E-Verify form I-9: 2025 Ultimate Guide

Why E-Verify form I-9 Integration is Critical for HR Compliance

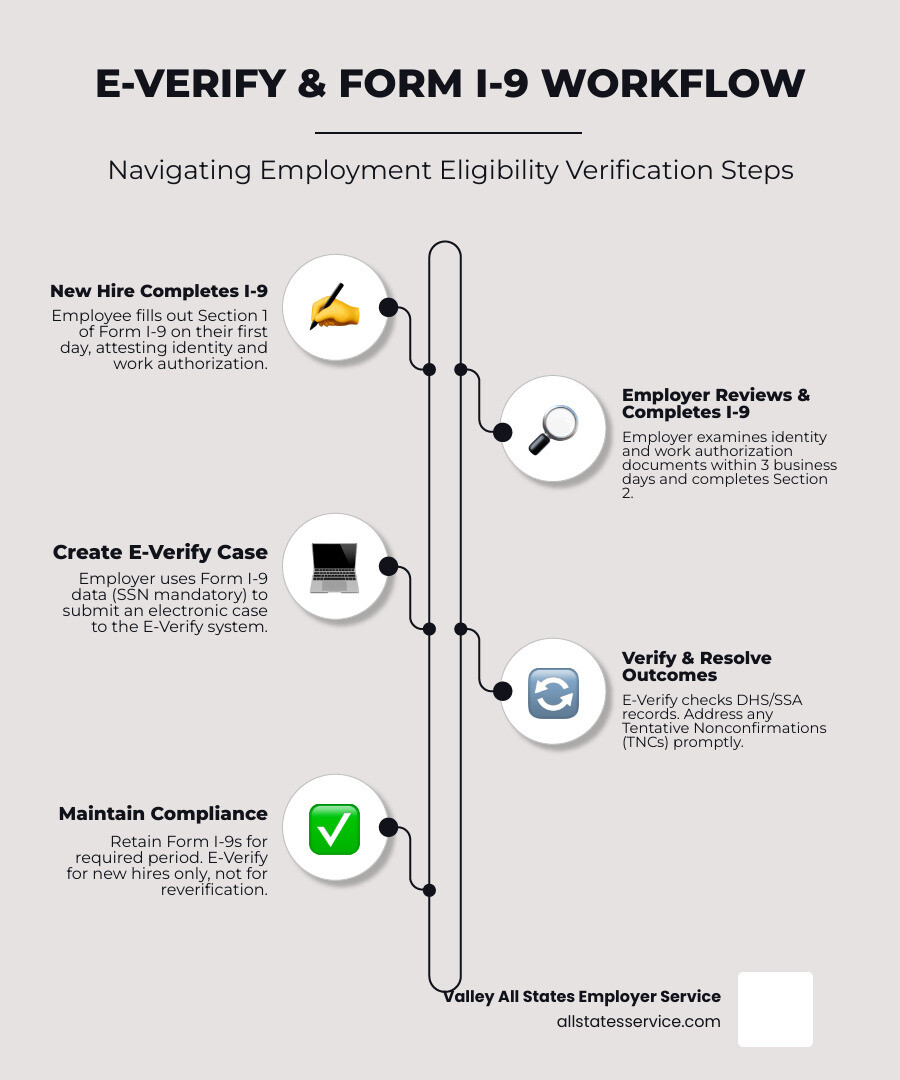

E-Verify form I-9 integration creates a comprehensive employment verification system that protects your business from costly penalties and ensures legal workforce compliance. Here’s what you need to know:

Key Integration Requirements:

- Complete Form I-9 first – Employees complete Section 1 on their first day; employers complete Section 2 within 3 business days.

- Create E-Verify case second – Use Form I-9 data for electronic verification through government databases.

- Social Security Number required – While voluntary on Form I-9, an SSN is mandatory for E-Verify.

- Photo ID for E-Verify – List B documents must have a photo for E-Verify employers.

- Cannot use E-Verify for reverification – Only Form I-9 can be used when employment authorization expires.

Form I-9 is the key element of E-Verify’s web-based system, yet many HR managers struggle with the complexity of managing both effectively.

Recent updates add to the challenge. The new Form I-9 dated “08/01/23” became mandatory on November 1, 2023, and includes special provisions for E-Verify employers to remotely examine documents under specific conditions.

The stakes are high. Immigration and Customs Enforcement (ICE) can impose fines from hundreds to thousands of dollars per violation. Proper integration of both systems creates multiple layers of protection while streamlining your hiring process.

The Foundation: Understanding Form I-9 Requirements

Form I-9 is the gatekeeper of your hiring process. Every employee you hire must complete this form, with no exceptions. The Immigration Reform and Control Act (IRCA) of 1986 made this a federal requirement for all U.S. employers, regardless of size.

Form I-9’s main job is simple: verify your new employee’s identity and legal authorization to work in the U.S. It’s your first line of defense against hiring issues.

Form I-9 versions change, which can be confusing. The latest version is dated “01/20/25” and expires on “05/31/2027.” The previous version dated “08/01/23” became mandatory on November 1, 2023, and is still valid. This newer form is streamlined to a single page.

When examining documents, your role is crucial. You must determine if they look genuine and belong to the person presenting them. You’re not a forensic expert, just someone using reasonable judgment.

Want to dive deeper into the nuts and bolts of this essential form? Check out our comprehensive guide: What is I-9 Form?.

Completing Section 1: The Employee’s Role

Section 1 belongs entirely to your employee. This is their moment to attest to their identity and legal work status.

Your new hire must check one of four boxes: U.S. citizen, noncitizen national, lawful permanent resident, or alien authorized to work. The government recently changed the wording from “noncitizen authorized to work” back to “alien authorized to work” to match federal statutes.

Timing is everything. Your employee must complete Section 1 no later than their first day of work for pay. They can fill it out after accepting your job offer, but it must be done before they start earning a paycheck.

Here’s where the E-Verify form I-9 connection gets interesting. On Form I-9, providing a Social Security Number is usually voluntary. But if you use E-Verify, that SSN becomes mandatory because the system needs it to verify employment eligibility.

Sometimes employees need help with Section 1. Anyone who helps them must complete Supplement A (the new name for the Preparer/Translator Certification), signing off that they helped and the information is accurate.

Getting Section 1 right from the start saves headaches later. For step-by-step guidance, take a look at our resource on I-9 Form Completion.

Completing Section 2: The Employer’s Responsibility

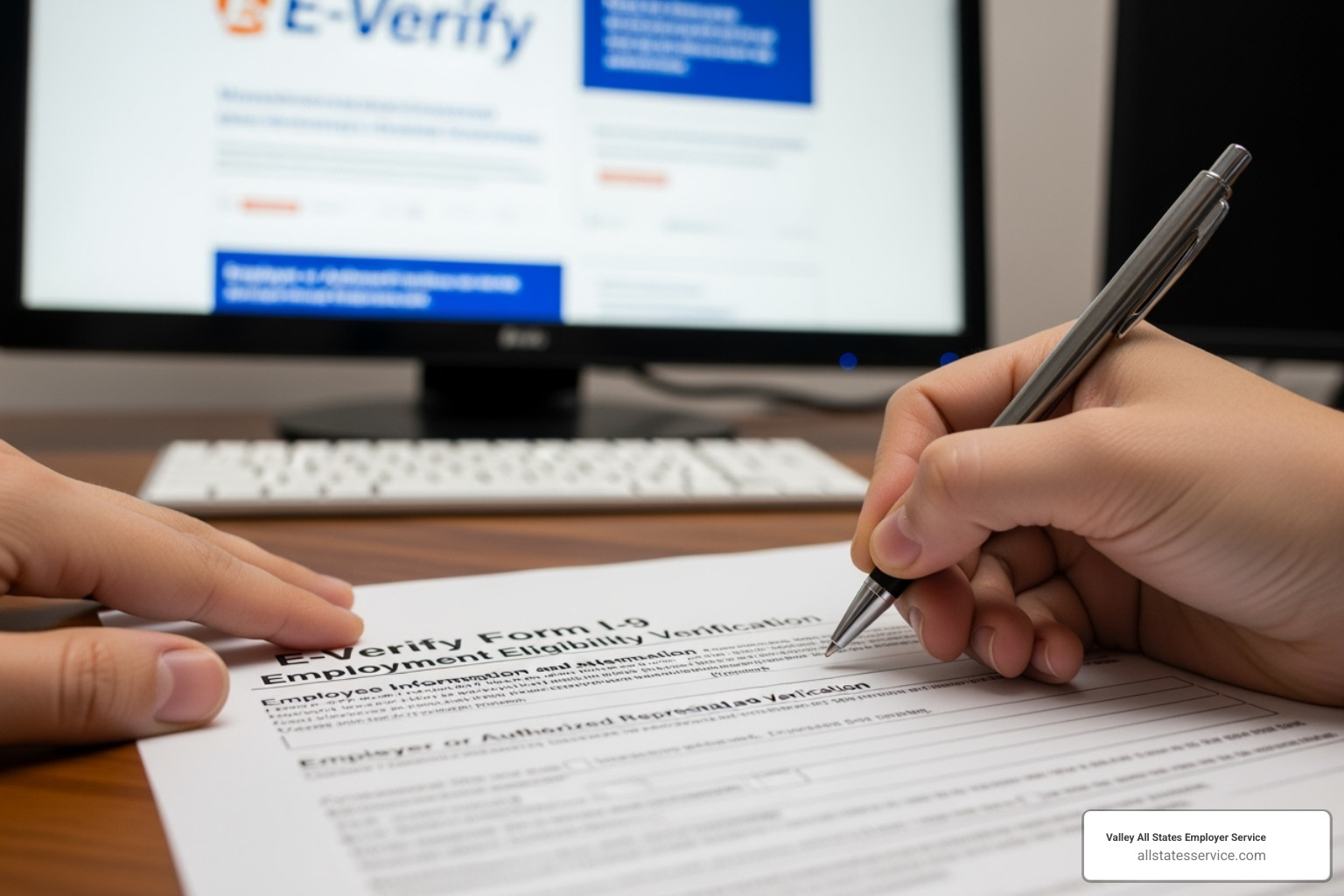

Now it’s your turn. Section 2 is where you examine your new employee’s documents and complete your portion of the form.

You have exactly three business days from your employee’s first day of work to finish Section 2. If someone starts on Monday, you must wrap this up by Thursday. There are no extensions.

Your employee chooses which documents to show you from the Lists of Acceptable Documents. They can present one document from List A (proving both identity and work authorization) or a combination of one from List B (identity) and one from List C (work eligibility). You cannot tell them which specific documents to bring; the choice is theirs.

During your document examination, you’re looking for two things: does the document appear genuine, and does it reasonably relate to the person presenting it? If something seems obviously fake or the photo doesn’t match, you can reject it and ask for different documentation.

After examining the documents, you’ll record the details in Section 2: document title, issuing authority, document number, and expiration date. Be accurate, as government inspectors will check this during audits.

Retention requirements are serious. Keep each completed Form I-9 for three years after the hire date or one year after the employee leaves, whichever is longer. Store them securely and be ready to show them to authorized officials from DHS, DOL, or DOJ.

The penalties for Form I-9 mistakes can be steep. Learn more in our guide on I-9 Compliance Penalties.

The Next Step: Integrating the E-Verify Process

After completing Form I-9, E-Verify is the next step. This internet-based system, operated by the U.S. Department of Homeland Security (DHS) and the Social Security Administration (SSA), takes employment verification to the next level. E-Verify compares Form I-9 information against federal databases to confirm a new hire is authorized to work in the U.S. The system is designed to be fast, free, and easy to use.

Unlike the mandatory Form I-9, E-Verify is voluntary for most employers. You can choose to enroll based on your business needs and compliance strategy.

However, some employers don’t get to choose. Federal contractors are often required to use E-Verify as part of their contract requirements.

State-specific mandates add another layer of complexity. States like Arizona, Mississippi, Georgia, and others have made E-Verify mandatory for certain employers. Requirements vary by state, so you’ll want to check your local rules.

Many businesses voluntarily use E-Verify for an extra layer of protection. For smaller businesses weighing this decision, our guide on E-Verify for Small Businesses breaks down the considerations.

Key Differences: Form I-9 vs. E-Verify at a Glance

Even seasoned HR professionals can get tripped up because E-Verify form I-9 integration isn’t just about using the same information twice. These systems have different rules.

Crucially, E-Verify doesn’t replace Form I-9. They work together, each with its own specific requirements.

| Feature | Form I-9 | E-Verify |

|---|---|---|

| Mandatory/Voluntary | Mandatory for all U.S. employers for every new hire. | Voluntary for most employers; mandatory for federal contractors and in some states. |

| SSN Requirement | Generally voluntary for employee to provide (unless E-Verify employer). | Mandatory for employers to create an E-Verify case. |

| Photo on List B Docs | Not required. | Required on identity documents (List B). |

| Reverification | Must be used to reverify expired employment authorization. | May not be used to reverify expired employment authorization. |

| Remote Examination | Traditionally required physical presence; new alternative procedure for E-Verify employers. | Allows for remote examination of documents under a DHS-authorized alternative procedure for enrolled employers. |

The Social Security Number requirement often catches employers off guard. While employees can leave the SSN field blank on Form I-9 in most cases, E-Verify won’t work without it. This creates a practical requirement for E-Verify employers to collect SSNs from all new hires.

The photo requirement for List B documents is another key difference. If you’re enrolled in E-Verify, identity documents must include a photo.

Perhaps most importantly, reverification rules are completely opposite. When an employee’s work authorization expires, you must use Form I-9 to reverify their eligibility. E-Verify cannot be used for this purpose.

Creating an E-Verify Case from Form I-9 Data

Once you’ve completed Form I-9, creating an E-Verify case is relatively straightforward, but with stricter timeline requirements.

The E-Verify case must be created within three business days of your employee’s first day of work. This aligns with the Form I-9 Section 2 deadline.

Information transfer is direct: employee name, date of birth, citizenship status, and document details all flow from Form I-9 into the E-Verify system. The key difference is that the Social Security Number becomes non-negotiable.

What happens when an employee doesn’t have an SSN yet? You must allow the employee to continue working while they obtain their SSN, then create the E-Verify case once it’s available. The system allows you to document the reason for any delay.

Managing multiple new hires and their E-Verify form I-9 requirements can be overwhelming. Outsourcing this process eliminates errors and saves time. Our E-Verify Employer Agent Service handles the electronic verification process efficiently, letting you focus on your business.

Navigating Special Scenarios and Recent Updates for E-Verify form I-9

Employment verification rules evolve, so staying current is critical. Let’s break down recent changes and tricky situations for E-Verify form I-9 compliance.

The latest Form I-9 (edition 01/20/25) has small but important changes. For example, the fourth checkbox in Section 1 now reads “An alien authorized to work” instead of “A noncitizen authorized to work” to align with federal statutes. If an employee used an older form, you must select “An alien authorized to work” when creating the E-Verify case. It’s a small but crucial detail.

Tentative Nonconfirmations (TNCs) can cause anxiety. A TNC means E-Verify found a mismatch, perhaps in the employee’s name or Social Security information. A TNC is not a final verdict. You must inform the employee and give them an opportunity to resolve the issue with the appropriate government agency.

When it comes to reverification, you cannot use E-Verify. Period. When an employee’s work authorization expires, you must use Form I-9’s Supplement B (formerly Section 3). Mixing this up can lead to compliance penalties.

The system has gotten smarter about tracking revoked Employment Authorization Documents. E-Verify’s Status Change Report alerts you if an EAD used for a case has been revoked by DHS, requiring you to take action.

Anti-discrimination provisions are actively enforced. You cannot demand specific documents, refuse valid ones, or treat employees differently based on their national origin or immigration status.

Managing these moving parts is complex. Our E-Verify I-9 Compliance services exist to help you steer these complexities.

The New Rule: Remote Document Examination for E-Verify Employers

Thanks to a rule published on July 25, 2023, the days of mandatory in-person document examination are changing.

This alternative procedure for remote examination is exclusively available to employers enrolled in E-Verify and in good standing. If you’re not enrolled, you must still perform in-person examinations.

The remote process works through a live video interaction between you and the employee. During the call, the employee must present their Form I-9 documents on camera. You must also get clear copies of the front and back of each document.

You are still responsible for determining if the documents reasonably appear genuine and relate to the person presenting them. The standards haven’t changed, just the method.

Document retention requirements are the same. You must keep the document copies and check the box in Section 2 of Form I-9 indicating you used the DHS-authorized alternative procedure.

This flexibility is a lifesaver for remote workforces and reinforces the value of E-Verify enrollment. Our guide on Remote I-9 Compliance can help you implement this new procedure correctly.

Handling Reverification and Updates with the E-Verify form I-9

Reverification is a compliance check-in for when an employee’s temporary work authorization expires. You must verify they are still eligible to work.

The process uses Supplement B (formerly Section 3) of Form I-9 to update an employee’s information without a new form.

Here’s the critical point: E-Verify cannot be used for reverification. This system is designed only for new hires. For existing employees, you must use Supplement B.

You must complete reverification by the date the employee’s current work authorization expires. Missing this deadline means the employee cannot continue working until the process is complete.

DHS can revoke Employment Authorization Documents (EADs), and E-Verify’s Status Change Report helps you stay informed. If an employee’s EAD is revoked, you must reverify their eligibility immediately.

Managing reverification schedules can be a full-time job. Our Third-Party I-9 Verification services can handle these ongoing compliance requirements.

Frequently Asked Questions about E-Verify and Form I-9

Navigating E-Verify form I-9 compliance raises common questions. Here are straightforward answers to the most frequent ones.

What happens if a new employee has applied for but not yet received a Social Security Number?

This is a common scenario. The good news is you don’t have to delay their employment.

The new employee completes Section 1 of Form I-9, leaving the SSN field blank. They can start working immediately; you cannot legally prevent them from working due to a pending SSN.

The challenge is with E-Verify, which requires an SSN to create a case. You must wait for the employee to receive their number before completing this step.

While waiting, attach a note to their Form I-9 explaining the pending SSN. If you miss the three-day E-Verify deadline, document the reason for the delay in the system. Once the SSN arrives, create the case immediately.

When dealing with unusual situations, Contacting E-Verify for guidance can prevent costly assumptions.

Can I use E-Verify for my existing employees?

This question often comes from employers looking to clean up compliance issues. The short answer is: probably not, but with important exceptions.

E-Verify is designed for new hires only. It’s a “front door” tool for your hiring process, not a “housekeeping” solution.

However, federal contractors often play by different rules. A federal contract with the Federal Acquisition Regulation (FAR) E-Verify clause may require you to verify all employees assigned to that contract, including existing staff.

For most employers, the rule is simple: E-Verify for new hires, Form I-9 for reverification of existing employees. Using E-Verify improperly can create compliance problems. Understanding the specific Federal E-Verify Rules that apply to your business is crucial.

What are the penalties for non-compliance with Form I-9 and E-Verify?

The penalties can be steep enough to seriously damage a business. Immigration and Customs Enforcement (ICE) takes employment verification violations seriously.

Substantive violations are serious errors that undermine the verification process, like failing to complete a Form I-9. Fines typically range from several hundred to over two thousand dollars per violation.

Technical violations are smaller errors like missing signatures or incorrect entries. They add up fast and can escalate to substantive violations if not corrected.

Paperwork violations, such as improper form completion or retention, can also cost hundreds to thousands of dollars per form during an ICE audit.

E-Verify has its own penalty structure. Misusing the system, such as for discriminatory purposes or failing to follow TNC procedures, can lead to removal from the program and additional fines.

In the most serious cases, employers who knowingly hire unauthorized workers face criminal prosecution, including significant fines and potential jail time.

Strong compliance practices are a smart business investment. Our guide on More on I-9 Compliance Penalties breaks down what you need to know to stay safe.

Conclusion: Streamlining Your Verification Process

Getting your E-Verify form I-9 processes right protects your business from costly penalties and helps you build a trustworthy workforce. We’ve covered the complexities, from Form I-9 rules to E-Verify integration, remote examination, and reverification.

These compliance requirements are not getting simpler. New forms and changing regulations can feel like a full-time job for HR teams. A single Form I-9 violation can cost thousands, and non-compliance puts your entire business at risk.

The good news is you don’t have to manage this alone.

At Valley All States Employer Service, we make E-Verify form I-9 compliance straightforward and stress-free. We handle the details, stay current on all regulations, and process verifications with precision. This turns compliance from a headache into a seamless part of your hiring process.

Think of us as your compliance safety net. We minimize errors and reduce your administrative burden, giving you confidence that your verification processes are handled by experts.

Ready to transform your verification process from a source of stress into a competitive advantage?

Learn more about our comprehensive employment and income verification services and find how we can help you build a stronger, more compliant foundation for your business.