Federal I9 Documents: Top 3 Critical Mistakes to Avoid

What is Form I-9 and Why Do the Documents Matter?

Federal i9 documents are the backbone of legal employment in the United States. Every person you hire must prove they can legally work here, and that’s where Form I-9 comes in.

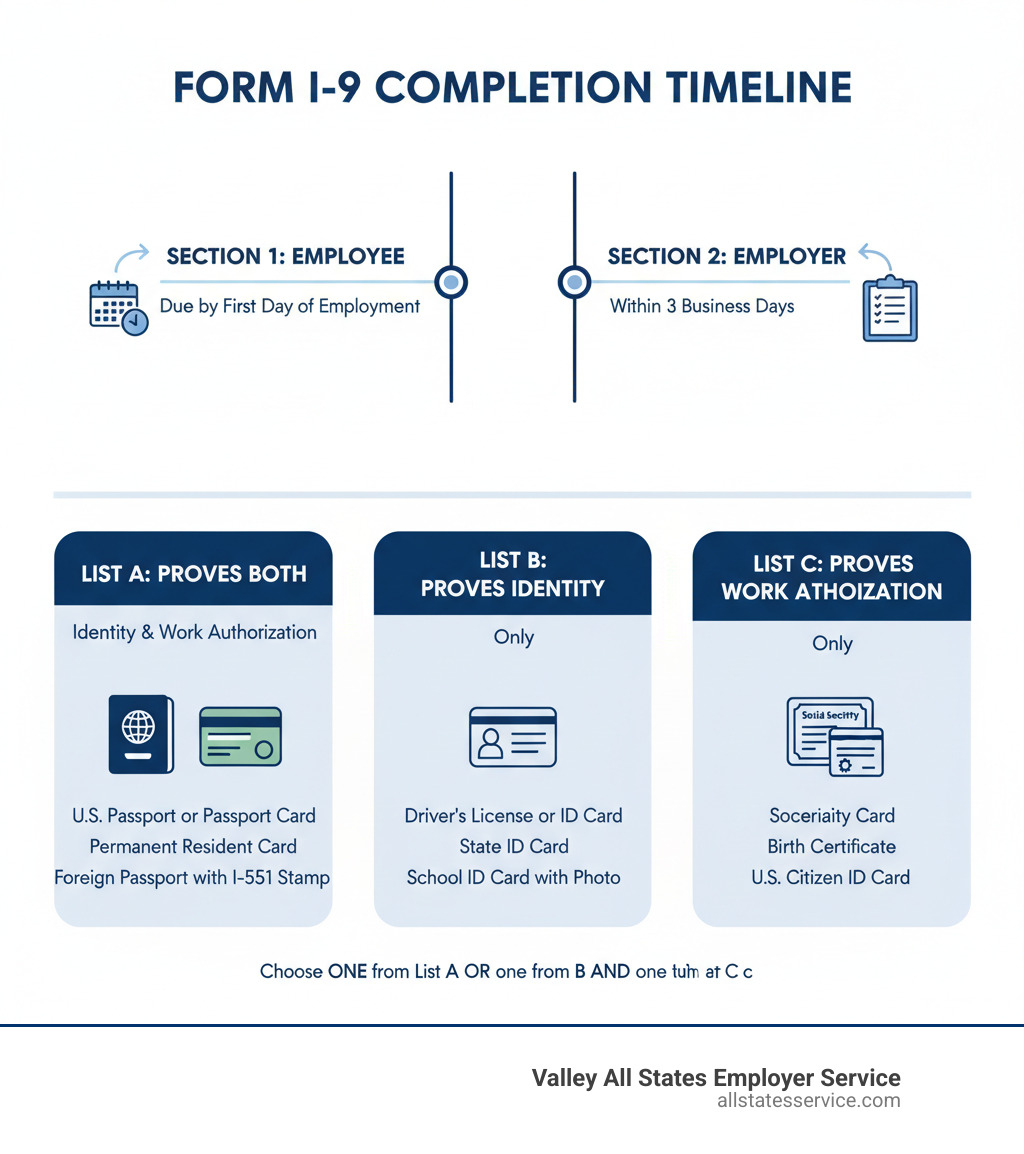

Quick Answer: Federal I-9 Documents Overview

- List A Documents: Prove both identity AND work authorization (U.S. passport, permanent resident card)

- List B Documents: Prove identity only (driver’s license, state ID)

- List C Documents: Prove work authorization only (Social Security card, birth certificate)

- Employee Choice: Workers pick which documents to show, you can’t demand specific ones

- Timing: Section 1 by first day of work, Section 2 within 3 business days

Here’s what makes this tricky for HR managers. The Immigration Reform and Control Act doesn’t just require Form I-9 completion. It makes you responsible for examining documents and ensuring compliance. Miss a deadline or accept the wrong document? You’re looking at fines that can range from hundreds to thousands of dollars per form.

Federal law requires every U.S. employer to complete Form I-9 for every new hire, regardless of citizenship status. The employee completes Section 1 on their first day, and you must examine their documents and complete Section 2 within three business days. These documents are your legal proof of verification, but the rules around the three document lists and acceptable receipts can be complicated.

The purpose of Form I-9, Employment Eligibility Verification, is to confirm an employee’s identity and work authorization. This federal requirement applies to every U.S. employer. You’re not just filling out a form; you’re upholding federal law and protecting your business from significant penalties. For a deeper dive, explore What is an I-9 Form?.

The Three Document Lists: Your I-9 Cheat Sheet

Think of federal i9 documents like a menu with three sections. Your new employees choose what to “order” from these lists, and you can’t tell them what to pick. This is federal law, designed to prevent discrimination.

The Form I-9 Acceptable Documents list from USCIS breaks everything into three categories. List A documents prove both identity and work authorization. List B and C documents work as a pair, one for identity and the other for work authorization.

You cannot specify which documents an employee must bring. They have the right to choose. You also cannot accept expired documents unless there’s an official extension. Our Verifying I-9 Documents guide walks you through document examination.

List A: Documents That Establish Both Identity and Employment Authorization

List A documents are the easiest option, as one document is all you need.

The U.S. Passport or U.S. Passport Card is a top choice, clearly establishing both identity and work authorization.

The Permanent Resident Card (Form I-551), or Green Card, also works. Older versions remain valid until they expire, even if the design is updated.

Employment Authorization Documents (Form I-766) are issued by USCIS and include photo identification along with explicit work authorization.

Foreign nationals might present a foreign passport with a temporary I-551 stamp or other USCIS endorsements. These are valid List A documents when properly issued.

List B: Documents That Establish Identity Only

List B documents answer “Who are you?” and must be paired with a List C document.

Driver’s licenses and state ID cards are the most common. They must include a photograph or identifying information like name, date of birth, gender, height, eye color, and address. A basic paper license is not sufficient.

School ID cards with photographs work for students, and U.S. Military cards or voter registration cards are also acceptable.

For employees under 18 without traditional ID, school records, report cards, or medical records can substitute.

List C: Documents That Establish Employment Authorization

List C documents prove work eligibility and complete the List B pairing.

The Social Security card is a familiar List C document, but it must be unrestricted. Cards with phrases like “NOT VALID FOR EMPLOYMENT” or “VALID FOR WORK ONLY WITH DHS AUTHORIZATION” are not acceptable.

U.S. birth certificates are also valid, but must be original or certified copies from a government authority with an official seal. Puerto Rico birth certificates issued before July 1, 2010, are not acceptable.

Certification of Report of Birth from the U.S. Department of State (Forms DS-1350, FS-545, and FS-240) is for people born abroad to U.S. citizens.

Other valid options include the U.S. Citizen ID Card (Form I-197). The USCIS Handbook for Employers (M-274) provides more examples.

What About Acceptable Receipts?

When documents are lost, stolen, or damaged, acceptable receipts give your employee time to get replacements.

Receipts for replacement documents are valid for 90 days. The employee must present the actual replacement document before this deadline expires.

Form I-94/I-94A with temporary I-551 stamps can serve as temporary List A documents for lawful permanent residents awaiting a replacement Green Card.

Refugee documentation like Form I-94/I-94A with refugee stamps also qualifies as a temporary List A document.

The key is tracking receipt expiration dates. When the temporary period ends, the employee must present the actual document. The M-274 Handbook has specific guidance on receipt validity.

Employer Essentials: Deadlines, Storage, and Responsibilities

As an employer handling federal i9 documents, you’re juggling more than just paperwork. You’re managing strict deadlines, precise storage requirements, and significant legal responsibilities. Miss a deadline or store forms incorrectly? Those penalties can really add up fast.

Let’s start with the timing that trips up so many employers. Your new employee must complete Section 1 no later than their first day of work. Not before they accept the job offer, but definitely by that first day. Then you have exactly three business days to examine their documents and complete Section 2.

Here’s how that plays out in real life. If someone starts on a Monday, you have until Thursday to get Section 2 done. Start on a Wednesday? You’ve got until Monday of the next week. This 3-day business rule doesn’t include weekends or holidays, which gives you a bit of breathing room.

The document examination part is where things get interesting. You need to physically look at the original documents, not photocopies. You’re checking whether they appear genuine and whether they reasonably relate to the person standing in front of you. You’re not expected to be a document expert, but you should notice obvious problems like different names or clearly altered information.

For detailed guidance on getting this right every time, our I-9 Form Completion resource walks you through each step. And when it comes to keeping those forms safe and organized, check out our guide on I-9 Record Keeping.

Your Step-by-Step I-9 Verification Checklist

Getting I-9 verification right means following the same process every single time. Employee completes Section 1 first, making sure they sign and date everything properly. If they need help from a preparer or translator, that person fills out Supplement A too.

Next comes the document presentation. This is where employees choose what to show you from the acceptable document lists. They might pick a passport from List A, or maybe a driver’s license and Social Security card from Lists B and C. Their choice, not yours.

Document examination happens within those crucial three business days. You’re looking at the originals, checking that they appear genuine and match the person presenting them. Then you complete Section 2 with all the document details, your signature, and the date.

Storing Form I-9 correctly protects both you and your employees. Keep completed forms separate from personnel files. This makes audits smoother and prevents unauthorized access to sensitive information.

The retention rules are straightforward once you know the formula. Hold onto each I-9 for three years from the hire date or one year after termination, whichever comes later. So if someone works for you for six months, you keep their I-9 for three years total. If they stay for five years, you keep it for one year after they leave.

Employee Rights and Employer Prohibitions

Here’s where many well-meaning employers accidentally cross the line. You cannot specify which documents an employee must present. Even if you’d prefer everyone just show a passport, you can’t require it. The law gives employees the right to choose from any acceptable document.

Anti-discrimination rules are serious business. You can’t ask for extra documents from someone because of their accent, appearance, or citizenship status. You can’t reject valid documents because you’re not familiar with them. Every employee gets the same treatment during the verification process.

Employee attestation in Section 1 carries legal weight. When employees check that box saying they’re authorized to work, they’re making a sworn statement. Your job is to accept that attestation unless the documents they present clearly contradict it.

The Form I-9 Employee Information Sheet explains these rights from the employee’s perspective. It’s worth reviewing so you understand what your new hires are thinking when they complete their section of the form.

Navigating Advanced I-9 Scenarios and E-Verify

The world of federal i9 documents doesn’t always follow a simple hire-and-file pattern. Real-world employment brings complications like document expirations, name changes, and employees who return after leaving. Let’s walk through these trickier situations that every HR professional faces.

Reverification becomes necessary when an employee’s work authorization expires. Think of it like renewing a driver’s license, but with federal compliance stakes. You’ll need to complete Section 3 of Form I-9 before the expiration date, examining new documents that show continued work eligibility. The employee chooses what to present from List A or List C, and you record the new information.

Rehiring former employees within three years of their original hire date gives you options. You can use their existing I-9 if it’s still valid and complete, or start fresh with a new form. If their work authorization expired during their absence, you’ll need to reverify. Beyond three years? Always complete a new Form I-9.

Name changes require updates in Section 3, whether from marriage, divorce, or legal name changes. The employee provides documentation of the change, and you record the new information while keeping the original form intact.

When documents have expiring authorization, timing becomes critical. Don’t wait until the last minute. Start the reverification process early, giving both you and your employee time to gather proper documentation. For specialized support navigating these complex scenarios, our I-9 Verification Assistance can guide you through each situation.

Special Instructions for Remote Examination of Federal I-9 Documents

The pandemic changed how we work, but it also permanently changed I-9 compliance. Those temporary COVID-19 flexibilities ended in July 2023, but they paved the way for something better: a structured alternative procedure for remote document examination.

Here’s the current reality for remote verification. If you’re enrolled in E-Verify, you can use the alternative procedure to examine federal i9 documents remotely through live video interaction. This isn’t a free-for-all video call, though. The process requires real-time examination where you can clearly see the documents, verify security features, and ensure they reasonably appear to belong to the person presenting them.

The three-business-day rule still applies, so your remote examination must happen within that window after the employee’s first day. You’ll need to keep clear copies of the examined documents and make a specific notation on the Form I-9 indicating you used the alternative procedure.

But here’s the catch: if you’re not enrolled in E-Verify or choose not to use this alternative, you must physically examine documents in person. No exceptions. The flexibility exists, but it comes with specific requirements and limitations.

For detailed guidance on implementing remote verification correctly, check out our resources on USCIS I-9 Remote Verification and Remote Employee I-9 Verification.

The Role of E-Verify in the I-9 Process

Think of E-Verify as your compliance safety net, not your primary defense. This internet-based system, operated by the Department of Homeland Security in partnership with the Social Security Administration, adds an electronic verification layer to your I-9 process.

E-Verify is not a substitute for Form I-9. You still complete every section of the form, examine documents, and meet all deadlines. E-Verify comes after, as an additional verification step that compares your employee’s information against federal databases.

Here’s how it works in practice. After completing Sections 1 and 2 of Form I-9, you enter the employee’s information into the E-Verify system. The system checks this data against DHS and SSA records, typically providing results within seconds. Most cases receive automatic confirmation, but some trigger additional review processes.

Federal contractors with contracts containing the Federal Acquisition Regulation E-Verify clause must use the system. It’s not optional for them. Some states also require specific employers to participate, making E-Verify mandatory rather than voluntary.

The benefits extend beyond compliance. E-Verify provides additional confidence in your workforce’s eligibility and helps reduce the risk of unauthorized employment. However, it also adds administrative complexity and potential delays when cases require additional review.

As experts in outsourced E-Verify workforce eligibility verification, Valley All States Employer Service helps employers steer this complex system, ensuring impartial and efficient processing while minimizing errors and administrative burden. Our I-9 E-Verify Compliance Guide offers comprehensive guidance, and you can find official information at the E-Verify official site.

Avoiding Costly Mistakes with Federal I-9 Documents

Let’s be honest: federal i9 documents can feel like a minefield. One small mistake and suddenly you’re facing fines that can range from hundreds to thousands of dollars per form. During an audit, these penalties add up fast, and what seemed like minor oversights can turn into major financial headaches.

The good news? Most I-9 mistakes are completely preventable once you know what to watch for. After helping countless employers steer these waters, we’ve seen the same errors pop up again and again. Understanding these common pitfalls is your first line of defense against compliance issues.

Think of I-9 compliance like maintaining your car. You wouldn’t wait for your engine to seize up before checking the oil, right? The same principle applies here. Our I-9 Compliance Penalties guide shows you exactly what’s at stake, while a proactive I-9 Self-Audit helps you spot problems before they become expensive disasters.

The reality is that even well-meaning HR professionals make these mistakes. It’s not about being careless. It’s about having systems in place that catch errors before government auditors do.

Top 3 Compliance Pitfalls and How to Avoid Them

After reviewing thousands of I-9 forms, these three mistakes account for the majority of compliance violations we see. Here’s how to avoid them:

Missing signatures, dates, or incomplete information is the most common error we encounter. Every single field on Form I-9 must be completed, signed, and dated properly. This sounds simple, but it’s surprisingly easy to overlook. Maybe an employee forgets to check a box in Section 1, or you accidentally leave the “Document Title” field blank in Section 2. Even if everything else is perfect, that one missing piece makes the entire form non-compliant.

The fix is straightforward: create a checklist and use it every time. Before you file any I-9, do a final review. Digital I-9 systems can automatically flag incomplete forms, which is why many employers are moving away from paper forms entirely.

Accepting photocopies or expired documents is another frequent violation that catches employers off guard. You must examine original documents, period. That means no photocopies, no screenshots, and definitely no expired documents (unless they fall under specific automatic extension rules that are clearly outlined by USCIS).

We’ve seen employers accept documents that looked official but weren’t actually on the List of Acceptable Documents. Train your staff to recognize valid documents and always double-check expiration dates. When in doubt, refer to the official USCIS lists. It’s better to ask an employee to bring a different document than to face penalties later.

Forgetting reverification is perhaps the most costly mistake because it’s easy to lose track of. If an employee’s work authorization has an expiration date, you’re legally required to reverify their eligibility before that date expires. Many employers set up their initial I-9 process well but don’t have systems to track when documents expire months or years later.

The solution is building a tracking system with automated reminders. Give employees plenty of advance notice so they have time to renew their documents or provide alternatives. This isn’t something you want to remember at the last minute.

The truth is, I-9 compliance doesn’t have to be overwhelming. Most errors happen because employers don’t have consistent processes in place. Once you establish clear procedures and stick to them, compliance becomes much more manageable.

Frequently Asked Questions about I-9 Documents

Working with federal i9 documents brings up plenty of questions. The rules can feel overwhelming, so let’s tackle the most common ones we hear from HR professionals.

How long must an employer keep an employee’s Form I-9?

You must keep each completed Form I-9 for three years from the hire date or one year after the employee leaves, whichever is later.

For an employee who works for two years, the three-year rule from their hire date applies. For an employee who works for five years, you must keep the form for one year after they leave, since that date is later.

Getting this retention calculation right is crucial for audit readiness. Our I-9 Record Keeping guide walks through more examples.

Can I accept an expired document for Form I-9?

The short answer is no. All documents presented must be unexpired at the time of examination.

However, some very specific situations involve automatic extensions. For example, USCIS may automatically extend the validity of certain documents during emergencies. These extensions are announced officially at the federal level.

Your safest bet is to always check the Employment Authorization Extensions page on the USCIS website for current information on any valid extensions.

What happens if an employee cannot provide acceptable documents within 3 days?

If an employee can’t produce acceptable documents or a valid receipt within three business days of starting work, you cannot continue employing them.

There is one lifeline: if an employee shows a valid receipt for a lost, stolen, or damaged replacement document, they get 90 days from their hire date to provide the actual document. This receipt rule does not apply if someone simply doesn’t have the right paperwork.

If the 90 days pass without the actual document, or if no receipt was provided in the first three days, you must terminate their employment. Continuing to employ them puts you at risk for severe penalties for “knowingly employing an unauthorized alien.” Federal law doesn’t offer wiggle room here.

Simplify Your I-9 and E-Verify Compliance

Let’s be honest. Managing federal i9 documents and E-Verify compliance feels like trying to solve a puzzle while someone keeps changing the pieces. The rules shift, the penalties are scary, and you’ve got a business to run. You didn’t become an entrepreneur to spend your days worrying about document verification deadlines.

That’s exactly why we exist. At Valley All States Employer Service, we’ve built our entire business around taking this headache off your plate. We provide expert guidance that cuts through the confusion and reduces the administrative burden that keeps you up at night. Our team handles the intricate details of E-Verify workforce eligibility verification so you can focus on what actually grows your business.

Think of us as your compliance safety net. We’ve seen every scenario, caught every common mistake before it becomes expensive, and we know how to ensure accuracy without slowing down your hiring process. Our approach is simple: we make the complex stuff disappear so you can get back to doing what you love.

The peace of mind is real when you know seasoned professionals are handling your I-9 and E-Verify processes. No more second-guessing whether you’ve missed a reverification date or wondering if that document looks legitimate. We’ve got your back.

Ready to stop wrestling with compliance paperwork? Streamline your workforce eligibility verification with Valley All States Employer Service today. Let’s take the complexity out of I-9 and E-Verify so you can focus on building the business you’re passionate about.