Stop Drowning in Paperwork, Start Growing Your Business

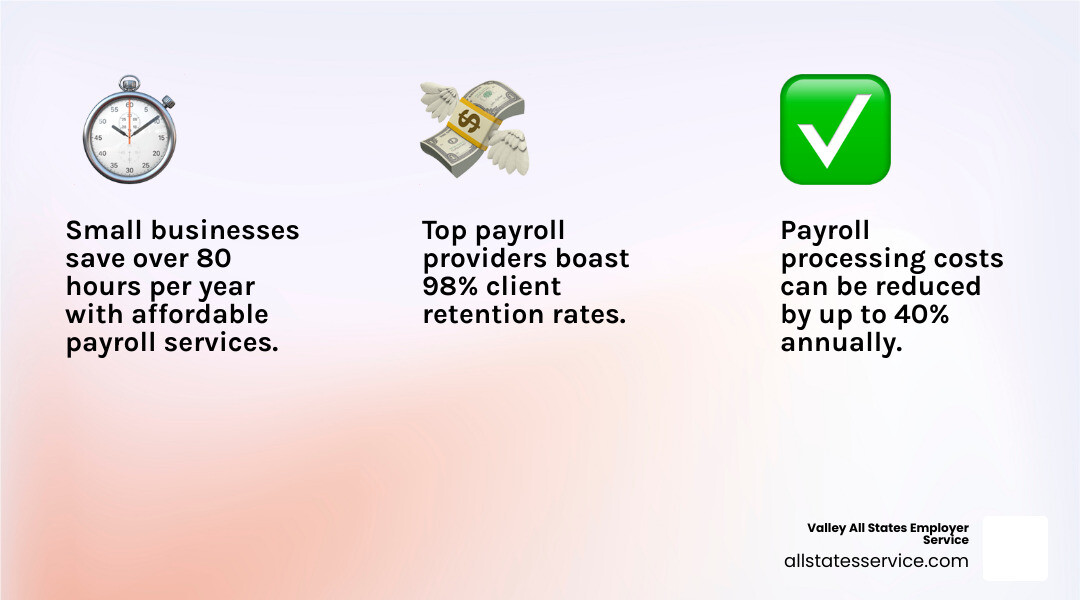

Affordable payroll services can save small businesses over 80 hours per year while reducing payroll costs by up to 40%, according to recent industry data. If you’re spending entire days each month calculating paychecks, filing taxes, and managing compliance paperwork, you’re not just busy, you’re losing valuable time that could be spent on growth. That 80-hour figure isn’t an exaggeration; it represents the time spent double-checking calculations, researching tax code changes, and correcting inevitable human errors.

For many business owners, payroll is a recurring source of stress. It’s a complex, high-stakes task where a single mistake can lead to unhappy employees and costly government penalties. The good news is that you don’t have to handle it alone.

Quick Answer: Top Affordable Payroll Services

- Gusto – Best overall value with a modern, user-friendly platform and integrated HR tools that grow with you.

- Paychex Flex – Best for businesses that need to scale, offering plans for solopreneurs up to enterprises with 1,000+ employees and robust support.

- ADP Run – Most reliable for compliance, backed by decades of industry leadership and strong tools to steer complex tax laws.

- QuickBooks Payroll – Best for existing QuickBooks users, providing seamless integration that simplifies accounting and bookkeeping.

The real cost of doing payroll yourself goes far beyond the obvious expenses. Consider this: one business owner switched from manual payroll processing to an automated service and found that “payroll used to take at least one full day per month, but with the new system, it takes less than an hour.” That’s a savings of at least 11 full workdays a year. What could you accomplish with 11 extra days to focus on sales, marketing, or customer service?

What makes payroll truly expensive isn’t the service fee; it’s the hidden costs of doing it wrong. A late tax filing can trigger penalties that far exceed a full year of payroll service fees. Manual calculations often lead to overpayments or underpayments, costing time, money, and employee trust to fix. Every hour you spend on administrative tasks is an hour you’re not steering your business toward its goals.

The payroll service landscape has changed dramatically. What once required expensive, complex desktop software now comes in affordable, cloud-based packages starting as low as $30-40 per month for small businesses. These modern platforms offer transparent pricing with no hidden setup fees, free trials, and customer support that actually helps solve your problems.

But “affordable” doesn’t just mean cheap. The best value comes from services that combine competitive pricing with features that give you back your time and peace of mind. Look for automated tax filings, employee self-service portals for pay stubs and W-2s, free direct deposit, and compliance alerts that keep you ahead of regulatory changes.

Here’s what you need to know if you are exploring affordable payroll services:

- They help even the smallest teams, including businesses with just one or two employees, by automating taxes and payments.

- They centralize your data, so you are not juggling spreadsheets, paper forms, and banking portals.

- They reduce risk by standardizing tasks like new hire setup, deductions, and year-end forms.

How these tools quickly pay for themselves

- Fewer errors, which means fewer corrections and less time reconciling pay.

- Auto-filed taxes, which reduces missed deadlines and penalty exposure.

- Self-service access for employees, which cuts routine questions about pay stubs and W-2s.

Ready to find out how much time you could save? Imagine running payroll from your phone in minutes, approving time off in the same place, and knowing taxes are handled. That is the everyday reality with the right provider.

What to expect when you switch

- A short onboarding period where prior payroll data is imported and tax accounts are connected.

- Simple test runs to catch any issues before the first live payroll.

- A clear calendar that shows upcoming payroll dates, tax filings, and year-end milestones.

When affordable payroll services blend automation with smart support, your operations feel lighter and your team gets paid accurately, on time, every time.

Ready to simplify your payroll process? Contact our team today to find which affordable payroll service fits your business best.

What Makes a Payroll Service Truly “Affordable”?

When you’re searching for affordable payroll services, it’s tempting to just sort by price and pick the cheapest option. But here’s the thing: truly affordable doesn’t mean the lowest sticker price. It means getting the most value for your money while avoiding the sneaky, unexpected costs that can blindside you later.

Think about it like buying a used car. The $2,000 car on the corner lot seems like a steal compared to the $5,000 one at the dealership. But when the cheap car needs a new transmission in three months and has constant electrical issues, was it really the more affordable choice? Payroll services work the same way. A low monthly fee can hide a mountain of extra charges and limitations.

The pricing game gets interesting because providers use different models. Understanding them is key to finding the right fit.

Some use a per-employee-per-month (PEPM) approach, where you pay a base fee plus a set amount for each employee. For example, a plan might be $39 per month plus $5 per employee. For a team of 10, your predictable monthly cost is $89 ($39 + $50). This model is popular because it’s easy to budget for and scales directly with your team size.

Other providers go with per-pay-run pricing. With this setup, you might pay a base fee plus a small amount per employee each time you run payroll. This can be cost-effective if you pay your employees monthly. However, if you run payroll weekly or bi-weekly, these costs can quickly surpass a PEPM plan. It requires careful calculation based on your pay frequency.

Then there’s the all-inclusive flat fee model, though it’s less common for very small businesses. You pay one monthly or annual amount regardless of employee count or how often you run payroll. It offers ultimate predictability but might feel expensive upfront if you only have a few employees.

Most popular services like Gusto and QuickBooks Payroll use tiered pricing. They offer Basic, Premium, and Elite plans with different features at each level. This lets you start with an affordable basic plan and upgrade to access more advanced HR tools or dedicated support as your business grows.

| Pricing Model | Description | Pros | Cons |

|---|---|---|---|

| Per-Employee-Per-Month | Base fee + monthly cost per employee | Predictable scaling, easy budgeting, common model | Can get expensive with larger teams |

| Per-Pay-Run | Base fee + cost per employee per payroll | Cost-effective for infrequent payrolls (e.g., monthly) | Adds up quickly with frequent pay runs (weekly/bi-weekly) |

| All-Inclusive Flat Fee | Single monthly fee regardless of size | Ultimate predictability, no surprises | May be pricier for very small teams or startups |

Here’s where many business owners get caught off guard: hidden fees. A low advertised price can be misleading once you account for all the extras. Before signing up, ask about potential charges for:

- Setup and Implementation: Some providers charge a one-time fee of $50 to $200+ to get your account set up.

- Year-End Tax Forms: While many include W-2 and 1099 processing, some charge extra per form or for filing.

- Tax Amendments: Made a mistake? Filing a corrected tax form like a 941-X could come with a hefty fee.

- Off-Cycle Payrolls: Need to run a special check for a bonus or a terminated employee? This often costs extra.

- Direct Deposit: This should be free, but some budget providers may still charge for it.

- Customer Support: Basic support might be free, but access to a dedicated specialist or phone support could be a premium feature.

Understanding your obligations is the first step. Resources like the IRS guide to business tax basics are helpful, but a good payroll service automates these complexities for you. The smartest approach is to look at the total cost of ownership, not just the monthly fee. A service that costs $20 more per month but includes free setup, unlimited support, and automatic year-end filings often delivers far better value than a “cheaper” option loaded with add-on fees.

Real affordability means finding a service that saves you more in time, stress, and potential penalties than it costs in dollars. When you’re not spending hours calculating withholdings or worrying about tax deadlines, that’s a powerful return on your investment.

Ready to compare apples to apples? Try these simple scenarios:

- Team of 6 paid bi-weekly on a per-pay-run plan at $10 per run plus $2 per employee per run equals about $28 per run, or roughly $728 per year. A PEPM plan at $39 plus $6 per employee totals $75 per month, or $900 per year, but could include filings and support that the per-run plan treats as add-ons.

- Team of 12 paid monthly might find per-pay-run pricing cheaper, but if you add year-end form fees and off-cycle runs for bonuses, the PEPM plan can still win on total cost.

A quick checklist before you buy:

- Ask for a written quote that includes payroll frequency, headcount, and all expected filings.

- Confirm what is included in base pricing and what triggers an add-on.

- Verify timelines for direct deposit, tax remittance, and year-end delivery.

- Review cancellation terms and data export options.

If you want to dig into the rules you are paying a provider to manage, see the IRS Employer’s Tax Guide (Publication 15) and the U.S. Department of Labor FLSA overtime rules. Even a quick skim shows how much compliance work affordable payroll services remove from your plate.

Bottom line, look beyond the sticker price. Choose the pricing model that fits your pay frequency and growth plans, and weigh the full picture of features, support, and risk reduction.