Why Verifying Employment and Income is a Critical Step

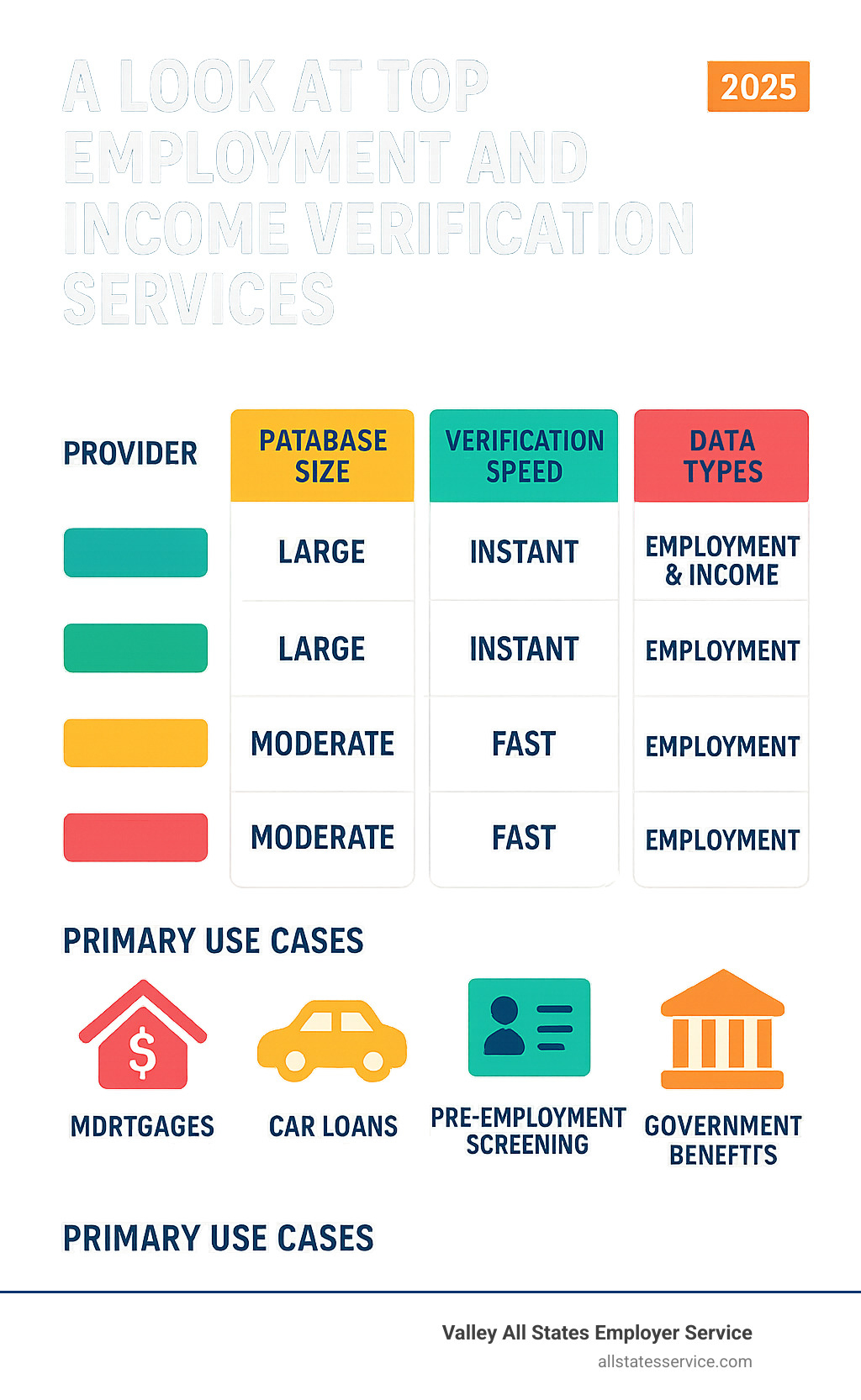

A Look at Top Employment and Income Verification Services

The employment and income verification services market looks a bit like the Wild West at first glance. You’ve got the big players dominating the landscape, scrappy newcomers trying to carve out their niche, and everything in between. But don’t worry, we’ve done the heavy lifting to break down who’s who and what they actually bring to your table.

Think of it this way, choosing a verification service is like picking a business partner. You want someone reliable, fast, and who won’t leave you hanging when things get complicated. Let’s walk through the major players and see what makes each one tick.

The Work Number® by Equifax

If verification services were a high-school yearbook, The Work Number would definitely win “Most Likely to Succeed.” They’ve already made it big, serving 3 million employers across the United States. That’s not just impressive, it’s game-changing for anyone who needs quick verification.

Their automated digital verification system never sleeps. Picture this, it’s 11 p.m. on a Sunday, and your potential tenant is trying to secure that apartment before someone else swoops in. With The Work Number, the landlord can verify employment instantly instead of waiting until Monday morning. No more losing deals to timing.

The beauty of their massive employer network is simple math. The more employers they work with, the higher your chances of getting instant verification instead of waiting days for manual research. Their system handles everything from basic employment confirmation to detailed income breakdowns including wages, bonuses, and historical payment data.

Here’s something cool, employees actually get control over their own data. They can log in to see who’s been checking their information, set up alerts when verifications happen, and even block access if needed. It’s like having a security system for your employment data.

HireRight

HireRight plays in a different league. While others focus purely on employment verification, HireRight treats it as part of a much bigger picture. They’re the Swiss Army knife of background screening, combining employment checks with criminal records, education verification, and professional license checks.

Their global reach sets them apart from the competition. If you’re hiring internationally or dealing with employees who’ve worked overseas, HireRight can verify employment history across different countries and jurisdictions. Try doing that with a phone call and see how far you get.

The company offers over 70 ATS integrations with major applicant tracking systems. This means your verification process flows seamlessly into your existing hiring workflow instead of creating another administrative headache. No more switching between multiple platforms or manual data entry.

Their 99.98% dispute-free results aren’t just a marketing number, they represent real reliability. When verification errors happen, they can derail hiring decisions or loan approvals faster than you can say “sorry, there’s been a mistake.”

HireRight also specializes in compliance-heavy industries. Need DOT employment verification for transportation companies? They’ve got you covered. Aviation screening for airlines? That too. For candidates navigating the process, comprehensive support is available through the HireRight Candidate Help Center.

If timing is crucial in your hiring process, our guide on Pre-Employment Background Check Time can help you plan more effectively.

Experian Verify

Experian Verify takes a refreshingly straightforward approach with their uConfirm service. Their philosophy is basically “throw it over the fence and let us handle everything.” For busy HR managers drowning in verification requests, this sounds like a dream come true.

Their single-source system aims to be your one-stop shop for employee verification needs across the United States. Instead of juggling multiple vendors and platforms, you work with one provider who handles all the complexity behind the scenes.

Accuracy and efficiency are their main selling points, and they back it up with secure, 24/7 access to verification information. This speed can make the difference between closing a deal and watching it slip away to a competitor with faster processes.

The uConfirm platform includes auditable transaction logging, so you can track exactly who requested what information and when. This audit trail becomes invaluable during compliance reviews or when disputes arise. It’s like having a detailed security camera for all your verification activities.

Employers interested in comprehensive verification solutions can explore the Experian Verify Income & Employment Fulfillment options for more details.

Other Notable Providers

The verification landscape includes several other players worth knowing about. Vault Verify and Truework focus on modernizing the verification experience with sleek interfaces and faster turnaround times. They often appeal to smaller employers who want alternatives to the corporate giants.

InVerify, which has now transitioned to The Work Number, previously offered specialized services including employee self-service portals for international travel documents. CCC Verify provides instant employment verifications with a focus on government agencies, offering free access to qualifying organizations while emphasizing privacy controls.

Thomas & Company offers verification services custom to different user types, including specialized services for government agencies like child support enforcement and Social Security Administration wage verification.

These niche providers often fill gaps that larger companies might overlook. They’re particularly valuable when you have unique compliance requirements or industry-specific needs that don’t fit the one-size-fits-all approach of major providers.

How the Verification Process Works from Start to Finish

Think of employment and income verification services as a well-oiled machine that turns what used to be a frustrating phone-tag game into a smooth, predictable process. Here’s how it actually works when someone needs their employment verified.

Everything starts when someone applies for something that requires proof of income. Maybe they’re buying their first home, leasing an apartment, or applying for a car loan. The lender or landlord needs to know this person really works where they say they do and earns what they claim.

The applicant signs a consent form giving permission to verify their information. This isn’t just a formality, it’s a legal requirement that protects everyone involved. Without proper consent, no verification can happen.

Next, the verifier (that’s the lender, landlord, or whoever needs the information) sends a request to the verification service. They include basic details like the person’s name, Social Security number, and employer, plus they specify exactly what they need to know.

Here’s where the magic happens. The verification service first checks if they already have this employer’s data in their system. If they do, instant verification delivers results in minutes. The system pulls current employment status, job title, hire date, and income information straight from payroll databases.

When instant data isn’t available, the service switches to researched verification. Real people contact the employer directly, usually through HR or payroll departments. They ask for the specific information needed and carefully document the response. This manual process typically wraps up within 1-3 business days of completion.

Finally, the verification results go back to whoever requested them. The whole journey from request to delivery can take anywhere from a few minutes to three business days, depending on whether automation or manual research was needed.

Data Collection and Security

When you’re dealing with someone’s employment and income information, security isn’t just important, it’s everything. These services handle some of the most sensitive personal data imaginable, so they’ve built fortress-like protection around it.

Most reputable verification services maintain SOC-II certification, which is like a gold standard for data security. This certification means they’ve proven they can handle confidential information properly. It covers everything from how they encrypt data to who can access it and how they track what happens to it.

FCRA compliance is another non-negotiable requirement. The Fair Credit Reporting Act sets strict rules about how employment information can be collected, stored, and shared. Verification services must follow specific procedures, including providing ways for people to dispute incorrect information.

Encryption protects data whether it’s moving between systems or sitting in storage. When your employment information travels from your employer to the verification service and then to a lender, it’s scrambled so thoroughly that anyone trying to intercept it would just see gibberish.

Secure portals ensure only authorized people can access verification information. Multi-factor authentication means you need more than just a password to get in. Role-based access controls make sure HR managers only see what they need to see, and loan officers only get the information relevant to their decisions.

Employee consent remains at the heart of everything. Workers must explicitly authorize the release of their information, and they typically have the right to see what information was shared and with whom. This transparency builds trust and gives people control over their personal data.

For employers who want comprehensive support managing these complex requirements, our Employer HR Compliance services can help steer the regulatory landscape.

The Role of Automation and Integration

Automation has completely transformed employment verification from a slow, error-prone manual process into something that works instantly and reliably. The difference is like comparing sending a letter to sending a text message.

Automated systems provide 24/7 availability, which is crucial in today’s always-on economy. A home buyer can get mortgage pre-approval on a Saturday night, and a renter can complete their application after business hours. The system never sleeps, never takes lunch breaks, and never forgets to return calls.

The Automated Eligibility Verification System approach dramatically reduces human error and speeds up processing times. Instead of waiting days for someone to call back with employment confirmation, automated systems deliver results in minutes with consistent accuracy.

For employers, automation significantly reduces HR administrative burden. HR staff no longer need to drop everything to answer verification calls throughout the day. The system handles these requests automatically, freeing up time for more strategic activities like employee development and retention.

ATS integration is particularly valuable for hiring processes. When verification services connect directly with applicant tracking systems, background checks and employment verification happen seamlessly as part of the normal hiring workflow. No more switching between different platforms or manually entering data multiple times.

Payroll system feeds ensure that verification data stays current without any manual effort. When someone gets a raise, changes job titles, or moves to a different department, this information flows automatically into the verification system. This keeps everything accurate without requiring HR to remember to update multiple systems.

What Happens When Information is Incorrect?

Even the most sophisticated systems sometimes contain errors, so having a solid dispute resolution process is essential for maintaining trust and accuracy. Nobody wants to lose out on their dream home because of a data entry mistake.

Employees have specific rights regarding their verification information. They can request copies of their Consumer Employment Report (CER) to see exactly what information is on file. This transparency helps identify potential problems before they derail important applications.

The dispute process typically starts when an employee contacts the verification service to report an error. They might need to provide supporting documentation like recent pay stubs, employment letters, or tax documents that show the correct information.

The verification service then investigates the dispute, often contacting the employer directly to clarify the information. If an error is confirmed, they update their records and notify any recent verifiers of the correction. This ensures that everyone working with outdated information gets the fix.

Correcting errors quickly is crucial because inaccurate information can derail loan applications, job offers, or rental applications. Most services prioritize dispute resolution and aim to resolve issues within a few business days. They understand that people’s lives are often on hold while these corrections get made.

For employees who find errors in their verification records, many services provide easy-to-use dispute forms, making it simple to start the correction process.

The key is catching errors early. Employees should review their verification information periodically, especially before applying for major loans or making job changes. A few minutes of checking can prevent weeks of headaches later.

The Benefits for Every Party Involved

When employment and income verification services work properly, everyone wins. It’s like having a trusted referee in a game where everyone needs the same information but nobody wants to waste time getting it.

Think about the old way of doing things. A lender calls your HR department asking about John’s employment. Your HR person drops everything, looks up John’s file, calls the lender back (maybe), and repeats this dance dozens of times each week. Meanwhile, John is sitting at the car dealership waiting to hear if his loan got approved, and the dealership is wondering why everything takes so long.

Modern verification services eliminate this frustrating cycle by creating efficiency gains for everyone involved. The speed improvement alone transforms what used to be a days-long process into something that happens in minutes.

Advantages for Employers

The biggest relief for employers is getting their time back. HR departments that used to spend hours each week answering verification calls can now focus on actually helping their employees grow and succeed.

Reduced administrative burden means your HR team isn’t constantly interrupted by verification requests. Instead of playing phone tag with lenders, they can work on strategic projects like improving employee engagement or developing training programs.

Risk reduction becomes automatic when you move from manual to automated verification. No more worrying about accidentally sharing the wrong information or violating privacy rules. The system handles everything according to strict compliance standards.

Improved compliance happens naturally because verification services stay current with changing regulations. They handle FCRA requirements, privacy protections, and audit trails so you don’t have to become an expert in employment law.

Faster onboarding for new hires becomes possible when background checks and employment verification happen quickly. Your new employees can start contributing sooner instead of waiting around for paperwork to clear.

The outsourcing benefits extend far beyond just saving time. When you partner with professional verification services, you’re essentially getting a specialized team that handles this function better than you could in-house. For comprehensive support with other HR functions, our HR Solutions Outsource services can help you focus on what matters most to your business.

Benefits for Employees

Employees love faster approvals. When you’re trying to buy a house in a competitive market, getting mortgage pre-approval in minutes instead of days can make the difference between getting your dream home or watching someone else buy it.

Control over personal data is a huge advantage with modern verification systems. You can see exactly who accessed your information and when. Some systems even let you set up notifications or block access if needed. It’s your data, and you should have a say in how it’s used.

Privacy protection is built into these systems from the ground up. Your employment information travels through secure, encrypted channels instead of being shared through informal conversations or unsecured emails.

The convenience factor eliminates the hassle of gathering documents for every application. Instead of digging up pay stubs and tax returns every time you apply for credit, you just authorize electronic verification and move on with your life.

Peace of mind comes from knowing your information is accurate and current. You can even access your own verification report to check for errors before they cause problems with important applications.

Gains for Verifiers (Lenders, Landlords)

Lenders and landlords benefit from speed and efficiency that transforms their decision-making process. Instead of waiting days for employment confirmation, they can make approval decisions quickly and confidently.

Increased accuracy reduces the risk of making decisions based on outdated or incorrect information. When data comes directly from payroll systems, you know it’s current and reliable.

Fraud prevention improves significantly when verification comes from trusted third-party sources rather than documents that could be altered. This protects lenders from approving loans based on false information.

Reliable data for decision-making enables better risk assessment and more confident approval processes. When you trust the accuracy of employment and income information, you can make faster decisions without second-guessing yourself.

Reduced manual follow-up saves time and resources that can be redirected to more complex cases or better customer service. Your verification staff can focus on building relationships instead of chasing down routine employment confirmations.

Key Considerations and The Future of Verification

The world of employment and income verification services is moving fast, and smart organizations need to understand both the current landscape and what’s coming next. Let’s explore the key factors that will shape your verification strategy.

Understanding the Costs

Here’s the reality about verification costs: someone always pays, but who depends on the setup you choose.

The verifier-pays model puts the cost on lenders, landlords, and other organizations requesting information. They typically pay between $15 and $55.95 per verification, which makes sense since they’re getting the value from that data. A mortgage lender might pay $25 to verify employment instantly rather than waiting three days for a manual process.

On the flip side, the employer-pays model involves companies paying subscription fees or per-employee costs to join verification networks. Think of it as an investment that pays dividends through reduced administrative headaches. Instead of your HR team spending hours each week answering verification calls, you pay a monthly fee and let the system handle it automatically.

Government agencies often get special treatment with reduced rates or free access. Verification services recognize that helping agencies efficiently manage benefit programs and social services serves the public good.

The choice between subscription versus per-verification pricing usually comes down to volume. Large organizations with frequent verification requests often prefer predictable monthly fees, while smaller companies might choose pay-as-you-go options.

Navigating Challenges and Compliance

Even the best verification systems face real-world challenges that require ongoing attention.

Data accuracy remains the foundation of everything. Automated systems are generally more reliable than manual processes, but they’re only as good as the information employers feed into them. Regular data updates and quality checks aren’t optional, they’re essential for maintaining trust.

Employee privacy concerns continue evolving as people become more aware of how their personal information gets used. Modern verification services must walk a careful line between efficiency and privacy protection. This means transparent consent processes, robust security measures, and giving employees control over their data.

Global verification complexities create headaches when dealing with international employees or multinational companies. Different countries have varying privacy laws and employment practices, making standardized verification much more challenging. What works perfectly in the United States might not even be legal in Europe.

Staying compliant with regulations requires constant vigilance as laws change. Services must adapt to new privacy requirements, employment regulations, and industry-specific compliance needs. It’s like trying to hit a moving target while blindfolded.

For organizations managing complex compliance requirements, our I-9 Self Audit services can help ensure all employment verification requirements are properly handled.

The future points toward even greater automation, with emerging technologies like AI-powered verification and blockchain security promising to make the process faster and more secure. We’re also seeing expanded global verification capabilities as the workforce becomes increasingly international. The companies that adapt to these changes will have a significant advantage in attracting and retaining talent while maintaining compliance.

Streamlining Your HR Compliance Beyond Income Checks

Employment and income verification services handle one piece of the workforce compliance puzzle, but there’s another critical verification step that every U.S. employer must complete, confirming your new hire’s legal right to work in the country.

This is where E-Verify becomes essential. You can review the federal program details on the official E-Verify website. While income verification helps with financial decisions, E-Verify verification is a federal requirement for many employers and a smart business practice for all. The process involves checking each new employee’s eligibility to work legally in the United States.

The challenge is that E-Verify can be tricky to manage in-house. The system has specific timing requirements, detailed documentation needs, and compliance rules that change regularly. A small mistake can lead to discrimination claims or federal penalties.

Valley All States Employer Service specializes in taking this burden off your shoulders. We handle the entire E-Verify process with expert precision, ensuring your business meets all federal employer requirements without the administrative headaches.

Think of it this way, you wouldn’t handle your own payroll taxes or workers’ compensation claims because the stakes are too high and the rules too complex. E-Verify falls into the same category. By outsourcing this critical function, you ensure compliance while freeing up your team to focus on what they do best.

The beauty of professional E-Verify services is the peace of mind they provide. You know every verification is handled correctly, on time, and in full compliance with federal regulations. Your HR team can focus on hiring great people instead of worrying about paperwork and deadlines.

Ready to simplify all aspects of your workforce compliance? Explore our comprehensive HR solutions.