Understanding Form I-9: The Employment Verification Requirement Every Employer Must Know

What is I-9 form? Form I-9, Employment Eligibility Verification, is a mandatory federal document that all U.S. employers must complete for every person they hire for employment after November 6, 1986. The form verifies both the identity and employment authorization of new hires, ensuring they are legally permitted to work in the United States.

Quick Answer:

- Purpose: Verify employee identity and work authorization

- Required by: All U.S. employers for every new hire

- Administered by: U.S. Citizenship and Immigration Services (USCIS)

- Legal basis: Immigration Reform and Control Act (IRCA) of 1986

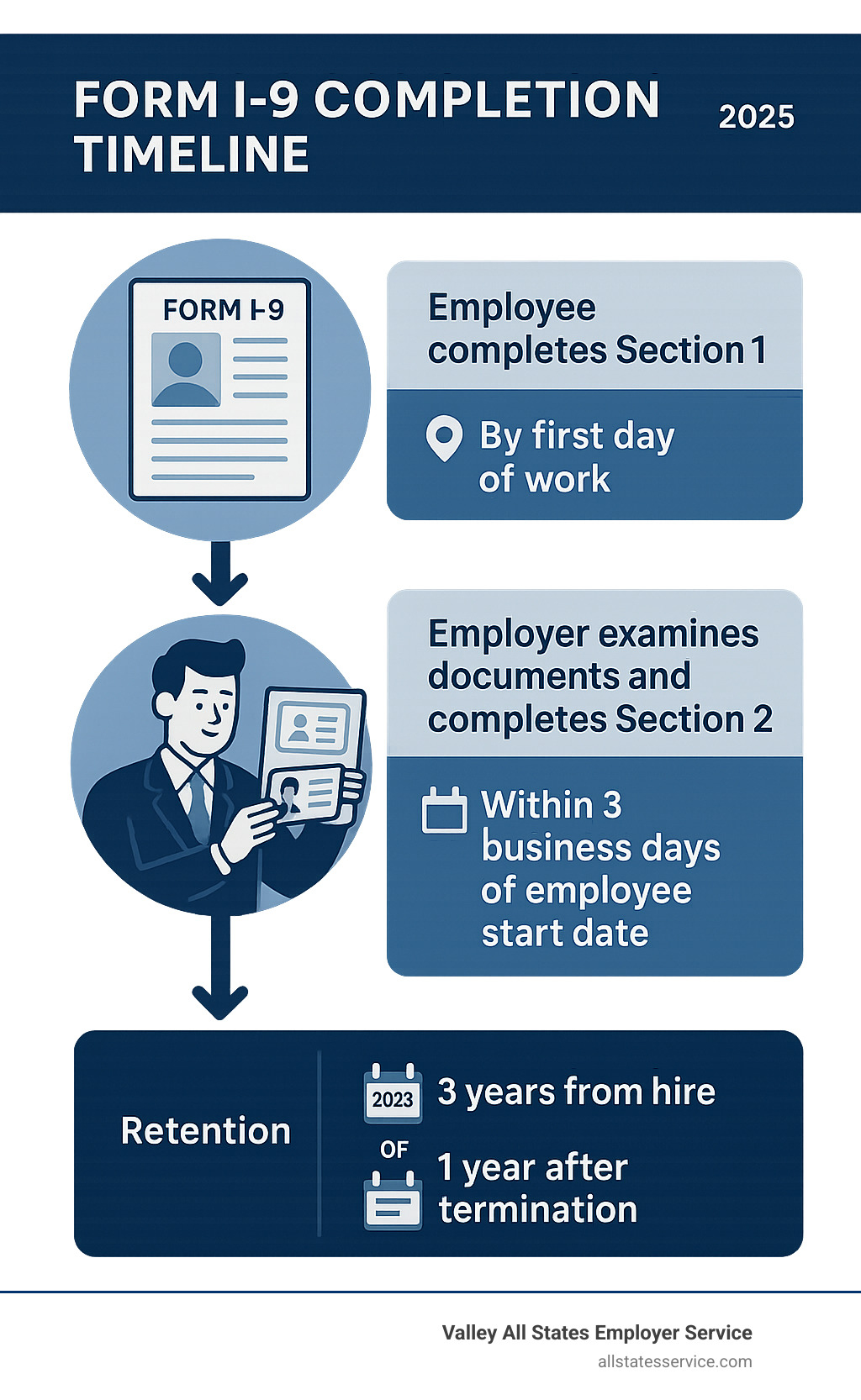

- Deadline: Section 1 by first day of work, Section 2 within 3 business days

If you’re an HR manager juggling multiple compliance requirements, you’re not alone. The I-9 process affects every single hire your company makes, and getting it wrong can lead to serious penalties. Federal law requires this verification for both U.S. citizens and non-citizens alike.

The stakes are real. Form I-9 paperwork violations can result in fines of $281 to $2,789 per violation, while knowingly hiring unauthorized workers can lead to fines ranging from $716 to $28,619 depending on the offense. But don’t worry, understanding the basics makes compliance much more manageable.

Every employer must complete and retain Form I-9 for every person they hire, as long as that person works for pay or other compensation. This includes everyone from part-time seasonal workers to full-time executives. The only exceptions are independent contractors and certain types of casual domestic workers.

What is the I-9 Form and Why is it Mandatory?

What is I-9 form in simple terms? Think of it as your legal checklist to make sure everyone you hire can actually work in the United States. The Form I-9, officially called Employment Eligibility Verification, is a federal requirement that proves two critical things about your new employees: who they are and whether they’re legally allowed to work here.

This isn’t just bureaucratic paperwork for the sake of paperwork. The Form I-9 exists because of the Immigration Reform and Control Act (IRCA) of 1986, which made it illegal for employers to knowingly hire workers who aren’t authorized to work in the U.S. Before this law, the responsibility largely fell on workers themselves to prove their status.

Now, every U.S. employer shares in preventing unauthorized employment. When you complete an I-9, you’re verifying both the identity and employment authorization of each new hire. This means confirming they’re either U.S. citizens, lawful permanent residents, or foreign nationals with proper work permits.

The U.S. Citizenship and Immigration Services (USCIS) oversees this entire process, providing the official forms and detailed guidance. Whether you’re running a small startup or managing a large corporation, this federal mandate applies to all U.S. employers without exception.

Who is required to complete Form I-9?

Here’s the straightforward answer: every person hired after November 6, 1986, who works for pay or other compensation must complete Form I-9. It doesn’t matter if they’re working full-time, part-time, seasonal, or temporary. Both citizens and noncitizens are subject to this requirement equally.

The law applies to all U.S. employers, regardless of company size, industry, or location. Whether you have one employee or thousands, the requirement remains the same. This includes paid employees in every capacity, from entry-level positions to executive roles.

However, there are some exceptions worth noting. You don’t need Form I-9 for independent contractors (those 1099 workers who run their own businesses). The form also isn’t required for casual domestic work that’s sporadic or irregular, like occasional babysitting or house cleaning.

People hired on or before November 6, 1986, who are continuing their employment are also exempt, though this exception becomes less relevant with each passing year.

What is the difference between Form I-9 and Form W-9?

If you’ve ever wondered why there are so many similar-sounding forms, you’re not alone. Form I-9 and Form W-9 might sound alike, but they serve completely different purposes in your hiring process.

| Feature | Form I-9 (Employment Eligibility) | Form W-9 (Taxpayer Identification) |

|---|---|---|

| Primary Purpose | Verifies identity and work authorization | Collects taxpayer ID for income reporting |

| Who Completes | All employees (citizens and noncitizens) | Independent contractors and vendors |

| Administered By | U.S. Citizenship and Immigration Services (USCIS) | Internal Revenue Service (IRS) |

| What It Prevents | Unauthorized employment | Tax reporting errors |

| Required Documents | Identity and work authorization docs | Just taxpayer information |

Think of it this way: Form I-9 answers “Can this person legally work for me?” while Form W-9 answers “How do I report payments to this contractor for tax purposes?” The I-9 is about employment eligibility, while the W-9 is purely about tax compliance.

You’ll use Form I-9 for your actual employees who receive W-2s at year-end. Form W-9 is for independent contractors who’ll receive 1099s. Getting this distinction right from the start helps you stay compliant with both immigration and tax requirements.

A Step-by-Step Guide to Completing the I-9

Getting what is I-9 form completion right comes down to understanding who does what and when they need to do it. Think of it as a carefully choreographed dance between you and your new employee, with very specific timing that can’t be missed.

Here’s the reality: employees must finish Section 1 by their first day of work. Not their second day, not when they get around to it. Their very first day. Then you have exactly three business days to complete Section 2. These aren’t suggestions, they’re federal requirements with real consequences if you miss them.

The three-day rule is particularly important to understand. If someone starts work on a Monday, you have until Thursday to complete your part. Start on a Wednesday? You have until the following Monday. Weekends and federal holidays don’t count, which gives you a little breathing room, but not much.

Understanding Section 1: What is the I-9 form requirement for employees?

Section 1 belongs entirely to your new employee. This is their show, and they need to get it right before they can legally start working for you. They’ll fill in basic information like their full legal name, address, date of birth, and Social Security number if they have one.

The most critical part is where they attest to their work eligibility status. They’re essentially raising their right hand and saying, under penalty of perjury, whether they’re a U.S. citizen, a noncitizen national, a lawful permanent resident, or an alien authorized to work. This isn’t a casual checkbox, it’s a legal declaration with serious implications.

Sometimes employees need help completing this section, especially if English isn’t their first language. That’s perfectly fine, but there are rules. If someone helps them, that person must complete Supplement A as a preparer or translator. They’ll need to provide their own information and sign off on their assistance.

We always recommend pointing employees to the official USCIS guidance on completing Form I-9 before they start. It answers most questions they might have and helps ensure they complete everything correctly the first time.

Decoding Section 2: What is the I-9 form process for employers?

Section 2 is where you step in as the employer, and frankly, this is where most compliance issues happen. Within those three business days, you need to physically examine the documents your employee presents. You’re looking at them to verify they appear genuine and actually belong to the person standing in front of you.

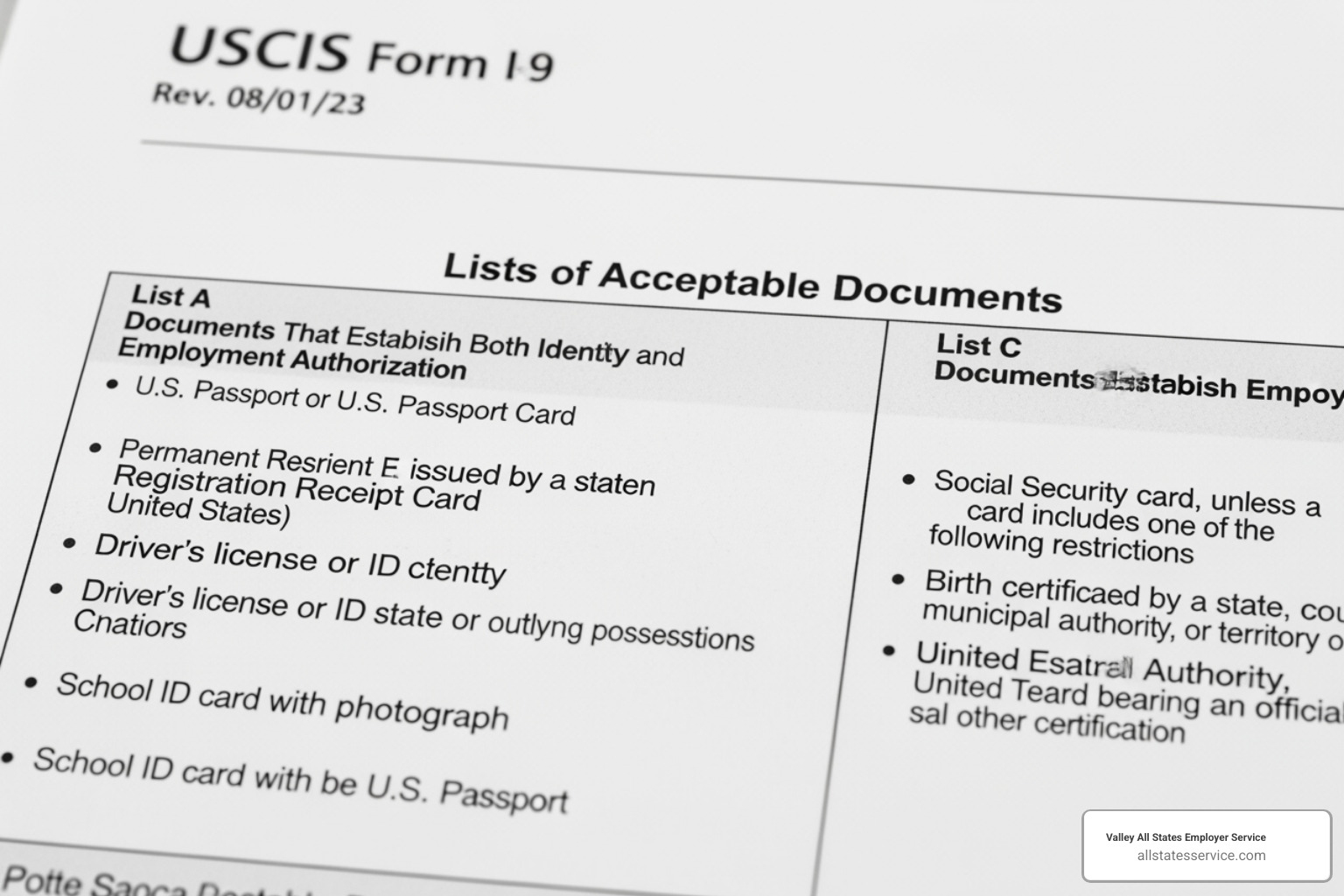

Your employee gets to choose which documents they present from the Lists of Acceptable Documents. They can go with List A documents that prove both identity and work authorization in one shot, like a U.S. passport or permanent resident card. Or they can mix and match with List B documents for identity (think driver’s license) plus List C documents for work authorization (like a Social Security card).

Here’s what you absolutely cannot do: tell them which specific documents to bring. That’s their choice, and pushing them toward certain documents can land you in discrimination hot water.

You’ll record the document details in Section 2, including the title, who issued it, the document number, and expiration date. Then you sign and date it, certifying that you examined everything and it looked legitimate.

Remote work has changed things a bit. If you’re an E-Verify employer, you might be able to use alternative procedures for remote document examination. There’s a specific checkbox for this in Section 2. It’s been a lifesaver for companies with distributed workforces. For more details about how E-Verify integrates with I-9 requirements, check out our comprehensive guide on E-Verify and I-9.

Supplement B: Reverification and Rehires

The I-9 process doesn’t end when someone gets hired. Supplement B comes into play in several ongoing situations that many employers forget about until it’s too late.

If an employee’s work authorization has an expiration date, you must reverify before it expires. No exceptions, no grace periods. The employee needs to present a new, unexpired document from List A or List C. Missing this deadline is one of the fastest ways to rack up compliance violations.

Rehiring within three years offers a shortcut. Instead of starting fresh with a brand new I-9, you can use Supplement B to update the existing form. This saves time and reduces paperwork, but only if the original form was properly completed and retained.

Legal name changes also trigger Supplement B, though the employee’s work authorization doesn’t need reverification unless their document has expired. It’s more about keeping records current and accurate.

The key with Supplement B is staying proactive. Set calendar reminders for expiration dates, track rehire timeframes, and don’t wait until the last minute. These situations sneak up faster than you think, and scrambling to fix them after the fact is both stressful and potentially costly.

Employer Responsibilities: Retention, Audits, and Penalties

Understanding what is I-9 form compliance means recognizing that our job doesn’t end when we finish filling out the paperwork. Think of I-9 compliance like maintaining your car, you can’t just buy it and forget about it. Proper record keeping, staying audit-ready, and understanding what happens when things go wrong are all part of being a responsible employer.

The reality is that I-9 violations can seriously impact your business. We’ve seen companies face hefty fines that could have been avoided with proper procedures. But here’s the good news: once you understand the rules, staying compliant becomes much more manageable.

How long must employers retain Form I-9?

Here’s where many employers get confused, but the retention rule is actually straightforward once you break it down. You must keep each completed Form I-9 for three years from the date of hire or one year after the employee’s employment ends, whichever comes later.

Let’s make this crystal clear with an example. Say you hired someone on March 1, 2020, and they left your company on March 1, 2021. You’d need to keep their I-9 until March 1, 2023 (three years from hire). But if that same employee stayed until March 1, 2024, you’d keep the form until March 1, 2025 (one year after termination, which is later than three years from hire).

The key word here is “later.” Always go with whichever date comes last, and you’ll be in compliance.

Storage matters too. Keep your I-9 forms in a secure location, separate from regular personnel files. Many smart employers use dedicated I-9 binders or electronic systems designed specifically for this purpose. This separation protects employee privacy and makes life much easier if you face an audit.

I-9 Audits and Inspections

Nobody likes surprise inspections, but being prepared makes all the difference. Several government agencies can knock on your door asking to see your I-9 records. Immigration and Customs Enforcement (ICE), the Department of Labor, and the Department of Justice all have this authority.

The process typically starts with a Notice of Inspection (NOI). This official document tells you that your I-9 records are about to be audited. The good news? You usually get at least three business days to gather your forms. During the actual audit, agents will examine your forms for completeness, accuracy, and proper retention.

Here’s where preparation pays off. Auditors look for missing signatures, incorrect dates, and incomplete sections. They also check whether you’ve kept forms for the required time periods. Organized records and a clear understanding of the I-9 process are your best defense during an inspection.

Smart employers don’t wait for an audit to find problems. Regular internal reviews can catch issues before they become expensive violations. If you’re interested in getting ahead of potential problems, check out our guide on I-9 Self-Audits to learn how to spot and fix common issues.

What are the consequences of non-compliance?

Let’s talk numbers, because I-9 penalties can hit your bottom line hard. The Department of Homeland Security doesn’t use a one-size-fits-all approach to fines. They consider factors like your business size, whether you made good faith efforts to comply, how serious the violation was, and your compliance history.

Paperwork violations might sound minor, but they add up quickly. Missing signatures, wrong dates, or incomplete sections can cost you $281 to $2,789 per violation. When you multiply that by the number of affected forms, the total can be staggering.

The stakes get much higher if you’re found knowingly hiring unauthorized workers. First-time offenses for each unauthorized worker can result in fines from $716 to $5,724. Second offenses jump to $5,524 to $14,308, while third and subsequent violations can cost $8,586 to $28,619 per worker.

In the most serious cases, patterns of hiring unauthorized workers or document fraud can lead to criminal charges and even prison time. These aren’t just theoretical penalties, they happen to real businesses that thought they could cut corners.

The bottom line? Compliance is always cheaper than penalties. Understanding these significant consequences shows why getting I-9 processes right from the start is so important. For a complete breakdown of what you might face, our resource on I-9 Compliance Penalties covers all the details you need to know.

Navigating Common I-9 Challenges

Let’s be honest: even with the best intentions, what is I-9 form completion can feel like navigating a minefield. We’ve seen countless employers stumble over seemingly simple requirements, and you’re definitely not alone if you’ve made mistakes along the way.

The most frequent issues we encounter? Missing signatures that somehow slip through the cracks, incorrect dates that don’t align with actual start dates, and the classic over-documentation trap. This last one is particularly tricky because many employers think they’re being thorough by asking for extra documents. But here’s the thing: requiring a U.S. passport when an employee has already provided valid List B and List C documents isn’t just unnecessary, it’s actually considered discriminatory under federal law.

How to Avoid Common I-9 Errors

The good news? Most I-9 errors are completely preventable with the right approach and a little extra attention to detail. We’ve helped hundreds of employers clean up their processes, and there are clear patterns in what goes wrong.

Spelling mistakes might seem minor, but they can trigger audit flags faster than you’d expect. A simple typo in someone’s name or address creates an inconsistency that auditors notice immediately. We always recommend having a second person review each form before filing it away.

Document combination errors are probably the most common violation we see. Employees need either one List A document OR one from List B plus one from List C. We’ve seen employers accept two List B documents thinking they’ve covered their bases, but that’s actually a compliance violation.

Timing issues create unnecessary headaches. Employees must complete Section 1 by their first day of work, period. Then you have exactly three business days to finish Section 2. These aren’t suggestions, they’re federal requirements with real penalties attached.

Over-documentation continues to trip up well-meaning employers. You cannot ask employees to provide specific documents or demand more than what’s required. The choice is theirs, not yours. This protection exists for good reason, preventing discrimination based on citizenship status or national origin.

When corrections are needed, there’s a specific process to follow. Draw a line through the incorrect information, write the correct details nearby, then initial and date the change. Never use correction fluid or completely black out information. The USCIS guidance on correcting errors on Form I-9 provides detailed instructions for handling these situations properly.

Regular training makes all the difference. Even a brief refresher session every six months can prevent most common errors. Your HR team needs to stay current on acceptable documents and understand why these requirements exist.

Can Form I-9 be completed electronically?

Absolutely, and many employers find electronic systems far more reliable than paper forms. However, not all electronic solutions are created equal. The Department of Homeland Security sets specific standards that compliant systems must meet.

Audit trails are essential in any electronic system. Every action taken on a form needs to be recorded: who accessed it, what changes were made, and exactly when. This creates the accountability that auditors expect to see.

Error-checking features are where electronic systems really shine. They can automatically flag missing information, incorrect date combinations, or invalid document selections before you submit the form. It’s like having a compliance expert looking over your shoulder for every single hire.

Secure storage protects sensitive employee information while making retrieval simple during audits. No more digging through filing cabinets or worrying about lost paperwork. Everything is organized, searchable, and properly retained according to federal requirements.

Automated reminders help you stay ahead of reverification deadlines. When an employee’s work authorization is set to expire, the system alerts you in advance so you can complete Supplement B on time.

The fillable PDF version available from USCIS requires manual signatures and doesn’t meet DHS standards for electronic completion. Dedicated electronic I-9 solutions, on the other hand, can facilitate electronic signatures and remote completion, which has been a game-changer for employers with remote workforces.

How does Form I-9 relate to E-Verify?

Think of the what is I-9 form as the foundation and E-Verify as the next level of verification. You always complete the I-9 first, then use that information to run the E-Verify check.

Here’s how the process works in practice. After completing the Form I-9 with your new employee, you enter specific information from both Section 1 and Section 2 into the E-Verify system. The system then compares this data against records from the Department of Homeland Security and Social Security Administration.

Results come back quickly, usually within seconds. Most of the time, you’ll see “Employment Authorized” and you’re done. Sometimes you’ll get a “Tentative Nonconfirmation,” which simply means there’s a data mismatch that needs to be resolved. The employee gets an opportunity to visit the appropriate agency and clear up any discrepancies.

Photo matching adds an extra layer of security for certain documents. The system displays the photo from government records alongside the document your employee presented, helping you verify that everything matches up correctly.

While Form I-9 completion is mandatory for every U.S. employer, E-Verify remains voluntary for most businesses. It becomes mandatory for federal contractors and employers in certain states, but many companies choose to use it voluntarily for the added verification it provides.

One important distinction: E-Verify cannot be used for reverification when employment authorization expires. For those situations, you still need to use the traditional Form I-9 process with Supplement B. For comprehensive information about how these systems work together, the E-Verify I-9 Central provides detailed guidance, and you can learn more about E-Verify and I-9 processes on our website.

Final Thoughts on I-9 Compliance

Mastering what is I-9 form compliance isn’t just another checkbox on your HR to-do list. It’s actually one of the smartest investments you can make in your business’s future. When you get the I-9 process right, you’re building a solid foundation for your entire workforce while protecting yourself from penalties that can seriously impact your bottom line.

Think about it this way: every single person you hire will need an I-9. Whether you’re bringing on your first employee or your thousandth, the process stays the same. But here’s the good news: once you understand the system and build good habits around it, compliance becomes second nature.

The key is staying proactive rather than reactive. Regular training for your HR team, organized record keeping, and prompt completion of all sections will save you countless headaches down the road. And let’s be honest, nobody wants to deal with an ICE audit when they could be focusing on growing their business instead.

At Valley All States Employer Service, we’ve seen how overwhelming I-9 compliance can feel, especially for busy employers juggling multiple priorities. That’s exactly why we specialize in taking this burden off your shoulders. Our expert team provides impartial, efficient E-Verify processing and I-9 verification assistance that minimizes errors and streamlines your entire hiring process.

You don’t have to steer these federal requirements alone. We’re here to help you turn what feels like a complex maze into a straightforward, manageable system that works for your business.