I-9 section 2: Master 3 Easy Steps

What You Need to Know About I-9 Section 2

I-9 Section 2 is where employers verify that new hires are legally authorized to work in the United States. As an employer, you are responsible for completing it within three business days of your employee’s first day of work.

Quick Overview: I-9 Section 2 Essentials

- Who Completes It: Employer or authorized representative (not the employee)

- When: Within 3 business days of hire (or by first day if job lasts less than 3 days)

- What You Do: Physically examine original documents, record their details, and sign an attestation

- Documents Needed: Either one List A document OR one List B plus one List C document

- Purpose: Verify employee identity and employment authorization

- Consequences: Civil fines ranging from hundreds to thousands of dollars per violation

By law, you must complete Form I-9 for every person you hire. While the employee fills out Section 1 on their first day, Section 2 is your responsibility.

This section requires you to physically examine documents your employee presents, ensure they appear genuine, record specific information from those documents, and sign an attestation. Miss the deadline, accept the wrong documents, or fill it out incorrectly, and you’re looking at serious penalties.

Completing Section 2 doesn’t have to be complicated. With the right knowledge and a systematic approach, you can handle this critical compliance task with confidence. Whether you’re an HR manager or a small business owner, understanding Section 2 requirements will save you time, stress, and potential legal headaches.

Let’s walk through everything you need to know to get Section 2 right, every time.

The Ground Rules: Who, What, and When for Section 2

Before filling out I-9 Section 2, you must understand its basic framework: who completes it, what it does, and when it’s due. Getting these fundamentals right is key to staying compliant.

If you’re new to Form I-9, our guide on What is an I-9? provides helpful context.

What is the Purpose of Form I-9 Section 2?

I-9 Section 2 exists to verify that your new hire is who they claim to be and is legally authorized to work in the United States. While your employee handles Section 1, Section 2 is where you step in to confirm everything checks out.

Think of it as the trust-but-verify moment in your hiring process. You examine actual documents, record what you see, and sign off that you’ve done your due diligence. This protects your business from penalties and helps maintain a legal workforce.

Who is Responsible for Completing Section 2 of Form I-9?

I-9 Section 2 must be completed by you, the employer, or an authorized representative. Unlike Section 1, the employee cannot complete this part.

You can designate an authorized representative, such as an HR manager, office administrator, or foreman, to handle this task. Critically, even if you delegate this task, you remain fully liable for any mistakes. Choosing a representative who understands the process is essential for protecting your business.

What is the Deadline for Completing Section 2 of Form I-9?

Timing is critical for I-9 Section 2. You have three business days from your employee’s first day of work to complete it. Business days exclude weekends and federal holidays.

So if someone starts working on Monday, you need to finish Section 2 by end of business on Thursday. Start on Wednesday? You have until Monday of the following week.

There’s one exception: for jobs lasting less than three business days, you must complete Section 2 no later than their first day of work. Short-term gigs don’t get the three-day grace period.

Missing these deadlines is a common I-9 violation that can result in serious penalties. The best approach is to make I-9 completion a standard part of your onboarding checklist.

Before you start, ensure your employee has completed Section 1 fully and accurately. You can’t do your part until they’ve done theirs. You can always download the official Form I-9 directly from USCIS.

The Document Review: A Step-by-Step Guide

After the employee completes Section 1, your role in I-9 Section 2 is to review their documentation. This involves carefully examining documents to establish identity and employment authorization according to specific rules.

What Documentation Can an Employee Present to Fulfill Section 2 Requirements?

Importantly, employees have the right to choose which documents they present from the Lists of Acceptable Documents. You cannot specify which documents to bring, as this is a crucial anti-discrimination measure.

The acceptable documents are divided into three categories. List A documents establish both identity and employment authorization. Think U.S. Passport, Permanent Resident Card (Form I-551), or Employment Authorization Document (Form I-766). If an employee presents a valid List A document, they don’t need to provide anything else.

List B documents establish identity only, such as a State Driver’s License or State ID Card. List C documents establish employment authorization only, such as a Social Security Card or U.S. Birth Certificate. If an employee doesn’t present a List A document, they must present one document from List B and one from List C.

For more detailed guidance on what to look for when examining these documents, check out our resource on Verifying I-9 Documents.

Common combinations include a U.S. Passport (List A), a Permanent Resident Card (List A), or a State Driver’s License (List B) paired with a Social Security Card (List C). You might also see a State ID Card (List B) with a U.S. Birth Certificate (List C).

What Are the Employer’s Responsibilities When Examining Employee Documentation for Section 2?

Your responsibility is to physically examine the original, unexpired documents in person. With limited exceptions for remote verification, photocopies, faxes, or phone photos are not acceptable.

You must determine whether the documents reasonably appear genuine and relate to the employee. You are not expected to be a document expert, but you must check for obvious signs of tampering, alteration, or forgery. If something seems off, you can ask the employee to present other acceptable documents.

The anti-discrimination rule applies throughout this process. You cannot refuse to hire someone because their documentation has a future expiration date. You also cannot discriminate based on citizenship status or national origin.

Immediately after examining the original documents, return them to the employee. Never keep an employee’s original identity or employment authorization documents.

Filling Out I-9 Section 2: A Field-by-Field Walkthrough

Once you’ve examined the employee’s documents and confirmed they appear genuine and relate to the individual, it’s time to accurately record this information in I-9 Section 2. Think of this as the moment where careful attention to detail pays off. One mistyped number or forgotten signature can turn into a compliance headache down the road.

Employee and Document Information

Start by transferring your employee’s information from Section 1. You’ll need their Last Name (Family Name), First Name (Given Name), Middle Initial, and Citizenship/Immigration Status (the number 1, 2, 3, or 4 they selected). Copy these exactly as they appear in Section 1. This isn’t the time for corrections or assumptions. Consistency matters here because it helps keep your form pages together and makes audits smoother.

Next comes the document information. Under the appropriate list (A, B, or C), enter the Document Title exactly as it appears on the document. If it’s a U.S. Passport, write “U.S. Passport,” not “passport” or “PP.” For a driver’s license, include the state, like “California Driver’s License.”

The Issuing Authority identifies who issued the document. For a U.S. Passport, that’s the “U.S. Department of State.” For a driver’s license, it’s typically the state’s Department of Motor Vehicles, which you’d write as “CA DMV” or “Texas DPS,” depending on the state. This field tells anyone reviewing the form where the document came from.

Now record the Document Number. This is the unique identifier printed on the document. Double-check this one. Transposed digits are one of the most common errors in I-9 Section 2, and they can raise red flags during audits.

For the Expiration Date, use the mm/dd/yyyy format. If the document doesn’t expire (like some older Social Security cards), write “N/A” in this field. Don’t leave it blank, as that can look like an oversight.

The Additional Information field deserves special attention. This space isn’t just for notes. It’s where you record specific compliance information like employment authorization extensions, SEVIS numbers for F-1 or J-1 students, or details about replacement documents. If you’re enrolled in E-Verify and you used the alternative remote examination procedure (more on that in a moment), you’ll check a box here to indicate that. If your employee presents a List B and List C combination and you use E-Verify, the List B document must include a photograph. This is where those details matter. For comprehensive guidance on working with E-Verify, check out our resource on I-9 E-Verify Compliance.

Accuracy isn’t optional in this section. It’s everything. Take your time, refer back to the original documents, and when in doubt, consult the Handbook for Employers (M-274). This handbook is your best friend for navigating the trickier aspects of I-9 compliance.

Dates and Employer Attestation in I-9 Section 2

Beyond the document details, I-9 Section 2 requires you to record specific dates and provide your official attestation. This is where you put your name on the line, literally.

First, enter the Employee’s First Day of Employment. This is the date your employee actually began working for pay, or will begin if you’re completing this section in advance. If you fill out Section 2 before their start date, use the expected date. Just know that if the actual start date changes, you’ll need to correct it, initial the change, and date it. Accuracy here matters because it establishes the timeline for your three-day completion window.

The Date of Examination is equally important. This is the date you (or your authorized representative) physically examined the documents and completed Section 2. This date should fall within three business days of the employee’s first day. If it doesn’t, you’ve got a timing violation on your hands.

Now for the Employer Signature. When you sign this section, you’re attesting, under penalty of perjury, that you physically examined the employee’s original documents, that they appeared genuine and related to the employee, and that to the best of your knowledge, the employee is authorized to work in the United States. This isn’t a casual signature. It’s a legal statement. If you’re using an authorized representative, they’ll sign here instead, but remember, you’re still ultimately responsible for any errors.

Include your Signer’s Title (like “HR Manager,” “Owner,” or “Director of Operations”), your Employer Business Name (the full legal name of your company), and your Employer Physical Address. That address must be a physical street address, not a P.O. Box. For companies with multiple locations, use the address that makes the most sense for where the employee works or where the I-9 was completed.

Handling Remote Hires and Authorized Representatives for I-9 Section 2

Remote work has changed a lot about how we do business, and I-9 compliance is no exception. The “physical examination” requirement in I-9 Section 2 used to be a significant obstacle for remote hiring. While there are still strict rules, there are now workable solutions.

If you have a remote employee, you can appoint an authorized representative to complete Section 2 on your behalf. This person takes on all your employer duties for this form: reviewing Section 1, physically examining the original documents in the employee’s presence, and completing Section 2. Your representative could be a personnel officer, a trusted colleague in another office, or even a notary public (though notaries shouldn’t use their official seal for I-9 purposes). The critical point here is that even though someone else is handling the paperwork, you, the employer, remain fully liable for any mistakes. That’s why training your representative thoroughly is not optional.

In July 2023, the Department of Homeland Security introduced a permanent alternative procedure for remote examination, but it comes with a specific requirement: you must be enrolled in E-Verify. If you meet that criterion, this procedure can be a game-changer for remote hiring.

Here’s how it works. Your employee sends you clear, legible copies of their acceptable documents (a List A document, or a List B and List C combination). Then you conduct a live video call with the employee. During this call, the employee must present the same original documents they sent copies of, and you must verify that they appear genuine and relate to the person on the screen. After the call, you retain the copies of the documents and check a box in the Additional Information field of Section 2 to indicate you used this alternative procedure.

This remote option is convenient, but it’s not a shortcut. The requirements are strict, and if you’re not enrolled in E-Verify or don’t follow the procedure correctly, you’re not in compliance. For a detailed walkthrough of this process, including common pitfalls and best practices, visit our I-9 Verification Remote Complete Guide.

Whether you’re handling I-9s in person or remotely, the fundamentals remain the same: accuracy, timeliness, and attention to detail. Get those right, and Section 2 becomes just another part of your onboarding process instead of a compliance risk.

Avoiding Common Pitfalls and Penalties

I-9 Section 2 isn’t complicated, but it’s unforgiving. Even well-meaning employers make costly mistakes. The government takes I-9 compliance seriously, and you’re liable for every error.

The most common mistake? Missing the three-business-day deadline. This violation is common in audits. The solution is to build I-9 completion into your onboarding process with automated reminders to ensure it’s never forgotten.

Another frequent error is accepting expired documents. Every document you examine must be unexpired at the time you review it. There are limited exceptions for certain receipts, but the general rule is clear: if it’s expired, it doesn’t count.

Over-documentation might seem safe but can create legal problems. If an employee presents a valid List A document like a U.S. Passport, you’re done. Don’t ask for more documents, as this can be viewed as discriminatory.

Specifying which documents an employee must bring is illegal. You cannot tell an employee what to bring. They choose from the acceptable lists, and your job is to examine the valid documents they present.

Incomplete or incorrect information creates its own set of problems. Leaving fields blank, recording wrong document numbers, or forgetting signatures all count as violations. Double-check everything before you close out the form.

Don’t forget about proper storage. I-9 forms must be kept for three years after the date of hire or one year after employment ends, whichever is later. They must be stored securely and separately from regular personnel files.

Getting it wrong leads to civil money penalties starting in the hundreds of dollars per form and climbing into the thousands. A pattern of violations can even lead to criminal penalties. Government audits are real and thorough. To understand the full scope of potential consequences, take a look at our detailed breakdown of I-9 Compliance Penalties.

Most violations are preventable. With the right systems and a clear understanding of the requirements, you can keep your I-9 records clean and your business protected.

Frequently Asked Questions about I-9 Section 2

We know that I-9 Section 2 can feel confusing, especially when you’re dealing with unique situations. Here are answers to the questions we hear most often.

What if an employee presents a receipt for a document?

Sometimes life happens. Documents get lost, stolen, or damaged. The good news? In certain situations, an employee can temporarily present a receipt instead of the actual document.

There are three types of receipts the government considers acceptable. First, if an employee’s document was lost, stolen, or damaged, they can give you a receipt showing they’ve applied for a replacement. This gives them 90 days from their hire date to present the actual replacement document to you.

Second, an employee might present a Form I-94/I-94A with a temporary I-551 stamp. This acts as a temporary Permanent Resident Card and remains valid until the expiration date printed on the stamp. If there’s no expiration date noted, it’s good for one year from the date it was issued.

Third, you might see a Form I-94/I-94A with a refugee admission stamp or with an attached Form I-766. This works as an acceptable List C document, but only for 90 days. Before that 90-day window closes, the employee needs to show you either an unexpired Employment Authorization Document (Form I-766) or a combination of one List B and one List C document.

The key here is tracking. Mark your calendar with these expiration dates and follow up with employees to make sure they present the actual documents on time. Missing these deadlines puts you at risk for violations, even if the employee started with a valid receipt.

Can I specify which documents an employee should provide?

No, and this is important. You cannot tell an employee which documents they should bring you to complete I-9 Section 2. The choice is entirely theirs.

Whether they present a U.S. Passport, a driver’s license with a Social Security card, or any other valid combination from the Lists of Acceptable Documents, your job is the same: accept what they choose, as long as the documents appear genuine and relate to the person standing in front of you.

Asking for specific documents is more than just a mistake. It’s considered discriminatory and can land you in serious legal trouble. Employees have rights here, and respecting their document choices is part of avoiding discrimination claims. Your role is to verify, not to dictate.

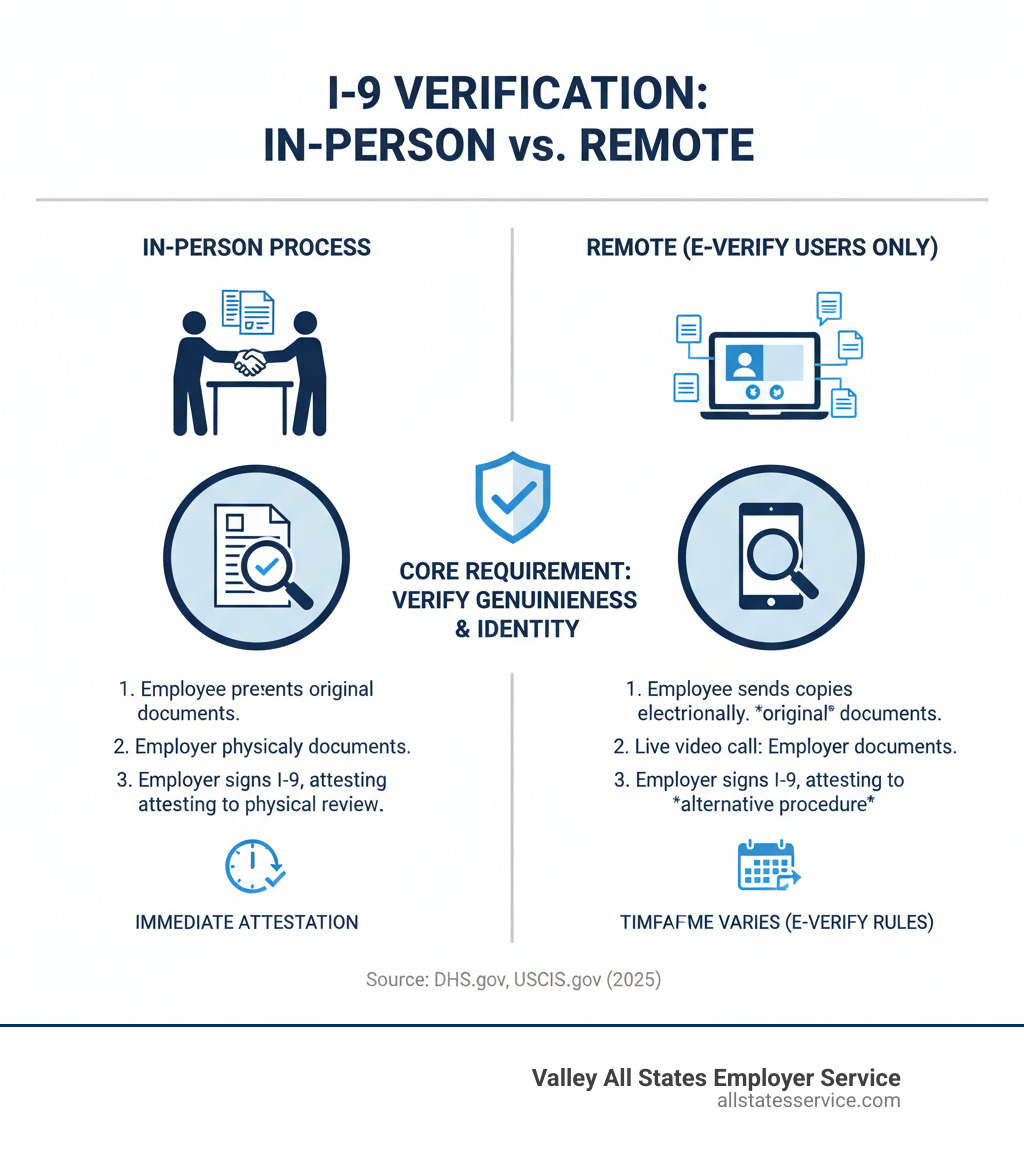

What’s the difference between in-person and remote document examination?

For years, completing I-9 Section 2 meant being in the same room as your employee. You had to physically handle their original documents, examine them, and complete the form right there.

The world of work has changed, though. With remote hiring becoming standard practice, the Department of Homeland Security introduced what they call an “alternative procedure” for document examination. This became a permanent option in July 2023, but it comes with a catch: it’s only available to employers enrolled in E-Verify.

Here’s how in-person examination works. You or your authorized representative meet with the employee face-to-face. You physically handle their original documents, check that they look genuine, verify they relate to the employee, and complete Section 2. It’s straightforward and has been the standard method since Form I-9 was created.

Remote examination using the alternative procedure is different. Your employee sends you clear, legible copies of their documents electronically, maybe through email or a secure portal. Then you schedule a live video call with them. During that call, they hold up the same original documents to the camera. You examine them visually, making sure they appear genuine and match the person on screen. After the call, you retain the copies they sent and check the box in the “Additional Information” field of Section 2 to show you used this alternative method.

Both methods require you to verify that the documents are genuine and relate to the employee. The core responsibility doesn’t change, just the logistics. If you’re considering the remote option, make sure you’re enrolled in E-Verify and meet all the requirements. For more details on E-Verify and how it works, you can Learn more about E-Verify.

Simplify Your Compliance Journey

Getting I-9 Section 2 right isn’t just about following the rules. It’s about protecting your business, building a legally authorized workforce, and sleeping better at night knowing you won’t face unexpected penalties. Accuracy matters. Timing matters. And let’s be honest, the administrative burden of keeping up with I-9 and E-Verify compliance can feel overwhelming, especially when regulations shift and every detail counts.

This is exactly where Valley All States Employer Service comes in. We specialize in outsourced E-Verify workforce eligibility verification, which means we handle the expert, impartial, and efficient processing that keeps your business compliant and your stress levels low. We know the ins and outs of every field, the critical deadlines that can’t be missed, and the documentation details that trip up even experienced HR teams.

You’ve got enough on your plate running your business. Let us handle the complexities of I-9 Section 2 so you don’t have to worry about turning a simple paperwork error into a costly penalty. We’re here to make employment eligibility verification straightforward, accurate, and painless.

Ready to take the guesswork out of I-9 compliance? Get professional I-9 Verification Assistance from our team today. We’ll help you steer these requirements with confidence, so you can focus on what you do best.