Human resources compliance: 2024 Confident Steering

Why HR Compliance is Your Business’s North Star

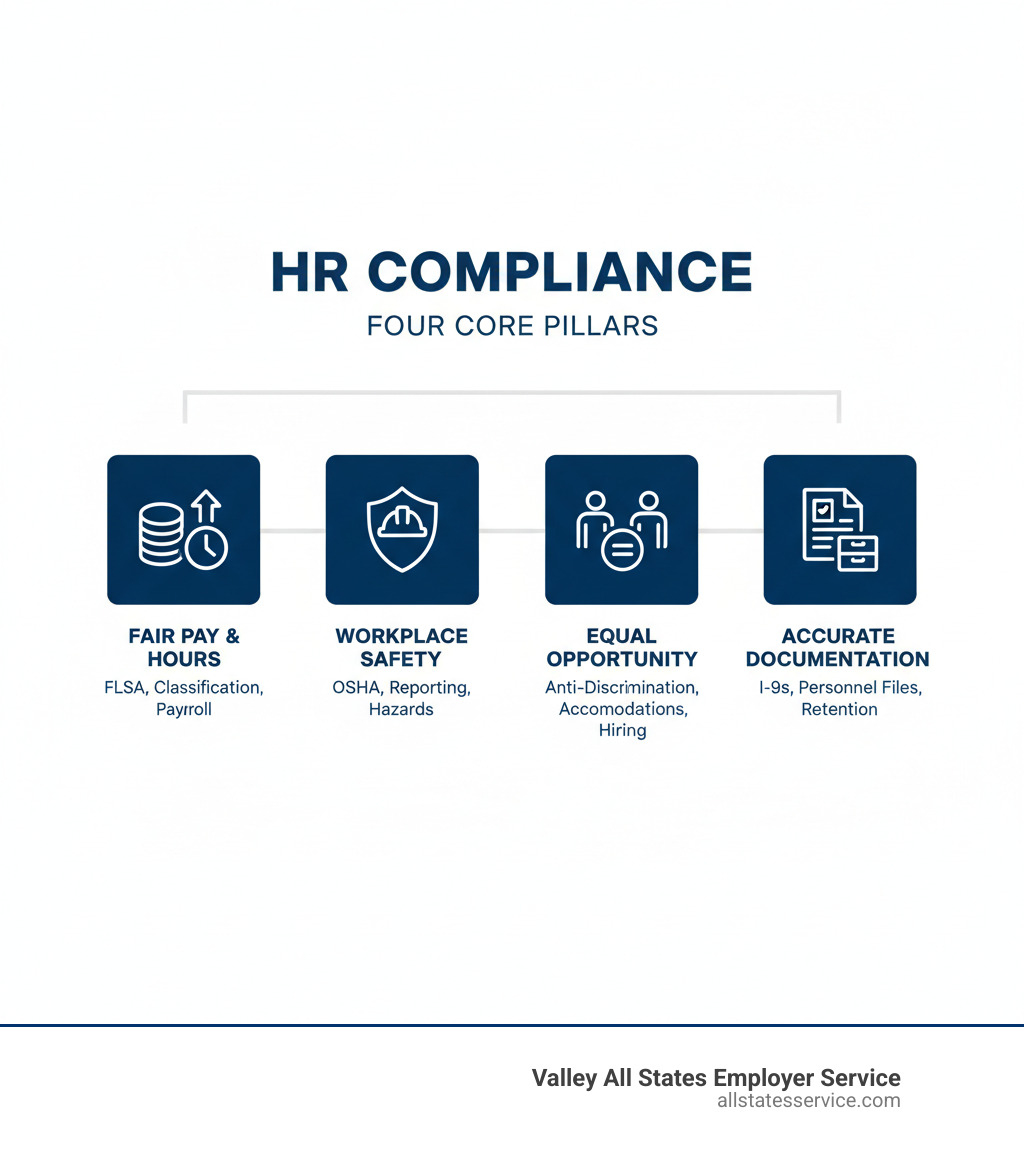

Human resources compliance means aligning your company’s policies and practices with all federal, state, and local employment laws. It covers everything from how you pay employees and maintain workplace safety to how you hire, manage leave, and prevent discrimination.

Quick Answer: What is Human Resources Compliance?

- Legal Adherence: Following federal laws like FLSA, FMLA, ADA, and Title VII

- Risk Management: Avoiding fines, lawsuits, and penalties that can cost millions

- Employee Protection: Ensuring fair treatment, safe workplaces, and proper documentation

- Business Reputation: Building trust with your workforce and maintaining credibility

- Proactive Strategy: Regular audits, clear policies, and ongoing training

HR compliance isn’t just about checking boxes. It’s about protecting your business from legal risk while building employee trust and safeguarding your company’s reputation.

The stakes are real. The U.S. Equal Employment Opportunity Commission filed 110 lawsuits challenging unlawful employment discrimination in a single fiscal year. U.S. corporations have paid out $3 billion in employment-related lawsuits since 2000.

Most organizations aren’t prepared. Only 22% of HR professionals say their company ranks at the top of the compliance maturity model. Business leaders spend an average of 5.3 hours per month on wage and hour compliance alone, with another 5 hours on workplace safety laws.

The choice is simple: be proactive or pay the price. A proactive approach involves regular audits, team training, and accurate documentation. Being reactive means scrambling after a complaint, facing investigations, and paying avoidable penalties.

For busy HR managers, compliance can feel overwhelming. Juggling numerous duties while keeping up with changing laws is a challenge. A single mistake, like a misclassified employee or an error on a Form I-9, can trigger costly audits and fines.

The good news? You don’t have to steer this alone. With the right strategy and support, compliance becomes manageable.

The Legal Labyrinth: Key Federal Laws Employers Must Steer

Federal employment laws are a complex highway system with rules that change based on your location, industry, and company size. The Department of Labor (DOL) and the U.S. Equal Employment Opportunity Commission (EEOC) enforce these regulations, which protect employee rights and define employer responsibilities. Understanding them is key to building a workplace where people feel safe, valued, and fairly treated.

Fair Pay and Working Hours

The Fair Labor Standards Act (FLSA) sets the ground rules for paying employees, establishing the federal minimum wage, overtime pay, and protections for young workers. A critical part of FLSA is classifying workers as exempt or non-exempt. A mistake here can lead to thousands in back pay for unpaid overtime.

Worker classification also extends to determining if someone is an independent contractor or an employee. This distinction affects taxes, benefits, and legal protections. Misclassifying even one person can trigger audits and penalties from multiple agencies.

The Department of Labor offers detailed guidance on these requirements. You can find more info about wage and hour laws on their website.

Anti-Discrimination and Equal Opportunity

Several federal laws protect employees from discrimination.

- Title VII of the Civil Rights Act of 1964 prohibits discrimination based on race, color, religion, national origin, and sex (which includes sexual orientation and gender identity). It covers all aspects of employment, from hiring to promotions.

- The Americans with Disabilities Act (ADA) requires employers to provide reasonable accommodations for qualified individuals with disabilities, unless it causes undue hardship.

- The Age Discrimination in Employment Act (ADEA) protects workers age 40 and older.

- The Equal Pay Act (EPA) mandates equal pay for equal work, regardless of gender. The Lilly Ledbetter Fair Pay Act of 2009 extended the time employees have to file a claim.

Other laws like the Pregnancy Discrimination Act (PDA) and the Genetic Information Nondiscrimination Act (GINA) offer further protections. All these laws also prohibit retaliation against employees who file a complaint or participate in an investigation. The EEOC takes this seriously, filing 110 lawsuits last year alone. For a complete overview, check out a guide to laws enforced by the EEOC.

Employee Leave and Benefits

Federal laws ensure employees can handle major life events without losing their jobs.

The Family and Medical Leave Act (FMLA) allows eligible employees of larger companies (50+ employees) to take up to 12 weeks of unpaid, job-protected leave. Despite its importance, 89% of employers say they need more FMLA training. You can learn more about employee eligibility for FMLA from the DOL.

The Affordable Care Act (ACA) requires employers with 50 or more full-time equivalent employees to offer affordable health coverage. COBRA lets employees continue their health insurance after leaving a job. Other key laws include ERISA (governing retirement and health plans) and HIPAA (protecting health information).

Understanding which laws apply often depends on your employee count. That’s why we focus on helping businesses understand HR Compliance for Small Business requirements.

Workplace Safety and Health

The Occupational Safety and Health Administration (OSHA) ensures employers provide safe working conditions. OSHA’s General Duty Clause requires a workplace free from recognized hazards that could cause death or serious harm. OSHA also sets specific standards for things like hazard communication and injury reporting.

OSHA offers a free on-site consultation program to help businesses identify hazards without risking penalties. To understand what applies to your business, explore workplace safety requirements by industry on OSHA’s website. For comprehensive strategies, consider Workplace Compliance Solutions.

Immigration and Employment Verification

Every employer must verify that their employees are legally authorized to work in the U.S. This is a cornerstone of human resources compliance for every hire.

The Immigration and Nationality Act (INA) requires employers to hire only individuals who can legally work in the U.S. and protects workers from citizenship or national origin discrimination. You document this using Form I-9, Employment Eligibility Verification for every new hire. The newest version of Form I-9 is now in effect, so employers must update their processes.

Many employers also use E-Verify, an internet-based system that confirms employment eligibility against government records. With increased immigration enforcement, I-9 violations carry serious penalties, reaching up to $30,000 per violation. Getting I-9s right is critical. For detailed guidance, explore our resources on Work Authorization Verification. Our I-9 E-Verify Ultimate Guide walks you through the process, and our guide on ICE I-9 Audit explains how to prepare.

Common HR Compliance Pitfalls and How to Avoid Them

Even with the best intentions, businesses can stumble into common human resources compliance pitfalls. These mistakes carry serious financial penalties, damage your reputation, and expose you to preventable lawsuits. Let’s look at the most frequent missteps and how to avoid them.

Misclassifying Workers

Worker misclassification is one of the costliest compliance mistakes. This happens in two main ways.

The first is confusing independent contractors with employees. While it’s tempting to classify workers as contractors to save on taxes and benefits, the IRS and Department of Labor look at the actual working relationship. If you control their work, they are likely an employee. Misclassification can lead to back taxes, steep penalties, and class-action lawsuits.

The second trap is mixing up FLSA exempt versus non-exempt status. Paying someone a salary doesn’t automatically make them exempt from overtime. The FLSA has specific criteria based on job duties and salary. Misclassifying a non-exempt employee as exempt means you owe unpaid overtime, which can result in substantial back pay claims.

For a deeper understanding, our Employment Compliance Ultimate Guide walks through these critical distinctions.

Inconsistent Policy Enforcement

Rules only work when applied equally to everyone. Inconsistent policy enforcement erodes trust and opens the door to discrimination claims. If you discipline one employee for an action but let another slide, you create legal risk, especially if the employees are in different protected classes.

This applies to everything from disciplinary actions and promotions to dress code. When employees see favoritism, morale drops. The best defense is clear documentation. Record what happened, when, and what action you took. This paper trail is invaluable if you ever need to defend your decisions.

Improper Documentation and Record-Keeping

In human resources compliance, if it isn’t documented, it didn’t happen. Poor record-keeping is a major liability. You need accurate personnel files and payroll records for every employee.

Different documents have different retention schedules. Payroll records must be kept for at least three years, while other documents have their own timelines. Knowing what to keep and for how long is mandatory. You also need to protect this information through strong data security practices to comply with laws like HIPAA.

Form I-9 documentation deserves special attention. Every employee needs a properly completed I-9, stored securely and separately from personnel files. Small errors can lead to big fines during an ICE audit. Our resources on I-9 Record Keeping and the Internal I-9 Audit Complete Guide can help you avoid costly mistakes.

Building a Proactive Human Resources Compliance Strategy

Moving from reactive problem-solving to proactive prevention is the key to effective human resources compliance. A proactive strategy mitigates risk and fosters a culture of trust and ethical behavior. Let’s explore the core components of this approach.

The Role of Regular HR Audits

Think of an HR audit as a health check-up for your compliance efforts. Instead of waiting for a lawsuit or government investigation, you can review your practices proactively.

Self-audits are an excellent way to identify internal weaknesses and catch issues before they escalate. A thorough gap analysis can pinpoint where your practices fall short of legal requirements. From there, you can develop clear action plans to address any problems.

If you need help, our HR Compliance Assistance can be a valuable resource for conducting these vital reviews.

When conducting an HR audit, examine these key areas:

- Recruitment and Hiring: Review job descriptions, interview questions, background checks, Form I-9 completion, and offer letters.

- Onboarding and Policies: Ensure new hire paperwork, policy acknowledgments, and initial training are properly documented.

- Employee Classification: Confirm FLSA exempt/non-exempt status and independent contractor vs. employee distinctions are correct.

- Compensation and Benefits: Check for minimum wage compliance, overtime accuracy, and proper benefits administration under ACA, COBRA, and ERISA.

- Safety and Worker’s Compensation: Review OSHA compliance, injury reporting, safety training, and workers’ comp insurance.

- DEIB: Evaluate anti-discrimination policies, reasonable accommodations, and equal pay practices.

- Data Privacy: Examine how you handle, store, and control access to sensitive employee data.

- Termination: Review final pay procedures, exit interviews, COBRA notifications, and documentation.

Developing and Maintaining Clear Policies

Your policies are the backbone of your compliance efforts. A comprehensive employee handbook is essential for outlining expectations, rights, and responsibilities. But policies must be living documents that evolve with the law.

Ensure clear policy communication so every employee understands the rules. Use acknowledgment forms to confirm employees have received and read the policies. Most importantly, perform regular updates to reflect new legislation, like the expanding pay transparency laws that require salary ranges in job postings in many states.

Effective Compliance Management Solutions can help manage policy development and dissemination seamlessly.

Effective Employee and Manager Training

Even the best policies are worthless if your team doesn’t understand them. Training turns compliance theory into workplace reality.

Anti-harassment training is often legally mandated and crucial for preventing hostile work environments. Managers need specific training on wage and hour rules to avoid costly FLSA violations. Safety procedures training is vital for preventing injuries. And with 89% of employers wanting more FMLA training, it’s clear that managers need better education on handling leave requests.

Effective training is engaging. Use interactive learning, real-world scenarios, and role-specific modules to make the education memorable.

Leveraging Technology and Expert Support for Human Resources Compliance

In today’s complex regulatory environment, technology and specialized expertise are invaluable.

HRIS platforms and payroll software can automate many compliance tasks, from tracking leave to ensuring accurate wage calculations. Technology can also streamline I-9 management and background checks.

For complex areas or multi-state operations, partnering with expert HR compliance support is a game-changer. External providers offer up-to-date knowledge and can manage specific processes so you can focus on your business.

Explore our Outsourced HR Compliance Ultimate Guide for a detailed look at how this support can help. For specialized help with workforce eligibility, our Compliance Outsourcing Solutions provide peace of mind.

Frequently Asked Questions about Human Resources Compliance

We know human resources compliance can be overwhelming. Let’s tackle some of the most common questions we hear from business leaders.

What are the consequences of non-compliance?

The consequences of non-compliance can hit your business from multiple angles.

- Legal Penalties: Government agencies like the DOL and EEOC issue fines, demand back pay, and take employers to court. Penalties for I-9 infractions alone can reach up to $30,000 per violation.

- Financial Repercussions: Beyond fines, you face legal fees, massive back pay obligations for wage violations, and potentially higher insurance premiums. A minor oversight can quickly become a budget crisis.

- Damaged Reputation: A discrimination lawsuit or safety violation can damage your brand, making it harder to attract talent and customers. People want to do business with companies that do the right thing.

- Decreased Employee Morale: When your team perceives the workplace as unfair or unsafe, trust evaporates. Productivity drops, turnover increases, and the culture can become toxic. In contrast, compliant organizations see 71% higher employee engagement.

What key HR compliance metrics should businesses track?

Tracking the right metrics helps you manage your compliance efforts effectively.

- Time to resolve compliance issues: How quickly do you investigate and address concerns?

- Employee classification accuracy: Are you correctly classifying workers as exempt/non-exempt and employee/contractor?

- Training completion rates: Is your workforce getting the required training on topics like anti-harassment and FMLA?

- Number of policy violations: Are certain policies repeatedly violated, suggesting they are unclear or poorly enforced?

- Audit findings: What do internal and external audits reveal about your compliance strengths and weaknesses?

- Employee engagement and turnover rates: These can be indirect indicators of a healthy, compliant workplace.

How does HR compliance differ for a small business?

The core principles of human resources compliance, like fair pay and non-discrimination, apply to everyone. The main difference lies in employee count thresholds.

Laws like FMLA (50+ employees) and the ACA’s employer mandate (50+ FTEs) apply to larger businesses. Title VII and the ADA generally apply at 15+ employees, while the ADEA applies at 20+. However, the FLSA’s minimum wage and overtime rules apply to most businesses, regardless of size.

Small businesses may have simpler structures but often lack dedicated HR resources. It’s also crucial to remember that state and local laws often have lower or no employee thresholds. Many state wage laws and local ordinances on paid sick leave or hiring practices apply to all employers.

Building good compliance habits early protects you as you grow. For guidance specific to your situation, our HR Compliance for Small Business resources can help.

Charting Your Course to Confident Compliance

Human resources compliance is not a one-time task. It’s an ongoing effort, like tending a garden, that requires regular attention and adaptation. When you approach compliance proactively, it becomes less about avoiding disasters and more about building a workplace where people thrive.

Getting compliance right protects your business from fines and lawsuits while creating an environment where employees feel respected. You build trust, strengthen your reputation, and lay a solid foundation for sustainable growth.

But some areas of compliance are trickier than others. Workforce eligibility verification, for example, can feel like a minefield. A single mistake on a Form I-9 could trigger an ICE audit with penalties reaching $30,000 per violation. That’s where partnering with an expert like Valley All States Employer Service makes sense. We specialize in expert, impartial, and efficient E-Verify processing, taking the guesswork and administrative headaches off your plate.

Think of it this way: you wouldn’t fix your own electrical wiring if you’re not an electrician. Why handle complex compliance requirements alone when experienced support is available?

Ready to steer compliance with confidence and protect your business from costly mistakes? Explore our outsourced compliance solutions and find out how we can help you build a compliant, thriving workplace.