Background verification previous company closed: Ultimate 2025

Why Background Verification Previous Company Closed is a Common Challenge

Background verification previous company closed situations are more common than you think. Over 160,000 U.S. businesses have permanently shut down since March 2020, and many Fortune 500 companies from 2003 no longer exist. If your former employer has closed, you’re not alone in facing this verification challenge.

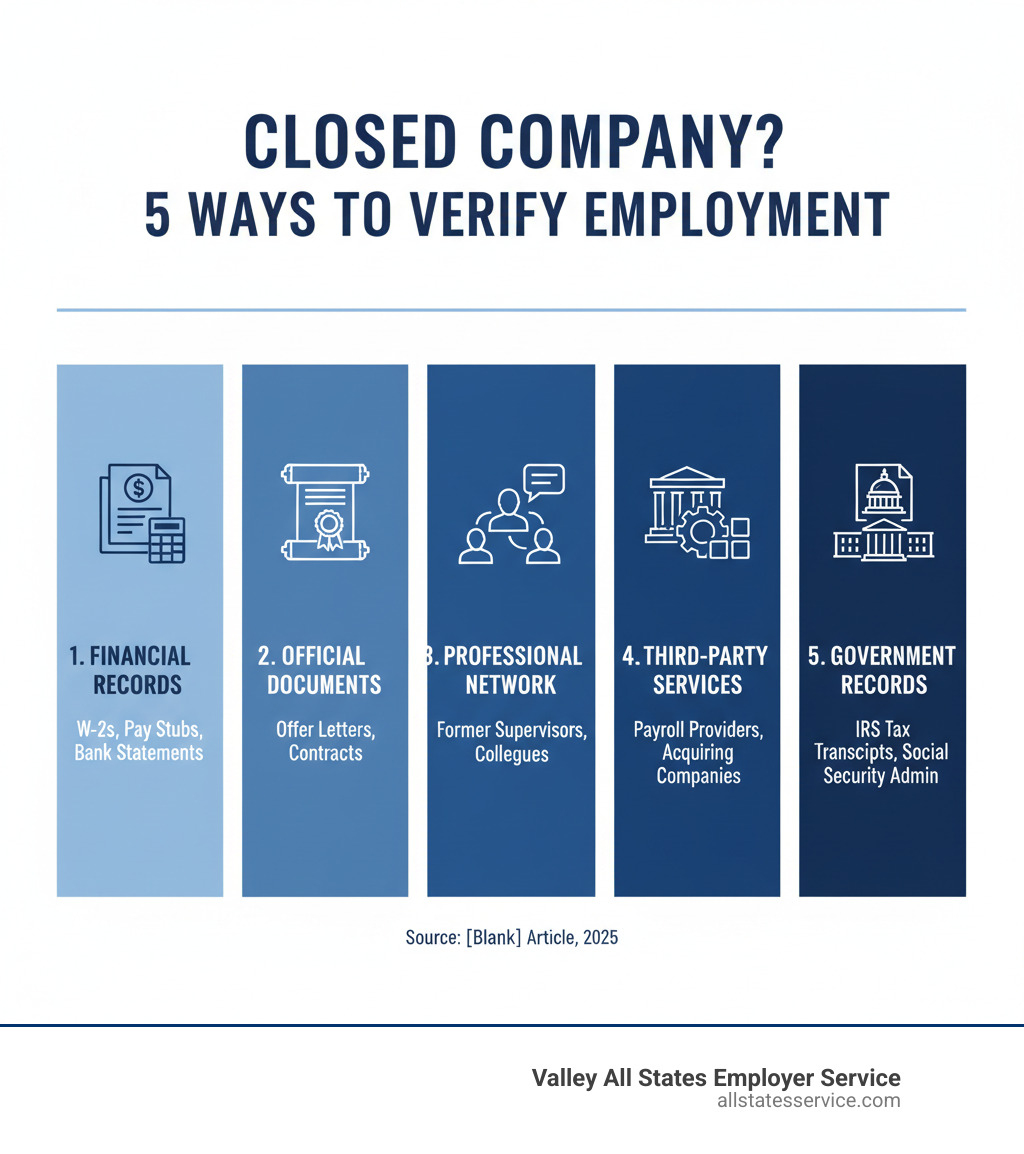

Quick Solutions for Closed Company Verification:

- Gather financial records – Pay stubs, W-2 forms, bank statements

- Find official correspondence – Offer letters, employment contracts, termination letters

- Contact former colleagues – Supervisors, managers, or coworkers

- Use government resources – IRS tax transcripts or Social Security records

- Check for acquiring companies – Contact the new company’s HR if a merger occurred

- Leverage third-party services – Payroll providers may retain records

The challenge is real. When a company closes, its HR department often disappears, leaving no one to confirm your employment. This creates a compliance headache for hiring managers and can make it feel like your work experience never existed.

However, employers expect this problem. Background check processes are designed to handle it. While federal law requires record-keeping for one to three years, these records often become inaccessible when a business shuts down.

Your job is to be your own advocate by providing alternative proof of your employment. This isn’t about overcoming suspicion; it’s about helping a potential employer check a compliance box so they can confidently hire you.

Why Verifying a Closed Company is a Challenge

When you apply for a job and list a company that no longer exists, the hiring manager faces a genuine problem. Their usual verification process fails because there is no one to call, no website to check, and no HR department to confirm anything.

Background verification previous company closed situations put employers in a tough spot. They have legal obligations under the Fair Credit Reporting Act (FCRA) to confirm your employment details. Without that verification, they take on risks they cannot afford. With over 160,000 businesses closing since March 2020, this scenario is common. However, hiring managers still need documentation. Understanding Employment Compliance Guide 2025 requirements explains why they can’t just take your word for it.

The Employer’s Dilemma

Here’s what keeps hiring managers up at night when they can’t verify a closed company: verifying dates, confirming job titles, dealing with inaccessible records, and the very real risk of fraud.

When a company shuts down, its entire infrastructure disappears. The HR contact, the employee database, and even the manager who could vouch for you may be gone or hard to find. Every piece of the normal verification puzzle becomes harder to locate.

The stakes are high, as fraud in the hiring process is a growing concern. Employers can’t afford to skip verification steps, even when the company no longer exists. They need to find alternative ways to confirm your employment history, which is why having strong Outsourced HR Compliance Ultimate Guide practices matters so much.

Without proper verification, employers worry about hiring someone who exaggerated their role or made up the job entirely. It’s not personal; it’s about protecting their company and ensuring they’re hiring qualified, honest employees.

What the Law Says About Record Keeping

You might be wondering: aren’t companies required to keep this information? The answer is yes, but with a big catch.

Federal regulations require employers to maintain employment records for at least one year and payroll records for three years. The problem is, when a business permanently closes, those legal requirements become nearly impossible to enforce.

The situation gets even more complex with state-specific laws. Some states have service letter laws that require employers to provide former employees with documentation about their employment. But when a company is going out of business, following these laws often falls to the bottom of the priority list.

Records get lost in the chaos of closure. They might be stored in boxes, saved on servers that get shut down, or simply disappear. This lack of centralized record keeping creates headaches for everyone, highlighting why understanding Human Resources Compliance is so important.

The reality is that legal requirements and actual practice don’t always align when a business closes. That’s why being prepared with your own documentation is so crucial.

Your First Line of Defense: Essential Employment Documents

When a company can’t speak for itself, your paperwork has to do the talking. This is the most powerful step you can take in a background verification previous company closed situation. Dig through your physical and digital files for any proof of your time there. These documents act as your personal employment archive, replacing the need for direct contact with a defunct HR department.

The documents you gather show hiring managers you are organized, prepared, and honest. Handing over official paperwork proactively transforms a potential red flag into a demonstration of your professionalism.

Financial and Tax Records

Your financial records are often the most reliable verification because they come from official sources like banks and government agencies.

Pay stubs and direct deposit notifications are verification gold. They show your employer’s name, pay periods, and often your job title. Holding onto several from different periods, especially your first and last, creates a timeline that’s hard to dispute.

Your W-2 forms are even better, as they are government-backed proof of your employment sent to the IRS. They contain your employer’s name, EIN, and total wages. If you no longer have old W-2s, you can request copies from the IRS website.

If your salary was direct-deposited, your bank statements can show regular deposits, proving consistent income from a specific company. This is a critical piece of the puzzle for Employment and Income Verification Services.

When sharing these documents, remember to black out sensitive information like your Social Security number until specifically requested.

Official Company Correspondence

Official letters and documents from your previous employer can also provide concrete proof of your tenure and role. These documents often sit forgotten in old email folders or file boxes.

Your offer letter or a formal employment contract is foundational evidence, outlining your job title, start date, and terms of employment.

Termination letters, separation notices, or a resignation acceptance letter can confirm your last day of employment and your position.

If you obtained referral letters from former supervisors, these are excellent for verifying employment. As Monster suggests, it’s wise to ask for these letters when possible.

Don’t overlook your performance reviews. These dated, signed documents demonstrate your active employment, role, and contributions within the company.

Any official document bearing the company’s letterhead and your name, especially with dates, helps piece together your employment history.

Alternative Verification: Leveraging Networks and Third Parties

If your paper trail is thin, don’t worry. Other credible methods can confirm your work history, though they may require more legwork.

When background verification previous company closed situations arise, your professional relationships and third-party record keepers become invaluable. The people who worked at the company and the systems that supported it often remain accessible.

Tapping into Your Professional Network

Your former coworkers and managers can vouch for your employment. Start with former supervisors or managers, as they carry the most weight. A direct manager who can confirm your employment dates, job title, and responsibilities is invaluable during a background check.

If you’ve stayed connected on LinkedIn, reach out. A simple message asking if they’d serve as a reference is reasonable, as most professionals are happy to help. A LinkedIn recommendation is even better, as these public endorsements serve as documented proof of your work relationship.

Don’t overlook former coworkers. They can still confirm that you worked at the company during the time you claimed. Multiple colleagues corroborating your story creates a compelling case. This network approach is a key component of our Employee Verification Service Complete Guide.

The Role of Third Parties and Government Agencies

If your former employer was acquired or merged with another company, the acquiring company’s HR department may have inherited employment records. It’s worth reaching out to them.

Many companies also outsource their payroll to third-party providers like ADP or Paychex. These providers maintain records independently. If you remember which service was used, contact them directly for verification. This is where understanding the Outsourced Employment Verification Ultimate Guide is useful.

Government agencies hold some of the most reliable records. The IRS Wage and Income Transcript lists data from your W-2 forms, showing each employer and income received. You can request this from the IRS website for official proof.

Similarly, the Social Security Administration maintains comprehensive earnings records. By requesting Form SSA-7050-F4, you can obtain documentation of your wages and employers.

In some cases, your credit report can help. Credit bureaus sometimes list employer information, which can provide supporting evidence.

For larger companies, news archives and social media can occasionally provide corroborating evidence. Archived versions of the company website (via the Wayback Machine) might mention your role or department and can support your claims.

With a little detective work and the right contacts, you can piece together a verification package that satisfies even the most thorough background check.

Proactive Steps and Navigating the Background Verification Previous Company Closed

The best way to handle a background verification previous company closed situation is to get ahead of it. Being transparent and prepared shows a potential employer that you are organized and honest, turning a potential red flag into a demonstration of professionalism.

How to Proactively Prepare for Future Verifications

Think of building a personal employment archive as career insurance. You’ll be grateful it exists when you need it.

Start by creating a digital archive of important employment documents like offer letters, contracts, pay stubs, W-2s, and performance reviews. Store them securely in cloud storage or on an external hard drive. It’s also wise to maintain a physical folder as a backup.

Don’t forget to save contact information for your direct supervisors and trusted colleagues. Keep their emails, phone numbers, and LinkedIn profiles. Years later, these individuals can provide crucial verification.

When leaving any job, request exit letters and referrals. Ask HR or your manager for a letter confirming your employment dates and job title. Also, request a referral letter from your supervisor. These documents become invaluable if your former employer no longer exists.

Keep your LinkedIn profile current with accurate employment dates and job titles, and encourage colleagues to write recommendations. These public endorsements serve as timestamped proof of your work history. For more on employer responsibilities, our HR Compliance Audit Guide 2025 provides valuable insights.

What to Do During a Background Verification When a Previous Company Closed

When you know a previous employer is defunct, honesty and proactive communication are your strongest assets.

Inform the recruiter or hiring manager early in the process. Mention that one of your previous employers has closed and that you have prepared alternative documentation. This transparency shows initiative and builds trust.

Provide documentation upfront. Assemble a packet of W-2s, pay stubs, and offer letters to present to the background check company or hiring manager.

Offer contacts from your network who can vouch for your employment. Provide names and current contact information for former supervisors, and make sure you’ve already asked for their permission.

Explain the situation clearly and concisely. For example: “My previous employer, ABC Marketing, ceased operations in 2022. I’ve compiled alternative documentation and contact information for my former supervisor to verify my employment there.”

Finally, be patient and cooperative. Background checks involving defunct employers take longer. Respond quickly to any requests for information. We work with Pre-employment Background Check Companies experienced in these situations, but your cooperation is key to supporting proper Workforce Eligibility Verification.

Frequently Asked Questions about Defunct Employers

Here are answers to common concerns job seekers face in a background verification previous company closed situation.

What if I can’t find any documents or contacts?

This is a tough spot, but not the end of the road. Focus on government-issued records. Request a tax transcript from the IRS website for W-2 information, or get your Social Security earnings statement, which lists your employers. Also, dig into your email archives for any correspondence with the old company.

If you come up empty, explain the situation honestly to the hiring manager. Show them what you did find and the steps you took. This demonstrates a good faith effort, which hiring managers appreciate.

Can a job offer be rescinded if my employment can’t be verified?

Yes, this can happen. Job offers are often contingent upon a successful background check. If a significant part of your work history can’t be verified and you can’t provide alternative proof, an employer may withdraw the offer for compliance and risk management reasons.

This is why being proactive is so important. The more proof you provide upfront, the better. We understand verification can be difficult when a company closes and we look for a candidate’s good faith effort to provide proof. Our goal is to move forward with your candidacy.

Should I leave a closed company off my resume?

Absolutely not. Never omit relevant work history, even if the company no longer exists. A gap in your resume raises more red flags than a defunct employer ever will. Hiring managers may wonder what you’re hiding.

A closed company is a neutral fact and doesn’t reflect poorly on you. Always be truthful on your resume and be prepared to verify your experience using the alternative methods discussed in this guide. When you’re upfront and prepared, you show integrity and professionalism.

Don’t Let a Closed Company Derail Your Career

Facing a background verification previous company closed situation can feel overwhelming, but it is a manageable challenge. You have more options than you think.

This guide covered the essential steps: gathering official documents, leveraging your professional network, and using government resources. The key is to be proactive, organized, and transparent throughout the process.

Companies close all the time. Employers and background check professionals are used to this. Your preparedness makes all the difference. Showing up with documentation and a clear explanation demonstrates professionalism and integrity, which works in your favor.

At Valley All States Employer Service, we understand the complexities of employment compliance. We help employers streamline their verification needs, and we believe candidates deserve to be empowered with the right knowledge too. Our mission is to make the verification process smooth for everyone.

To understand more about how modern verification works, explore our Employment Verification Process Ultimate Guide. If you’re an employer facing this challenge, we’re here to help. We specialize in handling these complex compliance situations with expertise.

Don’t let a closed company derail your career path. You’ve done the work, and now you have the tools to prove it.