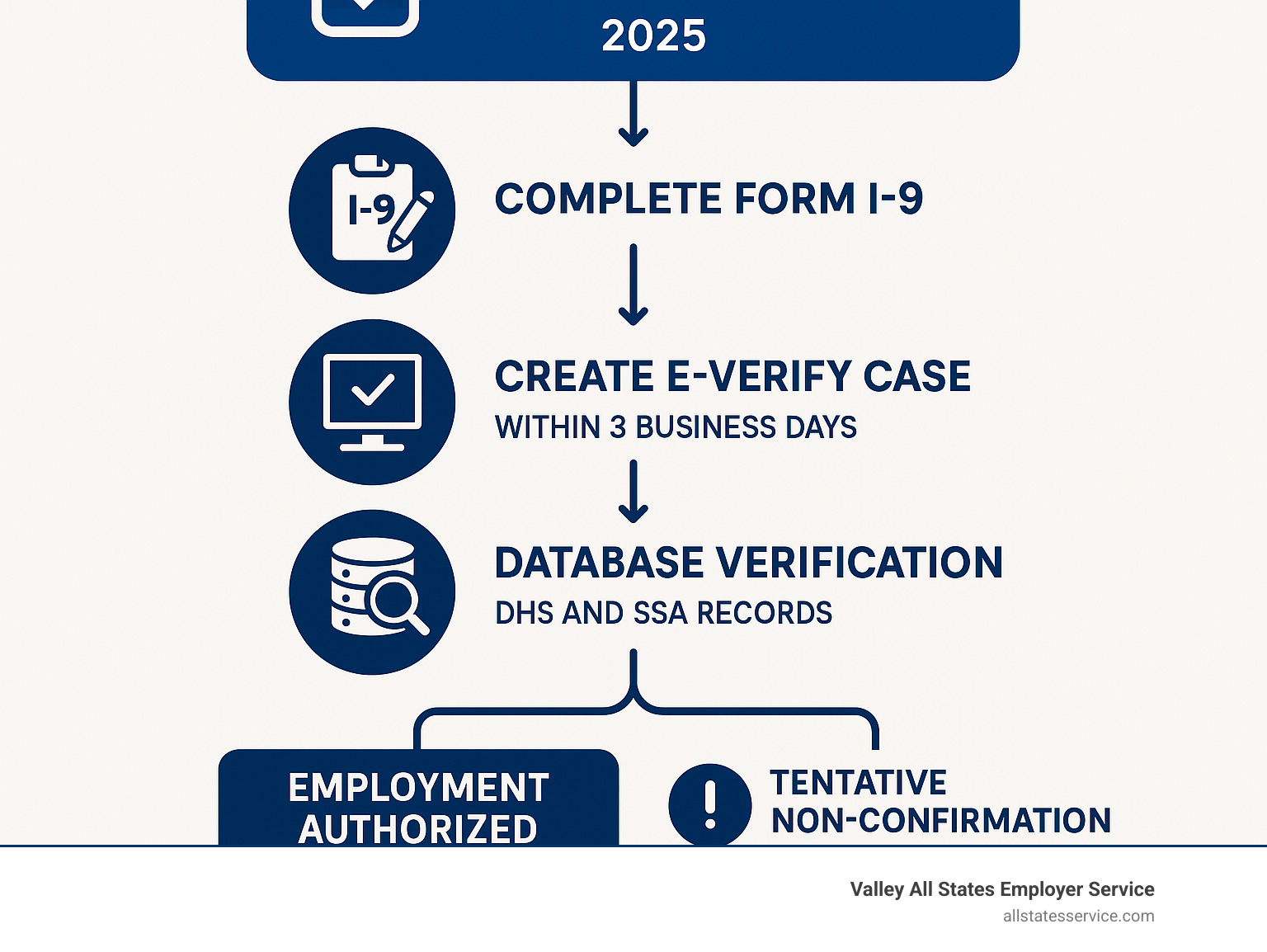

E-Verify doesn’t replace Form I-9. Instead, it builds on that foundation. While Form I-9 requires you to review documents and make determinations about work authorization, E-Verify takes the next step by electronically confirming that information against federal databases. For more detailed guidance on getting your I-9 process right, check out our I-9 Verification Assistance services. You can also find the official form at Form I-9, Employment Eligibility Verification.

The Federal Acquisition Regulation (FAR) E-Verify Clause

When you see the FAR E-Verify clause (48 C.F.R. Subpart 22.18) in your contract, consider it a binding commitment rather than a suggestion. This clause transforms E-Verify from an optional tool into a mandatory requirement that affects how you verify your entire workforce.

The rule kicked in for solicitations issued and contracts awarded after September 8, 2009. If your contract contains the FAR E-Verify clause, you must use E-Verify to verify all new hires and existing employees assigned to the federal contract. No exceptions, no shortcuts.

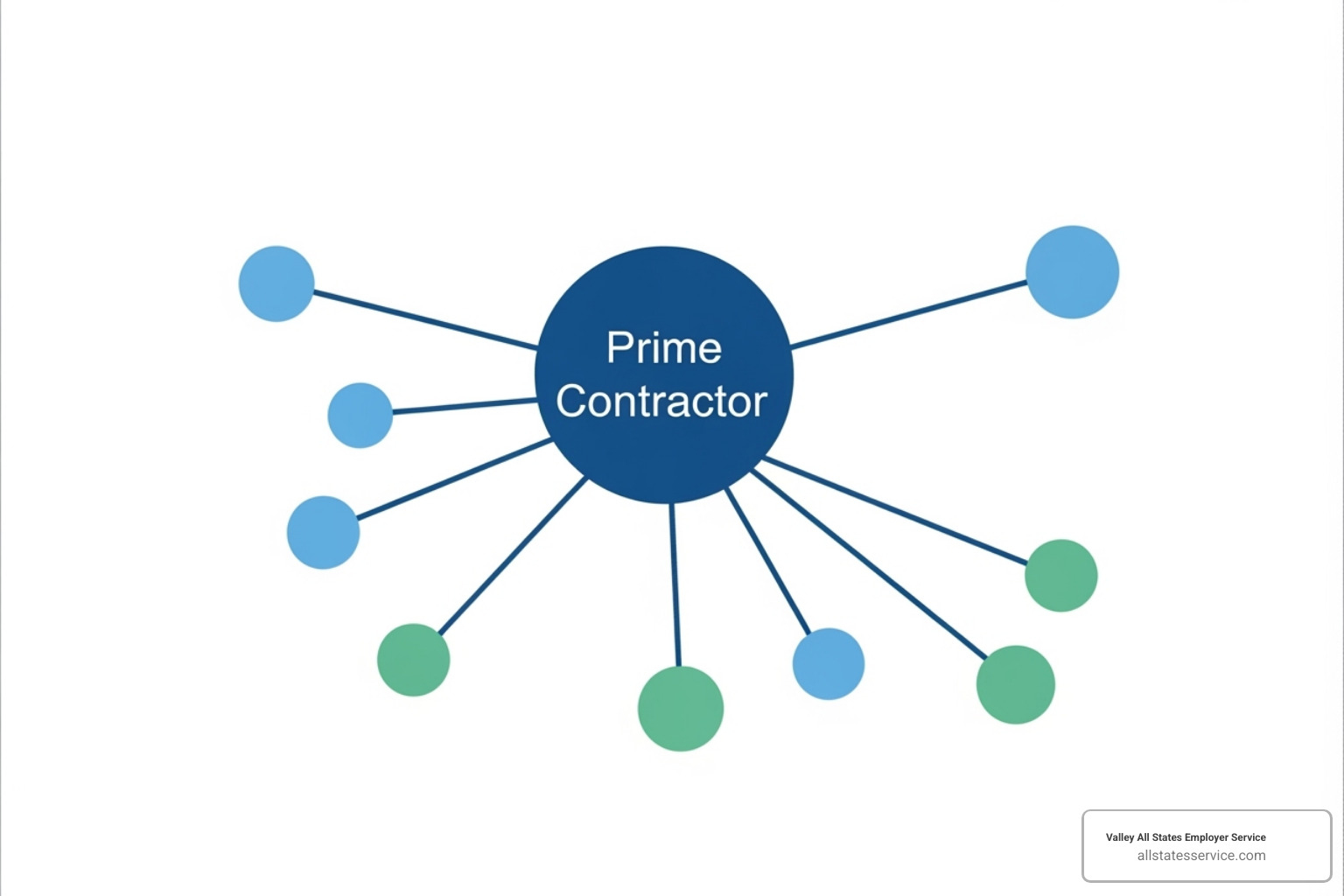

This requirement doesn’t stop with you. It flows down to every subcontractor in your chain. As a prime contractor, you must ensure that all covered subcontracts at every tier include the complete FAR E-Verify clause. You can’t use an abbreviated version or create your own summary. The full clause must appear in each subcontract to maintain compliance throughout the entire contracting chain.

The clause reinforces the government’s commitment to working only with organizations that maintain a legal workforce. For the complete text and specific details, reference The Federal Acquisition Regulation (FAR) E-Verify clause in a Federal Contract.

Key Differences Between Form I-9 and E-Verify

Understanding how Form I-9 and E-Verify work together is crucial for federal contractors. Form I-9 lays the groundwork, while E-Verify provides electronic confirmation of that information. But E-Verify for contractors involves more stringent requirements than standard Form I-9 procedures.

Document copying requirements set E-Verify apart from basic I-9 compliance. Federal contractors must make and keep copies of specific documents, including Form I-766 (Employment Authorization Document), Form I-551 (Permanent Resident Card), and U.S. Passports or Passport Cards. This creates a paper trail that supports your verification efforts.

Photo requirements add another layer of security. List B documents used for federal contracts must contain a photograph of the employee. This requirement helps prevent document fraud and ensures the person presenting the document is actually authorized to use it.

Database verification represents the biggest difference between the two systems. While Form I-9 relies on your visual inspection of documents, E-Verify electronically compares the information against DHS and SSA databases. This provides a more thorough verification process that catches discrepancies you might miss during manual review.

Timing requirements also differ slightly. Form I-9 must be completed by the employee’s third day of work, while E-Verify cases must be created within three business days after the employee starts work for pay. This electronic verification process makes it easier for government agencies to audit for fraud and ensures a higher level of compliance.

This improved verification process protects both you and your employees while maintaining the integrity of federal contracts. Learn more about our comprehensive approach through our E-Verify Background Checks services.

The FAR E-Verify Rule: Who’s In and Who’s Out?

Picture this: you just received a federal contract worth $200,000 with a six-month performance period. Congratulations! But here’s the catch you might not expect. Hidden within that contract language sits the FAR E-Verify clause, and it’s about to change how you verify every employee on your team.

E-Verify for contractors isn’t a blanket requirement for every federal contract. The government set specific thresholds that act like gatekeepers, determining exactly when contractors must jump into the E-Verify system. Understanding these boundaries can save you from compliance headaches or help you prepare for what’s coming.

Contracts and Contractors Subject to the Rule

The E-Verify federal contractor rule kicks in when your contract checks four specific boxes. Think of these as the “big four” criteria that determine your fate.

Contract value is the first hurdle. Your contract must exceed $150,000, which sits right above the simplified acquisition threshold. This isn’t just about the total potential value either. It’s about what the government is actually committing to pay.

Performance period creates the second checkpoint. Your contract needs a performance period of 120 days or more. A quick three-month project might slip under the radar, but anything longer puts you squarely in E-Verify territory.

Work location matters more than you might think. Some work must happen in the United States, including all 50 states, District of Columbia, Guam, Puerto Rico, U.S. Virgin Islands, and Commonwealth of the Northern Mariana Islands. If your team is working exclusively overseas, you’re off the hook.

Contract timing serves as the final filter. Your contract must be awarded on or after September 8, 2009, and include the actual FAR E-Verify clause. No clause, no requirement.

Here’s where it gets interesting for existing contracts. Bilateral modifications can pull older contracts into the E-Verify world. If a contracting officer modifies your existing contract to include the FAR E-Verify clause, you’re suddenly subject to the rule, even if the original contract predates 2009.

Indefinite-delivery/indefinite-quantity (IDIQ) contracts create their own special category. These umbrella contracts should be modified bilaterally by contracting officers to include the clause for future orders, but only if the remaining performance period extends at least six months and involves substantial work.

Exemptions and Exceptions to the Rule

Not everyone gets caught in the E-Verify net. The government carved out several exemptions that recognize the practical realities of federal contracting.

Commercially available off-the-shelf (COTS) items represent the biggest exemption category. This includes nearly all food and agricultural products. If you’re shipping bulk cargo like grains, oils, or produce, you’re likely exempt. The government recognized that requiring E-Verify for standard commercial products would create unnecessary administrative burden.

Work performed outside the United States gets a complete pass. If your entire team is working exclusively outside U.S. borders, the rule doesn’t apply. Interestingly, American Samoa and the Commonwealth of the Northern Mariana Islands aren’t considered part of the United States for this rule.

Security clearance holders enjoy a unique exemption. Employees with active confidential, secret, or top-secret security clearances don’t need E-Verify verification. The government figures if someone already passed a security background check, they’re probably authorized to work. However, interim security clearances don’t qualify for this exemption.

Special organizations get modified requirements rather than full exemptions. Institutions of higher education, state and local governments, and governments of federally recognized Native American tribes can choose to verify only employees assigned to covered federal contracts rather than their entire workforce. This recognition acknowledges that these organizations often have mixed funding sources and diverse employee populations.

The key is understanding where your contract fits in this complex web of requirements and exemptions. Getting it wrong can mean scrambling to achieve compliance after you’ve already started work. For detailed guidance on these exceptions and how they might apply to your specific situation, the Federal Contractors Q&As provide comprehensive answers to the most common questions contractors face.

Navigating E-Verify for Contractors: Key Requirements and Deadlines

Timing is everything in E-Verify compliance. Missing deadlines can jeopardize your contract and expose your organization to penalties. We’ve seen contractors scramble to meet requirements because they didn’t understand the timeline.

Verification Timelines You Must Follow

Enrollment Deadline: New E-Verify users must enroll within 30 calendar days of the contract award date. This deadline is firm and non-negotiable.

New Hire Verification: For new E-Verify users, you must begin verifying new hires within 90 calendar days of your enrollment date. Existing E-Verify users must verify new hires no later than the third business day after they start work for pay.

Existing Employee Verification: New E-Verify users have 90 calendar days from enrollment or 30 calendar days from the employee’s assignment to the contract (whichever is later) to verify existing employees assigned to the federal contract.

Entire Workforce Option: If you choose to verify your entire workforce, you have 180 calendar days to create E-Verify cases for all existing employees throughout your company.

Ongoing Verification: All verification must continue throughout the contract performance period. You can’t stop verifying employees once you start.

These timelines aren’t suggestions. They’re contractual obligations that can affect your ability to maintain federal contracts. For additional support in managing these requirements, explore our Automated Eligibility Verification System to streamline your compliance process.

Want to learn more about federal contractor requirements? The Federal Contractor E-Verify Webinar provides excellent training on timelines and program use.

Employee Verification: New Hires vs. Existing Staff

Understanding which employees require verification is crucial for compliance. The rules differ for new hires versus existing employees.

New Hire Requirements: All new employees hired after enrolling in E-Verify must be verified, regardless of whether they’re assigned to the federal contract. This applies to every hiring site in your organization.

Existing Employee Requirements: You must verify existing employees who are “assigned to the federal contract.” This means employees directly performing work under the contract in the United States.

Defining “Assigned to Contract”: An employee is considered assigned to a contract if they’re directly performing work under the federal contract. Employees performing support work, such as indirect or overhead functions, are generally not considered directly performing work under the contract.

Form I-9 Updates: For existing employees, you have two options when updating their employment eligibility verification:

- Complete a new Form I-9 when necessary

- Update existing Forms I-9 when allowable

The key is ensuring consistency in your approach. You must treat all employees the same way to avoid discrimination claims.

The Ripple Effect: Subcontractors, Mergers, and More

Federal contracts create a domino effect. When E-Verify for contractors requirements hit a prime contractor, they don’t stop there. They flow down through the entire contracting chain, touching subcontractors, independent contractors, and even companies going through mergers. Understanding this ripple effect can mean the difference between smooth compliance and costly surprises.

Think of it like a river system. The prime contract is the main river, and every subcontract is a tributary that must follow the same compliance rules. Miss one tributary, and the entire system becomes vulnerable.

Prime vs. Subcontractor: Understanding Your Role in E-Verify for Contractors

The relationship between prime contractors and subcontractors in E-Verify compliance is like a partnership with clear responsibilities on both sides. Prime contractors can’t just pass the buck and hope for the best, while subcontractors can’t claim ignorance of the requirements.

For prime contractors, your job includes more than just your own compliance. You must include the full FAR E-Verify clause in every covered subcontract. Not an abbreviated version or a summary, the complete clause. You’re also responsible for providing general oversight to ensure your subcontractors meet their E-Verify obligations.

Here’s where it gets interesting: you could face fines and penalties if you knowingly continue working with a non-compliant subcontractor. This means you need proof that your subs are enrolled and complying with E-Verify requirements.

Subcontractors face the same basic requirements as prime contractors when their work triggers the rule. The E-Verify requirement flows down when four specific conditions align: the prime contract includes the FAR E-Verify clause, the subcontract covers commercial or noncommercial services or construction, the subcontract value exceeds $3,500, and work happens in the United States.

The timeline pressure is real. Subcontractors have just 30 days from subcontract award to enroll in E-Verify, then must verify all new hires plus existing employees assigned to the federal contract work. Smart subcontractors provide their prime contractors with a copy of their E-Verify Company Profile page as proof of enrollment. This simple step protects both parties and demonstrates compliance.

One important distinction: subcontractors who only provide supplies (not services) dodge the E-Verify requirement entirely. But if you’re providing both supplies and services, the services portion triggers the full requirement.

For comprehensive guidance on these relationships, the Supplemental Guide For Federal Contractors provides detailed scenarios and examples.

Independent Contractors and Self-Employed Individuals

The world of independent contractors and self-employed individuals creates some interesting wrinkles in E-Verify compliance. The key lies in understanding who counts as an employee versus who operates as an independent business.

Self-employed individuals working alone generally don’t complete Forms I-9 on themselves, so they’re not required to use E-Verify for themselves either. This makes sense when you think about it. You can’t be your own employer for verification purposes.

But here’s where it gets more complex. If that same self-employed individual operates as a subcontractor under a covered federal contract and hires employees, they must use E-Verify for those employees. The requirement flows down to their workforce, not to them personally.

Independent contractors present a different scenario. Employers typically don’t complete Forms I-9 or use E-Verify for their independent contractors, based on common-law definitions of employer-employee relationships. The classification matters enormously here.

However, you can’t use an independent contractor if you know they’re not authorized to work in the United States. This creates a compliance obligation even without formal E-Verify verification. It’s a gray area that requires careful attention to worker classification.

When independent contractors serve as subcontractors under federal contracts with the FAR E-Verify clause, the requirements flow down to them for their own employees. They become responsible for verifying their workforce while remaining exempt from verification themselves.

For detailed guidance on these distinctions, see 6.3 Independent Contractors and Self-Employed Individuals.

How Mergers and Acquisitions Impact Compliance

Mergers and acquisitions throw a curveball into E-Verify compliance. When companies combine, the rules around employee verification become more complex, and timing becomes critical.

Acquired employees automatically become “existing employees” for E-Verify purposes in the acquiring company. This classification affects everything from verification timelines to procedural requirements. You can’t treat them as new hires, even though they’re new to your organization.

The verification timeline follows the same rules as other existing employees: 90 calendar days from enrollment or 30 calendar days from assignment to the federal contract, whichever comes later. This gives acquiring companies some breathing room, but not much.

Legal counsel consultation becomes essential during mergers and acquisitions. Employee classifications, contract obligations, and verification requirements can vary dramatically based on the specific structure of the transaction. What works for an asset purchase might not work for a stock purchase, and vice versa.

The biggest challenge is maintaining E-Verify compliance throughout the entire transition process. You can’t pause verification requirements while sorting out the organizational changes. This requires careful coordination between HR, legal, and operations teams.

Smart companies start planning their E-Verify compliance strategy during due diligence, not after the deal closes. By the time you’re signing papers, you should already know how you’ll handle the verification requirements for all affected employees.

The ripple effect of E-Verify for contractors extends far beyond the initial contract. Understanding these interconnected relationships and planning for complex scenarios helps ensure compliance throughout your entire business ecosystem.

Staying Compliant: Enrollment, Best Practices, and Consequences

Getting E-Verify for contractors right is not a set-and-forget chore. It is a daily discipline that shields your projects, protects your reputation, and keeps revenue flowing.

The Enrollment Process for Federal Contractors

- Visit the E-Verify Enrollment Application and select “Federal Contractor with FAR E-Verify Clause.”

- List every hiring site that will bring on new employees or verify existing ones.

- Choose whether to verify only contract-assigned staff or your entire workforce. This choice is permanent.

- Sign the Memorandum of Understanding and finish the federal-contractor tutorial.

- Already enrolled? Update your company profile within 30 days of receiving a contract that contains the FAR clause.

Consequences of Non-Compliance

- Civil penalties can reach $27,000 per ineligible worker, and DHS adjusts these fines for inflation.

- Contracts may be suspended or terminated, and repeat offenders risk debarment from future federal work.

- Prime contractors can face joint-employer liability if a non-compliant subcontractor slips through the cracks.

- The cost in lost time and reputation often outweighs any fine.

Best Practices for Ongoing Compliance

- Post required notices (E-Verify Participation and Right to Work) where applicants and staff can see them.

- Standardize procedures. Treat every employee the same way during Form I-9 and E-Verify steps to avoid discrimination claims.

- Run internal audits each month, documenting any corrections.

- Train your team so multiple people understand the process, reducing single-point failure risk.

- Consider an E-Verify Employer Agent to cut paperwork and minimize errors. See our E-Verify Best Practices guide for details.

- Stay current with regulatory updates through our E-Verify Customer Support services.

Contractors who weave these habits into daily operations turn compliance into a competitive edge. Ready to simplify the process and focus on building? Learn more about our outsourced E-Verify solutions.

Simplify Your Contractor Verification Process

Navigating the complexities of E-Verify for contractors requires diligence and expertise. From understanding FAR clauses to managing subcontractor compliance, the administrative burden can be significant. The construction industry alone has more than 383,000 job openings, and ensuring compliance while managing workforce needs creates additional challenges.

The reality is that E-Verify requirements will likely expand. As employment attorneys predict, “E-Verify is probably going to be everywhere someday. A lot of states are taking this into their own hands.” With 22 states already requiring E-Verify for some or all employers, staying ahead of compliance requirements is essential for long-term success.

Think of it this way: you wouldn’t build a structure without a solid foundation. The same principle applies to your compliance program. Without proper E-Verify processes in place, your federal contracting business sits on shaky ground.

At Valley All States Employer Service, we understand the unique challenges contractors face. We’ve seen how E-Verify for contractors can feel overwhelming, especially when you’re trying to focus on project deadlines and client relationships. Our expert, impartial, and efficient E-Verify processing minimizes errors and administrative burden, allowing you to focus on what you do best: delivering exceptional work for your clients.

We’ve helped contractors across the country steer these complex requirements successfully. Our comprehensive approach includes enrollment assistance, ongoing compliance monitoring, and expert support when challenges arise. Whether you’re a prime contractor managing multiple subcontractors or a small business landing your first federal contract, we provide the expertise you need to build solid compliance foundations.

The consequences of getting E-Verify wrong are too significant to ignore. Fines up to $27,000 per employee, contract suspension, and reputational damage can derail your business. But here’s the good news: with the right partner, compliance becomes manageable and sustainable.

You didn’t become a contractor to spend your days wrestling with government databases and compliance deadlines. You got into this business to build things, solve problems, and create value for your clients. Let us handle the verification complexities so you can get back to what matters most.

Don’t let E-Verify compliance become a barrier to your federal contracting success. Partner with experts who understand the intricacies of contractor verification and can protect your contracts and reputation.

Ready to build a foundation of solid compliance? Explore our comprehensive E-Verify and I-9 solutions and find how we can simplify your contractor verification process while ensuring complete compliance with federal requirements.