I-9 form verification Maryland 2025: Master Confidently

Why I-9 Form Verification Maryland Matters for Every Employer

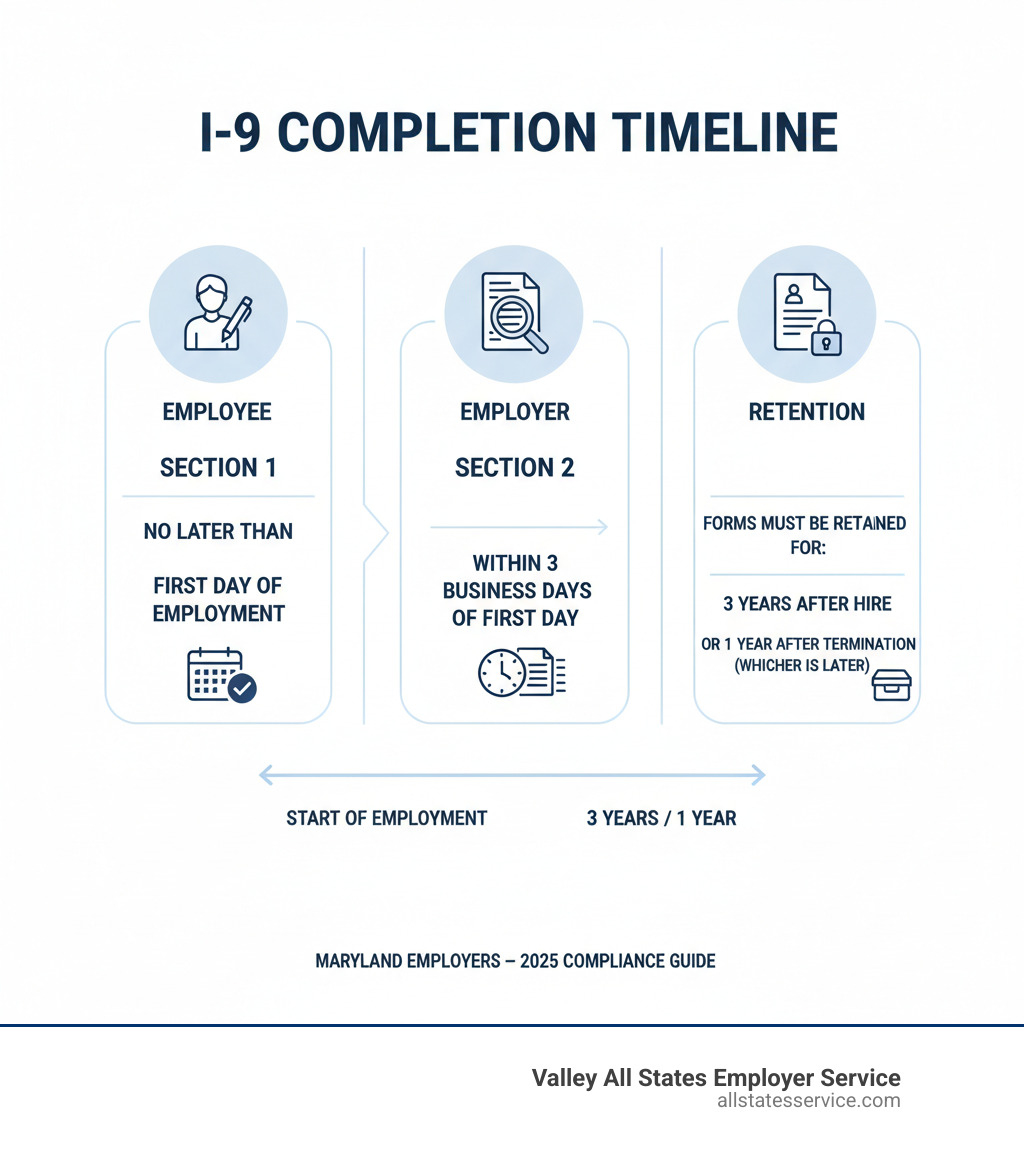

I-9 form verification Maryland is a federal requirement for every Maryland employer, regardless of business size. Here’s a quick overview:

Quick Answer: The I-9 Form Verification Process

- Section 1: New employee completes by their first day of work.

- Section 2: Employer reviews original documents and completes within 3 business days of hire.

- Documents: Employee chooses from List A (identity + work authorization) OR List B (identity) + List C (work authorization).

- Retention: Keep forms for 3 years after hire or 1 year after termination, whichever is later.

- Applies to: Every hire after November 6, 1986, including U.S. citizens and non-citizens.

Federal law requires you to complete Form I-9 for each new hire to verify their identity and legal authorization to work in the U.S. While it’s a federal rule, it applies to every Maryland employer.

The stakes are high. Incorrect or incomplete I-9 forms can lead to fines from hundreds to thousands of dollars per form. Small errors can add up quickly during an audit.

Fortunately, the I-9 process is manageable. Understanding the timeline, documents, and your responsibilities helps you onboard new hires while staying compliant.

This guide covers every step of the I-9 process, from the basics to special cases like remote hires and rehires, providing practical answers to protect your business.

Understanding the Basics of Form I-9

The Form I-9, or Employment Eligibility Verification form, is a federal requirement for every U.S. employer, including those in Maryland. The form verifies two key things: your new hire’s identity and their work authorization. It confirms they are who they say they are and are legally allowed to work in the U.S.

This federal law applies nationwide. The I-9 form verification Maryland employers complete follows the same rules for all employees, whether they are U.S. citizens or noncitizens. For more details, see What is an I-9?

Who Must Complete Form I-9?

U.S. employers must complete an I-9 for every person hired after November 6, 1986, when the law was enacted.

This applies to all new hires: full-time, part-time, seasonal, and temporary. The requirement covers all citizens and noncitizens equally.

Exceptions include true independent contractors, unpaid volunteers, and some casual domestic workers. For most hires, however, the I-9 is mandatory.

Key Responsibilities and Anti-Discrimination Rules

The I-9 process is a partnership between you and your new hire. The employee completes Section 1, attesting to their eligibility status. Crucially, they choose which acceptable documents to present to prove their identity and work authorization.

As the employer, you must provide the I-9 instructions, physically examine the employee’s chosen documents, complete Section 2, and retain the form. Skipping any step can cause audit problems.

Anti-discrimination rules are critical. You cannot specify which documents an employee should provide. The employee chooses from the lists of acceptable documents, and you must accept any valid document they present.

You must not discriminate based on citizenship, immigration status, or national origin. Treating all employees consistently is the law. Requesting extra or different documents from certain employees is a serious violation.

The USCIS I-9 Central website is the official resource. Always treat employees equally and follow the rules. Your role is to verify eligibility, not to act as an immigration officer.

The Step-by-Step I-9 Completion Process and Deadlines

The Form I-9 is a key part of onboarding. Getting it right from the start prevents future problems.

Section 1: Employee Information and Attestation

The new employee completes Section 1, providing basic information like name, address, and date of birth. Most importantly, they must attest, under penalty of perjury, to their employment eligibility status.

They check one of four boxes: a citizen of the United States, a noncitizen national, a lawful permanent resident, or an alien authorized to work. The last two categories require additional information, such as an Alien Registration Number.

The deadline for Section 1 is the employee’s first day of employment. It can be completed after a job offer is accepted but before the start date. Using an online onboarding portal can help ensure timely completion. For more guidance, see our page on I-9 Form Completion.

If anyone assists the employee with Section 1, they must complete the “Preparer and/or Translator Certification” section.

Section 2: Employer Review and Verification

After the employee completes Section 1, you or an authorized representative must complete Section 2. This involves reviewing the documents the employee presents to prove their identity and work authorization.

Physical document examination is key. You must examine original, unexpired documents to determine if they reasonably appear genuine and relate to the employee. You are not expected to be a document expert, but you can ask for another acceptable document if one seems questionable.

Remote examination is now an option. The Department of Homeland Security allows alternative procedures, such as using an authorized representative to conduct the inspection. We will cover remote options in more detail later.

After reviewing the documents, you record the information in Section 2 and sign, attesting that the documents appear genuine. Our Employer I-9 Verification Guide provides a detailed walkthrough.

Critical Deadlines for I-9 form verification Maryland

Timing is critical for I-9 form verification Maryland. Missing deadlines is a common and costly mistake.

Section 1 must be completed by the employee’s first day of work. Section 2 must be completed by you within three business days of the employee’s start date. For hires lasting less than three days, Section 2 is also due on the first day.

For example, if an employee starts on Monday, you have until Thursday to complete Section 2. If they start on Friday, the deadline is the following Wednesday.

Late completion can result in federal fines from hundreds to thousands of dollars per form. A form completed on the fourth business day is a violation, even if it’s perfect. A solid onboarding process that prioritizes I-9 completion is essential for Maryland businesses.

Navigating I-9 Documentation: Lists A, B, and C

Documents for I-9 verification are categorized into List A, List B, and List C. Understanding these lists is key for proper I-9 form verification Maryland and is simpler than it seems.

The employee chooses which acceptable documents to present. You cannot specify which documents they bring or reject a valid document from the approved lists. Your role is to verify that the chosen documents appear genuine and relate to the employee.

The Difference Between the Lists

List A documents establish both identity and employment authorization. One valid List A document is all that’s needed. Examples include a U.S. Passport, a Permanent Resident Card (Green Card), or an Employment Authorization Document (EAD).

List B documents establish identity only. They must be presented with a List C document. Common examples include a state-issued driver’s license, ID card, or a school ID with a photograph.

List C documents establish employment authorization only and must be paired with a List B document. The most common example is a Social Security card (without employment restrictions). Other options include a certified birth certificate.

Essentially, an employee can present one document from List A, or a combination of one document from List B and one from List C. For more details on document examination, see our guide on Verifying I-9 Documents.

Common Acceptable Documents and Receipts

From List A, you will often see U.S. Passports, Permanent Resident Cards (Green Cards), or Employment Authorization Documents. From List B, state-issued driver’s licenses and ID cards are most common. From List C, the unrestricted Social Security card is most frequent.

Always refer to the official List of Acceptable Documents from USCIS for the most current information, as the list can change.

The “receipt rule” provides temporary flexibility if an employee’s document is lost, stolen, or damaged. They can present a receipt for a replacement document instead of the actual document. There are three types of acceptable receipts:

- A receipt for a replacement document (from any list) is valid for 90 days, by which time the employee must present the actual document.

- The arrival portion of Form I-94/I-94A for certain refugees or parolees is valid for 90 days, by which time the employee must present an EAD or Green Card.

- Form I-94/I-94A with a temporary I-551 stamp acts as a temporary Green Card for up to one year, by which time the actual card must be presented.

Using receipts requires you to track the deadline and follow up to see the actual document. Missing this step is a serious compliance violation. Use calendar reminders or HR software to track these dates.

Advanced Topics in I-9 Form Verification Maryland

Beyond initial onboarding, I-9 form verification Maryland involves ongoing compliance for certain long-term scenarios.

Reverification, Rehires, and Retention

The I-9 process sometimes requires you to revisit the form after initial completion.

Expiring Work Authorization: For employees with temporary work authorization, you must reverify their eligibility before their authorization expires. Use Supplement B of Form I-9 to record the new, unexpired documents they present.

Not everyone needs reverification. U.S. citizens, noncitizen nationals, and lawful permanent residents (Green Card holders) never need to be reverified. A Green Card holder’s work authorization is permanent, even if the card itself expires.

Rehiring Employees: If you rehire an employee within three years of their original I-9 completion date, you can use their existing form. Complete Supplement B to note the rehire date and reverify work authorization if needed. After three years, a new Form I-9 is required.

Retention Rules: You must retain Form I-9 for each employee for a specific period after they leave. The rule is: keep the form for three years from the hire date or one year after employment ends, whichever is later. For an employee who worked for two years, you’d keep the form for three years from their start date. For an employee who worked five years, you’d keep it for one year after their termination. Our I-9 Audit Complete Guide offers more detail on retention.

Special Considerations for Remote Hires and I-9 form verification Maryland

Remote work presents a challenge for the physical document examination requirement.

Authorized Representative: You can designate an Authorized Representative to physically examine documents on your behalf. This can be almost anyone over 18. They complete Section 2, which you then review. This is a practical solution for remote hires.

Live Video Alternative: Companies enrolled in E-Verify may be eligible to use a live video inspection to examine documents remotely. This can streamline onboarding but has specific requirements. Our I-9 Verification Remote Complete Guide covers both remote methods.

Student Workers: The I-9 form verification Maryland requirements for student workers are the same as for any other employee. If a student cannot present their documents on time, their start date may need to be delayed.

Maryland-Specific Resources: The Maryland’s Guide to Work Authorization Documents is a helpful state resource for understanding the various documents you might see, especially when hiring New Americans.

E-Verify and Penalties: The Next Step in Compliance

After mastering the I-9 process, many employers consider E-Verify, an electronic system that adds another layer of verification.

What is E-Verify and Is It Required in Maryland?

E-Verify is a web-based system from DHS and SSA that compares Form I-9 information against government databases to confirm employment eligibility. You can learn more in our guide, What is E-Verify?.

For most private businesses in Maryland, E-Verify is voluntary. However, some exceptions may require its use. Federal contractors with a FAR E-Verify clause in their contract must use the system. Some Maryland state and local government agencies, like the City of Baltimore, also require E-Verify.

The legal landscape is changing, with more states mandating E-Verify. Stay updated on local requirements by checking our Maryland E-Verify page.

Avoiding Costly Penalties for Non-Compliance

The federal government takes I-9 form verification Maryland compliance seriously. U.S. Immigration and Customs Enforcement (ICE) audits can result in significant financial penalties for non-compliance.

Common mistakes include missing or incomplete forms, late completion, and accepting invalid documents. Other violations include improper storage or retention and discrimination, such as requesting specific documents or treating employees differently based on their perceived immigration status.

Fines for I-9 violations range from hundreds to thousands of dollars per form and can multiply quickly. Serious violations may also lead to criminal charges or debarment from federal contracts.

Good faith compliance can help reduce penalties. This means demonstrating genuine efforts to comply through clear policies, staff training, and reliable systems. However, it does not excuse negligence.

The best strategy is to establish solid processes from the start. For businesses using E-Verify, outsourcing to an expert like Valley All States Employer Service ensures accuracy and minimizes risk. Learn more about the risks on our I-9 Compliance Penalties page.

Frequently Asked Questions about the I-9 Process

Here are answers to common questions Maryland employers have about the I-9 process.

How do I handle I-9 verification for a fully remote employee in Maryland?

The physical document examination requirement still applies to remote employees. The most common method is to use an Authorized Representative. This can be any trusted person over 18 near the employee. They physically examine the documents, complete Section 2, and send it to you for review.

If your business uses E-Verify, you may be eligible to use a live video interaction to examine documents. This option has specific requirements but can simplify remote onboarding.

Our guide, Can I-9 Verification Be Done Remotely?, provides a detailed walkthrough of both methods.

Do I need to complete a new I-9 form if I rehire a former employee?

If you rehire a former employee within three years of their original I-9 completion, you can use their existing form. Simply complete Supplement B (Reverification and Rehire) to record the rehire date. If their work authorization has expired, you must also use Supplement B to reverify it by examining new documents.

If it has been more than three years, or if the employee’s name has changed, you must complete a new Form I-9.

Where can I find the official Form I-9 and related resources?

For I-9 form verification Maryland compliance, always use official resources from U.S. Citizenship and Immigration Services (USCIS). Always Download the latest Form I-9 from USCIS to avoid penalties for using an outdated version.

The USCIS Handbook for Employers (M-274) is the definitive guide for I-9 completion. It provides detailed instructions, document examples, and guidance on special cases. The I-9 Central website also provides training materials and policy updates, which are useful for staying current.

Conclusion

Proper I-9 form verification Maryland is more than a compliance task; it’s fundamental to protecting your business from penalties and ensuring a legal workforce. While there are details to manage, the process becomes routine with a solid understanding.

This guide has covered the key aspects of Form I-9, from deadlines and document lists to advanced topics like remote hires and E-Verify. The key is to be accurate, timely, and consistent. This approach ensures compliance with federal law and demonstrates your commitment to fair and legal hiring practices.

Managing the I-9 process, especially with E-Verify, can be complex. Outsourcing to an expert like Valley All States Employer Service reduces the administrative burden and minimizes the risk of costly errors. We provide accurate, efficient E-Verify and employment verification services so you can focus on your business.

Ready to make your hiring process smoother and more compliant? Simplify your hiring process with expert employment verification in Maryland and let us handle the details while you build your team with confidence.