I-9 Audit Training: Avoid Penalties 2025

Why I-9 Audit Training Is More Critical Than Ever

I-9 audit training gives HR teams the knowledge to verify employment eligibility, conduct internal audits, and respond to government inspections. Proper training covers completing Form I-9, identifying acceptable documents, avoiding common mistakes, correcting errors, and understanding retention rules.

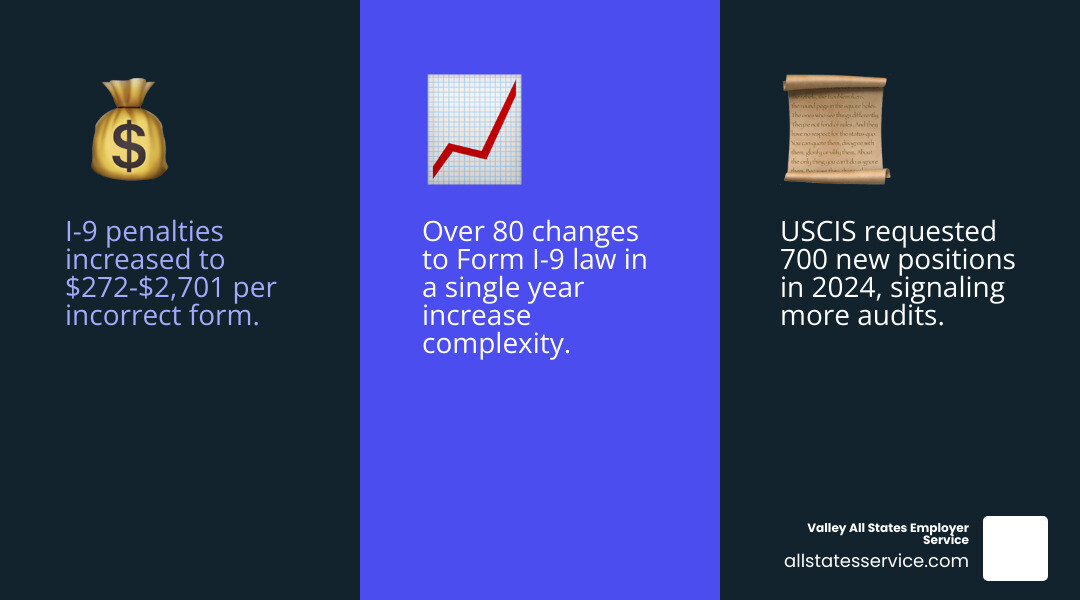

Immigration and Customs Enforcement (ICE) has significantly increased enforcement. Fines for incorrect I-9 forms now range from $272 to $2,701 per form. With the U.S. Citizenship and Immigration Services (USCIS) requesting funds to hire 700 new positions in 2024, audits are expected to become even more frequent.

For busy HR managers, a surprise audit can be a nightmare. Many employers complete these forms without proper training, viewing them as simple paperwork instead of the compliance landmine they are. Every U.S. employer must complete a Form I-9 for every employee. Mistakes can lead to thousands of dollars in fines or even criminal penalties.

The good news is that most I-9 violations are preventable. With the right training and regular internal audits, you can build a clear, compliant process without needing to be an immigration attorney.

Identifying the Red Flags: Common (and Costly) Form I-9 Mistakes

Form I-9 is complex, and small errors can lead to big penalties during an audit. Most mistakes follow predictable patterns, so knowing what to look for is the key to prevention. Effective I-9 audit training teaches you to spot and fix these issues before they become costly problems.

Section 1: Employee Errors

Although employees complete Section 1, you are responsible for ensuring it’s done correctly and on time. Common errors include missing personal information, checking the wrong citizenship status box, or forgetting to provide an A-number or I-94 admission number where required.

The employee’s signature and date are also mandatory. Section 1 must be completed and signed on or before the first day of employment.

Section 2: Employer Errors

This section is where most fines originate. You must enter the correct List A, B, or C documents after reviewing the employee’s valid, unexpired originals. Refer to the official list of acceptable documents from USCIS.

For each document, record the issuing authority, document number, and expiration date. Missing details are a red flag for auditors. You must also include your business information and sign and date Section 2 within three business days of the employee’s start date. Never accept invalid or expired documents. For more guidance, see our page on I-9 Form Completion.

Section 3 (Supplement B): Reverification Mistakes

Now called Supplement B, this section for reverification and rehires is often forgotten. The biggest mistake is failing to reverify employees whose temporary work authorization expires. You must also record complete document details during reverification. You may be able to use Supplement B to rehire an employee within three years, but only if specific conditions are met.

General Oversights

Beyond section-specific errors, watch for general mistakes. Using outdated forms is a common and costly violation, so always download the latest version from USCIS. Failing to follow retention rules (three years after hire or one year after termination, whichever is later) also leads to penalties. The worst mistake is not having an I-9 at all for an employee, which can result in severe fines.

Your Proactive Defense: A Step-by-Step Guide to Internal I-9 Audits

An internal I-9 audit is a proactive compliance checkup. It allows you to find and fix problems on your own terms, before they become expensive penalties during a government inspection. If you find errors during your own audit, you can correct them without fines. If ICE finds them first, penalties start at $272 per form.

Preparing for an Internal Audit

Good preparation is a cornerstone of effective I-9 audit training. First, set the scope of your audit, deciding whether to review all I-9s or a neutral, representative sample. Next, assemble an audit team of knowledgeable staff, ideally with formal training. Gather your resources, including the current Form I-9, the list of acceptable documents, and official guidance on internal audits. Finally, cross-reference your I-9 files with payroll to identify any missing forms. If your team lacks the bandwidth, consider consulting with compliance experts. Find more strategies in our guide on I-9 Self Audits.

Key Steps for Conducting an Internal Audit

1. Gather Forms: Collect I-9s for all current employees and former employees who fall within the retention period (three years from hire or one year from termination, whichever is longer).

2. Account for Every I-9: Compare your forms against payroll records. If an I-9 is missing, complete a current version immediately, but do not backdate it. Attach a memo explaining the late completion.

3. Verify Timeliness: Check that Section 1 was completed by the employee’s first day and Section 2 was finished within three business days.

4. Review Each Section: Methodically check each form for completeness and accuracy. In Section 1, confirm all employee information is present and signed. In Section 2, verify that acceptable, valid documents from the list of acceptable documents from USCIS were recorded correctly. Check Supplement B for proper reverification. Also, ensure you used the current version of the form.

5. Document Findings: Keep detailed notes on all errors and identify any patterns that may require additional team training.

6. Correct Errors Properly: For Section 1 errors, the employee must make the correction by drawing a single line through the error, writing the correct information, and initialing and dating the change. For Section 2 or Supplement B errors, you can make corrections using the same method. Never use whiteout. For major errors, you may need to complete a new I-9 and attach it to the old one with an explanatory memo.

7. Create an Ongoing Process: Document your audit process and schedule regular reviews (annually or quarterly) to make compliance a routine. Regular internal audits demonstrate good faith and protect your business. For more help, explore our resources on I-9 Form Completion.

When ICE Knocks: Navigating a Government Audit and Its Consequences

Even with strong internal processes and I-9 audit training, a government audit can happen. Knowing how to respond is crucial for protecting your business.

The Notice of Inspection (NOI) Process

An official audit usually starts with a Notice of Inspection (NOI) from ICE. You typically have just three business days to produce your I-9s. This short deadline highlights why being audit-ready is so important. Upon receiving an NOI, confirm the details with the agent, contact legal counsel immediately, and gather all requested documents.

What to Expect During an ICE I-9 Audit

ICE investigators will systematically review your I-9s for compliance. They look for missing forms, incomplete or incorrect information, use of outdated forms, and substantive violations like employing unauthorized workers. Understanding your rights and responsibilities can help you steer the process smoothly.

As an employer, you have the right to consult legal counsel, the three business days to produce documents, and the right to require a warrant for entry into private business areas. Employees have the right to be free from discriminatory treatment and to privacy regarding their immigration status.

Potential Penalties for Non-Compliance

The consequences of non-compliance are severe. Civil penalties range from $272 to $2,701 per incorrect form. Even simple paperwork errors can trigger fines. For substantive violations like knowingly hiring unauthorized workers, fines can be much higher.

Criminal penalties, including imprisonment for up to 10 years, can apply in egregious cases. There is no “good faith defense” for paperwork violations, and ignorance is not an excuse. Employers can also be held liable for “constructive knowledge” if they deliberately fail to investigate an employee’s status. For a detailed breakdown, see our guide on I-9 Compliance Penalties.

I-9 Retention Requirements: The 3-Year/1-Year Rule

Proper I-9 retention is critical. You must keep each employee’s Form I-9 for three years from the date of hire, or one year after termination, whichever is later. This requires a reliable system for tracking both hire and termination dates to avoid keeping forms too long or disposing of them too soon.

Advanced Compliance and Ongoing I-9 Audit Training

I-9 compliance is an ongoing process, not a one-time task. Rules change, workforces become more distributed, and effective I-9 audit training must evolve to address modern challenges like remote hiring and E-Verify.

Special Considerations: Remote Hires and E-Verify

I-9 Verification for Remote Employees

The requirement to physically examine original documents is challenging for remote hires. One solution is to use an authorized representative who can meet with the employee to complete Section 2. As of August 1, 2023, employers enrolled in E-Verify can use a permanent optional alternative procedure. This allows for remote examination of I-9 documents via live video, adding flexibility but also new compliance steps. Your team needs training on these options, which are covered in our guide to Remote I-9 Compliance.

How Audits Differ for Employers Using E-Verify

E-Verify is a companion system to Form I-9, not a replacement. If you use E-Verify, you must create a case for each new hire no later than the third business day after they start work. The E-Verify case number must be recorded on the Form I-9. During an audit, ICE will review both your I-9 forms and your E-Verify records for timeliness and procedural accuracy. This dual system requires more comprehensive I-9 audit training, as detailed in our guide on E-Verify and I-9.

The Importance of Continuous I-9 Audit Training

Immigration law changes constantly, so one-time training is not enough. An outdated process can put you at risk. Everyone involved in hiring needs regular updates on new form versions, acceptable documents, and remote verification rules. We recommend training at least annually.

Ongoing training is an investment that prevents costly fines and operational disruption. USCIS also offers free employment eligibility webinars that are updated to reflect current regulations. Keeping your team current helps them make fewer errors and protects your business.

Frequently Asked Questions about I-9 Audits

Here are answers to common questions about I-9 audits and I-9 audit training.

How often should employers conduct internal I-9 audits?

There is no federal mandate, but regular internal audits are a best practice. Most experts suggest a bi-annual or annual review of your I-9 forms. Frequent audits help you catch and correct mistakes before they become major liabilities. Combining regular audits with ongoing I-9 audit training creates a strong defense against violations.

What triggers an official ICE audit?

While some audits are random, most are triggered by specific events. Common catalysts include employee or competitor complaints and anonymous tips. ICE also targets specific industries like hospitality, construction, and agriculture for enforcement sweeps. Broader departmental investigations into a region’s hiring practices can also initiate an audit.

Can an employer correct a Form I-9 after an audit has started?

Yes, corrections are often possible. ICE typically provides a window, often 10 business days, to fix identified errors before imposing fines. For Section 1 errors, the employee must make the correction. For Section 2 or Supplement B errors, the employer can make the correction. The proper method is to draw a single line through the incorrect information, write the correct information, and initial and date the change. Never conceal the original entry. For major errors, you may need to complete a new Form I-9 and attach it to the original with a signed explanation. It is always better to find and fix errors during your own internal audits.

Make I-9 Compliance Your Strength

I-9 compliance doesn’t have to be a weakness. With solid I-9 audit training and a proactive approach, you can turn this requirement into a business advantage. A rock-solid compliance process protects your company’s reputation, avoids fines, and ensures smooth operations.

While other businesses scramble during an audit, you can have the confidence that your records are in order. A clear process makes compliance part of your culture, reducing stress and freeing you to focus on growing your business.

At Valley All States Employer Service, we understand the administrative burden of employment eligibility verification. We specialize in outsourced E-Verify workforce eligibility verification for employers. Our expert, impartial, and efficient processing helps you simplify your compliance burden, minimize errors, and reduce administrative tasks.

Don’t let I-9 compliance be a source of anxiety. Invest in I-9 audit training, implement robust internal audit procedures, and consider partnering with experts. Ready to turn compliance into a strength?

Get your complete I-9 audit guide today, or contact us to learn how Valley All States Employer Service can streamline your E-Verify process and strengthen your compliance posture.