Outsourcing HR Compliance: 3 Strategic Advantages

The High Cost of Getting HR Wrong

Outsourcing hr compliance means partnering with external experts to manage your employment law obligations, payroll, benefits, and regulatory reporting. For overwhelmed businesses, it’s a strategic way to reduce errors, save time, and avoid costly penalties without hiring more full-time staff.

What You Need to Know:

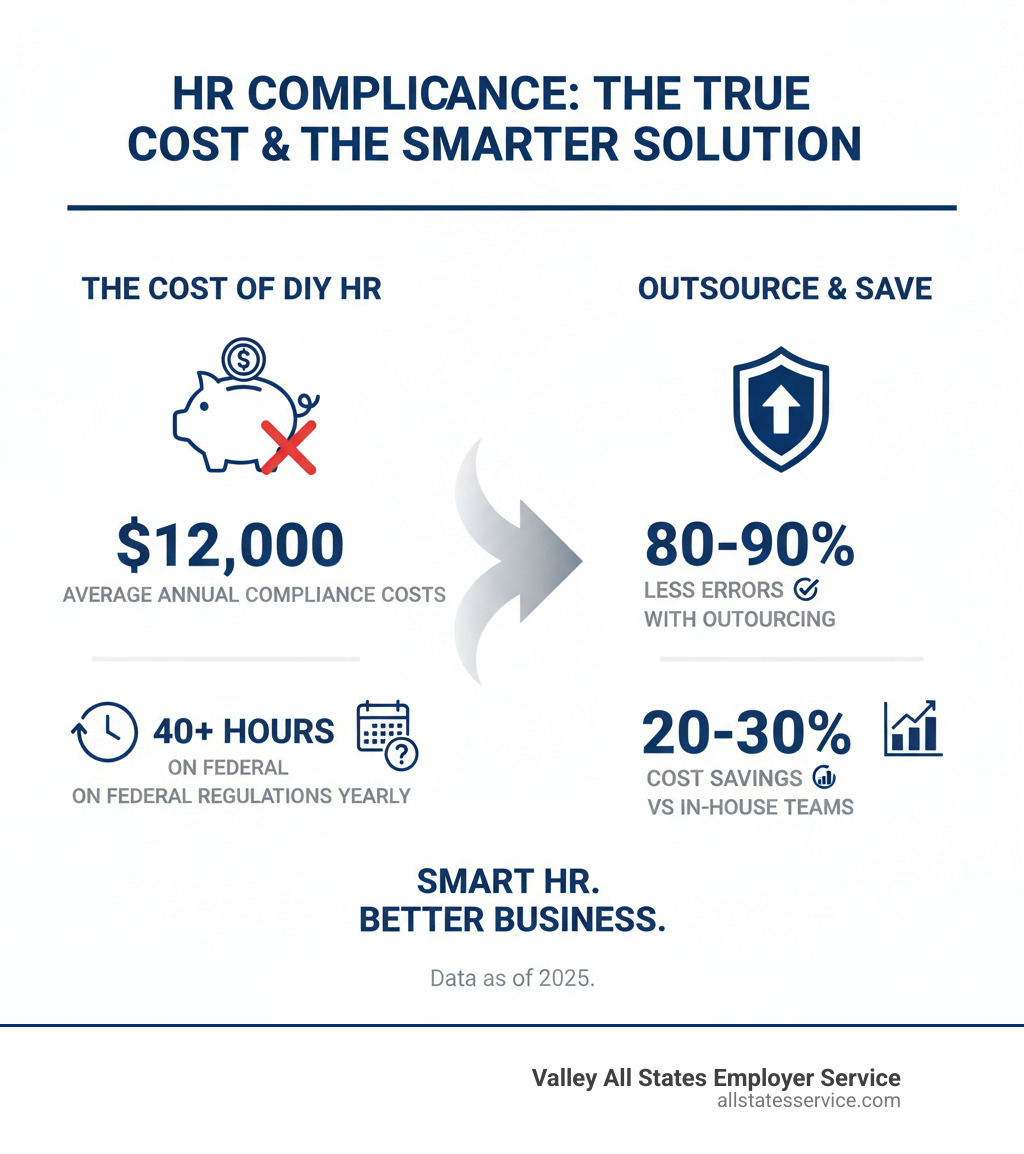

- Compliance errors drop by 80-90% when experts handle statutory requirements

- Average cost savings of 20-30% compared to maintaining in-house HR teams

- The average small business owner spends $12,000 annually just on compliance costs

- 1-in-3 small businesses spend over a full work week each year dealing with federal regulations alone

Getting HR compliance wrong can cost you far more than getting it right. Employment laws change constantly, with federal, state, and local rules often overlapping or contradicting each other. One misstep in employee classification, a missed reporting deadline, or an incorrect I-9 form can lead to fines that could cripple your business.

Most owners didn’t start a company to become experts in the Family and Medical Leave Act. They wanted to build something great. Yet many spend hours each week deciphering legal jargon instead of growing their business.

This is where outsourcing HR compliance becomes a strategic decision. It protects your business, frees your time, and gives you access to specialized expertise. Research shows companies that outsource HR see a significant return on investment. They spend less time on paperwork and more on what drives revenue, and they sleep better at night knowing experts are watching their compliance blind spots.

The Compliance Maze: Why Modern Businesses Struggle

Trying to stay compliant while running your business can feel like navigating a maze with no exit. This struggle is real for businesses of all sizes.

The biggest culprit is the sheer volume and complexity of regulations. Federal laws set one standard, your state adds its own, and your city might throw in local ordinances. You might be compliant at the federal level but violating a state law you didn’t even know existed.

For small business owners, this burden hits especially hard. 1-in-3 small businesses spend more than a full work week each year just on federal regulations. That’s 40+ hours you could be spending on customers, product development, or growing revenue.

Most small and mid-sized businesses lack a dedicated legal team or a full HR department with compliance specialists. This lack of in-house expertise makes costly mistakes almost inevitable. Those mistakes are expensive, involving fines, legal costs, and damage to your reputation. For some, a single compliance violation can be the difference between staying open and closing. This is why outsourcing hr compliance has become a key strategy for businesses that want to protect themselves. For practical guidance, check out our HR Compliance for Small Business resource.

The Main Challenges in Maintaining HR Compliance

What makes HR compliance such a persistent headache? Here are the specific challenges that keep business owners up at night.

-

Keeping up with legal changes: Employment laws are constantly evolving. Minimum wage increases, new paid leave laws, and expanded anti-discrimination policies can change without a central notification system, leaving you non-compliant without realizing it.

-

Ensuring accurate documentation: Every piece of paper matters, from I-9 forms to your employee handbook. One missing signature or outdated policy creates a vulnerability that can surface during an audit or lawsuit.

-

Managing employee classifications: Is someone an employee or an independent contractor? Are they exempt from overtime? Misclassifying a worker can lead to years of back wages, tax penalties, and fines from multiple government agencies.

-

Handling payroll and tax filings correctly: Navigating intricate regulations for withholdings, unemployment insurance, and other taxes is complex. A calculation error or missed deadline can trigger penalties that compound quickly.

-

Mitigating workplace risks: This includes everything from OSHA safety requirements to preventing harassment. It requires policies, training, proper investigations, and consistent enforcement to protect your business and your team.

How Outsourcing HR Compliance Provides a Strategic Advantage

Outsourcing hr compliance isn’t just checking a box; it’s a move that helps your business win. Think of it as bringing in a specialist to protect what you’ve built while you focus on building more.

You get access to specialized expertise that would be costly to hire full-time. These professionals track federal, state, and industry regulations daily, spotting problems you might miss.

The financial case is strong. Companies often see cost savings of 20% to 30% compared to maintaining an in-house team. Research shows the average ROI from outsourcing HR functions is 27.2%, meaning the investment pays for itself and then some.

More importantly, compliance errors drop by 80-90% when experts handle your statutory requirements. This is the difference between worrying about what you missed and knowing issues are being caught early. Outsourced providers conduct regular audits, identify gaps, and implement solutions proactively.

Your internal team gets their time back, leading to improved operational efficiency. Your staff can focus on employee development, culture, and retention. As your business grows, your compliance support scales with you. Expanding into new states or hiring seasonally becomes seamless. For more ways to maximize your team’s potential, our guide on how to Improve HR Efficiency offers practical approaches.

Key Functions to Outsource for Compliance

Some HR functions are ideal for outsourcing due to their technical and time-consuming nature.

-

Payroll and tax administration: External providers handle complex calculations, ensure timely payments, and file necessary paperwork, staying current on tax law changes so you don’t have to.

-

Benefits administration: Experts manage enrollment, answer employee questions, and ensure compliance with regulations like the ACA, often securing better rates.

-

Employee handbook and policy updates: Providers create and update handbooks to reflect current federal, state, and local laws, protecting your business.

-

E-Verify and I-9 compliance: This is our specialty at Valley All States Employer Service. We provide expert E-Verify and I-9 compliance services that are impartial and efficient. Our Outsourced Employment Verification Ultimate Guide explains everything you need to know.

-

FMLA and leave management: Outsourced providers handle the entire process, from determining eligibility to maintaining documentation, reducing your legal exposure.

The Benefits of Outsourcing HR Compliance for Any Size Business

Outsourcing hr compliance works for any size business.

-

Small businesses get an expert team they couldn’t otherwise afford, leveling the playing field.

-

Mid-sized companies scale efficiently, allowing their internal HR to focus on strategy while experts handle technical compliance.

-

Large enterprises supplement their teams for specialized areas or objective third-party oversight.

For every business, the result is peace of mind for leadership. Knowing professionals are managing compliance lets you focus on growth. Our Compliance Management Solutions can be customized to fit your needs.

Navigating the Risks and Legal Responsibilities of Outsourcing

Outsourcing hr compliance offers incredible benefits, but it’s a partnership that comes with responsibilities and potential pitfalls. You wouldn’t hire a contractor without checking their credentials and contract; the same principle applies here.

Potential loss of direct control is a common concern. It’s natural to feel uneasy handing over important functions. The key is to establish clear communication channels, detailed service level agreements, and regular performance reviews to stay informed without micromanaging.

Data security is another major consideration. Your HR files contain sensitive information like social security numbers and medical records. You must have absolute confidence in your provider’s security measures and verify their compliance with data protection regulations.

Service quality gaps can also occur. Not all providers operate at the same level of excellence. Thoroughly vetting candidates by checking references and reading reviews is essential.

Also, watch out for hidden fees. Some contracts bury additional charges in the fine print. Demand transparent pricing before you sign anything. If a provider can’t give you a straightforward answer about costs, it’s a red flag.

Your Legal Responsibilities When Outsourcing HR Compliance

Here is the most important thing to understand about outsourcing hr compliance: ultimate liability remains with the employer. Period.

Even if you outsource every HR function, you are still legally responsible for ensuring your company follows all applicable laws. Your provider is an expert guide, but not a legal shield. When a regulator comes knocking, they’re knocking on your door.

-

Understand the service agreement: This document is your roadmap. It should spell out exactly what services will be delivered, your responsibilities, and how data will be protected. Have your attorney review it.

-

Vet your provider’s credentials: Check their track record, experience in your industry, and certifications. A reputable provider will welcome these questions. Companies like Valley All States Employer Service, for example, specialize in specific compliance areas, giving you confidence in their focused expertise.

-

Maintain legal oversight: Having your own legal counsel periodically review your outsourcing agreements is smart business. A strong Compliance Management System should include this kind of ongoing oversight.

-

Ensure clear communication: This is a partnership that requires regular check-ins and transparent information sharing. When your business changes, your compliance partner needs to know.

By navigating these risks and understanding your responsibilities, you can harness the power of outsourcing without leaving your business exposed.

Choosing the Right Partner and Leveraging Technology

Finding the right partner for outsourcing hr compliance is a critical decision. This partner will handle vital business functions and sensitive data, so it’s worth taking the time to get it right.

-

Conduct a needs assessment. Before you start looking, evaluate your specific pain points. Is it payroll, I-9 compliance, or benefits administration? Knowing what you need helps you find a partner whose strengths align with your weaknesses.

-

Verify their expertise and certifications. Look for teams with relevant credentials (like SHRM-CP or SPHR) and experience in your industry and business size. A provider focused on large corporations might not understand a startup’s challenges.

-

Check client references. Any reputable provider will connect you with current clients. Ask them tough questions about responsiveness, problem-solving, and overall service quality. You’ll learn more from a 15-minute call than from hours of reviewing marketing materials.

-

Demand transparent pricing. A good provider will offer a clear breakdown of costs. You need to understand exactly what you’re paying for and what’s included. Avoid partners who can’t be upfront about fees. For those exploring Employee Outsourcing Companies, pricing transparency is non-negotiable.

-

Ensure seamless technology integration. Ask how their systems will work with yours. Can their platform integrate with your accounting software? A modern provider’s technology should make your life easier, not create more manual data entry.

The Role of Technology in Compliance Outsourcing

Technology has transformed outsourcing hr compliance. Today’s solutions are sophisticated, secure, and intuitive.

A Human Resource Information System (HRIS) is at the heart of most modern solutions. It acts as a central hub for all employee data, from payroll details to performance records. A good HRIS reduces manual errors and makes it easy to generate reports for audits.

Automated record-keeping is a game-changer. Every I-9 form, training certificate, and policy acknowledgment is stored digitally with timestamps and audit trails. This ensures you’re always prepared for an inspection.

Cloud-based platforms provide 24/7 access to your HR data from anywhere. This flexibility is invaluable for businesses with remote teams or traveling leadership. If you’re considering Outsourcing Payroll Cloud solutions, this accessibility is a key benefit.

Many providers offer compliance dashboards for a real-time overview of your compliance status. These tools flag upcoming deadlines and potential issues, turning compliance from a reactive scramble into a proactive strategy.

Of course, data encryption and security measures are fundamental. Leading providers invest heavily in protecting your sensitive employee information with military-grade encryption, secure servers, and strict access controls.

Frequently Asked Questions about Outsourcing HR Compliance

It’s a big decision, and you deserve straight answers. Let’s tackle some of the most common concerns about outsourcing hr compliance.

Is outsourcing HR compliance more cost-effective than hiring in-house?

For most businesses, yes. An in-house hire involves salary plus benefits, training, office space, and software, which adds up quickly. With outsourcing, you pay a predictable fee for access to an entire team of experts.

Research shows companies typically see a 20% to 30% reduction in HR costs when they outsource. Preventing just one major compliance fine can easily justify years of outsourcing fees. When you factor in the expertise and technology, the ROI becomes even clearer.

Does outsourcing mean I’m no longer legally responsible for compliance?

No, you are still ultimately responsible. The law does not allow you to transfer your legal liability to a third party.

Think of your provider as an expert co-pilot. They guide you through regulations and perform critical tasks to reduce your risk, but they don’t assume your legal liability. This is why a clear service agreement is so important. The right partner works with you as a trusted advisor, but ultimate accountability remains with your business.

What’s the difference between a PEO and other HR outsourcing models?

The world of HR outsourcing has a few common models:

-

A PEO (Professional Employer Organization) enters into a co-employment relationship, becoming the “employer of record” for tax and insurance purposes. This can help you secure better benefits packages due to their larger employee pool.

-

An ASO (Administrative Services Organization) provides similar services like payroll and HR support but without the co-employment relationship. Your business remains the sole employer, which some businesses prefer.

-

HR consulting or project-based outsourcing is for specific needs, like developing an employee handbook or conducting an HR audit. It’s less about ongoing administration and more about getting expert help when you need it.

-

Functional outsourcing means handing over specific tasks to specialized providers. For example, you might outsource only payroll or benefits. Our services at Valley All States Employer Service are a perfect example of functional outsourcing, as we focus on expert E-Verify processing to take one critical compliance function off your plate.

Conclusion: Make Compliance Your Strength, Not Your Weakness

We’ve explored HR compliance, from the maze of regulations to the advantages of outsourcing hr compliance. It all boils down to this: getting HR right isn’t just about avoiding penalties. It’s about building a resilient, efficient organization.

Think of outsourcing hr compliance as a smart strategic move, not a surrender. You’re not just handing off tasks; you’re investing in your business’s future. This shift frees you from administrative burdens to focus on what drives growth: innovation, expansion, and leading your team.

The benefits are tangible: access to specialized expertise, significant cost savings, and proactive risk management. Most importantly, you gain the peace of mind that comes from knowing experts are watching your back.

At Valley All States Employer Service, we understand how critical accurate and efficient compliance is. Our unique expertise in outsourced E-Verify workforce eligibility verification is designed to minimize errors and lighten your administrative load. We provide expert, impartial processing to ensure you meet federal requirements without the headaches.

Don’t let compliance be your weakness. Transform it into a strength. Leverage expert partnerships, protect your business, and focus your energy on what you do best.

Ready to simplify your compliance strategy? Explore our Outsourced HR Compliance Ultimate Guide to see how we can help you steer the landscape with confidence.