Employment law Maryland: Avoid 2025 Woes

Why Employment Law Maryland Matters for Your Business

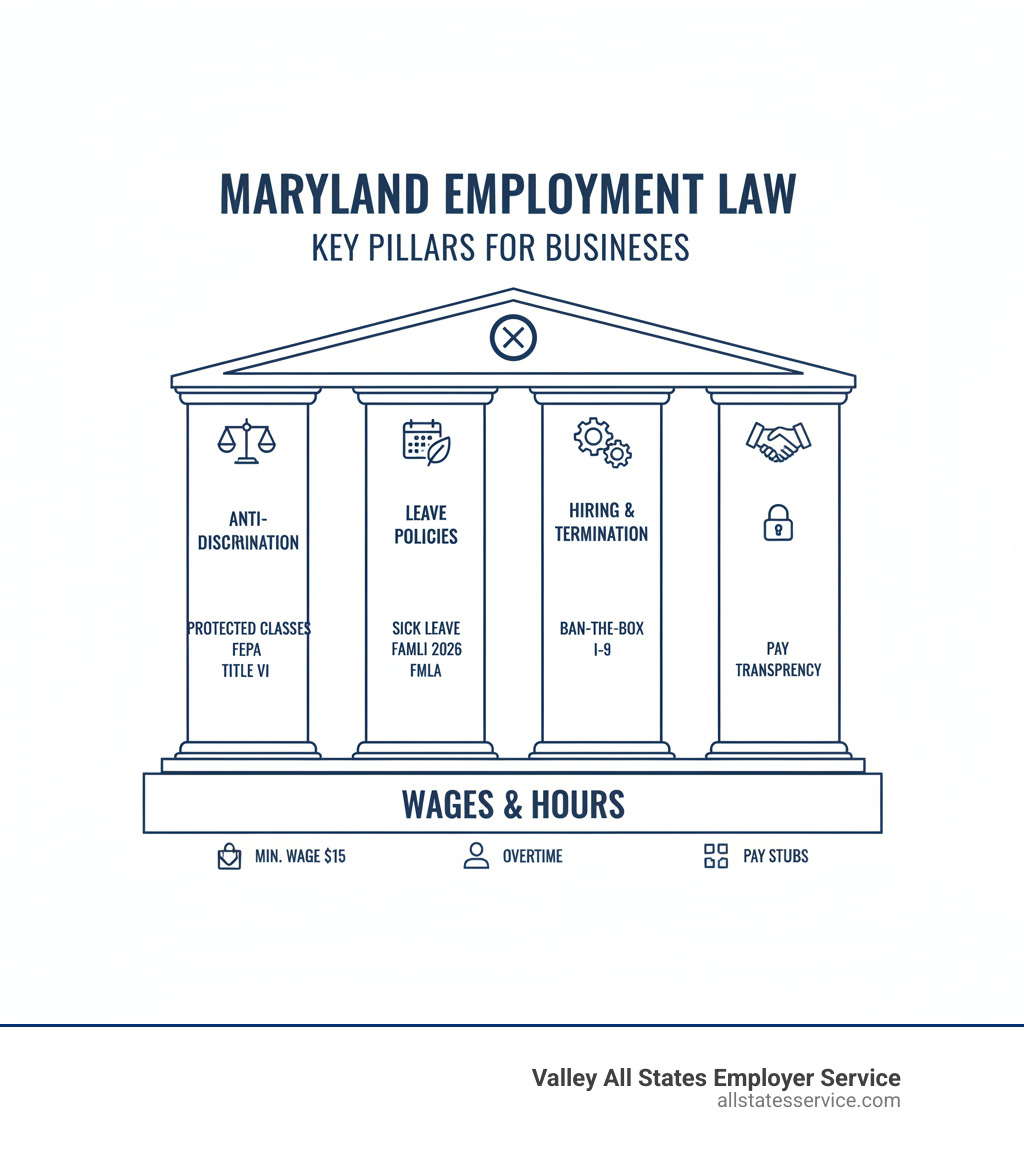

Employment law Maryland governs the entire employer-employee relationship, from hiring and wages to leave and termination. For any business, understanding these rules is essential for avoiding costly lawsuits, protecting your reputation, and creating a fair workplace.

Quick Answer: What Maryland Employers Must Know

- Minimum Wage: $15.00/hour (15+ employees); phased increase for smaller employers.

- At-Will Employment: Termination for any legal reason is allowed, but key exceptions apply.

- Anti-Discrimination: Laws protect employees based on race, sex, age, disability, and more.

- Leave Rules: Paid sick leave is required for most, with Paid Family Leave starting in 2026.

- Hiring Compliance: “Ban-the-Box” and pay transparency laws are in effect.

- I-9 Verification: Federal law requires employment eligibility verification for all new hires.

The stakes are high, with the median wrongful termination verdict reaching $182,333. Even minor compliance mistakes can lead to investigations, fines, and reputational damage.

Maryland’s laws are a mix of federal, state, and local rules, which can be overwhelming for busy HR managers and owners. This guide breaks down your core obligations under employment law Maryland, covering wages, discrimination, leave, hiring, and termination. You’ll learn what applies to your business and how to avoid common pitfalls.

Understanding Your Core Obligations Under Employment Law Maryland

As a Maryland employer, you operate within a detailed legal framework. These rules are the guardrails that keep your business out of court and help you build a stable workforce. Let’s review the core principles of employment law Maryland every business leader needs to know.

What ‘At-Will’ Employment Really Means for Your Business

At-will employment is the default in Maryland, meaning either the employer or employee can end the relationship at any time for any reason, or no reason at all. However, the key is that the reason must be legal. This distinction is where many employers run into trouble.

You cannot fire someone for reasons that violate public policy, break an implied contract, or cross other legal lines.

- Public policy violations include terminating an employee for filing a workers’ compensation claim, reporting wage violations, refusing to break the law, or serving on a jury. Maryland’s Health Care Worker Whistleblower Protection Act is one example of these protections.

- Implied contracts can be created through employee handbooks, verbal promises, or consistent company practices. If your handbook outlines a progressive discipline process, a court may require you to follow it before termination.

- Covenants of good faith and fair dealing are less common but can apply if an employer acts in bad faith, such as firing someone to avoid paying earned commissions.

At-will employment offers flexibility, but it is not a free pass. Understanding its limits is crucial for avoiding wrongful termination claims. For more context, see the ‘at-will’ doctrine in Maryland.

Preventing Discrimination and Harassment in Your Workplace

Discrimination and harassment are illegal under federal and state employment law Maryland. Both levels of law protect employees based on protected classes, including race, color, religion, sex (covering pregnancy, sexual orientation, and gender identity), age (40+), national origin, disability, marital status, and genetic information.

Federal laws like Title VII and the Americans with Disabilities Act set the baseline. Maryland’s Maryland Fair Employment Practices Act (FEPA) expands on these protections. FEPA generally applies to employers with 15+ employees, but harassment complaints can be filed against a business with just one employee.

Your responsibilities include:

- Creating robust written policies that define prohibited conduct and provide clear reporting channels.

- Conducting regular training, especially for managers, to recognize and respond to issues.

- Investigating all complaints promptly and taking immediate corrective action if misconduct is found.

- Preventing retaliation against any employee who reports an issue or participates in an investigation.

Navigating Wrongful Termination Claims in Maryland

Even in an at-will state, a termination is wrongful if the reason breaks the law. Common claims include:

- Retaliation: Firing someone for engaging in a protected activity, like reporting a safety violation or taking protected leave.

- Whistleblower Protection: Terminating an employee for reporting illegal or unethical activities.

- Discrimination: Firing someone based on their membership in a protected class.

- Breach of Contract: Violating the terms of a written or implied employment agreement.

Thorough documentation is your best defense. Keep detailed records of performance reviews, disciplinary actions, and communications. Ensure the reason for termination is legitimate, non-discriminatory, and consistent with your policies. A clear paper trail is crucial evidence if you need to defend your decision.

A Maryland Employer’s Guide to Wages, Hours, and Leave

Getting payroll right is a legal requirement. Correctly handling wages, hours, and leave protects your business from penalties and builds trust with your team. Mistakes can trigger back pay claims and government investigations.

Mastering Maryland’s Wage and Hour Laws

Maryland’s wage laws have seen significant changes. Staying current is essential.

- Minimum Wage: As of January 1, 2024, the minimum wage is $15.00 per hour for employers with 15 or more employees. For employers with 14 or fewer employees, the rate is $13.40 per hour and will increase incrementally to $15.00 by July 1, 2026.

- Tipped Employees: The minimum cash wage is $3.63 per hour. However, the employee’s total earnings (cash wage plus tips) must equal the state minimum wage. You must make up any shortfall.

- Overtime: Following the federal Fair Labor Standards Act (FLSA), non-exempt employees must be paid 1.5 times their regular rate for hours worked over 40 in a workweek.

- Pay Stubs: A law effective October 1, 2024, requires detailed wage notices each pay period. These must include your business information, pay dates, hours worked, rates of pay, gross and net pay, and a list of all deductions.

Maryland’s wage payment laws require timely payment of all earned wages. Withholding wages in bad faith can result in triple damages for the employee.

Managing Employee Leave: Sick, Safe, and Family Leave

Maryland’s employee leave laws have expanded, requiring careful tracking.

The Maryland Healthy Working Families Act requires employers to provide earned sick and safe leave. Employees accrue one hour of leave for every 30 hours worked, up to 40 hours per year. This leave is paid for employers with 15+ employees and can be unpaid for smaller employers.

Maryland’s Paid Family and Medical Leave (FAMLI) program is rolling out. Contributions to the fund begin July 1, 2025, and employees can start claiming benefits on July 1, 2026. The program will provide up to 12 weeks of paid leave for qualifying events, with benefits capped at $1,000 per week. For more details, visit Paid Family and Medical Leave.

Federal FMLA still applies to employers with 50+ employees, providing up to 12 weeks of unpaid, job-protected leave. Other state laws, like the Parental Leave Act (15-49 employees) and the Flexible Leave Act, also create leave obligations.

What about breaks? Maryland law generally does not require meal or rest breaks for adult employees, with some exceptions. Minors (under 18) must get a 30-minute break for every five hours of work. Retail employees working more than six consecutive hours are also entitled to a 30-minute break. While not always required, offering breaks is a good practice for morale and productivity.

Hiring and Firing: Compliance from Start to Finish

The employee lifecycle, from application to final day, is filled with legal checkpoints. A compliant approach to hiring and termination protects your business and promotes a fair workplace.

Compliant Hiring and Onboarding in Maryland

Your hiring process sets the tone and is a common source of compliance issues.

- Pay Transparency: As of October 1, 2024, Maryland law requires employers to disclose minimum and maximum salary ranges in all internal and external job postings. You are also prohibited from asking about an applicant’s salary history before making a job offer.

- “Ban-the-Box” Legislation: For employers with 15+ employees, you cannot ask about criminal history until after an in-person interview. Local laws, like in Prince George’s County, may have stricter rules for smaller employers and limit consideration of older convictions.

- Work Eligibility Verification: Federal law requires you to complete and retain a Form I-9 for every new hire to verify their identity and authorization to work in the U.S. While E-Verify is not mandatory for all private employers, it is required for certain government contractors. We can help you steer these complex rules. Learn more about our E-Verify services and get I-9 Verification Assistance.

- Marijuana and Drug Testing: While recreational marijuana is legal in Maryland, you can still enforce drug-free workplace policies and prohibit on-the-job impairment. It’s wise to update policies to focus on impairment rather than just positive tests for non-psychoactive metabolites.

Best Practices for Employment Contracts and Non-Competes

Employment contracts and restrictive covenants are powerful tools when used correctly.

While at-will is the default, a written employment contract can clarify terms like compensation, duties, and termination procedures, reducing the risk of future disputes.

Restrictive covenants, such as non-compete and non-solicitation agreements, are scrutinized by Maryland courts. To be enforceable, they must be narrowly custom to protect a legitimate business interest, be reasonable in scope and duration, and not cause undue hardship. Maryland law already prohibits non-competes for low-wage employees, with further restrictions for certain healthcare workers coming in 2025.

Keep an eye on the new federal FTC rule that aims to ban most non-compete agreements nationwide. The FTC’s new non-compete rule is facing legal challenges, but it could dramatically change how employers use these agreements.

When an employee departs, final pay must be issued on the next scheduled payday. Severance packages can be used to secure a release of claims, but the terms must be carefully documented.

Frequently Asked Questions about Employment Law Maryland

Navigating employment law Maryland raises many questions. Here are straightforward answers to some of the most common concerns from business owners and HR managers.

Do I have to provide meal or rest breaks to my employees?

Generally, no. Neither federal nor Maryland law requires meal or rest breaks for most adult employees. However, there are critical exceptions:

- Minors: Employees under 18 must receive a 30-minute break for every 5 consecutive hours of work.

- Retail Employees: Under the Healthy Retail Employee Act, workers are entitled to a 30-minute break for shifts of more than 6 consecutive hours.

If you choose to offer short breaks (5-20 minutes), federal law requires they be paid. Longer meal periods (30+ minutes) can be unpaid, but only if the employee is completely relieved of all duties.

How long do I need to keep employee records in Maryland?

Record retention is a legal requirement. Different records have different timelines:

- Payroll Records: The FLSA requires you to keep payroll records (wage rates, hours, deductions) for at least three years. Supporting documents like time cards should be kept for two years.

- I-9 Forms: You must keep a Form I-9 for each employee for three years after their hire date, or one year after their employment ends, whichever is later. Proper I-9 management is crucial to avoid penalties during an audit. We provide expert guidance on I-9 Record Keeping rules.

- Personnel Files: While no single law dictates a retention period, it is best practice to keep these files for at least four to six years after an employee leaves. This covers the statute of limitations for most potential employment claims. Records for FMLA leave or OSHA incidents must be kept for five years.

What are the key differences in employment law Maryland for small businesses?

Many state and federal laws have employee thresholds, meaning small businesses may be exempt from certain rules. It’s crucial to know where your business falls.

- Minimum Wage: Employers with 14 or fewer employees have a lower, phased-in minimum wage rate until July 1, 2026. Those with 15+ employees must pay the full $15.00/hour rate.

- Sick and Safe Leave: The law applies to all employers, but it must be paid leave for businesses with 15+ employees. It can be unpaid for those with 14 or fewer.

- FMLA: The federal Family and Medical Leave Act only applies to employers with 50 or more employees. However, Maryland’s Parental Leave Act covers employers with 15-49 employees.

- Anti-Discrimination (FEPA): Maryland’s main anti-discrimination law generally applies to employers with 15 or more employees. However, harassment claims can be brought against a business of any size.

- Ban-the-Box: The statewide law delaying criminal history questions applies to employers with 15 or more employees, though some local ordinances have lower thresholds.

As your business grows, you will cross these thresholds. We offer custom HR Compliance for Small Business solutions to help you manage these evolving obligations.

Proactively Manage Your HR Compliance and Avoid Legal Risk

You’ve made it through the maze of employment law Maryland, and if your head is spinning a bit, we understand. From minimum wage tiers and sick leave accruals to I-9 forms and non-compete restrictions, the sheer volume of rules can feel overwhelming. But here’s the thing: this isn’t information you can afford to ignore or file away for “someday.”

Every obligation we’ve discussed represents a potential legal landmine if left unaddressed. A missed pay stub detail. An outdated harassment policy. A premature criminal background check. Any one of these missteps can trigger investigations, lawsuits, or penalties that drain your resources and damage your reputation. The median wrongful termination verdict alone hits $182,333, and that doesn’t include the time, stress, and distraction of defending your business in court.

The good news? You don’t have to tackle this alone, and you don’t have to wait for a problem to arise before taking action.

Proactive management is your best defense. This means building strong HR policies before you need them. Training your managers on discrimination and harassment prevention before an incident occurs. Keeping your wage and hour practices current before an audit lands on your desk. Documenting performance issues as they happen, not scrambling to reconstruct events when an employee files a claim.

Think of compliance as preventive maintenance for your business. You wouldn’t wait for your car engine to seize before changing the oil. The same principle applies here. Regular attention to your employment practices saves you from costly breakdowns down the road.

This is where expert assistance makes all the difference. At Valley All States Employer Service, we specialize in taking the complexity out of employment compliance. We know the regulations inside and out because this is what we do, day in and day out. Our services, particularly in E-Verify and I-9 verification, are designed to minimize errors and lift the administrative burden off your shoulders. We handle the details so you can focus on what you do best: running and growing your business.

We’ve helped countless Maryland employers steer hiring compliance, avoid verification pitfalls, and build systems that stand up to scrutiny. We’re not just a vendor. We’re your partner in creating a workplace that’s legally sound, fair, and ready for whatever comes next.

Your employees are your most valuable asset. Protecting them, and protecting your business, starts with getting compliance right. Whether you’re a small startup just figuring out your first hires or an established company looking to tighten your processes, we’re here to help.

Ready to simplify your employment verification processes and ensure full compliance in Maryland? Get help with Employment Verification in Maryland today. Let’s work together to keep your business on solid legal ground, from the first application to the final paycheck.