internal i 9 audit: Your #1 Defense Against Fines

Why a DIY I-9 Audit is Your Best Defense Against Costly Fines

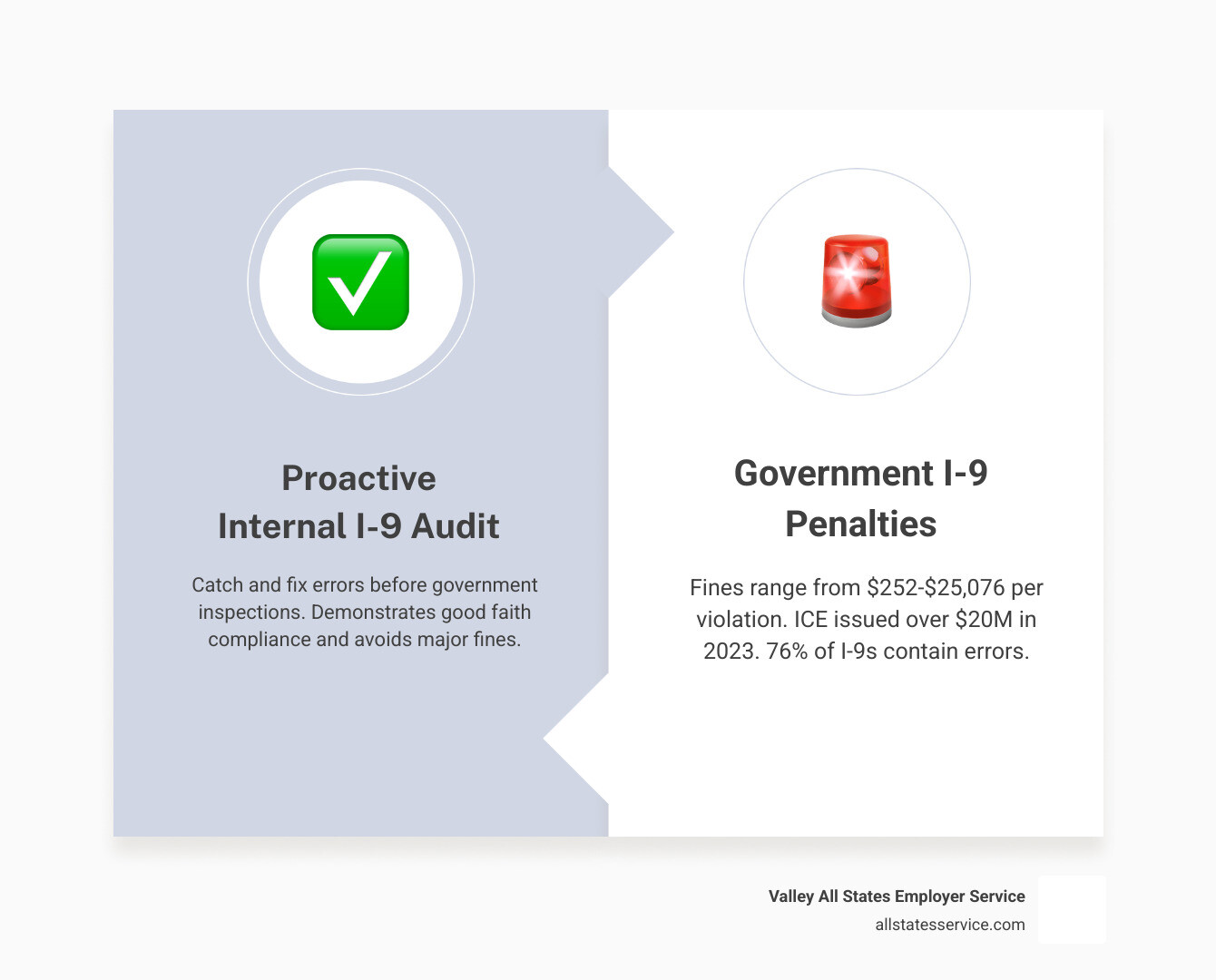

An internal i 9 audit is a voluntary review of your company’s Form I-9 records to find and fix errors before government inspectors do. This proactive compliance measure helps businesses avoid hefty penalties and demonstrates a good-faith effort to maintain legal employment practices.

Key Steps for Conducting an Internal I-9 Audit:

- Gather all I-9 forms for current and terminated employees.

- Review each form for completeness and accuracy in all sections.

- Identify missing forms and obtain them from current employees immediately.

- Correct technical errors using proper line-through and initial methods.

- Complete new forms for substantive errors that cannot be corrected.

- Document your process with an audit log showing all findings and corrections.

- Purge expired forms according to the 3-year/1-year retention rule.

The stakes are high. ICE issued over $20 million in civil penalties for I-9 violations in 2023 alone, with fines ranging from $252 to $25,076 per violation. With research showing that 76% of I-9 forms contain at least one error, the risk is significant.

The good news is that most of these costly mistakes are preventable through regular self-audits. By conducting internal reviews, you can catch and fix problems before they become expensive government violations, protecting your business from fines, operational disruption, and reputational damage.

Preparing for Your Internal I-9 Audit

Starting an internal i 9 audit without a plan can lead to confusion and missed compliance issues. A little upfront preparation ensures the process runs smoothly and effectively.

Decide on the Scope

First, determine which I-9 forms you’ll review. Auditing all employees provides a complete picture of your compliance status and avoids any risk of discriminatory selection. This is crucial, as I-9 audits must follow a strict non-discrimination policy.

For larger companies, auditing every form may be impractical. In that case, you can use random sampling with neutral criteria. For example, you could review forms for employees hired in the last three years, a specific department, or new hires from a certain period. Be sure to document your selection method. Also, consider focusing on high-risk areas, such as periods of high-volume hiring or turnover in your HR department.

Gather Your Tools

Before you begin, assemble your audit toolkit:

- Current employee roster and payroll data to verify who needs an I-9 and their hire dates.

- All physical and electronic I-9 forms for current and terminated employees. I-9s should have separate storage from general personnel files.

- An audit log template to track findings and corrections. This log is your proof of a good-faith compliance effort.

- The USCIS Employer Handbook and the Guidance for Employers Conducting Internal Audits from the Department of Justice. These are your essential guides.

- Your audit team, which may include representatives from HR, legal, and management.

Ready to get started? Our I-9 Self Audit resources can provide additional guidance as you begin this important compliance process.

A Step-by-Step Guide to Conducting the Audit

Now that you’re prepared, let’s walk through the practical steps of conducting your internal i 9 audit. Think of this as following a recipe, where each step builds on the last to create a thorough and effective audit.

Step 1: Gather and Organize All I-9 Forms

Your first task is collecting every Form I-9 for current employees and terminated employees that you’re still required to keep. Create two separate files (physical or digital): one for current employees and another for terminated employees. This separation is a compliance best practice. As you gather forms, start an audit log to document your process, findings, and corrections. This log is critical for showing good-faith compliance. For more guidance, see our I-9 Record Keeping resource.

Step 2: Address Missing or Incomplete Forms

Once you’ve gathered your forms, your first priority is to ensure you have a completed Form I-9 for every current employee. If you find any missing I-9s, address this immediately. Contact the employee, explain it was an administrative oversight, and ask them to bring in acceptable documents to complete the form without delay. You must examine original documents. Document your good-faith effort in your audit log, noting when you found the issue and when it was resolved. Need a refresher? Our What is an I-9? page covers the fundamentals.

Step 3: Review Each Form for Accuracy and Timeliness

Now for the detailed detective work. Examine each Form I-9 section by section.

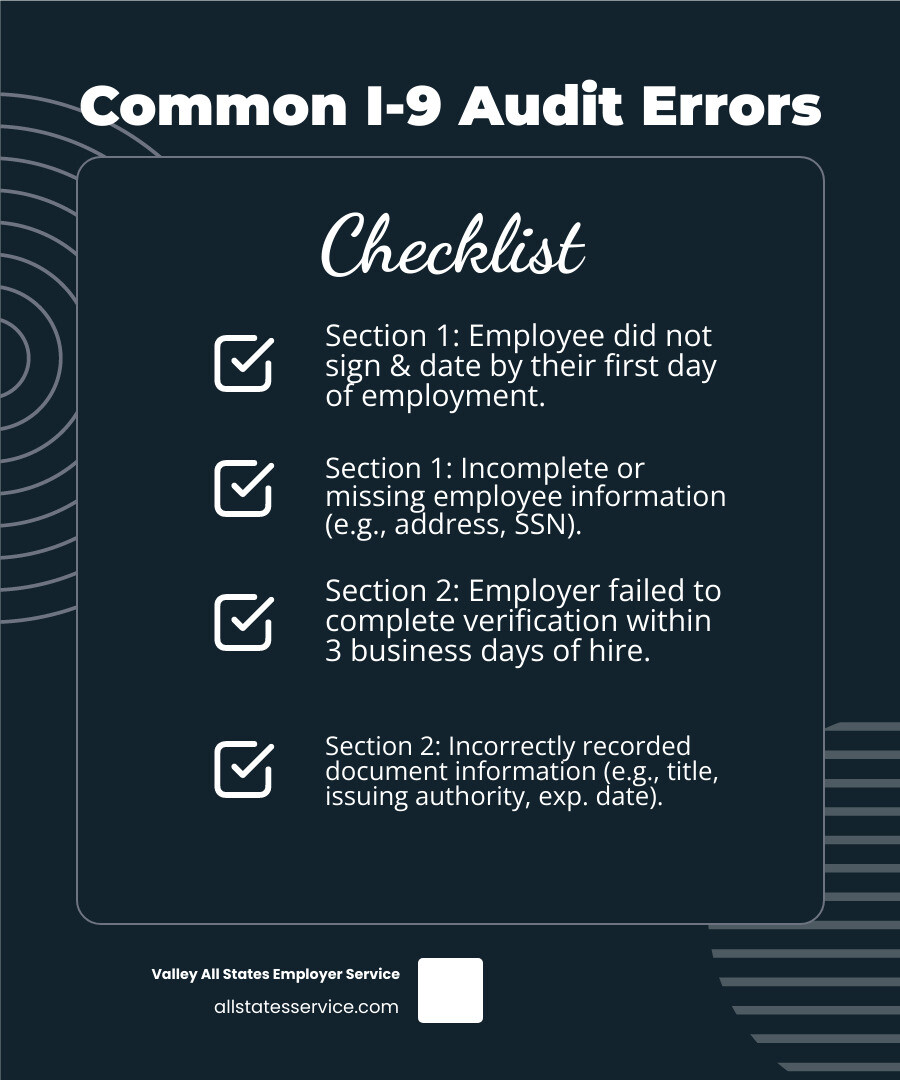

- Section 1: Check that the employee filled in all required fields and signed and dated the form by their first day of employment.

- Section 2: Confirm you properly examined the employee’s documents, recorded accurate information, and certified their eligibility. The date of hire must match payroll records, and this section must be completed within three business days of their start date.

- Section 3: For reverification or rehires, check that this section was completed correctly and on time.

Don’t forget to verify you’re using the correct I-9 version. Using an outdated form is a violation. You can confirm the Current Form I-9 version on the USCIS website.

Step 4: Purge Old I-9s Correctly

Good record-keeping means knowing when to let go. Keeping I-9s too long creates unnecessary risk, while purging them too early is a violation. The retention rule for terminated employees is the “3-year/1-year rule.” You must keep each I-9 for three years from the date of hire OR one year after termination, whichever date is later.

For example, if an employee worked for five years, you would keep their I-9 for one year after their termination. If they only worked for six months, you would keep it for three years from their hire date. When it’s time, dispose of forms securely by shredding or permanent deletion. Calculating retention dates accurately is key to compliance.

Identifying and Correcting Common I-9 Errors

A staggering 76% of I-9 forms contain at least one error, so it’s likely you’ll find some issues during your internal i 9 audit. The good news is that most of these errors are simple to spot and fix once you know what you’re looking for.

Technical vs. Substantive Errors: What’s the Difference?

Understanding the distinction between technical and substantive errors is crucial because it dictates how you correct them and the potential penalties.

| Error Type | Description | Example | Correction Method |

|---|---|---|---|

| Technical | Minor omissions or mistakes that don’t compromise verification | Missing middle initial, incomplete address | Line-through and initial method |

| Substantive | Errors that affect the verification process | Missing signature, wrong document information | Complete new form or detailed correction |

Technical errors might result in lower fines, especially if you can demonstrate good-faith compliance efforts. Substantive errors, however, can trigger the full range of penalties from $252 to $25,076 per violation.

Your Guide to a Compliant Correction Process

How you fix errors matters just as much as finding them. For technical errors, use the line-through and initial method. Draw a single line through the incorrect information, write the correct information nearby, and have the person who made the original entry initial and date the change. Never use correction fluid or black out the original entry.

Substantive errors often require you to complete a new form entirely. If an employee forgot to sign Section 1, or if you recorded completely wrong document information in Section 2, starting fresh is usually the safest approach. Attach an explanatory memo to the file documenting why the new form was necessary.

A critical rule: never backdate corrections. The correction date should reflect when you actually made the fix. Backdating can be seen as falsification of records, which creates far bigger problems. The USCIS guidance on correcting Form I-9 provides detailed instructions, and our I-9 Form Completion page offers more practical tips.

Why a DIY I-9 Audit is Your Best Defense Against Costly Fines

An internal i 9 audit is a voluntary review of your company’s Form I-9 records to find and fix errors before government inspectors do. This proactive compliance measure helps businesses avoid hefty penalties and demonstrates a good-faith effort to maintain legal employment practices.

Key Steps for Conducting an Internal I-9 Audit:

- Gather all I-9 forms for current and terminated employees.

- Review each form for completeness and accuracy in all sections.

- Identify missing forms and obtain them from current employees immediately.

- Correct technical errors using proper line-through and initial methods.

- Complete new forms for substantive errors that cannot be corrected.

- Document your process with an audit log showing all findings and corrections.

- Purge expired forms according to the 3-year/1-year retention rule.

The stakes are high. ICE issued over $20 million in civil penalties for I-9 violations in 2023 alone, with fines ranging from $252 to $25,076 per violation. With research showing that 76% of I-9 forms contain at least one error, the risk is significant.

The good news is that most of these costly mistakes are preventable through regular self-audits. By conducting internal reviews, you can catch and fix problems before they become expensive government violations, protecting your business from fines, operational disruption, and reputational damage.

Preparing for Your Internal I-9 Audit

Before we dive into reviewing each Form I-9, some preparation can make the entire internal i 9 audit process smoother and more effective. A little planning goes a long way.

Decide on the Scope

First, we need to decide what we’re actually auditing. Auditing all employees is the most comprehensive approach and helps us avoid any allegations of discrimination. However, for larger organizations, this can be time-consuming.

If auditing every I-9 isn’t feasible, we can consider a non-discriminatory sampling method. This might involve focusing on I-9s from employees hired within a specific timeframe, like the last three years, or those from a particular department. The key is that the selection criteria must be neutral. We should also consider any “high-risk” areas, such as periods with a surge in new hires or changes in our HR team.

Gather Your Tools

To conduct a thorough internal i 9 audit, we’ll need a few essential items:

- Current Employee Roster & Payroll Data: This is our master list to ensure we have an I-9 for everyone and to cross-reference dates.

- All Physical and Electronic I-9 Forms: Gather every I-9 for both current and terminated employees.

- Audit Log Template: A structured way to document our findings and corrective actions, which is invaluable for showing our good faith efforts.

- Official Guidance: The USCIS Employer Handbook (M-274) and the Guidance for Employers Conducting Internal Audits are our go-to resources.

A successful internal i 9 audit starts with good preparation. For more insights, you can also explore our I-9 Self Audit resources.

A Step-by-Step Guide to Conducting the Audit

Now that we’re prepared, let’s walk through the practical steps of our internal i 9 audit. Breaking the process down makes it much more manageable.

Step 1: Gather and Organize All I-9 Forms

Our first mission is to collect every Form I-9 for all current employees and retained forms for terminated employees. We recommend maintaining two separate files (physical or digital): one for current staff and another for former staff. As we gather these, we should start an audit log to record all findings and corrections. This log is critical for demonstrating our compliance efforts. For detailed guidelines, our I-9 Record Keeping page offers valuable information.

Step 2: Address Missing or Incomplete Forms

Once we have our I-9s, the first check is to ensure we have a form for every current employee. If we find any missing I-9s, this becomes our highest priority. We should immediately contact the employee, explain it was an oversight, and have them complete the form with acceptable documentation. We must view original documents, not copies. Documenting this outreach and the form’s completion is vital for showing our good-faith effort. To refresh our knowledge, we can visit our What is an I-9? page.

Step 3: Review Each Form for Accuracy and Timeliness

This is where the detailed work of our internal i 9 audit truly begins. We’ll go through each Form I-9, section by section.

- Section 1 (Employee Information): We’re checking that the employee completed all fields and signed and dated the form by their first day of employment.

- Section 2 (Employer Verification): We need to verify we properly examined the employee’s documents, recorded the correct information, and completed the section within three business days of the start date. The hire date must match payroll records.

- Section 3 (Reverification and Rehire): We check if reverification was needed and, if so, that it was completed correctly and on time.

A crucial aspect is checking that we’re using the most current version of Form I-9. Using an outdated version is a violation. We can always confirm the Current Form I-9 version directly from USCIS.

Step 4: Purge Old I-9s Correctly

Part of our internal i 9 audit is knowing when to properly dispose of old I-9 forms. The rule for terminated employees is the “3-year/1-year rule”: we must retain the form for three years from the date of hire or one year after the date of termination, whichever date is later.

For example, if an employee worked for five years, we keep the I-9 for one year after termination. If an employee worked for six months, we keep it for three years from their hire date. Once the retention period is over, we must securely destroy the forms to protect employee information.

Identifying and Correcting Common I-9 Errors

Since a staggering 76% of I-9 forms contain at least one error, it’s highly likely we’ll find some issues during our internal i 9 audit. Knowing what to look for and how to fix it is paramount.

Technical vs. Substantive Errors: What’s the Difference?

Understanding the distinction between technical and substantive errors is crucial because it dictates how we correct them and the potential penalties.

Technical errors are minor mistakes that don’t undermine the verification process, like a missing apartment number. These are generally less serious.

Substantive errors go to the heart of employment eligibility verification. Examples include missing signatures, failure to examine documents, or completing sections outside the required timeframes. These typically carry steeper penalties.

Your Guide to a Compliant Correction Process

When we find errors, how we fix them matters. For technical errors, we use the line-through and initial method. Draw a single line through the incorrect information, write the correct information nearby, and have the person who made the error initial and date the change. Never use correction fluid.

Substantive errors often require us to complete a new form entirely. If a section is missing a signature or has completely wrong document information, starting fresh is the safest approach. We should attach a memo to the file explaining why the new form was necessary.

A critical rule is to never backdate corrections. The correction date must be the date the fix is made. Backdating can be seen as falsification of records, which is a much more serious problem. The USCIS guidance on correcting Form I-9 provides detailed instructions, and our I-9 Form Completion page offers more practical tips.